Author: Zen, PANews

As an important bridge between traditional finance and cryptocurrency, real world assets (RWA) are gradually becoming the focus of market attention. However, the current RWA market still faces many challenges: low efficiency, high cost, and the connection between the traditional financial system and the on-chain ecosystem is not smooth, and the bottleneck for further development needs to be broken through.

To solve this problem, a fully integrated and modular chain Plume application focusing on RWAfi was born. As the first RWA public chain that truly serves crypto-native users, Plume is committed to providing a more efficient, transparent and convenient solution A to create a dynamic, fluid and composable solution, redefining finance by providing the RW market, making it as versatile as native crypto assets.

Financing of tens of millions, deployed assets exceeding one billion

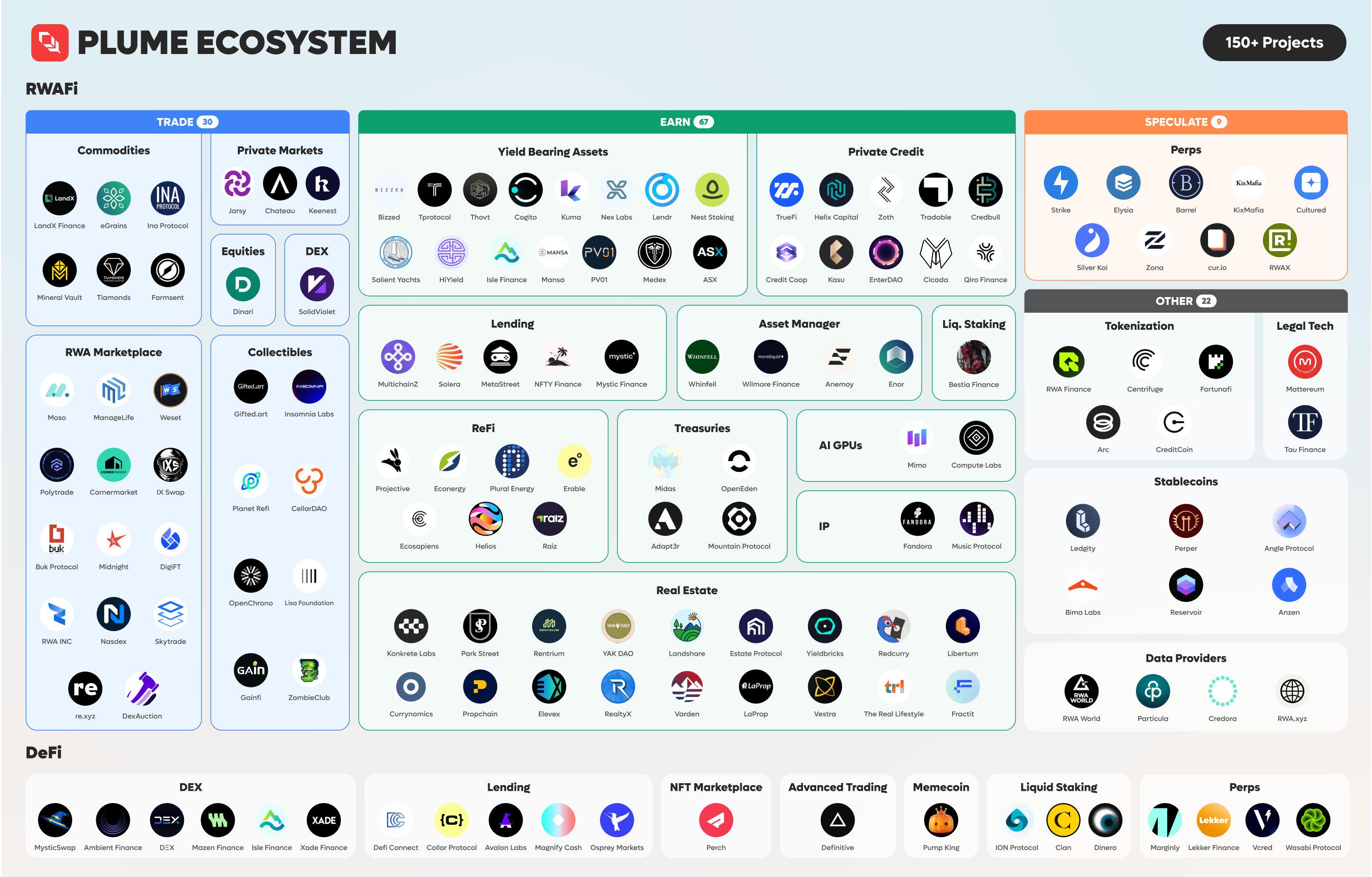

After nearly a year of rapid development, Plume Network has been recognized by the community, institutions, emerging banks and crypto-native protocols (such as lending agreements, perpetual contract DEX, AMM, etc.) as the best solution for RWAfi. Currently, more than 180 projects have been built on Plume, with cumulative assets deployed exceeding US$1 billion, and hundreds of millions of assets are about to be put on the chain. In the two-month test campaign, Plume also achieved remarkable results: the number of active wallets exceeded 3.75 million, and the on-chain transaction volume exceeded 270 million, fully demonstrating the activity of the ecosystem and the enthusiasm of users to participate.

In November, Plume held a pre-deposit event with an initial goal of $5 million, but it was quickly filled in 70 seconds, with a response beyond expectations. In the face of huge community demand, Plume immediately raised the upper limit to $30 million, and eventually exceeded the goal in 90 minutes, with oversubscription reaching 6 times the original plan.

Plume's growth potential has also been recognized by many well-known VCs, and it has now raised a total of $30 million in financing. In May of this year, Plume announced the completion of a $10 million seed round of financing, led by Haun Ventures, with participation from Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. This round of financing has laid a solid foundation for Plume's innovation and expansion in the RWAfi field.

On December 18, Plume announced the completion of a $20 million Series A financing (total raise of 30M). Investors in this round of financing include Brevan Howard Digital, Haun Ventures, Galaxy Ventures, Lightspeed Faction, Superscrypt, Hashkey, Laser Digital (under Nomura Group), A Capital, 280 Capital, SV Angel, Reciprocal Ventures, etc.

With the help of DeFi concept, a blockchain ecosystem designed specifically for RWA

