Author: Weilin, PANews

Trump's DeFi project World Liberty Financial (WLFI) purchased a large amount of crypto assets in December, with cumulative expenditures approaching US$45 million, including ETH, cbBTC, LINK, AAVE, ENA and the latest ONDO.

Since its launch in September, the project has claimed to be a decentralized finance (DeFi) platform. On December 13, the World Liberty Financial community passed the first proposal to deploy an Aave v3 instance. Although the project has made initial progress, from the current situation, the leadership team is mostly new faces, and there is still some uncertainty about the practicality and innovation of the project.

Cryptocurrency purchases in December total nearly $45 million

According to blockchain data platform Lookonchain, World Liberty Financial has purchased a large amount of crypto assets through a wallet since November 30, including $30 million worth of Ethereum (ETH) and $10 million worth of Coinbase Wrapped BTC (cbBTC). Other purchased assets include LINK, AAVE, ENA, and the latest purchase of Ondo tokens worth $250,000. The specific data of these purchases are as follows:

Use $30 million USDC to buy 8,105 ETH at $3,701 per ETH.

Use 10 million USDC to buy 103 cbBTC at a unit price of 97,181 USD;

Use $2 million USDC to buy 78,387 LINK at $25.5 per LINK.

Use $2 million USDC to buy 6,137 AAVE at $326 per AAVE.

Use $500,000 USDC to buy 509,955 ENA at $0.98 per unit.

Use $250,000 USDC to purchase 134,216 ONDO at a unit price of $1.86.

In addition, although COW is not on the asset list of World Liberty Financial, Cowswap has been used to purchase tokens on the chain in recent times, which is also one of the most commonly used DEXs by Ethereum founder Vitalik Buterin.

