After a week of ups and downs in tariff frictions, the market finally got some respite over the weekend, but it is still unclear how long this respite will last, because the tariff issue is an event-driven emergency that leads to risk aversion of funds and a temporary collapse of sentiment, so volatility will also be very large.

However, once the market confirms the fundamental changes brought about by tariffs and the release of risk aversion, the entire financial market will be able to find a new balance. This is why global stock markets, especially US stocks, ended a week of volatility with a rise last Friday. We can see this from the changes in the volatility index of the S&P 500.

It can be seen that the VIX index hit a recent high last week. The only extreme events that can be compared with it in the past few years are the Bank of Japan's interest rate hike last year and the financial turmoil caused by the epidemic in 2020. This is why the market has experienced such large fluctuations in the past week. After all, it is rare in history.

Well, when this huge fluctuation comes to a temporary end, the factors affecting the trend of the Crypto market will return to the old-fashioned "inflation" and "interest rate cuts", because only interest rate cuts can usher in "flooding the golden mountain" and bring hope of growth to risky assets led by BTC.

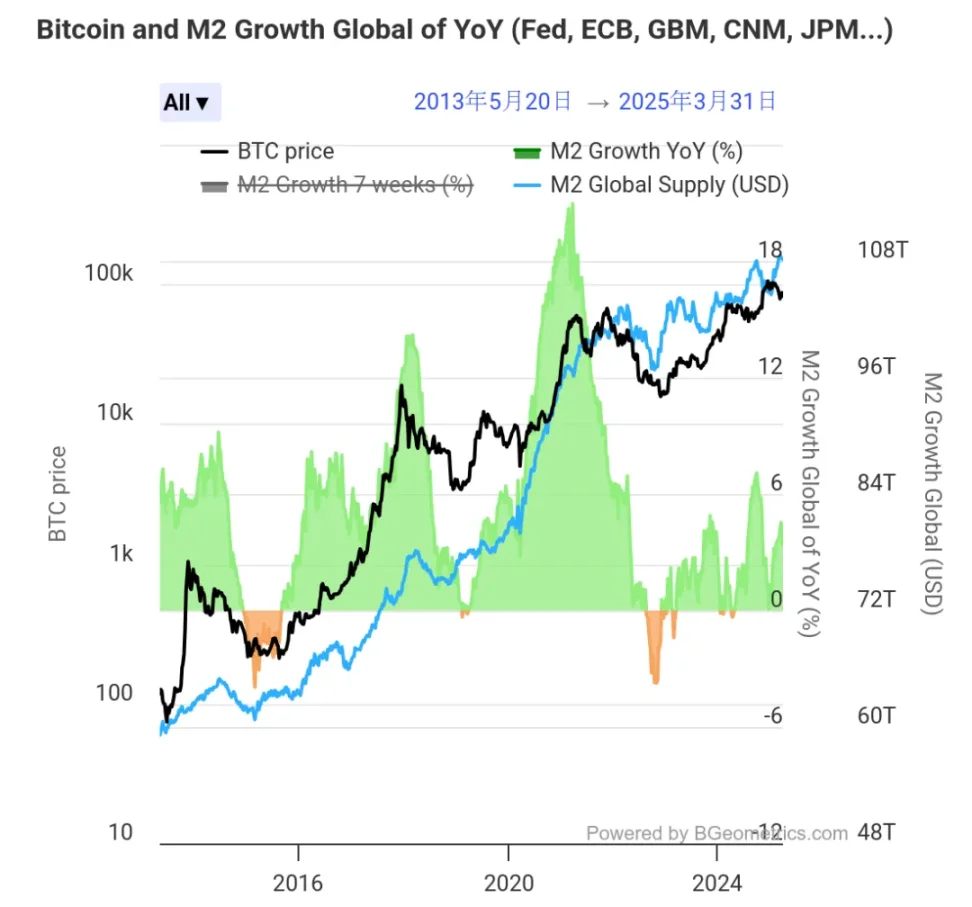

We can analyze this correlation by comparing the trends of global broad money supply (M2) and BTC over the past 10 years. The figure below shows that the huge increase in BTC over the past 10 years is based on the surge in global M2, and this correlation trend far exceeds other financial data.

This is why BTC always fluctuates whenever the US releases data related to inflation or interest rate cuts, because it ultimately affects whether new funds can enter the Crypto field.

However, at present, it seems that most people in the Crypto market are only focused on the Fed’s path of interest rate cuts, while ignoring another data worthy of attention - the size of PBOC assets, that is, the size of central bank assets, which reflects the current liquidity of my country’s currency.

