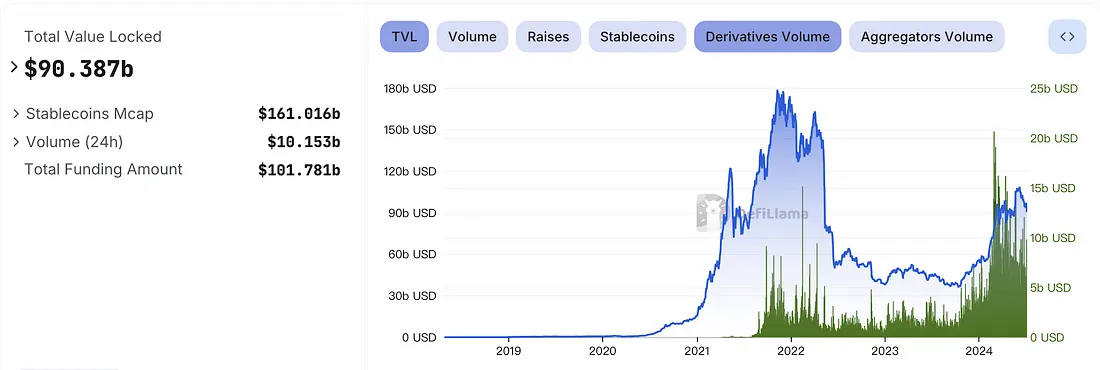

The hot centralized exchange contract market has also made the derivatives Dex track highly anticipated. With the launch of emerging derivatives Dex projects in the past two years, the proportion of on-chain derivatives transactions in the entire DeFi transactions has gradually increased.

Further digging into the transaction data of derivatives dex, we can find that the new growth is mainly brought by emerging projects, especially those without tokens. Among them, the transaction volume growth of SynFutures @SynFuturesDefi is particularly eye-catching.

From the data of Deflama, we can see that the transaction volume of SynFutures has experienced explosive growth since March this year, which is mainly due to the release of V3 and the introduction of the points reward plan. So if we put aside the points incentive, is the SynFutures project still attractive?

Derivatives projects have been constantly innovating and iterating in recent years, and most of these innovations revolve around liquidity and transaction speed. SynFutures is no exception. As a project that has been deeply involved in the entire bear market, it has undergone several iterations, and the most critical core goal is also liquidity.

Users who frequently participate in on-chain contract transactions may find that the optional trading varieties on the chain are relatively limited. Most derivative Dex can only trade mainstream coins with large market capitalization. Currently popular derivative Dex basically adopts the pool mode (such as GMX) or the order book mode (such as dydx). For the pool mode, in order to avoid the risk transmission of small-cap tokens, isolated pools are often used, but small-cap tokens have low liquidity and are not easy to meet the liquidity requirements of isolated pools. For the order book mode, there are certain market-making and risk management costs, so it is more inclined to choose high-cap tokens with good liquidity.

SynFutures is different from most derivatives Dex. SynFutures not only meets the derivatives trading needs of large-cap mainstream coins, but also includes various small-cap coins, including MEME. Any token can enter SynFutures without permission and open the contract trading market. However, it is very challenging to provide trading liquidity for small-cap tokens. How does SynFutures solve the liquidity problem of small coins? Next, let's talk about the design highlights of SynFutures.

Project Highlights

According to official documents, the highlight of the current V3 version is its original Oyster AMM model, which features: single-token centralized liquidity for derivatives, permissionless on-chain order books, a single model for unified liquidity, and a user protection stabilization mechanism.

Single token centralized liquidity means that liquidity providers only need to deposit one token, without pairing, to provide liquidity, and adopt a centralized liquidity mechanism. Speaking of centralized liquidity, you may think of Uniswap V3. Since most trading activities only occur within a limited price range, the traditional infinite range constant product AMM model has low capital efficiency. Centralized liquidity means that liquidity corresponds to an effective price range, and by guiding liquidity to the active trading range, the utilization efficiency of liquidity is greatly improved.

The permissionless on-chain order book refers to the democratization of market access. Any asset, such as MEME, can also enable the automated "market maker" function. When SynFutures was first created, there were three core goals:

1. Make it accessible to everyone;

2. Highly decentralized;

3. Compatible with as many trading pairs as possible.

Since the earliest version V1, SynFutures has focused on solving the problem of derivative trading of small assets. Due to the lack of liquidity of small assets, it is difficult to meet the liquidity requirements of the traditional AMM model. Complex infrastructure and risk management issues make the order book model unwelcome for small volatile assets. Centralized liquidity can just solve the AMM liquidity problem, and SynFutures v3 also introduces an order book model, which uses a permissionless on-chain order book model combined with a centralized liquidity model to provide more liquidity possibilities while eliminating dependence on centralization.

