Author: Ray's New World

Recently, Hyperliquid's public listing mechanism has caused heated discussions. However, the reason why this matter can attract market attention is inseparable from a Twitter post by Moonrock Capital CEO Simon on November 1 this year. He claimed that "Binance requires a potential project to provide 15% of its total token supply to ensure its listing on CEX, which accounts for 15% of the total token supply, worth about 50 million to 100 million US dollars."

At the same time, Sonic Labs co-founder Andre Cronje also wrote that "Binance does not charge listing fees, but Coinbase has repeatedly asked for fees and quoted $300 million, $50 million, $30 million, and the most recent offer is $60 million."

Why is there always a dispute over listing fees?

In the decentralized Crypto world, centralized CEXs have become the main participants. However, the black box operation of CEX listings is difficult for the market to buy, and there are "rumors" about CEX listings every once in a while. He Yi, the founder of Binance, once said after listing PNUT and ACT that "no listing fees were charged." Even a strong company like Binance needs to get out of the whirlpool of public opinion about "listing fees" through the listing of coins.

He Yi’s response to the controversy over listing fees

Despite this, it is still difficult for the market to be convinced that CEX has no listing fees. Even if there is no "open and aboveboard" fee, there are still many rumors about hidden token fees. Although some leading CEXs clearly list no listing fees in their announcements, the project owners still need to pay a corresponding deposit to ensure that the price of the token remains stable after listing. At the same time, the CEX's investment share and activity funds and other matters must be agreed upon with the CEX when listing. These hidden listing fees that are difficult to explain have also become the reason why the market concludes that CEX's listing is a "black box" operation.

On the one hand, such a cumbersome and opaque listing mechanism is an additional burden for the project parties. The project parties need to spend extra costs to deal with the listing affairs of CEX, which will lead to the problem of reverse screening. The project parties are not interested in long-term development, but will have the expectation of "good luck with listing", which ultimately leads to most of the projects listed on the exchange running away.

