This article was edited by the Ringing Finger Research team

This article was edited by the Ringing Finger Research team

Please indicate the source and link when reprinting

1. DeFi Industry Observation

1. Trump becomes the first “Bitcoin President” in American history

On November 6, 2024, Trump was successfully elected as the President of the United States. He not only changed the political arena, but also became the first leader to support cryptocurrency, a position that was in stark contrast to the previous Biden administration. During the campaign, Trump explicitly supported cryptocurrency policies, allowing donations in cryptocurrencies such as Bitcoin, and publicly opposed Biden's anti-crypto policies.

As early as May, Trump announced that supporters would be allowed to donate using cryptocurrencies supported by Coinbase Commerce. In addition to policy support, Trump also personally participates in crypto assets, such as his NFT collection "Mugshot Edition", which contains many commemorative images.

What is even more striking is that Trump's crypto assets have reached $6.25 million, including a large amount of ETH and meme coin TRUMP, showing his emphasis on the crypto market. He also plans to fire the SEC chairman after taking office, strengthen support for the Bitcoin and crypto industries to ensure that the United States becomes a "superpower" for crypto and Bitcoin, and announced that the United States will retain all national Bitcoin reserves.

2. Bitcoin surpasses $90,000 this week

Bitcoin performed strongly this week, breaking through $90,000 in a short period of time, setting a new record high and refreshing the market value ranking again. After setting new highs last week, Bitcoin's market value has surpassed Meta and firmly ranked as the ninth largest asset in the world. Market analysts believe that the recent strong rebound of Bitcoin reflects the rising market demand for encrypted assets, and also because the US policy attitude towards cryptocurrencies has gradually become more friendly, adding momentum to the subsequent price trend.

3. On-chain Alpha Mining: SynFutures’ Perp Launchpad Creates a New Perpetual Contract Model

With the expansion of the Base ecosystem, SynFutures launched a new perpetual contract platform, Perp Launchpad, which lowers the entry threshold of the perpetual contract market with a unique "one-stop launcher" model. The platform attracts a large number of on-chain users, especially participants in the Restaking and Meme coin tracks, with its low Gas environment, deep incentives and efficient liquidity management, and provides a convenient trading pair release channel for new tokens.

Highlights of Perp LaunchpadSynFutures' Perp Launchpad aims to simplify the release process of perpetual contracts, allowing any token to create trading pairs on the platform without permission. Taking Lido as an example, its wstETH/ETH trading pair achieved $260 million in trading volume and nearly $920,000 in peak TVL within 2 months of launch, demonstrating the platform's rapid growth potential. Investors can earn annualized returns by providing liquidity, and can also look forward to future token airdrops and rewards.

The multi-asset application SynFutures has attracted Restaking enthusiasts to collaborate with Lido and others, opening up new channels for the monetization of Restaking assets. In particular, BTC Restaking assets have gradually become the new favorite in the perpetual contract market. The BTC/ETH trading pair has become a popular choice for many investors because of its price correlation, providing a stable pricing benchmark.

Challenges and Potentials Although SynFutures has achieved initial success in perpetual contracts, the performance of Meme coin contracts has been relatively mediocre, mainly because high volatility and impermanent loss discourage traders. SynFutures is characterized by lowering the issuance threshold, trying to include both "blue chip assets" and "retail favorites" in its market, opening a new chapter in perpetual contracts.

Source: https://www.panewslab.com/zh_hk/articledetails/y8rx08geFt.html

4. UK first: Pension fund officially includes Bitcoin in its investment portfolio

Recently, a British pension fund directly invested in Bitcoin for the first time, becoming the first in the country, and five independent institutions jointly managed the private keys. With the assistance of consulting firm Cartwright, the fund allocated 3% of its assets to Bitcoin and plans to launch a Bitcoin employee benefit program. Some companies have expressed interest. This marks the further expansion of pension funds' investment in crypto assets, not limited to indirect methods such as ETFs.

