时隔1个多月,币安新一期Lanchpool终于来了。不过,跟很多人预想的不一样,这次打新的Usual并没有那么热门,包括笔者在内的很多老韭菜都踏空了。

究其原因,Usual做的是稳定币发行,很多老韭菜会自觉联想到上一轮牛市大火的算稳,每每听到这俩字都会联系到暴雷。直到今天,本人依然记得当年顶着上百U的Gas冲算稳,然后就没有然后了。

事实上,Usual跟大家理解的算稳完全不同。他们的稳定币由现实世界资产(RWA) 1:1 支持且完全合规,这些特征跟原先的算法稳定币截然不同。

参考官方介绍,Usual是一种多链基础设施,它将贝莱德、Ondo、Mountain Protocol、M0、Hashnote实体不断增长的代币化真实世界资产(RWA)整合在一起,将其转化为无需权限、链上可验证和可组合的稳定币USD0。

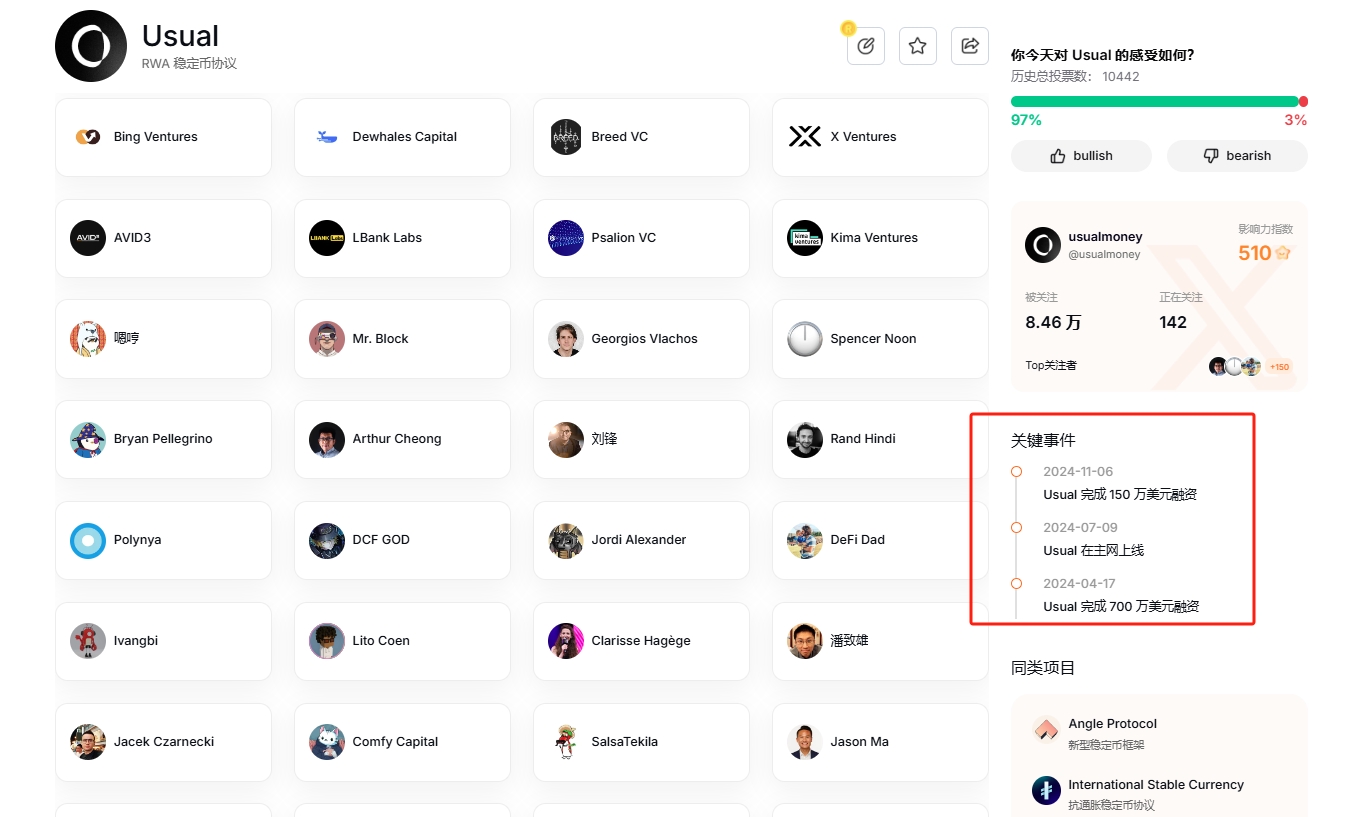

今年4月,Usual宣布完成700万美元融资,IOSG和Kraken Ventures领投,GSR、Mantle、Starkware、Flowdesk、Avid 3、Bing Ventures、Breed、Hypersphere、Kima Ventures、Psalion、Public Works和X Ventures等参投.

7个月后,Usual宣布完成150万美元新一轮融资,Comfy Capital、早期加密项目投资方echo、Breed VC创始人Jed Breed等参投,具体估值数据未披露。

也就是说,Usual公开披露的融资金额只有850万美金,这个规模跟那些动辄融资千万甚至过亿的项目相比,显然不是一个量级。但是,当大多数人在撸那些天王级项目时,Usual直通币安了,如果此前没撸过可以参与Lanchpool挖矿。