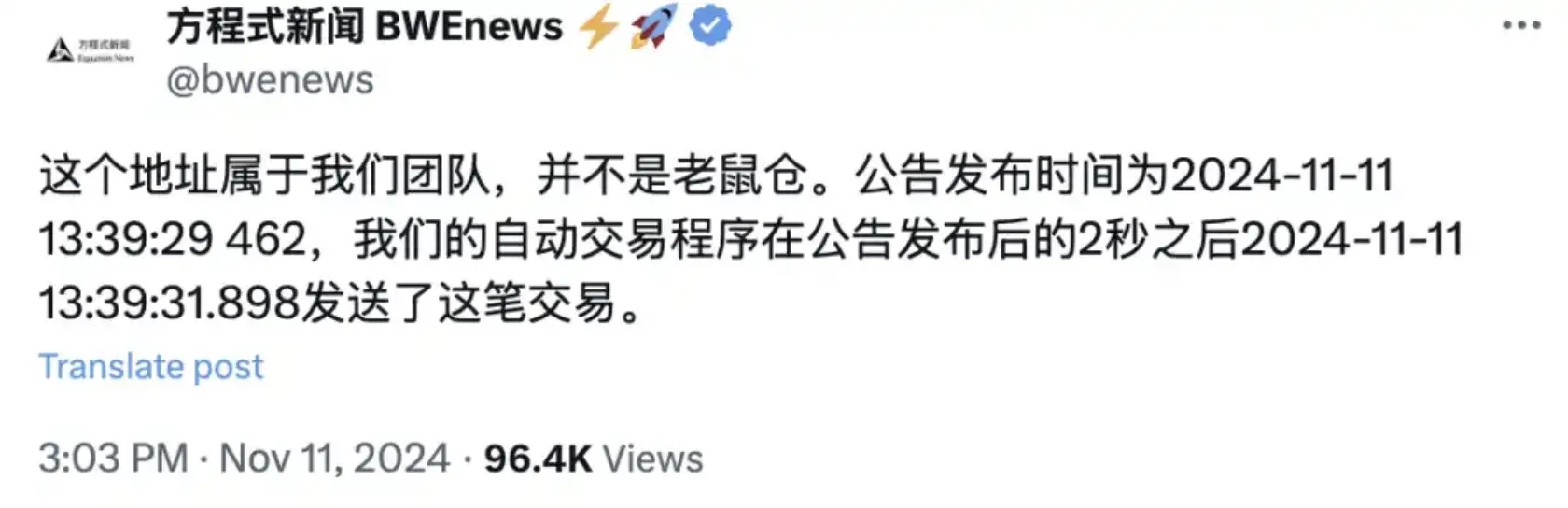

On the other hand, the unfair listing of CEX has even evolved into a niche track. Researching listing has become a serious "business", and listing has become a compulsory course for many investors and KOLs. For example, some time ago, Formula News made a huge profit of 3 million US dollars after ACT was listed through news trading on listing.

Equation News conducts preemptive trading through coin listing announcement

It can be said that cryptocurrencies have suffered from centralization for a long time. The wealth effect of each coin listing is almost taken away by CEX (coin listing fees) and scientists (preemptive trading after coin listing). The project party has to bear a considerable coin listing fee and thus sacrifice the quality of the project. Everything is ultimately paid for by retail investors. The logic of the coin listing incident is exactly the same as that of retail investors embracing memecoin and rejecting VC coins today. The core is still inseparable from fairness.

