Source: Talking about Li and other things

Yesterday (March 23), Trump tweeted on the social media Truth Social: I love TRUMP (token), very cool. As shown in the picture below.

However, judging from the price performance of the TRUMP token on that day, it did not seem to generate much trading volume, and the highest increase on that day was only about 7%. This shows that the overall market sentiment is still not optimistic enough. Even if the president calls for orders, people no longer have that crazy purchasing power.

In fact, there have been quite a few positive factors in the market in recent days, such as: the U.S. Treasury Department lifted sanctions on Tornado Cash, the SEC stated that proof-of-work (POW) mining does not involve the issuance and sale of securities, the SEC terminated the lawsuit against Ripple (XRP), Trump spoke at the Blockworks Digital Asset Summit (in a pre-recorded statement) and reiterated that the United States will take measures to ensure that it becomes the "cryptocurrency capital of the world", White House officials said that the United States may use its gold reserves to buy more Bitcoin, institutions such as MicroStrategy continue to buy more Bitcoin, Trump displayed the Bitcoin white paper hanging on the wall of the White House, and the IMF (International Monetary Fund) is adding Bitcoin to its own reserves... and so on.

But the overall market reaction is relatively flat. The current market gives people the feeling that the narrative is still very strong (encryption has risen to the national level), but liquidity is very weak.

So, has the market completely fallen into a bear market atmosphere?

First of all, this question depends on your definition of a bear market. If you think that the current price of Bitcoin at $86,000 (the price at the time of writing this article) means a bear market, then it is a bear market for you; if you think that the current decline of your holdings by more than 60% means a bear market, then it is a bear market for you...

Recently, through the backend data and the interactive discussions in the group, I found that many people are still pessimistic and at a loss. Some messages or private messages continue to ask me questions about price predictions or trading operations, such as: How much do you think the market will fall next? Do you think Bitcoin can rise to 90,000 this month? Can I buy XX coin now? I am stuck with XX, should I switch to XX now? ... and so on.

Those who can ask the above questions are basically new users or users who don’t usually read Hualihuawai’s articles. In fact, I have never had a standard answer to such questions. If you must ask, then the only answer is “I don’t know”. In addition, I am a person who speaks more directly, and asking me such questions basically does not give you any psychological comfort. But those who know me (the views of past articles) should know that I am a long-term optimist of Bitcoin. Asking me whether Bitcoin can be bought is equivalent to holding a ready-made answer without reading it, and trying to find the questioner to ask for the answer.

As far as the current market is concerned, the one that is still a little bit hot (relatively discussed more in the group) is CZ’s hype of MemeCoin with BNB Chain, but the gameplay is still the old Meme+hype method, Chinese KOLs are busy interacting and shouting orders, and players are still playing PvP games through speed pass (see who enters earlier and who runs faster). This gameplay will not have much impact on the overall market at this stage. Perhaps, we need some more positive catalysts to re-promote or bring a new wave of staged market.

