In the early morning of March 4, the crypto market's "horrifying night" made investors deeply realize the cruelty of the crypto market. The market shows that BTC fell rapidly from the weekend high, falling below $86,000, with a 24-hour drop of 4.39%; ETH even fell below $2,200, a drop of more than 6%. This plunge not only filled the $77,000 gap in CME Bitcoin futures, but also tore open the deep contradictions under the market's prosperity - when favorable policies, technical laws and capital games are intertwined, who is actually controlling the direction of the market? .

False prosperity: the “paper bull market” on March 2

Looking back at the grand occasion on March 2 when Trump announced that XRP, SOL, and ADA would be included in the U.S. strategic reserve, the scene of Bitcoin soaring by $10,000 in 3 hours seemed like a distant past. However, the on-chain data revealed the essence of this carnival: it was a "castle in the air" driven by futures leverage.

- Spot market false fire: Although major exchanges recorded a net inflow of 13,000 BTC, Binance's spot trading volume was only 65,000 BTC (about US$5.97 billion), far lower than the 104,000 BTC (US$7.7 billion) at the same level in November last year. What really drives prices is the surge in futures positions on CME and Bybit - the total open interest exceeded US$53.8 billion, of which US$14.3 billion was concentrated on CME.

- The "reverse signal" of stablecoins: USDT and USDC on-chain reserves decreased by $580 million in 24 hours, and the proportion of stablecoin/BTC trading pairs soared to 67%. This seems to be a surge of funds into the crypto market, but in fact it is a "pass the buck" of existing funds under the catalysis of leverage.

- Precise harvesting of whales: addresses holding 1,000+ BTC increased their holdings by 42,000 BTC during the surge, but three anonymous addresses transferred more than 10,000 BTC in a single transaction. The on-chain trajectory shows that most of these chips came from cold wallet activations, suggesting that "smart money" that had already made arrangements took advantage of the favorable conditions to sell.

This surge, which lacked real financial support, had already laid the groundwork for the subsequent plunge.