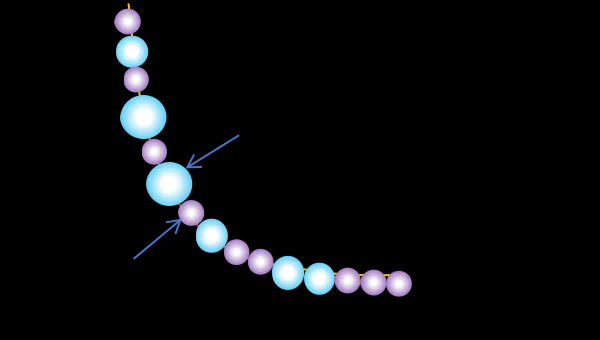

A single model for unified liquidity refers to the combination of centralized liquidity and order books. Oyster AMM has created a unified liquidity system with a single model, so that traders can enjoy efficient and predictable atomic transactions. In the data structure design of Oyster AMM, each price point is called a Pearl, and the pearls of all price points are strung together like a liquidity necklace composed of large and small pearls. Each pearl includes all centralized liquidity at that price position, as well as all open limit orders at that price position. When there is a limit order in the pearl at the price point of a transaction, the liquidity of the limit order is used first, otherwise the liquidity of the AMM is used. If the transaction scale is large and one pearl cannot meet the demand, the liquidity of the next pearl is used, and so on.

As a derivative Dex that supports any currency, in addition to the design of maximizing liquidity, security is also a top priority. After years of product iteration, SynFutures has a lot of experience in designing user protection and stability mechanisms. The mechanisms introduced by Oyster AMM include: dynamic penalty fees, which prevent price manipulation by imposing fines on significant deviations between transaction prices and mark prices; a dynamic fee system that balances the risk-return status of LPs; a stable mark price mechanism that uses an exponential moving average process to mitigate the risks of sudden price fluctuations and large-scale liquidations. In addition, the liquidity pools of different tokens adopt an isolated pool model to avoid risk transmission.

Unique liquidity provision method

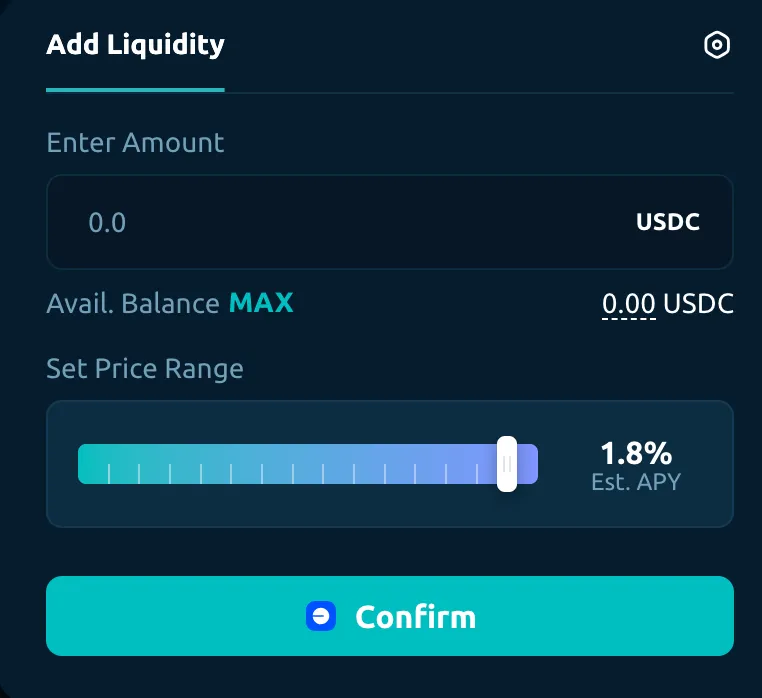

If you open the Synfutures liquidity provider interface, you can see a range selection slider that uses APY forecast values to represent the range. This is related to Oyster AMM's unique liquidity provision method.

