By KarenZ, Foresight News

The entry of top market maker Castle Securities into Bitcoin market making is a sign of the maturity of the Bitcoin market and a key step for traditional financial forces to compete for future asset pricing power. At the same time, for retail investors, it may mean a gradual weakening of their voice.

On February 25, Bloomberg reported that Citadel Securities is seeking to become a liquidity provider for cryptocurrencies. People familiar with the matter said the company aims to join the list of market makers on various exchanges, including those operated by Coinbase Global, Binance Holdings and Crypto.com. Once approved by the exchange, the company initially plans to set up a market making team outside the United States.

This move not only marks a major strategic transformation for Castle Securities, but also indicates that the crypto market may usher in new changes.

Citadel - The King of Hedge Funds

Hedge fund Citadel and market-making firm Citadel Securities were both founded by “program trading genius” Kenneth C. Griffin. In 1987, Ken Griffin, then 19 years old, began his trading career in a Harvard dormitory, and then in 1990 he founded his own investment group Citadel (formerly Wellington Financial Group) with $4.6 million.

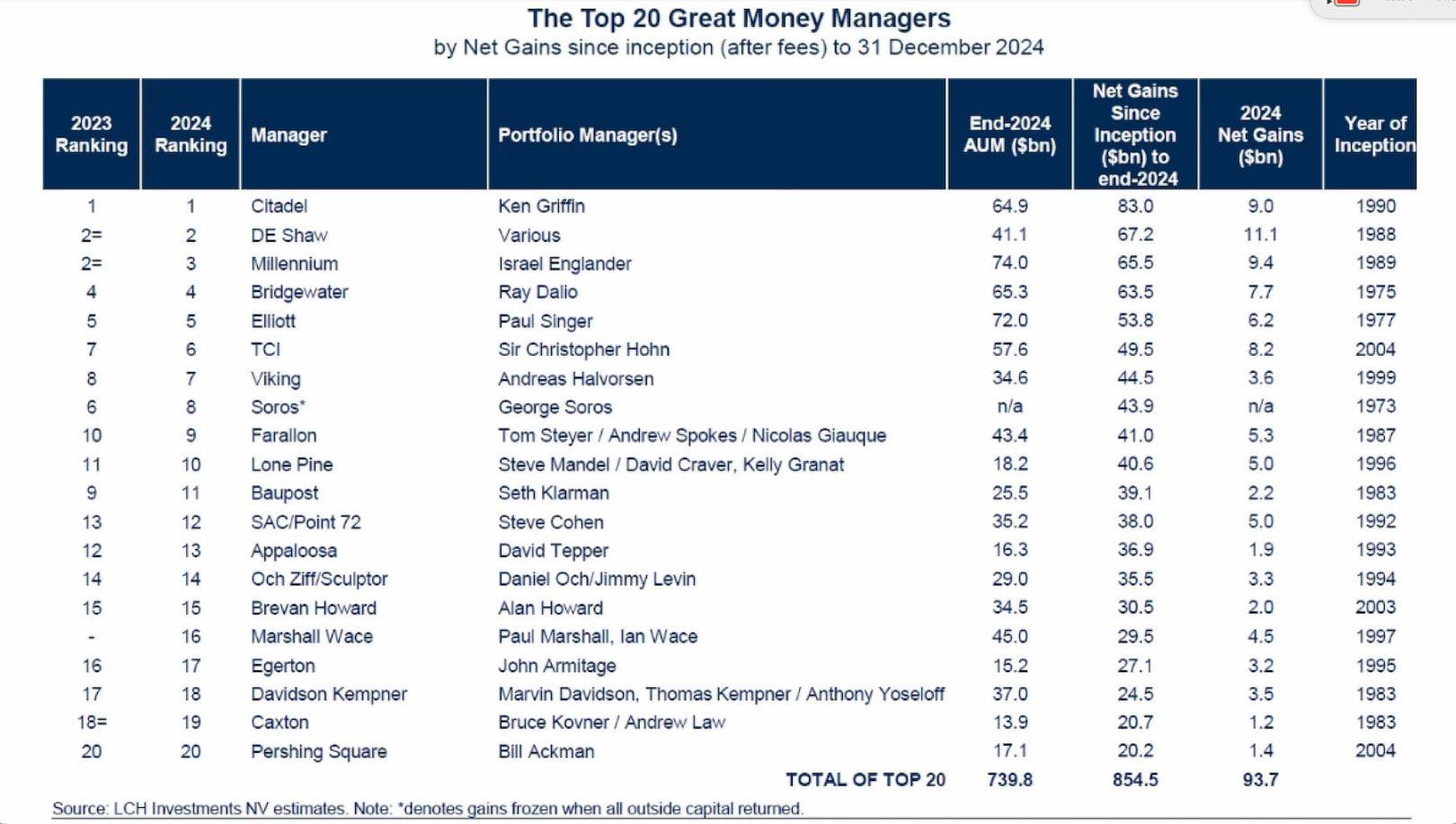

Citadel's assets under management have reached US$66 billion by the end of 2024. According to statistics from LCH Investments , among the top hedge funds, Citadel has the highest net income since its launch by the end of 2024, reaching US$83 billion, surpassing DE Shaw, Millennium, and Bridgewater Fund.

Citadel Securities - the largest designated market maker on the New York Stock Exchange

The market making department launched by Kenneth C. Griffin in 2002 was later spun off from Citadel and operated independently to become Citadel Securities. Today, Citadel Securities has become one of the world's largest market makers, especially in the US capital market. Citadel Securities' main business is to provide liquidity for traditional financial markets such as stocks, options, fixed income products, ETFs, etc., and ensure that buyers and sellers in the market can efficiently match transactions through high-frequency trading technology and algorithms.

According to the official website, Citadel Securities has a nominal daily trading volume of US$503 billion, accounting for approximately 35% of retail stock trading in the United States and is the largest designated market maker on the New York Stock Exchange (accounting for 65% of the market share).

The turning point for Castle Securities to become famous was the GameStop short squeeze in 2021. At that time, American retail investors pushed up the stock prices of "meme stocks" such as GameStop through social media, causing institutions that shorted these stocks to suffer heavy losses. As a major market maker in the US stock market, Castle Securities handled a large number of related transactions. In this incident, Castle Securities became famous by demonstrating strong transaction execution capabilities.

