Since the Fed started to cut interest rates, market sentiment has been high. With the US election day approaching, the "Trump trade" has continued to heat up, and assets such as US stocks, foreign exchange, and cryptocurrencies have all shown a strong wealth effect. However, financial market fluctuations are unpredictable, and many investors have been repeatedly frustrated in the vicious circle of "buying high and selling low". In fact, by learning from the success rules of some top investors, retail investors can also gradually build an efficient long-term investment strategy to avoid losses and achieve steady returns.

1. Clarify investment goals and targets

Before you start investing, it is important to clarify your target rate of return and expected holding period. Choose appropriate investment targets based on these goals. For example, young people who have just entered the workplace and have limited funds on hand can give priority to low-risk, stable value-added asset types, such as gold, bonds, and indices; while if you pursue high returns and can bear higher risks, you can focus on stocks, crypto assets, foreign exchange and other products with greater volatility.

2. Develop a reasonable fund allocation plan

Good money management is the cornerstone of successful investment. Once you enter the market and buy assets, their value will begin to fluctuate with market prices. Invest money in the market that you can afford to lose and avoid the psychological pressure caused by excessive positions or high leverage operations. It is usually recommended to follow the "631 rule" or "541 rule" and allocate funds to daily expenses, savings and risky investments in a ratio of 6:3:1 or 5:4:1. On the premise of ensuring a stable life, investing with idle funds can effectively reduce the impact of market fluctuations on life.

3. Diversify your investments to reduce risk

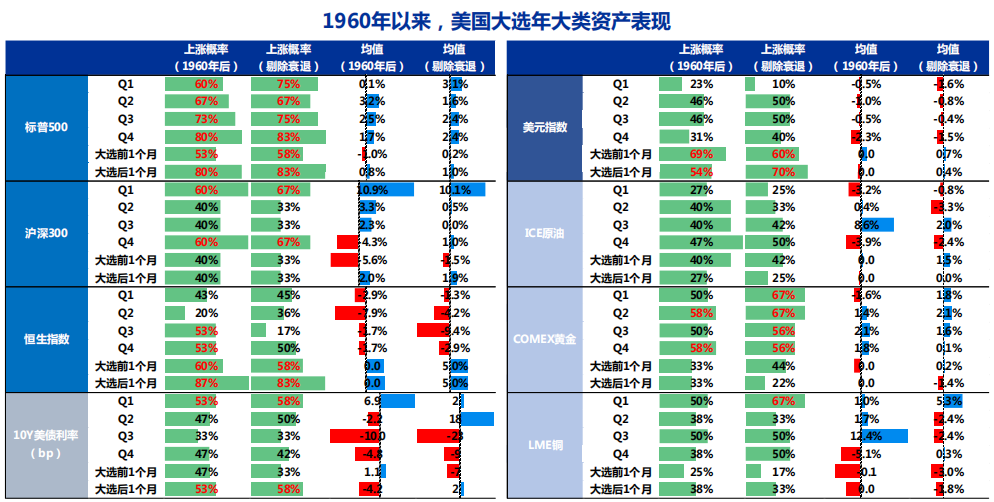

"Don't put all your eggs in one basket" is an important principle in the investment world. Diversification not only reduces risk, but also increases the possibility of returns. By allocating assets in different categories, different regional markets and different industries such as stocks, foreign exchange and commodities, investors can reduce the impact of fluctuations in a single market or industry. Financial markets will not all rise or fall at the same time. For example, when the stock market is down, safe-haven assets such as gold may perform strongly. The diversification of investment portfolios can effectively hedge the volatility risk of a single market.

Comparison of annual performance of global major asset classes in the past decade

Comparison of annual performance of global major asset classes in the past decade