Pension funds around the world are gradually getting involved in the crypto space. Florida and New Jersey in the United States have publicly stated plans to invest in Bitcoin ETFs, while the Michigan Retirement System has purchased the Grayscale Ethereum spot ETF. This trend reflects that as Bitcoin's position becomes more solid, more pension funds will consider incorporating crypto assets into their investment portfolios in the future.

Source: https://foresightnews.pro/article/detail/70945

5. EigenLayer consultant changes, Ethereum neutrality faces challenges

On November 2, Ethereum Foundation members Dankrad Feist and Justin Drake announced their resignation from EigenLayer advisory positions to focus on "more neutral" work. This change has caused the community to question whether they are making profits from it. Dankrad said that this move was aimed at avoiding conflicts of interest, and Justin admitted that accepting the advisory position was a wrong decision and did not receive any tokens.

As a public good foundation, the Ethereum Foundation has always emphasized non-profit and neutrality, but its members often participate in advisory roles in different projects, triggering discussions in the community about the neutrality of Ethereum. Although Ethereum founder Vitalik Buterin often advocates technical neutrality, how to balance interests in a rapidly developing ecosystem is still a major challenge.

Source: https://foresightnews.pro/article/detail/70891

6. The number of active users of TON Hamster Game dropped sharply, and the token plummeted by 76%. Has the "earn by clicking" model reached a bottleneck?

The once popular Telegram game "Hamster Kombat" is facing severe challenges. The latest data shows that the game's monthly active users have dropped sharply from 300 million in August to 41 million, a decrease of 86%. In addition, the game token $HMSTR has also plummeted by 76% in just over a month, raising market concerns about its future.

What is the reason for the sharp decline in users and token value?

The decline of Hamster Fighter can be attributed to multiple factors. In addition to the impact of the crypto market downturn, the game failed to deliver on its promises to the community, coupled with delayed airdrops and lower-than-expected returns, which led to users gradually losing confidence and even feeling "tricked" by the developers. These problems have caused players to widely question the integrity of the game and weakened the market's trust in its tokens.

Possibility of revival?

The Hamster Fighter team plans to integrate NFT as in-game assets in the second season, hoping to increase user engagement. But whether this plan can save the game from its decline remains to be seen. Analysts believe that in order to regain user trust, the development team must improve gameplay, increase reward mechanisms, and strengthen communication with the community, otherwise it will be difficult to regain its foothold in the fierce market.

Source: https://web3plus.bnext.com.tw/article/3269

7. Ethereum launches Mekong testnet for Pectra upgrade, focusing on improving user experience and network efficiency

The Ethereum development team recently launched a temporary test network called Mekong for the upcoming Pectra upgrade. The test network is designed to experiment with specific code changes and evaluate their impact on the network. Although Mekong is short-lived, it contains all proposed Ethereum Improvement Proposals (EIPs) and is considered a fully functional test environment for Pectra.

Initially, the Pectra upgrade plan included about 20 EIPs, but it has now been reduced to about 8, with a focus on improving user experience and network efficiency. The main changes include:

- Improve the user experience and account abstraction of crypto wallets

- Increase the maximum stake limit for validators from 32 ETH to 2,048 ETH

- Update deposit and withdrawal mechanisms, etc.

These changes will be tested on the Mekong testnet, then deployed to other public testnets, and finally implemented on the Ethereum mainnet. Developers said that although there may be some minor specification changes or minor EIP adjustments, the functions included in the Mekong testnet will gradually enter the public testnet and eventually be deployed to the Ethereum mainnet.

Source: https://www.theblock.co/post/324970/ethereum-mekong-testnet-pectra?utm_source=twitter&utm_medium=social

8. Bitcoin staking standardization: Solv Protocol leads the new revolution of staking

As the demand for Bitcoin staking increases, Solv Protocol is leading the market standardization by launching the Staking Abstraction Layer (SAL). SAL provides a unified technical framework for staking, solving the difficulties of Bitcoin staking decentralization and liquidity management, allowing users to easily participate in cross-chain staking and earn returns. Solv not only improves the liquidity of assets, but also brings more flexible income strategies to DeFi users, helping the Bitcoin staking market to develop in a mature and diversified direction, and becoming an important cornerstone in the future DeFi ecosystem.

