Quick Reading

✅ Macro market summary

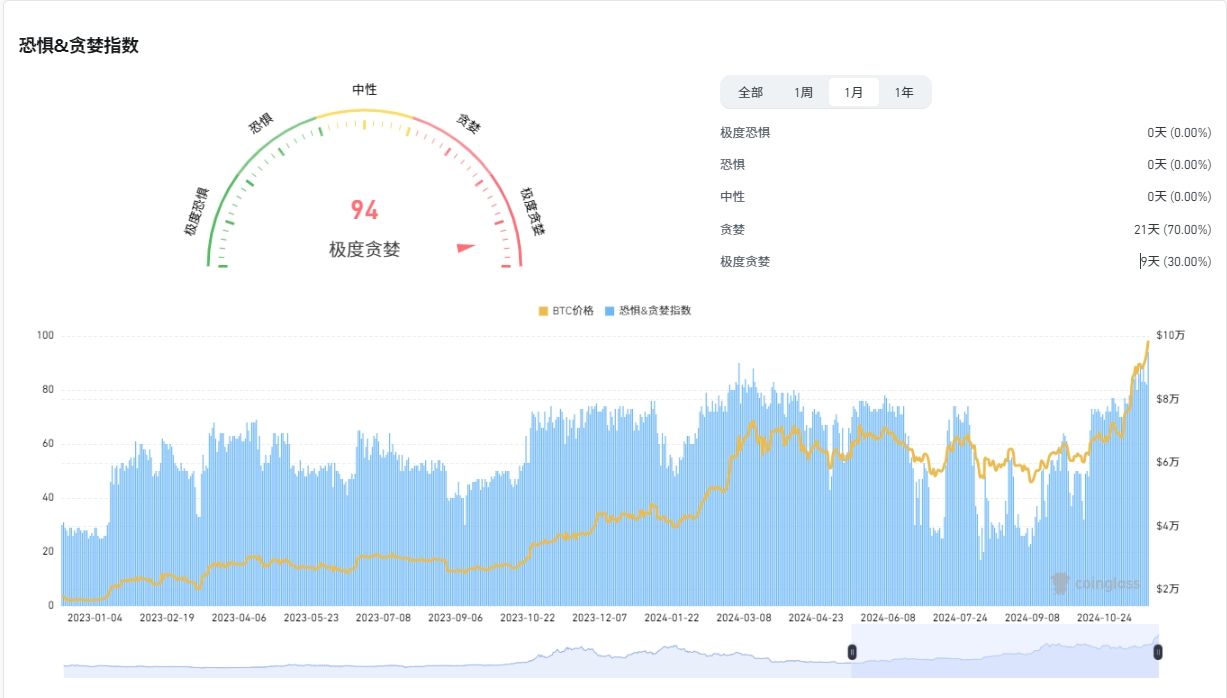

Market sentiment index : 90 (previous value) → 90 (current value)

Bullish sentiment:

- U.S. stocks continue to maintain an upward trend to provide support for the currency price

- Trump's market ignites bullish sentiment in crypto markets

Bearish sentiment:

- SOL12.26 faces a large number of unlocks

- 12.27 is the delivery date for options and futures, and the market is expected to experience large fluctuations

📊Market summary

- BTC is approaching the 100,000 mark, and subsequent positions should not be too aggressive

- The USDC premium index is better than expected, and institutional funds are moving forward steadily.

- The trading on the market is active, and the probability of capital diffusion is high

🔥Summary of popular tracks

- BTC hits the 100,000 mark, altcoins generally rise, and the pace of MEME slows down.

- The greed index has reached 98 and is about to reach its peak, so you need to pay attention to the risks.

- The rise of DeSci on the track surface brings new exposure to the copycat market to investors.

in conclusion:

On the one hand, this week, as BTC is about to break through the 100,000 mark, the altcoin market has generally followed the rise, and the MEME track has begun to die down. It may take some time to adjust and wait for the next heavyweight narrative to appear before it can bring about the myth of getting rich quickly again.

On the other hand, the rise of the DeSci track has opened up new risk exposure for the copycat market. The relatively low market capitalization track and higher odds are suitable for investors with higher risk appetite to learn about.

📌Popular Projects

1. AminoChain (DeSci, Infrastructure)

Cause of heat

- DeSci meme hot

- Head mechanism push

- New narrative hype

Recommended attention

- Related early projects

- DeSci Ecosystem Development

2. Open Loot (games, gaming platforms)

Cause of heat

- OKX spot trading launched

- Built by Big Time Team

- Fair token distribution

Recommended attention

- Subsequent price trend

- Overall platform construction

Key data release date

(The following content is the full version of this issue of Observation).

1. Macro Analysis

1. Market Overview

1.1 Comparison between Bitcoin and traditional financial markets (such as US stocks and gold)

- Bitcoin vs. Gold: Comparison of properties as safe-haven assets.

- Bitcoin and Nasdaq: As BTC market cap grows and ETFs are approved, correlation with the stock market becomes stronger.

BTC showed a stronger upward trend compared to Nasdaq. Nasdaq had a certain degree of correction this week, but it is still in an upward trend. Gold also recovered its previous losses and resumed its upward trend.

