Written by: Tony Ling, pen name Long Ye

Abstract

- As of the time of writing this article, Q4 2024, this is the beginning of a new round of bull market in the cryptocurrency world.

- In the macro field, the value of BTC is analogous to bonds and stocks in financial history, and is the "fuel" for a new round of development in human technology; in the meso field, it is the currency and index of the digital world that humans will inevitably enter in the future; in the micro field, it is the implementation of a new round of legal supervision and the compliance of currency issuance, thereby siphoning private investment demand from all over the world.

- This may be the last "grassroots" cycle of the crypto industry, and also the last mega cycle in which BTC has a huge beta increase. This means that after this cycle, BTC's beta will be greatly reduced, but it does not mean that there will be no 100-fold alpha opportunities in the broad token issuance market.

- The top of this round of BTC bull market will appear in Q4 of 2025, with a high point of 160,000-220,000 US dollars. Before that, in addition to the "first wave" that has already occurred, there are two more significant bull market mid-term trends.

- Now is the 1999 of the Internet era, which means that after the bull market reaches its peak in the next 12-18 months, the crypto industry will usher in a long winter, just like the bursting of the Internet bubble in 2000-2001. Of course, this is also an opportunity for the industry to reshuffle and reorganize. I am looking forward to it.

When I feel the bull market is coming, that’s when I produce the most articles.

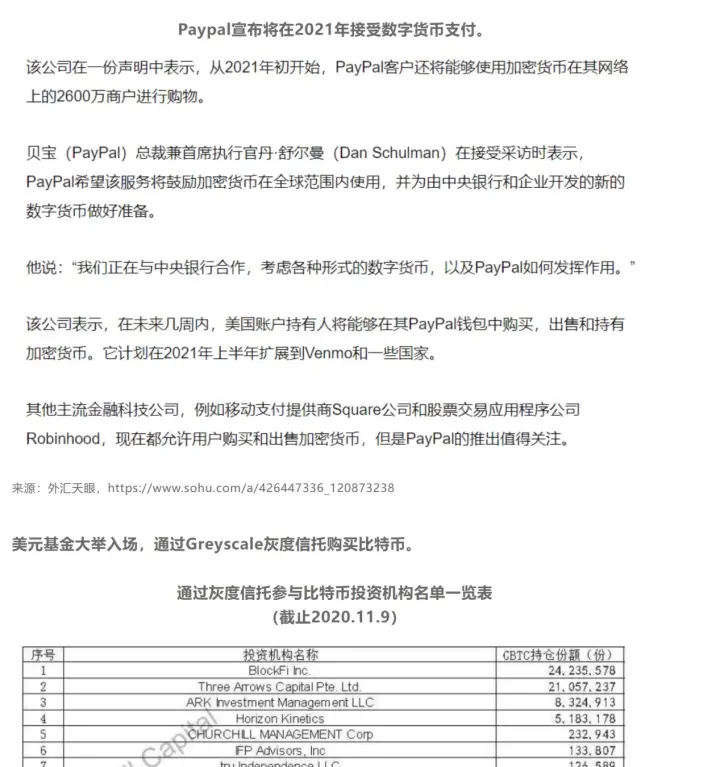

About 4 years ago, at the beginning of the last bull market, I wrote "How Should We Invest in Digital Currency in 2021?" When we talk about the entire digital currency industry, it is inevitable to mention the value and price of BTC first.

If you already believe in the value of Bitcoin, you might as well jump directly to the fifth part, which is the expected future price trend of Bitcoin.

one

From the perspective of industry, I would like to discuss the value of BTC at three levels: macro, meso and micro. From a macro perspective, BTC represents the risk aversion expectations of the entire financial market of mankind, and the third "financial medium" that can be capitalized after bonds and stocks in human history; from a meso perspective, BTC is the "digital age" that humans will inevitably enter in the future, that is, the "index" with the best output value in the web3 world; from a micro perspective, BTC is gradually improving in terms of compliance supervision, and will attract a large amount of "traditional old money" in mainstream countries such as the United States. In third world countries, it siphons off the unmet private investment demand in the local area.

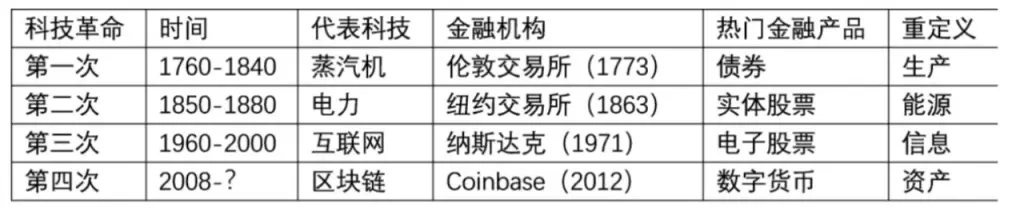

At the macro level, we regard Bitcoin as an epoch-making asset in the history of human finance, so the most important thing is to understand the changes in financial history. In "How Should We Invest in Digital Currency in 2021?" Part 1 of the Four Parts, the status of digital currency is corrected from the perspective of technological history. Behind every technological revolution, important financial infrastructure and a new financial "medium" have emerged.

