Original article "【10,000 Words Research Report】A comprehensive guide to the tokenization of real-world assets (RWA): technical challenges, legal barriers and industry case analysis, exploring the application of tokenization in various fields", the following is one of the contents:

As blockchain technology matures and becomes more widely used, the tokenization of real-world assets is evolving rapidly, a phenomenon known as the "great tokenization." This revolution in asset ownership, trading, and value creation is changing the landscape of trillions of dollars in markets. Imagine being able to own a piece of air above Manhattan and trade it like a stock; or investing in a Picasso masterpiece for just $50; or being able to easily buy government bonds with the touch of a phone screen, or even buy 30 minutes of communication time with your favorite cryptocurrency personality (this time can be traded and its value will fluctuate). These are not far-fetched ideas, but realities that are happening today.

The advent of asset tokenization has made many markets that were once out of reach accessible. Today, real estate ownership is fragmented, and investors can buy shares of properties around the world for far less than the price of a good dinner. Government securities, which have traditionally been the monopoly of large institutional investors, are also gradually moving to the blockchain, allowing ordinary investors to participate. Whether it is energy, time, airspace, or intellectual property, mortgages, car rentals, carbon credits, as long as it is an asset, whether tangible or intangible, tokenization is being explored.

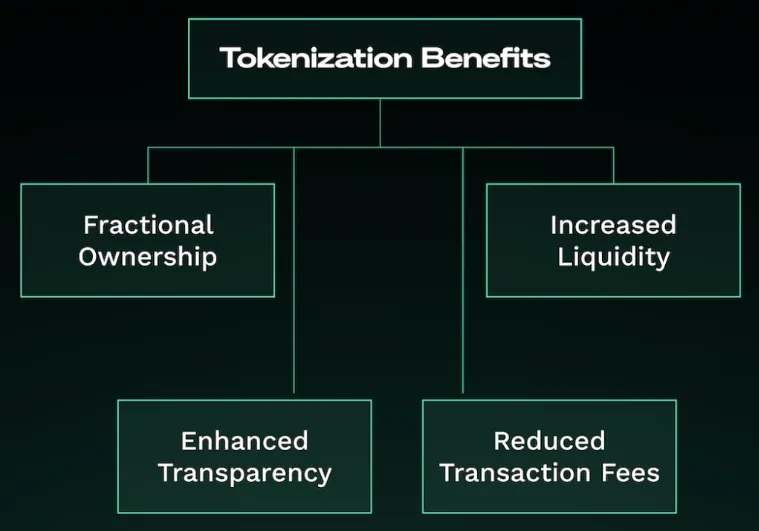

The core of asset tokenization is to convert the rights of assets - whether physical assets or digital assets, tangible or intangible - into digital tokens on the blockchain. This seemingly simple process contains infinite possibilities, which are mainly reflected in the following four advantages:

1. Enhanced liquidity

Through tokenization, assets can be bought and sold at any time, improving market liquidity.

2. Achieve split ownership

Investors can purchase partial interests in assets, which greatly lowers the investment threshold for high-value assets.

3. Improve transparency

The openness and immutability of blockchain technology make the asset transaction process more transparent and reduce the risks of fraud and disputes.

4. Reduce transaction fees

Through technologies such as smart contracts, intermediary fees in traditional transactions can be significantly reduced.

The impact of this change is far-reaching. In the field of scientific research, the tokenization of intellectual property is changing the way biomedical research is financed, attracting more attention from small investors. The tokenization process in the high-end spirits market has also made assets that were previously considered luxury goods accessible to more people. Even precious metals such as gold are being redefined in the wave of digitalization, allowing investors to own and trade partial rights in gold without touching the physical object.