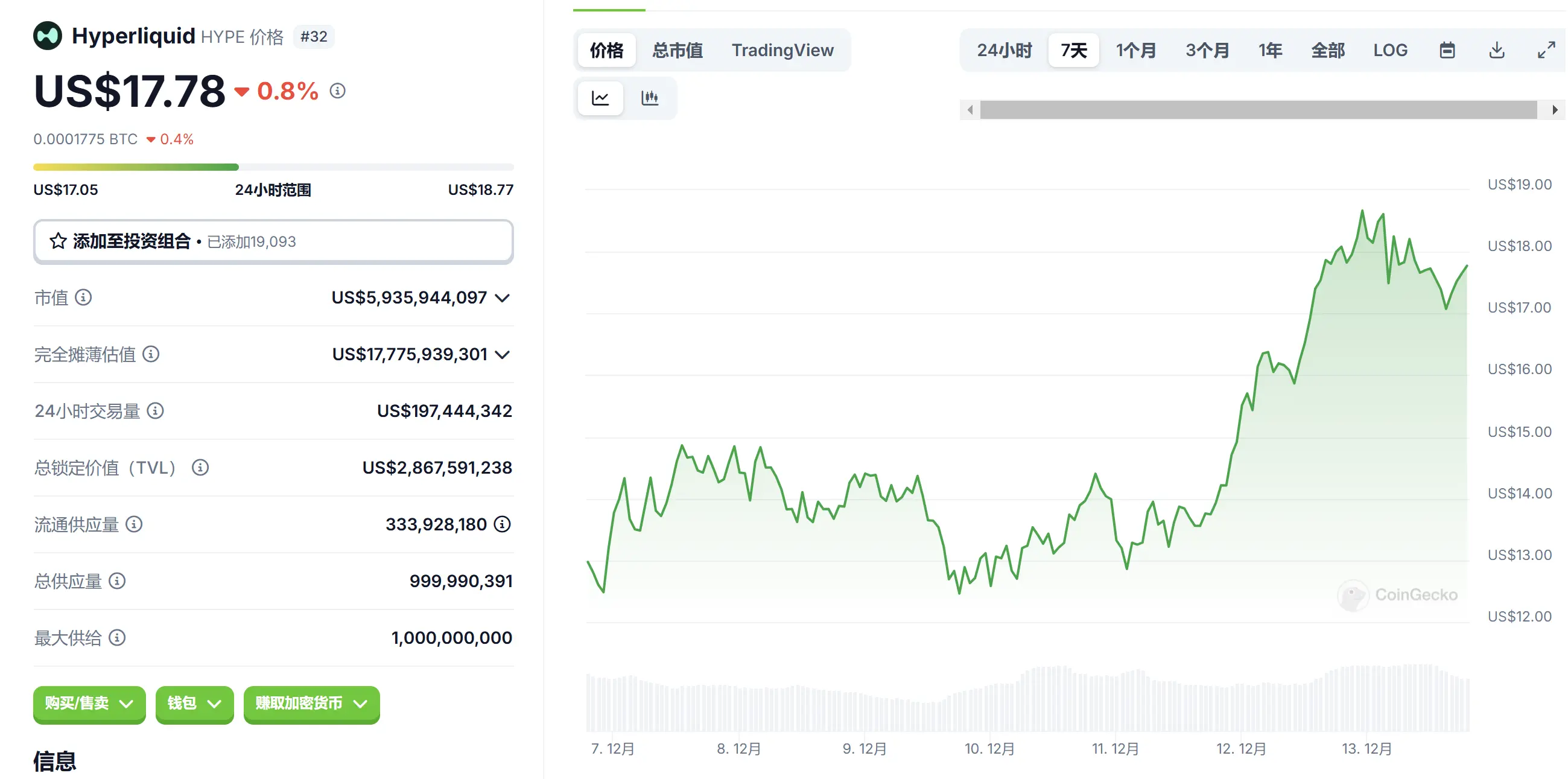

HYPE hits new highs again and again, what is the market optimistic about?

However, the emergence of Hyperliquid broke the deadlock of "black box listing".

Hyperliquid's popularity in the crypto world can be traced back to the rise of HYPE. It took HYPE only two weeks after its tge to enter the top 50 in terms of market capitalization, surpassing new and old projects such as Fantom and Bittensor, and even Arbitrum itself. Although the Perp DEX narrative is no longer a new narrative, Hyperliquid has successfully focused the market's attention on DEX again.

The coin listing mechanism is indispensable

Just today, HYPE broke through $20, setting a new record high. Behind the new high, on the one hand, it is inseparable from Hyperlqiuid's precise "market aesthetics", which keenly captured the market pulse of "VC to meme" in this cycle. As a project that looks like "VC gathering temperament", Hyperliquid did not follow the old path of VC financing first, then increasing the volume and then listing on the exchange for shipment. Its founder Jeff has also publicly expressed his dissatisfaction with this form and market logic many times.

On the other hand, Hyperliquid's team operations and project development are also online. Hyperliquid's ambition is not limited to PerpDEX, but it is also actively building a "transaction" public chain with low latency, high throughput, high-frequency transactions and order books. When the underlying logic is transformed from PerpDEX to a public chain, its valuation ceiling is also opened.

In addition to the above reasons, the open and transparent listing mechanism of Hyperliquid is also a factor that cannot be ignored for its success. So how does Hyperliquid list its tokens?