Although there are already quite a few Layer 1s in the industry, and new projects are constantly entering the field, making the competition increasingly fierce. However, due to the customized requirements of permission management, compliance, liquidity, etc. in the series of operations of real-world assets on the chain, Plume realized the need to create a blockchain designed specifically for RWA and achieve the goal by embedding more customization and functions at the network level.

Unlike the traditional RWA model, by leveraging DeFi principles, Plume aims to create a more efficient and accessible ecosystem for crypto users and traditional financial institutions, the first and only protocol focused on RWAfi. RWAfi is a new model in the field of blockchain finance, which means that tokenized RWA is as composable and flexible as native crypto assets. Based on the concept of focusing on adopting crypto-native, Plume starts from the perspective of building what crypto users really need, giving priority to composability, liquidity, permissionlessness and interoperability, and designing products and businesses around RWAfi.

Plume's modular infrastructure is designed to support the tokenization and management of real-world assets. The core components of its architecture are the tokenization engine Arc, the smart wallet, and the on-chain data highway Nexus. Through the collaborative work of these components, Plume provides a smooth and secure environment for managing multiple asset classes, ensuring compliance, and facilitating data integration.

Arc is designed to simplify the creation, registration and management of tokenized RWAs. It supports the tokenization of physical and digital assets and integrates with compliance and data systems to ensure the accuracy, security and compliance of each asset in the network. As an efficient asset tokenization engine, Arc's structure enables asset issuers to tokenize assets quickly and economically, while automated compliance checks reduce operational complexity and costs.

Plume's smart wallet is designed to truly realize the composability of RWA assets, providing customizable control functions for managing digital assets, income tools, and contract-based interactions. Users can access advanced DeFi functions such as income generation and liquidity management through the smart wallet. It achieves maximum functionality while maintaining asset security and user control.

Nexus is a fundamental component of the Plume architecture, bringing real-world data to the blockchain to power new use cases such as prediction markets, DeFi applications, and speculative indexes. Nexus' data pipeline integrates reliable off-chain data, connects with external sources, and delivers real-time, actionable insights directly into the blockchain. By providing accurate, real-time data, users can make informed decisions about tokenized assets, thereby improving the functionality and accuracy of on-chain financial products.

In terms of core functions, Plume focuses on accelerating the on-chain of real-world assets, liquidity and regulatory compliance, providing a comprehensive framework covering liquidity management, built-in anti-money laundering (AML) compliance and data access functions.

