Author: 0xkyle

Compiled by: Felix, PANews

Overview

So far, the 2024 cycle has seen Solana dominate, with the main narrative of this cycle, Memecoins, all generated on Solana. In terms of price, Solana is also the best performing L1 blockchain, up about 680% year to date. While memecoin and Solana are deeply intertwined, Solana as an ecosystem has generally ignited interest since its 2023 recovery, with its ecosystem thriving, protocols such as Drift (Perp-DEX), Jito (Liquid stake), Jupiter (DEX-Aggregator) all having tokens valued in the billions of dollars, and Solana's active addresses and daily transactions exceed all other chains.

Raydium, the premier DEX in the Solana ecosystem, is at the heart of this thriving ecosystem. The old saying “sell shovels during a gold rush” perfectly captures Raydium’s position: to power the liquidity and trading that fuels the memecoin craze. Benefiting from the flow of memecoin transactions and broader DeFi activity, Raydium has solidified its position as an important infrastructure in the Solana ecosystem.

This article aims to use a data-driven approach to disassemble Raydium’s position in the Solana ecosystem using a first principles approach.

About Raydium

Launched in 2021, Raydium is an automated market maker (AMM) based on Solana that enables permissionless pool creation, lightning-fast transaction speeds, and a way to earn yield. Raydium's key difference is structure: Raydium is the first AMM on Solana and has launched the first order-compatible hybrid AMM in DeFi.

When Raydium was launched, it adopted a hybrid AMM model that allowed idle pool liquidity to be shared with a central limit order book, while general DEXs at the time could only access liquidity in their own pools. This meant that Raydium's liquidity also created a market for OpenBook, which could be traded on any OpenBook DEX GUI.

While this was a major difference in the early days, this feature has since been turned off. Raydium currently offers three different types of pools, which are:

- Standard AMM pool (AMM v4), formally known as hybrid AMM

- Constant Product Exchange Pool (CPMM), supporting Token 2022

- Centralized Liquidity Pool (CLMM)

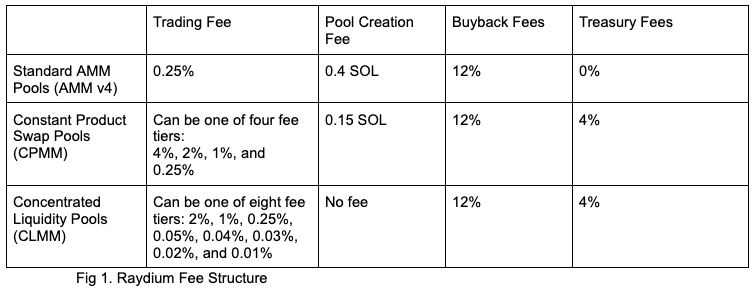

For every exchange that occurs on Raydium, a small fee is charged based on the specific pool type and pool fee level. This fee is split into two parts, used to incentivize liquidity providers, RAY buybacks, and treasury.

The transaction fees, pool creation fees, and protocol fees for different mining pools on Raydium are documented below. Here is a brief description of what each term means and their respective fee levels:

- Transaction fees are fees charged to traders in Swap transactions.

- The buyback fee is a percentage of the transaction fee required to buy back Raydium tokens.

- The Funding Fee is the percentage of the transaction fee allocated to fund management.

- The pool creation fee is a fee levied when a pool is created, designed to discourage pool spam. The pool creation fee is controlled by the protocol multisig and is reserved for protocol infrastructure costs.

Overview of Solana Ecosystem DEX

Figure 2: Solana’s TVL in DEX

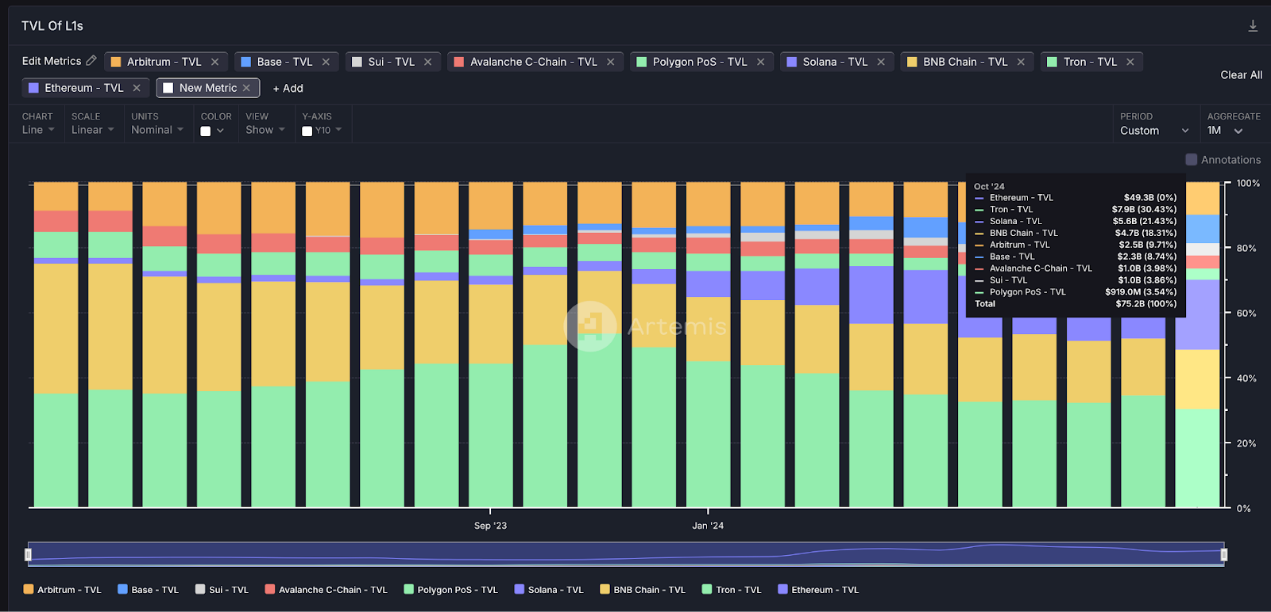

The above mainly analyzes the working principle of Raydium. The following is an assessment of Raydium's position in the field of Solana DEX. There is no doubt that Solana has successfully ranked among the top L1s in the 2024 cycle. Solana's TVL ranks third, second only to Tron (second) and Ethereum (first).

