In September 2024, OpenEden received a strategic investment from Binance Labs, the venture capital and incubation arm of Binance. As Binance's venture capital arm, Binance Labs has been committed to identifying, investing in and empowering potential blockchain entrepreneurs, startups and communities. This investment in OpenEden also reflects its optimism about the RWA field and its trust in the OpenEden team.

Reading highlights

- Overview of OpenEden U.S. Treasury Bond On-Chain Protocol

- OpenEden project operation mechanism and project advantages

- OpenEden competes with Ondo and other protocols

- OpenEden latest market data

- Future prospects of OpenEden

OpenEden Overview

OpenEden is a RWA (real world asset) tokenization protocol, currently focusing on the field of U.S. debt on-chain. It was founded in early 2022 by Jeremy Ng, former head of Gemini Asia Pacific, and Eugene Ng, former head of business development for Asia Pacific. OpenEden has released its first product, OpenEden TBill Vault. This product is designed to allow stablecoin USDC holders to earn income by minting TBILL tokens.

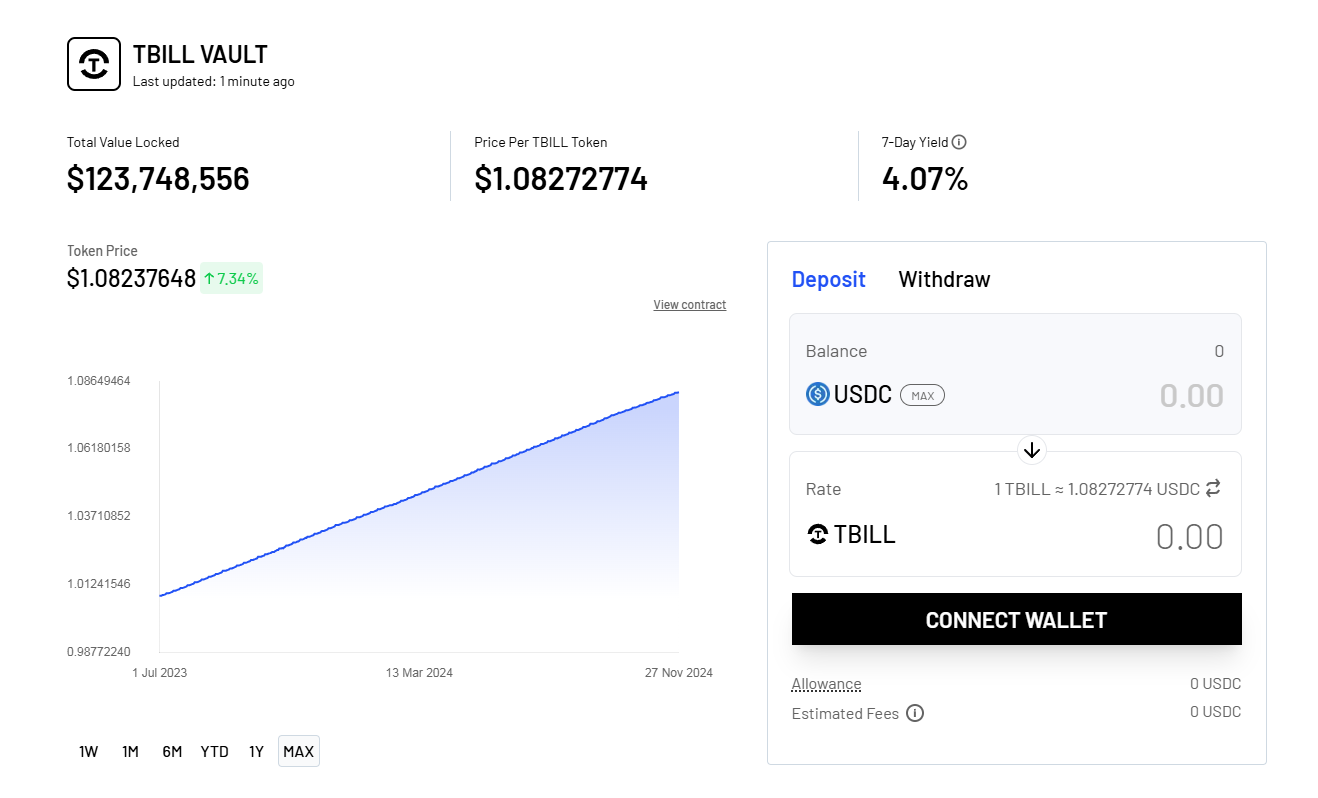

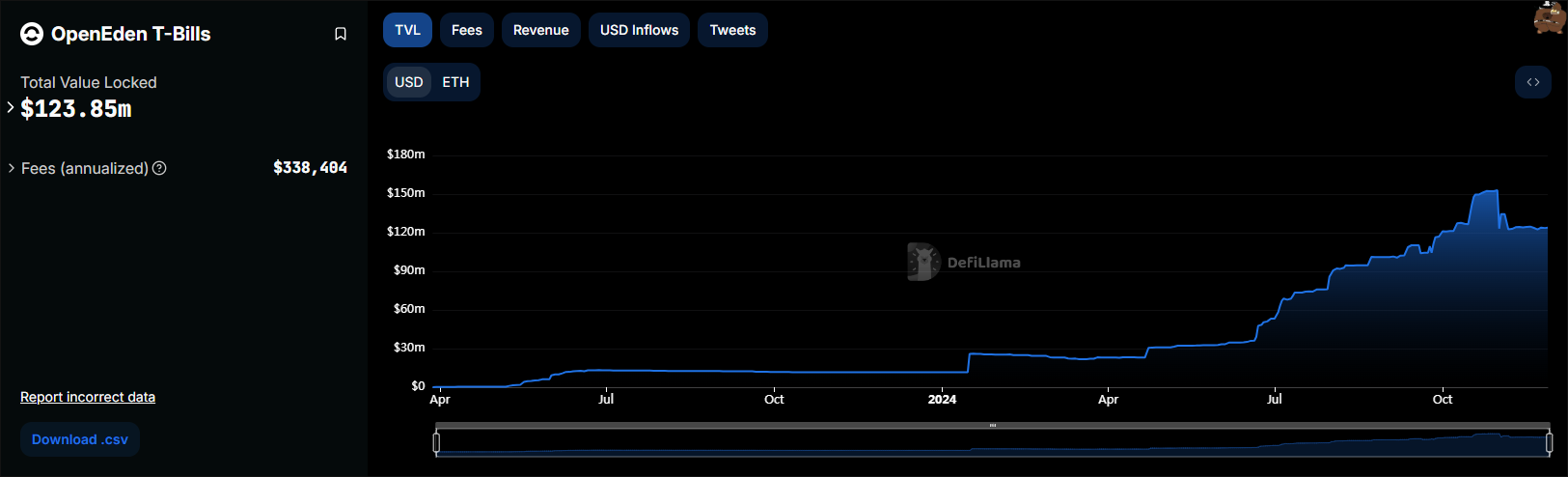

The current TVL is $125 million, which is in the middle of the track. For the time being, there is only one product, $TBILL. Its highlight is that the team has set up a reserve mechanism to help investors quickly exit liquidity, and the reserve ratio is dynamically adjusted by the team in real time.

The development of OpenEden

The project was founded in 2022 by two former senior regulatory executives of the Gemini exchange. With their extensive experience in the financial field, Jeremy Ng and Eugene Ng saw the huge potential of the tokenization of physical assets (RWA) and founded OpenEden. They are committed to building a bridge to the new financial system and providing investors with more diversified investment options.

Jeremy Ng (Co-Funder)Highlights: CFA (2002), Goldman Sachs, JP Morgan, Deutsche Bank, Leonteq, Gemini.