2. Macro Column

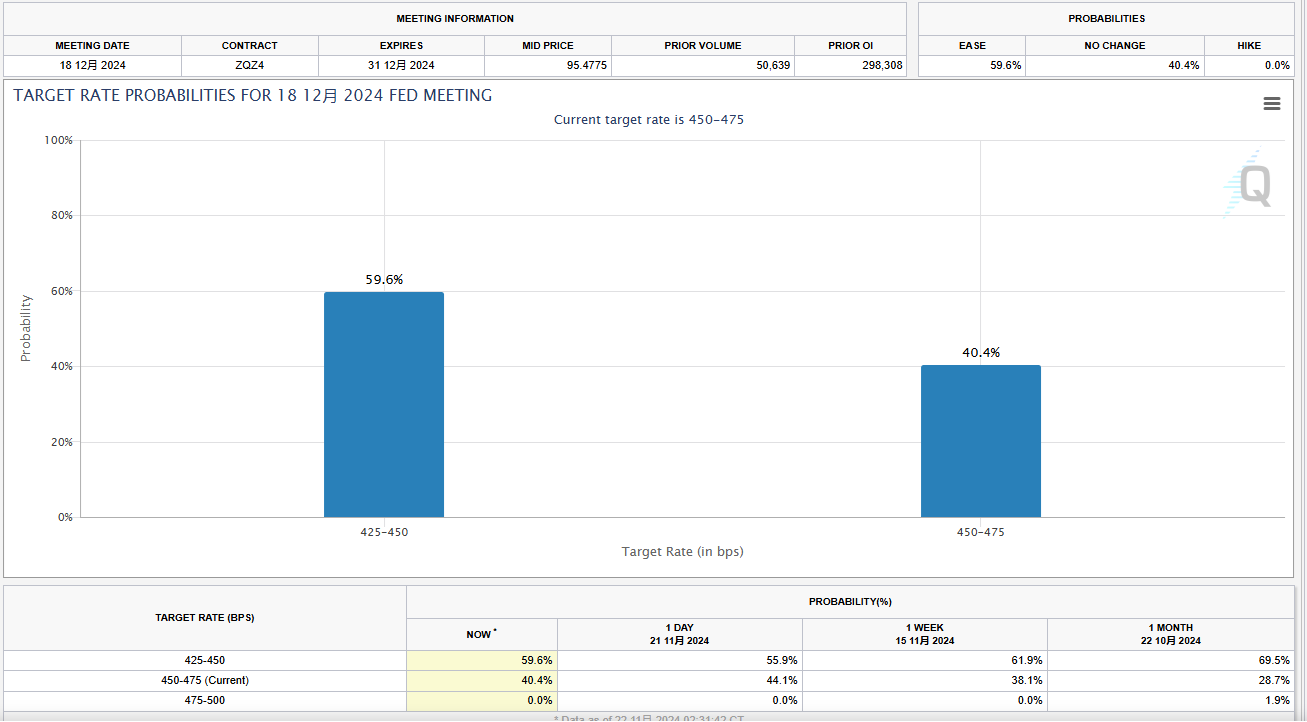

2.1 Probability of the Federal Reserve cutting interest rates in December

- Current target rate range: 450-475 bps

- Market expectations for future interest rate changes: For the Federal Reserve meeting on December 18, 2024, the market's expectations for interest rates are distributed as follows:

Probability distribution

- Probability of rate cut to 425-450 bps: 59.6% More than half of market participants expect the Fed to implement a rate cut in the future, lowering the target rate to 425-450 bps. This probability has increased slightly compared to 1 day ago (55.9%), reflecting that market expectations for rate cuts are increasing.

- Probability of maintaining the current interest rate (450-475 bps): 40.4% Nearly 40% of market participants still believe that the Fed will choose to stay put and maintain the current interest rate range. Compared with one week ago and one month ago, the expectation of maintaining the current interest rate has increased.

- Probability of a rate hike to 475-500 bps: 0% The market has completely ruled out the possibility of a rate hike, which shows that investors generally believe that the current economic environment does not support tighter policies.

2. Industry Analysis

1. Fund Flow

1.1 Stablecoin Fund Flow

Although the issuance of stablecoins this week has slightly decreased compared to last week (-407 million), the overall daily flow average is still in a strong range.

1.2 ETF Fund Flow

This week, all ETFs were in a state of net inflow, with a total inflow of 3.335 billion, which was more than the sum of the previous two weeks. The stable inflow of ETFs also laid the foundation for BTC prices to continue to break new highs.

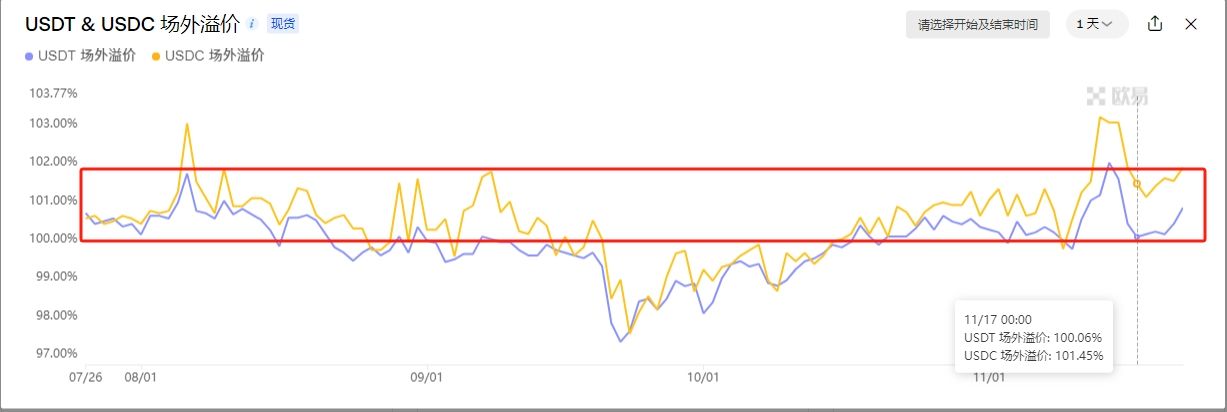

1.3 Analysis of premium or discount in OTC transactions

After the OTC premium and discount reached an extreme value last week, it returned to the range this week. It can be clearly seen that the premium difference between USDT and USDC has widened, with USDC performing strongly, but the overall level is still above water.

The exchange balance also increased significantly this week, with USDT showing the most obvious performance, with an inflow of 3 billion (balance of 32.23 billion) and USDC inflow of 293 million (balance of 3.265 billion). This is also one of the possible reasons for the increase in the premium difference between USDC and USDT.

