Author: Biteye core contributor Viee

*The full text is about 4,500 words and the estimated reading time is 8 minutes

"Less than an hour after ACT went live, Twitter exploded."

In November, the listing of ACT and PNUT on Binance ignited the entire market, and the price of ACT rose 10 times in just 10 minutes. Some people bought A7 coins, while others were upset about selling them. Coin holders became rich overnight, which also led to the "gold rush" in the Meme market in November, just to chase the next 100-fold gold dog.

The feeling of missing out is like a domino effect, triggering widespread speculation about Binance’s coin listing strategy: Why did Binance choose these coins, and who will be the next lucky winner?

The outstanding performance of ACT and PNUT has aroused attention and new thinking about the mechanism of listing coins on Binance. What kind of wealth code is hidden behind these narratives and carnivals? Why can Binance ignite the market again and again? The following data statistics and analysis will reveal the underlying logic of the "Binance Wealth Effect" from the root.

01 In-depth analysis of Binance’s new coins in November

Judging from the new coin yield data last month, Binance has shown a flexible strategy in selecting projects that is highly synchronized with market trends. According to the following table, we will deeply analyze Binance's listing logic from two dimensions: wealth effect and coin selection tendency.

1. Data analysis: Most new coins hit record highs after listing on Binance

From the historical data, the performance of new coins on Binance usually follows a cycle of "explosion-high-pullback-stabilization". Take ACT and PNUT as examples: at the beginning of the launch, market sentiment was quickly ignited, and prices rushed to a high point in a short period of time; then they entered a natural pullback stage. Let's analyze them one by one below:

The short-term wealth effect is significant, and the first-day increase is amazing

Judging from the data, the wealth effect of Binance’s new coins after they are launched is particularly prominent. Especially the first-day performance, which has become a key window for obtaining high returns. For example:

ACT: The increase on the first day of listing was as high as 2100%, and the highest increase reached 4500%, bringing rich returns to short-term investors.

PNUT: The first-day increase was 255%, reaching a maximum of 2118%, also showing strong market potential.

THE: As a non-Meme coin, it performed outstandingly on the first day of listing, with the highest increase of 197%, far ahead of its peers.

The explosive power of these projects is due to Binance’s precise screening before listing. On the other hand, market sentiment is often high in the early stages of listing, and the influx of funds drives prices up rapidly, creating a short-term “wealth-making effect”.

In the rush stage, most new coins hit record highs after listing

Data shows that more than 60% of tokens hit their all-time highs (ATH) after listing on Binance, which to some extent reflects the influence of Binance's new coins in the market.

Moreover, a closer look reveals that the performance of new coins that have appeared in the past three months is particularly impressive. Among them, 9 new coins quickly hit their all-time highs (ATH) after listing on Binance, almost becoming a "must-rise password". Surprisingly, among the 12 old coins, even some of them hit highs in the last bull market or at the beginning of the year, they broke out again with the support of the Binance platform, and 7 of them set new highs after listing on Binance. It can be seen that on the one hand, the explosive power of new coins often outperforms old tokens, and the market's pursuit of new projects is obvious. On the other hand, old coins can still break through historical records, which shows the powerful influence of the "Binance effect". Perhaps, this is not only the market's fanatical pursuit of new projects, but also a strong verification of Binance's listing strategy and platform appeal.

After the pullback, most tokens are still worth investing in

Although some new coins have experienced a correction after a short-term surge, overall, more than half of the tokens still maintain a significant increase in price before the launch, with an increase of more than 20%. For example, ACT, PNUT, DRIFT, THE and other tokens that have performed relatively well have shown strong market resilience.

A pullback does not mean a complete loss of investment value; on the contrary, it may provide opportunities for potential long-term investment.

2. Binance’s coin listing strategy: Go with the flow and return to users and the market

By interpreting this data, we can find an interesting phenomenon: Meme coins account for a considerable proportion of Binance's new coins, such as CHILLGUY, BAN, SLERF, etc. This is not accidental. In the past few months, the explosive power of the Meme sector has been obvious to all. Meme coins have become a hot spot in the crypto market due to their strong community culture, social media effects, and low threshold for participation. And Binance has obviously hit the right node of this wave of market sentiment.

Meme coins listed on Binance often have several core features: "broad narrative, strong community, and fair stakes."

