Author: Alex Pack and Alex Botte, Partners at Hack VC

Compiled by: Yangz, Techub News

summary

- Ethereum has not performed as well as mainstream currencies such as Bitcoin and Solana in this cycle. At least in the eyes of opponents, the culprit is Ethereum's strategic decision to modularize. But is this true?

- In the short term, the answer is yes. We have found that Ethereum’s shift to a modular architecture has had an impact on the price of ETH due to lower fees and reduced token consumption.

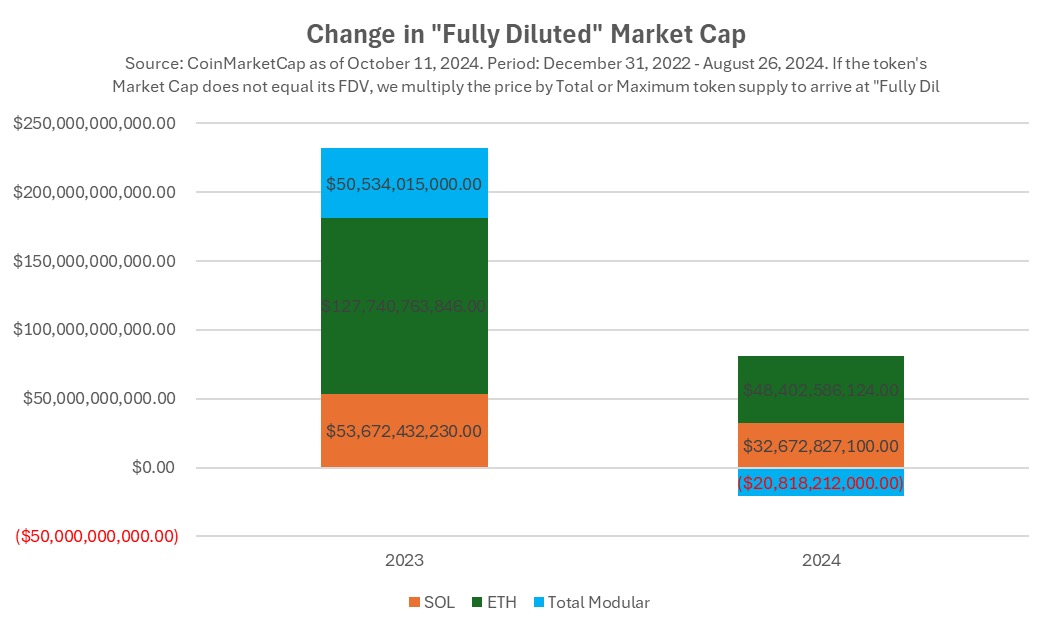

- If you add up the market cap of Ethereum and its modular ecosystem, the picture changes. In 2023, the value generated by Ethereum modular infrastructure tokens is about the same as the value of Solana as a whole, both $50 billion. But in 2024, these tokens as a whole will not perform as well as Solana. In addition, the gains of these tokens mainly belong to the team and early investors, not ETH token holders.

- From a business strategy perspective, Ethereum’s modular transformation is a reasonable way to maintain its ecological dominance. The value of a blockchain depends on the size of its ecosystem, and while Ethereum’s market share has fallen from 100% to 75% in nine years, it is still a high share. We compared it with Web2 cloud computing company Amazon Web Services, whose share fell from nearly 100% to 35% during the same period.

- From a longer-term perspective, the biggest benefit of Ethereum’s modular approach is that it makes the network future-proof against technological advances that could make it obsolete. With L2, Ethereum has successfully survived the first major “catastrophe” of L1, laying a good foundation for its long-term resilience (albeit with trade-offs).

What went wrong?

Compared to Bitcoin and Solana, Ethereum has performed poorly in this round of market. Ethereum has risen 121% since 2023, while Bitcoin and SOL have risen 290% and 1452% respectively. We have heard many claims about this phenomenon, saying that the market is irrational, the technical roadmap and user experience cannot keep up with peers, and the market share of the Ethereum ecosystem is being taken away by competitors such as Solana. So, is Ethereum destined to become the AOL or Yahoo of the cryptocurrency field?

The main culprit for Ethereum’s poor performance is actually a very deliberate strategic decision made by Ethereum nearly five years ago to move to a modular architecture and subsequently decentralize and unbundle its infrastructure roadmap.

In this article, we explore a modular approach to Ethereum, using data-driven analysis to assess how this strategy affects ETH’s short-term performance, Ethereum’s market position, and its long-term prospects.

Ethereum’s strategic shift toward modular architecture: How crazy is it?

In 2020, Vitalik and the Ethereum Foundation (EF) made a bold and controversial call to unbundle the various parts of the Ethereum infrastructure stack. Instead of Ethereum handling all aspects of the platform (execution, settlement, data availability, ordering, etc.), Ethereum is intentionally allowing other projects to provide these services in a composable manner. At first, they encouraged the new Rollup protocol as Ethereum L2 to handle execution issues (see Vitalik's 2020 article "Rollup-centric Ethereum Roadmap"), but now there are hundreds of different infrastructure protocols competing to provide technical services that were once thought to be the exclusive monopoly of L1.