Eugene Ng (Co-Funder)Highlights: Barclays Capital, Citi, Deutsche Bank, Matrixport, Gemini, DWF LABS.

He graduated with top honors from Singapore Management University with a major in Business Administration, and obtained a Master's degree in Finance from the Hong Kong University of Science and Technology. He then obtained a Master's degree in International Finance from the Leonard N. Stern School of Business at New York University with top honors.

In April 2023, OpenEden released its first product, OpenEden TBill Vault. This product aims to allow stablecoin USDC holders to earn income by minting TBILL tokens.

In September 2024, Binance Labs received strategic investment. Binance Labs' investment has brought new development opportunities to OpenEden. This is not only a recognition of the OpenEden project, but also provides strong financial support and resource integration capabilities for its future development.

In October of the same year, OpenEden expanded rapidly and set an annual peak of 150 million US dollars in project locked TVL, becoming one of the top five tokenized treasury bond issuers in the world; although the overall data has declined, it is still in a relatively leading position.

OpenEden's unique operating mechanism

As a RWA (real world asset) tokenization protocol, OpenEden mainly focuses on the field of U.S. Treasury bond on-chain, and its operating mechanism is unique.

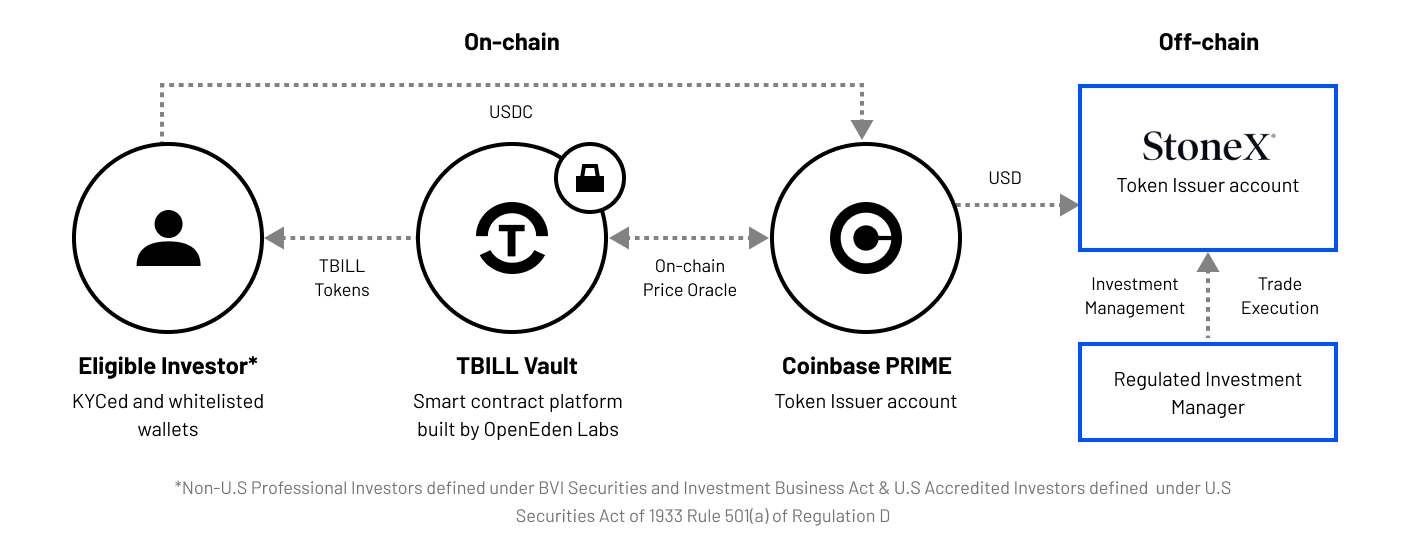

First, OpenEden provides users with a new channel to invest in U.S. Treasuries by investing most of its assets directly in short-term U.S. Treasuries off-chain. During the investment process, OpenEden strictly implements KYC and AML checks to ensure the security and regulatory compliance of the investment. At the same time, a small portion of USDC remains on the chain to ensure instant withdrawals around the clock, providing users with liquidity guarantees for funds.