2. Derivatives market data

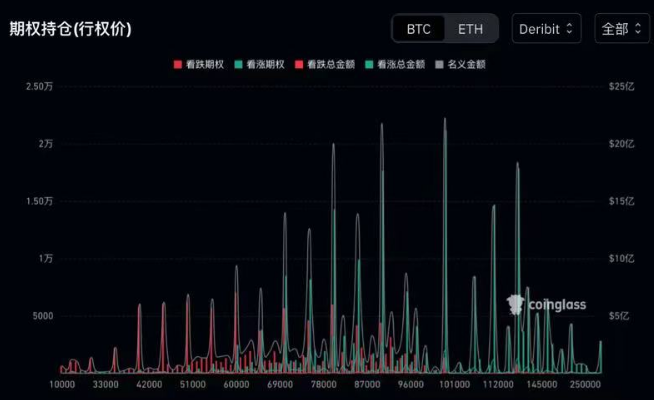

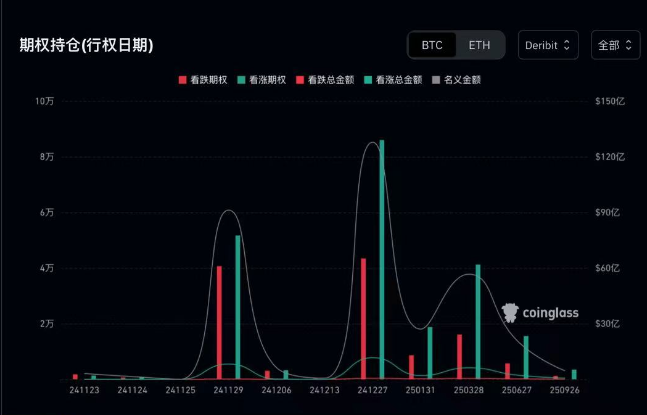

2.1 Options Market

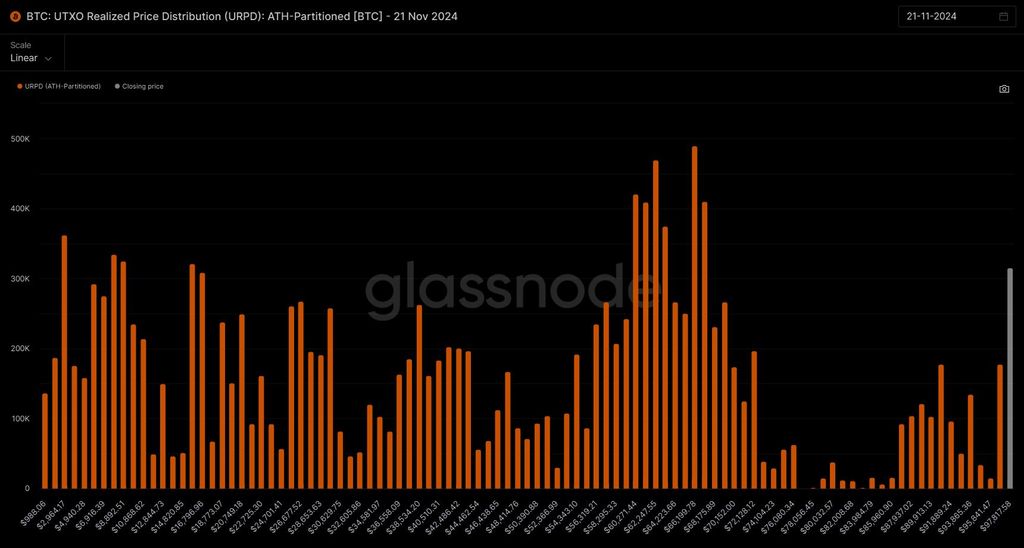

The strike price of the options market has shifted to the right to a greater extent than the chip peak of the previous period, from 90,000 last week to the 101,000 range, indicating that the market is very confident that BTC will hit 100,000, and the market has also shown a strong optimistic expectation.

Currently, the main options are concentrated on the options for delivery on December 27 at the end of the year. The witching day at the end of the year will be an important turning point for the switching of market sentiment. It is necessary to focus on monitoring the volatility and market sentiment shift on that day.

2.2 Contract Market

Funding Rate

The funding rate has not reached the previous high, indicating that the market still has room to rise, and the fomo sentiment has not reached a high point. It is necessary to pay attention to the abnormally large amount of funding rate, which is likely to be a peak signal.