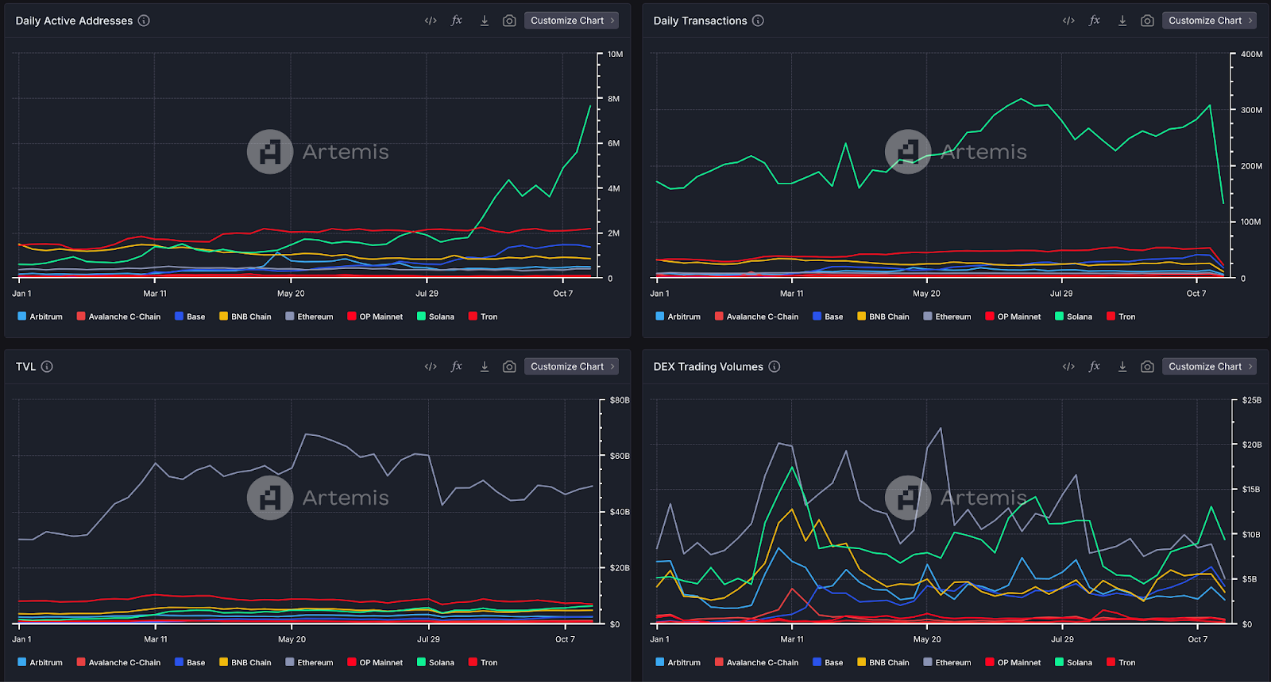

Figure 3: Daily active addresses, daily transaction volume, TVL, and DEX transaction volume

Solana continues to dominate in terms of user activity metrics such as daily active addresses, daily transaction volume, and DEX transaction volume. The increase in activity and token liquidity on Solana can be attributed to several factors: The memecoin boom on Solana. Solana's fast and low-cost settlement, coupled with a smooth user experience for DApps, has fueled the growth and prosperity of on-chain transactions. With tokens like $BONK and $WIF reaching multi-billion dollar market caps, and the emergence of Pump.fun. As a memecoin launch platform, Solana has actually become the home of memecoin trading.

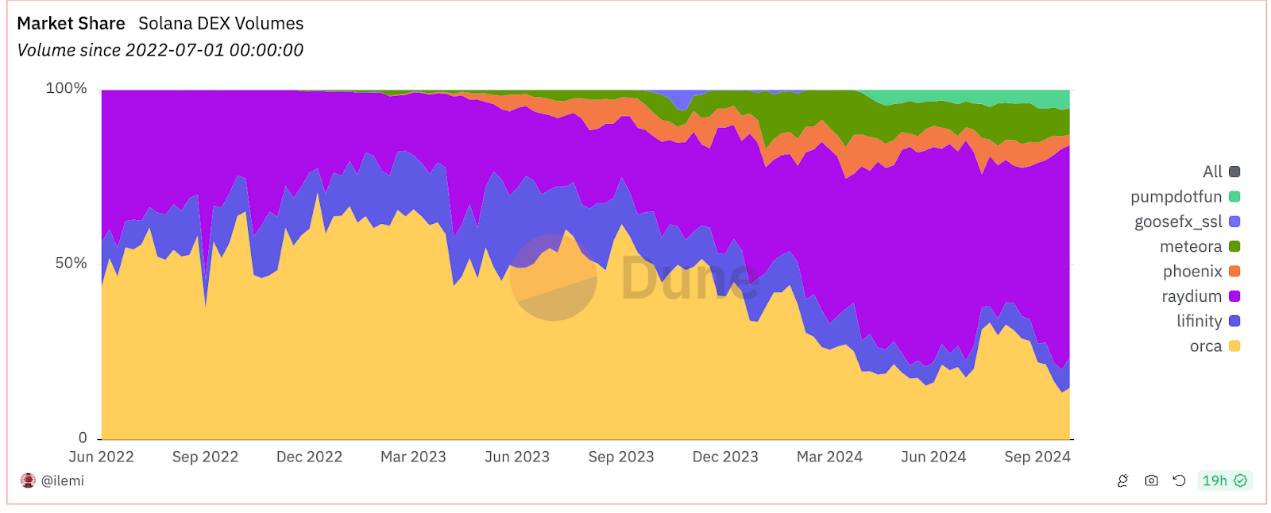

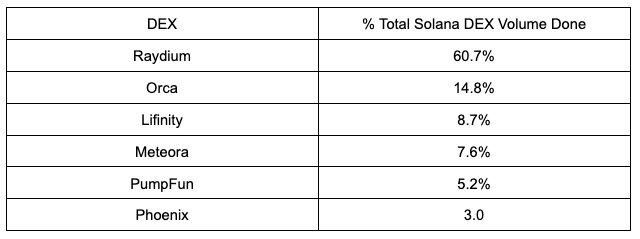

Solana has been the most used L1 in this cycle and continues to dominate in terms of trading activity. As a direct beneficiary of the increase in activity, this means that DEXs on Solana are doing very well - more traders means more fees, which means more revenue for the protocol. However, even among DEXs, Raydium has managed to capture a considerable market share, as shown in the figure below:

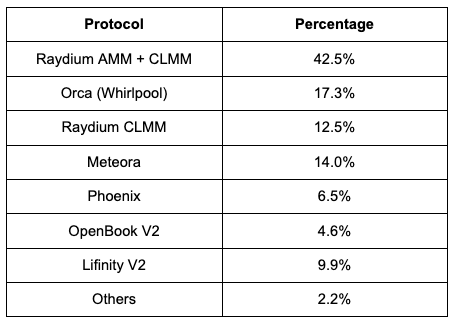

Figure 4: Solana ecosystem DEX transaction volume market share among various DEXs

Raydium ranks first among Solana DEXs, with the highest trading volume among all Solana DEXs, accounting for 60.7% of the market share of the total trading volume of Solana DEX. This is because Raydium allows a variety of activities on it - from memecoins to stablecoins.

