Written by Yangz, Techub News

Nearly a month after rumors about Pump.fun developing its own AMM fermented, the leading Memecoin issuance platform in the Solana ecosystem officially announced the launch of its native DEX, PumpSwap. Coupled with the news that Raydium will also launch a native Memecoin issuance platform LaunchLab, which was revealed by Blockworks earlier this week, the former "comrades-in-arms" have become "rivals", and the battle for the Solana Memecoin market has officially begun.

Talking about the relationship between Pump.fun and Raydium, it was actually mutually beneficial and symbiotic at first. Pump.fun's Memecoin issuance mechanism can be roughly divided into two stages. The first is the "internal disk" stage, relying on its own Bonding Curve mechanism (simply put, the higher the token price, the more tokens are released) to match transactions. When the token trading volume reaches 69,000 US dollars and successfully "graduates", it will enter the "external disk" stage. At this time, liquidity will migrate to Raydium and continue to be open for trading, and Raydium will charge a listing fee of 6 SOL. It can be said that Pump.fun's "internal disk" stage provides early price discovery for tokens, and by transferring to Solana, the DEX ranked first in TVL, a natural market balance mechanism is introduced for these Memecoins, which to a certain extent helps to alleviate the extreme price fluctuations that may be caused by a single curve model.

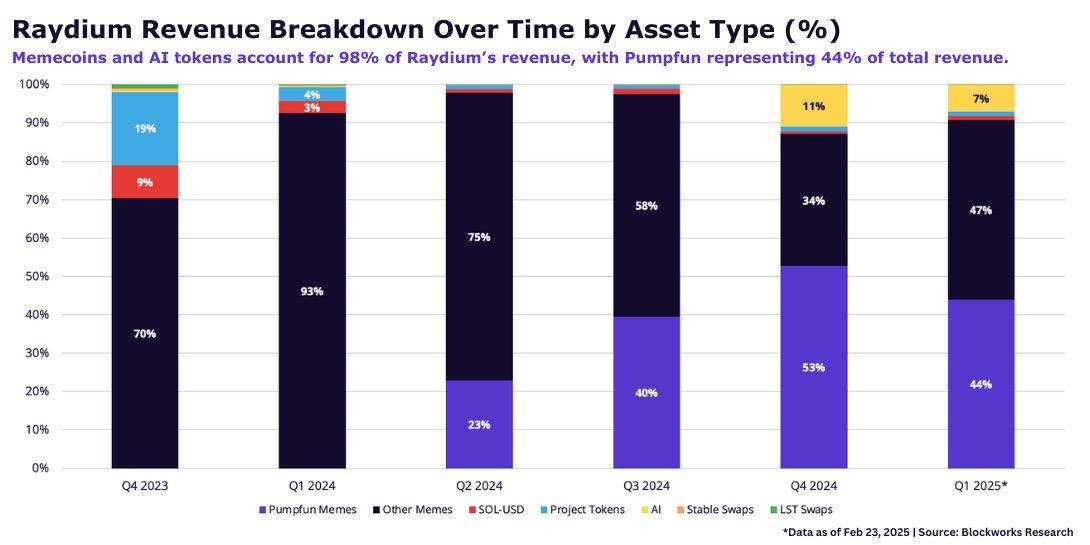

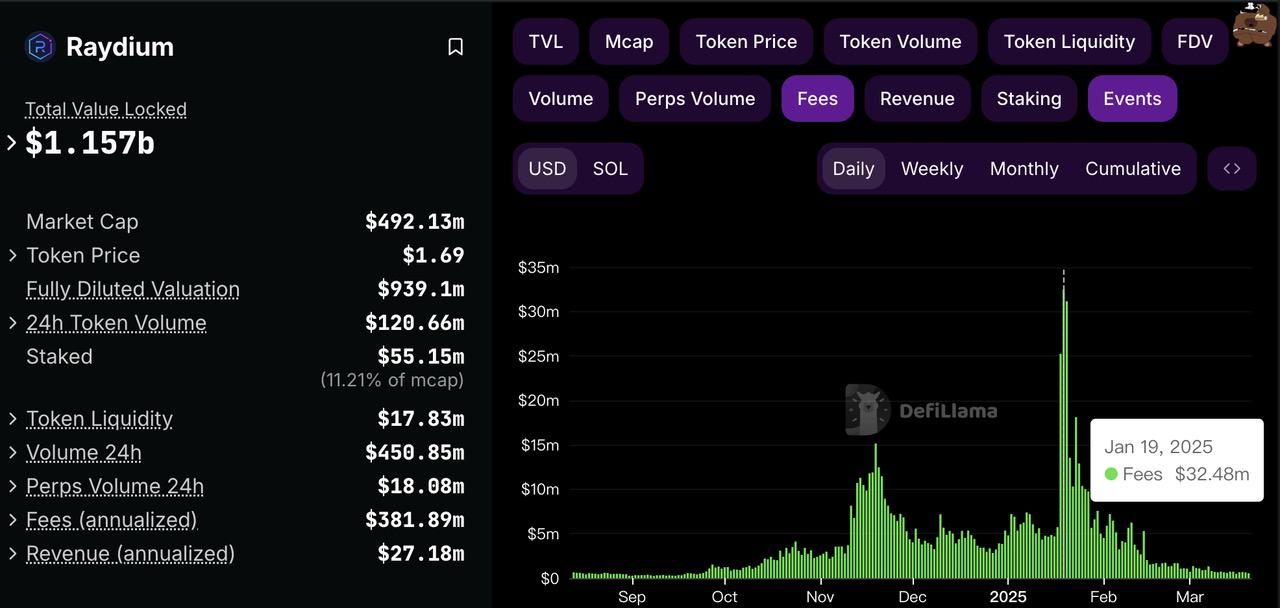

Data released by Blockworks Research shows that since the second quarter of last year, a large part of Raydium's revenue has come from the transaction fees of Pump.fun Memecoin, of which in the fourth quarter of last year, the proportion reached 53% (Raydium charges a 0.25% handling fee for each transaction). Although there was a slight decline in the first quarter of this year (as of February 23), the proportion still reached 44%. In addition, DefiLlama data shows that benefiting from the craze of Solana Memecoin last year and the popularity of Pump.fun, Raydium's daily transaction volume in 2024 soared from about US$245 million to more than US$2 billion.