It is worth mentioning that Zhao Peng, CEO of Castle Securities, is a Chinese American born in Beijing in the 1980s. He was admitted to the Department of Applied Mathematics at Peking University in 1997, and later went to the University of California, Berkeley to pursue a doctorate in statistics. He also worked as a summer quantitative research assistant at Lehman Brothers. After graduation, Zhao Peng joined Castle Securities. He started as a senior quantitative researcher, served as global market making director and chief scientist, and was finally promoted to CEO in 2017.

After becoming CEO in 2017, Zhao Peng promoted the company's international expansion, especially in the Asian and Chinese markets. In 2023, Castle Securities China Co., Ltd. obtained the Qualified Foreign Investor (QFII) qualification and submitted an application to establish a securities company in China in January 2025.

Castle Securities: From watching and cautiously testing the waters to entering the crypto market

The history of Castle Securities' involvement in the crypto market has gone from founder Kenneth C. Griffin comparing Bitcoin to the tulip bubble to calling it "one of the greatest stories in the financial field" to admitting that he "regretted not buying cryptocurrencies earlier." This not only reflects its strategic adjustment to emerging markets, but also reflects the trend of traditional financial giants gradually accepting crypto assets.

Initially, the founder of Castle Securities was skeptical and wait-and-see about the crypto market. Cryptocurrency was seen as a high-risk, high-volatility asset class in its early days, and regulatory uncertainty also deterred many traditional financial institutions. Castle Securities is known for its solid position in the stock, options and fixed income markets, so it would not easily get involved in an immature field. As the founder, Kenneth C. Griffin was publicly skeptical of cryptocurrencies.

However, with the rapid development of the crypto market and the growing interest of institutional investors, Castle Securities' attitude began to loosen. After the GameStop incident, the retail craze and market volatility drew people's attention to the potential connection between traditional finance and emerging assets. In the same year, the trading volume in the crypto market surged, and assets such as Bitcoin and Ethereum were gradually seen as investable categories. In the same year, Kenneth C. Griffin also bid more than $43 million in 2021 for a rare copy of the U.S. Constitution, beating the DAO organization ConstitutionDAO (ConstitutionDAO raised more than 10,000 ETH at the time).