One way Raydium achieves this is by providing multiple options for pool creators and liquidity providers when creating new markets. Users can choose to select a fixed product pool for price discovery at the initial launch, or choose a narrower range of LPs in a centralized liquidity pool: allowing initial price discovery on Raydium while still remaining competitive in SOL-USDC, stablecoins, LST, and other markets.

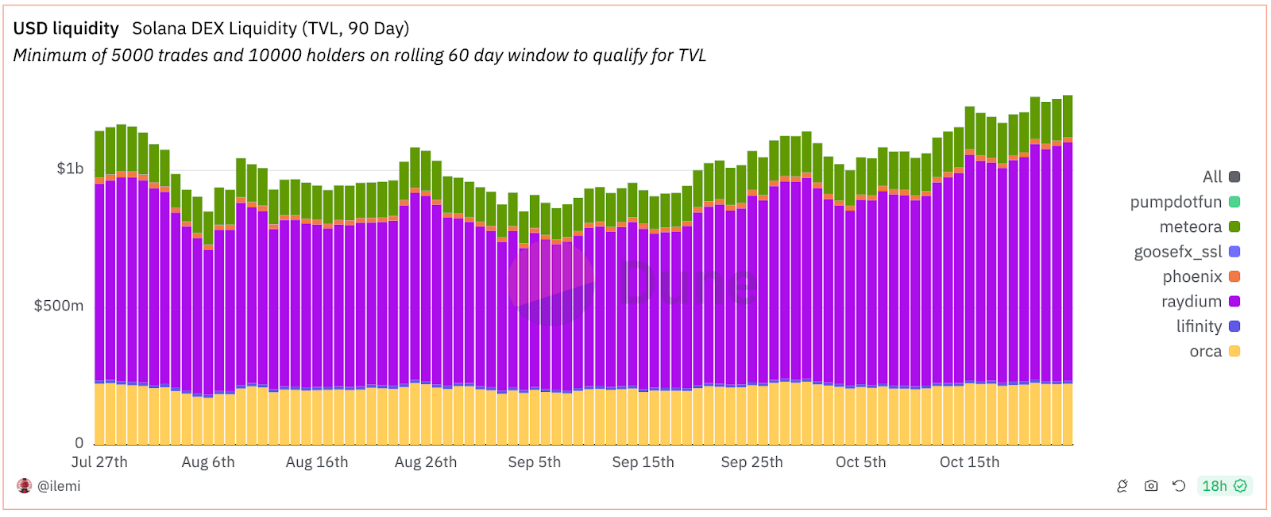

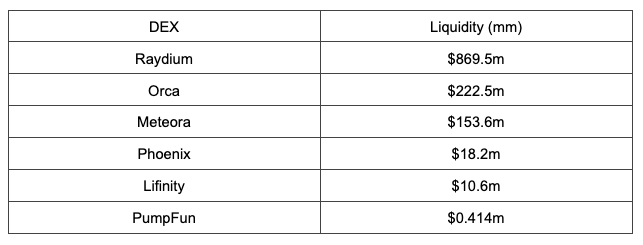

Figure 5: Solana DEX Liquidity

Most importantly, Raydium remains the most liquid DEX. It is worth noting that trading is often a matter of economies of scale, as traders flock to the exchanges with the most liquidity to avoid slippage on their trades. Liquidity generates liquidity: when the largest DEXs acquire the most traders, it becomes a positive flywheel, attracting LPs, allowing them to earn money from fees, which in turn attracts more traders eager to avoid slippage.

Liquidity is often an overlooked factor when comparing DEXs, but is critical when evaluating the best performing DEXs (especially considering that traders on Solana are trading memecoins). Fragmentation of liquidity between different DEXs can lead to a poor user experience and frustration with buying different memecoins each time between different DEXs.

The relationship between Memecoins and Raydium

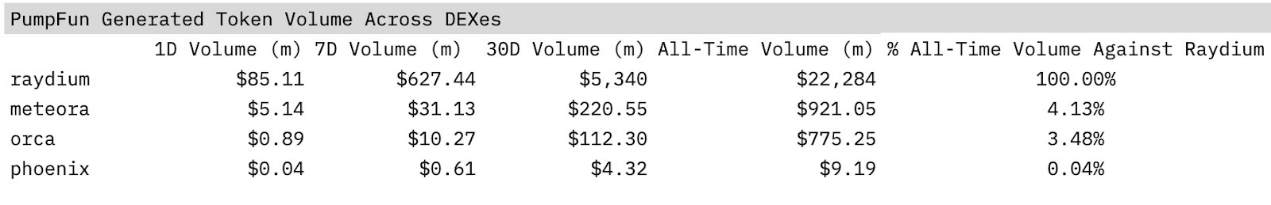

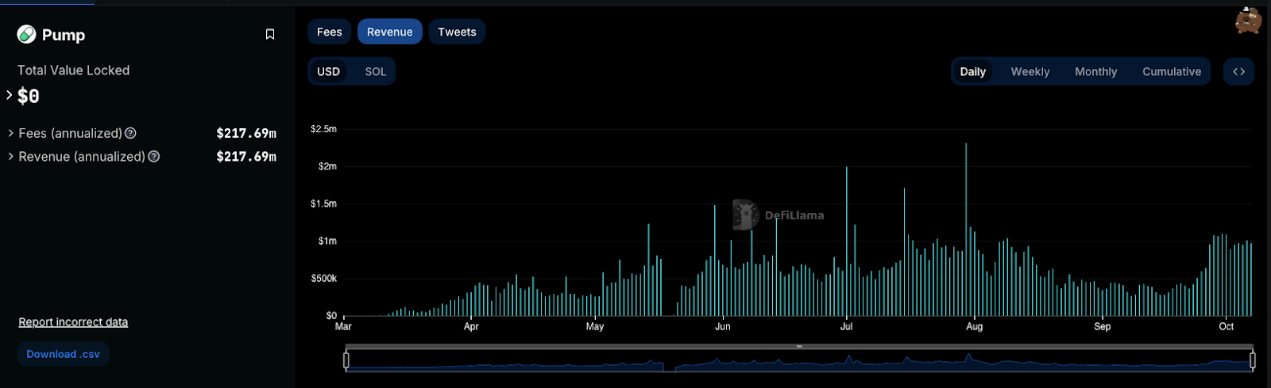

Raydium’s popularity can also be attributed to the resurgence of memecoins on Solana, specifically Pump.fun, a memecoin issuance platform that has raked in over $100 million in fees since its inception earlier this year.