Broad narrative and moderate market capitalization: Choosing projects with broad influence, clear narrative and relatively small market capitalization not only lowers the threshold for user participation but also ensures market activity.

Strong community cohesion: Priority will be given to Meme coins that have a strong influence in overseas communities, can drive global market sentiment, and spark discussions in Chinese communities.

Fairness of chips: Ensure that the project mechanism is transparent and fair, and avoid the risk of excessive concentration of chips or market manipulation.

For example, projects such as CHILLGUY and SLERF have already accumulated a large number of users and hot topics on the chain before listing on Binance. The ACT community has strong cohesion, and the AI Agent narrative is broad enough and very novel.

It can be seen that Binance's Meme listing logic is not just a simple follow-up. Looking back at the first half of this year, the market had complained about high FDV tokens, but Binance did not blindly launch new products, but instead supported small and medium-sized market value tokens. In the second half of the year, it chose a more flexible and market-oriented response strategy - screening tokens that truly have a community foundation and narrative potential. The performance of ACT and PNUT is the best proof of this strategy: behind the release of the wealth effect is the precise grasp of market demand.

02 Multiple gameplay and strategies for Binance’s new coin launch

The above data analysis is mainly for the tokens listed on Binance in the form of spot or contract. In fact, Binance's "currency listing" gameplay has long surpassed traditional spot trading and formed a mature and diversified mechanism. Whether it is an old player with a high risk appetite or a novice who hopes to win in a steady manner, Binance has corresponding strategies and channels to allow users to get what they need, and even advance in multiple lines. Next, let's take stock of several popular ways to participate provided by Binance:

1. Spot and contract

Needless to say, spot and contract are the most familiar ways for users to participate. When a new coin is launched, the spot market often sets off a wave of price increases. Especially after the launch of this round of Meme coins, many players seized the opportunity to double their money in the spot market. The contract market is more suitable for traders who pursue high leverage and high returns. They can go long or short and capture profits from market fluctuations.

Strategy: In-depth research on new currency projects, don’t be a “headless fly”

Every time a new coin is launched, market sentiment tends to heat up quickly, but the real winners are often those players who have done enough homework in advance. You can judge the real potential of a project by in-depth study of the project's white paper, token economic model, and community activity.

2. Launchpool

Binance's Launchpool is the first choice for risk-free mining and stable returns. It provides users with the opportunity to stake BNB, FDUSD and other assets for mining. For projects that have been successfully launched, such as ENA and TON, users can not only obtain project tokens, but also enjoy high annualized returns. At the beginning of this year, Launchpool set off a craze, and the annualized returns of some projects even reached more than 200%, becoming an important channel for chasing new coins.