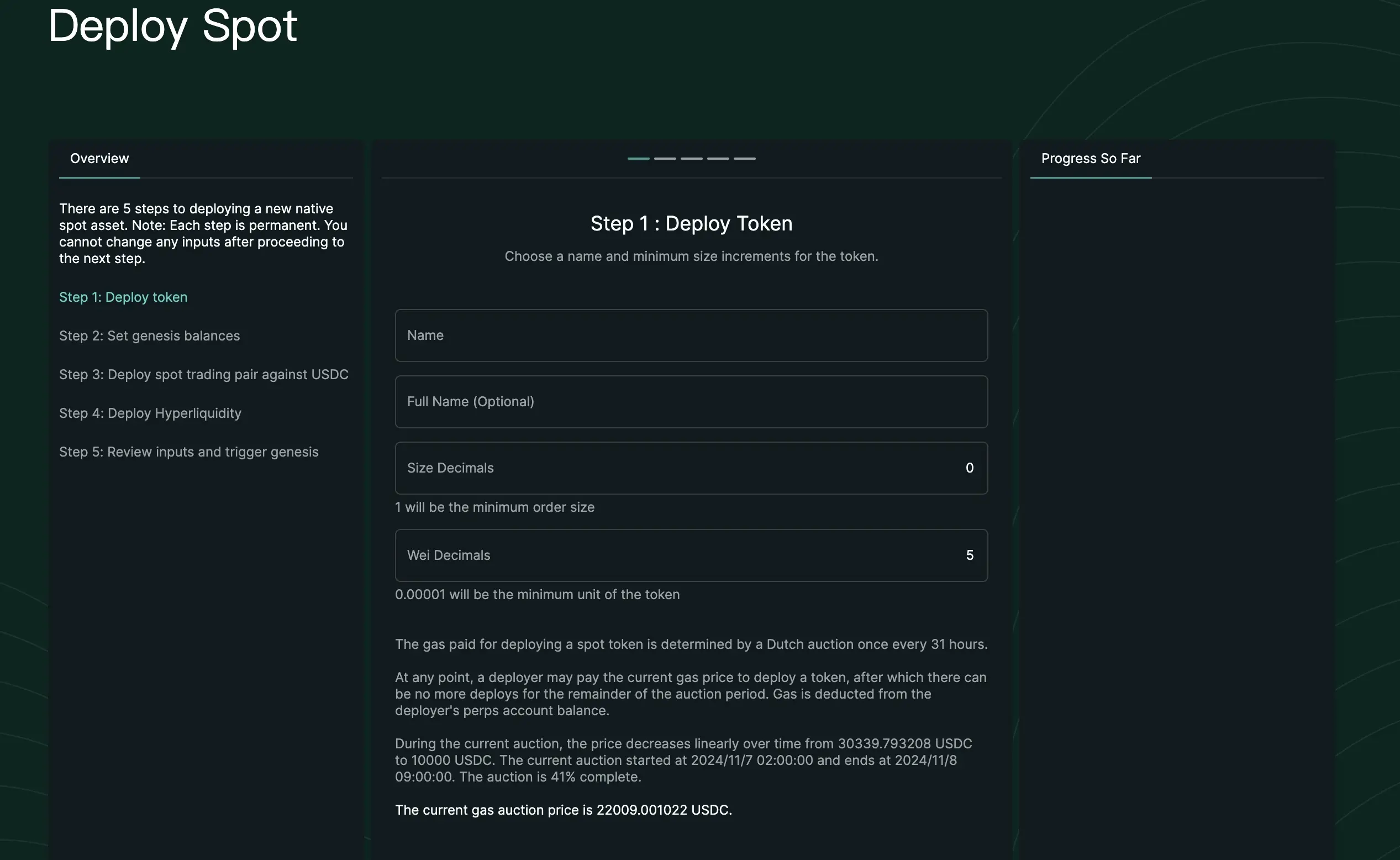

Dutch Auction

Hyperliquid uses Dutch auction to auction the ticker of tokens. Its listing process is also relatively open and transparent, and there is a detailed introduction in the official documents.

First, if the project wants to launch spot products, it needs to apply for the deployment rights of the HIP-1 native token (HIP-1 is the token standard established by Hyperliquid), and then the Dutch auction mechanism will be used to determine who will get the final token ticker. The Dutch auction is also called a descending price auction. The starting price of the auction will start at a price higher than the market expectation, and then the price will continue to decrease and the transaction will be completed when the first price is accepted. From the perspective of game theory, the Dutch auction reflects the true psychological expectations of the bidder and can achieve the auction at a fair price.

Hyperliquid deployment spot process

Project parties need to pay a gas fee when deploying tokens on Hyperliquid, but this gas auction fee will be fed back to the HLP Vault in the future.

At the same time, Hyperliquid's auctions are usually held every 31 hours, and a maximum of 282 spot products are available throughout the year. This passive "limit" method also indirectly improves the quality of online projects.

In summary, compared with the shady operations of CEX that confuse the public, Hyperliquid’s listing mechanism is open and transparent, and the gas auction price collected will be subsequently fed back to the community in the form of staking to form a virtuous circle.

Auction Mechanism Derivative Gameplay

With this open auction mechanism, more interesting routes will emerge in the future. For example, this auction mechanism will also lead to "ticker" disputes. When zkSync was listed on major exchanges earlier this year, Polyhedra Network, which originally used the ZK token ticker, gave the gold medal ticker ZK to zkSync, and then Polyhedra's token was changed to ZKJ.

It is foreseeable that more projects will have the same "fighting" behavior after listing on Hyperliquid in the future. Project parties will fight for the token ticker that is more suitable for them. Even in Web2, stories like "Sina spent 8 million yuan to buy weibo.com" and "Finance was bought by Moniker for 3.6 million US dollars in 2007" will soon be staged on Hyperlqiuid.

