Author:Sha

SynFutures will hold a formal TGE and community airdrop today (December 6) at 6pm in Singapore. This article will review the development history and ecological highlights of SynFutures. The only two highlights in the decentralized derivatives track in the past year are Hyperliquid and SynFutures. **Hyerliquid held a TGE and airdrop last week, setting a record for the largest airdrop amount in history, which makes people full of expectations for SynFutures, which is also in the derivatives track. Today's article mainly helps readers understand the development process of SynFutures, its current industry status and the challenges it may face in the future.

1. SynFutures, a decentralized derivatives company

The SynFutures team has been focusing on the decentralized derivatives track since 2021, and has continued to iterate 3 versions in the process.

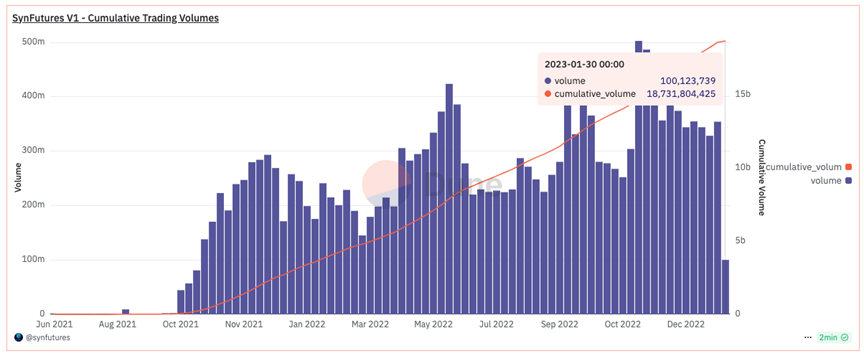

Its first version is an AMM that supports futures trading (expiring contracts), which was launched on Polygon in 2021. Users can use up to 10x leverage for trading. At the same time, the team also developed the first BTC mining difficulty delivery contract on the entire network. Miners can go long or short on Bitcoin mining difficulty based on their own predictions of Bitcoin mining difficulty. In the one and a half years since its first version was launched, it has achieved a total transaction volume of US$18.7 billion, which was a very impressive achievement at a time when spot dex and perp dex were still in the conceptual stage.

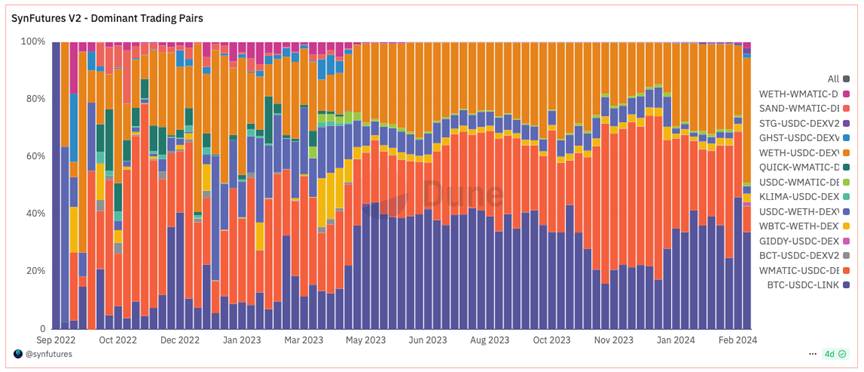

If the first version is SynFutures' MVP, then the second version can be said to be SynFutures' further exploration into the decentralized derivatives track. In the second version, SynFutures is targeting the larger market of perpetual contracts. After all, compared with expiring contracts, perpetual contracts have a wider audience and higher trading volume. Based on this, SynFutures launched the industry's first purely on-chain decentralized futures and perpetual contract trading platform, while also allowing users to create decentralized derivatives markets without permission. The biggest change brought about by this version is that it supports more trading pairs. In addition to mainstream trading pairs such as BTC and ETH, the mainstream assets of the Polygon network at that time can be said to be included, and helped SynFutures become one of the decentralized derivatives exchanges with the highest trading volume on Polygon.

