As the clock strikes 2025, the market seems to have entered garbage time.

Even Bitcoin did not expect that $100,000 would become the criterion for judging whether a bull or a bear market is a bull market. Bitcoin was thought to have reached $100,000 on Monday, marking the beginning of the next upward trend. However, Bitcoin began to run out of steam before it had even started to bounce for two days. During the U.S. trading session on Tuesday, the intraday low hit $92,600, a nearly 10% drop from Monday’s high of more than $102,000 in two days, and is now trading at $94,212.

Bitcoin is watching from the sidelines, while altcoins surrender. ETH returns to $3,300, SOL falls below $200, and altcoins fall by 10%, with institutional tokens such as ADA, RNDR, and Aptos leading the decline. Even the U.S. stock market was affected, with share prices of leading mining companies such as TeraWulf, Bit Digital, Bitdeer, IREN, and Hut 8 falling by 5-8%.

Although the decline is still controllable, as the low point of Bitcoin is close to the price before the New Year, market sentiment is also receding in the rising tide. The sale of Silk Road has also poured cold water on the market. There are a lot of discussions in the market, and even many analysts believe that Bitcoin will fall to $70,000 before Trump's inauguration speech. For example, analyst Ali Martinez said that the key support area of BTC is currently hovering between $97,041 and $93,806. He believes that if Bitcoin cannot meet this demand, it will fall sharply to $70,085.

To see whether this prediction comes true, we must first analyze the reasons for this round of decline.

The market generally believes that the macro data released on Tuesday was the trigger for this decline. The report released by the U.S. Bureau of Labor Statistics showed that the number of JOLTS job vacancies in the United States in November exceeded 8 million, significantly exceeding expectations and exceeding the estimates of all economists surveyed by the media, setting a six-month high. This JOLTS data was mainly driven by the growth of the business services industry, while the demand for workers in other industries was mixed.

The US JOLTS job vacancies in November were 8.098 million, which was expected to be 7.74 million. The previous value in October was revised up from 7.744 million to 7.80 million. The job vacancies in November continued the rebound trend in October. In September, the JOLTS job vacancies unexpectedly fell sharply, hitting a three-year low, triggering recession fears.

The ISM Services PMI was released at the same time as JOLTS. The ISM Services Index recorded 54.1 in December, higher than the market expectation of 53.3 and the previous 52.1. This growth was mainly due to the significant increase in the service price payment sub-index, which jumped from 58.2 in November to 64.4, reaching the highest level since February 2023.

Overall, the macro data can be described as impressive, but it is this impressive data that has led to a decline in the market. The market generally believes that due to the strong support of macro data, the Federal Reserve is very likely to continue to maintain a hawkish stance, so the path of interest rate cuts needs to be repriced. In other words, as the macro environment improves, there is no need to open the floodgates, but the liquidity shock to risky assets is inevitable. After the data was released, traders no longer bet on the Federal Reserve to cut interest rates before July. The S&P 500 and Nasdaq fell, in contrast to the soaring U.S. 10-year Treasury yield and the U.S. dollar index.

Coincidentally, today the Federal Reserve released the minutes of the Federal Open Market Committee (FOMC) policy meeting in December last year. The content is basically the same as last month, and it is clear that interest rate cuts will become more cautious. Committee members expect that the pace of interest rate cuts in 2025 will slow down significantly, and only 75 basis points are expected to be cut throughout the year.

The macro environment is the key background, but Trump’s relentless remarks have further fueled risk aversion among investors.

Just yesterday, CNN reported that four sources revealed that US President-elect Trump is considering declaring a "national economic emergency" to provide a legal basis for his widespread imposition of large tariffs on allies and competitors. The report stated that after the United States enters a "national economic emergency", Trump will be allowed to use the International Economic Emergency Powers Act (IEEPA) to formulate a new tariff plan. IEEPA unilaterally authorizes the US President to manage imports during the relevant national emergency."

On January 7, at a 70-minute press conference at Mar-a-Lago in Florida, Trump made outrageous remarks. He not only said that he would make Canada the 51st state of the United States "through economic means", but also did not rule out the use of force to seize the Panama Canal and Greenland. He also promised to rename the Gulf of Mexico as the "American Gulf". He also did not let go of the Middle East issue. He emphasized that if Hamas did not release the Israeli hostages before he took office, "the Middle East would fall into chaos". Such arrogant words successfully attracted public opinion attacks from Canada, Denmark and other countries after the press conference, and also made the market worried about the trend of the global economy.