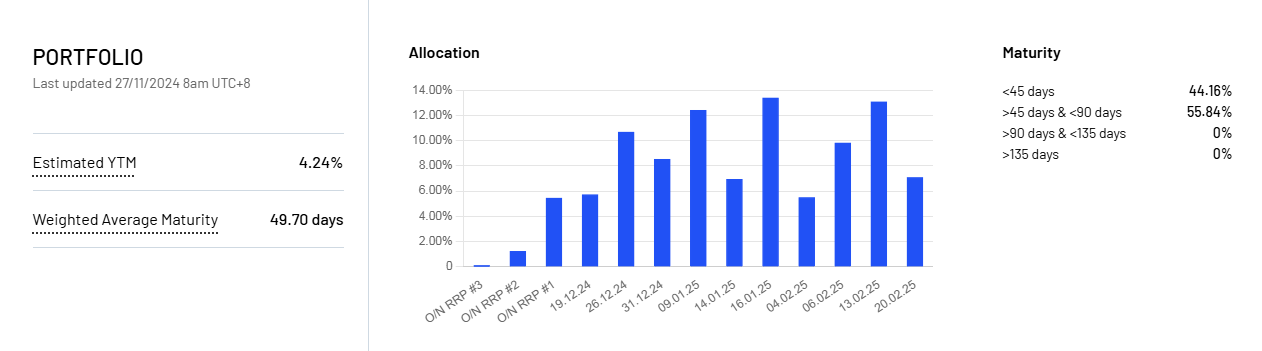

Secondly, the first product released by OpenEden, OpenEden TBill Vault, allows stablecoin USDC holders to earn income by minting TBILL tokens. TBILL tokens are backed by short-term US government treasury bonds, and their value and reliability are guaranteed by reverse repurchase agreements. In the issuance process, OpenEden uses advanced technical means to ensure the security and stability of the tokens.

TBILL is an ERC-20 standard RWA token used by OpenEden. Each $TBILL is pegged to $1, and the yield changes with the change of short-term US Treasury bonds TBill. Currently, a total of $110 million worth of TBILL has been minted, with a YTM of 4.31%.

- To purchase $TBILL, investors must first pass OpenEden's KYC certification. The agreement requires investors to meet the definition of "Professional Investors" in the British Virgin Islands Securities and Investment Business Act 2010, and "Accredited Investors" in the United States as defined in Section 501(a) of Regulation D promulgated under the Securities Act. Only investors with assets of more than US$1 million can meet the above conditions.

- After passing the KYC certification, investors remit $USDC to the designated address of $TBILL, and Coinbase Prime, as the token issuer, purchases assets from the fund manager and entrusts them to the off-chain custodian for custody. At the same time, the minted RWA tokens are sent to the whitelist wallet registered by the investor, completing the entire purchase process.

In addition, OpenEden has also cooperated with Solayer to launch the tokenized US Treasury stablecoin sUSD, providing investors with more investment options. sUSD uses Solayer's Request for Quote (RFQ) protocol to operate as a decentralized trading market matching engine. Users can make quotations through USDC, and the system will automatically match qualified tokenization institutions to put US Treasury bonds (RWA) on the chain to generate sUSD. All transactions are automatically executed by smart contracts, without the need for third-party fund custody, ensuring transaction transparency and security.

In summary, OpenEden's operating mechanism provides investors with a safe, convenient and efficient investment method by putting U.S. bonds on the chain, while also providing a new way for the integration of traditional finance and the crypto world.

OpenEden's significant development advantages

OpenEden has many significant features and advantages, standing out among RWA platforms.