Pump.fun memecoins are directly linked to Raydium. When a token launched on Pump.fun reaches a market cap of $69,000, Pump.fun will automatically deposit $12,000 worth of liquidity into Raydium. Continuing with the previous point about liquidity, this means that Raydium is actually the most liquid platform for trading memecoins. It's like a virtuous cycle, pump.fun is combined with Raydium -> memecoins are issued there -> people trade there -> get liquidity -> more memecoins are issued there -> get more liquidity, and the cycle repeats.

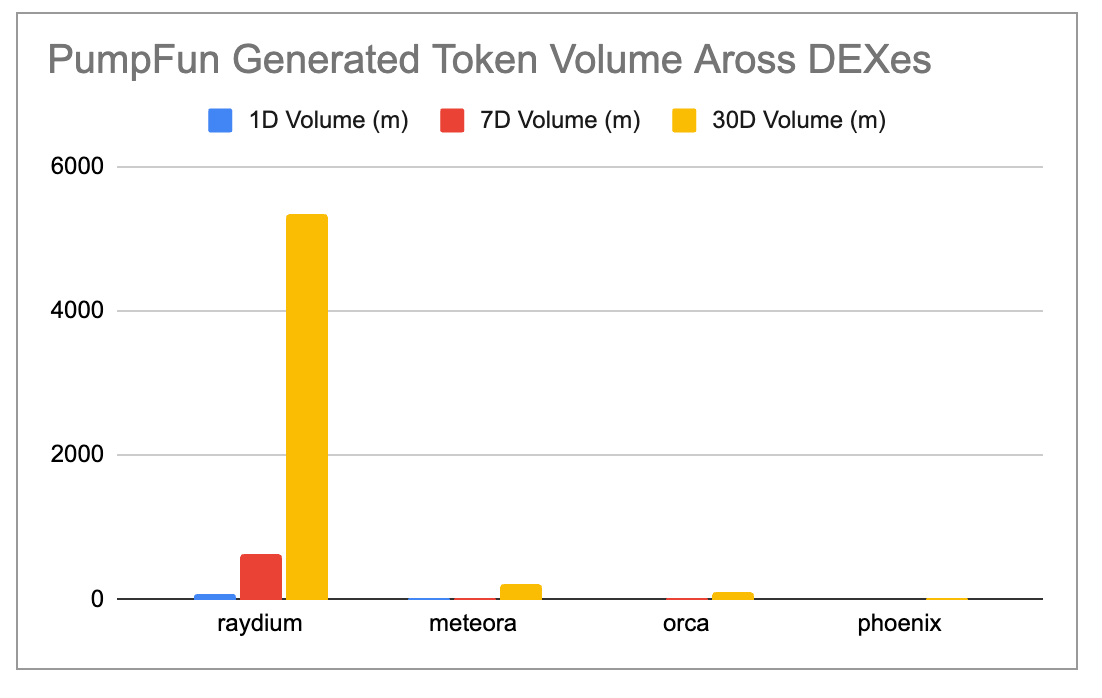

Figure 6: Number of tokens generated by Pump.Fun on DEX

Therefore, Pump.fun is attributed to Raydium, and almost 90% of the memecoin generated by Pump.fun is traded on Raydium. Just like a shopping mall in a city, Raydium is the largest "shopping mall" on Solana, most people go to Raydium for "shopping", and most "businesses" (tokens) want to "open stores" there.

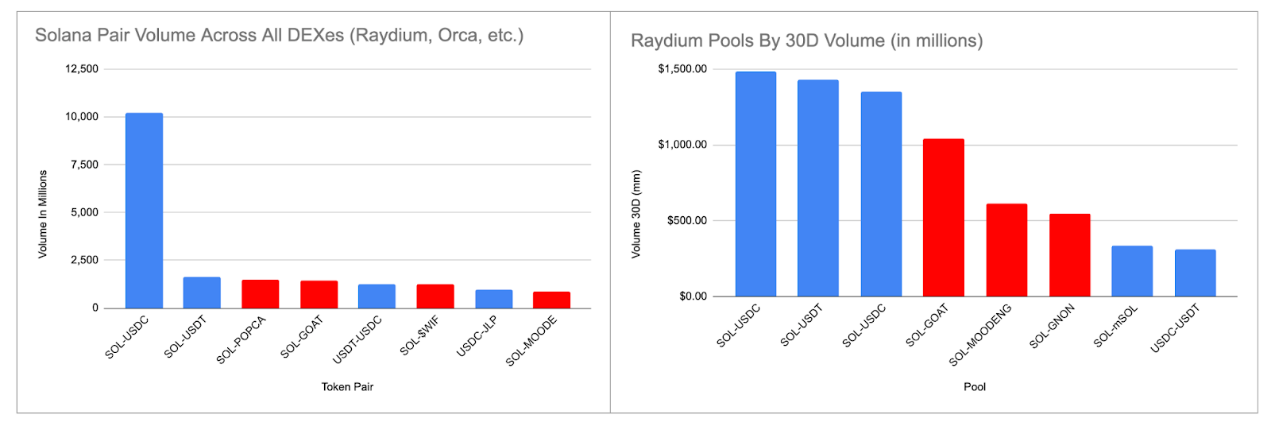

Figure 7. Trading volume of DEX token pairs on Solana and Raydium

Figure 8: Raydium transaction volume by token type

It is worth noting that while Pump.fun relies on Raydium, this is not the case, and Raydium does not rely solely on memecoins. In fact, according to Figure 8, the top 3 token pairs with the largest trading volume in the past 30 days are SOL-USDT/USDC, accounting for more than 50% of the total trading volume. (Note: the two SOL-USDC pairs are two different pools with different fee structures).