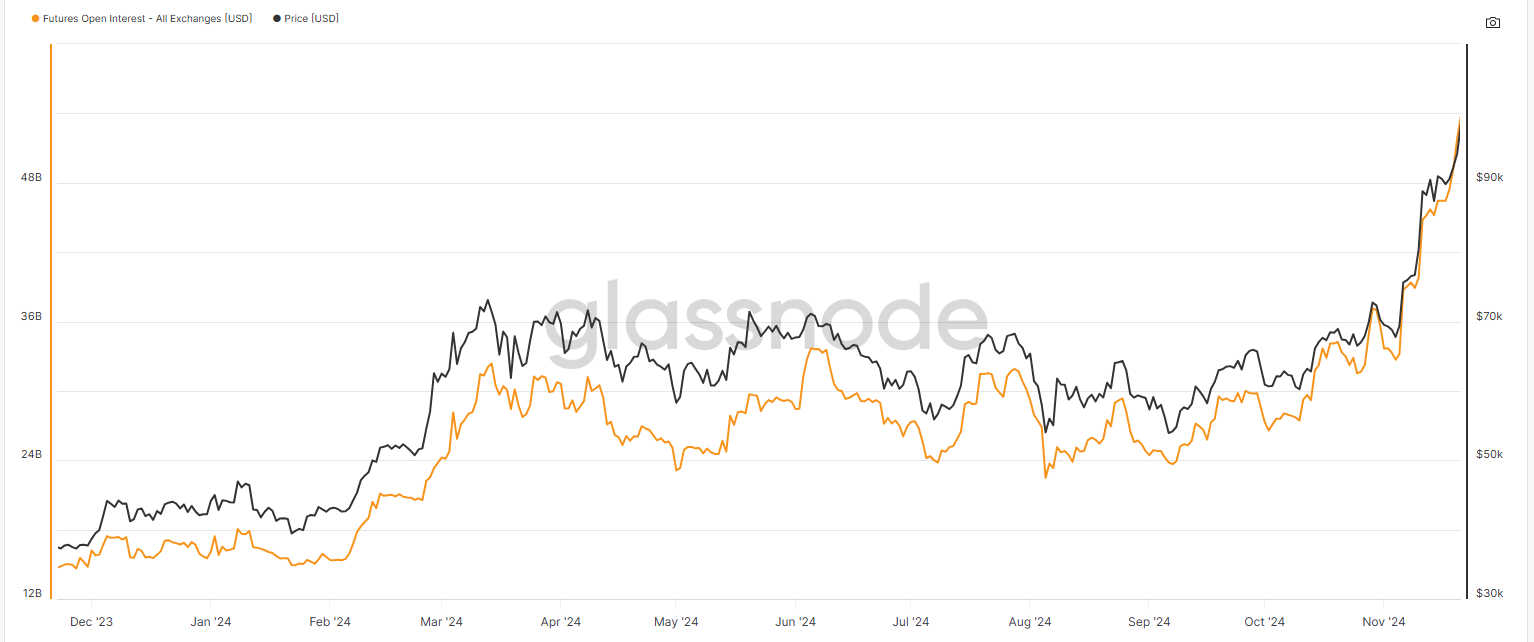

Futures Open Interest

The contract holdings have soared recently. The market speculation sentiment is brewing and continues to remain high. It is necessary to pay attention to the chip gathering area in the liquidation map and pay attention to the situation of BTC callback or pull-up to judge the market direction.

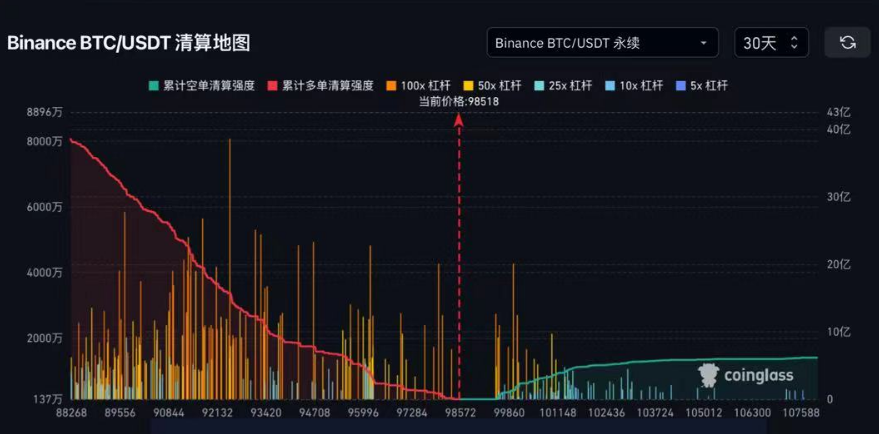

Clearing Map

The 30-day chips are concentrated around 920,000~93,000. If the callback touches this range, there will be a large liquidation, which needs to be paid close attention to. If it approaches this point but does not fall below it, it may become a good entry time for short-term trading.

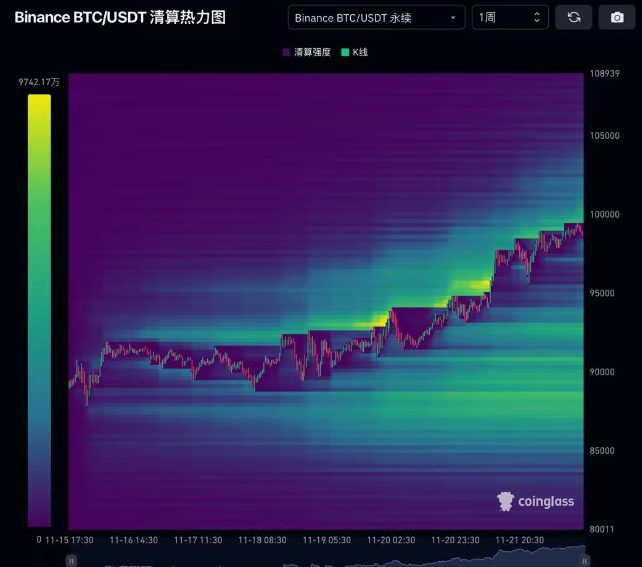

The 7-day liquidation map shows that 95,000 still gathers a lot of chips. If it falls below, it may fall back to 93,000. If it stabilizes, it is expected to hit 100,000.

3. Related price indicators

3.1 Cryptocurrency Market Value and BTC Market Share

The market value of cryptocurrencies also hit a new high this week, reaching 3.41 trillion, a year-on-year increase of 12.9% compared to 3.02 trillion last week (15th). BTC's market share reached 60.5%, and it has also reached the resistance level ahead. If BTC's market share remains flat at its current position, overall funds may overflow to other currencies.

3.2 BTC Transaction Volume

The overall trading volume of BTC is also in a very active state. Although the volume has declined this week, it is still in a strong period overall.

3.3 Greed Index

As BTC is about to break through the 100,000 mark, the greed index has reached its annual extreme, reaching 94.