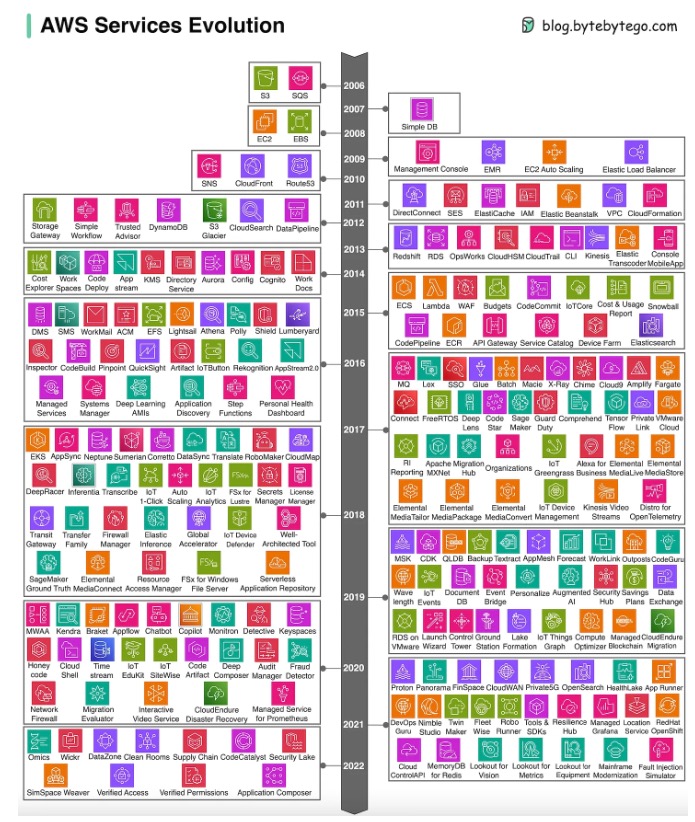

To better understand how radical this idea is, imagine a scenario in Web2. A Web2 service similar to Ethereum is Amazon Web Services (AWS), the leading cloud infrastructure platform for building centralized applications. Imagine if AWS had decided to focus only on its flagship products like storage (S3) and compute (EC2) when it was first launched 20 years ago, instead of the dozens of different services it offers now. AWS would have missed out on great revenue opportunities and been unable to market its expanding suite of services to customers. With a full suite of products and services, AWS could have created a "walled garden" that would have made it difficult for its customers to integrate with other infrastructure providers, thereby locking in its customers. Of course, this is what happened. AWS now offers dozens of services, making it difficult for customers to leave its ecosystem, and its revenue growth rate is amazing (from hundreds of millions of dollars in the early days to about $100 billion in annual revenue today).

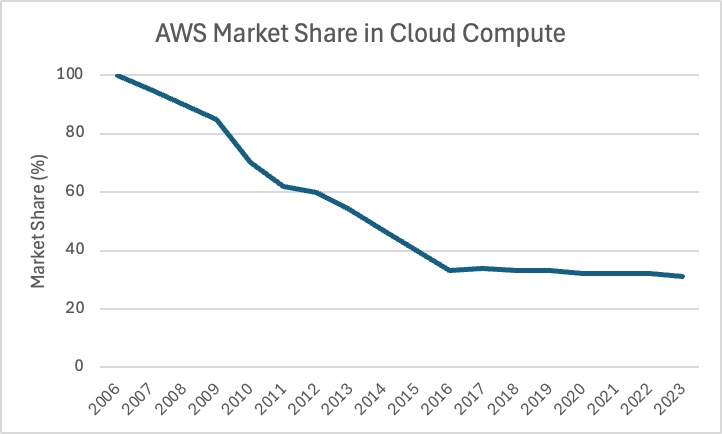

However, in terms of market share, over time, AWS's market share has gradually been taken away by other cloud computing providers. Competitors such as Microsoft Azure and Google Cloud have been steadily expanding their market share every year, and AWS's market share has dropped from the initial 100% to around 35% now.

What if AWS took a different approach? What if AWS recognized that other teams might build certain services better and opened up its APIs, prioritized composability, and encouraged interoperability, rather than creating a closed environment? AWS could have allowed an ecosystem of developers and startups to build complementary infrastructure, resulting in better, more professional infrastructure, a more developer-friendly ecosystem, and a better overall experience. This wouldn't have brought AWS more revenue in the short term, but it would have given AWS a larger market share and a more vibrant ecosystem than its competitors.

Still, it may not be worth it for Amazon. Because it is a public company, it needs to optimize for revenue, not a "more vibrant ecosystem." For Amazon, splitting and modularization may not make sense. But for Ethereum, it may make sense because Ethereum is a decentralized protocol, not a company.

Decentralized protocols, not companies

Like companies, decentralized protocols have usage fees, or to some extent “revenues.” But does this mean that the value of the protocol should be based solely on these revenues? No, this is not the case.

