Author: Weilin, PANews

On the afternoon of November 6, Republican presidential candidate Trump was successfully elected as the new 47th President of the United States. The election results showed that Trump won the key swing state of Pennsylvania, thus ultimately gaining the first 270 electoral votes and defeating Democratic candidate Harris.

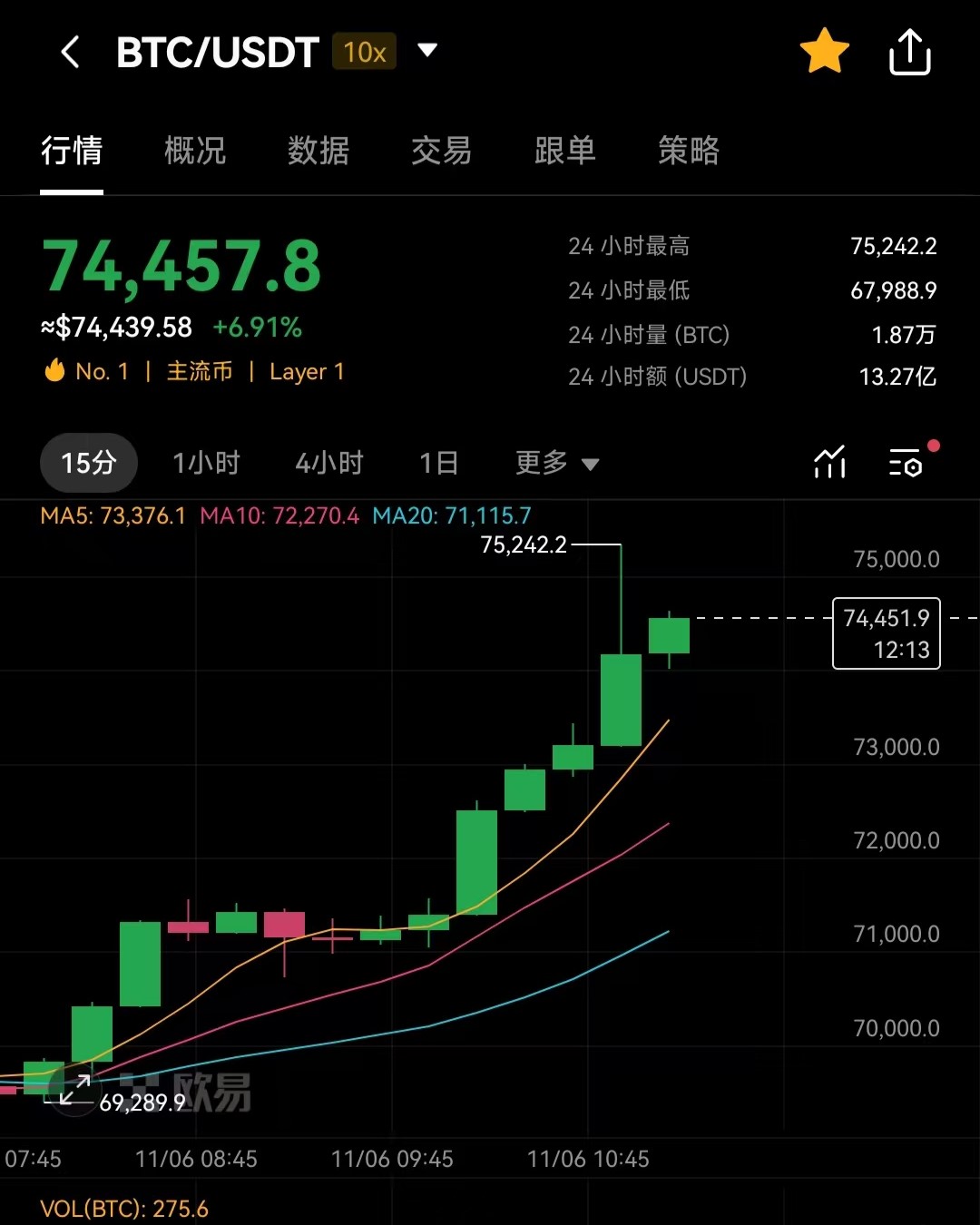

As the news of Trump's election spread, the crypto market reacted strongly, and the price of Bitcoin broke through the historical high around 11:20 on November 6, reaching around $75,000. At this time, all eyes were on the cryptocurrency market, and crypto users and investors couldn't help but ask: How will Trump's election affect the future trend of the crypto market?

Bitcoin rises to all-time high after winning the key swing state of Pennsylvania

The prices of Bitcoin and other cryptocurrencies reacted quickly during the election counting, especially after Trump basically secured his advantage and won Pennsylvania. This change is not only a positive reaction of the market to Trump's encryption policy, but also shows the market's optimistic expectations for the prospects of encryption assets.

