Author: Kaori, BlockBeats

After the bull market correction phase a few days ago, the price of ETH once again stood at $3,900. Looking back at the development of Ethereum over the past year, there are many complex factors and emotions. On the one hand, the Cancun upgrade was successfully completed and the spot ETF was officially approved, ushering in a new bull market in terms of technology and fundamentals; but on the other hand, as Bitcoin, SOL, and BNB broke through historical highs one after another, the price of ETH is still hovering around the $4,000 mark.

From the ETH price trend chart above, we can see that Ethereum has gone through three major stages this year, and the rise in the three stages corresponds to different reasons. At the beginning of the year, the Bitcoin spot ETF was approved, and the price of Ethereum rose with market sentiment, breaking through $4,100 at one point, but at the end of March, it also began to fall with the market. Due to the strong rise of SOL and its ecology, the Ethereum ecosystem is facing a large outflow of liquidity.

In May, the Ethereum spot ETF was approved and the price briefly surged, but its demand was not as strong as that of Bitcoin. The market's initial reaction to the launch of the Ethereum ETF was negative, as speculative investors who bought the Grayscale Ethereum Trust and expected it to be converted into an ETF took profits, resulting in a $1 billion outflow of funds, which put downward pressure on the price of Ethereum. In addition, ETH's narrative of being biased towards scientific and technological products is less likely to impress the traditional market than BTC's "digital gold", and the SEC's restriction on Ethereum spot ETFs from engaging in staking functions has objectively weakened its appeal.

After that, disputes over the Ethereum Foundation, the re-staking ecosystem, and the roadmap followed one after another, and Ethereum entered its darkest moment.

In November, the dust settled on the US election. The pro-crypto Republican Party and Trump brought stronger confidence and liquidity injection to the entire crypto ecosystem, and Ethereum also ushered in the third wave of growth this year. This time the rise is different from the past. Institutions have entered the market openly, and the improvement of liquidity fundamentals is the market using funds to tell us what institutions recognize and are optimistic about; and Ethereum is destined to continue its original intention of "the world's computer".

Liquidity fundamentals improved

Since December, Ethereum spot ETF has seen net inflows of over US$2.2 billion for half a month in a row. Nate Geraci, president of The ETF Store, said on social media that consultants and institutional investors are just beginning to pay attention to this field.

In the third quarter of this year, banks such as Morgan Stanley, JPMorgan Chase and Goldman Sachs significantly increased their holdings of Bitcoin ETFs, almost doubling their holdings quarter-on-quarter, but their investment scope is not limited to Bitcoin. According to the latest 13F filing, these institutions have since then also begun to purchase Ethereum spot ETFs.

In addition, the Wisconsin Investment Committee and Michigan Retirement System purchased Bitcoin spot ETFs in the first two quarters, and Michigan further purchased Ethereum spot ETFs worth more than $13 million in the third quarter. This shows that pension funds, which symbolize low-risk preferences and long-term investments, not only recognize the role of Bitcoin as a digital value storage, but also value the growth potential of Ethereum.

When the Ethereum spot ETF was first passed, JPMorgan Chase pointed out in a report that the demand for the Ethereum spot ETF would be much lower than that for the Bitcoin spot ETF. However, the report predicts that the spot Ethereum ETF will attract up to US$3 billion in net inflows for the rest of the year. If staking is allowed, this figure may be as high as US$6 billion.

Jay Jacobs, head of U.S. thematic and active ETFs at BlackRock, said at the "ETFs in Depth" conference that "our current exploration of Bitcoin, especially Ethereum, is just the tip of the iceberg. Only a very small number of clients hold (IBIT and ETHA), so our current focus is on this aspect rather than launching new altcoin ETFs.

In a survey report by Blockworks Research, the vast majority (69.2%) of respondents currently hold ETH, of which 78.8% are investment companies or asset managers, indicating that institutional participation in ETH staking has reached a critical mass driven by yield generation and network security contributions.