1. Invest in U.S. bonds, with a considerable return, and an expected annualized return of 5.5%

OpenEden provides investors with a channel to invest in U.S. bonds. The expected annualized rate of return currently offered to investors is close to 5%, which is quite attractive compared to many traditional low-interest financial management channels and some volatile crypto investment categories. OpenEden's U.S. bond investment brings higher returns to investors.

2. Flexible trading: not restricted by US trading hours and supports 24/7 redemption

One of the main features of OpenEden is that it breaks the "shackles" of traditional U.S. bond investment being restricted to the U.S. domestic trading hours. Relying on the unbounded nature of blockchain technology, users can freely carry out U.S. bond purchase operations at any time of the day. This provides great convenience for investors, who do not need to worry about trading time restrictions and can make investment operations at any time according to their needs. At the same time, users can also redeem TBILL 24/7, and the liquidity of funds is fully guaranteed.

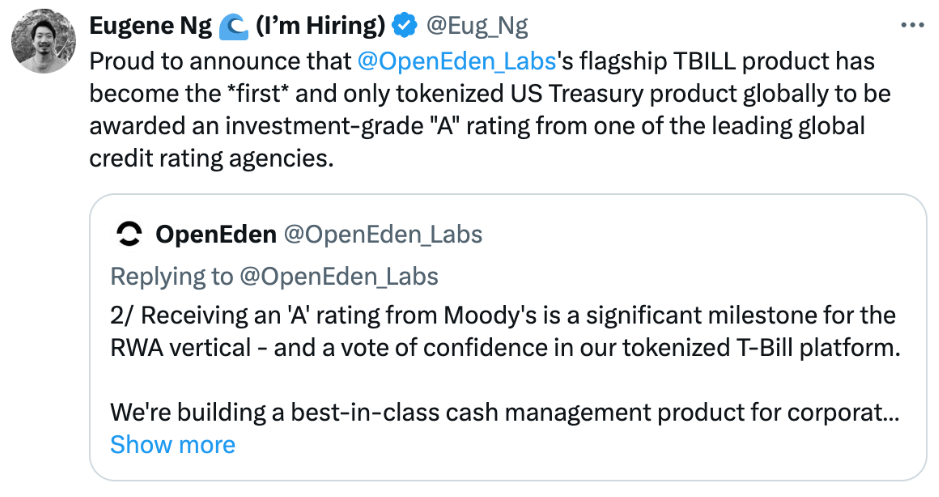

3. Authoritative rating support: the first RWA token to receive Moody’s “A” rating

As early as June 2024, OpenEden successfully won the "A" rating from Moody's Ratings with its solid and stable operating foundation, rigorous and compliant risk control system, and innovative and efficient business structure. As a world-renowned and highly credible rating agency, Moody's has undoubtedly given OpenEden a shining label of "high-quality assets", making it stand out in the mixed RWA market and become a high-quality target trusted by many institutions and individual investors.

4. Cumulative TVL reached 150 million US dollars, attracting more than 150+ institutional clients

So far, its locked value (TVL) has soared to over 150 million US dollars (currently slightly down to nearly 125 million US dollars), and the cooperation map continues to expand, and has successfully attracted more than 150 institutional clients to join in and build a large and active investment ecosystem. The participation of institutional clients has further enhanced OpenEden's market influence and credibility. The participation of institutional clients has also brought more funds and resources to OpenEden, which will help promote the sustainable development of the project.

Competing with Ondo Finance

Both OpenEden and Ondo Finance focus on the field of asset tokenization, but there are many differences in business focus and operational logic.

Business model

OpenEden mainly focuses on the field of U.S. Treasury on-chain, and provides investors with a channel to invest in U.S. Treasury by investing most of its assets directly in short-term U.S. Treasury bonds off-chain. At the same time, OpenEden has also made a number of improvements to Vault, including on-chain price oracles, faster smart contract transactions, Uniswap widgets, security enhancements, institutional-level guarantees, and user interface improvements.