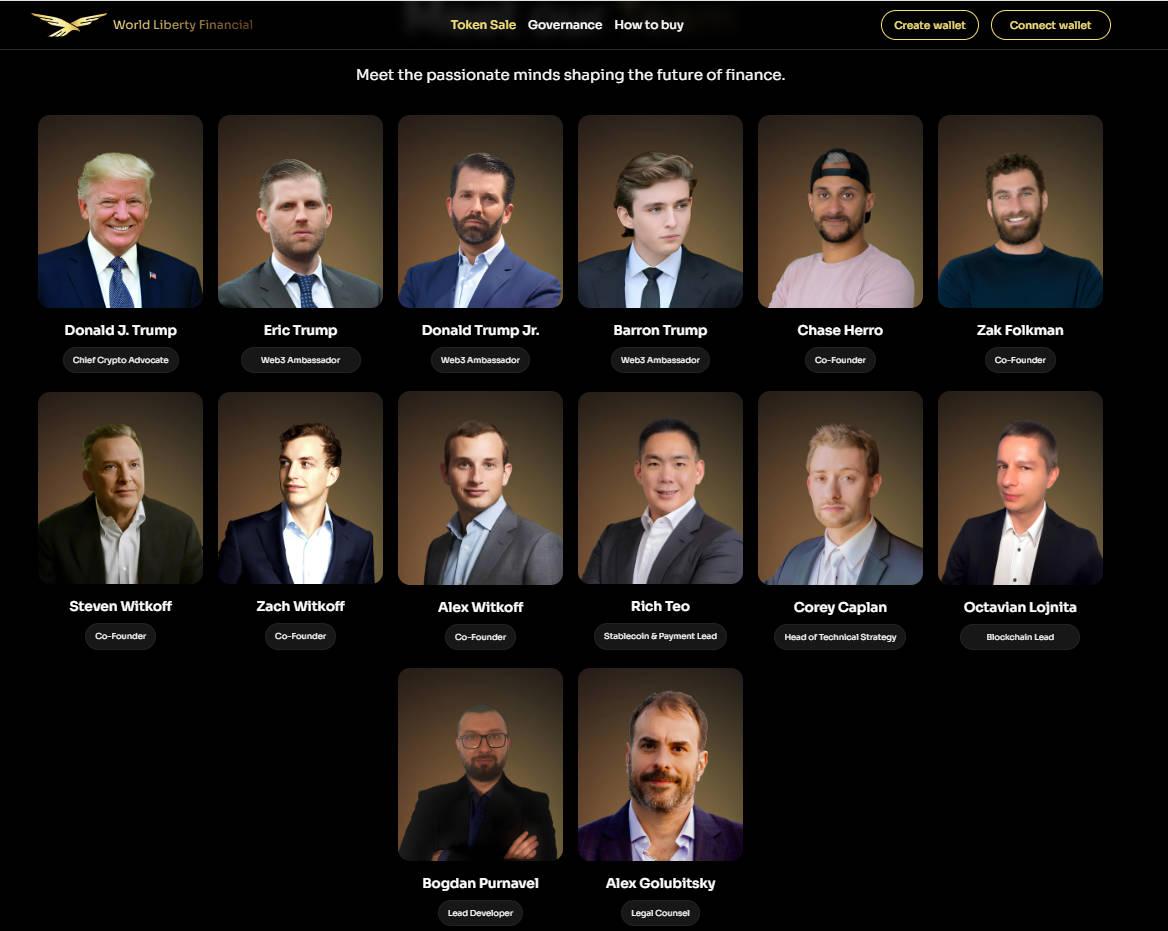

World Liberty Financial, which was launched in September, describes itself as a decentralized finance (DeFi) platform for cryptocurrency trading and lists President-elect Trump as the "chief crypto advocate," with his sons Donald Trump Jr., Eric Trump and Barron Trump serving as "ambassadors." Companies associated with the family are entitled to 75% of net income.

The project has had a dismal record in selling its eponymous token, World Liberty Financial (WLFI). According to the roadmap, $1.5 billion is the fully diluted valuation of the project, and WLFI's "first sale" plans to raise $300 million and sell 20% of the token supply. But as of December 17, 4.99 billion WLFIs have been sold, which, at a unit price of $0.015, totals $74.85 million, less than a quarter of the $300 million target. It is worth mentioning that Justin Sun disclosed that he invested $30 million in WLFI, becoming the project's largest investor. Apart from this, no institution has announced investment in the project.

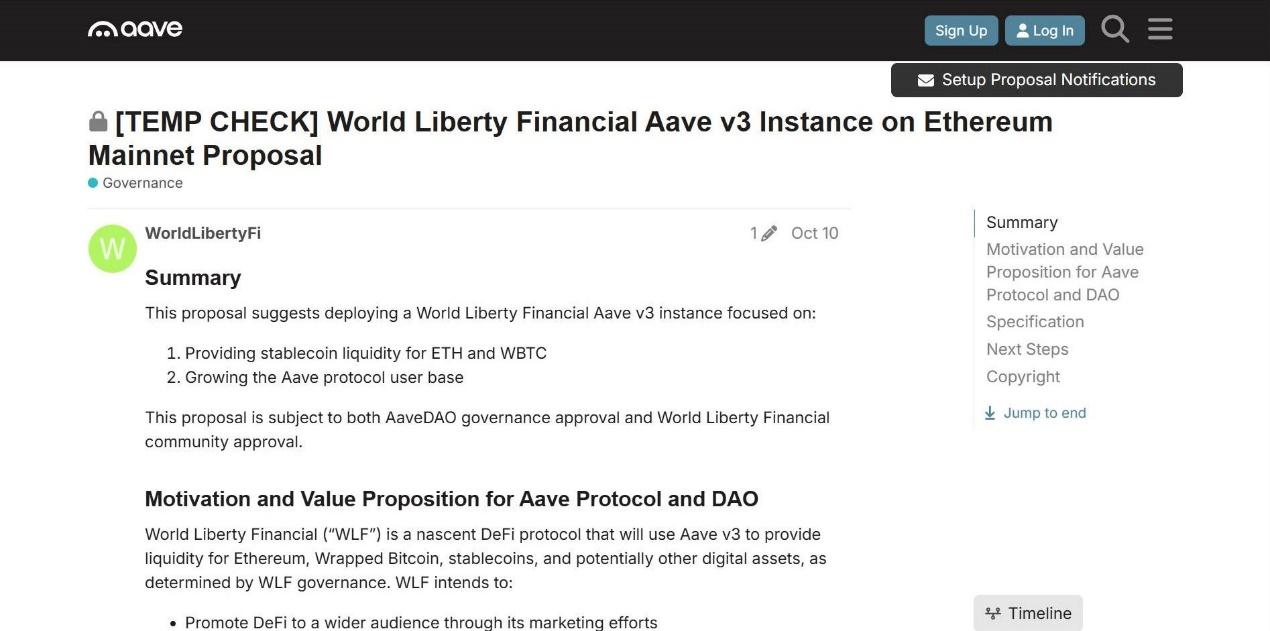

The WLFI community voted to pass the first proposal to deploy a lending instance based on Aave v3

At the same time, the good news is that on December 13, the World Liberty Financial governance page showed that the WLFI community voted to pass the first proposal to deploy a lending instance based on Aave v3 on the Ethereum mainnet.