Behind finance is the change of the times. Standing at the present moment, it may be the most confusing moment of the global political and economic situation in the past 30 years, and it is also the most fragile and most likely moment of reshuffle of the traditional financial order. Now I can no longer trace whether there were financial venues similar to the London Stock Exchange and the New York Stock Exchange when the famous financial bubble such as "Dutch tulips" appeared hundreds of years ago, or whether the Dutch vendors were accustomed to offline transactions, but only hyped but did not establish rules and order, so that this bubble finally turned into a bubble. However, in the long river of history, every technological innovation remembered by mankind has a change in the financial paradigm behind it, and the change in the financial paradigm is the inevitable product of the change of the times. These are mutually causal, but also complement each other, and finally wrote a bold and colorful stroke in human history. I have no way to predict whether the second industrial revolution would still start in Britain if the Civil War had not brought about a dramatic change in the social structure of the United States, reshaped from the social class and encouraged technological innovation to enter the real industry, but eventually flourished in the United States and became a milestone.

At the same time, I have a more radical point of view: when everyone is talking about the sluggish economy and how to find a viable business model - why does business itself need a business model? Has the word "business model" itself lost its meaning?

Here are more of my thoughts, which are a bit complicated. I will not elaborate on them here. I will expand on them as the most important part in my future article "The Four Parts of Crypto Capitalism - Philosophical Essays on Business and Investment". (Related reading: "The Four Parts of Crypto Capitalism: Token Issuance, a New Paradigm of Financing" )

[Excerpt: The context behind discussing business models in the contemporary business and financial environment refers to the general path that has been developed by the mainstream business entities in the past 100 years, which is the "corporate system": expanding the market scale, increasing the number of employees, and finally going public, and pricing stocks in the form of profit*PE. This path may not be established in the future.

Of the value of today’s “social capital” (or “private economy”), equity companies may account for 95%, and listed companies that use stocks as value anchors account for most of the capital value. But in the future, these values may exist more in “business” (why not limited partnerships) and “tokens” (foundations).

two

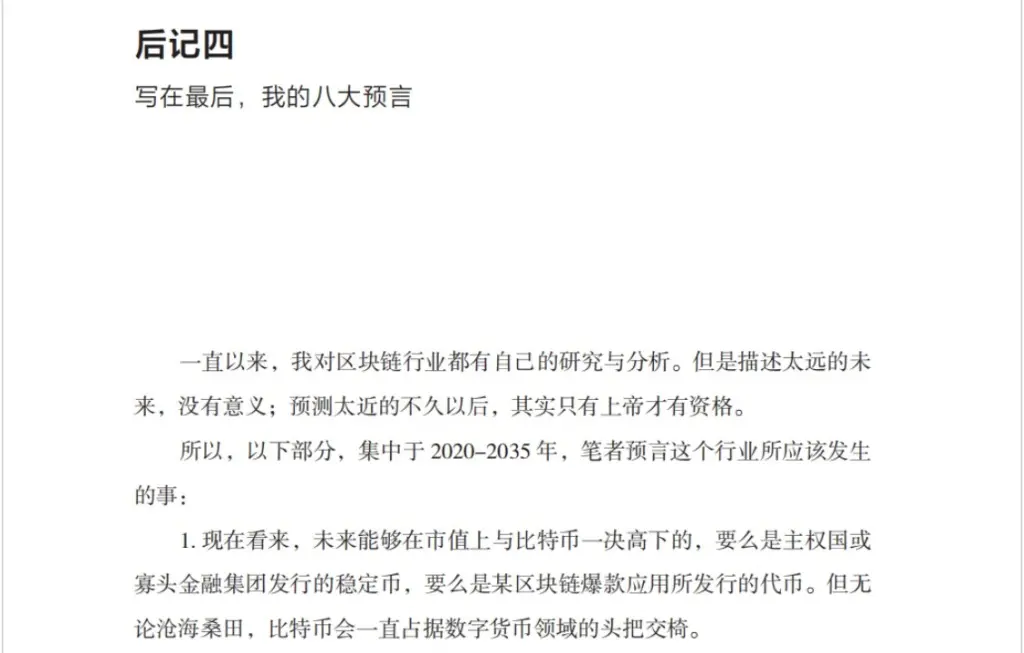

Spend more time talking about the industry perspective of BTC. At the end of the book I wrote in 2021, the first of the eight predictions mentioned that BTC is unbeatable. Refer to the postscript 4 of my electronic version of the book "Unlocking the New Password-From Blockchain to Digital Currency"

From the perspective of the technology industry, web3 is an inevitable trend in the future, and Bitcoin is the core asset of the entire web3 world, or in economics, it should be called "currency". In the ancient times of barter, gold was the most common "currency". After the development of the modern national system and financial system, national currency is the most common "currency". In the future, with the advent of the digital age, in the virtual space of the metaverse, all life in the digital world will require a new "currency".