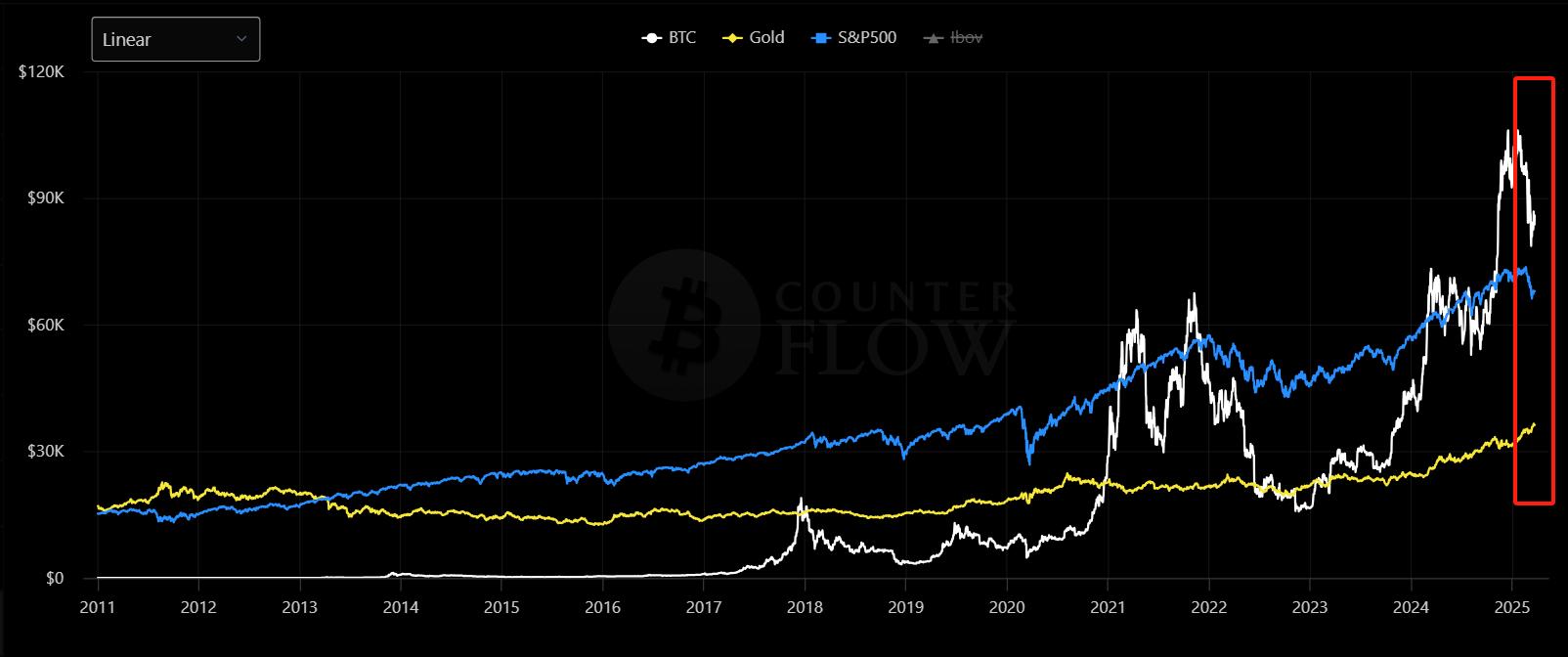

Now many people's expectations for the market seem to be mainly focused on changes in the macro environment, such as Trump's tariffs and other policy changes, the Fed's interest rate cuts, etc. From the overall situation, we seem to be at a new turning point or approaching a new turning point. Especially since this year, as gold continues to rise, Bitcoin and the S&P 500 index have experienced a relatively obvious pullback, as shown in the figure below.

Although compared with Bitcoin in previous cycles, Bitcoin in this cycle has a long-term super narrative under the approval of ETFs and the recognition of the US government (strategic reserves, etc.), it is subject to some macro issues and investors do not seem to fully favor such high-risk assets. Here we might as well make a simple assumption: as gold continues to reach new highs and reaches a staged peak, when gold re-enters a new consolidation or correction, high-risk assets such as Bitcoin may show some new trend changes or staged reversals.

As for when this new trend change or phased reversal will occur, I don’t know. Here I can make another blind guess. If the market continues to usher in new black swans, maybe we will see Bitcoin starting with 7 again (new opportunities for investors to increase their positions), and if the market continues to climb slowly at the current pace (in recent weeks), then maybe we can also see some new phased opportunities in the second quarter of this year (new selling opportunities for speculators).

The macro factors we mentioned above (such as interest rate cuts) have a long-term impact on the market. If you are more concerned about short-term market opportunities, then in addition to paying attention to some technical indicators (such as MACD, RSI, etc.), the simplest thing is to pay extra attention to the flow of funds from different angles as mentioned in our previous article. Here are two simple examples:

- ETF fund inflow/outflow

The inflow of funds into ETFs usually has a relatively positive impact on the overall market sentiment. For example, starting from March 14, the Bitcoin ETF has generated positive inflows again. If we compare this with the price trend of Bitcoin, we can find a certain correlation.

- Inflow/outflow of funds on the chain

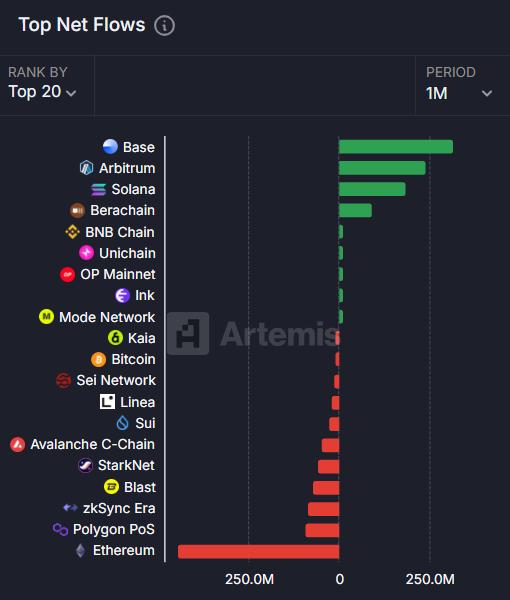

If you like to chase opportunities on the chain, then in the general direction, just follow the smart money. See which ecosystem the money is running to, and pay attention to the project opportunities in the corresponding ecosystem in a timely manner. As shown in the figure below.

Of course, different indicators or methods may also produce different effects (long-term or short-term effects), but the best way to deal with investment confusion is to form one or more of your own methods, and then continue to execute and optimize your trading strategies based on these methods. At the same time, doing so can also reduce your extreme pessimism in a bear market (not buying when you should buy) and extreme optimism in a bull market (not selling when you should sell) to a certain extent.

Whether it is consumption or investment, before deciding to do anything, we must be prepared for both situations. For example, buying a car may fall, buying a mobile phone may fall, and buying Bitcoin may also fall, but compared with cars and mobile phones, the decline of Bitcoin is only a short-term correction in the long run. Moreover, you can of course own multiple assets such as Bitcoin and Ethereum at the same time, but you must plan your priorities well and invest money that does not affect your life. If you are not speculating in the short term, then the basic priority must be BTC > ETH (yes, that's right, although many people are FUDing Ethereum now, I personally still look forward to its overall development at this stage) > other cottages > MemeCoins.

The game in the crypto market is becoming more and more difficult. Some historical experiences and indicators have become invalid. For most ordinary people, if you still don’t know what to do, just remember one sentence: when you have no better choice, Bitcoin will be your only and reliable choice.