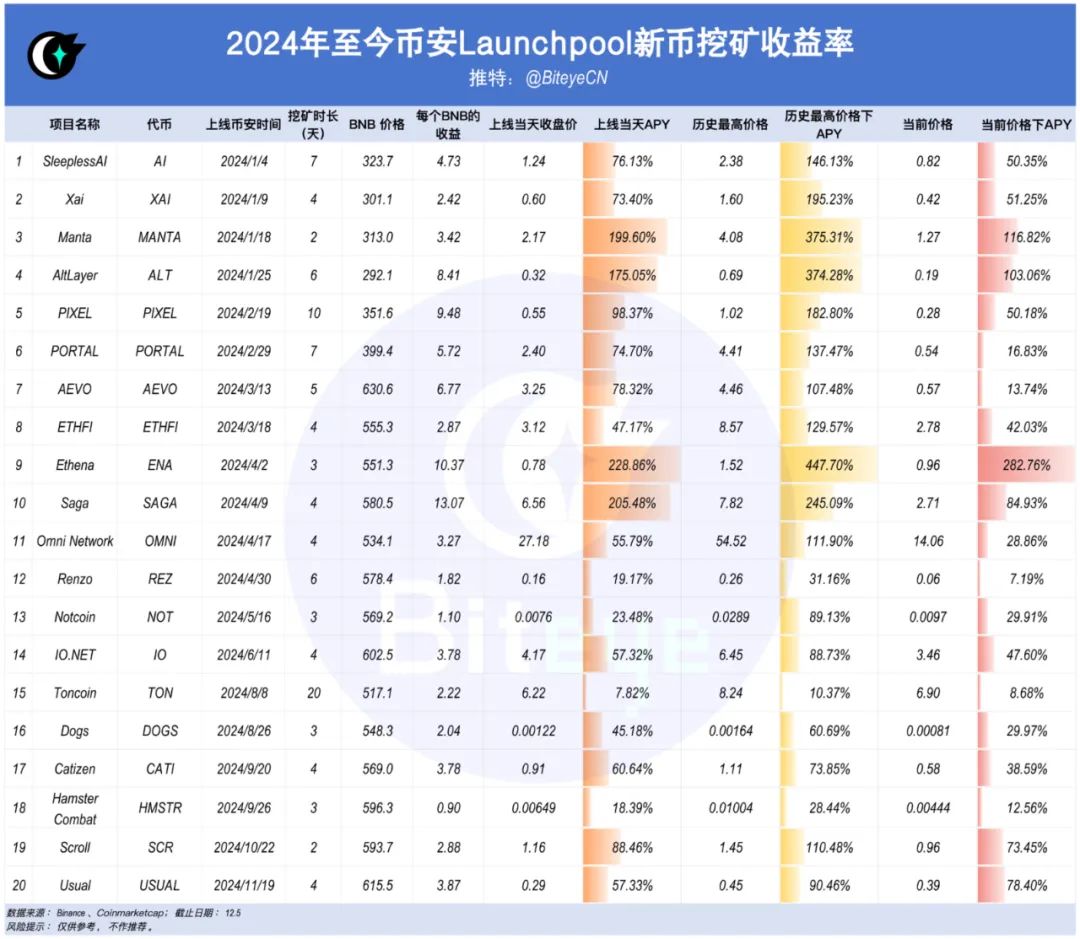

The figure below shows Biteye's calculation of the annualized rate of return for the complete mining cycle of projects that have been launched from 2024 to the present based on Binance's public data.

Judging from the data of the last 20 Launchpools, most projects have excellent APY performance on the first day of launch, with an average yield of over 100%. For example, Ethena's annualized yield on the first day of launch was as high as 288.86%, and its APY at its historical highest price reached an astonishing 447.7%. Similarly, Manta's APY at its historical highest price reached 375.31%, showing huge profit potential.

In addition, it can be seen from the listed currencies that there are many high-quality projects, most of which have strong fundamental support, which is also one of the important reasons for the subsequent rise in currency prices. Take Usual as an example, its APY reached 57.33% on the day of its launch, and its current market performance exceeded the opening, with an APY of 78.40%. The same is true for ENA, with a current APY of 282.72%, far exceeding its performance on the first day of launch.

In general, Binance Launchpool not only provides a safe and low-threshold participation opportunity, but also brings considerable returns. At the same time, Launchpool has stable returns without taking big risks. Especially for users who hold BNB for a long time, the returns are even more significant.

Strategy: Pay attention to Launchpool and airdrop opportunities, and accumulate small gains into big wins

For investors with low risk appetite, Launchpool and BNB holder airdrops are excellent ways to enter the market. Holding BNB not only allows you to participate in mining, but also reduces the cost of holding positions, and is also an important source of low-risk returns.

3. Pre-market trading

Pre-market trading is a new feature provided by Binance for users, allowing users to buy and sell specific tokens before the tokens are officially listed on the spot market, thereby locking in price advantages earlier. This stage is usually more volatile, but it also means potential high-yield opportunities.

Strategy: Make good use of pre-market trading to seize market opportunities

Pre-market trading provides an opportunity to plan ahead, but the volatility is large. Reasonable setting of stop-profit and stop-loss to avoid blindly chasing ups and downs is the core strategy of pre-market trading.

4. BNB holders airdrop

For users who hold BNB for a long time, airdrop activities are undoubtedly one of the most stable ways to "win without effort". Holding positions means income. Binance often takes snapshots of BNB holders and airdrops tokens of newly launched projects. For example, before some popular projects go online, BNB holders may be eligible for token airdrops. At the end of November, Binance HODLer launched the second phase of the latest airdrop project, Thena (THE). According to the data provided by users, an average of 1 BNB was airdropped for 1.455. The current price of THE is around 2.9U, and the income is still considerable.

5. Megadrop Web3 wallet task

The Megadrop platform provides two ways to participate: lock BNB and complete Web3 tasks. Users can accumulate points by purchasing BNB regular products. The longer the lock-up period and the greater the amount, the higher the points. At the same time, these locked BNB can also automatically participate in Launchpool mining, achieving "killing two birds with one stone" without additional operations. For retail investors who do not have a large amount of BNB, completing tasks in the Binance Web3 wallet can also obtain airdrop points, which truly lowers the threshold for participation.