Plume uses its network of compliance partners to verify the compliance of tokenized assets and ensure that transactions comply with relevant regulatory requirements. It simplifies the regulatory compliance process and user registration process by integrating compliance directly into the platform. With integrated compliance functions, users can participate in RWAfi transactions with confidence and access a wider range of opportunities on the Plume network while meeting the necessary legal standards.

In terms of key asset liquidity and market efficiency, Plume promotes liquidity development by working with trusted liquidity providers and deploying yield enhancement mechanisms. Its trading function improves the liquidity options of RWA tokens and supports market activities through staking, yield farming, and integration with DeFi protocols. This allows users to participate in asset transactions by reducing slippage and improving asset stability, and take advantage of liquidity and yield opportunities in the RWA market.

Focus on real returns and focus on serving crypto-native users

As a special field where blockchain technology and traditional assets meet, RWA has great potential from the traditional financial industry. Perhaps based on this, most RWA projects are currently led by people with a traditional financial (TradFi) background, who try to bring traditional financial products to the blockchain. However, mainstream users on the blockchain tend to be more crypto-native rather than traditional financial users, so most products find it difficult to find a fit with the market.

Plume believes that if you want to truly drive the growth of RWA, you must first base yourself on the needs of on-chain users. The concept of its RWAfi is not only to put RWAs on the chain, but also to follow what users are already doing when combining the traditional and crypto-native worlds, and tailor products for them that are easy for them to understand and accept. This is because on-chain users are usually the most dynamic and innovative when exploring RWAfi application scenarios, and have a strong demand for real returns, liquidity, and composability. In essence, Plume meets these needs in a way similar to DeFi and makes the product fit the market. Users are exposed to decentralized financial products on the surface, but behind them are real real-world assets that can bring real returns.

As an open, permissionless chain, Plume provides an easy-to-use, compliant and efficient asset on-chain tool that anyone can freely build and promote without restrictions. Among the hundreds of agreements that Plume has attracted, these assets cover a variety of categories. At present, Plume's asset categories can be roughly divided into three categories: collectibles, alternative assets and financial instruments. Collectibles include wine, art, watches, sneakers and Pokémon cards; alternative assets mainly include private credit, real estate or green energy projects; financial instruments are mainly stocks or corporate bonds.

However, for the vast majority of crypto users, the category of the asset itself is not important, its use and potential returns are the key points. Therefore, based on the starting point of benefiting existing on-chain users, Plume also focuses its work on the three most important use cases for crypto users. The first category is yield farming, the core of which is to earn income by depositing funds, circulating operations, etc., while achieving efficient and convenient operations. The second category is trading, including buying, selling, lending, and traditional spot trading. The third category is speculation, which mainly involves derivatives and other similar high-risk investment operations. Plume focuses on assets and application scenarios related to these protocols to make them more in line with the actual needs of crypto users.

Plume focuses on bringing real returns through income-generating assets and introducing real users through existing markets to expand the use cases of the crypto ecosystem and RWAs. For example, Plume provides users with the opportunity to earn income from $100 million worth of solar assets by partnering with Projective Finance, an RWA project in the renewable solar energy field. Projective Finance tokenizes "commercial solar construction loans and leveraged post-operational assets" that will serve development projects in public school districts. Plume Network said, "These projects have 100% contracted revenue and predictable costs." According to the statement, both teams believe that the school district's commitment to these development projects reduces the overall risk of tokenized projects and expects a return rate of between 9% and 18%.

In addition to emphasizing on-chain user needs, Plume also serves traditional financial institutions and can solve major challenges in compliance and liquidity in promoting institutional adoption. This two-way service strategy makes it possible to achieve innovation and breakthroughs in the RWAfi field and meet the different core needs of crypto-native users and traditional financial institutions.

Looking ahead, Plume, which is about to officially launch its mainnet, will technically further enhance the scalability and security of its infrastructure on the existing basis, and further integrate to improve data privacy; in terms of ecological development and RWA expansion, there is no doubt that more asset classes will be added, including tokenized luxury goods, stocks, and new forms of goods; in addition, by expanding cooperation with financial institutions, Plume will make it easier for institutional investors to obtain tokenized RWA. This strategic positioning not only promotes the connection between the crypto world and traditional finance, but will also make Plume an important bridge to promote the development of RWAfi.