Institutions are actively participating in ETH staking, but the degree and methods of participation vary. Regulatory uncertainty has led to different attitudes among all parties, with some institutions proceeding cautiously while others are less concerned. Institutional participants have a high level of awareness of the operational aspects and risks associated with staking.

The tide is turning

Since the collapse of FTX, Coinbase, Kraken, Ripple and others have been severely cracked down by US regulators such as the SEC, and many crypto projects cannot even open accounts in mainstream US banks. In the last bull market, traditional financial institution investors who entered the market due to DeFi also suffered huge losses. For example, large funds such as Toma Bravo, Silver Lake, Tiger, and Cotu not only suffered setbacks on FTX, but also invested in some crypto projects at high valuations that did not fulfill their grand promises, and the funds have not yet returned.

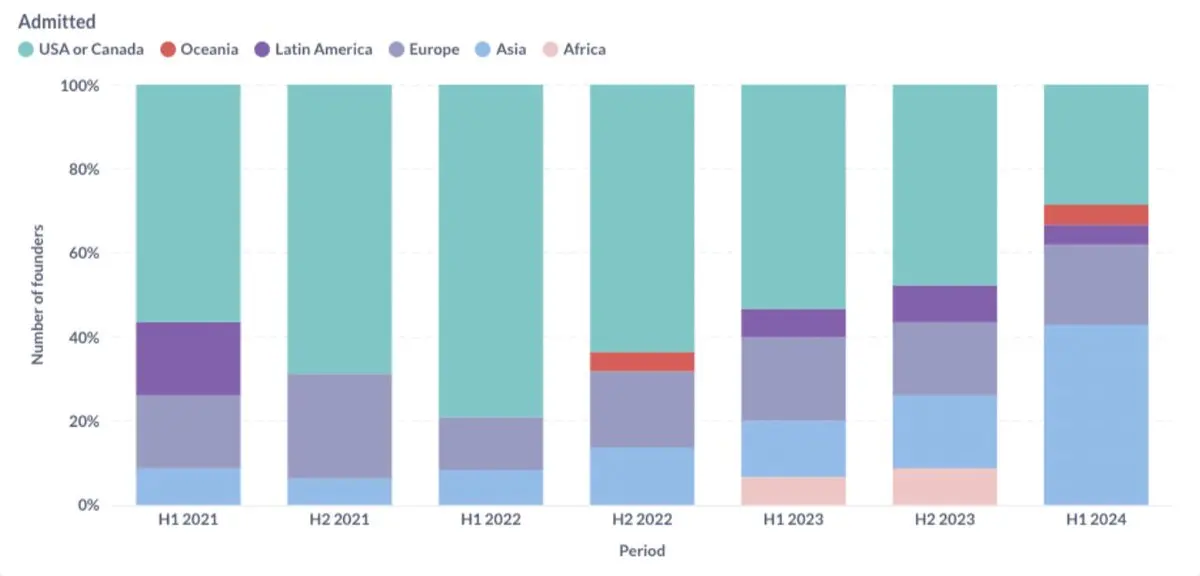

In the second half of 2022, many DeFi projects were forced to move outside the United States. According to Alliance DAO co-founder qw, "Two years ago, about 80% of the crypto startups that met the criteria were located in the United States. However, this proportion has continued to decline since then and is currently only about 20%."

But on November 6, Trump won the election, and the green light the US financial system had been waiting for came on.

Trump saves the cryptocurrency world

Trump’s victory has undoubtedly cleared regulatory doubts for institutional adoption.

After establishing the Department of Government Efficiency, directly gathering a series of Wall Street financial elites such as Musk, Peter Thiel, and Marc Andreessen under his command, and appointing Paul Atkins as the chairman of the SEC, Trump also appointed PayPal co-founder David Sacks as the "White House Director of Artificial Intelligence and Cryptocurrency Affairs." A series of measures show that Trump will create a government with loose crypto regulation.