4. On-chain market data

4.1 On-chain address data

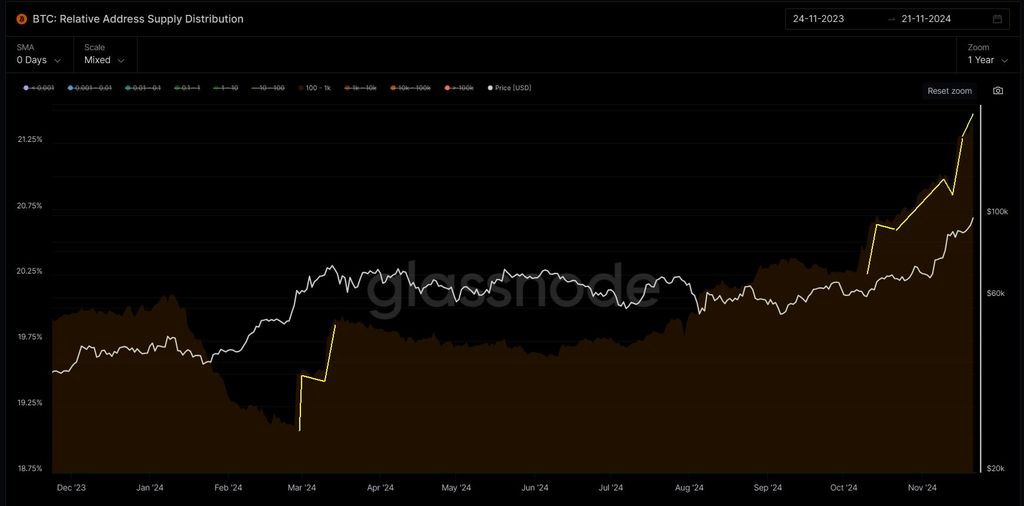

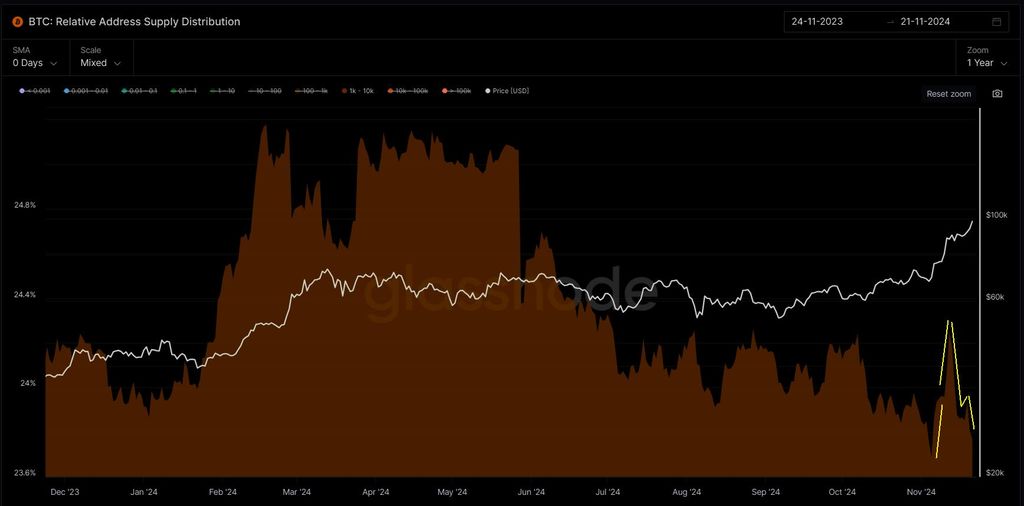

In the on-chain data, the number of addresses and holdings of 100-1K continued to grow, but the holdings of addresses with holdings of 1K-1W further decreased as the price rose, and there was a reduction in holdings.

