Author: Yangz, Techub News

On the evening of December 12, Avalanche announced that it had completed a $250 million financing through a locked token sale. Galaxy Digital, Dragonfly and ParaFi Capital led the investment, and more than 40 investment companies including SkyBridge, SCB Limited, Hivemind, Big Brain Holdings, Hypersphere, Lvna Capital, Republic Capital, Morgan Creek Digital, FinTech Collective, CMCC Global, Superscrypt, Cadenza, Chorus One and Tané Labs participated in the investment. The funds raised will be used to promote an upgrade called "Avalanche9000".

To be honest, I haven't heard of Avalanche9000 before. Compared to the popular Memecoin, the progress of many old public chains has been overlooked in this bull market. As early as the beginning of September, Avalanche announced the launch of the Avalanche9000 upgrade (or Etna upgrade), and regarded it as the "biggest upgrade" since its launch. Simply put, Avalanche hopes to change its original expansion form "subnet" through Avalanche9000 and build it into Avalanche L1. According to Avalanche, Avalanche9000 will allow new Avalanche L1 custom staking, gas tokens, and governance while retaining the advantages of fast termination time and high throughput of the subnet. But specifically, how can this upgrade be achieved?

As one of the original "Ethereum killers", Avalanche started the "subnet road" in 2022, allowing various applications to create their own application chains. However, to become a subnet validator, you need to verify the Avalanche main network (Primary Network) at the same time, including the contract chain (C-Chain), platform chain (P-Chain) and transaction chain (X-Chain). This means that the validator must allocate at least 8 AWS vCPUs, 16 GB RAM and 1 TB storage space for network verification, in addition to a minimum stake of 2,000 AVAX.

At first, this requirement may not be too high, but as AVAX appreciates (AVAX price is around $52 at the time of writing), the overall operating cost will become higher and higher (the minimum staking requirement can be lowered, but frequent changes may not be Avalanche's consideration). In the long run, such a high entry barrier will affect the adoption of the Avalanche ecosystem.

Therefore, the Avalanche Foundation launched proposal ACP-77 in April, which aims to completely reform the creation and management of subnets and give subnet creators greater flexibility.

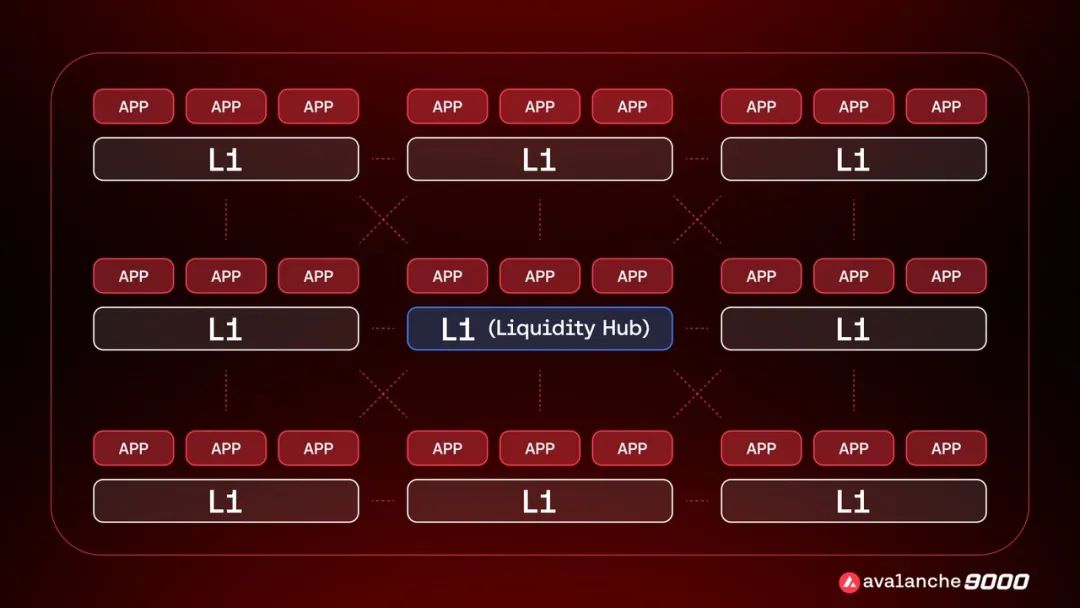

According to the proposal, Avalanche L1 validators will no longer need to validate the main network at the same time. They only need to synchronize with P-Chain, which will track changes in its own Avalanche L1 validator set and handle cross-L1 communication through AWM. In addition, Avalanche L1 can decide and implement its own verification rules and staking requirements, and P-Chain will no longer support the distribution of staking rewards for Avalanche L1. In other words, the sovereignty of Avalanche L1 returns from P-Chain to L1 itself.

On the other hand, the proposal plans to change P-Chain's fee mechanism from a fixed fee per transaction to a dynamic fee that is more in line with the user-pays principle, thereby ensuring the long-term economic sustainability of Avalanche after the removal of the 2000 AVAX staking requirement. Specifically, the dynamic fee mechanism is related to multiple factors such as the total number of Avalanche L1 validators registered on P-Chain. Fees will be adjusted based on network usage, and fees will increase when the total number of Avalanche L1 validators exceeds the target usage rate, and vice versa.

In addition to the proposals in ACP-77, other implementation foundations of Avalanche9000 include two major interoperability protocols: Inter-Chain Token Transfer (ICTT) and Inter-Chain Messaging (ICM).

ICTT is a set of smart contracts deployed in multiple subnets based on the cross-chain communication protocol Teleporter and Avalanche Warp Messaging technology, allowing users to transfer tokens between subnets. Each token transferor consists of a "home" contract and at least one (or more) "remote" contract. The "home" contract is located in the subnet where the assets to be transferred are located. The "remote" contract exists in other subnets.

ICM is designed to enable seamless communication between C-Chain and new and existing Avalanche L1s. As long as a new L1 is deployed through Avalanche, it will be immediately supported and can interact with other L1s at any time. With ICM, developers only need to call sendCrossChainMessage on the TeleporterMessenger contract to send information from one Avlanche L1 to another. (Note: The Github technical documentation related to ICM has not yet been released. Interested students can refer to the relevant courses of Avalanche Academy.)

From September 3rd to now, only more than three months have passed, but the progress of Avalanche9000 is not slow. In the month of the official announcement, the Avalanche Foundation announced the launch of two incentive programs, namely Bounty9000 with a maximum reward of US$9,000 and Retro9000, a retroactive incentive program of US$40 million, which aims to reward developers who develop L1 and related tools on Avalanche. On November 26, Avalanche9000 was upgraded and launched on the Fuji testnet, and the latest expected time for the mainnet launch is December 16.

Avalanche said that the Avalanche9000 upgrade will reduce the deployment cost of Avalanche L1 by 99.9% and reduce the transaction cost on the existing C-Chain by 25 times. Currently, more than 500 L1s are under development, covering areas such as tokenization of real-world assets (RWA), loyalty and rewards, games, payments, and institutional projects.

Avalanche9000 will undoubtedly make a significant contribution to Avalanche's expansion. However, in an environment where market sentiment is more inclined to pursue high-risk assets without a clear technical basis, can such technological advances bring Avalanche back to investors' horizons? In fact, not only Avalanche, but also NEAR's layout on AI, Polkadot's 2.0 plan, and the TradFi wave on Aptos, etc., have been submerged in the torrent of Memecoin. Memecoin's "instant burst" attribute has its market logic, and various technological advances often take longer to settle and verify.