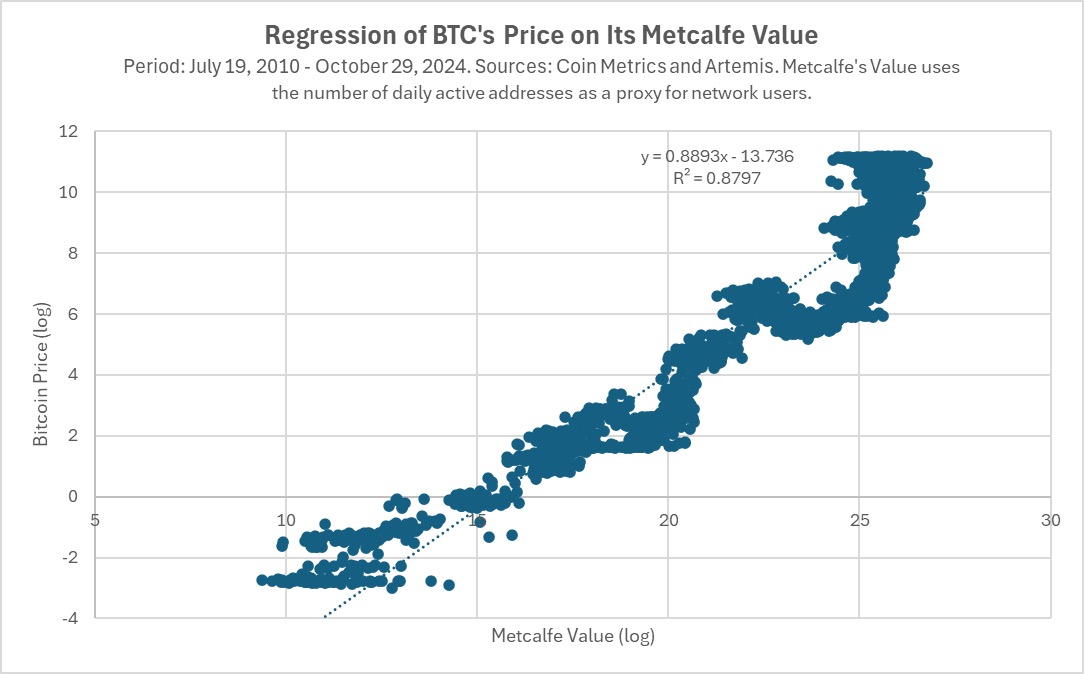

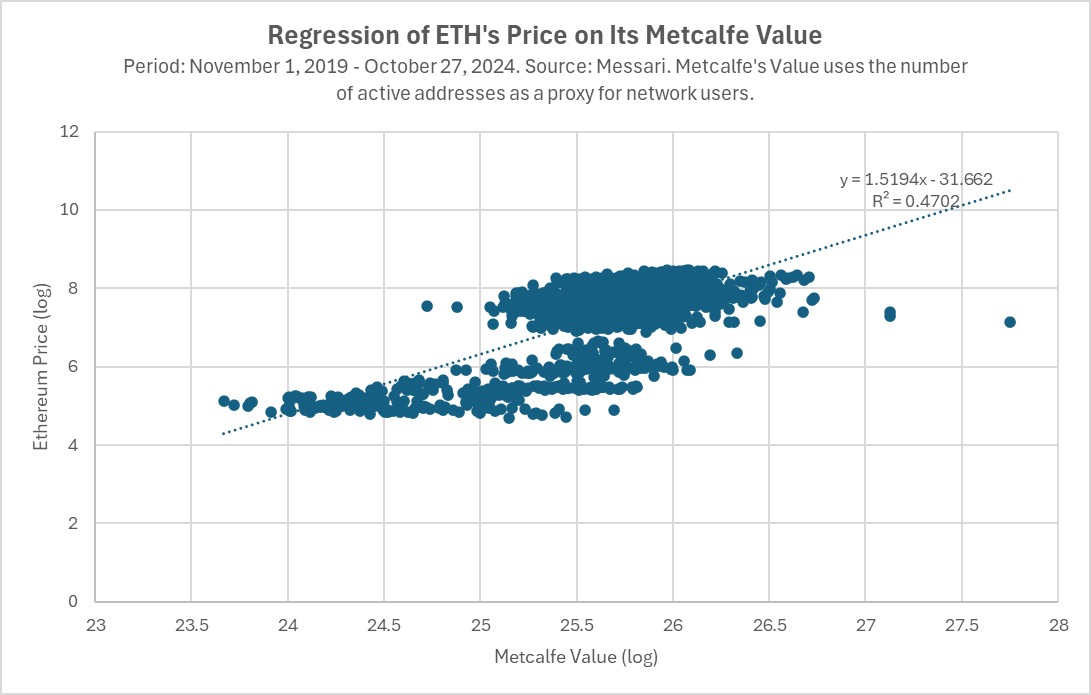

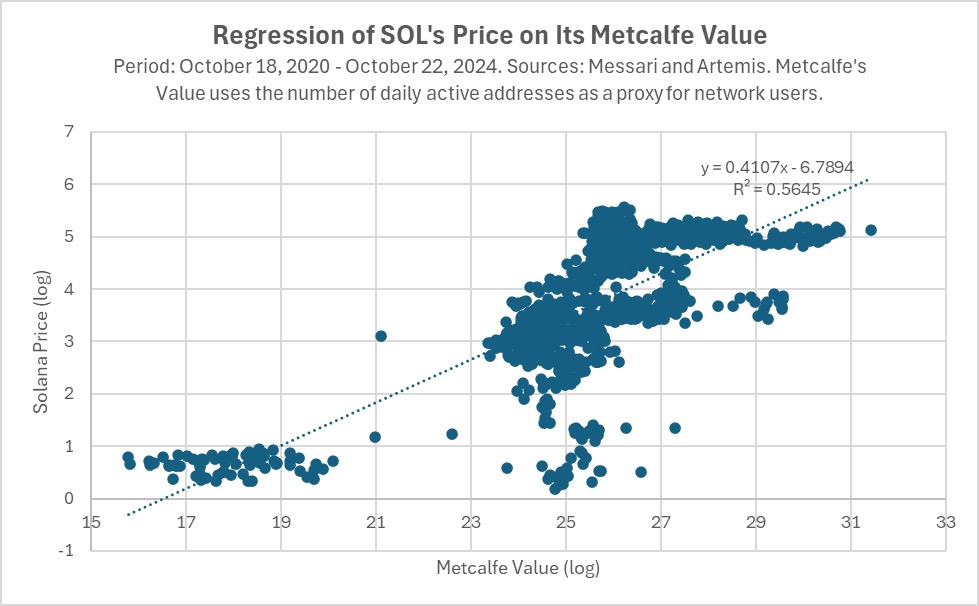

In Web3, the value of a protocol is determined by the overall activity on its platform, by having the most active ecosystem of builders and users. Below is our analysis of the relationship between token price and Metcalfe value (a measure of the number of users in the network) for Bitcoin, Ethereum, and Solana. In all cases, token price has been highly correlated with Metcalfe value, a relationship that has persisted for several years, and in the case of Bitcoin, for more than a decade.

