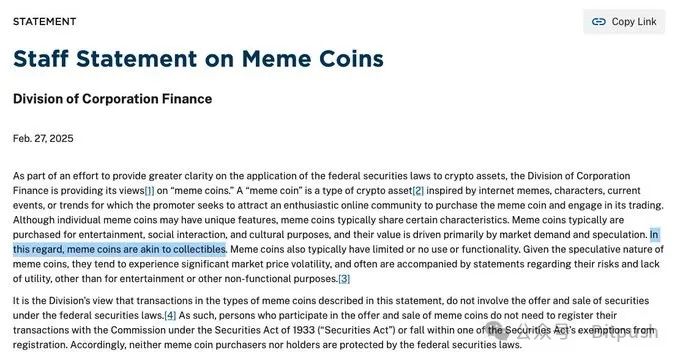

The U.S. Securities and Exchange Commission (SEC) has recently taken a series of actions: withdrawing investigations and enforcement actions against crypto giants such as Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, seeking a settlement with Justin Sun and the Tron Foundation, releasing its position on Memecoin, stating that it is not a "security," etc., sending a strong signal of softening regulation.

The new SEC leadership, represented by SEC Acting Chairman Mark T. Uyeda and Hester Peirce, is intent on ending its previous tense confrontational stance and instead seeking to establish a more constructive dialogue framework with the crypto industry.

Uyeda even publicly admitted that the SEC's regulation of cryptocurrencies in the past few years has mainly relied on "enforcement actions" rather than "full communication", suggesting that the regulatory approach needs to be reversed. Uyeda promised to promote transparency in crypto policy making, set up a cryptocurrency working group, and take the initiative to engage in high-level dialogue with major industry players, including the Cryptocurrency Innovation Council (CCI), MicroStrategy founder Michael Saylor, and Robinhood representatives, who have all met with the SEC.

Crypto reserve bills in U.S. states encounter obstacles, with Bitcoin volatility as a major concern

As the SEC's regulatory direction changes, state governments are becoming more cautious about Bitcoin reserves.

According to the database Bitcoin Laws, 24 states in the United States have proposed strategic crypto reserve bills. However, in the past month, the crypto reserve bills in Montana, North Dakota, South Dakota and Wyoming have all encountered setbacks and failed to pass.

Lawmakers have generally expressed concerns about the volatility of digital assets such as Bitcoin.

Jennifer Schulp, director of financial regulation research at the Cato Institute, said in an interview with Bloomberg that the volatility of Bitcoin and all digital assets is a recognized problem, and this problem will still exist even if the industry outlook is positive.

Since reserves are typically used for low-risk investments to protect future funding needs, Bitcoin's price volatility greatly reduces its attractiveness as a state reserve asset.

BitPush previously reported that South Dakota's reserve bill proposed allocating up to 10% of the state's funds to Bitcoin, but it was ultimately shelved. Although politicians including Trump and Senator Cynthia Lummis have proposed the idea of establishing a national strategic Bitcoin reserve, at present, states remain conservative in actual operations.

“If at the national level, a very pro-crypto government is taking the time to consider a strategic Bitcoin reserve, it makes sense that states would do the same and not rush into it,” Schulp said.

Stablecoins and market structure become legislative focus

The White House has set up a policy task force led by venture capitalist David Sacks to develop a comprehensive regulatory framework. At the same time, Congress has also accelerated its legislative pace. The Senate Banking Committee plans to vote on the stablecoin bill next month. Stablecoin regulation is expected to become a breakthrough in recent legislation.

Tyler Williams, the new crypto adviser to the U.S. Treasury Department, spoke at a private digital asset event in Washington, D.C., emphasizing that promoting stablecoin legislation is an important task at hand.

“We should be as supportive as possible of our friends in Congress who are working on stablecoin policy,” the former Galaxy Digital lawyer said at the event.

He believes that establishing a legal framework for dollar-denominated stablecoins would be “a really good use case” for industry allies to push for in Washington, saying: “If we can develop a regulatory framework for it in a way that allows states, bank regulators, and all of the ecosystem to operate under the same rules, I think that would be a pretty good outcome for Washington.”

Beyond stablecoin legislation, the deeper level of the game lies in how to set operating standards for exchanges such as Coinbase and how to define the securities and commodity attributes of digital assets, which is directly related to the division of responsibilities and power boundaries between the SEC and the Commodity Futures Trading Commission (CFTC).

Short-term regulatory pressure may ease, but long-term challenges remain severe

Overall, although the US states have not made rapid progress in crypto reserves, the adjustment of the SEC's regulatory strategy at the federal level has brought some breathing space to the crypto industry. However, there are still many variables in the future regulatory framework. The friction between the crypto industry and the SEC may ease temporarily, but the "protracted war" surrounding cryptocurrency legislation has just begun.