Macroeconomic recession looms over the market

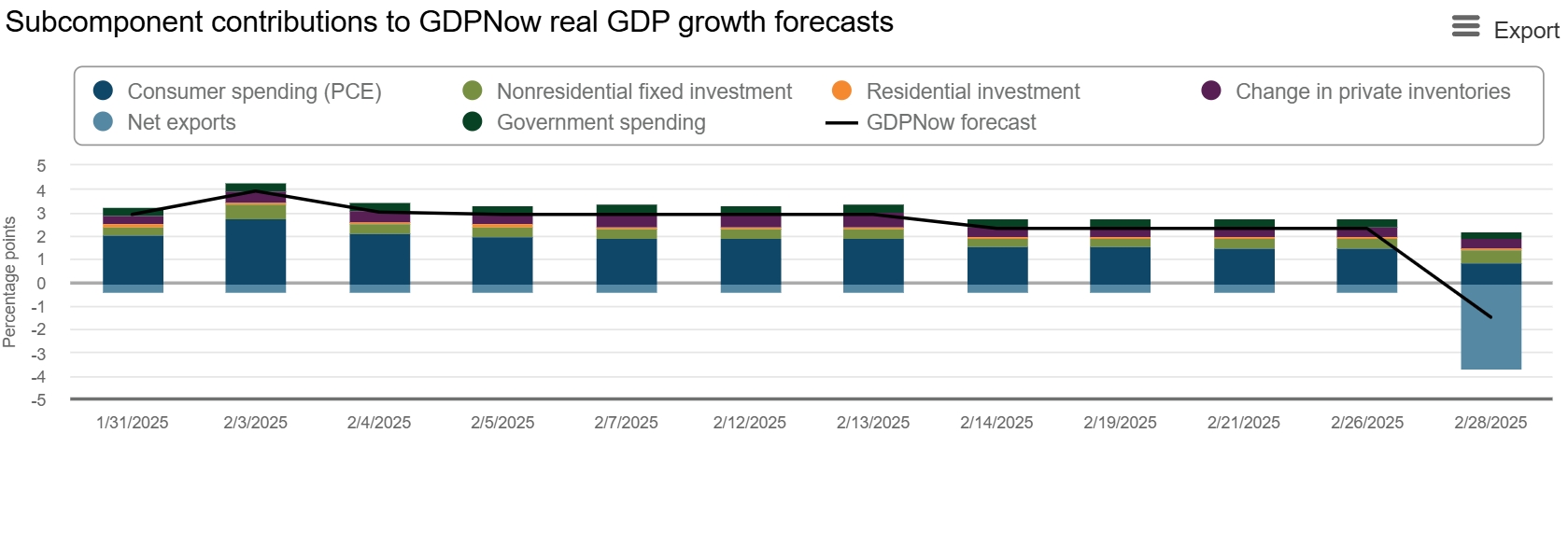

At present, the global macroeconomic situation has put significant pressure on the cryptocurrency market. Taking the United States as an example, the Atlanta Federal Reserve's GDPNow model predicts that by the end of the first quarter of 2025, the US GDP will shrink by 2.8%, a catastrophic reversal from the 3.9% growth predicted four weeks ago. This recession expectation has made investors more cautious about risky assets, and cryptocurrencies, as high-risk assets, are naturally the first to bear the brunt.

Since the approval of the spot Bitcoin ETF, the connection between cryptocurrencies and traditional financial markets has become increasingly close. In the economic boom, this integration may attract more funds to flow into the crypto market; but under the expectation of recession, its disadvantages are exposed. Once the US economy hits a low point, the turmoil in the traditional market will quickly spread to the crypto market, weakening investor confidence. The sharp fluctuations in Bitcoin prices in the past few days are a reflection of this trend - although there was a brief rise over the weekend, the gains were quickly wiped out, and the low market sentiment is evident.

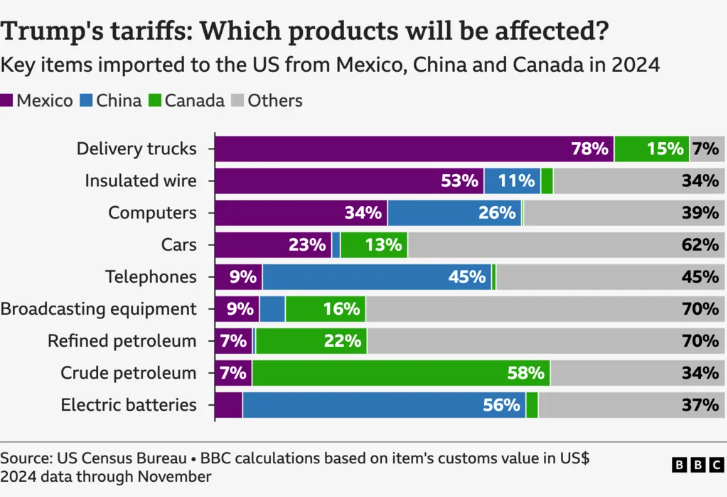

Trade war: Tariff policy shatters illusions

The escalation of the trade war has further exacerbated market uncertainty. US President Trump recently announced additional tariffs on Mexico and Canada, and made it clear that "there is no room for negotiation." After that, he announced on Truth Social that from April 2, a "reciprocal tariff" policy would be implemented on the European Union, Japan, South Korea, etc., that is, reciprocal measures would be determined based on the tariff levels of each country on the United States. This tough attitude exceeded market expectations. Previously, many people believed that Trump's tariff policy might just be a bargaining chip and had a certain degree of flexibility. However, the latest statement shows that the tariff war has been fully launched and the market has to face this reality.

The increase in tariffs will push up the prices of imported goods, which will in turn increase inflationary pressure in the United States. In a high inflation environment, the Fed's room for interest rate cuts is compressed, and high interest rates may last longer. This not only increases the risk of economic recession, but also suppresses the cryptocurrency market that relies on liquidity and risk appetite. The market crash on March 4 is a direct reflection of this expectation adjustment.

In addition, the ongoing conflict between Russia and Ukraine has also cast a shadow on the market. Ukrainian President Zelensky said the war would not end soon, dashing the market's expectations for a short-term resolution of the conflict. The combination of geopolitical risks and tariff policies has further weakened investors' risk appetite.