Why is the market so focused on ecosystem activity when pricing these tokens? Stocks are priced based on growth and earnings. Currently, the theory of how blockchains accrue value to their tokens is nascent and has little explanatory power in the real world. Therefore, it makes sense to value the network based on its strength (number of users, assets, activity, etc.).

More specifically, token prices should actually reflect the future value of their network (just like stock prices reflect the future value of a company, not its current value). This brings us to the second reason why Ethereum might want to modularize, which is to use modularity as a kind of "future-proofing" to increase the likelihood that Ethereum will remain dominant in the long term.

In 2020, when Vitalik wrote the "Rollup-centric Roadmap", Ethereum was at the 1.0 stage. Ethereum is the first smart contract blockchain ever, but it is clear that there will be several orders of magnitude (OOM) improvements in the future in terms of scalability, cost, and security of blockchains. The biggest risk for first movers is that they are slow to adapt to new technological paradigm shifts and miss the next OOM leap. In the case of Ethereum, this is the transition from PoW to PoS and the transition to a blockchain with 100 times greater scalability. Ethereum needs to foster an ecosystem that can scale and make major technological advances, otherwise it risks becoming the Yahoo or AOL of its time.

In the world of Web3, decentralized protocols replace companies, and Ethereum believes that in the long run, cultivating a strong modular ecosystem is more valuable than mastering all infrastructure, even if it means giving up control of the infrastructure roadmap and revenue from core services.

Next, let’s look at how this modular decision is implemented using data.

Ethereum modular ecosystem and its impact on ETH

We look at the impact of modularization on Ethereum from the following four aspects:

- Short Price (Unfavorable)

- Market capitalization (somewhat favorable)

- Market share (favorable)

- Future technology roadmap (to be discussed)

Cost and price: Unfavorable

In the short term, Ethereum’s decision has had a clear impact on the price of ETH. Although the price of Ethereum is still rising sharply from the trough, in certain periods of time, Ethereum’s performance is not as good as many competitors such as Bitcoin, SOL, and even the Nasdaq Composite Index.

This is undoubtedly largely due to its modular strategy.