After the election results were announced, Trump delivered a victory speech, saying "This is the greatest political movement ever. We are going to help our country recover," and "This will truly be America's golden age." He thanked voters, the winning states, his family, and his campaign team and other supporters. Trump also mentioned Musk and his Starlink project, saying "We must protect our genius," and thanked them for their help during the hurricane in North Carolina. In addition, Trump revealed that more than 900 campaign rallies have been held during the campaign.

Before the election, investors generally believed that whether Trump or Harris was elected, the regulatory environment of the cryptocurrency market would usher in major changes, and the market's support for Trump was more prominent. Compared with Harris's vague position, Trump's cryptocurrency policy was more clear and radical. He not only proposed a "strategic reserve" plan for Bitcoin, but also stated that he would promote a more open policy for the crypto market. According to multiple analyses, Trump's election may further boost Bitcoin prices.

Can Trump's encryption policies and promises be fulfilled?

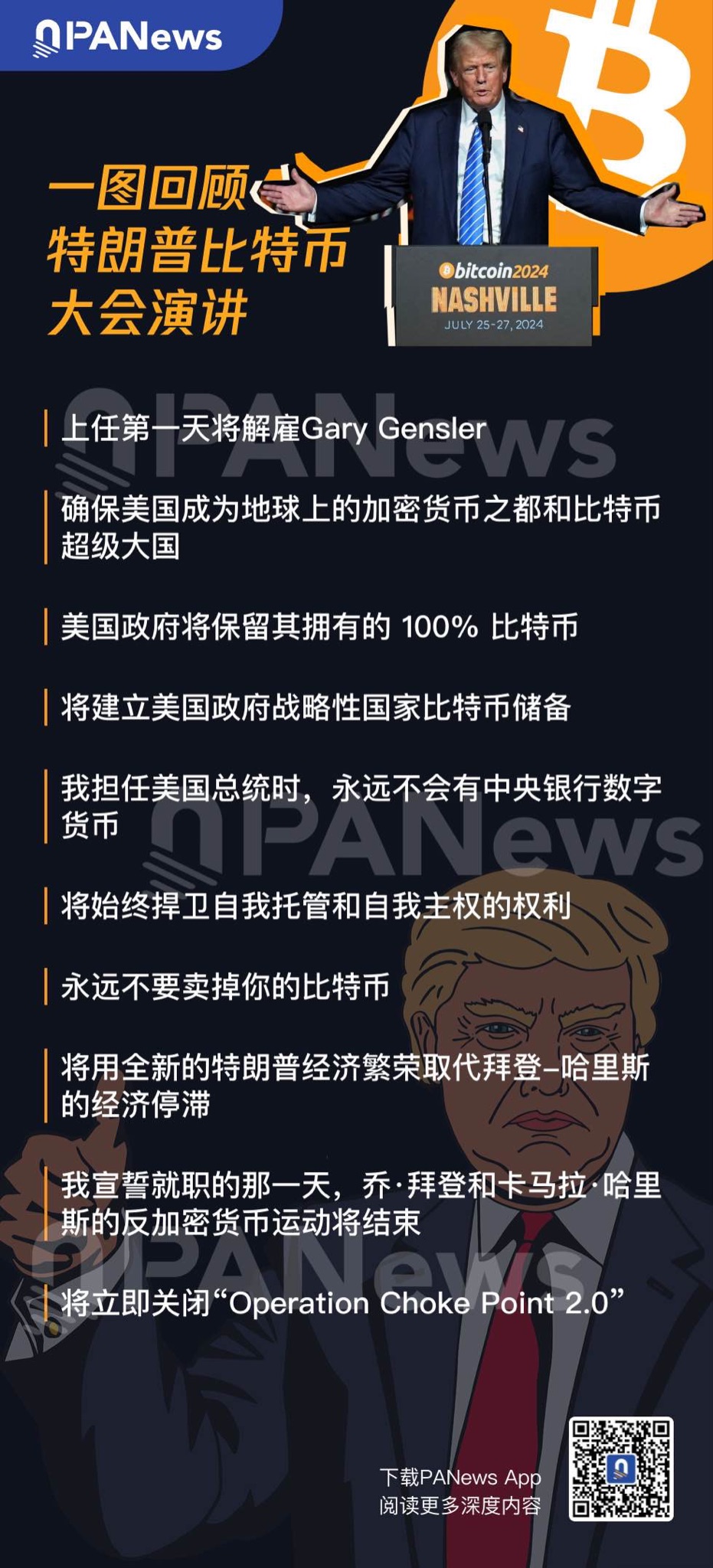

Trump's position on cryptocurrency policy was made clear as early as July this year. At the Bitcoin Conference held in Nashville, the United States, he publicly promised to stop creating a digital dollar (CBDC). He also promised to establish a strategic reserve of Bitcoin in the United States. In addition, Trump proposed to set up a special cryptocurrency policy working group called the "Presidential Advisory Committee on Bitcoin and Cryptocurrency."