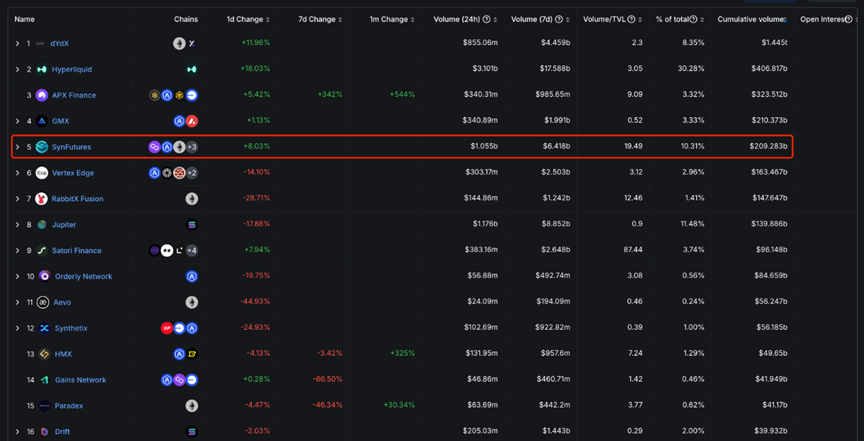

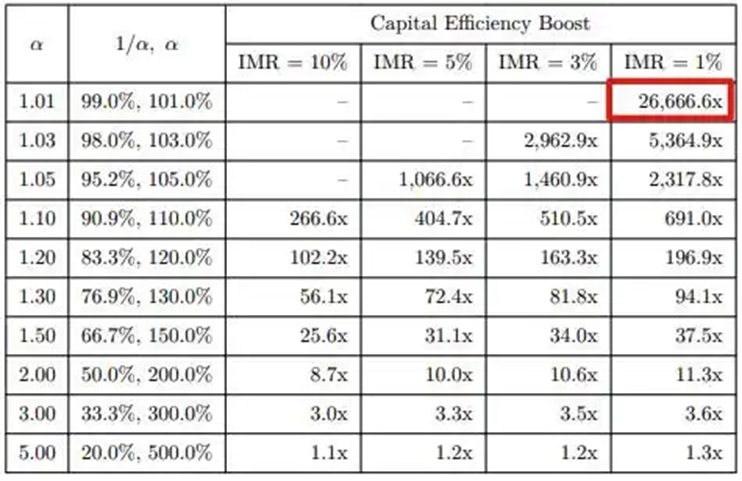

Based on the experience of operating and developing the above two versions, and in order to further improve capital efficiency, SynFutures launched its Oyster AMM designed for derivatives trading this year, which can increase capital efficiency by up to 26666x. After its launch, this version has generated a cumulative trading volume of more than 200 billion US dollars, ranking fifth in total trading volume among all perp dex. Compared with earlier launched protocols such as GMX and Hyperliquid, its performance is not inferior.

2. UniSwap is committed to becoming a derivatives track

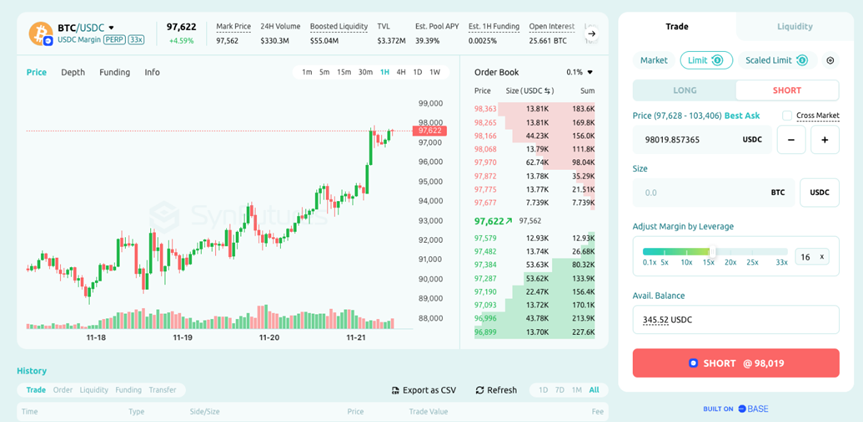

SynFuturesV3 draws on the centralized liquidity model of UniSwapV3 to launch Oyster AMM (oAMM) specifically designed for contract trading, allowing LP to concentrate liquidity in a specified price range, maximizing capital efficiency and liquidity depth, while maintaining complete decentralization while providing traders with a good trading experience and minimizing trading friction.