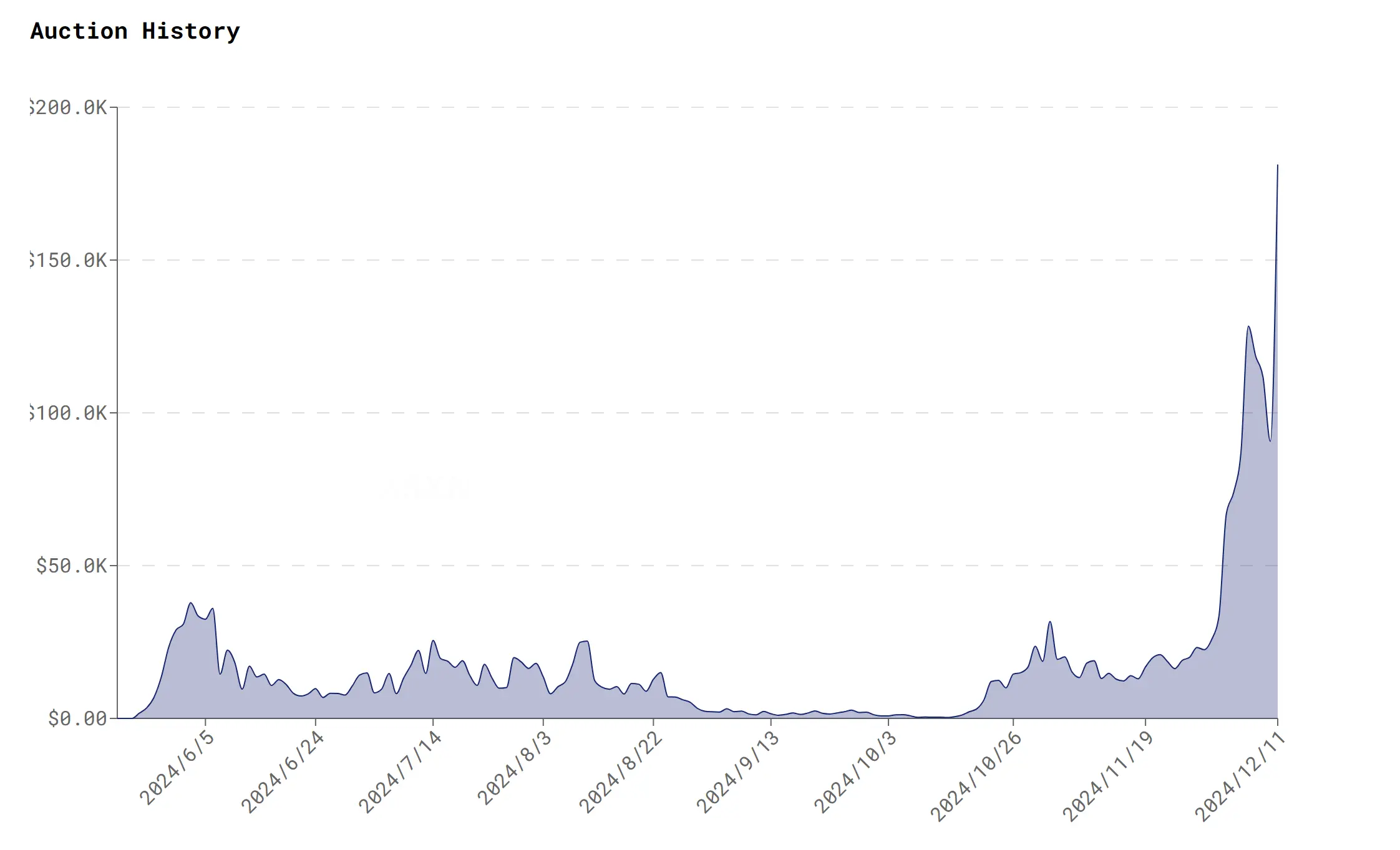

The "big mistake" that cost $180,000

After Hyperliquid completed the "epic" airdrop at TGE, the auction price continued to break new highs. As early as around June this year, its auction ceiling had been hovering around 35,000 US dollars, failing to break the previous hard cap of 35,000 US dollars. However, after TGE, Hyperliquid received unprecedented market attention, and this time it was directly "pushed back" to 128,000 US dollars, breaking through the previous shackles in one fell swoop. On December 11, it achieved a historical high with a FARM auction of 180,000 US dollars.