As of December 16, Aave DAO has a treasury worth $347 million. Initially, when World Liberty Financial announced that it would build on the Aave protocol, the Aave community was skeptical. However, in October, the situation changed after World Liberty Financial proposed to allocate 7% of its WLFI tokens and 20% of future fees generated by WLF to Aave DAO, the crypto collective that manages the Aave protocol.

The proposal proposes deploying an Aave v3 instance based on World Liberty Financial (WLF), with highlights including:

- Provide stablecoin liquidity for ETH and WBTC.

- Expand the user base of the Aave Protocol.

The proposal needs to be approved by AaveDAO and WLF community governance. If the proposal is approved, users will be able to deposit USDC and USDT stablecoins, as well as ETH and wBTC on the protocol. These assets can be used as collateral to borrow other assets on Aave.

The proposal mentioned that the benefits to Aave are to bring a large number of new users and liquidity to Aave, build brand loyalty and awareness among new DeFi users, and consolidate Aave's leading position in the digital asset lending market.

Next, the proposal has several steps: 1. If the temperature check (TEMP CHECK) reaches a consensus, it will be submitted to the Snapshot stage. 2. If the Snapshot vote passes, it will enter the ARFC stage. 3. Release the standard ARFC and collect feedback from the community and service providers. 4. If the ARFC Snapshot passes, the AIP vote will be released for final confirmation and execution.

The WLFI leadership team is not a familiar face, where do they come from?

There are many new faces behind Trump's DeFi project that are not well known in the crypto circle. In addition to Trump and his family members, the five co-founders of this project are Chase Herro, Zak Folkman, Steven Witkoff, Zach Witkoff and Alex Witkoff.

Among them, Chase Herro has a rather special background. He has reportedly been involved in a number of businesses seemingly unrelated to the crypto industry, including marijuana sales and weight loss products, and has shown off luxury cars and private jet trips on social media, but has little reputation in the crypto circle. The only crypto project he publicly participated in, Dough Finance, attracted only a few million dollars and suffered a serious hacker attack. A token he promoted on the podcast of influencer Logan Paul plummeted 96% after the promotion. In a speech in 2018, he called himself "the scum of the Internet" and said regulators should "kick people like me out."

Additionally, another co-founder, Chase Herro’s business partner Zak Folkman, had a controversial background in running a service called Date Hotter Girls, where he gave lectures on how to pick up women.

As for Steven Witkoff, he is a familiar friend of Trump and a real estate developer. He donated $2 million to Trump's campaign. After Trump won the election, he appointed him as a special envoy to the Middle East. Witkoff's sons Alex and Zach are listed as co-founders of World Liberty Financial.

In addition to these co-founders who have relatively distant ties with the crypto market, the backgrounds of the heads of other specific business units appear to be more professional and closer to the crypto industry.

For example, Rich Teo, who is the head of stablecoins and payments, is also an OG in the crypto field. He co-founded the exchange itBit in 2012, and then co-founded the stablecoin company Paxos. He is currently the CEO of Paxos Asia. In addition, Rich is also an advisor to the AI-driven SocialFi project RepubliK and has retweeted many tweets about the project on Twitter.

Corey Caplan serves as Head of Technical Strategy. Corey Caplan is the co-founder of Dolomite, a DeFi platform that launched on Arbitrum One in October 2022 and has since expanded to other blockchain ecosystems, including Polygon’s zkEVM, Mantle, and X Layer, and offers a variety of services including margin trading, lending, and portfolio management.

Bogdan Purnavel serves as the lead developer. He was also a developer at Dough Finance and his online nickname is 0xboga. The head of blockchain at World Liberty Financial is Octavian Lojnita. According to his online resume, he is from Romania and is a full-stack developer. Octavian Lojnita also worked at Dough Finance before.