From real estate to rare whiskey, from carbon credits to future earnings, the potential of tokenization seems to have no boundaries. It not only changes the way we invest, but also reshapes our understanding of ownership and value. In the following report, we will take a deep dive into the world of tokenization and its far-reaching impact, analyze various unique projects, study the technology that drives this change, and look forward to the future trends of asset ownership and trading. Let us witness how the "great tokenization" reshapes the global financial ecosystem on a whole new level.

1. “The Great Tokenization”: The Rise of Trillion-dollar Opportunities

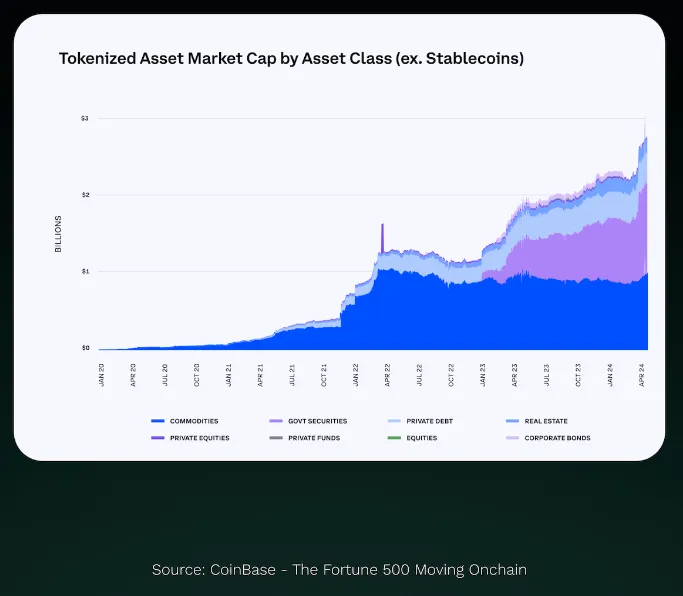

Around the world, trillions of assets are waiting for the possibility of tokenization. According to RWA.xyz, approximately $185 billion of assets have been tokenized (including stablecoins), a figure that has attracted widespread attention. This makes people wonder: what does this great tokenization wave mean? And how can individuals seize this opportunity and realize benefits?

1. Blockchain: The cornerstone of tokenization

The role of blockchain is particularly important when discussing asset tokenization. Although cryptocurrencies are sometimes seen as "solutions in search of problems", the advantages of blockchain become very clear in the context of asset tokenization. There are many long-standing problems in the traditional asset management field that are troubling investors, issuers and regulators. The lack of transparency in the private equity market has caused asset pricing deviations and increased risks; the poor liquidity of high-value assets (such as real estate and art) has caused large amounts of funds to be locked up for a long time; high barriers to entry make it difficult for small investors to diversify their assets; and the inefficient processes of multiple intermediaries make transactions slow, costly and error-prone. In addition, limited trading hours limit investors' rapid response to global events, and the market's opacity provides opportunities for fraud and manipulation.

Blockchain technology provides a solution to these long-standing problems. It records all transactions through an immutable public ledger that is accessible to any participant. This unprecedented transparency and security not only enhances trust among investors, but also significantly reduces the risk of fraud and improves the transparency issues of many asset markets.

2. Revolutionary changes in trading methods

Another breakthrough of blockchain technology is its enhanced tradability. The technology enables 24-hour non-stop trading, breaking the limitations of time zones and reducing the reliance on intermediaries. This continuous market activity injects new vitality into traditionally illiquid assets. Imagine being able to buy and sell a portion of real estate as easily as trading stocks. This is the charm of tokenization.

And these benefits are not limited to transparency and tradability. The programmability of blockchain, especially through the application of smart contracts, opens up new possibilities for asset management and governance. Dividend distribution, voting rights and other complex processes can be automated, improving efficiency and providing new opportunities for investors to participate. This mechanism effectively solves the cumbersomeness of corporate behavior management in traditional systems.

