Author: Golem

Editor: Hao Fangzhou

2024 is coming to an end, and people in the cryptocurrency circle also have their own year-end summary: one is to see whether the return on investment this year has outperformed the market (as a reminder, BTC has risen by more than 130% this year), and the second is to summarize the development of the track/ecosystem they are concerned about this year.

The Solana ecosystem, Base ecosystem, TON ecosystem, and AI Agent track all had their highlights this year. As for the Bitcoin ecosystem, although many things also happened this year, ecological infrastructure and application innovation were developing, but it was far from what people expected in early 2024.

Therefore, some people use "failure" to summarize the silence of the Bitcoin ecosystem this year, but there are also firm ecosystem OGs who choose to "believe" as always. As an ordinary player in the Bitcoin ecosystem from beginning to end, I choose to use the word "regret" to end this year.

2024 is actually off to a good start

2024 is actually a good start for the Bitcoin ecosystem. People have high expectations for the Bitcoin ecosystem since the beginning of the year, believing that 2024 will be the year when the Bitcoin ecosystem completely explodes and enters the mainstream vision, just as people now believe that 2025 will be the year when the AI Agent ecosystem explodes.

Why did we have such high expectations for the development of the Bitcoin ecosystem in 2024? Perhaps it is because since the birth of the Ordinals protocol in December 2022, the Bitcoin ecosystem has experienced a year of growth and consensus building, and has transitioned from the "barbaric era" to the "industrial era" as a whole. Project parties, VCs, and mainstream exchanges have entered the market, forming three major tracks: a layer of asset issuance protocols, L2, and Bitcoin staking.

From the perspective of the first-layer asset issuance protocol, influenced by Binance's launch of BRC 20 token ORDI and SATS spot trading at the end of 2023, the inscription concept became popular again in the early 2024. Not only did the popularity affect other chains to follow suit and start the inscription mode, but it also led to the rise of other first-layer asset protocols such as ARC 20, SRC 20, PIPE and other protocol tokens. At the same time, the rune pre-mining and airdrop gameplay launched by RSIC and Runestone in January 2024 also made people look forward to the Runes protocol that will be launched in the future.

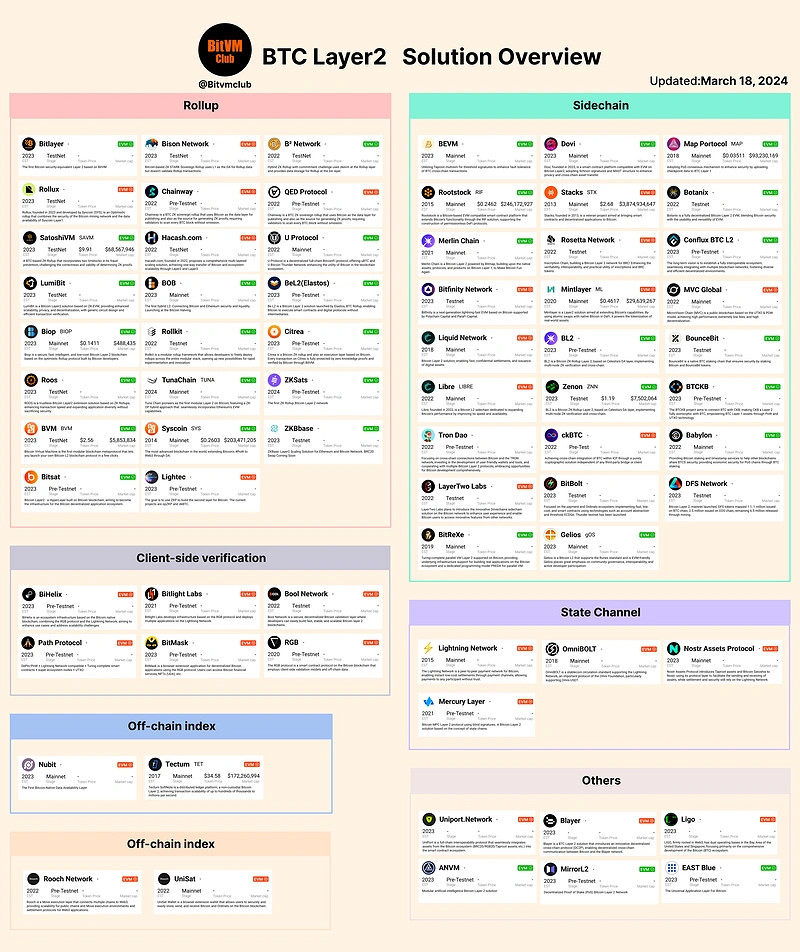

From the perspective of L2 development, Bitcoin L2 has experienced a blowout development in early 2024. With the hot issuance and trading of layer-one assets, the congestion problem of the Bitcoin mainnet and the players' demand for improving the playability of mainnet assets have made Bitcoin L2 a popular entrepreneurial direction. At the beginning of 2024, it was counted that more than 100 Bitcoin L2 projects appeared in the market in a short period of time. Although there are many shoddy and "cut-and-leave" entrepreneurial projects among them, on the whole, domestic and foreign VCs have begun to invest in Bitcoin L2 on a large scale. Everyone expects Bitcoin L2 to reproduce the glory of Ethereum L2 ecology in 2024.