Trump's crypto policy is not limited to the idea of a strategic reserve of Bitcoin. He also emphasizes protecting Americans' free control over crypto assets. The Republican platform specifically mentions: "We will defend the right to mine Bitcoin and ensure that every American has the right to independently keep their own digital assets and trade them freely without government surveillance and control."

Compared with Trump's positive attitude, Democratic candidate Harris's crypto policy appears more vague and conservative. Although she mentioned digital asset-related policies, she did not clearly explain how to deal with Bitcoin and other crypto assets, nor did she propose a specific and operational plan like Trump. This has led the market to generally believe that Trump's victory may bring more relaxed and favorable cryptocurrency regulatory policies.

With Trump's election, what changes will the regulatory environment of the crypto market usher in in the future? At least two key pieces of legislation will receive attention during Trump's term: the Financial Innovation and Technology Act of the 21st Century (FIT21) and the Payment Stablecoin Act. FIT21 is one of the core pieces of legislation for cryptocurrencies in the United States and is expected to be further advanced after the election. The FIT21 bill has been approved by the House of Representatives and has received broad support from Republican and Democratic lawmakers. The passage of this bill will make cryptocurrency regulation in the United States clearer and more standardized.

Currently, the crypto regulatory environment in the United States is relatively fragmented, with different regulatory agencies having different policy positions, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FINCEN), and the Internal Revenue Service (IRS).

The goal of the FIT21 Act is to clearly define the regulatory framework for cryptocurrencies and eliminate existing regulatory confusion and uncertainty. Many lawmakers believe that the SEC's regulation in the crypto field is too strict and hinders the development of the crypto industry.

The Payment Stablecoin Act was proposed by Republican Congressman Cynthia Lummis and Democratic Congressman Kirsten Gillibrand to provide a clear regulatory framework for stablecoins. The bill requires large stablecoin issuers to register with the Office of the Comptroller of the Currency (OCC) and stipulates that 1:1 asset reserves are required. In addition, the bill also gives the Federal Reserve regulatory power over stablecoins and prohibits the issuance of algorithmic stablecoins. For Trump, how to view this bill and its implementation will also be an important part of future policies.

Market forecast: Bitcoin may rise to $80,000 to $90,000 in the next two months

Even before the election results were announced, Bernstein analysts led by Gautam Chhugani said on Nov. 4 that the election would have a "short-term impact" on cryptocurrency sentiment and affect the price of Bitcoin, which is currently trading around $68,000, down from a seven-month high of more than $73,000 set last week. Chhugani predicted that if pro-crypto candidate Trump wins the election, Bitcoin could rise to $80,000 to $90,000 in the next two months, breaking its all-time high of nearly $73,800 set in March.

The Bernstein analysis team maintained its price target of $200,000 for Bitcoin by the end of 2025, regardless of the election results. They explained that for the $1.4 trillion digital asset, "the genie is out of the bottle," with the spot Bitcoin ETF as the latest driving force, further enhancing the value of this decentralized currency.

Standard Chartered analyst Geoff Kendrick wrote in October that he expected Bitcoin could reach $125,000 if Trump wins the election.

PlanB, the creator of the Bitcoin Stock-to-Flow (S2F) model, predicts that after Trump wins the election, the price of Bitcoin will reach $100,000 in November. In December, with the influx of ETF funds, Bitcoin soared to $150,000. In January 2025, the crypto industry returned to the United States, and Bitcoin climbed to $200,000. In February 2025, the price of Bitcoin fell back to $150,000. PlanB believes that investors' profit-taking will cause Bitcoin to fall back to $150,000 briefly after hitting a high. By March to May 2025, Bitcoin will show a global trend and the price will break through $500,000. 2026-2027 will be a market adjustment and bear market.

The Giver, an anonymous senior investor, is relatively conservative in his predictions, believing that the election-driven rise in Bitcoin is more of a temporary phenomenon than a long-term trend. The Give believes that Bitcoin prices will soar in the short term, but are unlikely to continue into the next year due to the limited market capacity in the fourth quarter of 2024.

Alex Krüger, an Argentine economist, trader and consultant, believes that if Trump wins the election, the target price of Bitcoin by the end of the year will be $90,000.