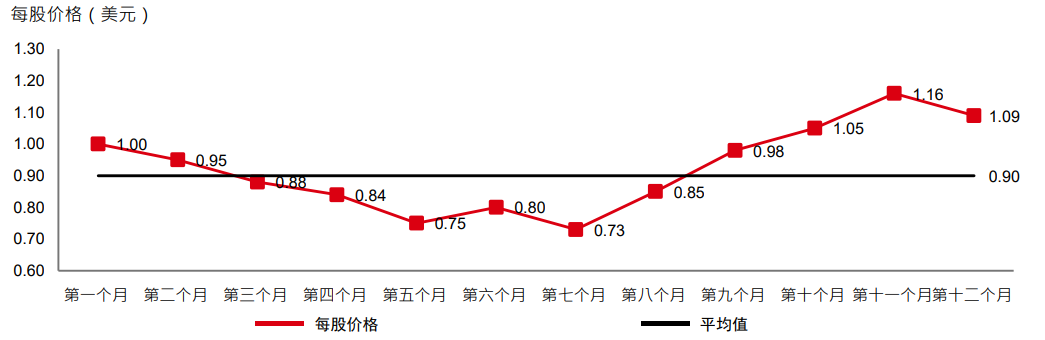

4. Invest regularly and in fixed amounts to smooth out costs

Buying low and selling high is the ultimate goal of all investors, but the market is unpredictable and predicting the top and bottom is extremely challenging. Regular fixed investment is an ideal strategy for steady long-term investment. Regardless of whether the market goes up or down, you invest at a fixed time and amount. You can buy more units at low prices and fewer units at high prices, smoothing the overall investment cost and reducing dependence on market timing. As time goes by and the market recovers, assets may grow exponentially. For example, investing $1,000 a month can better spread the risk than investing $12,000 at a time, and the potential returns are more substantial.

Comparison between fixed investment and one-time investment

5. Manage expectations

The market is volatile, and profitable or losing positions may lead to emotional investing, causing you to deviate from your investment plan. Financial market fluctuations are expected. Understand the volatility of assets with different risk levels, manage expectations, plan in advance how to deal with different situations, and avoid gambling mentality. For example, the world is holding its breath for the US election, and the policy proposals of different candidates have different impacts on different financial assets. Be prepared in advance so that if the market encounters adjustments and asset prices fall sharply, you will not be caught off guard and make hasty decisions during the market downturn.

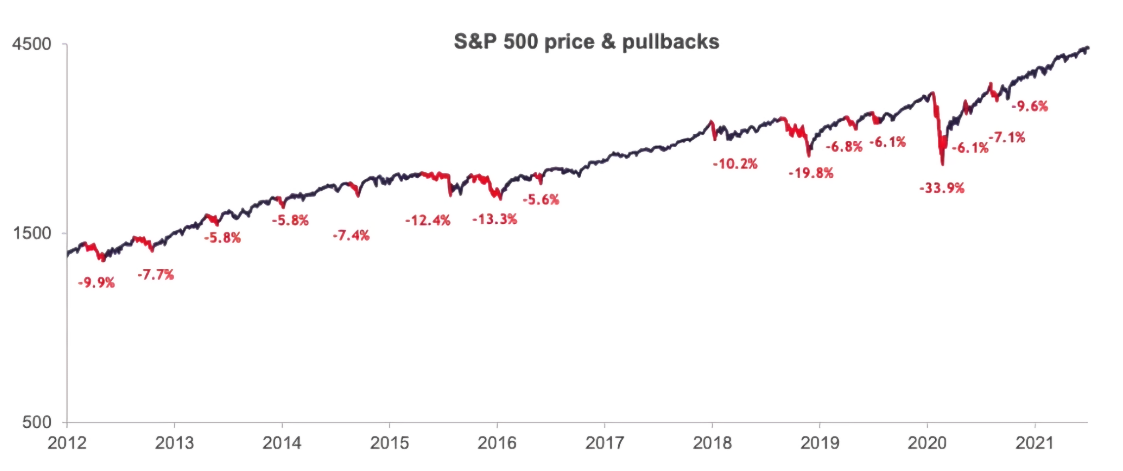

6. Avoid being swayed by short-term news

Market news is frequent and emotional. Sensational headlines and negative news reports will make the situation more disturbing. Don't panic because of short-term negative news. Focus on the fundamentals of the company/project. According to past records, short-term fluctuations may occur at any time, but they will not hinder the long-term growth of the market. The market will rebound sharply after a serious setback.