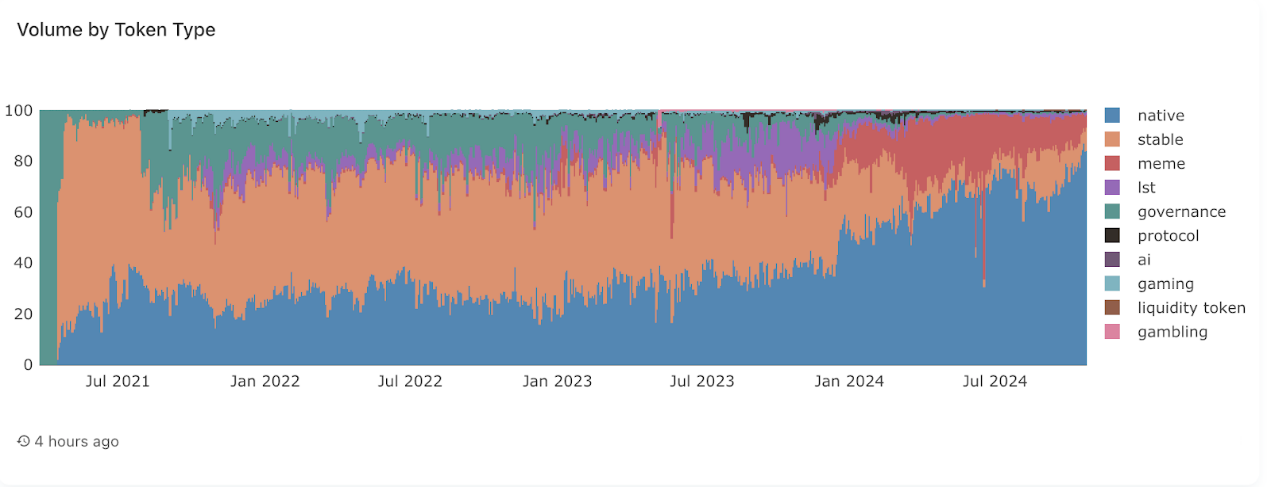

This is also confirmed by Figures 7 and 9, with Figure 7 showing that SOL-USDC far outpaces all other DEX pairs in terms of trading volume. Figure 7 represents the trading volume of all DEXs, and it still shows that the trading volume of the entire ecosystem is not necessarily driven only by memecoin. Figure 9 further shows Raydium's trading volume by token type. It can be seen that "native" occupies the largest market share, over 70%. Therefore, while memecoin is an important part of Raydium, it is not all of it.

Figure 9: PumpFun revenue

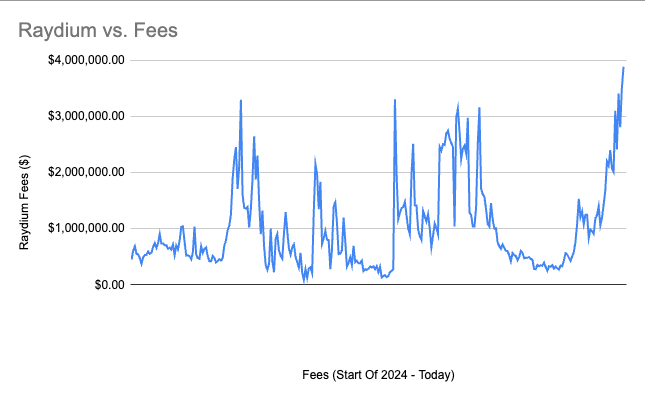

Figure 10: Raydium revenue

That being said, memecoin is highly volatile, and volatile pools typically charge higher fees. So while memecoin may not contribute as much in terms of volume as the Solana pool, it contributes significantly to Raydium's revenue and fees. This was evident in September, as memecoin is a cyclical asset that tends to underperform significantly in "bad" times as risk appetite wanes. Subsequently, Pump.Fun's revenue fell 67% from an average of $800,000 per day in July/August to approximately $350,000 in September; Raydium's fees fell similarly during this period.

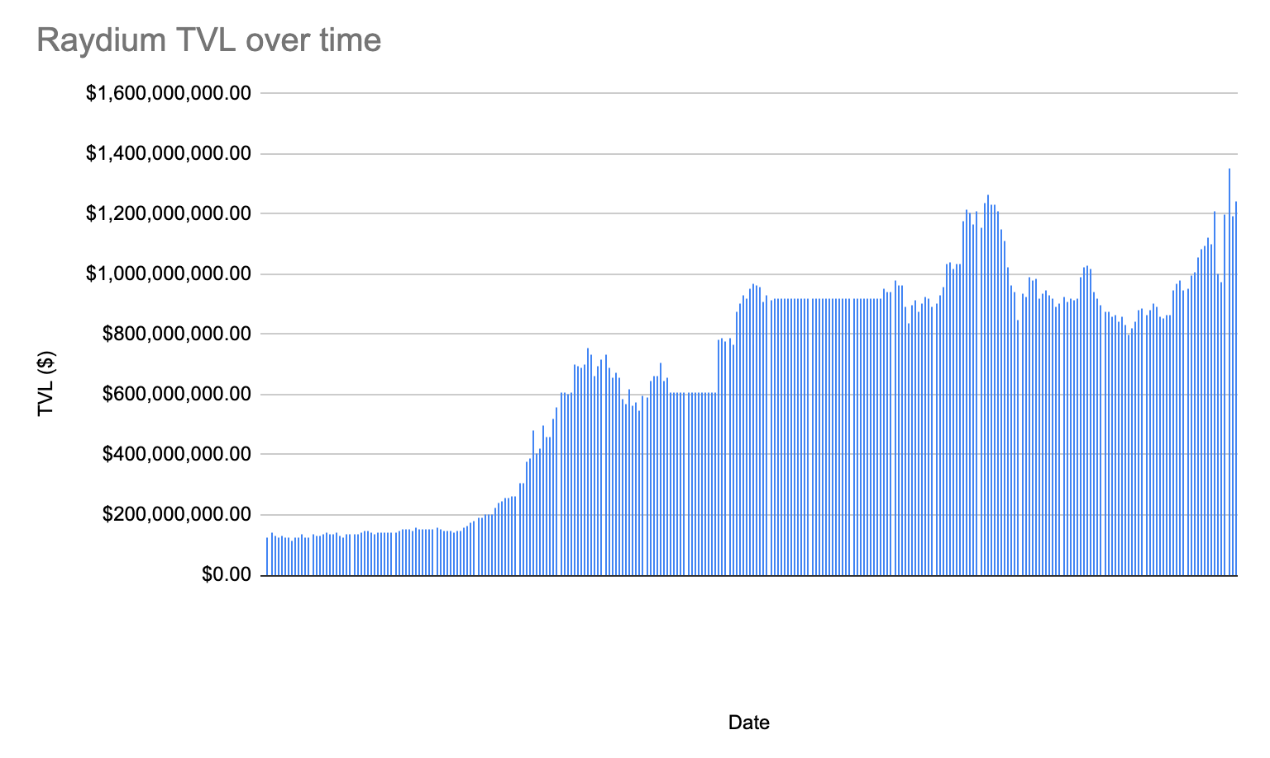

Figure 11: Raydium TVL

But like the rest of crypto, the industry is highly cyclical, and it’s normal to see metrics decline during bear markets as risk fades. Instead, think of TVL as a measure of how antifragile a protocol really is. While revenue is highly cyclical, rising and falling as speculators come and go, TVL is a measure of how sustainable a DEX is, and how it will stand the test of time. TVL is akin to the “occupancy rate” of a mall, where the occupancy rate of a store may vary from season to season, just as in reality, as long as the occupancy rate of a mall is above average, it can be considered successful.