Source: https://foresightnews.pro/article/detail/71003

9. Innovative exploration of UniFi Layer2 solutions

Puffer Finance recently launched the UniFi Layer2 solution, which is based on Based Rollup + native AVS verification system to create a new generation of Layer2 architecture. This Rollup As A Service (RAAS) model based on Ethereum mainnet functions (Proposer + AVS) not only enhances the security and decentralization of Layer2, but also allows Based Rollup and AVS services to have a wider market potential.

Innovative sorting mechanism based on Based Rollup

Based Rollup delegates the Layer2 sorting function to the Proposer of the Ethereum mainnet, solving the problem of centralized Sequencer by packaging submitted transactions. However, this method cannot solve the consensus consistency between Layer2s, so Puffer Finance further introduces AVS decentralized verification services to provide additional security consensus in addition to transaction sorting.

Fast confirmation transaction processing flow

UniFi's transaction process uses Layer1 Proposer to sort, and then AVS verifies to provide pre-confirmation. Unlike traditional Layer2, transactions initiated in UniFi can be confirmed instantly without long waiting times, which is more user-friendly for needs such as quick withdrawals.

Two-tier verification architecture: TEE + Multiprover

In order to speed up the final confirmation, UniFi uses TEE secure enclave to isolate and process verification, achieve millisecond-level consensus, and establish a standardized security mechanism to improve overall verification efficiency and reliability.

Through these innovations, UniFi not only solves the centralization problem of Layer2, but also builds a decentralized interoperability platform. In the future, it will be able to provide standardized cross-chain services for more Layer2 applications and promote asset circulation and liquidity sharing.

Source: https://www.panewslab.com/zh_hk/articledetails/5jg5ge08Ft.html

10. Base on-chain liquidity engine: Aerodrome

Aerodrome is an innovative liquidity engine that combines multiple decentralized exchange (DEX) models such as Curve, Convex, and Uniswap v3. As the main DEX on Base, it enables holders to vote on the fees and emissions of the liquidity pool through the "veAERO" incentive mechanism, and uses automated market makers (clAMM) to improve capital efficiency. These mechanisms make Aerodrome the preferred liquidity platform on Base.

Solving the flaws of the traditional DEX model

Aerodrome solves the dilemma of traditional DEX in liquidity provision, fee allocation and sustained growth. LPs receive 100% AERO emission incentives, while traders benefit from high liquidity and better execution results. These designs have contributed to the rapid growth of Aerodrome, which has accounted for 63% of Base's market share.

Coinbase’s Push

With the close cooperation between Base and Coinbase, the economic activities of the Base platform have grown rapidly, and the DAU and transaction volume have gradually increased, which has greatly promoted the usage of Aerodrome. The investment of Coinbase Ventures also shows the potential of Aerodrome as the main DEX on the Base chain.

Future development expectations

It is expected that with the steady growth of Base and Aerodrome, TVL will reach US$4 billion within a year and monthly trading volume will reach US$50 billion. As the core liquidity engine of the Base ecosystem, Aerodrome will continue to benefit from the booming DeFi and blockchain markets.

Source: https://www.chaincatcher.com/zh-tw/article/2151070

2. DeFi Data Dashboard

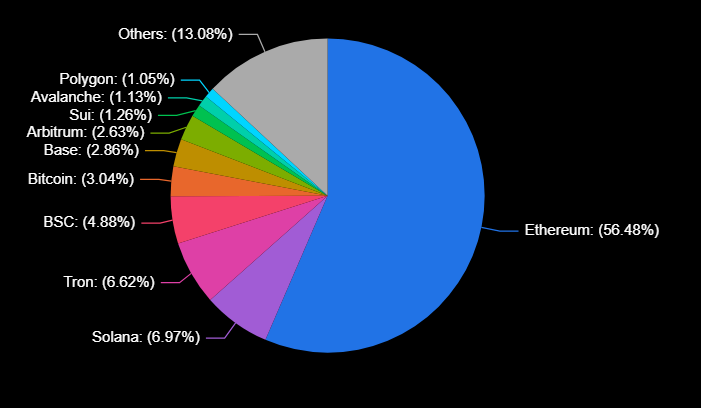

1. TVL data

This week's TVL did not change much compared to last week and remained stable.