S&P Index's pullback and trend over the past decade

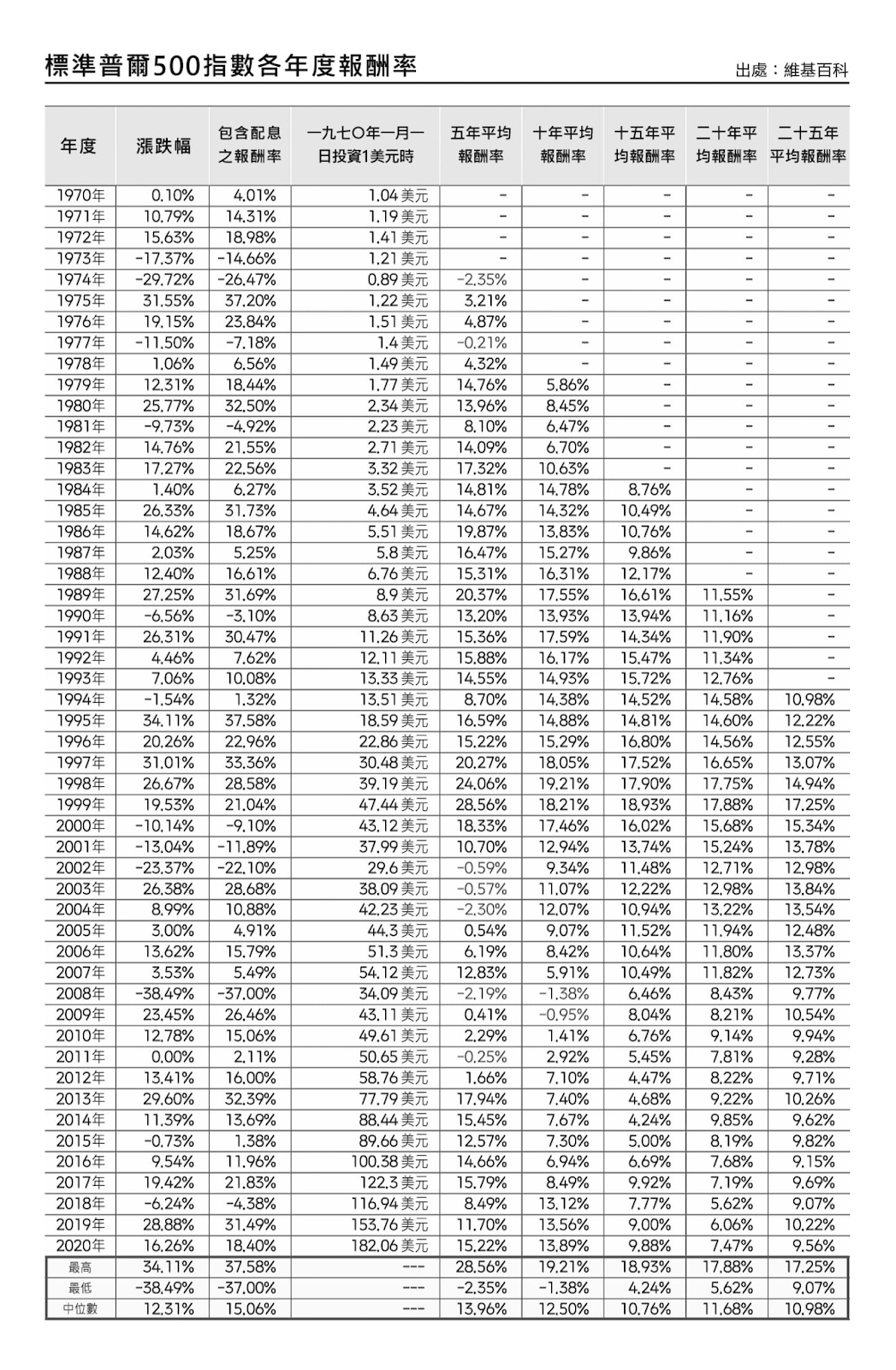

7. Long-term investing increases the chances of positive returns

From a short-term perspective, risky assets such as stocks, indices, and Bitcoin are more risky than fixed-income assets such as bonds. However, from a long-term perspective, as the holding period increases, they become almost a "risk-free" asset. Past records also show that although financial markets fluctuate in the short term, they are still on the rise in the long run. Although the market recovery method is not static, long-term investment in stocks/tokens of good companies often has higher return potential. In short, the security and potential returns of investment gradually become more prominent when held for a long time. As the saying goes, long-term investment is gold.

8. Summarize experience and keep learning

Investing is not something that can be achieved overnight. Reviewing and learning are the guarantee of continued success. After each transaction, investors should reflect on their gains and losses in decision-making. For example, some people are always stuck because of chasing rising prices, or miss market opportunities because of panic selling. By summarizing these lessons learned, investors can make more rational decisions in similar situations in the future. In addition, the financial market and investment environment are constantly changing, and it is necessary to review and adjust investment plans regularly. Always follow new market trends, combine fundamental analysis, and constantly update investment knowledge and skills to ensure that the investment targets held are still in line with your financial goals.