The last record-breaking $128,000 ticker battle originated from "SOLV". At the same time, it is noted that Solv Protocol will hold a TGE in the near future, so it is very likely that this ticker was bought by Solv Protocol. In the past, the token tickers auctioned by Hyperliquid were usually memes, such as PIP, CATBALL, etc.

After this airdrop went viral, the popularity of Hyperlqiuid also began to soar. SOLV's record-breaking auction was a turning point for Hyperliquid to move from a meme park to a regular onboarding. Solv Protocol will also be the first top project to be launched on Hyperlqiuid.

At the same time, Solv's entry into the platform has brought a significant "catfish effect" to Hyperlqiud, which not only sets an example for Hyperliquid's subsequent ticker auctions, but also drives the transaction structure towards a more benign direction.

Hyperliquid Auction History

On the one hand, after Solv led the ticker auction market to break through the previous hard cap, the token tickers auctioned by Hyperliquid also "got better". The market regarded the SOLV auction as a reference for the post-TGE quotes. For example, BUZZ, SHEEP and other tickers have reached quotes of more than 100,000 US dollars, and the lowest HYFI was also sold at 90,000 US dollars. Then on December 11, the FARM ticker set a new record with 180,000 US dollars.

The final owner of FARM's token ticker is @thefarmdotfun. The Farm is building the world's first GenAI artificial intelligence agent game. Users can generate different types of pet-type AI agents through the GenAI model. When these AI pets are minted or traded, FARM tokens will be used for charging. Under the premise of a fixed total amount, 50% of FARM as a fee will be destroyed. FARM's $180,000 was not wasted. Within a few hours after the opening, the market value of $30 million was quickly passed, approaching $50 million. At the same time, it also opened up the imagination space of the Hyperliquid ecosystem again.

FARM’s market capitalization was close to 50 million USD when it opened on December 13