Similar to a crowded mall, Raydium’s TVL has remained consistent over time, indicating that while revenue may fluctuate with market prices and sentiment, it has proven its ability to become a staple in the Solana ecosystem and become the best and most liquid DEX on Solana. So while memecoins do contribute to some of its revenue, memecoin volume is not always the case, and liquidity still flocks to Raydium regardless of the market.

Raydium and Aggregators

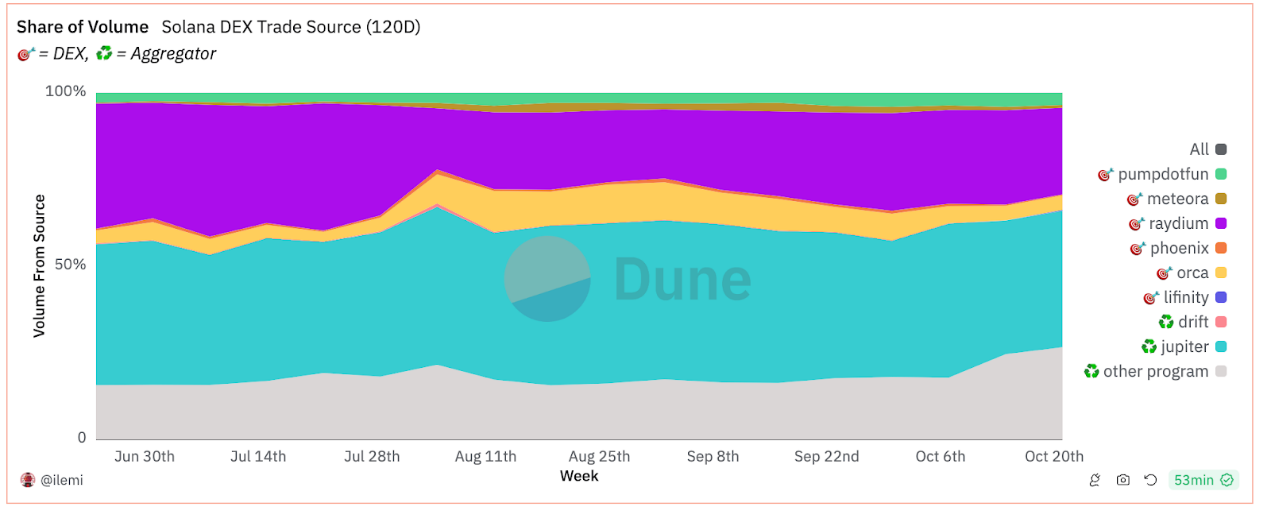

Figure 12: Solana DEX transaction sources

While Jupiter and Raydium do not compete directly, Jupiter is a key aggregator in the Solana ecosystem, trading through the most efficient path across multiple DEXs, including Raydium. Essentially, Jupiter acts as a meta-platform, ensuring that users get the best prices by sourcing liquidity from various DEXs such as Orca, Phoenix, Raydium, etc. On the other hand, Raydium, as a liquidity provider, powers many of Jupiter's transactions by providing deep liquidity pools for Solana-based tokens.

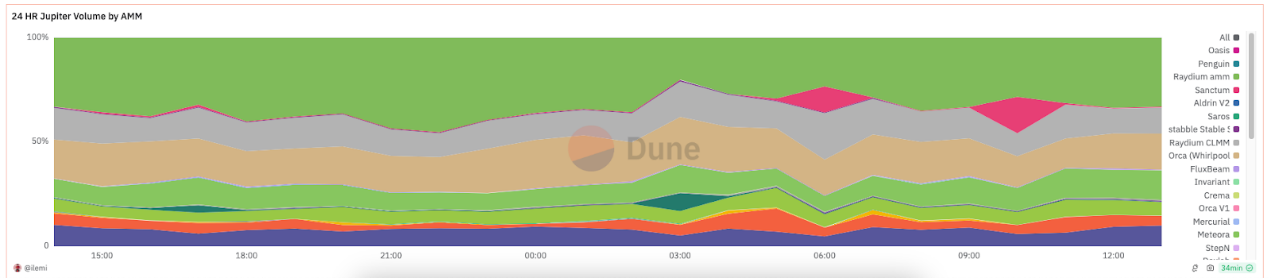

Figure 13: 24-hour Jupiter AMM trading volume

While the two protocols are fairly evenly matched, the share of organic volume directly generated by Raydium is slowly increasing, while Jupiter’s share is slowly decreasing. Meanwhile, Raydium accounts for nearly 50% of all pending orders on Jupiter.

This shows that Raydium has successfully built a stronger, more self-sufficient platform that can attract users directly rather than relying on third-party aggregators such as Jupiter.

The increase in direct trading volume shows that traders are finding value in interacting with Raydium's native interface and liquidity pools as users seek the most efficient and comprehensive DeFi experience without going through an aggregator. Ultimately, this trend highlights Raydium's capabilities as a liquidity provider in the Solana ecosystem.