踏空归踏空,对于Usual这个项目的研究还是不能错过的,毕竟人家实打实上了宇宙所,还是有几把刷子的。

1.创始人:曾是法国总统政治顾问

Usual CEO Pierre Person曾是法国国会议员,主要从事货币政策方面的工作,还给法国总统马克龙当过政治顾问。

2022年,这哥们创立Usual,旨在通过去中心化数据来重建一个稳定的反馈机制,让用户可以获得更多的数据所有权。

时至今日,Usual平台总TVL已超过3.7亿美元。

2.USD0:首个流动存款代币

USD0是Usual提供的首个流动存款代币(LDT),由真实世界资产(RWA)以1: 1的超短期限支持,确保其稳定性和安全性。同时,USD0作为聚合各种美国国库券代币的RWA稳定币,可以通过两种不同的方式铸造:

①直接RWA存款:用户将符合条件的RWA存入协议,1: 1获得等值的USD0;

②间接USDC/USDT存款:用户将USDC/USDT存入协议,1: 1接收USD0。这种间接方法涉及第三方抵押品提供商,他们提供必要的RWA抵押品。

3.$USUAL:总供应量的90%分配给社区

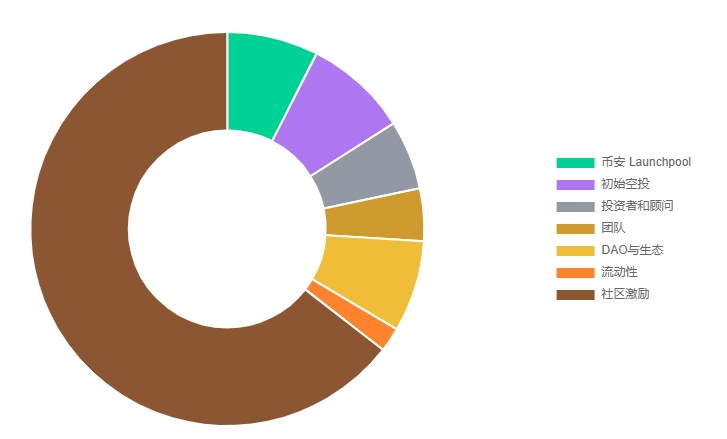

$USUAL 总供应量 40亿枚,初始流通12.37%,其中币安Launchpool份额7.5%。

官方文档中强调,代币总供应量的 90% 将分配给社区,10% 分配给内部人员(团队、顾问、投资者),确保用户公平分配和真正的参与。

作为官方治理代币,$USUAL持有者未来将拥有平台协议的实际收入、未来收入和基础设施所有权。

值得注意的是,USUAL是通缩性的,就像比特币的减半机制,越早参与分配的代币就会越多。

更多项目信息,可查阅币安研报:https://www.binance.com/zh-CN/research/projects/usual