Analysts at JPMorgan Chase said that several stalled cryptocurrency bills after Trump took office may be quickly approved, including the 21st Century Financial Innovation and Technology Act (FIT21), which may provide much-needed regulatory clarity for the crypto industry by clarifying the regulatory responsibilities of the SEC and CFTC. And said that as the regulatory framework becomes clearer, the SEC's strategy of increasing enforcement may evolve into a more collaborative approach, and its Staff Accounting Bulletin No. 121 (SAB 121) that restricts banks from holding digital assets may be repealed.

High-profile lawsuits against companies like Coinbase could also be mitigated, settled, or even dropped. Regulatory notices to companies like Robinhood and Uniswap could be reconsidered, reducing litigation risk for the broader crypto industry.

In addition to department and bill reforms, the Trump team is also considering drastically reducing, merging or even eliminating major banking regulators in Washington. People familiar with the matter revealed that when interviewing potential bank regulators, Trump advisers asked some people in the Department of Government Efficiency whether the Federal Deposit Insurance Corporation (FDIC) could be abolished. Trump advisers also asked potential candidates for the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency. In addition, it has proposed plans to merge or completely reform the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency and the Federal Reserve.

As policy dividends are gradually released, larger amounts of institutional funds in the US market are expected to return to the crypto market.

DeFi renaissance underway

More stable capital such as family offices, endowment funds, pension plans, etc. will not only deploy Ethereum spot ETFs, but will also re-enter the DeFi field that has been verified in the previous cycle.

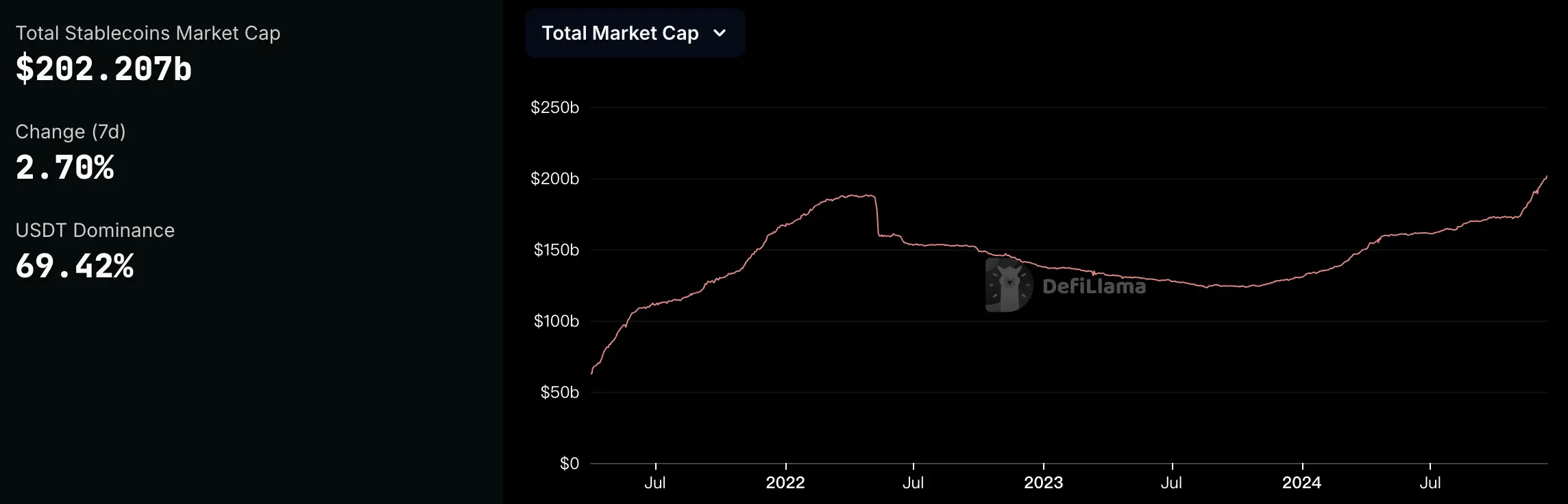

Compared with 2021, the total supply of stablecoins has reached its highest level. In the more than a month since Trump's victory, the total amount of stablecoins has increased by nearly US$25 billion. The current total market value of stablecoins is US$202.2 billion.