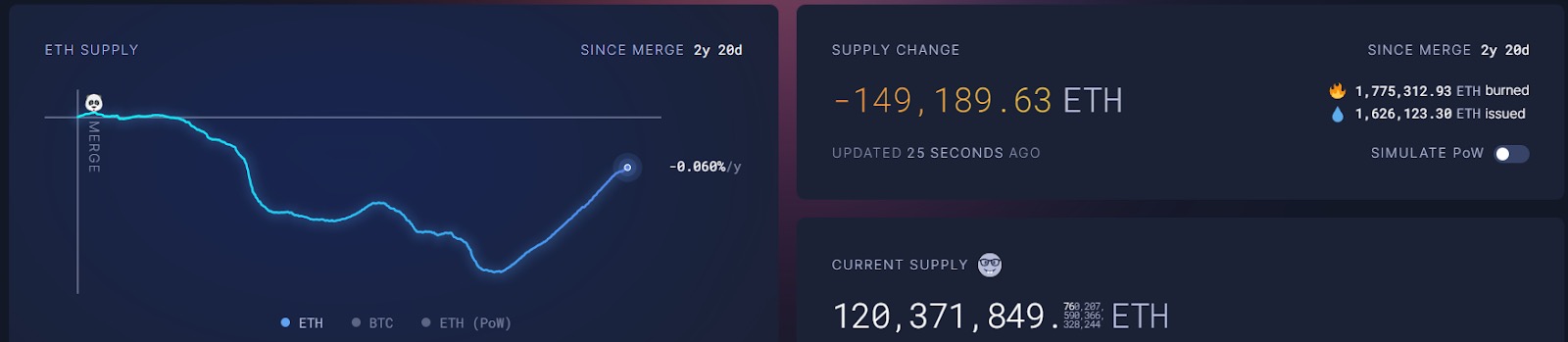

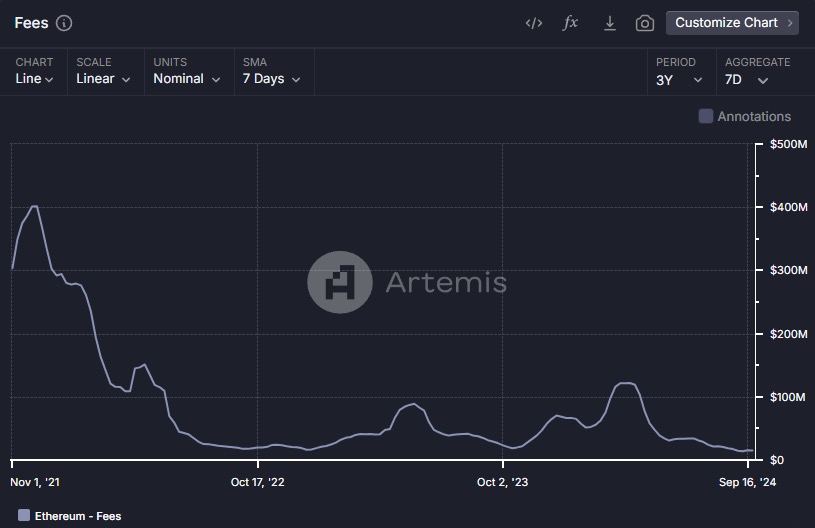

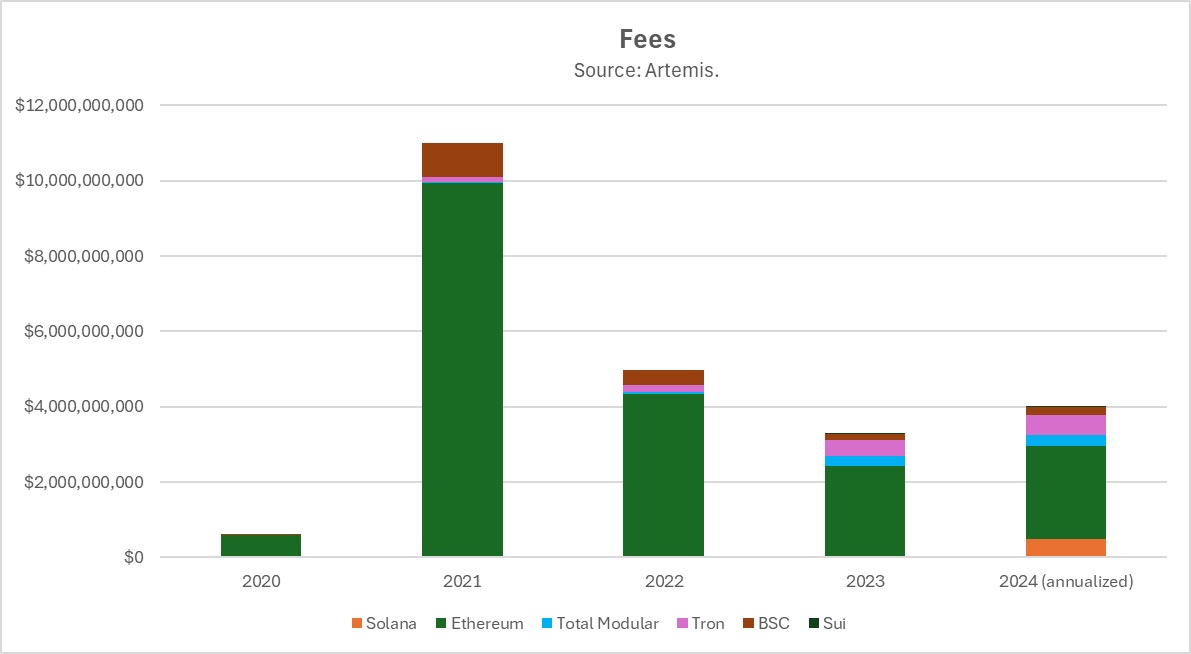

The first way Ethereum's modular strategy affects the price of ETH is by reducing fees. In August 2021, Ethereum introduced EIP-1559, which means that excess fees paid to the network will cause ETH to be destroyed, thereby limiting supply. This is somewhat equivalent to stock buybacks in the public stock market, which will put positive pressure on prices. In fact, it did work for a while.

But with the launch and development of L2 for execution and even alternative data availability (DA) layers like Celestia, Ethereum fees have fallen. By abandoning core revenue-generating services, Ethereum's fees and revenue have fallen. This has had a big impact on the price of ETH.