Ondo Finance launched a tokenized fund to provide institutional investors with the opportunity to invest in U.S. Treasuries and institutional-grade bonds. Its product OUSG mainly provides liquid exposure to short-term U.S. Treasury ETFs, and the majority of the portfolio will be invested in iShares Short-Term Treasury ETFs.

Revenue

OpenEden has an expected annualized return of 5.5%, which offers a high return on investment.

The yield to maturity of Ondo Finance is close to that of OpenEden. However, there may be differences in the stability and risk of the returns. OpenEden is guaranteed by a reverse repurchase agreement and has a Moody's rating of "A", which has certain advantages in terms of investment value and reliability.

OpenEden's current market development

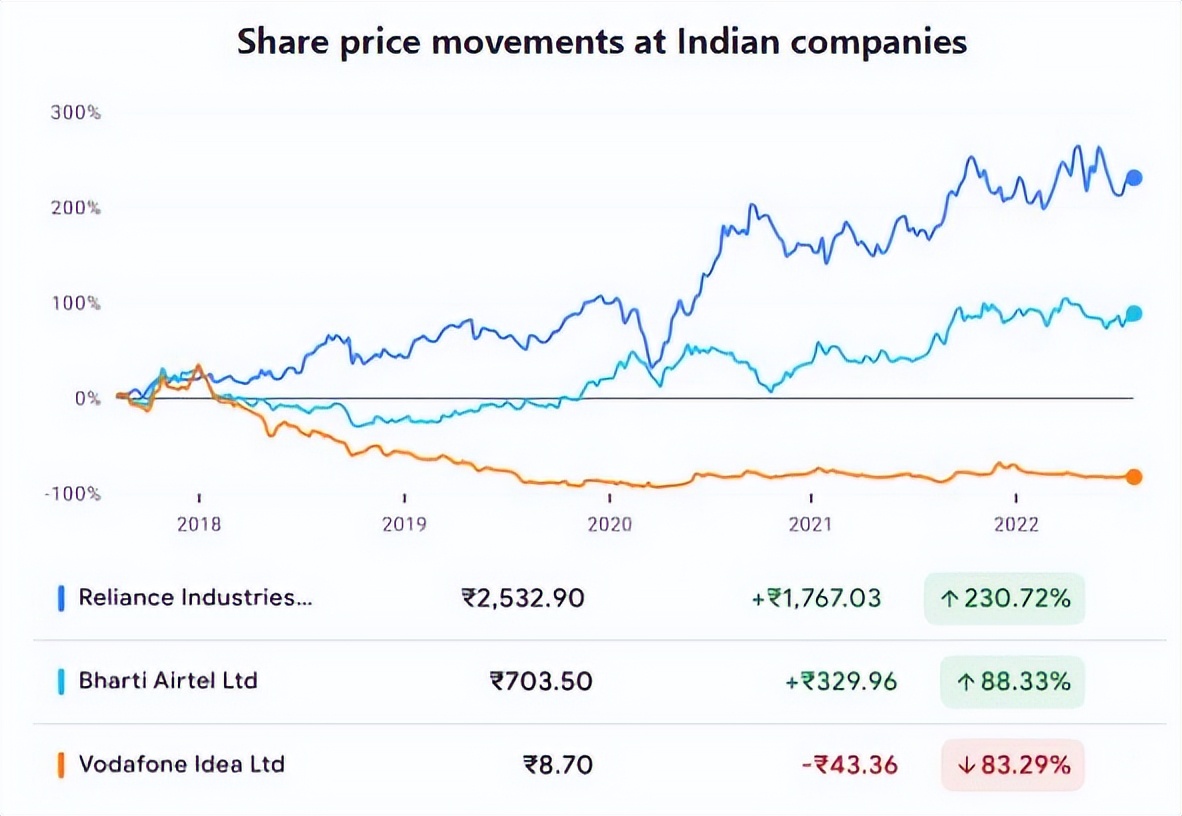

OpenEden was not doing well last year, with TVL hovering below $20 million. But it experienced an explosion this year, with TVL growing faster in the second half of the year, increasing from $35 million to $100 million in three months.