As the leader of U.S. crypto-listed companies, Coinbase has made achievements in the DeFi field in addition to its political contributions this year. On the one hand, it is the largest crypto ETF custodian, and on the other hand, it launched cbBTC.

Since cbBTC faces the same custody and counterparty risks as most Bitcoin ETFs, some traditional financial institutions may reevaluate whether to continue paying fees to hold Bitcoin ETFs and instead turn to participating in the DeFi ecosystem at almost zero cost. This shift may bring capital inflows to market-tested DeFi protocols, especially when the yields offered by DeFi are more attractive than those of traditional finance.

Another major DeFi sector in this cycle is RWA. In March this year, BlackRock, through cooperation with the US tokenization platform Securitize, issued the tokenized fund BUIDL (BlackRock USD Institutional Digital Liquidity Fund), and officially entered the RWA track in a very high-profile manner. Capital giants such as Apollo and Blackstone, which control huge capital pools, are also preparing to enter this market and bring a large amount of liquidity injection.

After the Trump family launched the DeFi project, compliant DeFi has been a hot topic. Uniswap, Aave, Lido and other old Ethereum blue-chip DeFi projects immediately responded to Trump's victory in price, and they all rose and broke through, while COW, ENA, ONDO and other rising stars in the DeFi sector also reached new highs one after another.