Therefore, it is meaningless for some people to keep asking "Why is your investment a token?". Blockchain and crypto need "+", just like when someone asks you what track you want to invest in, you say "I want to invest in equity companies" or "I want to invest in an Internet company". Web3, as a special industry, and crypto, as a new market means and financial medium, are gradually combining with other industries - blockchain + AI = DeAI, blockchain + finance = Defi, blockchain + entertainment/art = NFT + metaverse, blockchain + scientific research = Desci, blockchain + physical infrastructure = Depin...

The trend is clear, but what does it have to do with us? In other words, how can we gain wealth appreciation after seeing the trend clearly?

Then let’s turn our attention to AI.

The main themes of the business world in recent years are two different things. AI is undoubtedly a hot topic that has been pursued by capital and can be put on the table. Crypto is surging in the dark, where various legends and myths of getting rich quickly gather, but it is also a place with many restrictions that makes it unattainable for many people.

The potential of the AI market is widely believed to be worth trillions of dollars, especially in the fields of generative AI, AI chips, and related infrastructure. However, for investors, everyone believes that AI is a sunrise industry and is willing to invest their money in it, but what to invest in? Can you invest in AI ETF index funds now to fully cover the AI ecosystem and effectively track industry growth?

No. Nvidia's stock price rose nearly three times in 2024, while the performance of most AI-themed ETFs during the same period was mediocre. Looking further ahead, Nvidia's stock price performance will not be positively correlated with the growth of AI's overall output value - chip companies will never be the only Nvidia.

Comparison of the performance of mainstream AI ETFs and Nvidia stock in 2024

AI is the main theme, but will there be a product that can anchor the future development of the AI industry market value? Will the value of this ETF increase as the output value of the entire AI industry increases? Just like the Dow Jones Index/S&P 500 ETF represents the development of Web0 (equity companies), the Nasdaq ETF represents Web1, and the investment opportunities of web2 are not presented in an index. The most suitable index for the Web3 world, or the value of the entire digital world of mankind in the future, is BTC.

Why must the value of the Web3 world be measured in BTC?

Because, since the birth of computers and the Internet, humans are destined to spend more and more time in the virtual world rather than the real world. In the future, we can wear VR/AR glasses and go to Yellowstone Park at home, return to China's Tang Dynasty to experience the palace, enter the virtual conference room you set up and drink coffee face to face with friends on the other side of the earth... The boundary between reality and virtuality will become more and more blurred. This is what the future digital world, or metaverse, will look like. And there, if you want to decorate the virtual space, and if you want the digital people there to dance for you, you always need to pay - this cannot be US dollars, RMB, or even physical assets. The most suitable and only thing I can think of that can be accepted by the entire digital world is Bitcoin.

I remember in the movie "The Revolution of 1911", Mr. Sun Yat-sen held up a 10-yuan bond and said: "When the revolution is successful, this bond can be exchanged for 100 yuan."

three

Return to the present moment.

We live in a country with a stable economy, and legal tender can be trusted. But this is far from saying that the world's financial system is as stable as the society we live in: the first thing the new president of Argentina did when he took office was to announce the abolition of Argentina's legal tender system-anyway, no one in Argentina trusts the legal tender issued by the government, so why bother? Turkey's inflation rate in 2023 reached +127%, and correspondingly, its citizens' digital currency ownership rate was as high as 52%. Especially in third world countries, in the process of gradual improvement of information technology infrastructure in recent years, its traditional legal tender mobile payment and digital currency payment methods have developed almost simultaneously. In contrast, just like around 2010, when China's information technology was booming, it skipped the 1.0 era of POS and bank card swipe payment and directly entered the 2.0 era of mobile payment. Third world countries have begun to develop in recent years, and digital currency payment in the 3.0 era has directly replaced the mobile payment method in the 2.0 era, making digital currency payment a common scene in daily payment.

Here comes an interesting debate. Bitcoin has no controller. If it is used as a currency or "currency", it cannot realize the government's macro-control function of legal tender. In fact, the US dollar is also issued by enterprises, so the so-called government macro-control must give way to the interest groups behind it. Capital power is the driving force of the world. If legal tender must be macro-controlled, then the interest groups that mine Bitcoin are the biggest regulators.