So, why did this pair of partners who once "helped each other" choose to "travel separately"?

Pump.fun said in today's official tweet, "From day one, our goal has been to create the most frictionless token trading environment. The migration of token liquidity will slow the momentum of the token and bring unnecessary complexity to new users. Now, the migration can be done immediately and for free." In addition, it is also investing in creating a more sustainable ecosystem. In the future, "a certain percentage of the protocol revenue will be shared with the token creators" (currently, each transaction on PumpSwap charges a 0.25% handling fee, of which 0.2% is allocated to the liquidity provider and 0.05% is allocated to the protocol. After the creator income sharing function is launched, the fee distribution will change) . Simply put, Pump.fun's move is intended to implement its original intention of "frictionless trading" while ensuring that "the fat water does not flow to outsiders' fields."

Infra, an anonymous core contributor of Raydium, also revealed in an interview with Blockworks that the protocol had actually started developing LaunchLab "several months ago", but because they did not want the Pump.fun team to feel that Raydium was in direct competition with them, they had been shelving the project. It was not until the news broke in the market that Pump.fun would develop its own AMM that Raydium realized that if it did not take action, it would probably "eat up all the money". Infra also pointed out that the popularity of Pump.fun was to a certain extent due to the solid infrastructure provided by Raydium, but it did not regard LaunchLab as a killer of pump.fun, "it just provides an alternative for teams that do not want to develop programs from scratch and Pump.fun users who like to use Raydium's AMM v4 for liquidity pool migration."

