Author: Sleeping in the Rain Source: substack

There is a very obvious phenomenon in the current market, that is, the serious differentiation of user groups - some are buying new shares at the first level, some are chasing hot spots at the second level, some are going all in on AI Agent, some are playing with Layer1 other than SOL and ETH, and some are looking for mining.

But I have to mention that although mining in a bull market is not as exciting as cryptocurrency speculation, the returns are still considerable, such as the $M3M3 LP pool on Solana and the $USD0 pool on Pendle.

Today, I want to talk to you about a revenue opportunity on BSC - @AstherusHub.

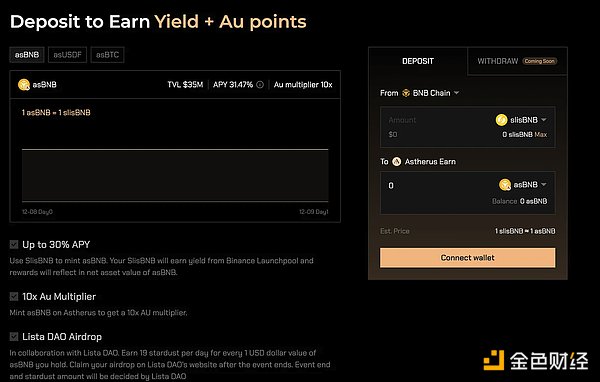

Currently, the TVL of Astherus asBNB is 35M and the APY is 31.47%.

Let’s take a look at the revenue composition of Astherus asBNB:

1. Income from Binance Launchpool and other BNB related activities (such as Hodler Airdrops) (34.17%) + slisBNB’s own liquidity staking income (1.43%)

PS Hodler Airdrops distribution process: After ListaDAO receives the relevant tokens, it will convert all the tokens into BNB and transfer them to Astherus, and Astherus will then convert BNB into asBNB and transfer it to the user. The user needs to collect it on the Astherus front end.

2. AU Points (mint as BNB to get 10x AU Points multiplier)

3. ListaDAO Airdrop (1 USD worth of asBNB can get 19 stardust. The stardust acquisition efficiency of asBNB is higher than that of slisBNB, which is 15 stardust/1 USD)

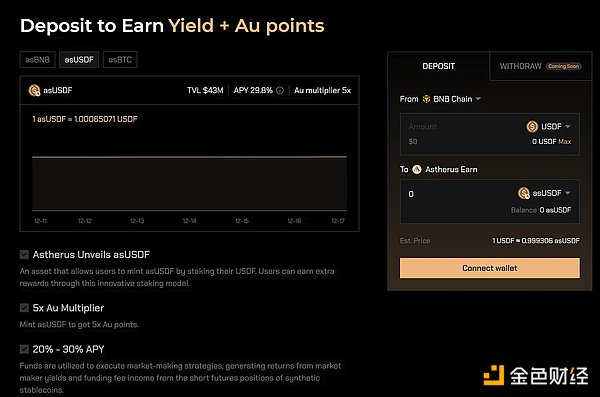

In addition, Astherus also has a stablecoin product $USDF (USDT 1:1 exchange). USDF is similar to Ethena's USDe, and the source of income is the fee income of short hedging. The AU Points multiplier of USDF is 5x, 30% APY.

I would like to add that during the non-Launchpool period, users can mint asBNB immediately. If asBNB is minted during the Launchpool period, users need to wait until the Binance Launchpool rewards are distributed + asBNB NAV is updated, which is about 3-5 days after the Launchpool rewards are distributed to receive asBNB. During this waiting process, users can still earn AU Points.

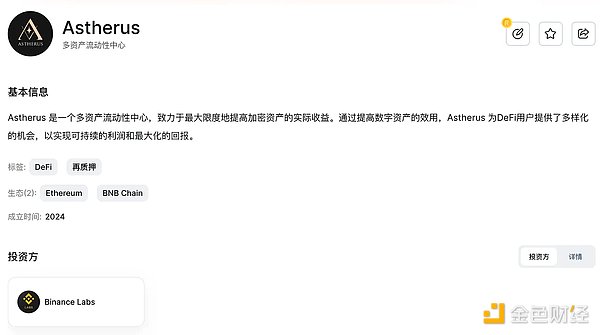

Let's take a look at the introduction and background of the Astherus project:

PS Astherus received strategic investment from Binance Labs on November 28.

In general, BSC is still following the Ethereum model, from the basic configuration of DeFi to LSD liquidity pledge, and then to Eigenlayer Restaking, one layer after another. At present, the core of BSC is still Pancakeswap and ListaDAO. ListaDAO's expansion of BNB lies in liquidity pledge, and Binance Labs invested in Astherus to promote BNB Restaking, which is also a layer of nesting dolls. By the way, we can look forward to Pendle's support for Astherus points later.

Thena is a ve33 on BSC. Whether it can rise depends on the ecological prosperity of a chain, or cabals can also drive the development of the ecology by pulling up the ve33 token (such as Base's $AERO). Therefore, whether $THE can rise in the future depends entirely on whether the BSC ecology can develop, or whether Binance has the motivation/incentive to drive the prosperity of the BSC ecology by pulling up $THE. Some actions of Binance reflect its attention to the BSC ecology, such as listing BSC tokens. Therefore, I am still optimistic about the performance of $THE from the end of this year to Q1 next year.