4.2 On-chain chip data

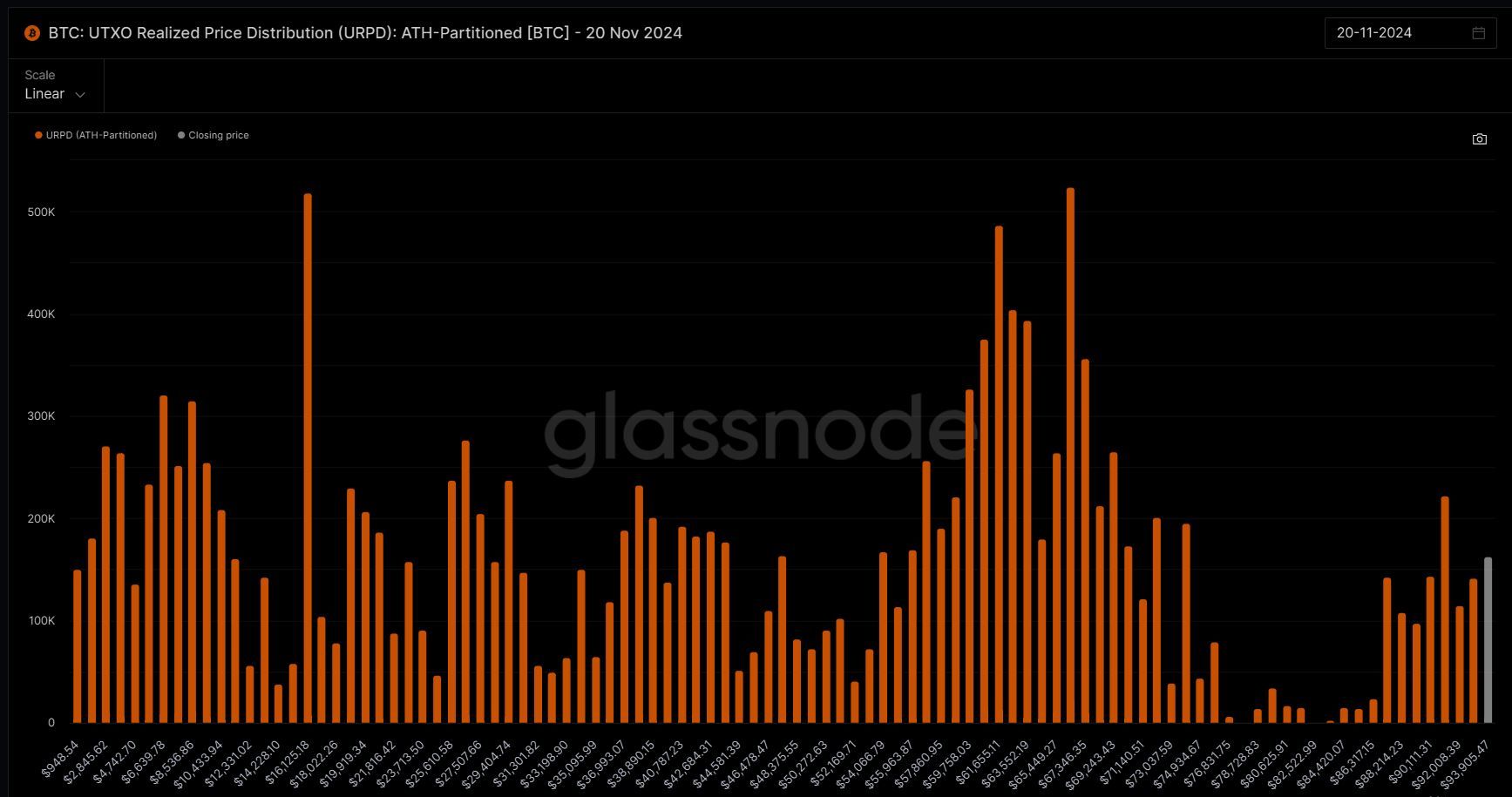

This Friday, 1.62% of the chips appeared at 97307.92, and 0.93% of the chips appeared at 98300.86. Combining the price and time of this week, it means that 2.55% of the chips on the chain were transferred upward on Thursday and Friday. The price rose so fast that a gap appeared near 95,000.

We combine the chip structure of Wednesday below. Note that when the price reached a new high of 93900 on Wednesday, there were still 0.82% of chips around 93905. On Friday, the highest column near the new high, 97307, had 1.62% of chips, indicating that some chips could not be held and profit taking began at 97000. However, the chips below 60,000-70,000 still showed a double peak structure, and the overall structure was not destroyed.

4.3 On-chain related indicators

After four to five days of adjustment, the MVRV indicator of short-term chips has risen again as prices rise, and is still in the high area.

5. Technical analysis and trading strategies

5.1 Technical analysis this week

As we mentioned in our weekly report last Saturday, the current market is undoubtedly a strong market. Both from the perspective of capital and on-chain data, it supports a strong long market. Judging from the four-hour line, the market has not been fully released, and there is a possibility that it will continue to hit new highs in the short term of two or three days.

This week, the market experienced a sideways adjustment from the 16th to the 18th (yellow line in the figure), and a short upward attack on the 18th (white line in the figure). It is obvious that there are two phenomena: one is the twists and turns of BTC's K-line (long Yin and Yang), and the other is that ETH's rebound is suppressed by 3200. From a short-term perspective, this place is not a strong performance, and it should be adjusted in the short term, but what is outrageous is that BTC does not adjust when it should (note the comparison with ETH here), which shows that although it did not rise before, BTC shorts did not have enough power to smash the market, so the market continued to rise. On Thursday night, combined with the news that the SEC chairman resigned, ETH was directly brought up.

5.2 Trading suggestions for next week

Let's analyze the current market situation. This article was written at 8 pm on the 22nd. The weekly average is above the 21-week average, and the weekly MACD opening is expanding. It is still in the technical strong stage. The daily MACD is strong again. The overall market is still based on long-term thinking. However, the MACD indicator is too high, obviously at a high level. We all know that it has risen from 70,000 to 98,000 in three weeks. This kind of rise is unsustainable, and the US stock micro-strategy has already experienced a callback. Although BTC did not show a callback on Thursday night, I tend to think that ETH has just pulled up, and the overall market sentiment is enthusiastic and has withstood the callback.

100,000 is just around the corner. It may have reached a new high when the weekly report is issued this week. From the perspective of market psychology, 100,000 is an integer point. In transactions, previous highs and lows and integers often play an important role. After breaking through a key position, it loses its reference. Historically, in March and April this year, it broke through the previous high, and then began to fluctuate and pull back at the previous high position. In terms of the degree of breaking the circle, 100,000 has already had a strong publicity effect in traditional media. From the perspective of market operation, whether it breaks through 100,000 or not, it has reached this position, and it is very likely that there will be a significant pullback next week.

In terms of trading strategy next week, existing long positions should be reduced when the market is high, leaving some bottom positions and not increasing them. If there is no obvious sudden sell-off or obvious weekly adjustment, no more heavy long positions, but short-term short-term betting on small waves can be achieved. There is no peak in the bull market, so pay attention to risk control.

3. Market Heat and Public Opinion

1. Overview of Shanzhai

Abstract:

- BTC hits the 100,000 mark, altcoins generally rise, and the pace of MEME slows down.

- The greed index has reached 98 and is about to reach its peak, so you need to pay attention to the risks.

- The rise of DeSci on the track surface brings new exposure to the copycat market to investors.