69 Bitcoin L2s summarized by @Bitvmclub in March 2024

From the perspective of Bitcoin staking, Babylon, a Bitcoin staking protocol, announced in December 2023 that it had completed a financing of $18 million, officially opening the Bitcoin staking and re-staking narrative. With EigenLayer, a re-staking narrative project of the Ethereum ecosystem, as a role model, people believe that with Bitcoin's stronger consensus foundation and security than Ethereum, the Bitcoin staking and re-staking track will have a very broad prospect in 2024, which will not only awaken the dormant Bitcoin whales to participate in the Bitcoin ecosystem, but also form a re-staking ecosystem that is no less than Ethereum.

In addition to the above three major tracks showing an overall positive trend in early 2024, the construction of the general infrastructure of the Bitcoin ecosystem (such as wallets, cross-chain bridges, and trading markets) has also gradually improved during this period. Unisat and OKX Wallet have technically supported multiple asset protocols and have become the main wallets and trading markets in the Bitcoin ecosystem.

The Bitcoin spot ETF was approved and listed on January 11, 2024, marking the official integration of Bitcoin into traditional finance. At the same time, this has once again strengthened people's expectations for the Bitcoin ecosystem, because a network worth trillions of dollars will also develop its ecosystem into a market size of hundreds of billions of dollars.

However……

Unfortunately, in 2024, the Bitcoin ecosystem did not receive attention and development that surpassed the previous bull markets, and at the same time entered a long period of silence.

Mainnet asset performance is getting worse

On April 20, 2024, Bitcoin ushered in its fourth halving, and Runes, a token protocol developed by Casey, the founder of Ordinals, was also announced to be launched. In order to grab the inscription number, the project party raised the on-chain handling fee to more than 2,000 satoshis/byte. People believed that this was the beginning of Runes relaying BRC 20 to make the Bitcoin ecosystem continue to prosper, but unexpectedly, Runes peaked at the beginning, and the speculative enthusiasm subsided in just two weeks. Although the market value of Runes briefly exceeded US$2 billion in June and November, the vitality and liquidity of new listings in the ecosystem have been in a state of sluggishness for a long time.

At the same time, other asset protocols also performed similarly this year. ORDI fell 70% from its peak this year. When new assets were born, they caused FOMO among on-site funds, but later became worse and worse due to the lack of new funds and traffic participation, such as PIZZA airdropped by Unisat and CAT 20 born from the Fractal network.

The reasons are, firstly, because of the previous Bitcoin bull markets, the narrative of fair asset issuance of Bitcoin after Rune has failed to excite the outside world and cannot generate wealth effect again; secondly, China and foreign countries do not take over each other, and the ecology has not formed a synergy. The larger communities are mainly led by overseas users, and the main funds in the Chinese-speaking area are still in BRC 20, such as this year's popular "ground promotion coins" 𝛑, 𐊶, etc.

Bitcoin L2 survival rate is less than 20%

At the same time, it is a pity that the Bitcoin L2 ecosystem did not prosper as expected in 2024. "Except for the Lightning Network, all other Bitcoin L2s are castles in the air," Casey, founder of the Ordinals protocol, criticized Bitcoin L2 in an interview.

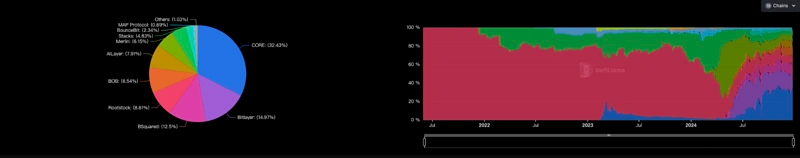

In the past 12 months, there have been more than 100 Bitcoin L2 projects in the market, but according to DefiLlama data, there are only 19 L2s left, with a TVL of only about $2.8 billion. On the other hand, the TVL of Arbitrum alone in the Ethereum ecosystem L2 is $3 billion.

So, regarding capacity expansion, the L2 ecosystem on Ethereum has been proven to be feasible, so why is the development on the Bitcoin ecosystem not satisfactory?

Most early Bitcoin L2s lacked innovation. In the early days of the Bitcoin L2 track, in order to attract investment and quickly build an ecosystem, many L2s adopted an EVM-like architecture + cross-chain bridge approach to expand the Bitcoin mainnet. Although this approach draws on the experience of Ethereum, it is not only convenient and fast to build chains, but also has low user education costs, but it lacks innovation and is generally questioned by voices such as "If this is also called Bitcoin L2, then Ethereum is the best Bitcoin L2." This has been proven to be true, but when the craze faded, these quickly assembled L2s quickly died out.