Due to the uncertainty of the impact of macro interest rate cuts and tariffs, the market's risk aversion sentiment has become prominent. The three major US stock indexes have fluctuated and weakened, the US dollar index has risen sharply, and non-US currencies have plunged. The crypto market is naturally not immune. ETFs representing institutional funds also show this point. On January 8, the US Bitcoin spot ETF had a net outflow of US$583 million in a single day, and the Ethereum spot ETF had a net outflow of US$159 million in a single day. Both funds have a trend of outflow.

Another incident that made matters worse was this morning, when DB News said that according to an official, the U.S. Department of Justice has been approved to liquidate 69,370 BTC seized in the Silk Road case, with a total value of approximately $6.5 billion. The rumors are not groundless. As early as December 3, the U.S. government transferred 19,800 SilkRoad-related bitcoins worth nearly $2 billion to Coinbase Prime, which the market interpreted as the government's preparation for sale. The expected increase in selling pressure has intensified market panic, and BTC has fallen by more than 1% in a short period of time, once again touching below $94,000.

Despite the continued panic, at this stage, there are less than 10 days until Trump's official swearing-in and inauguration speech, and February is the earnings season, so the market outlook is still relatively more positive than negative. From the news perspective, there is still support for the positive information.

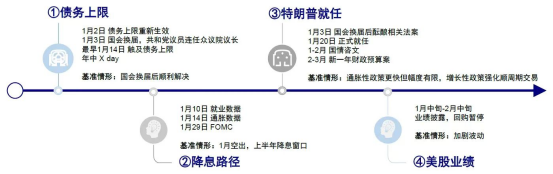

The main trading lines and key nodes in 2025, Image source: CICC

First, the lawsuit between Coinbase and the SEC has taken a turn for the better. The U.S. District Court for the Southern District of New York approved Coinbase's interlocutory appeal motion, and it can appeal to the Second Circuit Court against the SEC's allegations. During this period, the case is temporarily suspended. The reason is that the judge believes that there are differences in the legality of cryptocurrencies in different courts across the country, so this legality needs to be ruled. If the Second Circuit Court agrees to hear the case, the federal government will have the opportunity to resolve the controlling legal issue of the scope of the SEC's statutory power over digital assets. It is worth noting that since this is an appeal in the middle of the lawsuit, it will greatly increase the possibility of the case being dismissed, and the SEC will face a very passive situation at that time. If the appeal is successful, the SEC's question about the securities attributes of the currency listed on Coinbase may also be solved, and the altcoin ETF will be expected to be promoted.

Second, the chairman of the CTFC, who once strived to become the highest regulatory agency for cryptocurrencies, resigned. However, he still expressed his positive sentiment towards crypto regulation in his last public speech, and the Trump team has begun to look for a successor chairman who is friendly to cryptocurrencies. Current CFTC Commissioner Summer Mersinger, a16z Crypto Policy Director and former CFTC Commissioner Brian Quintenz, and Kraken's Chief Legal Officer Marco Santori are all under consideration. It can be seen that the Trump team has a highly unified consensus on the unbundling of crypto regulation.

In this context, the attitude of whales towards the future trend of Bitcoin can be described as quite positive, and picking up bargains and bottom fishing have become common operations for whales.

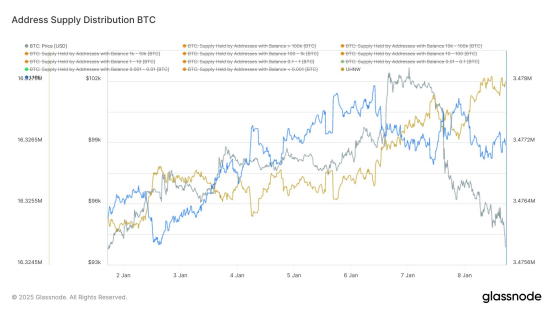

The data compiled by @Phyrex_Ni shows that panic sentiment is evident among small holders. During the decline in the past two days, investors holding less than 10 BTC have a clear trend of reducing their holdings, and the holdings of exchanges have continued to decline. However, large holders are relatively confident, and investors holding more than 10 BTC have a clear trend of increasing their holdings.

