Written by: Loki, BeWater

How did Ethena-USDe achieve 50% monthly growth?

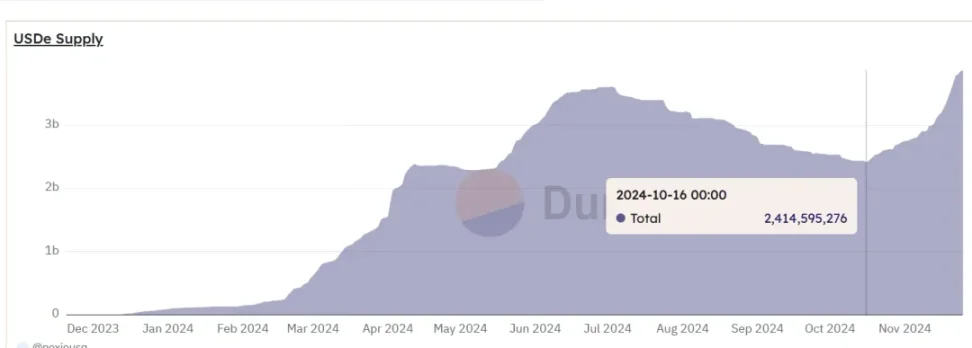

In the past month, the total issuance of USDe increased from 2.4 billion to 3.8 billion, achieving a monthly growth of over 58%. The underlying logic is that after BTC broke through a new high, the long sentiment was strong, and the increase in funding rates raised the pledge yield of USDe and brought about the growth of USDe. Although it has dropped compared to the previous few days, the APY shown on the Ethena official website on November 26 was about 25%.

MakerDAO becomes the “unexpected winner”

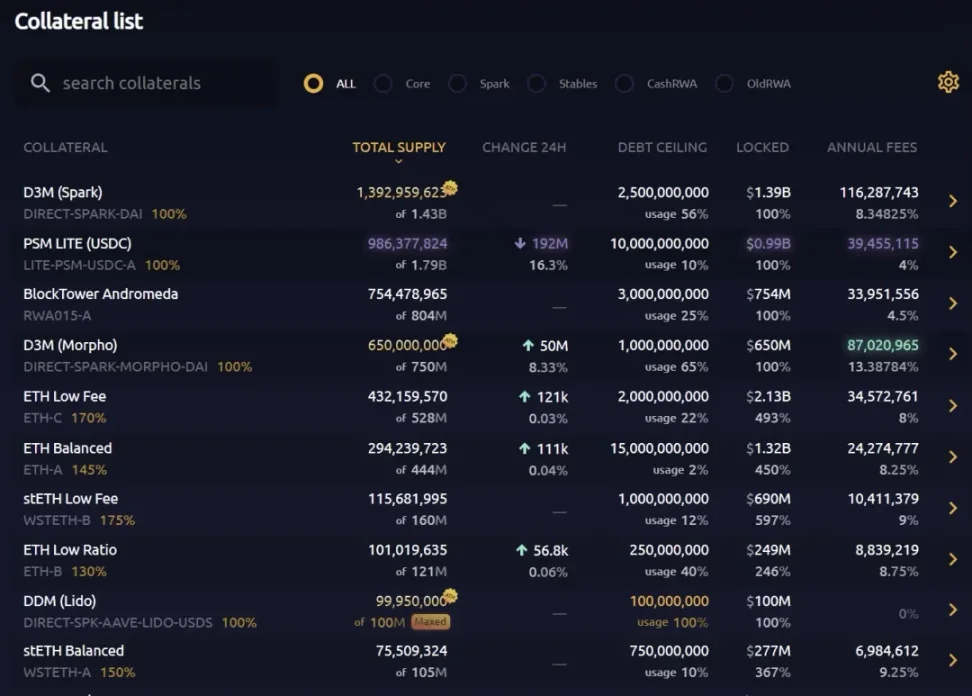

At the same time, MakerDAO has become a hidden winner. The current daily income of Maker has increased by more than 200% compared with one month ago, setting a new high. The huge growth is closely related to Ethena. On the one hand, the high pledge APY of USDe has brought huge lending demand for sUSDe and PT assets, and the total scale of DAI borrowed with sUSDe and PT as collateral in Morpho is about 570 million US dollars, the loan utilization rate exceeds 80%, and the deposit APY is 12%. In the past month, the total amount of loans issued by the Maker D3M module through Morpho has increased by more than 300 million US dollars. In addition to the direct path, the lending demand of sUSDe and PT has also pushed up the utilization rate of DAI in other indirect channels. Sparkfi's DAI deposit rate has reached 8.5%.

At the same time, the balance sheet shows that Maker has issued DAI loans totaling $2 billion to Morpho and Spark through the D3M module, which is close to 40% of Maker's assets. These two items alone have generated $203 million in annualized fees for Maker, equivalent to $550,000 in daily revenue for MakerDAO, accounting for 54% of MakerDAO's total annualized fees.