3. Break down barriers and expand investment opportunities

Combined, these features democratize investment opportunities in unprecedented ways. High-value assets that were once accessible only to wealthy investors can now be divided into smaller, more accessible units. This model of fractional ownership not only expands access to a variety of assets such as art and commercial real estate, but also enables more investors to build a diversified portfolio, breaking down the high barriers that have long excluded small investors.

2. Advantages of Tokenization

The core of tokenization is to create a digital representation of an asset through blockchain technology. This process covers a wide range from real estate, works of art to intangible assets such as intellectual property. Each token represents a partial ownership of the underlying asset, making the ownership structure of the asset more granular and flexible.

The Four Pillars of Tokenization

- Fractional ownership: A key benefit of tokenization is the ability to divide assets into smaller, more affordable units, democratizing investment opportunities that were previously inaccessible. For example, instead of needing millions to invest in high-end real estate, investors can purchase tokens that represent a small portion of the property.

- Enhanced transparency: Blockchain technology provides an immutable record of transactions. This transparency not only reduces the risk of fraud, but also enhances market trust while simplifying the audit process.

- Lower transaction costs: By removing intermediaries and streamlining the transaction process, tokenization can significantly reduce the costs associated with the transfer and management of assets.

- Improved liquidity: Tokenization transforms traditionally illiquid assets into easily tradable digital tokens, potentially creating new, more liquid markets for a wide range of assets.

Tokenization of tangible and intangible assets

One of the most compelling aspects of tokenization is the tokenization of intangible assets. Such assets have often been difficult to turn into liquid, tradable commodities in the past. But through tokenization, intangible assets such as the rights to personal time or intellectual property can now be turned into liquid assets that can be easily bought and sold.

- Tangible assets: Physical assets with real, measurable value, such as real estate or art.

- Intangible assets: Assets that have no physical form but still hold value, such as intellectual property, future earnings and carbon credits.

While the tokenization of tangible assets such as real estate and art is groundbreaking in itself, even more exciting is the potential to bring intangible assets to the blockchain. These assets have often lacked a suitable value exchange mechanism in the past, but now, through tokenization, intellectual property, future earnings, and even personal time are creating entirely new markets and redefining the concept of value.

Imagine trading the future earnings of an emerging artist, investing in the patent for a groundbreaking medical discovery, or purchasing the carbon offset potential of a portion of a rainforest. These intangible assets that were previously difficult to quantify and trade are now accessible and liquid through tokenization.

3. Current Status of Tokenization

The writing of this report stems from an in-depth study of the real-world asset (RWA) tokenization space, and the authors found that there is much more activity in this space than most people think. This phenomenon is exciting, and we hope that it will attract more attention to the tokenization movement and its various projects.

Recent market forecasts indicate that the tokenization market is poised for explosive growth. It is estimated that by 2030, the market size of tokenized assets could reach between $2 trillion and $10.9 trillion, depending on the source of the forecast that is trusted. Real estate, debt instruments, and investment funds are seen as the main drivers of this growth and are expected to be the three largest tokenized asset classes.