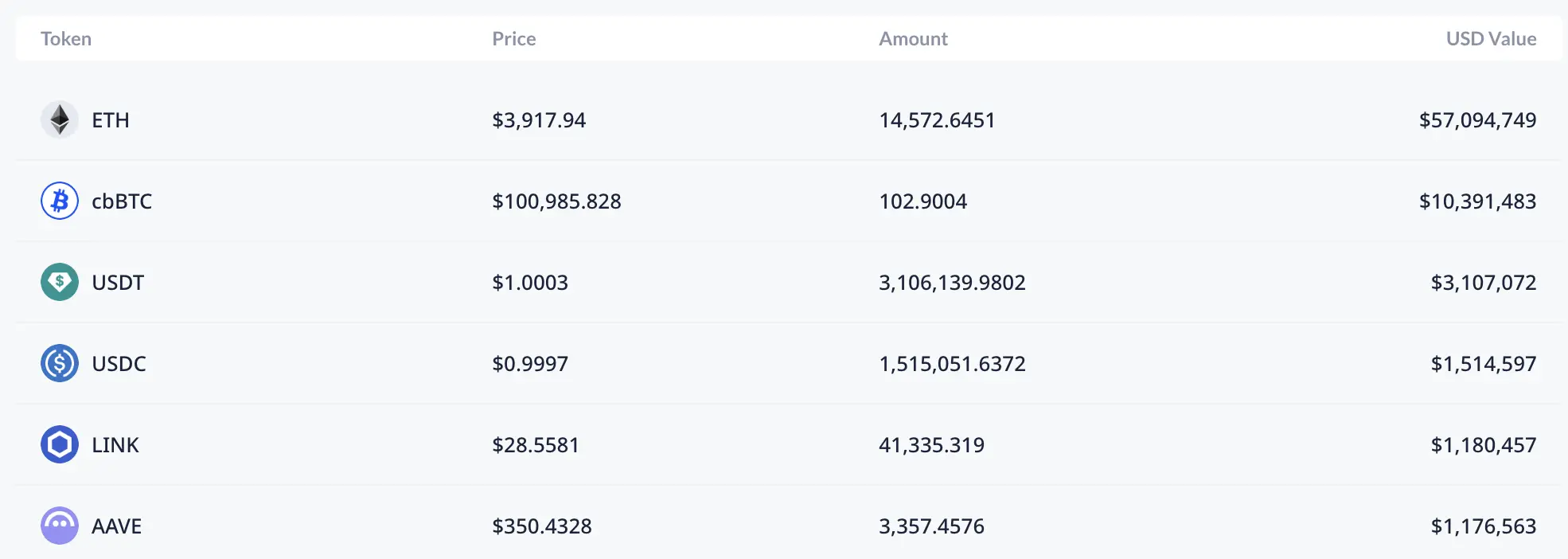

At the same time, Trump's encrypted DeFi project WLFI has also been trading Ethereum tokens frequently recently. After exchanging 5 million USDC for 1,325 ETH in multiple transactions, its multi-signature address bought $10 million ETH, $1 million LINK and $1 million AAVE respectively. The recent news of whales increasing their holdings of ETH suggests that both institutions and whale accounts are returning to the Ethereum ecosystem.

WLFI multi-signature address holding information

The recent performance of new and old projects in the DeFi track at the price level is beyond description. At present, the TVL of DeFi is about 100 billion US dollars. The total value of current cryptocurrencies and related assets is about 4 trillion US dollars, of which only 2% of the funds are truly active in the DeFi field, which is still very small compared to the size of the entire cryptocurrency market. This means that with the warming regulatory wind, DeFi still has huge room for growth.

Aave is a typical beneficiary of this round of "capital repatriation". Its price broke through before Trump won the election, and since then its TVL and revenue have shown explosive growth: TVL broke through the historical high of 22 billion US dollars in October 2021; the token price has risen from the low of 80 USDT this year, breaking through the March high of 140 USDT in early September and accelerating in late November; the protocol's total daily revenue exceeded the second peak in September 2021, and the weekly revenue set a record high.

Although Aave recently upgraded to V4, the innovative momentum at the technical level may not be enough to support such a large-scale increase. The promotion from the regulatory and financial levels is obviously a more important logic, and this promotion will even overflow to the NFT track that was also favored by institutions in the last cycle.

The Future of Ethereum

Ethereum encountered a series of controversies and discussions related to its ecological development in the middle of this year. With the rise of Solana, the new old blockchain began to seize Ethereum's developers and user base, and the ecosystem began to shake. Ethereum seemed to have forgotten its original goal. As the first blockchain to build smart contracts, Ethereum successfully made major institutional investors pay for it in the last cycle through its first-mover advantage. Whether it is DeFi, chain games, NFTs, or the metaverse, they cannot escape the Ethereum ecosystem. Its original intention of "world computer" has been deeply rooted in people's hearts.