Ethena has become the core of the DeFi revival

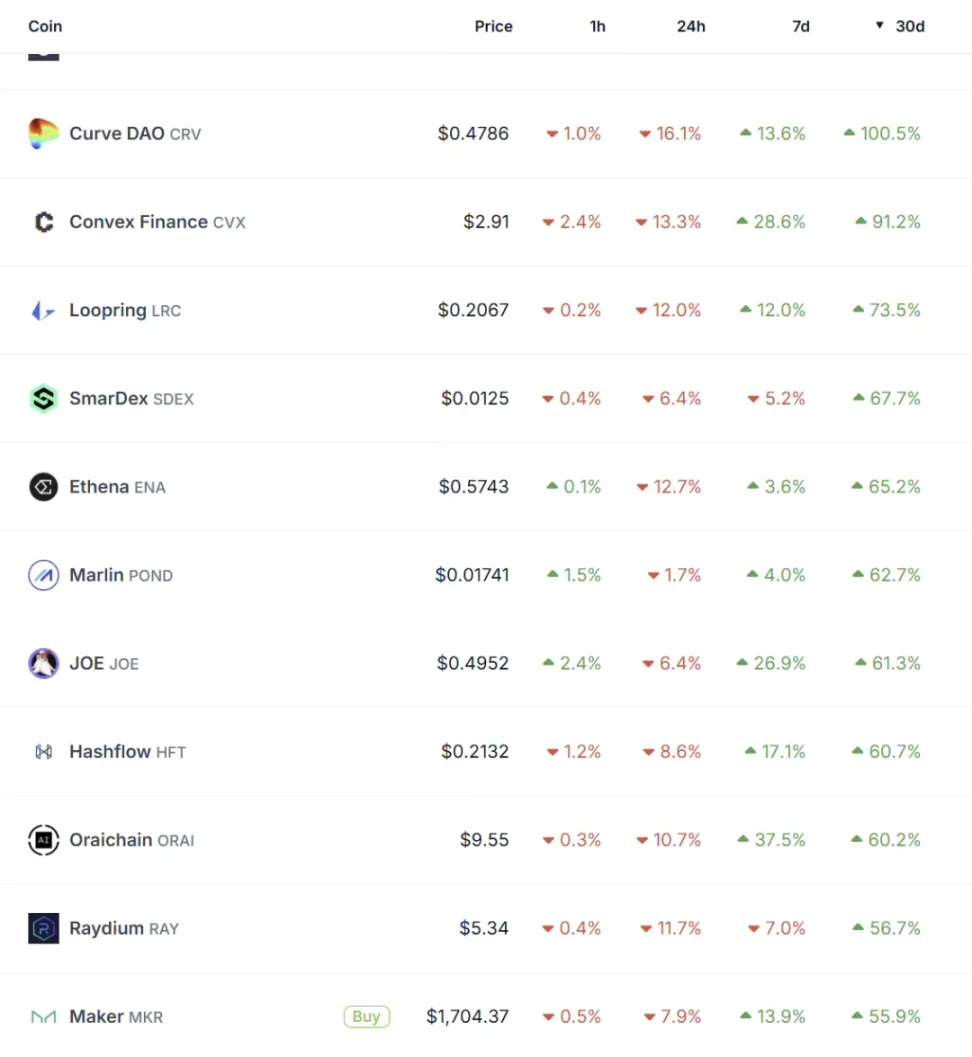

USDe's growth path has become very clear here. BTC's new high bullish sentiment has pushed up the funding rate, affecting USDe's staking yield, while MakerDAO has benefited from the complete and highly liquid funding impact link and the "central bank attributes" brought by the D3M module, becoming the water carrier of USDe, and Morpho has played the role of "lubricant" in this process. The three protocols constitute the core of growth, and the protocols in the outer circle, such as AAVE, Curve, and Pendle, have also absorbed the benefits brought by USDe's growth to varying degrees. For example, AAVE's DAI borrowing utilization rate exceeds 50%, and the total amount of USDS deposits is close to 400 million US dollars; USDe/ENA related trading pairs have occupied the second, fourth, and fifth places in Curve's trading volume rankings and the first and fifth places in Pendle's liquidity rankings. Curve, CVX, ENA, and MKR have also achieved a monthly increase of more than 50%.

Is the growth spiral sustainable?

In this growth spiral, almost every participant is a beneficiary. USDE leveraged miners/lenders can obtain extremely high but variable yields through leverage, DAI deposit users obtain higher but relatively stable yields, low-level arbitrageurs mint/borrow DAI by staking Warp BTC and ETH LST and earn interest spreads, and high-level players obtain excess returns through a combination of DeFi protocols, while the protocols reap higher TVL, revenue, and coin prices.

The key to growth or not lies in whether the interest rate difference between USDe and DAI will continue to exist. Since DAI provides a relatively predictable monetary policy, the focus of this issue is on USDe. The influencing factors include: ① Whether the bullish sentiment of the bull market can continue ② Whether Ethena can obtain higher APY distribution efficiency through the improvement of economic models and the increase of market share ③ Competitors' competition for the market (such as the interest-bearing stablecoin strategy recently launched by HTX and Binance)

Will D3M make DAI the next LUNA?

Along with the growth comes the concern about the security of D3M. The basic feature of D3M is that it allows direct and dynamic generation of DAI tokens without the need for traditional collateral in another token. Some people believe that this is "printing money without an anchor." However, from the perspective of the balance sheet, the DAI minted by D3M is collateralized by sDAI. Compared with the traditional method of first increasing assets and then increasing liabilities, the minting process of D3M occurs simultaneously. At the same time, considering that sDAI is eventually lent by USDe, the collateral eventually becomes sUSDe or PT with an LTV of more than 110%, and eventually becomes a "long and short synthetic asset position with an LTV ratio of more than 110%."

Based on this, D3M will not directly turn DAI into UST or a non-collateralized stablecoin, but it will indeed increase some risks:

- An excessively high proportion of the D3M module will make DAI once again a "shadow stablecoin", similar to how PSM turned it into a "shadow USDC"

- Ethena's operational risk, contract risk, and custody risk will be transmitted to DAI, and Morpho and other intermediate links will further stack risks.

- Lowering the overall LTV of DAI