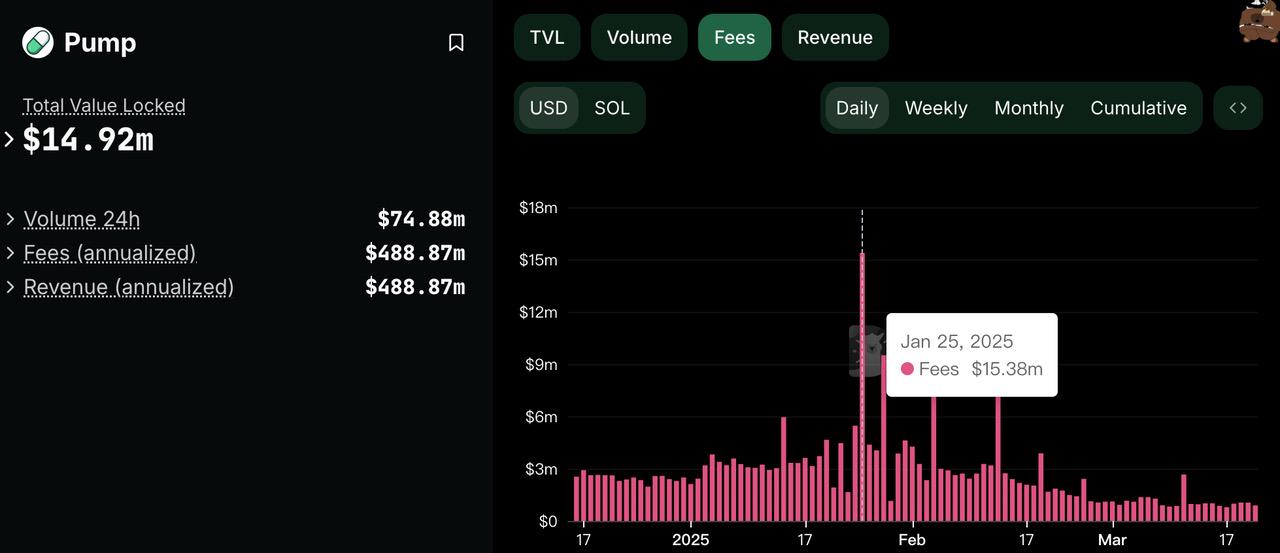

Although neither party has explicitly stated that they want to confront their former "comrades-in-arms", considering the fact that a series of scandals have caused the Solana Memecoin ecosystem to fall into a downturn, the market has long known that "traveling separately" is nothing more than "all about money". DeFiLlama data shows that compared with the peak of about 15.38 million US dollars at the end of January this year, the current transaction fee of Pump.fun has dropped to the level of 1 million US dollars, and the transaction fee of Raydium has also dropped from the level of 30 million US dollars to 600,000 to 700,000 US dollars.

In my opinion, this is a "survival battle" for traffic and users under the shrinking Memecoin market. As the Solana ecosystem Memecoin craze recedes, both parties are facing the pressure of sharply reduced revenue and user loss. But the problem is that with CZ bringing popularity to BNB Chain ecosystem Memecoin and Solana itself facing "external troubles", how much space is left for them in the current Memecoin market? A head-on confrontation between the two in the context of Solana's declining traffic may only be a war of attrition.

The popularity of the Memecoin market is highly dependent on emotion-driven. Once the money-making effect fades, users tend to quickly turn to other hot spots. If PumpSwap and LaunchLab cannot provide enough appeal in this battle, it is likely to be in vain. Of course, one thing that cannot be ignored is that PumpSwap has not limited itself to Memecoin. It has now expanded support for token transactions of multiple popular projects including PENGU, APT and TRON, trying to expand its influence. As for LaunchLab, in addition to providing linear, exponential and logarithmic combined curves to match the demand and price of tokens, and allowing third-party user interfaces to set their own fees, whether it will bring other new mechanisms still needs to wait for further announcements from Raydium and market feedback.

Ultimately, who will win this battle for survival depends not only on their respective subsequent actual performance, but also on the overall direction of the Solana ecosystem. If Solana's Memecoin narrative can heat up again, perhaps we will witness Raydium breaking Pump.fun's dominance in the "Solana Memecoin" field; or, Pump.fun will take advantage of the momentum and further consolidate its leading position.