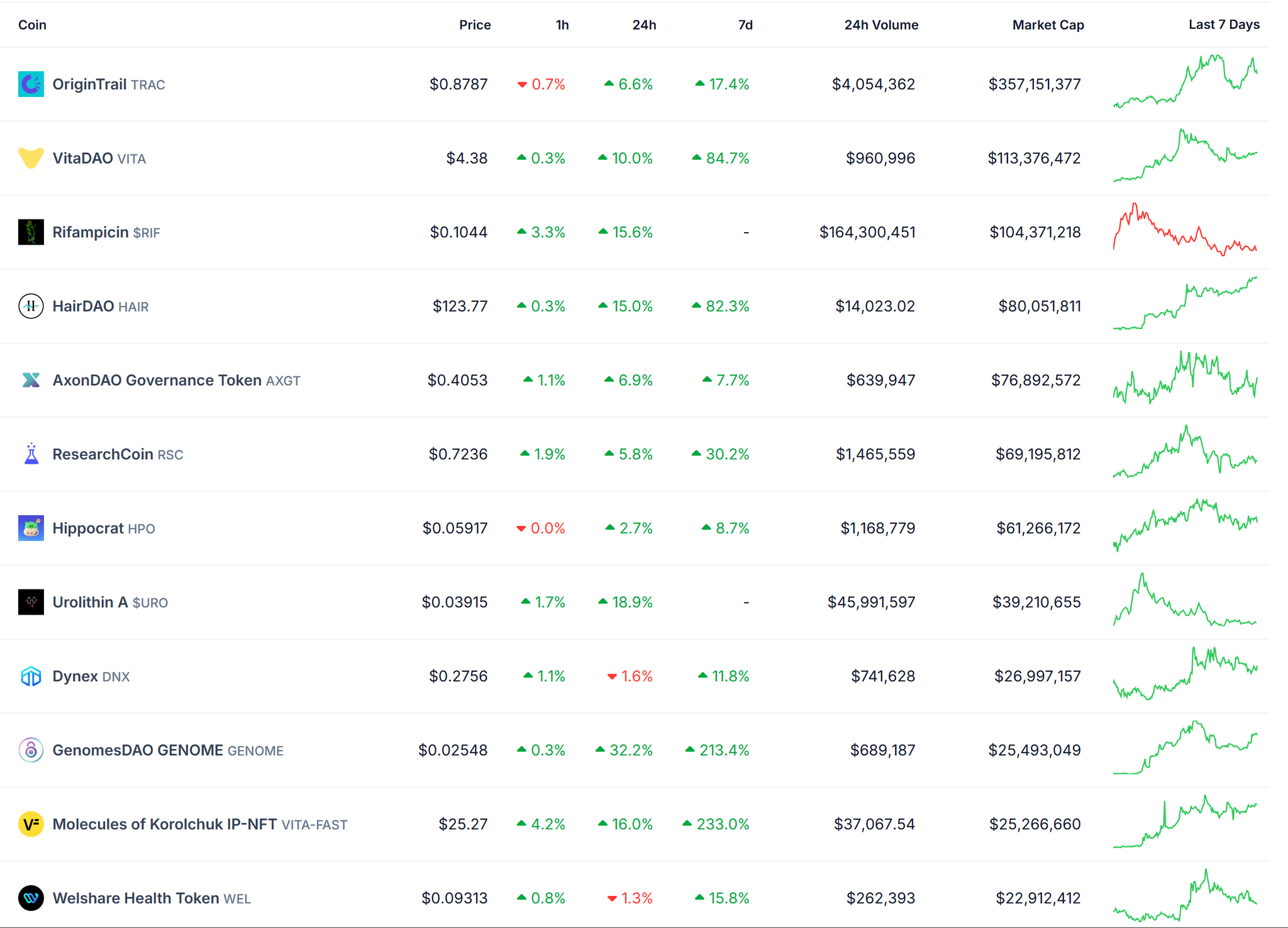

1.1 List of copycat stocks with the highest growth rate

This week, BTC hit the $100,000 mark, and the altcoin market generally rose by 10-30%. Some tokens rose by more than 50% or even doubled. The overall market situation was relatively optimistic. MEME, which was relatively strong last week, temporarily died down this week and entered a period of adjustment.

1.2 Fear and Greed Index

The market sentiment index and CMC sentiment index have reached extreme greed and are about to reach their peak.

The BTC sentiment index has reached a one-year high again on Friday after a long period of panic range fluctuations. According to past experience, a peak in sentiment may lead to a correction. $100,000 is an important threshold for BTC, and there is a possibility of a correction after a breakthrough, so we need to pay attention to risks.