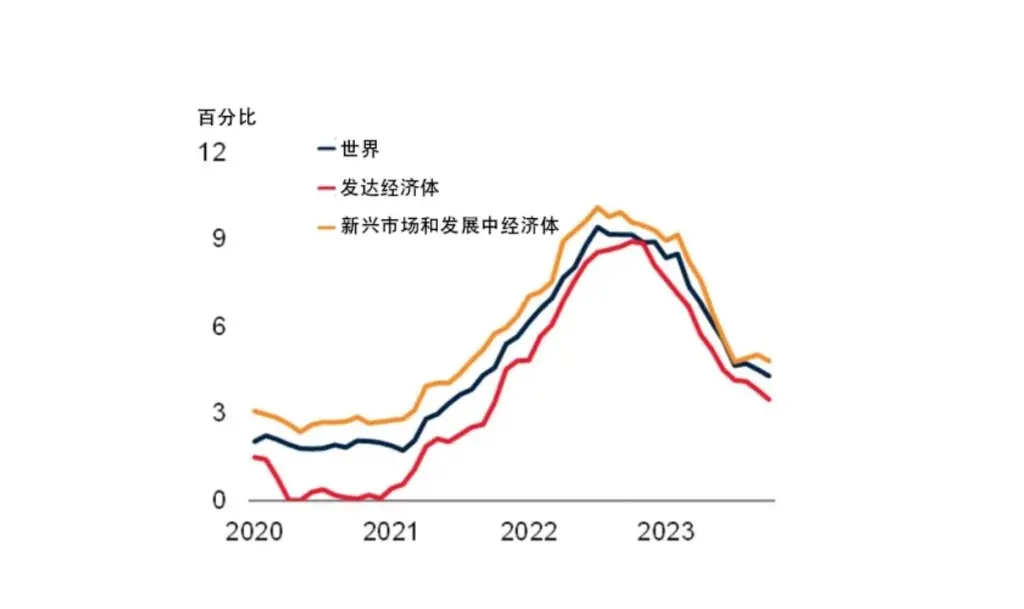

Changes in inflation rates of major economies in recent years

Changes in Argentina's inflation rate in recent years

From a micro perspective, as the speed of capital flow accelerates, technology and financial cycles are becoming shorter and shorter. In an environment with weak economic anti-fragility, the traditional equity market requires an 8-10 year lock-up period. This long-term investment feature makes many people worry about liquidity issues. Currency rights provide the possibility of early cashing out, which can not only attract more retail funds to enter, but also provide early investors with more flexible exit expectations.

In the traditional equity market, angel round or early investors usually seek to partially exit through equity transfer or corporate buybacks about 5 years after the establishment of the company, that is, when the company has entered a relatively mature development stage but is still some time away from IPO or acquisition (usually 8-10 years). This model can effectively alleviate the time cost of investment, but compared with currency rights, its liquidity is obviously more limited.

The appeal of the currency-right model is that it allows early investors to realize capital recovery earlier through the issuance or circulation of tokens, while attracting a wider range of market participants. This flexibility may have a profound impact on the structure of the traditional equity market. In this regard, you can refer to "Crypto Capital Theory Part 2 (Part 2): A Battlefield Without Gunfire - VC or Token Fund?"

On the other hand, the financial markets of most sovereign countries in the world are extremely fragmented and lack liquidity, and the inherent global financial characteristics of crypto have greatly attracted this group of funds, including South Korea, Argentina, Russia, etc. The stock market development of some Southeast Asian countries, mainly Vietnam, cannot keep up with the speed of wealth accumulation of the middle class, and the participation of these emerging classes in the financial market has directly skipped the stage of the local financial market and completed the transition to crypto. In the context of global digital currency compliance and integration with mainstream financial markets, the investment demand of private assets in these countries cannot be met by the weak local financial infrastructure-the main board market (KOSPI) and the start-up market (KOSDAQ) of the Korean stock market have more than 2,500 listed companies, but 80% of the companies have a market value of less than 100 million US dollars, and the daily trading volume is negligible. The digital currency market, which has absorbed global retail funds, has the most sufficient liquidity and has become their best target for investment.