According to the product yield list previously released by Binance, the standard annualized interest rate for subscribing to BNB 120-day fixed-term products is around 3.5%.

The following figure shows the profit calculation of the two Megadrops. It can be seen that the annualized interest rate is basically in line with expectations or even higher than 3.5%. If you participate in Web3 tasks at the same time, the probability of doubling is high. For example, BounceBit can reach an annualized rate of up to 9.7%.

Compared with Launchpool, Megadrop focuses on providing users with early participation opportunities before listing, while lowering the threshold through on-chain tasks and attracting new users in a more friendly way. Launchpool calculates rewards based on staking BNB or designated tokens, covers more projects, and is suitable for long-term investors. Overall, Megadrop has expanded the audience range of Binance's new listings and also injected more vitality into BNB and Web3 wallets.

In short, whether it is the classic spot and contract gameplay, or the innovative Launchpool, pre-market trading and Web3 tasks, it can be seen that Binance’s ambition is not limited to short-term surges, and it is building a full-scale profit ecosystem.

03How to understand the listing effect of Binance?

Twitter's cryptocurrency ecosystem is a wealth amplifier and a narrative generator.

In the second half of 2024, the rise of the Meme market has become a trend that cannot be ignored. From the classic SHIB to the recently popular ACT, the biggest feature of Meme coins is undoubtedly their high spreadability and strong community attributes. Unlike VC coins, the key to Meme coins lies in their narrative ability. Whether they can leverage community sentiment determines the fate of the coin. Behind these tokens, there is not only liquidity, but more of a cultural phenomenon and community power. They can quickly form a self-propagation effect on social platforms, attracting a large number of investors and retail investors to participate. This also makes the Meme market the main battlefield for hot money.

As the market gradually becomes more rational, Binance is also showing a more far-reaching influence on long-term value.

For example, the liquidity protocol THENA (THE) recently launched by Binance is a low TVL, low market value, and low financing project. This reflects that Binance focuses on helping the market develop in a healthier and more sustainable direction and screening projects that are more valuable to the industry, rather than just focusing on popularity and capital. This may lead to a de-bubble movement in the crypto market.

In this sense, Binance is more like a "wealth maker". Through precise token screening, strict listing standards and powerful traffic amplification effect, it transforms tokens into a kind of "narrative capital", driving the entire industry in a healthier and more rational direction.

04 Tips for new currency practice: understand the market and keep up with the pace

Whether you are a novice or an old hand, understanding Binance's multi-dimensional "currency listing" mechanism is only the first step. How to capture opportunities more safely and efficiently in this process is the real challenge. This is a game that requires strategy, patience and insight. The following are some practically proven tips that may help you to be at ease in the next round of opportunities.

1. Keep an eye on market trends and KOL analysis, and pay attention to community popularity

The crypto market is a sentiment-driven market, especially during the launch of new coins. Paying attention to the opinions of KOLs on Twitter can usually capture the direction of the market. In addition, the key to the success of Meme coins lies in community consensus, and potential projects can be captured in advance through social media, on-chain data, etc.

2. Grasp the best entry time and pay attention to stop profit and stop loss

The initial volatility of new coins is the largest, often accompanied by huge increases and pullbacks. It is recommended to set clear entry and exit strategies to avoid emotional operations. Especially within 1 hour after the opening of the new coin, the market sentiment fluctuates violently, so you need to be particularly cautious. The first day of opening has large fluctuations, so set a stop profit point to avoid missing out on opportunities due to greed.

3. Diversify your investments and avoid a “all-in” mentality

There are always risks in the market. Diversifying funds among different new currency projects can not only reduce the impact of the failure of a single project, but also increase the stability of overall returns.

05 Conclusion

Every time a new coin is launched, it is a touchstone for the market, a self-test for every player, and a contest about market trends, community power and investor mentality.

In the game of cryptocurrency wealth, the real winners are always those who understand the market and keep up with the pace. For ordinary investors, to seize the opportunity of Binance's new coins, they not only need to keep up with the platform's trends, but also need to deeply understand its listing logic.

Where will the next ACT and PNUT be? Maintain keen insight and participate cautiously and flexibly. Binance has set the stage. How the story unfolds ultimately depends on us.