When everyone is paying attention to the financial market on the West Coast, they ignore our own financial liquidity. In fact, it is also closely related to the rise and fall of BTC. After all, we are a great country, one of the best.

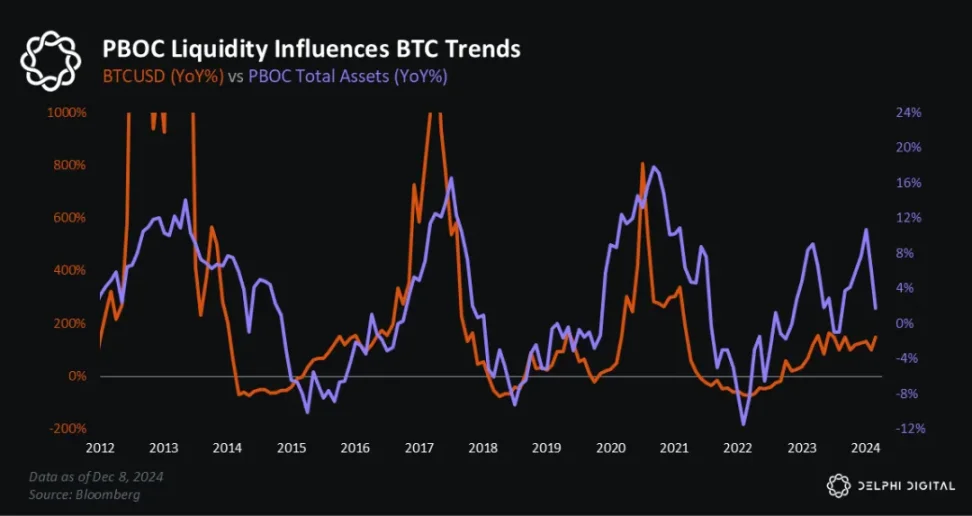

The figure below shows the changes in the growth of BTC and the growth of PBOC asset size in the past three cycles. It can be seen that this correlation fluctuation runs through almost every big rise in BTC, and it also corresponds to the cycle of every 4 years.

PBOC’s liquidity played a role in the 2020-2021 Crypto bull market, the 2022 bear market, the recovery from the cycle low in 2022-early 2023, the surge in Q4 2023 (before the BTC ETF was approved), and the Q2-Q3 pullback in 2024.

Also a few months before the 2024 US election, PBOC's liquidity turned positive again, just in time for a wave of "election bulls."

However, we can see in the figure below that the scale of POBC began to decline after September 2024, and bottomed out at the end of 2024, and has now risen to its highest point in the past year. From the perspective of data correlation, changes in PBOC liquidity usually precede significant fluctuations in the BTC and Crypto markets.

Interestingly, in the BTC bull market of 2017, the Federal Reserve was not the one that “flooded the market with money”. Instead, it raised interest rates three times throughout the year and implemented quantitative tightening. However, risk assets led by BTC still performed very optimistically in 2017, as the size of PBOC hit a new high that year.

Even the increase in the S&P 500 is somewhat correlated with the liquidity of PBOCs. From historical data, the annual correlation coefficient between the total assets of PBOCs and the S&P 500 is about 0.32 (based on data from 2015-2024).

Of course, in a sense, the correlation will be amplified in the short term because the PBOC quarterly monetary policy report overlaps with the Federal Reserve's interest rate meeting time window.

In summary, we can find that in addition to paying close attention to the US's monetary easing, we also need to pay attention to changes in domestic financial data. A week ago, the news was released: "Monetary policy tools such as reserve requirement ratio cuts and interest rate cuts have sufficient room for adjustment and can be introduced at any time." What we need to do is to track this change.

It is worth noting that in terms of asset size, as of January 2025, my country's total deposits are US$42.3 trillion, while the United States' total deposits are approximately US$17.93 trillion. It has to be said that in terms of deposit size, we have more financial possibilities. If liquidity improves, perhaps there will be some changes.

Of course, another point that needs to be discussed is whether liquidity can flow into the crypto market if available. After all, there are still certain restrictions. However, Hong Kong has already given an answer. Judging from the looseness and convenience of policies, it is different from a few years ago.

Finally, I would like to end this week's review with a quote from Mr. Lei Jun: "When the wind blows, even pigs can fly." It is better to ride on the momentum than to sail against the current. Besides waiting, all we have to do is to dare to step up and fly into the wind when the wind blows.