https://defillama.com/chains

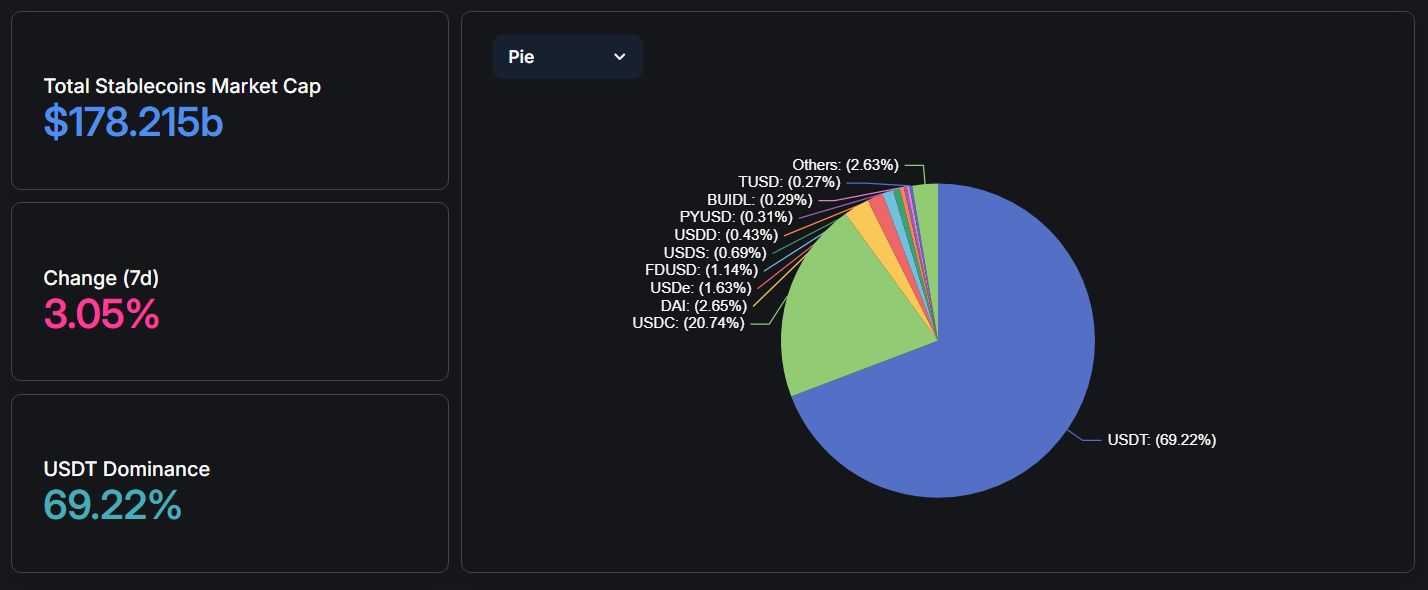

2. Stablecoin issuance

The total market value of stablecoins is now $178.22 billion, up 3.04% in 7 days, of which USDT accounts for 69.22%, a slight decline.