Bitcoin L2 started the TVL grab war too early. Perhaps influenced by Ethereum L2 Blast, Bitcoin L2 learned to use points and team incentives to stimulate TVL growth from the beginning. Merlin is a popular chain in Bitcoin L2. On February 9, 2024, Merlin fired the first shot in the Bitcoin TVL grab war. In just 24 hours, its TVL reached 543 million US dollars. At the same time, B² Network, BEVM and Bitlayer also started TVL grabbing.

In the end, Merlin won the competition with a TVL of over 3 billion USD within a month, and launched its official token MERL on OKX on April 19. After the launch, the price of MERL reached a high of 1.78 USDT, but then quickly collapsed, with a drop of 85% from the high point. Since then, those who pay attention to prices have turned from expectations to disappointment and criticism of the Bitcoin L2 ecosystem.

Who endorses the Bitcoin staking narrative?

Babylon, with its luxurious financing lineup and "sexy narrative", and the Bitcoin re-staking ecosystem behind it are another anticipated track in the Bitcoin ecosystem in 2024. When the first phase of Babylon's mainnet pledge was launched in August, it attracted the attention of the entire network, reaching the upper limit of 1,000 BTC in just 3 hours. Currently, Babylon's TVL is 57,051.72 BTC, equivalent to about US$5.64 billion. However, compared with EigenLayer's TVL of US$15.718 billion, Babylon's TVL is only 1/3 of it. At the same time, in the context of Bitcoin's continuous breakthroughs, the market attention received by Babylon has not increased. Who has recognized the Bitcoin pledge narrative?

The market and the product are mismatched, and the real big players are not willing to hand over their Bitcoin. Babylon's narrative slogan is to unlock the liquidity of 21 million BTC through staking, but the market may not buy it. The market is more accepting of Ethereum as a native financial asset on the chain, while Bitcoin is still regarded as "digital gold", which can also partially explain why the scale of Bitcoin spot ETF funds is much larger than that of Ethereum spot ETF.

For large Bitcoin holders, as Bitcoin continues to rise, they are even more reluctant to hand over their Bitcoins, while for traditional finance, Bitcoin spot ETF and MSTR are the BTCFi they really like. This is completely inconsistent with the fact that the Ethereum ecosystem encourages staking from a mechanism perspective.

Babylon sets the stage, but someone else performs the show. According to data from Babylon's official website, re-pledge protocols such as Lombard, Solv Protocol, PumpBTC, Bedrock and Chakra account for more than 60% of Babylon's total pledged volume. The operation of these platforms can be summarized as users exchanging their BTC for the platform's packaged version of BTC, and the platform deposits BTC into Babylon, and users can enjoy the dual benefits of Babylon and platform points. But the problem is that the BTC deposited by users and the platform's packaged version of BTC may not be limited to 1:1, and the packaged version of BTC in circulation is more than the locked BTC value, which may contain liquidity risks.

At the same time, the security of the re-pledge agreement is also worth considering. Previously, Bedrock suffered a loss of about 2 million US dollars on DEX due to an attack. Although Babylon claims to use a self-custody solution to protect user funds, most of the re-pledge agreements behind it use a custody solution, which is inconsistent with the concept originally promoted by Babylon. Therefore, not only are large investors unwilling to pledge BTC, but retail investors will also hesitate to participate in staking when the returns are unclear and the security is insufficient.

In summary, although the Bitcoin ecosystem had a good start in 2024, the Runes protocol reached its peak performance as soon as it was launched, various asset protocols quickly cooled down, the dramatic development of Merlin and a number of Bitcoin L2s, and the Babylon ecosystem did not bring the expected BTCFi bull market, all made us regret the development of the Bitcoin ecosystem this year.

Will everything be better in 2025?

It should be emphasized that what I said above is not to be bearish on the Bitcoin ecosystem, or to make a final conclusion about it - there is always a gap between people’s beautiful expectations for the future and the actual situation in reality, and I call this gap "regret", which is also my summary of the Bitcoin ecosystem this year.

To this day, the Bitcoin ecosystem still has firm holders and builders. ORDI, Rune DOG, PUPS and other communities are continuing to build, OKX Wallet and Unisat are still continuing to build infrastructure, although the Bitcoin L2 bubble burst, the surviving teams have not given up, OP_CAT and other series of innovations are on the way, Babylon may hold TGE in January-February 2025...

In 2025, will everything be fine? Although we did not see a larger-scale outbreak of the Bitcoin ecosystem this year, I still believe that the Bitcoin ecosystem will still be the protagonist of this cycle, and I am confident to welcome 2025.

If it were you, what keyword would you give to the Bitcoin ecosystem this year?