- Central heating liquidity - oAMM greatly improves the liquidity depth and capital utilization efficiency of AMM by allowing LP to add liquidity to a specified price range, while supporting larger and more transactions, creating more fee income for LP. From its documentation, we can see that its capital efficiency can be up to 26,666.6 times the original;

- Pure on-chain order book - oAMM implements a pure on-chain order book without relying on a centralized server, allowing market makers to make markets by placing limit orders and directly receive ⅓ of the transaction fee share, which is conducive to SynFutures attracting market makers from centralized trading platforms to participate in on-chain market making and provide a better trading experience;

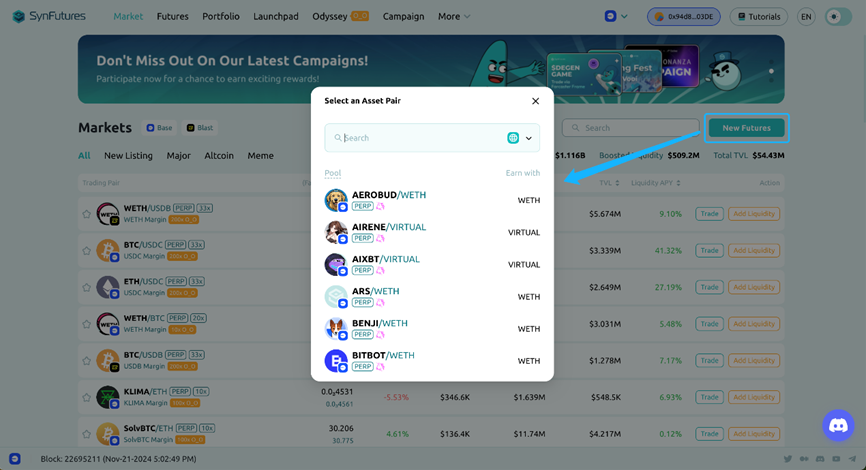

- Permissionless listing - Another major innovation of oAMM is that it has the permissionless feature like UniSwapV3, allowing any ERC-20 token to be used as collateral, and the entire listing process can be completed within 30 seconds. This means that any project can create a perpetual contract market for its own token on SynFutures;

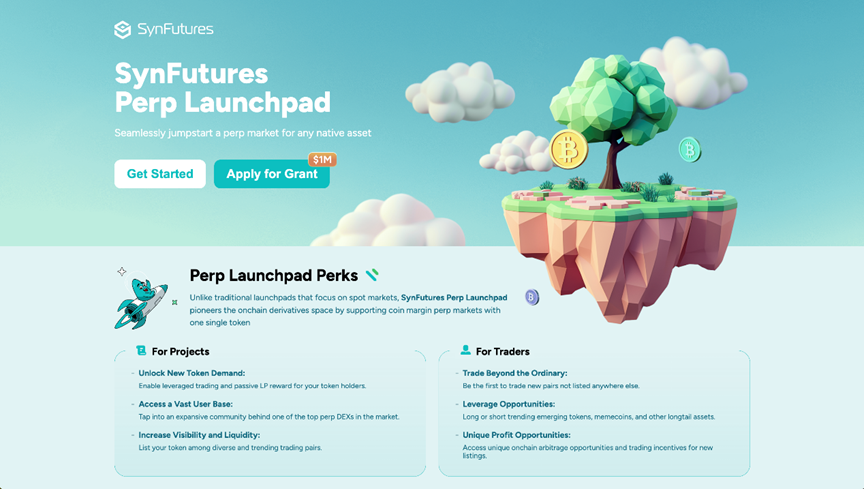

- Perp Launched - Based on its permissionless listing feature, SynFutures recently launched the industry's first derivatives perpetual contract issuance platform based on the model of Pump.fun. Project parties only need to use their own project tokens to provide liquidity, open their own perpetual contract market, and obtain commission income from user transactions.