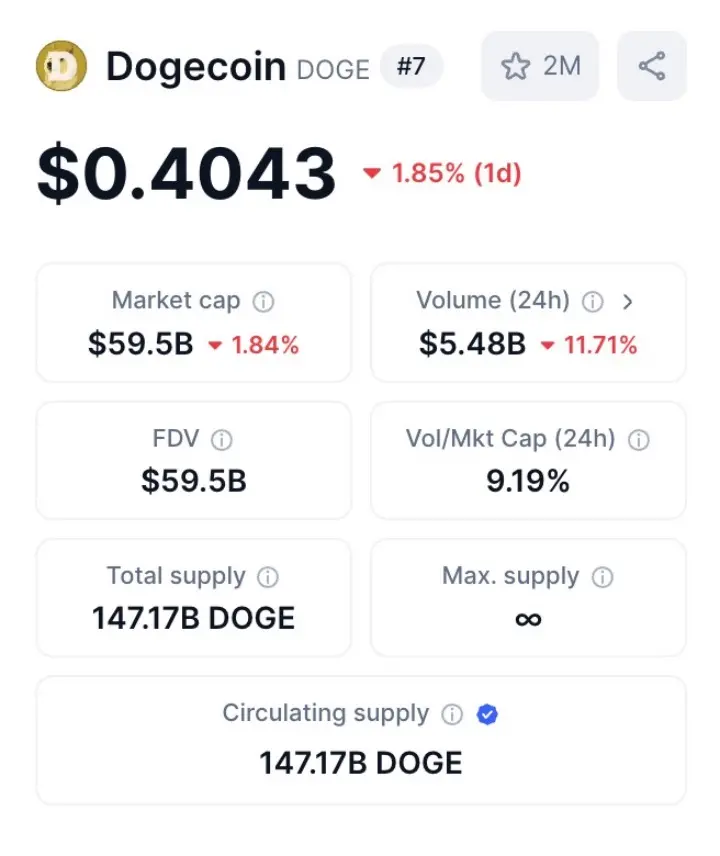

Doge current market value and trading volume

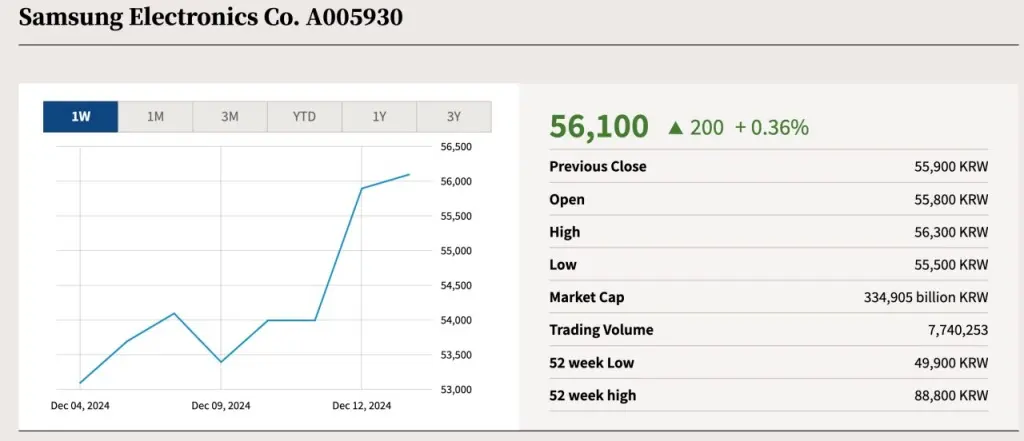

Samsung's current market value and trading volume

Note: As can be seen from the figure, Doge's current market value is about 60B USD, and Samsung's market value is about 234B USD, which is about 4 times that of Doge. However, Doge's 24h trading volume has reached 5.5B, which is tens of thousands of times that of Samsung.

In the United States, a strategic location in the global digital currency market, 2025 is likely to usher in a new cryptocurrency legal system reform. The two most important bills, FIT21 and DAMS, will affect the future fate of the cryptocurrency circle. The core of these two blockchain bills, which are regulated by the Commodity Futures Trading Commission (CFTC) rather than the Securities and Exchange Commission (SEC), is to treat token issuance (coin issuance) as commodity trading rather than securities issuance, and thus be managed by the CFTC. Considering that these two bills were proposed by the Republicans and the current SEC Chairman Gary Gensler represents the Democratic Party, the bills face great resistance. However, with Trump re-elected as president, the possibility of the bill passing has increased significantly because the Republicans have the upper hand.

To explain this bill, in layman's terms, the issuance of coins is treated as a commodity and is regulated by the CFTC, which is legalized, which can greatly promote the enthusiasm for coin issuance and financing. Enterprises can raise funds through coin issuance legally and compliantly, attracting more capital to flow into the coin circle. In addition, with a stable channel for long-term compliant development, more people will continue to work in this industry after making money. Most importantly, after the United States took the lead in introducing this bill, it will officially unveil the global digital currency financial market, blockchain technology market, and competition between countries. "Grabbing projects" and "grabbing talents" may occur further in the future in the completely globalized and free-flowing coin circle. If the US policy is more friendly, even if coin issuance is no longer a gray industry but a prestigious financial innovation, founders who live in relatively crypto-friendly countries such as Singapore and Switzerland will soon have a large migration.