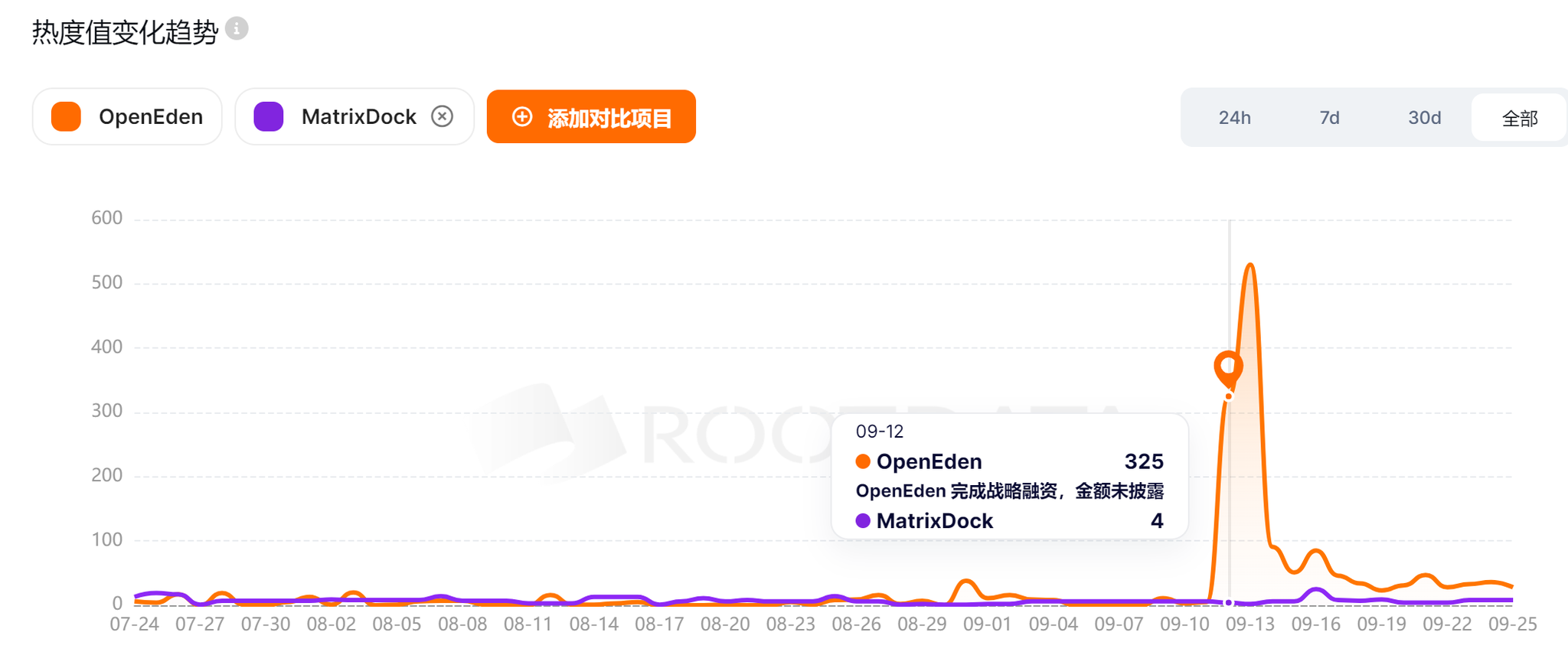

The reason for OE's poor performance in the first half of the year was largely due to the competition from MatrixDock, a US debt RWA project in Singapore:

MatrixDock is an RWA protocol under Wu Jihan's Singapore-based crypto asset management platform MatrixPort. It aims to provide TBill risk exposure to users who have passed KYC. Its RWA token is $STBT.