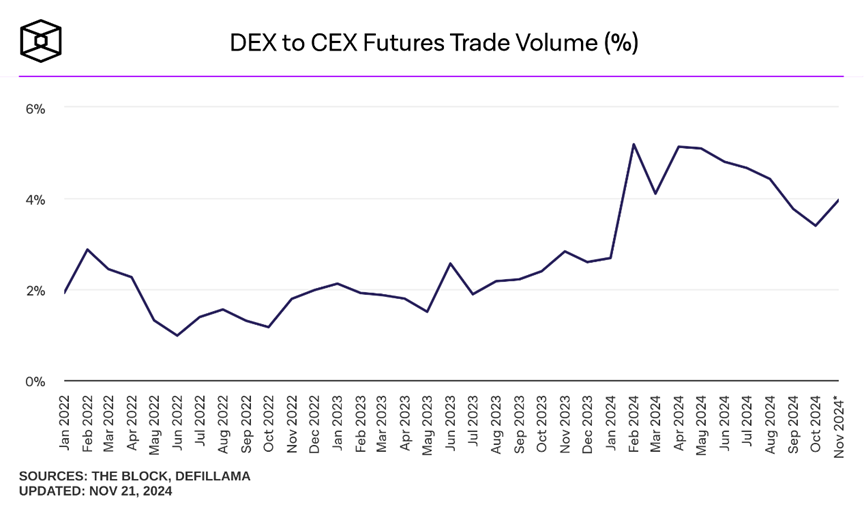

3. Data Performance

Looking back at the development of the decentralized derivatives track in the past few years, new projects are emerging and old projects are dying. Although good progress has been made, its market share is still insignificant compared to centralized exchanges, less than 5%. On the one hand, this is related to the bottleneck encountered in the development of DeFi, and on the other hand, the derivatives track has higher requirements for speed, and the underlying public chain still has a big bottleneck in this area, which hinders the development and innovation of the track.

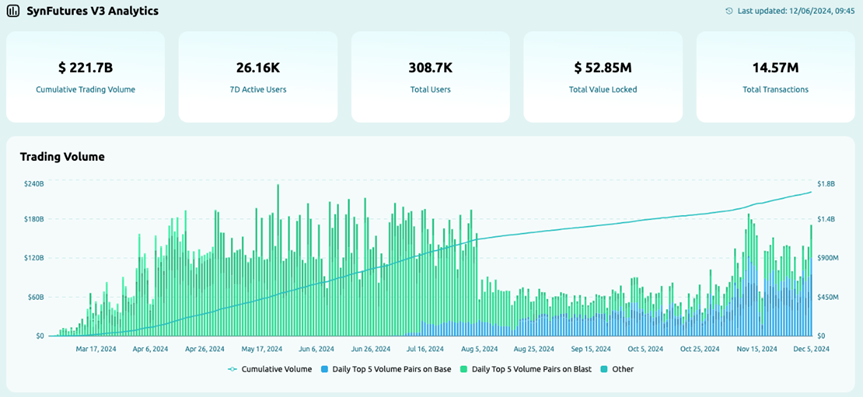

SynFutures generated over 220 billion USD in trading volume in 9 months, which is a very impressive performance.