Four

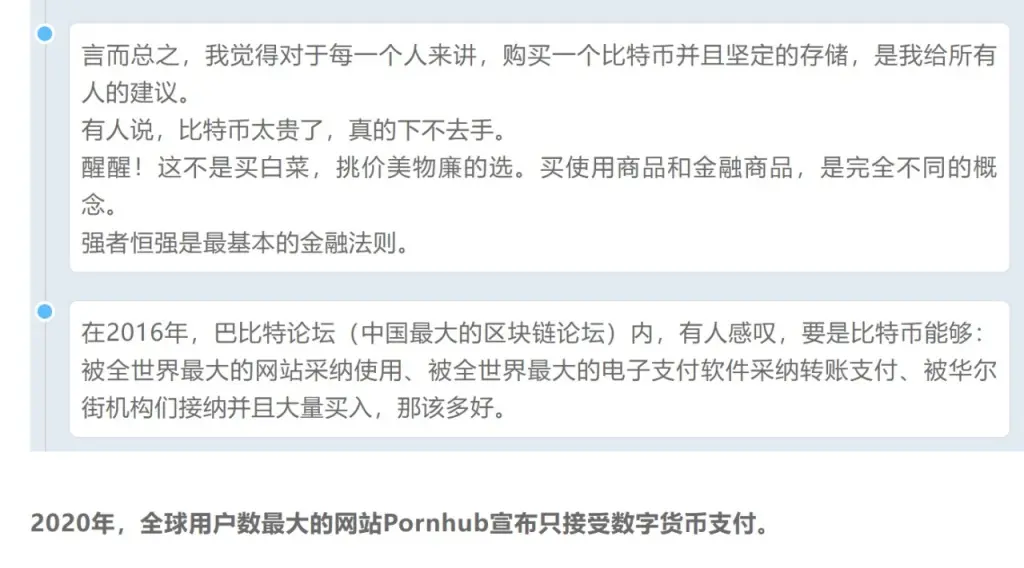

Looking back to 2016, when the number of cryptocurrencies in the world could be counted on one’s fingers, and BTC was like a game coin, which could be directly deposited into the exchange with RMB for “recharge and purchase”, we, the natives of the token circle, had hopes for the future. (For details, please refer to the end of “How should we invest in digital currency in 2021? - Part 1 of the Four Parts” )

That is my dream too.

My original plan was that these goals would take 8-10 years to achieve.

But it only took us four years.

It was at that time that I had a new dream - since Bitcoin has been gradually accepted by mainstream society as a monetary asset, other digital currencies, or tokens, in addition to digital equity, must also play the role of digital commodities. In this way, in the future digital world of mankind, in addition to financial value, they must also generate utility to enable mankind to better enter the digital world.

Oh yes, this thing, later everyone gave it a new name - NFT.

"Digital commodities in the Metaverse Era" is my definition of the future of NFT. It is also the most important part of truly realizing the web3ization and digitization of "commodities in the Internet Era" and thus mass adoption.

That is why I was determined to build the NFT industry in early 2021. In the series of articles "The Road to the Future - Five Steps to Web3" , I described its future.

five

Of course, the most intuitive way to attract people, or to make more people willing to read the articles I write, is naturally to rely on the increase in BTC.

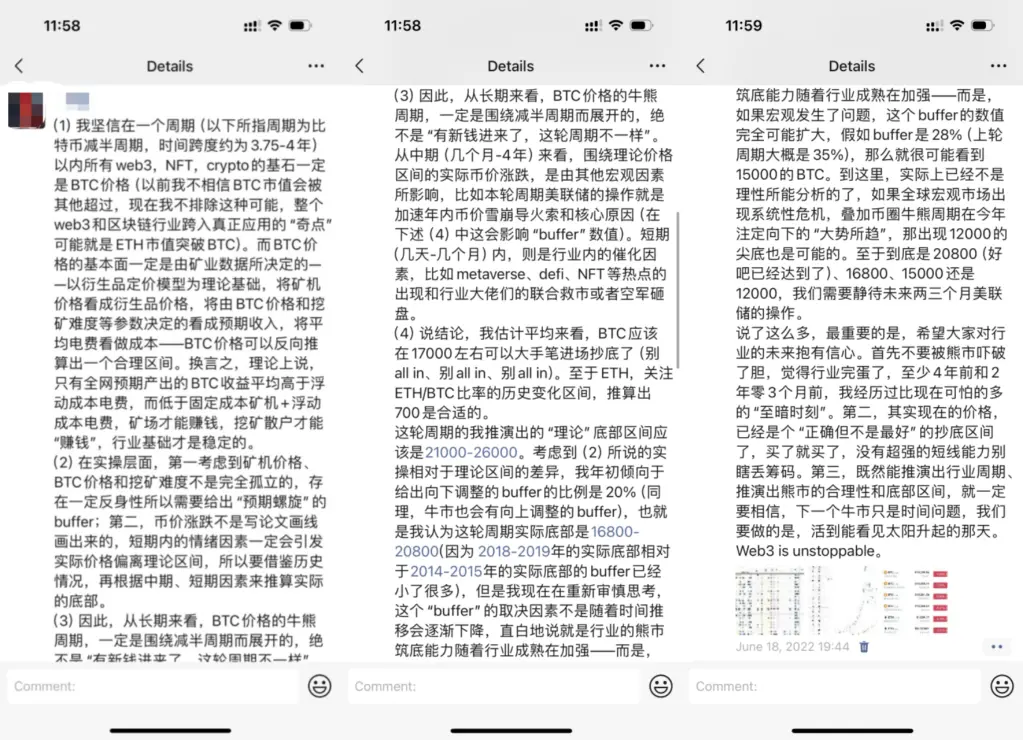

It’s time to get to the point. I need to mention my prediction for the BTC market: the peak of this round of BTC will appear at the end of 2025, and the reasonable range should be between 160,000 and 220,000 US dollars. After that, in 2026, it is recommended that everyone should go short and rest.