https://defillama.com/stablecoins

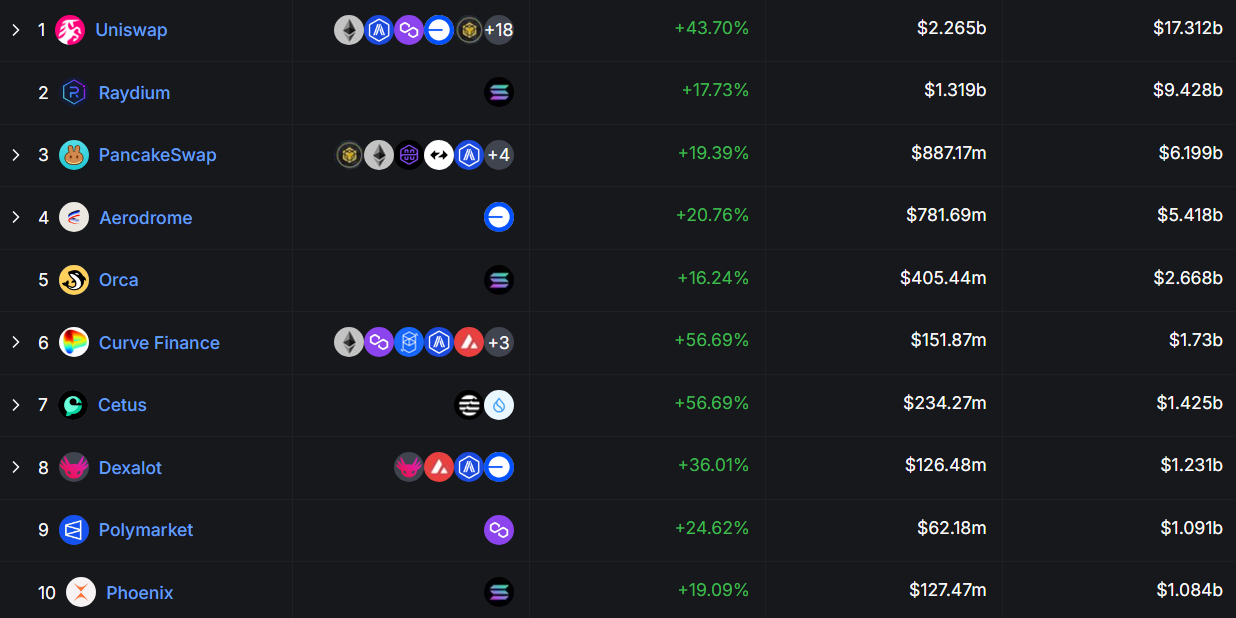

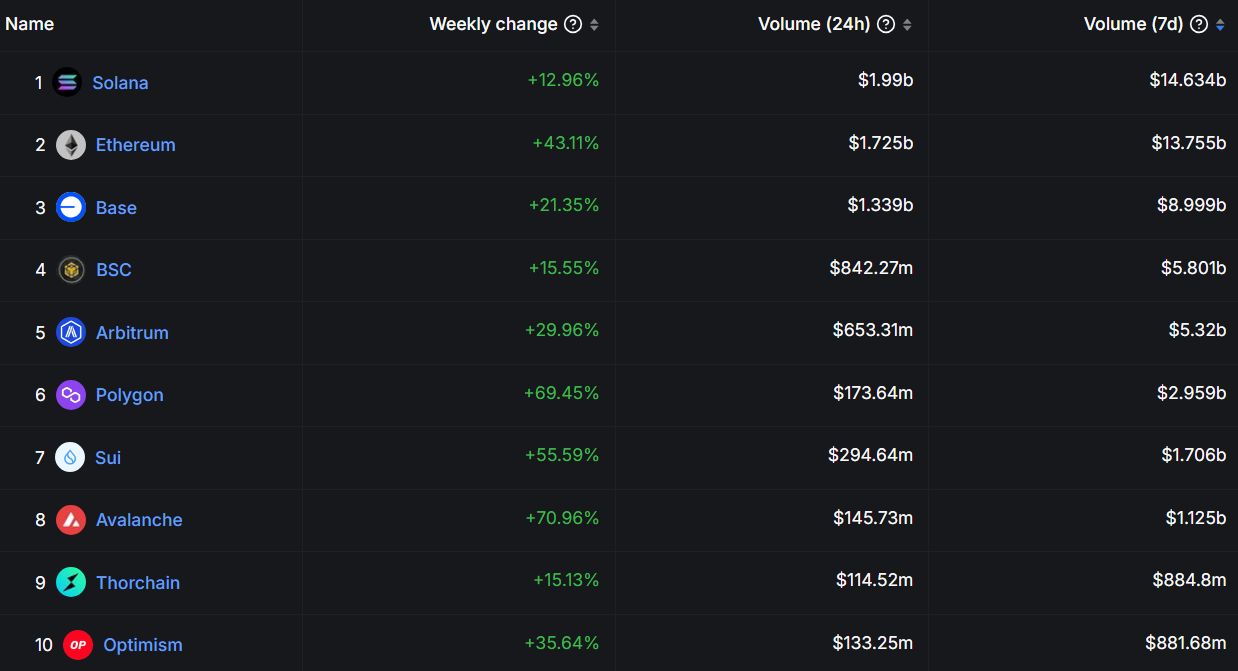

3. DEX Data

According to the latest data, Uniswap still maintains its leading position in the decentralized exchange (DEX) market. This week, the DEX on the Solana chain has continued to perform very well. The transaction volume of Solana's DEX in the past 7 days reached 14.634 billion US dollars, ranking first in the entire chain.

https://defillama.com/dexs

https://defillama.com/dexs/chains

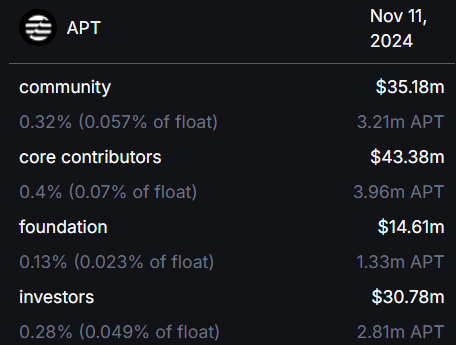

4. Token unlocking data

Aptos (APT) unlocked approximately 11.31 million tokens at 2:00 pm on November 11th (UTC+8), accounting for 2.18% of the current circulation and worth approximately $128 million. The unlocking event may have an impact on the market, and investors should pay close attention to relevant developments.

https://defillama.com/unlocks

3. Snap DeFi Radar

The DeFi Radar focuses on the macro trends and data insights of the DeFi market. KOL guests will be invited from time to time to share their views and deeply analyze the industry's hot spots and development trends.

This episode's guest: Cyrpto Paul

As Bitcoin hits a new high of over 90,000, everyone is beginning to expect that the overflow of funds can drive other sectors and lead a wave of altcoin season. It is very important to first understand the context and trends of the market. There are many sectors and currencies, which sector will be the leader?

Looking at the current DeFi ecosystem, the restaking narratives that were originally so aggressive have all fallen from the altar, and the market has begun to turn to the Meme asset issuance narrative led by pumpfun. We can think about how the Meme asset issuance can be extended to create different tracks.