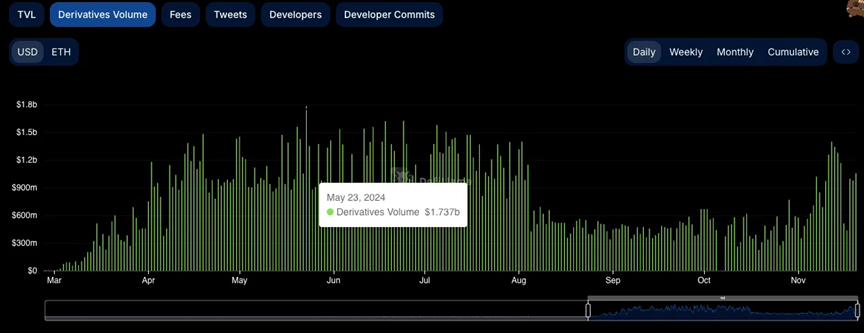

The highest daily trading volume is 1.7 billion US dollars

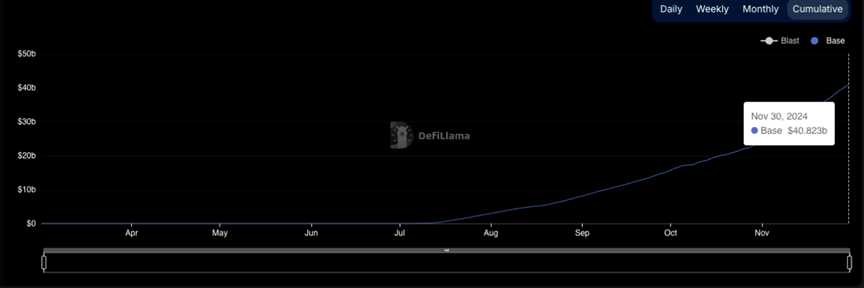

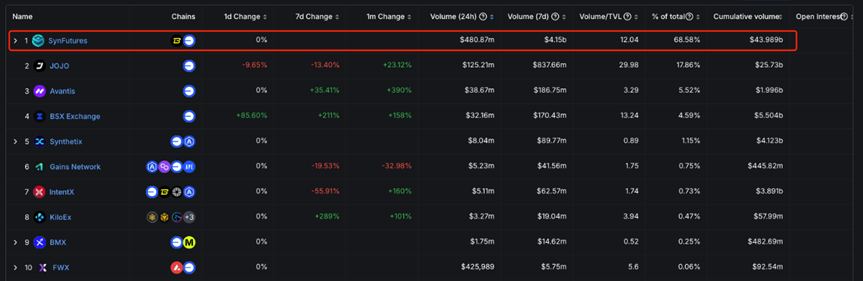

And from the data in Base:

- Base was launched on July 1, and the transaction volume exceeded 100 million US dollars 10 days after launch

- Cumulative trading volume is close to 40 billion US dollars, with an average daily trading volume of 240 million US dollars

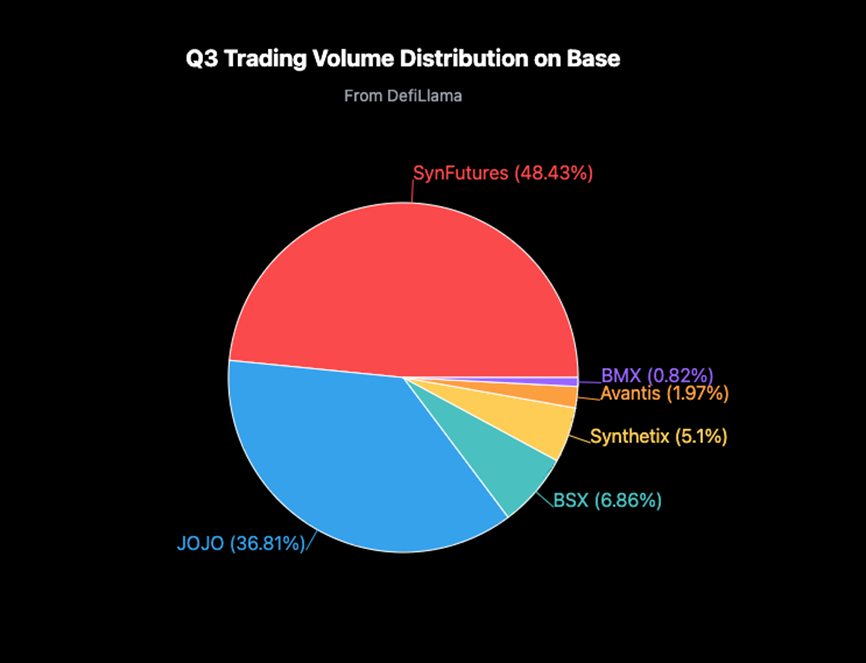

- Q3 transaction volume accounts for nearly 50% of the Base network

- The transaction volume in the past 24 hours accounts for 68% of the Base network, which is 4 times that of the second place;