Raydium and The World

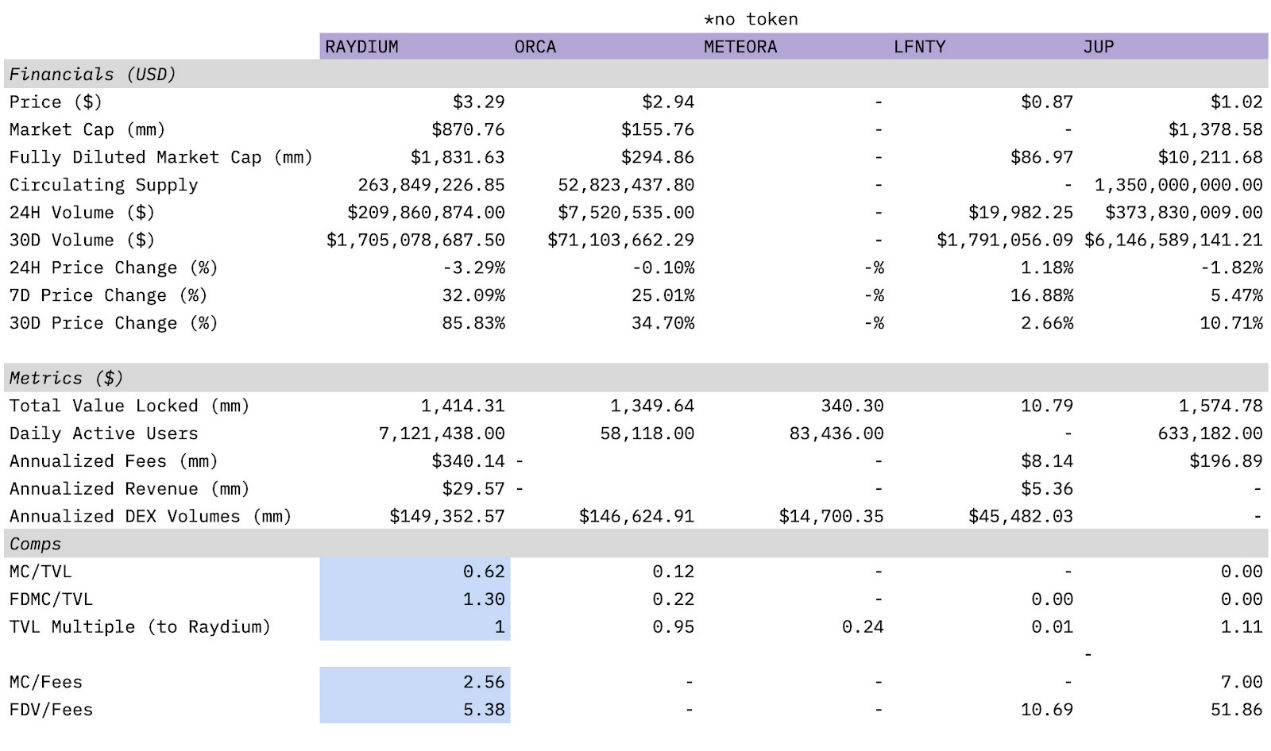

Finally, here’s a comparison chart built using the Artemis plugin for Raydium, comparing other DEXs on Solana, including aggregators.

Figure 14: Raydium and Solana DEX

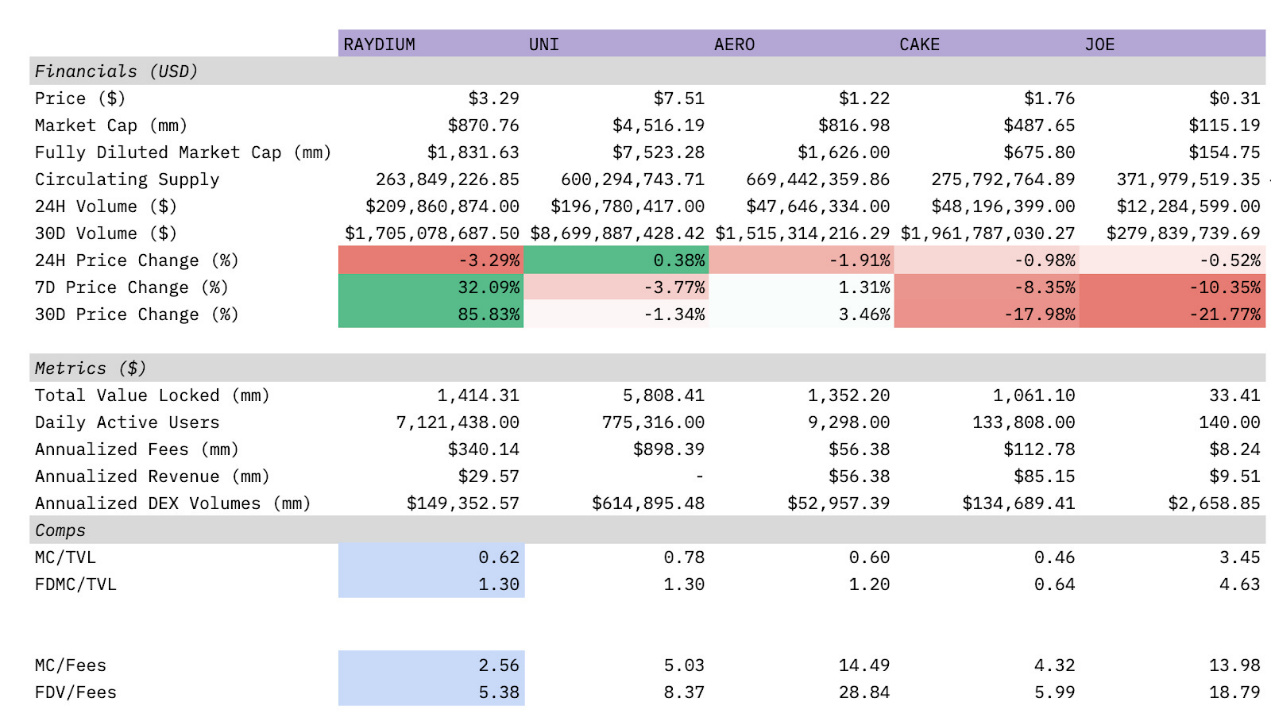

Figure 15: Raydium and popular DEX

In Figure 13, Raydium is compared to the most popular DEXs on Solana, namely Orca, Meteora, and Lifinity, which together account for 90% of the total Solana DEX volume. Jupiter is also listed as an aggregator. Meteora does not have a token, but it is still included for the sake of comparison.

It can be seen that among all DEXs, Raydium has the lowest MC/Fees and FDV/Fees. Raydium also has the largest number of daily active users, and the TVL of all other DEXs is more than 80% lower than Raydium - except Jupiter.

In Figure 14, Raydium is compared to other more traditional DEXs on other chains. Raydium’s annualized DEX volume is more than double that of Aerodrome, but with a lower MC/Earnings ratio.

Raydium Token

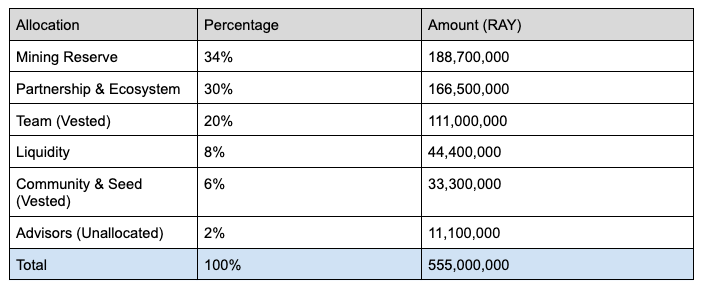

Raydium’s token economics are as follows:

Note: Team and Seed (25.9% of total) fully locked in first 12 months after TGE, and unlocked linearly daily in months 13 - 36. Vesting ends on February 21, 2024.