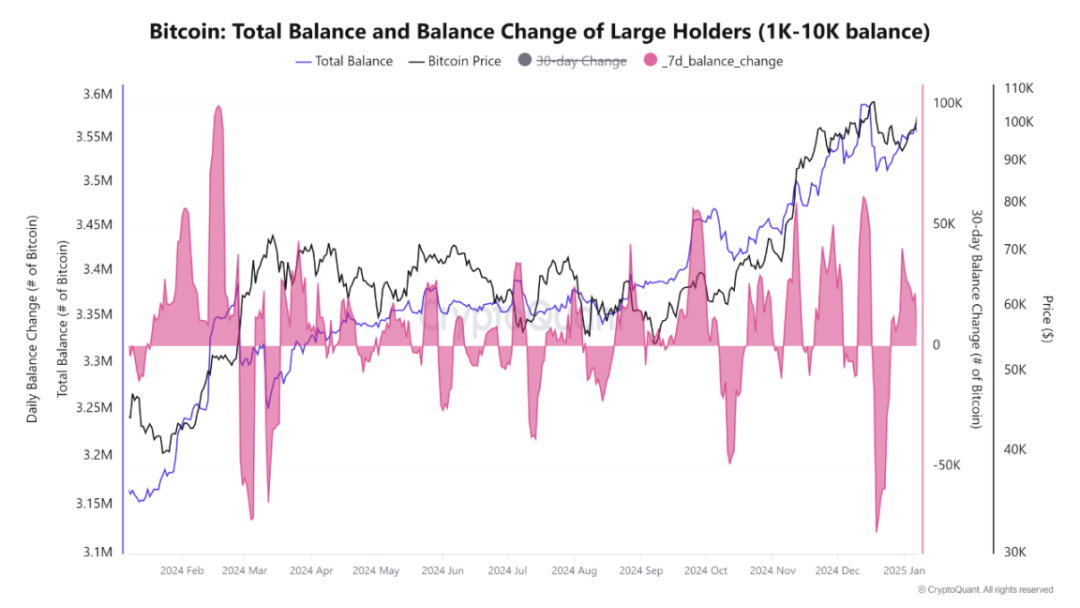

Cauê Oliveira, head of research at Blocktrends, confirmed the data, saying that institutional investors sold a large amount of Bitcoin at the end of 2024, but are now starting to buy it at prices below $100,000. In the week after December 21, wallets holding 1,000 to 10,000 BTC sold 79,000 BTC, but recently, the group has been hoarding Bitcoin when the price is below $95,000.

As for the Silk Road, which caused panic, the impact may not be as great as expected. First of all, Trump once publicly promised that the US government would not sell any Bitcoin after his election. This move is undoubtedly a slap in the face, and there may be a reversal later. Even if it is confirmed that it can be sold, it will not be done overnight in terms of time, and it may take several months of approval process. Secondly, in order to maximize profits, large-scale sales usually take the form of over-the-counter acquisitions, and the impact on prices is relatively controllable. In addition, even if it is a one-time entry into the market, it will only take more than a week based on the current liquidity, so there is no need to cause panic. CryptoQuant CEO Ki Young Ju said, "Based on the realized market value, $379 billion entered the market last year, with about $1 billion in liquidity per day. The $6.5 billion (Bitcoin) sold by the US government may be absorbed within a week."

Therefore, some institutions are very optimistic and believe that the decline caused by selling pressure is a buying opportunity. Arthur Hayes, co-founder of BitMEX, wrote in response to Silk Road’s entry into the market that “Diamond Hand is ready to buy at the bottom.”

Overall, although the sentiment has declined and there is indeed panic, with the support of institutions and whales, the crypto market will not usher in an avalanche even if it falls. The current bottoming concentration area of Bitcoin is still around $95,000, and the price is mostly based on this. A big drop may return to the fluctuation below $90,000, but the probability of $70,000-80,000 is small.

In addition to the continued attention to Trump's administration, the next important event for the market to watch is the US non-farm payrolls report for December, which will be released on Friday night. Although the ADP "small non-farm" data on Wednesday was lower than expected, which gave the market a little relief, the big non-farm data often differs greatly from the ADP, and the non-farm data is one of the key factors in the Fed's policy decisions, so it is the focus of the market. A job market that is lower than expected may cause the Fed to turn dovish again.

Currently, the market generally expects that the number of new non-farm jobs in the United States will slow down to 153,000 in December and the unemployment rate will remain at 4.2%.