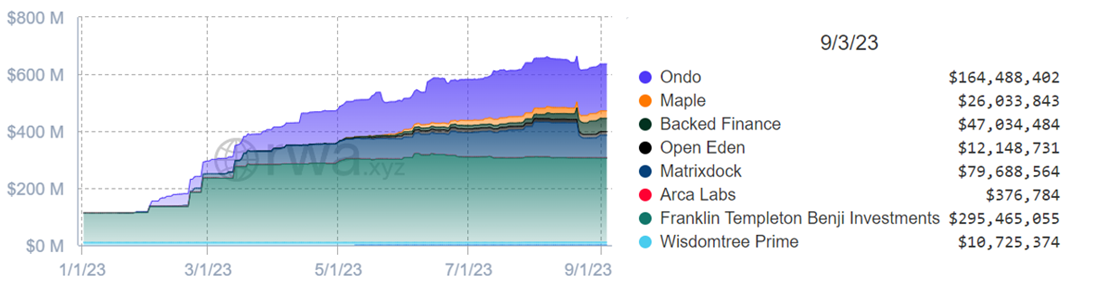

In September last year, the RWA Treasury bond track was mainly composed of Franklin Templeton, Ondo, MatrixDock, Backed, Maple, OpenEden, etc.

$STBT’s TVL was about $80 million at the time, and it could reach $100 million at its peak, but now the two have swapped positions in the Treasury bond track. This may be due to OpenEden’s active business expansion and increased TVL, and also due to their persistence in operating on Twitter, which gained a certain amount of exposure and eventually formed a snowball effect.

At present, OpenEden has shown a strong development trend in the market. Its tokenized U.S. Treasury bonds had a peak TVL of over $150 million, making it one of the top five tokenized Treasury bond issuers in the world. In the Treasury bond RWA market, although OpenEden's market share is relatively small at present, it is growing rapidly.

Future development prospects of OpenEden

Under the current trend of on-chain asset tokenization, OpenEden has shown great development potential with its focus on the field of U.S. debt on-chain and a series of advantages. Such as:

- Launch of tokenized U.S. Treasury bills on the XRP Ledger

- Institutional investment cooperation, Ripple plans to set up a fund and invest $10 million in specific TBill tokens

- Cooperating with Solayer to launch the tokenized U.S. Treasury bond stablecoin sUSD provides investors with more investment options.

As the trend of on-chain asset tokenization continues to develop, OpenEden is expected to occupy a larger share of the RWA market.

However, OpenEden also faces some challenges in its development. Compared with its competitors, OpenEden has a relatively small market share and needs to continue to work hard and innovate to improve its competitiveness. At the same time, OpenEden also needs to face the uncertainty of regulatory policies and the risks brought by technological innovation.

Having recently received strategic investment from Binance (the amount was not disclosed), its exposure and product positioning may push OpenEden into a new stage of development.

In addition, for the evaluation of OpenEden's future prospects, we can also refer to the successful experience of Ondo Finance:

The Ondo Finance team has an outstanding TradiFi background, and its members come from well-known institutions such as Goldman Sachs and Merrill Lynch. At the same time, the protocol itself has a good relationship with BlackRock and has strong investors to support TVL. Coupled with good market-making operations after the coin issuance, it has become the largest leading target in the RWA field.

The OpenEden team also has a good financial background and has now received support from Binance. Due to compliance reasons, many tokens in the treasury market are currently unable to issue tokens. If the OE team can solve this problem and successfully issue tokens, it will be the second treasury bond RWA token, and its future development prospects are very worth looking forward to.

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Cage / Mat / Darl / WolfDAO

Proofread by: Punko

Special thanks: Thanks to the above partners for their outstanding contributions to this issue.