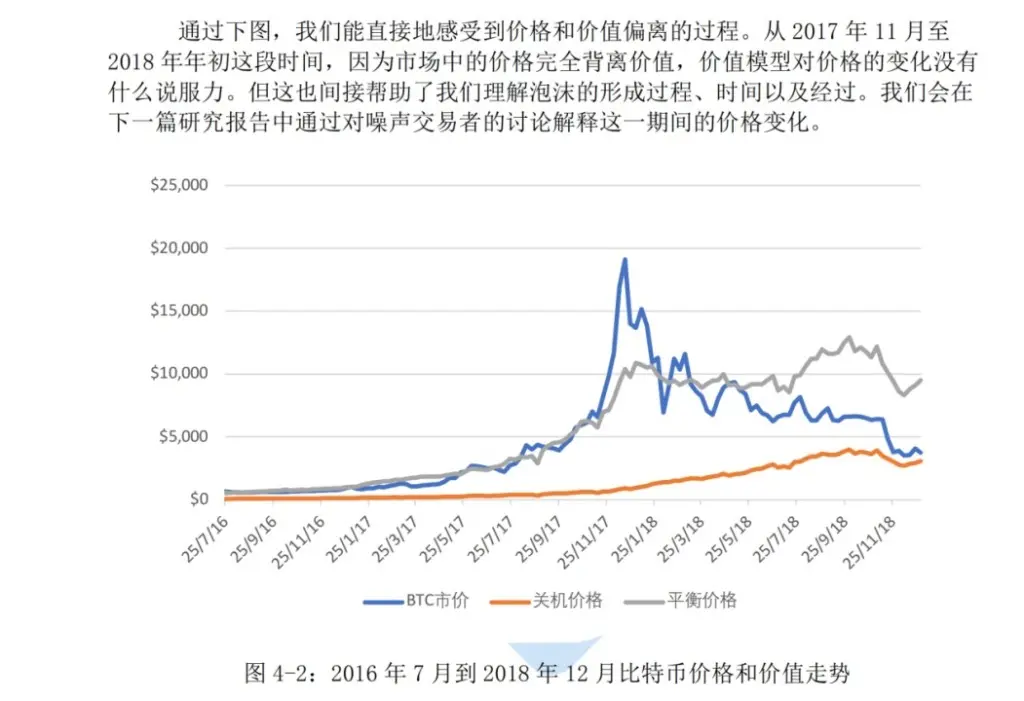

In my paper "Bitcoin Valuation Model under Miner Market Equilibrium - Based on Derivative Pricing Theory" published on January 1, 2019, I mentioned the bottom of the four-year cycle from 2018 to 2021.

And what I mentioned in 2022, the bottom of the four-year cycle of 2022-2025.

From the current perspective, the entire cryptocurrency industry is at a critical crossroads. Today's digital currency industry is like the Internet industry at the turn of the century. In the next 1 to 2 years, the bubble will not be far away. With the passage of crypto-friendly laws such as FIT21 in the United States, the compliance supervision of assets such as currency rights has been completed. A large number of very traditional old money that once lacked understanding of crypto and even completely sneered at it will begin to accept BTC and make 1%-10% level configurations. However, after this, if blockchain and digital currency cannot be gradually combined with traditional industries and truly usher in the "blockchain + industry" transformation, just like the Internet industry combined with consumption, social, media, etc. and transformed them, I really don't see any new funds, and there is no reason for this industry to have amazing growth opportunities again. Defi in 2020, NFT and metaverse in 2021, these are all the right direction, and they also set off a wave of innovation at the time. Throughout 2024, BTC hit new highs, but the entire blockchain industry did not have enough innovation to talk about. The market was just filled with more memes and Layer 1 & 2 & 3, but no new "business concept innovation". Moreover, in 2025, which I can see, the atmosphere of the entire industry has determined that I am pessimistic about the emergence of milestone "business concept innovation".

A rising tide lifts all boats. Now the water is flooding, and small rafts are everywhere. Boatmen are competing to see who can row faster, and even laugh at those bulky, machine-powered iron boats. But when the big waves recede, the wooden boats will run aground. Only by maintaining constant machine power can they sail out of the harbor and into the sea.

Even, to make an interesting prediction, the sign that the cryptocurrency bubble has reached its peak will be that Buffett, the world's biggest Bitcoin opponent, will start to change his tune and even participate in the industry. The staged victory of a revolution is often the moment when the crisis is most lurking.