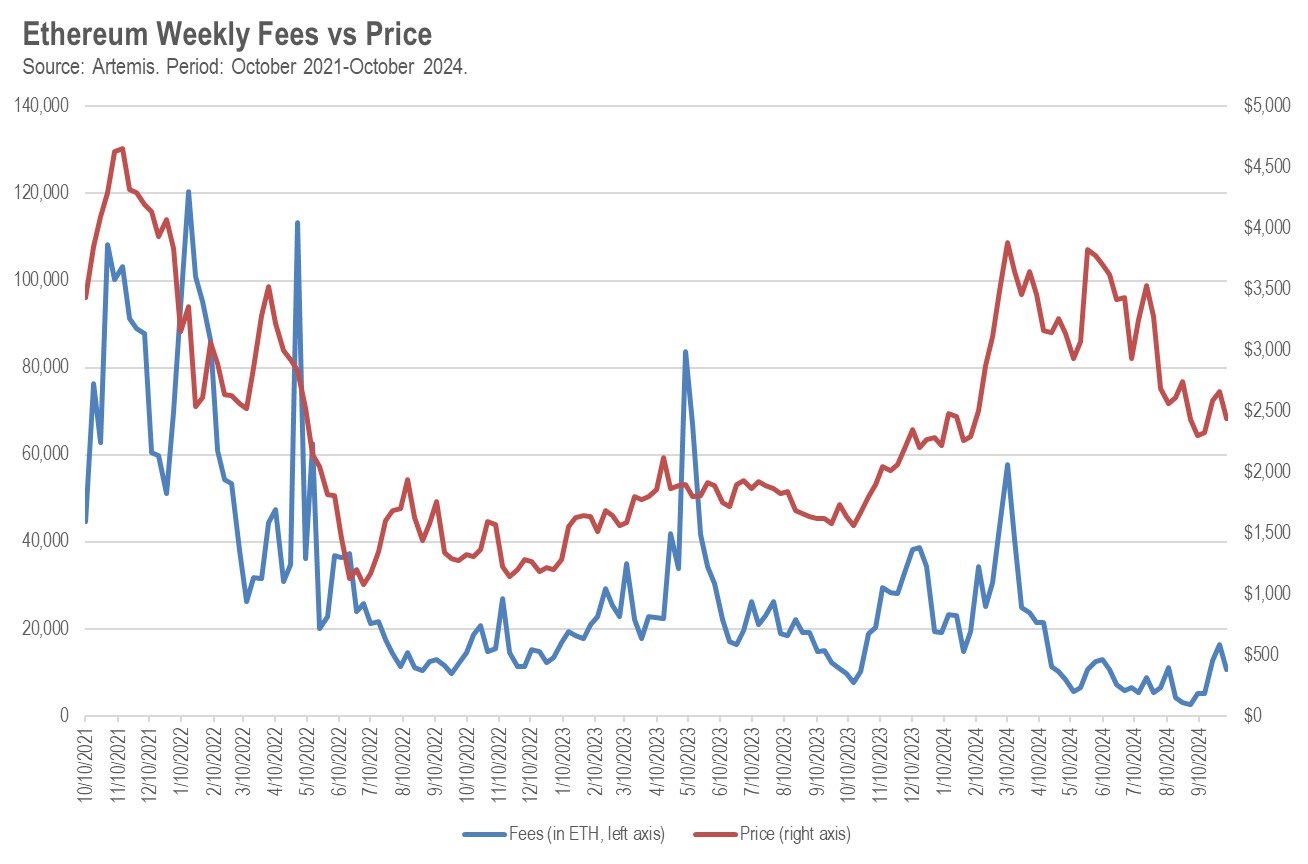

Over the past three years, the relationship between Ethereum fees (in ETH) and ETH price has been statistically significant, with a weekly correlation of +48%. If fees generated by Ethereum fall by 1,000 ETH in a week, the ETH price depreciates by an average of $17.

Of course, these fees don’t go nowhere, they flow to new blockchain protocols, including L2 and DA layers, etc. This brings us to the second reason why modular strategies may hurt ETH prices, that is, most of these new blockchain protocols have their own native tokens. Before, investors only needed to buy one infrastructure token to get exposure to all the exciting growth happening in the Ethereum ecosystem, but now they have to choose from many different tokens (CoinMarketCap lists 15 tokens in its "modular" category, and dozens more are receiving venture capital in the private market).

This new category of modular infrastructure tokens could hurt the price of ETH in two ways. First, if blockchains were considered companies, then they should be completely devalued, and the sum of the market caps of all "modular tokens" would become the market cap of ETH. This is usually the case in the stock world. When companies split, the market cap of the old company usually decreases as the market cap of the new company increases.

But for ETH, it could be worse than that. Most crypto traders aren’t particularly sophisticated investors, and when faced with the prospect of having to buy dozens of tokens to get “all the cool growth that’s going to happen on Ethereum” instead of just one, they might get overwhelmed and simply not buy any tokens. This psychological overhead, along with the transaction costs of buying a basket of tokens instead of just one, could hurt the price of both Ethereum and modular tokens.

Market capitalization: Favorable (to some extent)

Another way to estimate the impact of Ethereum’s modular roadmap on its success is to look at how its absolute market cap has changed over time. In 2023, Ethereum’s market cap increased by $128 billion. In contrast, Solana’s market cap increased by $54 billion. While the absolute numbers are higher, Solana’s growth was off a much lower base, which is why its price has increased by 919% while ETH’s has only increased by 91%.

However, the picture changes if you factor in the market cap of all the new “modular” tokens that come with Ethereum’s modular strategy. In 2023, this number grows by $51 billion, roughly in line with Solana’s market cap growth.

What does this mean? One explanation is that with the shift in modular strategy, the Ethereum Foundation has created the same value for a modular infrastructure ecosystem that is consistent with Ethereum as Solana. Not to mention the $128 billion market cap it has created for itself. Imagine how envious Microsoft or Apple would be of Ethereum if they spent years and billions of dollars trying to build their own developer ecosystem around their products.

However, this is not the case in 2024. SOL and ETH continue to grow (albeit modestly), while the market cap of modular blockchains is declining overall. This may be the market losing confidence in the value of Ethereum's modular strategy in 2024, or it may be pressure from token unlocking, and of course, it may be that the market is overwhelmed by the psychological cost of buying a basket of tokens to go long on Ethereum-related infrastructure, compared to just buying a single token to go long on the Solana technology ecosystem.

Let’s move from price action and what the market is telling us to the actual fundamentals themselves. Maybe the market in 2024 is wrong and the market in 2023 is right. Does Ethereum’s modular strategy help or hinder it from becoming the leading blockchain ecosystem and cryptocurrency?