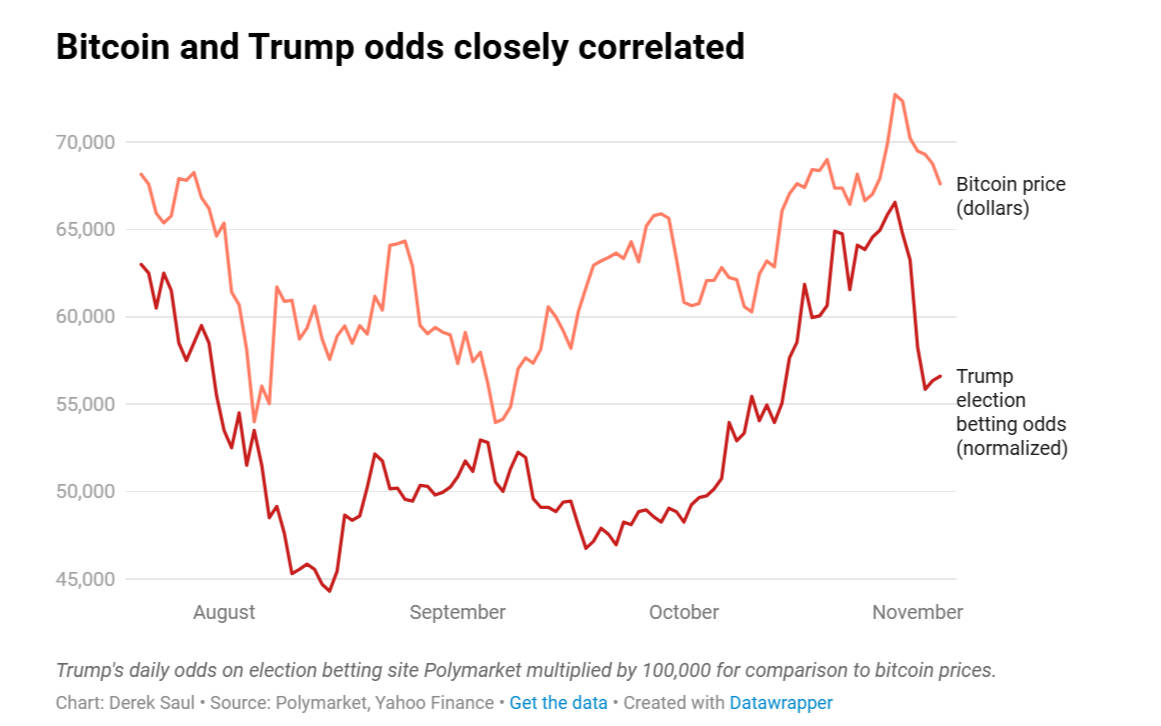

Previous data showed that the election is one of the factors affecting the price of Bitcoin, and the trend of Bitcoin and Trump's probability of winning in the prediction market are consistent.

Meanwhile, according to BloFin Academy’s analysis, while there may be a phenomenon of “selling the truth” after the election for some meme stocks and meme coins, the best trading strategy for assets such as Bitcoin (BTC) and gold (GLD) seems to be “selling volatility.” Usually, “selling the truth” is a common phenomenon after big events, and the reasons behind it are varied: as uncertainty disappears, investors and institutional traders tend to choose to take profits or stop losses, while long-short strategies based on statistical arbitrage will also cause the prices of outperforming assets to pull back.

As the derivatives market develops, the position adjustment and hedging of market makers have become an important factor in "realizing the truth", especially for assets with high volatility or low liquidity. For some meme stocks (such as DJT) and meme coins, it is almost a "foregone conclusion" that prices return to normal after the event. This return is usually driven by two main factors: the significant deviation of the return distribution from the normal level provides opportunities for statistical arbitrage, and the rapid decline in implied volatility after the event also accelerates this process.

For Bitcoin (BTC) and Gold (GLD), although the decline in volatility will lead to selling pressure, their price decline will be relatively limited compared with meme assets. More importantly, the returns of Bitcoin and Gold have not deviated significantly from the normal distribution, so after a short-term adjustment, their potential for continued rise is still greater than that of meme assets.

Unlike gold, Bitcoin has stronger price momentum, which stems from its higher negative Gamma. Negative Gamma means that the hedging behavior of market makers will increase market volatility, driving prices to change faster when they rise or fall. On the other hand, gold's higher positive Gamma means that during the price increase, the hedging behavior of market makers will impose more resistance to price increases, making the upward trend more gentle.

BloFin Academy believes that the situation of Ethereum (ETH) is similar to that of gold. Since the Gamma peak is located in the strike price range of about $2,500-2,600, when the ETH price continues to rise, the selling behavior of market makers will form resistance to its rise. Considering that the Gamma peak comes from weekly options, the hedging behavior of market makers will continue to limit the upside of ETH prices in the next few days.

BloFin Academy concludes that selling volatility is currently the best strategy for most traders.

In general, how the crypto market will develop in the future still requires continued attention to the Trump administration's specific policies and legislative progress in the crypto field. For investors, only by maintaining a flexible and adaptable strategy can they gain an advantage in this market game full of uncertainty.