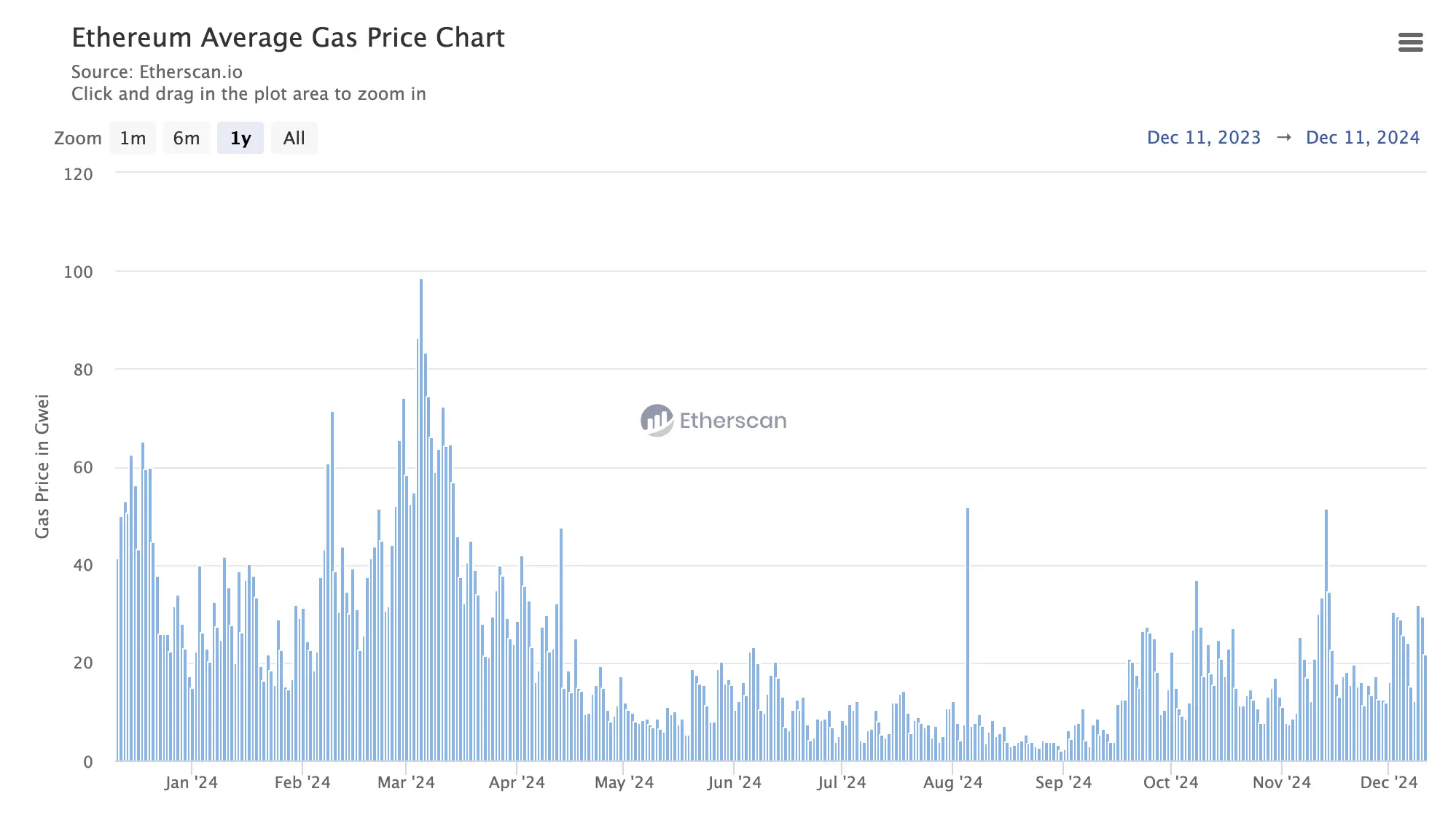

Although the liquidity fundamentals of Ethereum have improved optimistically, from the perspective of Ethereum itself, its daily average number of transactions, gas fees, number of active addresses and other on-chain data indicators have not increased significantly. This shows that the activity on the Ethereum chain has not increased synchronously with its price, and the block space is still in excess.

Ethereum Gas Fee Level

In the past few years, Ethereum has focused on building the infrastructure of cryptocurrency, providing the market with a large amount of cheap block space. On the one hand, this move has improved Dapp's access to blocks and reduced the transaction costs of the L2 expansion solution. On the other hand, due to insufficient market liquidity and low transaction demand, Ethereum's huge block space has not been fully utilized.

However, this is not a real problem in the long run. As mentioned above, institutional funds are gradually flowing back and even starting to build exclusive blockchain use cases. For Ethereum, which has a secure and flexible architecture, to B is its advantage. Not only does it have an overwhelming advantage in security, it is also compatible with many EVM projects, providing developers with an option that is almost "impossible to be fired."

The long-term value of Ethereum will depend on the scarcity of its block resources, that is, the actual and continuous demand for Ethereum block settlement in the world. As institutions and applications continue to pour in, this scarcity will become more prominent, thus laying a more solid value foundation for Ethereum. Ethereum is an institutional world computer. Starting with DeFi, institutions will solve the problems of Ethereum block surplus and roadmap disputes in the future.

In early December, Ethereum researcher Jon Charbonneau wrote a long article analyzing why Ethereum needs a clearer "North Star" goal. He also suggested concentrating Ethereum's ecological power on the "world computer", just like Bitcoin's "digital gold" and Solana's "on-chain Nasdaq".

Ten years have passed, and Ethereum is no longer in the startup stage, but its future in the next decade is already clearly visible.