Ethereum ecosystem and ETH’s dominance: Favorable

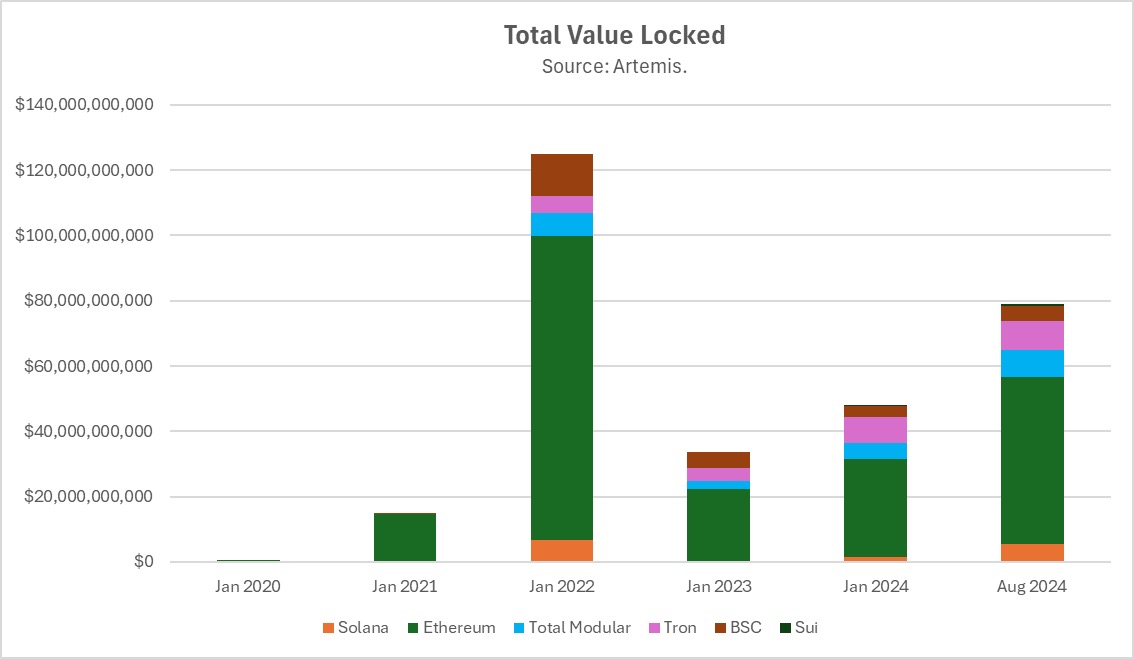

In terms of fundamentals and usage, infrastructure aligned with Ethereum is performing exceptionally well. Ethereum and its L2s have the highest total value locked (TVL) and fees among their peers, 11.5x that of Solana, with L2 alone outperforming Solana by 53%.

If we think in terms of TVL market share, Ethereum had 100% market share when it was launched in 2015. Despite hundreds of L1 competitors, Ethereum and its modular ecosystem still maintains about 75% market share to this day.

In 9 years, the market share has dropped from 100% to 75%, which is pretty good! To put it in perspective, AWS's market share dropped from 100% to about 35% in about the same period.

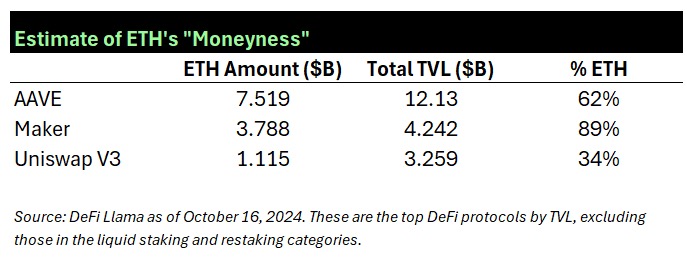

But is ETH really benefiting from the dominance of the "Ethereum ecosystem"? Or is Ethereum and its modular parts thriving without ETH itself as an asset? It turns out that ETH is a ubiquitous part of the broader Ethereum ecosystem. When Ethereum expanded to L2, so did ETH. Most L2s use ETH to pay for gas, and most L2s have at least 10 times more ETH in their TVL than other tokens. Looking at the table below, you can see the dominance of ETH assets in the three largest DeFi applications in the Ethereum ecosystem in their mainnet and L2 instances.

Technical level: To be discussed

From a technical roadmap perspective, Ethereum’s decision to modularize the L1 chain into independent components allows projects to specialize and optimize in their specific areas. As long as these components remain composable, DApp developers can build using the best existing infrastructure, ensuring efficiency and scalability.

Another greater benefit of modularity is that it makes the protocol "future-proof". Imagine if a new technological innovation changes the rules of the game, only the protocol that adopts this innovation can survive. This situation often happens in the history of technology. For example, AOL missed the transition from dial-up to high-speed broadband Internet, and its valuation fell from $200 billion to $4.5 billion. And Yahoo missed the transition to mobile Internet due to its slow adoption of new search algorithms (such as Google's PageRank), and its valuation fell from $125 billion to $5 billion.

However, if your technology roadmap is modular, then as an L1 you don’t have to catch every new wave of technological innovation, your modular infrastructure partner can catch it for you.

So, has Ethereum’s strategy worked? Let’s take a look at the infrastructure that has actually been built to match Ethereum:

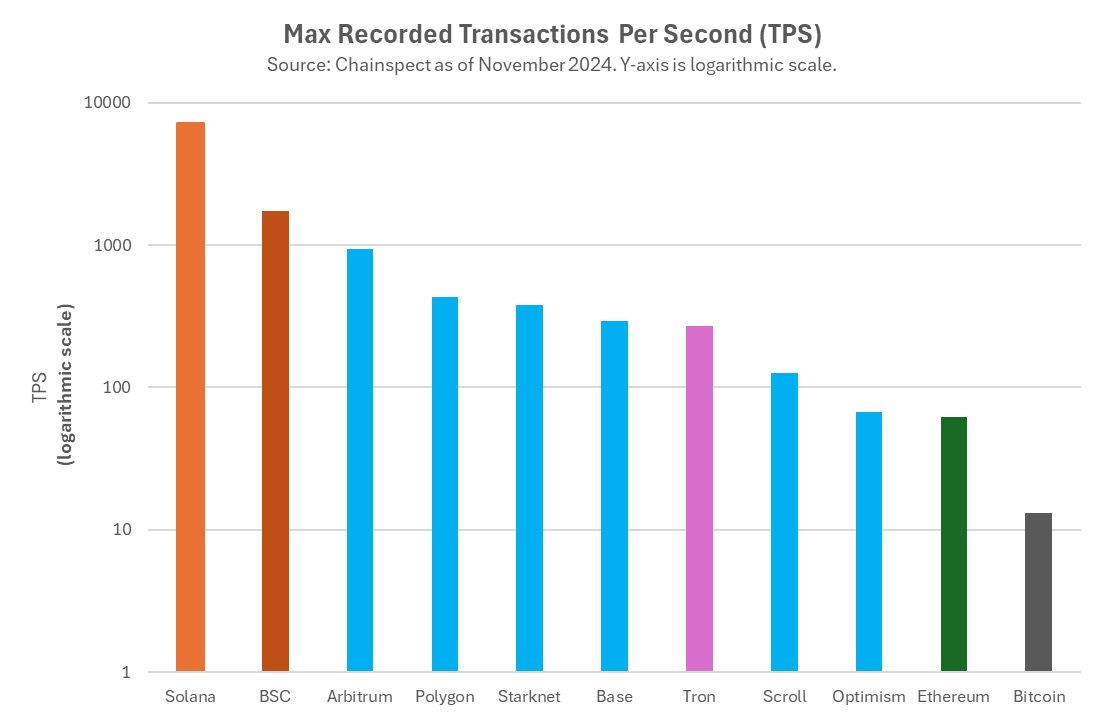

L2 with best-in-class scalability and execution cost. At least two novel technical approaches have been successful here, namely optimistic Rollup represented by Arbitrum and Optimism, and Rollup based on zero-knowledge proof represented by ZKSync, Scroll, Linea and StarkNet. In addition, there are more high-throughput, low-cost L2. Cultivating two blockchain technologies that bring scalability OOM improvements to Ethereum is no easy task. Dozens (if not hundreds) of L1s launched after Ethereum have not yet launched version 2.0 with a hundred-fold scalability and cost improvement. With these L2s, Ethereum has survived the "first mass extinction event" of blockchain and successfully expanded to a hundred-fold transaction volume per second (TPS).

- New blockchain security model. Innovation in blockchain security is crucial to the survival of a protocol. Just look at how every mainstream L1 today uses PoS instead of PoW. The "shared security" model pioneered by EigenLayer may be the next major shift. Although other ecosystems have also launched other shared security protocols, such as Bitcoin's Babylon and Solana's Solayer, Ethereum's EigenLayer is a pioneer.

- New Virtual Machines (VMs) and Programming Languages. One of the biggest criticisms of Ethereum is the Ethereum Virtual Machine (EVM) and its programming language, Solidity. Solidity is a low-abstraction programming language that, while easy to code in, is prone to vulnerabilities and difficult to audit, which is one of the reasons why smart contracts based on Ethereum have been hacked. For non-modular blockchains, it is almost impossible to try to use multiple VMs or replace the initial VM with another one, but this is not the case for Ethereum. A new wave of alternative VMs are being built in the form of L2, allowing developers to code in alternative languages that do not use the EVM but can still build in the Ethereum ecosystem. Examples of this include Movement Labs, which is adopting the Move VM built by Meta and promoted by Sui and Aptos; zk-VMs such as RiscZero, Succinct, and implementations built by the a16z research team; and teams such as Eclipse that are bringing Rust and Solana VMs to Ethereum.

- New approaches to scalability. Like other internet infrastructure or AI, we can expect OOM scalability improvements every few years. Even now, Solana has been waiting for years for the next major improvement, called Firedancer, built by a single team (Jump Trading). In addition, there are new hyper-scalability technologies in development, such as parallelized architectures from L1 teams such as Monad, Sei, and Pharos. If Solana cannot keep up, these technologies may pose a threat to its survival, but not Ethereum, it will simply incorporate these technological advances through a new L2. This is exactly what new projects such as MegaETH and Rise are trying.

These modular infrastructure partners have helped Ethereum integrate cryptocurrency’s biggest technological innovations into its own ecosystem, avoid catastrophe, and innovate alongside its competitors.

However, this also comes at a cost. As Kyle from Composability said, Ethereum adds a lot of complexity to the user experience when it adopts a modular architecture. It will be easier for ordinary users to get started with a monolithic chain like Solana because they don’t have to deal with issues such as cross-chain and interoperability.

Summarize

So, in summary, what does Ethereum’s modular strategy bring?

- The modular ecosystem has a strong “opinion.” In 2023, the market gave the same growth to modular infrastructure tokens aligned with Ethereum as it did to Solana, but this was not the case in 2024.

- At least in the short term, the modular strategy hurts the price of ETH by resulting in lower fees.

- But if you think about the modular approach from a business strategy perspective, things start to make more sense. In the 9 years since Ethereum was founded, its market share has dropped from 100% to 75%, while Web2 competitor AWS has dropped to around 35% in the same period. In the world of decentralized protocols, the scale of the ecosystem and the dominance of the token are more important than fees.

- If you consider the modularity strategy from a long-term perspective and the need for Ethereum to fend off OOM technology improvements in the future that could make it the AOL or Yahoo of the cryptocurrency world, then Ethereum is doing pretty well. With L2, Ethereum has already survived the first “mass extinction event” of the L1 chain.

Of course, all this comes at a price. Ethereum’s modular composability is worse than that of a single chain bundled together, which hurts the user experience.

As for when (if ever) the benefits of modularity will offset the loss of fees and competition from infrastructure tokens aligned with modular Ethereum when it comes to actual ETH price, it is unclear. Of course, this is great for the early investors and teams behind these new modular tokens as they can get a piece of the Ethereum market cap, but the fact that modular tokens have been launched at unicorn valuations in many cases means that these economic benefits are unevenly distributed.

In the long run, Ethereum may become a stronger player by investing in nurturing the broader ecosystem. Rather than losing ground in the cloud computing market like AWS did, or losing everything like Yahoo and AOL did in the Internet platform wars, it is laying the foundation for the next wave of blockchain innovation to adapt, scale, and thrive. In an industry where success is driven by network effects, Ethereum's modular strategy may be the key to maintaining the dominance of smart contract platforms.