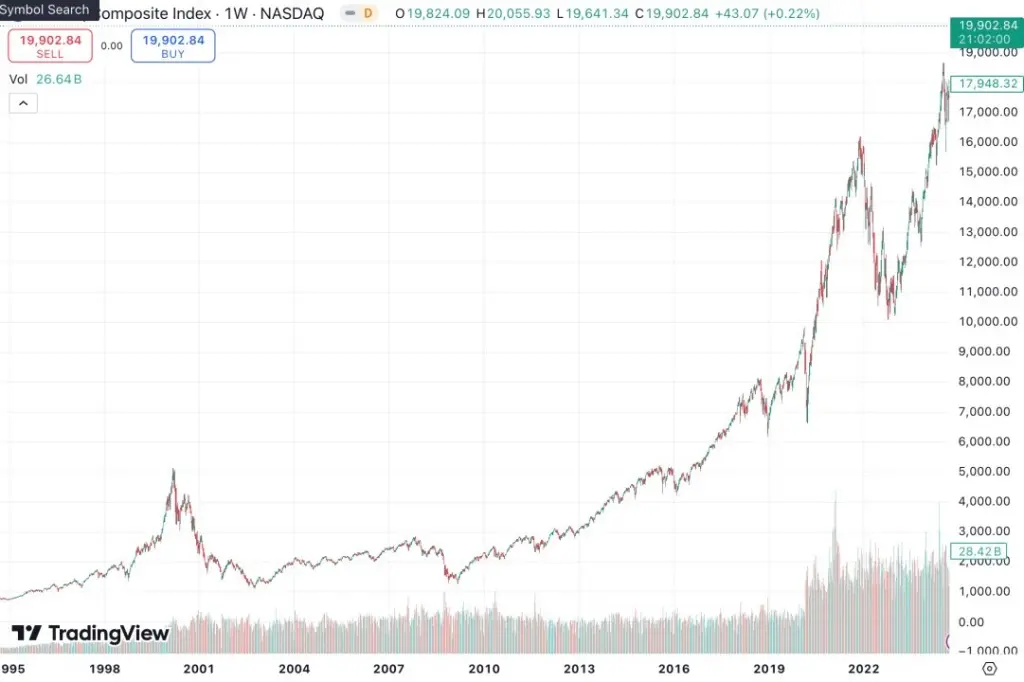

The current cryptocurrency industry can be compared to the Internet era in 1999. After a rapid blowout that is on the right track, the digital currency industry may usher in a drastic adjustment due to a huge bubble starting from the end of 2025. Looking back at history, the Internet industry ushered in Netscape's initial public offering (IPO) in December 1995, and then Yahoo's listing in April 1996 triggered a market boom. On March 10, 2000, the Nasdaq index hit a historical peak of 5408.6 points. However, the bubble quickly burst, and the market entered a cold winter in 2001. Although the broad cold winter lasted until 2004, the real low point was in October 2002, when the Nasdaq index almost fell below 1,000 points, marking the lowest point of the industry from a financial perspective.

In 2020, MicroStrategy successfully increased the value of its stock by purchasing BTC, achieving a significant stock-to-coin linkage effect for the first time. In February 2021, Tesla announced its purchase of Bitcoin, a move that became a landmark event for the giant to officially enter the market. These historical moments can't help but remind people of the blockchain industry's "1995-1996" - when the Internet boom first began.

Looking ahead, I think that by the end of 2025, the price of Bitcoin may reach a long-term peak, but in early 2027, it may hit a new low. Once the FIT21 bill is passed, it may start a wave of currency issuance by all people, just like the unprecedented grand occasion of the ".com" era.

If the threshold for token financing drops to almost zero, and even ordinary people can issue their own tokens just like high school students can easily learn to make a website, then the limited capital in the market will be quickly diluted by the influx of various tokens. In such an environment, the last wave of "violent bull market" for token issuers may not last more than three months. Subsequently, due to the imbalance of market supply and demand and the depletion of capital, the industry will inevitably usher in a comprehensive collapse.

However, before that, in the next 12 months, we still have a potential beta increase of nearly 2 times for BTC, and for ordinary people, due to the concentration of global liquidity, there are countless early currency opportunities that can increase by "hundreds or thousands of times" in a very short period of time - why not participate?

Also, looking back at the Internet industry, which was turbulent and criticized by many media as a "bubble". Today, the Nasdaq index has broken through the 20,000 point mark. Looking back, it looked like a mountain in 2000, but now it is just a small hill. Even if you entered the Internet industry in 2000 and persisted until today, it is still almost the right choice.

What about BTC? It’s just small hills one after another.

It has been 3202 days since I bought my first BTC on March 7, 2016.

I still remember the price at the moment I clicked the mouse. It was 2807 RMB, which is less than 400 US dollars.

Many people have asked me, how high do you think BTC can rise to?

This question is meaningless. The price of gold has been hitting new highs these days and years.

The meaningful question is, how high can the price of BTC rise before a certain point in time?

Let's wait and see.

The best is yet to come.