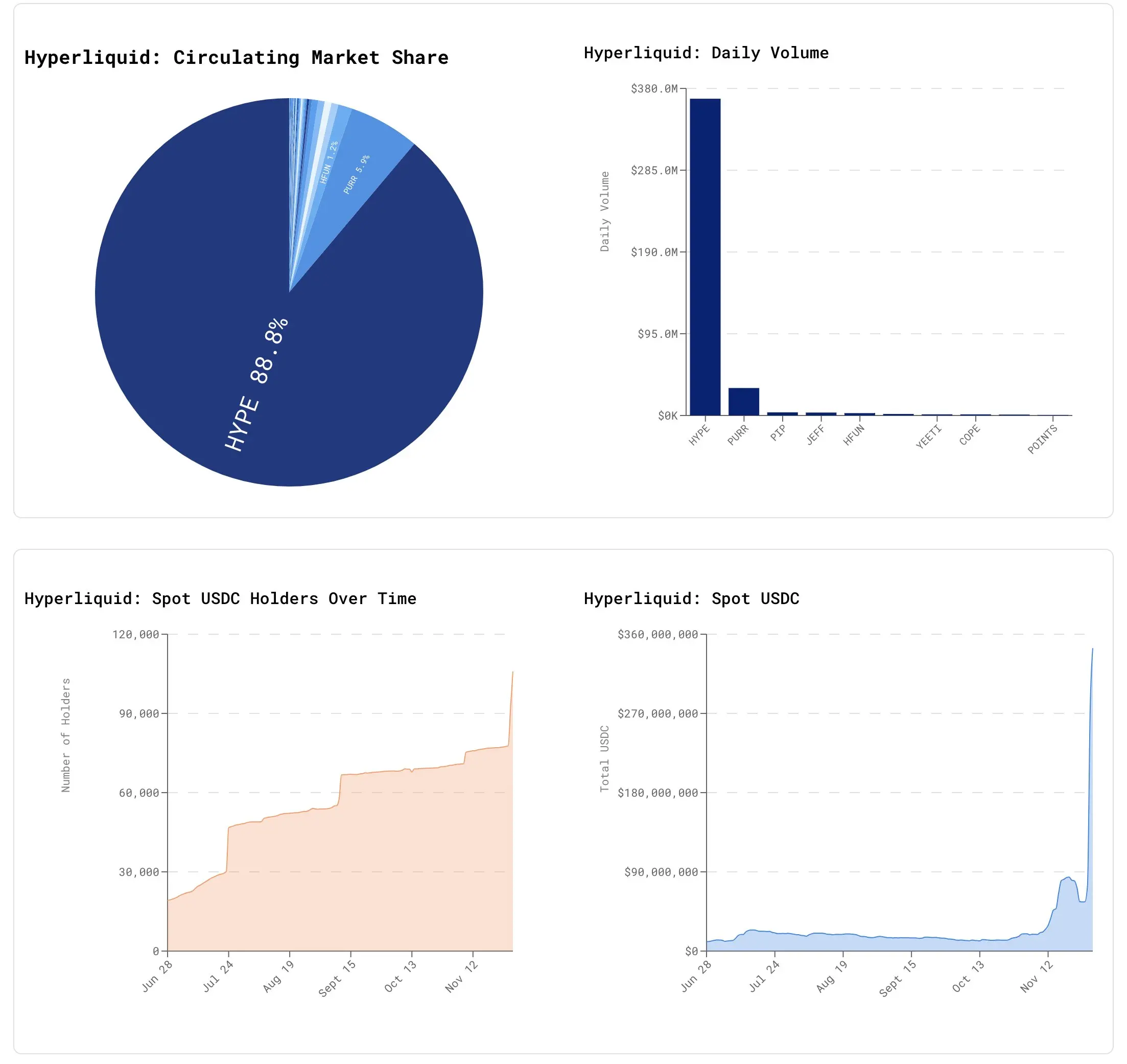

On the other hand, according to AXSN data, the daily trading volume of the token HYPE has become a monopoly in Hyperliquid, reaching a trading volume of 360 million US dollars, far ahead of tokens such as PURR, PIP, and JEFF. With the listing of SOLV, the trading structure of Hyperliquid will be further optimized. With the market attention and public opinion fermentation brought by the listing of Solv Protocol, more project parties will choose to debut on Hyperliquid in the future, and the trading volume will be more dispersed in the future.

Hyperliquid transaction structure distribution

What has Hyperliquid changed?

As Jeff, the founder of Hyperlqiuid, said, "ownership goes to the believers and doers, not rent-seeking insiders." Hyperliquid's development is also in line with

Two-way cooperation with the project party

For VC coins, listing on Hyperliquid is also a mutually beneficial and symbiotic market behavior. The listing auction itself is also a form of advertising. Solv became the traffic center of market discussion because it won the Hyperliquid auction ticker without paying additional advertising fees.