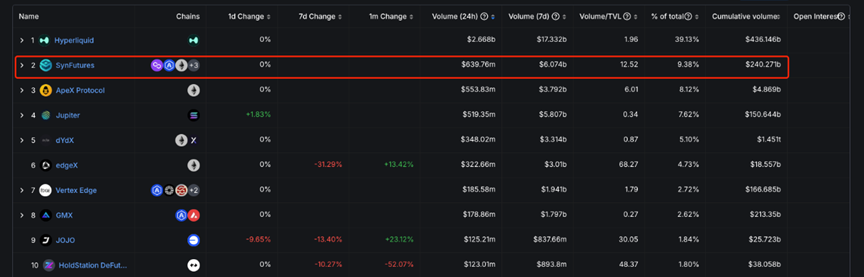

- The trading volume in the past 24 hours ranks second among all platforms, second only to Hyperliquid

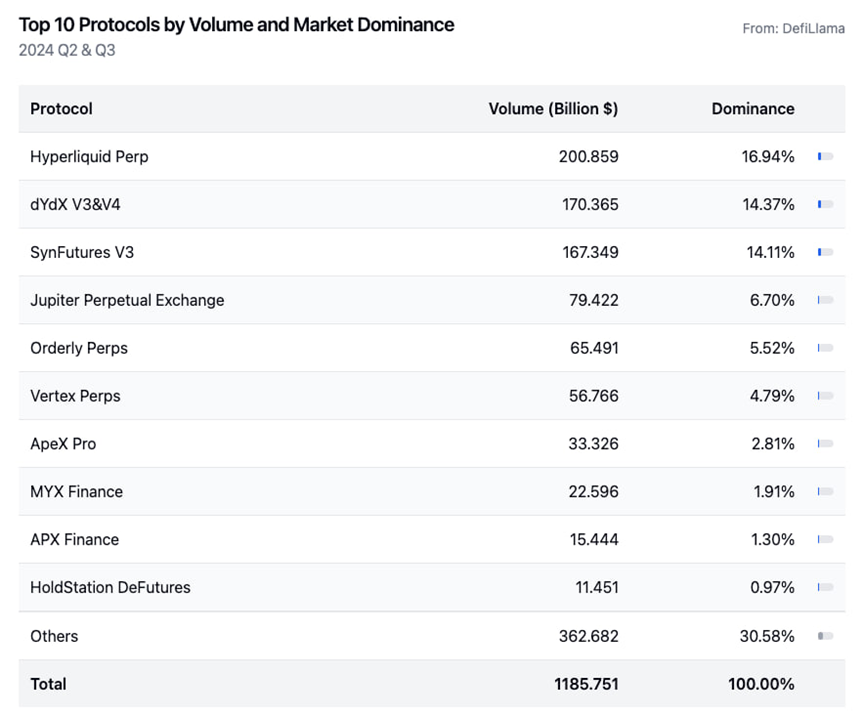

According to DefiLlama data, the on-chain perpetual contract trading volume in Q2 and Q3 was US$1,185.7 billion, and the top three accounted for more than 45% of the trading volume, namely Hyperliquid (16.94%), dYdX V3 & V4 (14.37%) and SynFutures (14.11%).

4. Team

The SynFutures team has extensive experience in finance, derivatives, TradFi, DeFi, etc. It not only has veterans in traditional finance, but also Degen in the emerging field of DeFi.

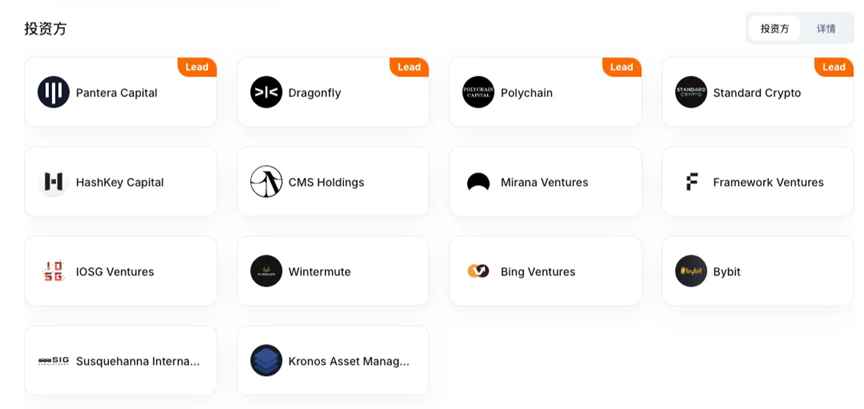

From Rootdata , we can see that its founder Rachel participated in the establishment of Matrixport after joining Bitmain in 2018. Because she has always been interested in DeFi, she founded SynFutures in early 2021. It has received support from well-known Eastern and Western investment institutions including Pantera, Polychain, Dragonfly, SIG, etc., and has accumulated more than US$37.4 million in financing.

