By: Bright, Foresight News

On March 19, US time, the U.S. Federal Reserve ended its two-day monetary policy meeting and announced that it would maintain the target range of the federal funds rate between 4.25% and 4.50%, in line with market expectations.

The cryptocurrency market rose in response, with Bitcoin's four-hour line rising for nine consecutive days, reaching a peak of $87,453.67. Ethereum strongly broke through the range of fluctuations, breaking through the $2,000 mark, reaching a peak of $2,069.90. Market liquidity expectations are relatively improved.

As of 13:00 on March 20, the total amount of liquidation in the whole network in the past 24 hours was $355 million, including $257 million of short positions and $97.7425 million of long positions, mainly short positions. It is worth noting that before the Federal Reserve FOMC meeting, the rise of Ethereum once caused the liquidation amount of Ethereum to exceed that of Bitcoin.

Powell: Fed needs "technical adjustments"

The Fed did not move its policy as expected, but it did send a lot of dovish signals. Fed Chairman Powell mentioned "uncertainty" 16 times in an hour-long speech at the White House press conference, repeatedly emphasizing the uncertainty of the US economic outlook.

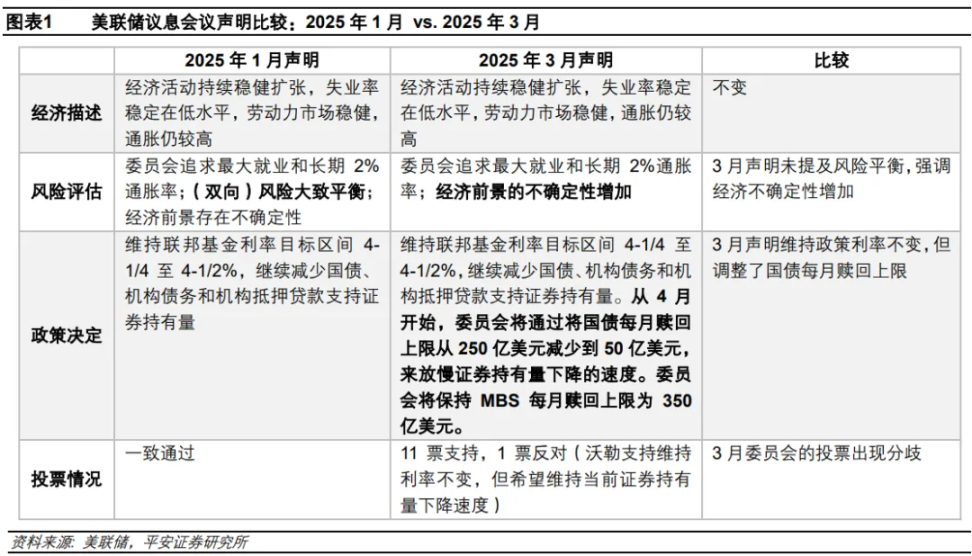

Compared with the interest rate meeting in January, the Fed deleted the statement that "the risks to achieving employment and inflation goals are roughly balanced" and raised the core PCE inflation forecast to 2.8% in 2025. This adjustment may imply that the Fed's confidence in a soft landing of the economy has weakened, and global markets have begun to bet on future interest rate cuts.

At the same time, since April, the monthly reduction limit of US Treasury bonds has dropped sharply from US$25 billion to US$5 billion, and the reduction limit of MBS has remained at US$35 billion. Although Powell called this move a "technical adjustment", the market interpreted the Fed's move to significantly slow down the pace of balance sheet reduction as the end of quantitative tightening (QT). For a time, US Treasury yields fell 8-11 basis points, gold broke through US$3,050/ounce to a record high, and the US stock market Nasdaq and Dow Jones rose.

Trump: Cut interest rates immediately!

Trump posted on Truth Social after the FOMC meeting: "As US tariffs begin to transition to the economy (easing!), the Fed would be better off cutting rates. April 2 is American Liberation Day!!"

Trump strongly demanded that the Federal Reserve "immediately cut interest rates" and accused the high interest rate policy of being a continuation of "Biden inflation." Last month, Trump posted on Truth Social that "interest rates should be lowered, which will go hand in hand with the upcoming tariffs!! "It can be seen that the core logic is: lowering interest rates can reduce the government's debt costs of up to 36 trillion, while cooperating with tariff policies to promote the return of manufacturing.

Earlier, Trump's national economic adviser Hassett publicly stated that the White House predicts that the economic growth rate in 2025 will be 2.5%, which is much higher than the Fed's latest forecast of 1.7%. The disagreement stems from Trump's optimism about tariff policy - he believes that protectionist measures can "revitalize manufacturing", but economists warn that it may trigger a global trade war and push US inflation to more than 2.5%. Fitch Ratings pointed out that Trump's tariffs and the "huge uncertainty" surrounding tariffs are two driving factors behind the potential economic slowdown and short-term price increases. This uncertainty is likely to freeze any interest rate cuts by the Federal Reserve, leading to a widening gap between Trump and the Federal Reserve.

Crypto Season Change: Slow Recovery

In the crypto-native market, recent favorable news from the regulatory level has led to the early recovery of some currencies, which may further promote the warming of the market under the premise of macroeconomic relaxation.

On March 12, the direct positive stimulus of Abu Dhabi's sovereign fund's $2 billion investment in Binance led to BNB and the BSC ecosystem taking the lead in the recovery of the crypto chain, and gave birth to phenomenal BSC meme trends such as MUBARAK, whose market value exceeded $200 million. On March 19, according to DeFiLlama data, the BSC ecosystem DEX's trading volume in the past 24 hours reached $2.664 billion, surpassing Ethereum's $1.356 billion and ranking first.

On the evening of March 19, the good news that "the US SEC will give up appealing Ripple" directly stimulated XRP to rise by 11.46% in a short period of time, with the highest point reaching $2.59. On March 20, Ripple CEO Brad Garlinghouse revealed in an interview with Bloomberg that the XRP ETF is expected to be listed by the end of 2025. He also said that Ripple Labs' IPO is not impossible.

Regarding the market outlook, BitMEX co-founder Arthur Hayes tweeted on X, "Powell has fulfilled his promise, and quantitative tightening (QT) basically ended on April 1. Next, if we want to really push the market into a bull market, we must either restore the supplementary leverage ratio (SLR) exemption policy or restart quantitative easing (QE). $77,000 may be the bottom of Bitcoin, but the stock market may have to go through another round of shocks before Jay (Powell) can completely turn to the Trump team."

Wall Street traders are already betting on rate cuts in June and July. But in the short term, those who are still in the crypto market need to remain flexible, after all, the "Sword of Damocles" of tariffs that will take effect on April 2 is still hanging high. Perhaps it's time to, as Arthur Hayes said, "keep cash on hand."