Kenneth C. Griffin also stated in an interview in 2022 that cryptocurrency is one of the greatest stories in the financial field in the past 15 years, and admitted that Citadel will be exposed to cryptocurrency in the next few months.

In January 2022, Citadel Securities announced that it had received $1.15 billion in minority equity financing from Sequoia Capital and Paradigm (an investment institution focusing on the cryptocurrency field). Paradigm co-founder Matt Huang said at the time: "I look forward to Citadel Securities expanding its technical expertise to the crypto market."

It is worth mentioning that after the UST decoupling incident in 2022 caused drastic market fluctuations, rumors on the Internet alleged that Citadel Securities and BlackRock borrowed a large amount of Bitcoin from Gemini and sold UST, causing the crash. In response, a representative of Citadel told Bloomberg that Citadel does not trade stablecoins including UST. Later in 2023, Terraform Labs also filed a motion requiring Citadel Securities to submit relevant transaction data for May 2022. In response, Citadel Securities responded that only two test transactions were conducted in March 2022, a few months before the UST crash, with a transaction value of only US$0.13, and refuted Terraform Labs' claims.

Starting in the second half of 2022, Castle Securities has taken more substantial steps. In June, according to Bloomberg, Kelly Brennan, head of ETFs at Castle Securities, said that if crypto ETFs are approved by regulators, they will be ready to make markets for these products. In addition, Castle Securities has launched the institutional-grade cryptocurrency exchange EDX Markets with Charles Schwab, Fidelity Digital Asset, Paradigm, Sequoia Capital and Virtu Financial, aiming to provide a safe, efficient and compliant trading environment for crypto-native companies and large global financial institutions. EDX Markets completed a financing in June 2023, when investors included Miami International Holdings, DV Crypto, GTS, GSR Markets LTD and HRT Technology. Subsequently, in January 2024, EDX Markets completed its Series B financing, led by Pantera Capital and Sequoia Capital.

In August 2022, Citadel Securities also invested in digital asset and foreign exchange brokerage Hidden Road Partners. In February 2023, Citadel Securities reported a 5.5% stake in cryptocurrency-friendly bank Silvergate Capital.

After entering 2023, the signs of Castle Securities' entry are more obvious, such as the expansion, integration and internationalization of EDX Markets, and being selected by BlackRock as an authorized participant (AP) of iShares Bitcoin Trust (IBIT). At the end of last year, Kenneth C. Griffin said that he regretted not buying cryptocurrencies a few years ago.

What impact will Castle Securities’ entry into crypto market making have?

The transformation of Castle Securities from a wait-and-see attitude to a market entry is not accidental. The institutionalization of the crypto market, the gradual clarification of regulations, and competitive pressure have jointly promoted this process.

This not only marks the further recognition of the crypto market by traditional financial giants, but may also reshape the landscape of Bitcoin and crypto trading. On the one hand, this symbolizes the extension of traditional financial infrastructure to the crypto field, which will further promote the transformation of Bitcoin from a marginal asset to a mainstream investment category, especially its acceptance among institutional investors, which may attract more traditional players such as hedge funds and pension funds to enter the Bitcoin market and allocate Bitcoin.

On the other hand, Castle Securities' market making may significantly increase the order depth and trading volume of the Bitcoin market, bringing higher transparency and stability to the crypto market. At the same time, Castle Securities provides liquidity to mainstream exchanges such as Coinbase and Binance, which will enhance the trading experience of these platforms and attract more institutional capital inflows.

Its entry may also trigger the follow-up of other financial giants (such as Jane Street, etc.), intensifying competition in the field of crypto market making. Of course, this will also squeeze the market share of existing crypto market makers. Small and medium-sized market makers may be marginalized because they cannot match the technology and cost advantages of Castle Securities.

However, for retail investors, the entry of Castle Securities brings both convenience and hidden challenges. With the influx of institutional funds and professional market makers, the Bitcoin and crypto markets may shift from being a "hotspot for retail investors" to being a main field for institutions, and the voice of retail investors may gradually shrink.