Oyster AMM only uses one parameter α to define the effective range of concentrated liquidity, because SynFutures' liquidity range is designed like this:

Pa(min) = Pc/α,

b(max) = α · Pc, α > 1

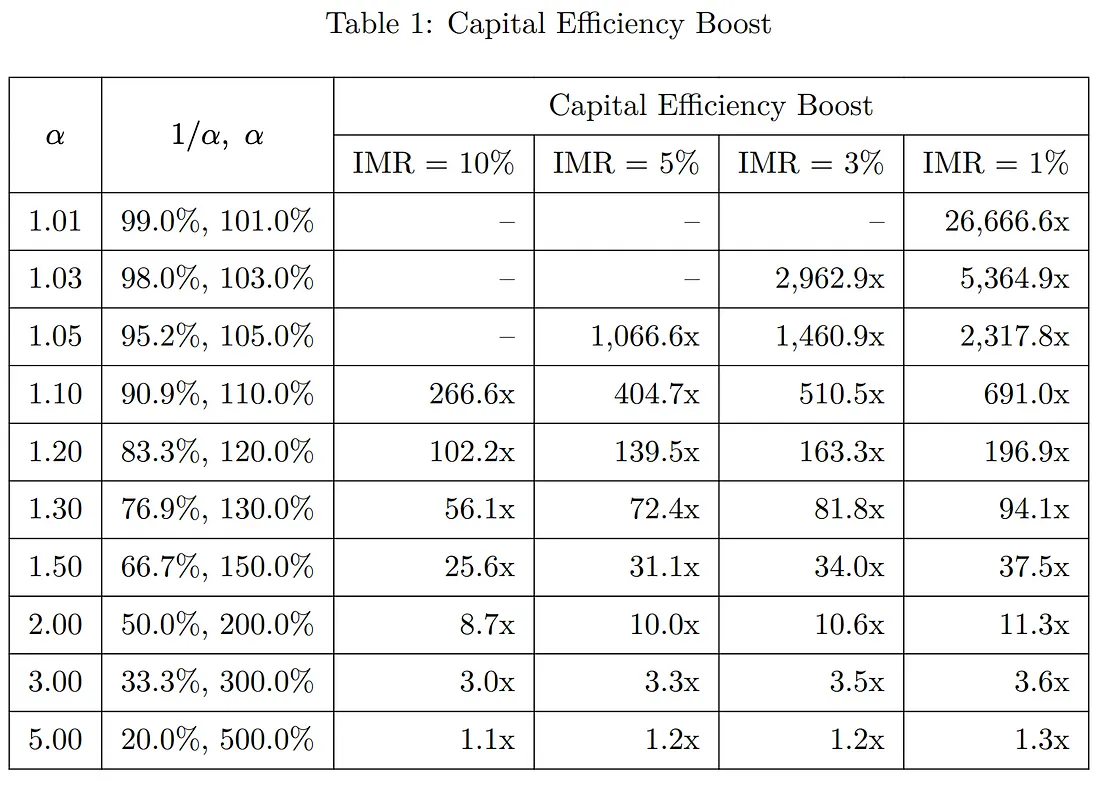

Therefore, the larger α is, the wider the effective range of liquidity is, and vice versa, the smaller α is, the narrower the effective range of liquidity is. The white paper provides a calculation table, which shows the changes in capital utilization efficiency under different α:

Although liquidity providers will pursue capital utilization efficiency, the smaller α is, the better. Because after exceeding the range, this part of liquidity will become a net position, which will not only no longer enjoy liquidity benefits, but also require payment of an execution fee. In addition, if you do not want to hold any positions, you need to close the net positions generated by exceeding the range.

Team and Funding

As a veteran team, SynFutures has raised nearly $38 million in total so far, and just completed a new round of $22 million led by Pantera Capital in October last year, with participation from top institutions such as HashKey Capital and SIG. In the A and seed rounds of financing during the last bull market, investment institutions also included leading institutions such as Polychain Capital.

Co-founder Rachel Lin graduated from Peking University and the National University of Singapore. She has served as senior vice president of Matrixport, senior expert of Ant Financial, and vice president of Deutsche Bank's Global Markets Department. She has many years of experience in financial derivatives, Internet finance, and large-scale blockchain payment projects.

Co-founder Matthew Liu graduated from Peking University and Northwestern University-Kellogg School of Management, and served as head of global partnerships at Ant Group.

Recent Events

Recently, SynFutures launched the Base chain. At a time when MEME is hot, SynFutures launched a six-week Meme Perp Summer event. It will cooperate with MEME, the hottest on the Base chain, and will release a series of new products in the next few weeks.

In addition to MEME coins, SynFutures has also launched some popular LSD and LRT asset pairs, such as wstETH/ETH and weETH/ETH. These relatively stable asset pairs can set liquidity in a smaller price range to improve the efficiency of capital utilization.

Future Outlook

In short, SynFutures has filled a gap in the derivatives trading market through innovation and adhered to the original intention of decentralization. In the future, the launchpad function may be launched to support the issuance of more MEME coins. However, the V3 version has not been online for a long time, and the trading demand for small coins remains to be seen. With the continued popularity of Meme coin transactions, more community tokens will most likely be launched in the future. Driven by the booming cycle of small coin transactions, we look forward to a broader imagination space.