1. The impact of tokenization

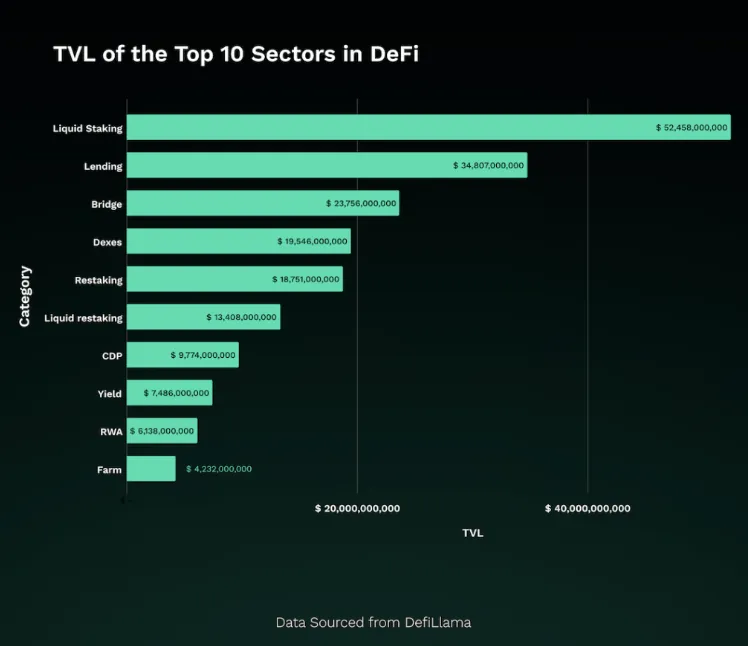

In the decentralized finance (DeFi) space, the impact of tokenization has already begun to emerge. As of 2024, real-world assets have taken an important position in DeFi, becoming the ninth largest market segment with a total locked value of $6.13 billion. This data shows that investors' confidence in tokenized assets is growing, and also demonstrates their important role in connecting traditional finance and DeFi.

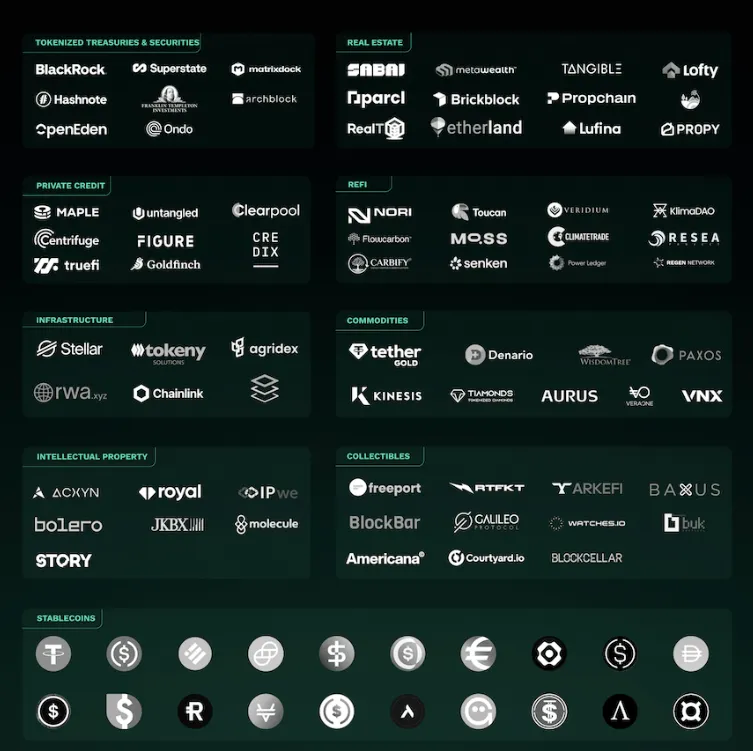

2. Ecosystem Overview

The RWA ecosystem is evolving rapidly, with a variety of projects emerging to bring traditional assets to the blockchain. The field ranges from traditional financial instruments such as tokenized treasuries and securities to more innovative developments such as tokenized intellectual property. These projects are committed to tokenizing assets such as private credit, real estate, commodities and high-value collectibles, demonstrating the diversity of blockchain technology in reshaping asset ownership and trading methods.

This ecosystem is compelling because of its potential to transform traditional markets. By improving accessibility, liquidity, and efficiency, these projects are changing the way financial markets work. Whether it is enabling fractional ownership of high-end real estate, providing more opportunities for art investment, or creating new ways to trade goods, tokenization is pushing the boundaries of finance and asset management. As the market matures, the integration between traditional finance and blockchain technology is also deepening, and stablecoins based on real-world assets are serving as a bridge between the two fields. This dynamic and rapidly developing ecosystem reflects the huge potential of blockchain to completely change the way we understand, value, and trade assets in the global economy.