Raydium tokens have multiple use cases: $RAY owners can stake their tokens to earn additional $RAY. Most importantly, $RAY is a mining reward used to attract liquidity providers to Raydium, thereby increasing the depth of the liquidity pool. While Raydium tokens are not governance tokens, governance methods are being developed.

While issuing tokens fell out of favor after the summer of DeFi, Raydium has a very low annual inflation rate and its annualized buyback is one of the best tokens in DeFi. Annualized issuance is currently around 1.9 million RAY, of which RAY staking accounts for 1.65 million of the total issuance, which is negligible compared to the issuance of other popular DEXs at their peak. At current prices, RAY issues about $5.1 million worth of RAY per year. This is very low compared to Uniswap, which has an issuance of $1.45 million per day before full unlocking, or $529.25 million per year.

A small transaction fee is charged for every swap in each pool on Raydium. As stated in the documentation, "Depending on the specific fees of a given pool, this fee is split between incentivizing liquidity providers, RAY buybacks, and the treasury. In summary, 12% of all transaction fees are used to buy back RAY, regardless of the fee tier of a given pool."

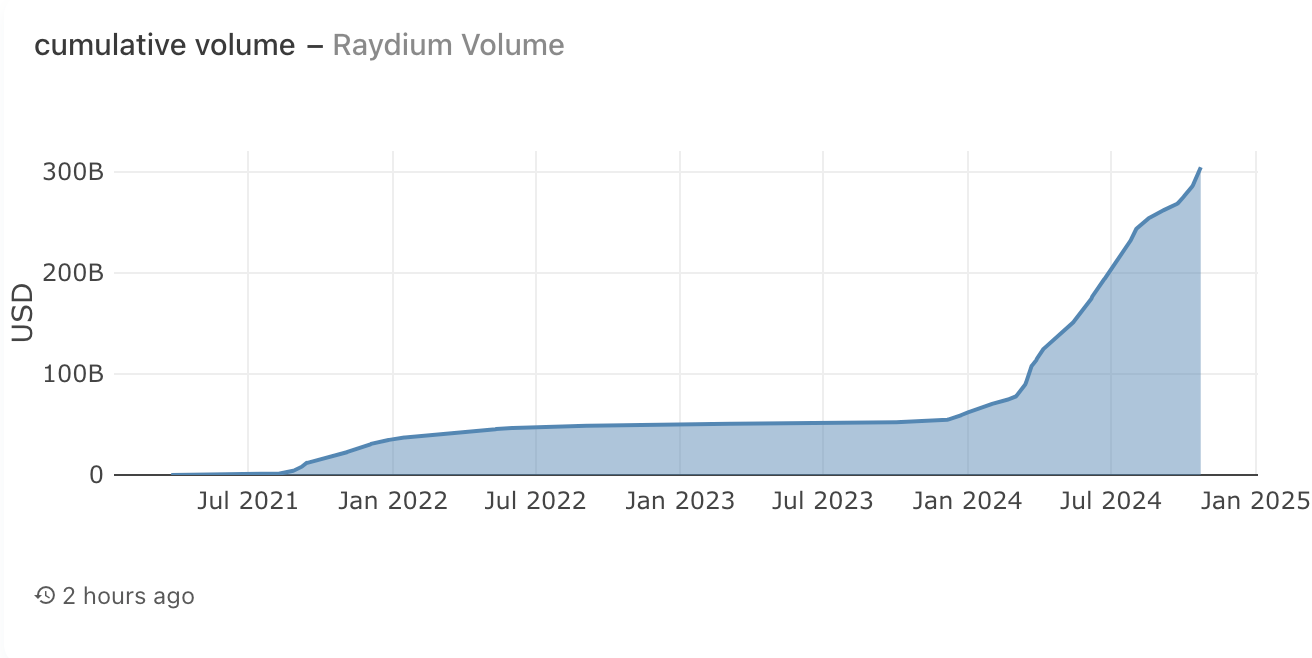

Figure 16: Raydium cumulative transaction volume

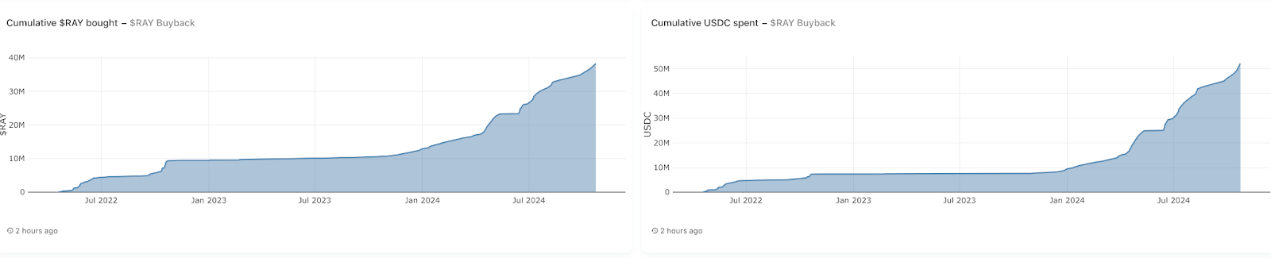

Figure 17: Raydium buyback data

Raydium has accumulated over $300 billion in trading volume and successfully repurchased approximately 38 million RAY tokens, equivalent to $52 million. Raydium's repurchase program is the most eye-catching among all DeFi projects, helping to push Raydium to the top of all DEXs on Solana.

The Case for Raydium

In conclusion, Raydium is basically ahead of all DEXs on Solana and is well-positioned to succeed as Solana continues to grow. Raydium has experienced growth over the past year and it doesn’t seem to be stopping anytime soon as the memecoin craze continues, with the latest memecoin craze centered around artificial intelligence (like $GOAT).

As a major liquidity provider and AMM on Solana, Raydium's unique position gives it a strategic advantage in gaining market share from emerging trends. Most importantly, Raydium's commitment to innovation and ecosystem growth is reflected in its frequent upgrades, incentives for liquidity providers, and active engagement with the community. These factors show that Raydium is not only ready to adapt to the changing DeFi environment, but also ready to lead DeFi.

Related reading: A Deep Dive into Aerodrome, the Liquidity Engine on Base