Alex Golubitsky serves as Legal Counsel. Alex Golubitsky is an international tax attorney whose career spans tax law, securities law, entity formation, contract drafting, and litigation. He serves as a partner at MetaLeX Pro, LLP and as General Counsel at Brisa Max Holdings VI, LLC.

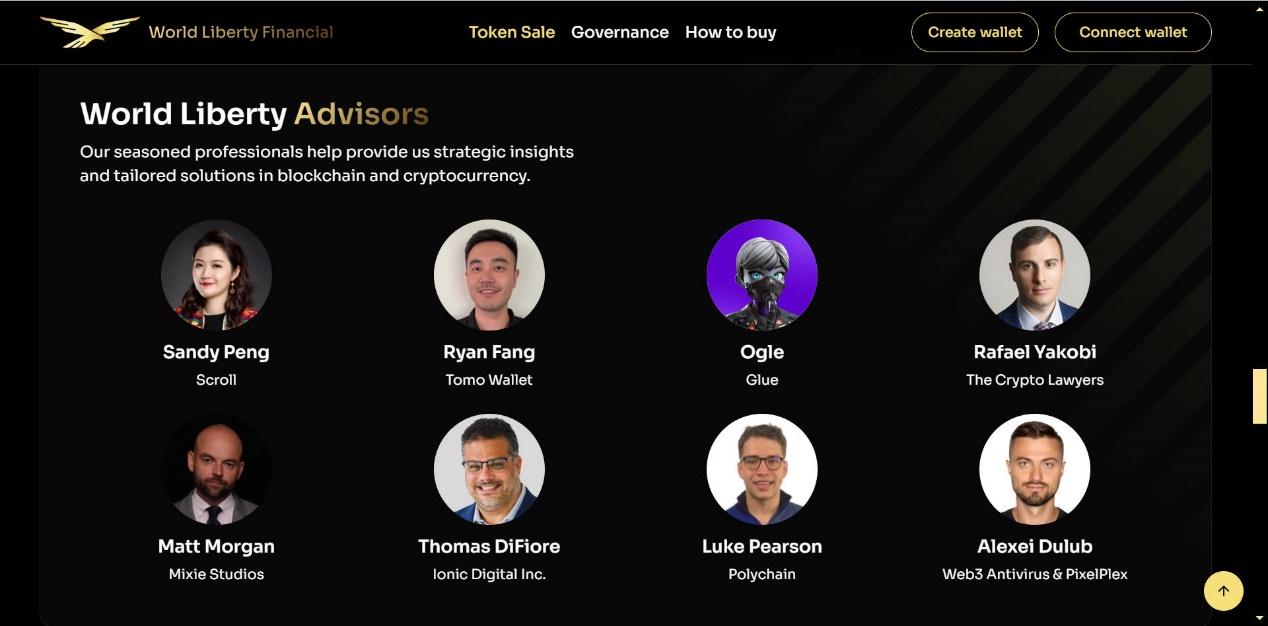

In addition, World Liberty Financial also has an advisory team consisting of venture capitalists, lawyers and blockchain engineers. Sandy Peng, co-founder of Ethereum's second-layer blockchain Scroll, and Luke Pearson, general partner of Polychain Capital, are both advisors to the project.

At present, World Liberty Financial’s large-scale token purchase has caused different opinions from the outside world.

Nicolai Søndergaard, a research analyst at Nansen, told Bloomberg that World Liberty Financial’s token purchases could be “an effort to gain more trust or to promote its own project by drawing attention to these assets, because if these assets perform well, World Liberty Financial could also benefit.”

Although World Liberty Financial's plans may sound innovative to those unfamiliar with cryptocurrencies, startups like this are common, but few succeed. Many such companies are set up just to sell tokens and make a profit, Robot Ventures general partner Tarun Chitra previously told the outside world.

In general, the Trump family's DeFi project World Liberty Financial has demonstrated its ambition in the crypto field through large-scale coin purchases and cooperation with Aave. Their investment targets are screened and have become a weather vane for investors. However, its leadership team is relatively unfamiliar, and the practicality and innovation of the project are still uncertain. Nevertheless, as a project initiated by the family of the "crypto president" of the United States, it will still attract widespread attention from the market, and the follow-up situation deserves further attention.