5. Token Economics Model

SynFutures announced the establishment of the SynFutures Foundation and the launch of its native token F last week, and will announce the airdrop details and TGE date in the near future.

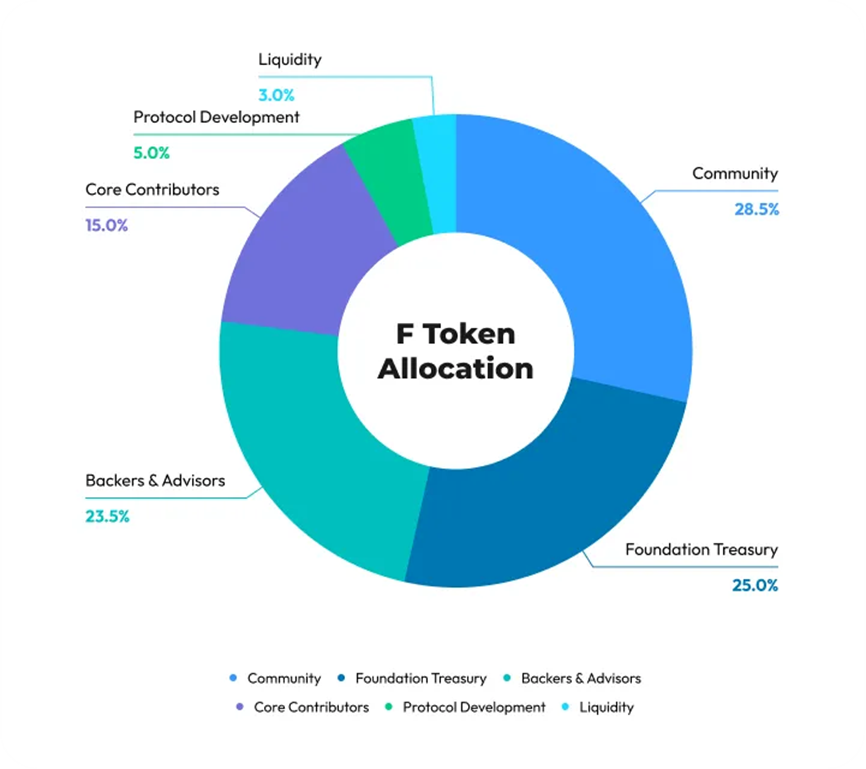

According to its announcement, the SynFutures Foundation will be committed to promoting the long-term development of the protocol and achieving joint decision-making through community governance proposals. F tokens will be allocated to the community, early supporters and consultants, foundation treasury, core contributors, protocol development and liquidity support. In addition to governance voting rights, holders can also enjoy rights such as fee refunds, staking rewards, and airdrop bonuses in the second quarter.

The total amount of F token is 10 billion, including:

- 28.5% allocated to the community;

- 23.5% is allocated to early supporters and advisors;

- 15% is allocated to the foundation;

- 15% allocated to subsequent protocol development

- 3% is allocated to liquidity.

The initial circulation is 12%, of which the airdrop is 7.5%

6. Online Time

- The Bybit Launchpool was launched on December 2 and ended on December 5;

- Bybit’s first launch time is Dec 6 (Friday) at 6pm Singapore time;

- The community airdrop will be available for collection simultaneously on Dec 6 (Friday) at 6pm Singapore time.

Summarize

There is still huge room for growth in the decentralized derivatives market, and the industry is in urgent need of innovators to bring better solutions. SynFuutres, which was launched this year and made its mark, has performed well in this field over the past year, and has also brought some new possibilities and opportunities to this field. We look forward to its future introduction of more innovations and further promotion of the industry's development.