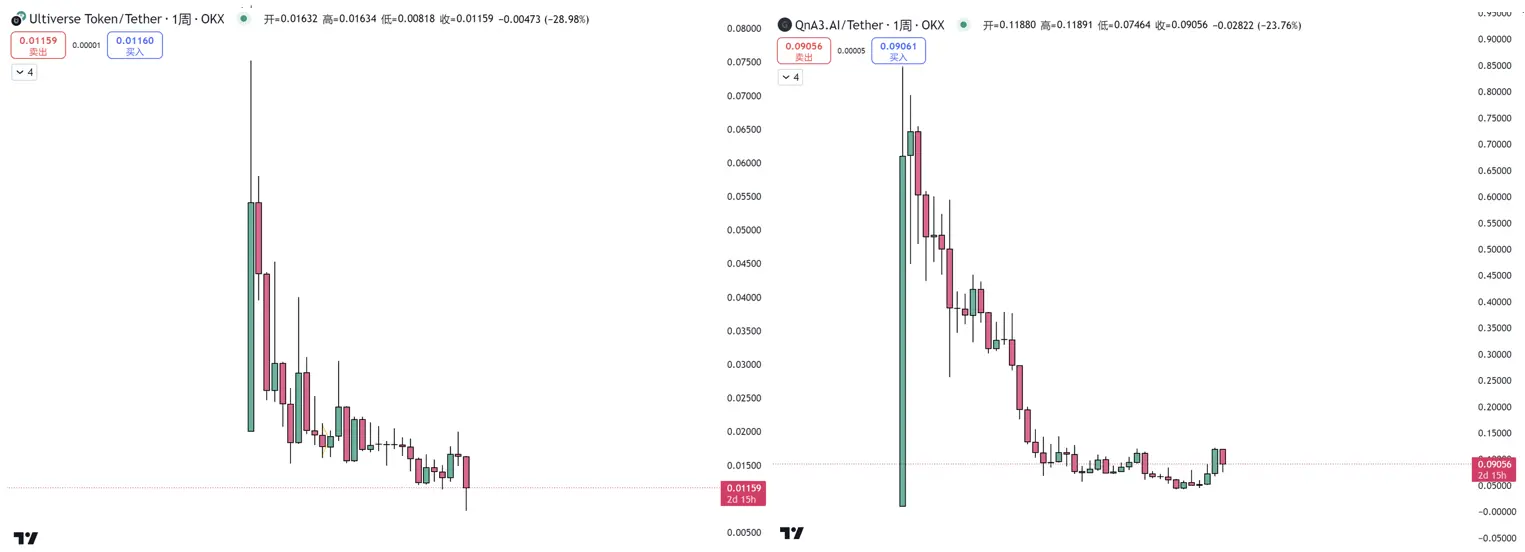

For many copycat project developers, it is still difficult to stabilize the market even if some of their projects are listed on major exchanges. If they cannot be listed on first-tier CEXs during the bull market, it is basically difficult to maintain a good-looking "K-line". Without liquidity, there is no traffic, and there is no follow-up story. Most unpopular tokens have become "high heels" or "Christmas trees" after being listed.

Many tokens are difficult to maintain even if they are listed on major exchanges

Hyperlqiuid provides a more economical solution, which can not only meet the needs of the first major exchange, but also "grab a seat" on a good trading platform at a low cost. After the subsequent access to HyperEVM, the tokens purchased from Hyperliquid can be used in other EVMs, which further highlights its relative advantage in cost-effectiveness. Although Hyperliquid does not have the strong listing effect of CEX at present, the SOLV auction event has received widespread market attention, which further highlights its status in the eyes of crypto people.

Hyperliquid's epic airdrop is more like a vigorous market education, allowing more people to know Perp DEX, understand, contact and use it; the transparent coin listing plan is the first shot in the fight against behind-the-scenes operations, resistance, struggle and victory.

From the perspective of the industry, the emergence of Hyperliquid is both a historical process and a choice of the times. Under the call of the masses, the market has voted with its feet again and again for fairness. Hyperliquid's open listing mechanism is a revolution in the existing CEX listing black box operation, forcing the entire industry to become more open and transparent.

What kind of entrepreneurial spirit does Crypto need?

The founder of a company often determines the spiritual core of the company. This sentence is vividly illustrated in Hyperliquid.

After FTX went bankrupt, founder Jeff no longer trusted CEX and refused to accept any VC investment. In Jeff's eyes, most projects would first obtain investment from top institutions, then use various so-called points plans to embellish data, and finally exit by listing on large trading platforms. This industry model seems to have become the ultimate template for most project parties to rise to prominence: write stories, attract investment, and list on large exchanges. In the end, retail investors bear everything and face a mess. This kind of quick success and quick profit industry chaos is ultimately unsustainable.

In the end, Hyperliquid witnessed the victory of Jeff's decentralized spirit. The transparent and open mechanism and the strong cohesive community pushed PerpDEX to the climax of 2.0. Jeff can also proudly say: We did not distribute tokens to any private investors, centralized trading platforms, or market makers. The bullet fired many years ago hit the forehead at this moment.

The history of Crypto development is also a history of the struggle for decentralization, from the birth of Bitcoin to the capitalization dispute of Neiro. No matter how Crypto changes, victory and justice will always stand on the side of the masses, on the side of fairness, and on the side of decentralization.