The meme craze on Solana is already well known to the entire market, and other chains will definitely want to follow suit because the effect is very good. Base actually has great potential. After all, backed by Coinbase, the net inflow of funds in the ecosystem has continued to rise. The net inflow in the past month has even surpassed Solana. Funds are the key to determining market trends. We can pay more attention to what special tracks there are on Base.

Recently, SynFutures, the largest contract DEX on Base, launched Perp Launchpad. Any project with a market value of less than 1 million US dollars can apply. This is very suitable for low-market-cap Memes. It is equivalent to adding a contract market to pumpfun, promoting the liquidity of low-market-cap tokens and the utilization of on-chain funds. This can be regarded as a new variant track.

We can pay attention to the native currency on SynFutures' Perp Launchpad, because the best advertisement is to pull the price. If SynFutures wants to operate the Meme contract market seriously, it is necessary to pull the price of a native leading Meme. However, the volatility of Meme itself is huge, and the addition of contracts will increase the risk sharply. Hedging and hedging are necessary conditions for long-term survival in the market.

Net capital inflow chart: https://app.artemis.xyz/flows

Cyrpto Paul

Paul is a dual-wield player who is proficient in both contracts and chains. He started in the circle and made a fortune from NT$200,000 to NT$10 million. He knows what newbies want. He studies day and night like an owl, selflessly shares cryptocurrency information, and is committed to helping more people understand the cryptocurrency circle in depth.

- END -

【Disclaimer】: The market is risky, so be cautious when investing. This article is for learning purposes only and does not constitute any investment advice. Not Financial Advice, Do Your Own Research.