This series of policies not only hit the U.S. stock market, but also affected the crypto market through its linkage effect with the U.S. stock market. Crypto market maker Efficient Frontier pointed out that if the U.S. stock market continues to weaken, the crypto market may face greater adjustment pressure.

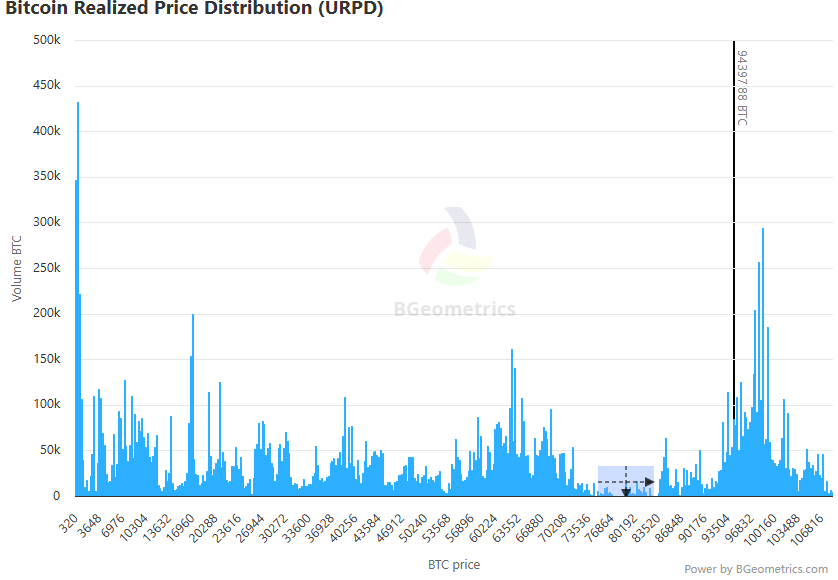

Futures Gap Filling: A Technically Driven Pullback

From the perspective of technical analysis, the filling of the CME (Chicago Mercantile Exchange) Bitcoin futures gap is one of the important triggers of this decline. The so-called CME gap refers to the difference between the CME Bitcoin futures price and the spot price, which is usually formed after weekends or holidays. Historical data shows that the probability of CME gap filling is more than 90%, and the URPD (unrealized profit/loss distribution) indicator also shows that there is a significant gap near $77,000. Historically, all URPD gaps have been filled.

Recently, the market price has fallen rapidly to this level and then rebounded rapidly. This trend is highly consistent with the characteristics of gap filling. In the case of low market sentiment and intensified technical selling pressure, gap filling tends to amplify price fluctuations and form the technical basis of "painting door market". Although the time of gap filling is uncertain, its probability and influence cannot be ignored.

Outlook for the future: Supervision and capital flows become the key

Looking ahead, crypto market movements are likely to be driven by:

- Market differentiation under high regulatory pressure The US SEC has established a "Crypto Regulatory Working Group" to explicitly crack down on speculative tokens that lack practical value (such as Meme coins). DeFi and GameFi may also face scrutiny due to excessive narratives. In addition, the EU MiCA regulations will take full effect in January 2025, which may further squeeze the living space of altcoins.

- Funds are concentrated in compliant assets. The Trump administration's "Strengthening U.S. Digital Financial Technology Leadership" executive order and the "Payment Stablecoin Clarity Act" have released positive signals. However, funds may flow to policy-supported assets (such as BTC, ETH, and stablecoins) instead of comprehensively boosting the altcoin market.

- Opportunities in short-term fluctuations Although macro risks have not dissipated, events such as Ethena's $100 million financing and the launch of the Ethereum Pectra upgrade test network have injected some vitality into the market. If Trump's "Crypto Summit" on March 7 can provide a clear policy direction, it may become a catalyst for a new round of market conditions.

Conclusion: When the Tide Goes Out

The filling of the CME gap has completed the self-correction of the technical side, but the real test of the market has just begun. The White House Crypto Summit on March 7 may bring new policy sparks, but investors should be vigilant: in the context of macroeconomic headwinds, unclear regulatory framework, and capital stock game, any positive news may become a catalyst for long and short kills. For ordinary investors, it is particularly important to remain rational in this "painting door market". Focusing on compliance main lines and assets with sound fundamentals may be a better strategy to cross the cycle.