Original title: "Why Fluid will kill Aave & Curve (or Uniswap)"

Written by: Foxi_xyz, Crypto Kol

Compiled by: zhouzhou, BlockBeats

Editor's note: This article talks about how Fluid subverts the traditional DeFi model by combining lending and trading. Its dynamic debt mechanism not only allows borrowing to earn transaction fees as liquidity, but also greatly improves capital utilization, creating $39 in liquidity for every $1 TVL. At the same time, it analyzes the potential of INST and believes that with strong growth and the upcoming DEX, the price may rise to more than $8, making it a project worth paying attention to.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

Fluid's lending protocol has sparked a craze: the monthly growth is as high as 3 times, and the TVL has reached 800 million US dollars. But lending is not a new concept in DeFi. The real killer is Fluid's upcoming decentralized exchange. Let's take a look at why this new DEX design may disrupt the market, whether INST's current valuation is worth buying, and how much potential it has in the future.

What is Fluid?

Fluid is a money market protocol launched by the Instadapp team. Holding INST is equivalent to directly participating in the growth of Fluid. It is similar to other money market protocols (such as Aave and Kamino), but with improvements in the liquidation mechanism. Lending itself is difficult to have disruptive innovation, but when Fluid combines lending with DEX, it shows new possibilities in the lending market, which is the key to Fluid's success.

Fluid may become the super DeFi of this cycle

Beyond the traditional currency market

To understand the potential of Fluid, we must first understand the limitations of the current DeFi liquidity ecosystem: traditional money markets and DEXs are independent of each other, which greatly limits capital efficiency. These assets have only one purpose - to generate lending income. Similarly, the liquidity provided to DEXs such as Uniswap can only earn transaction fees.

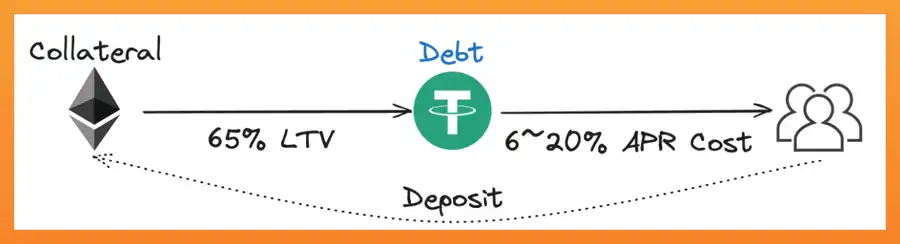

Traditional loan model

This fragmentation results in high costs for users:

- Low capital utilization

- Liquidity is fragmented across different protocols

Fluid DEX: The perfect combination of lending and trading

Fluid DEX redefines the way DEX works. Unlike traditional DEX that focuses on transactions, Fluid DEX integrates the functions of trading platforms and currency markets, and may become the most capital-efficient DEX design in DeFi.

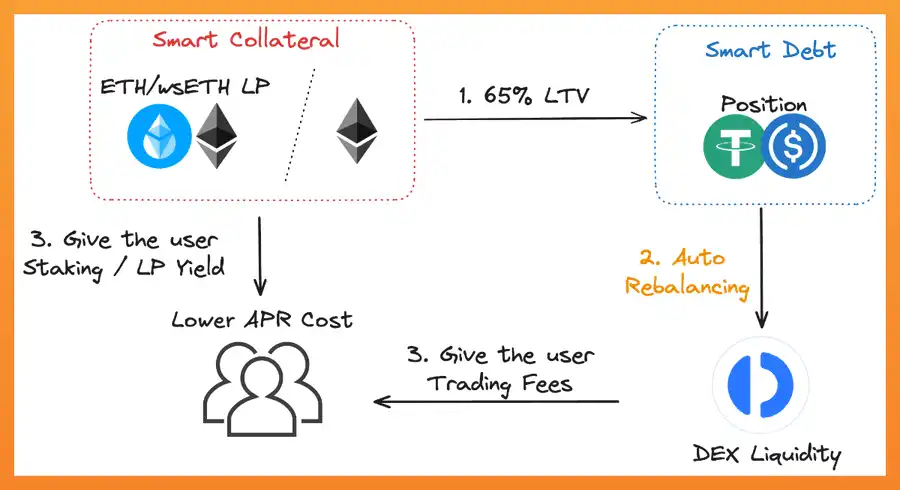

Core innovation: Smart mortgage and smart debt

Smart mortgage (regular function)

Users can use liquidity pairs (such as ETH/wstETH or ETH/WBTC) as collateral. Liquidity provision (LP) tokens are used as collateral for lending and earn trading fees from DEX. This has been reflected in many new lending protocols.

Smart Debt (Real Innovation)

This is the most revolutionary design of Fluid DEX. Traditional DeFi regards debt as pure liability, and users only need to pay interest after borrowing. Fluid subverts this model, allowing debt positions to be used to provide liquidity and earn transaction fees.

The key innovation is the automatic rebalancing of “smart debt”, which becomes the liquidity in DEX

Dynamic debt mechanism and automatic rebalancing

Unlike traditional fixed assets, users borrow dynamic debt positions in Fluid. When traders want to make an exchange (such as USDC for USDT), the system does not need to use the traditional liquidity pool, but automatically adjusts the borrower's debt structure (reduce USDC debt and increase USDT debt). This debt rebalancing mechanism serves as a source of liquidity for DEX while bringing transaction fee income to borrowers.

Automatic rebalancing example:

After borrowing 1000 USDC and 1000 USDT and depositing them into Fluid DEX, someone converts 500 USDC into USDT:

- Your USDC debt is reduced to 500

- Your USDT debt increases to 1500

- You earn a fee from this transaction

- Total debt remained constant while earnings were generated through trading activities.

Capital efficiency at scale

The combination of smart collateral and smart debt achieves unprecedented capital efficiency. Through innovative design, Fluid can create up to $39 of effective liquidity for every $1 of TVL. This is not theoretical data, but is achieved through the following carefully designed system:

- High loan-to-value (LTV) ratios, up to 95% on certain assets, thanks to advanced liquidation mechanisms.

- Leverage both collateral and debt as sources of liquidity.

- Automated risk management system that adjusts positions based on market conditions.

In a bull market, the market chases high leverage and high capital efficiency, which may further increase Fluid's TVL and fee income.

Valuation: Is it worth buying INST now?

Source: Coingecko, Token Terminal, Deflama, other sources

TVL/FDV multiples still have room to grow

Fluid's FDV/TVL ratio is 0.78x, which still has a lot of room for improvement compared to Aave's 0.19x. More importantly, Fluid's TVL has grown to $516 million without large-scale token incentives, demonstrating its strong organic growth capabilities.

Strong cost-generating capability

Fluid generates approximately $15.95 million in revenue per year through its lending protocol, and its fee/FDV ratio is 3.98%, which is competitive with emerging lending protocols such as Morpho and Euler. With the upcoming launch of DEX, its revenue is expected to increase further:

- Regular transaction fees

- Additional benefits of smart debt

On the whole, it is expected that the price of INST will reach at least US$8.

Looking to the future: DEX will be Fluid’s killer app

Rather than relying on token incentives to drive growth, Fluid achieves an organic growth cycle through efficient capital utilization:

Efficient capital utilization -> Lower borrowing costs -> Attract more TVL -> Increase DEX liquidity -> More transaction fees -> Further reduce borrowing costs

While Fluid’s success in the lending space is impressive, its upcoming DEX may be the real innovation. By redefining the relationship between lending and trading, Fluid is not only improving existing tools, but also creating new capital efficiency possibilities.