1.3 Key indicators

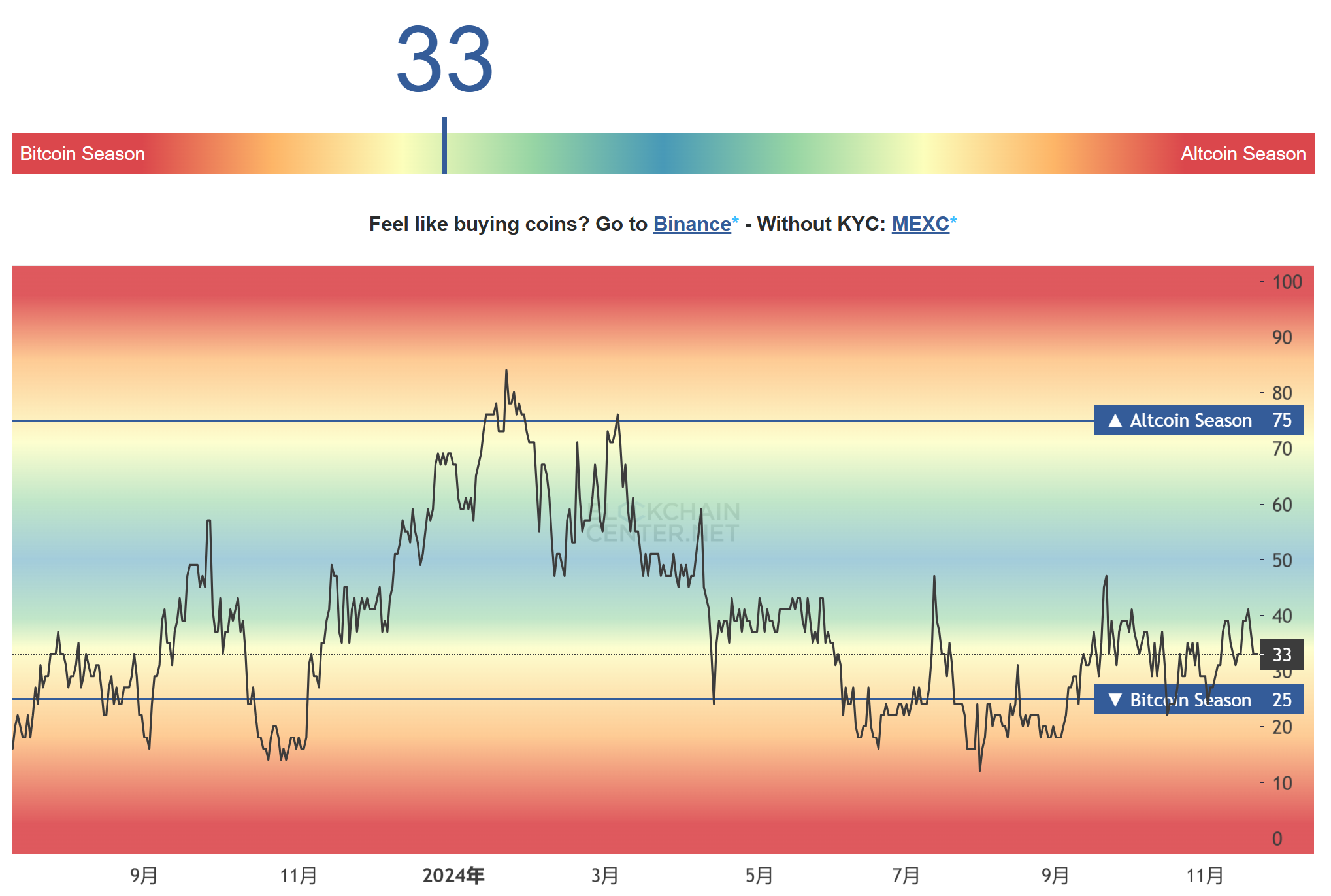

The Alt Index shows that we are at 33 and some altcoins are already showing signs of starting up.

This Friday, BTC’s market share is still at 60%, with no downward trend for the time being.

TOTAL3 has confirmed that it has broken through the bull-bear conversion resistance in March and April 2022, and the buying volume of altcoins this week is relatively considerable.

However, the USDT market share has often fallen below the trend and has not rebounded again in the triangle, which also indirectly shows that the copycat buying volume this week is relatively considerable.

1.4 Copycat inflow

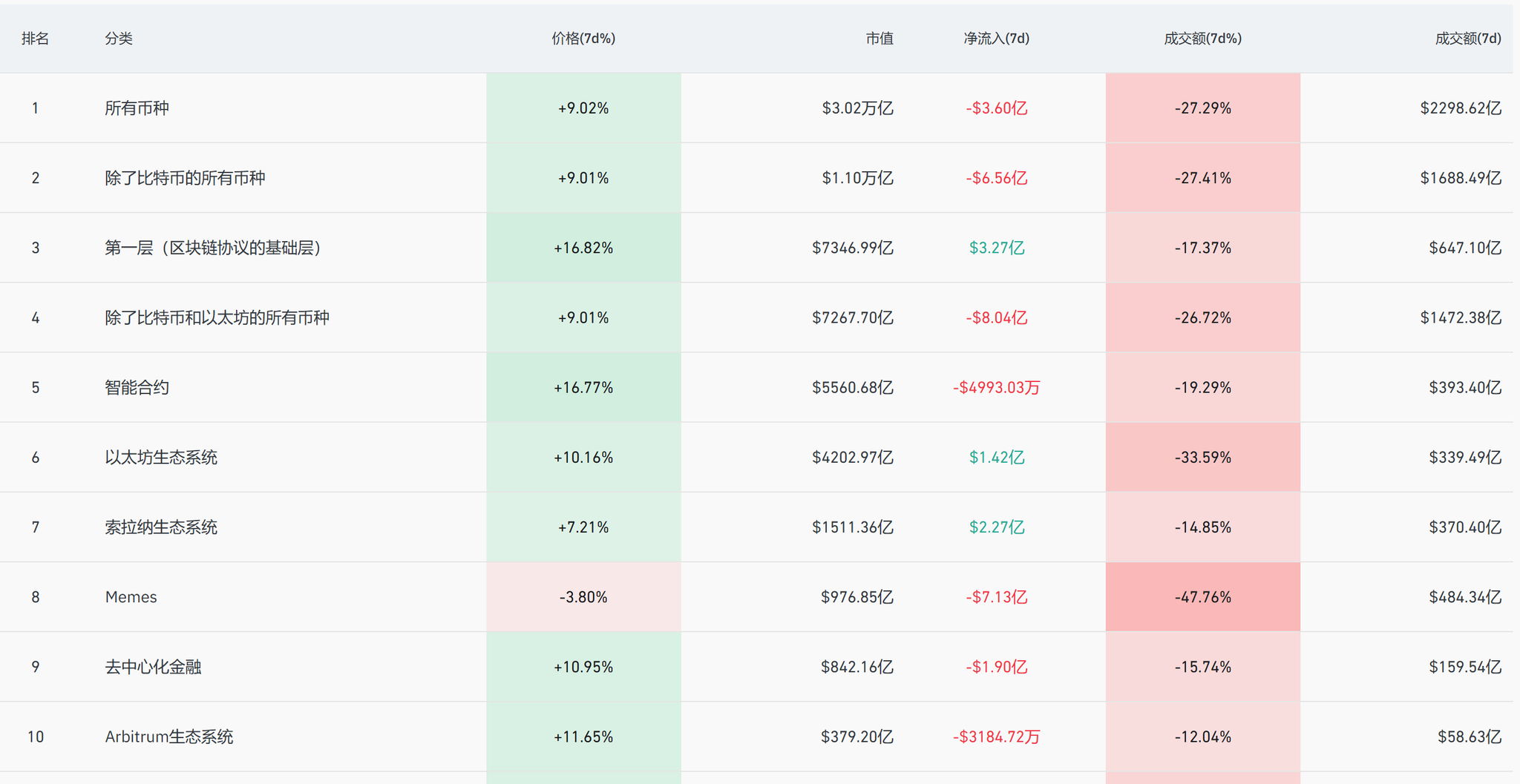

This week, the net outflow of all currencies was 360 million US dollars, and the transaction volume decreased by 27% month-on-month. However, it can be seen that the market inflow during the week was focused on the ETH and SOL ecosystems. The MEME sector had a net outflow of 700 million US dollars, and a receding tide has appeared.

1.5 Track Ranking

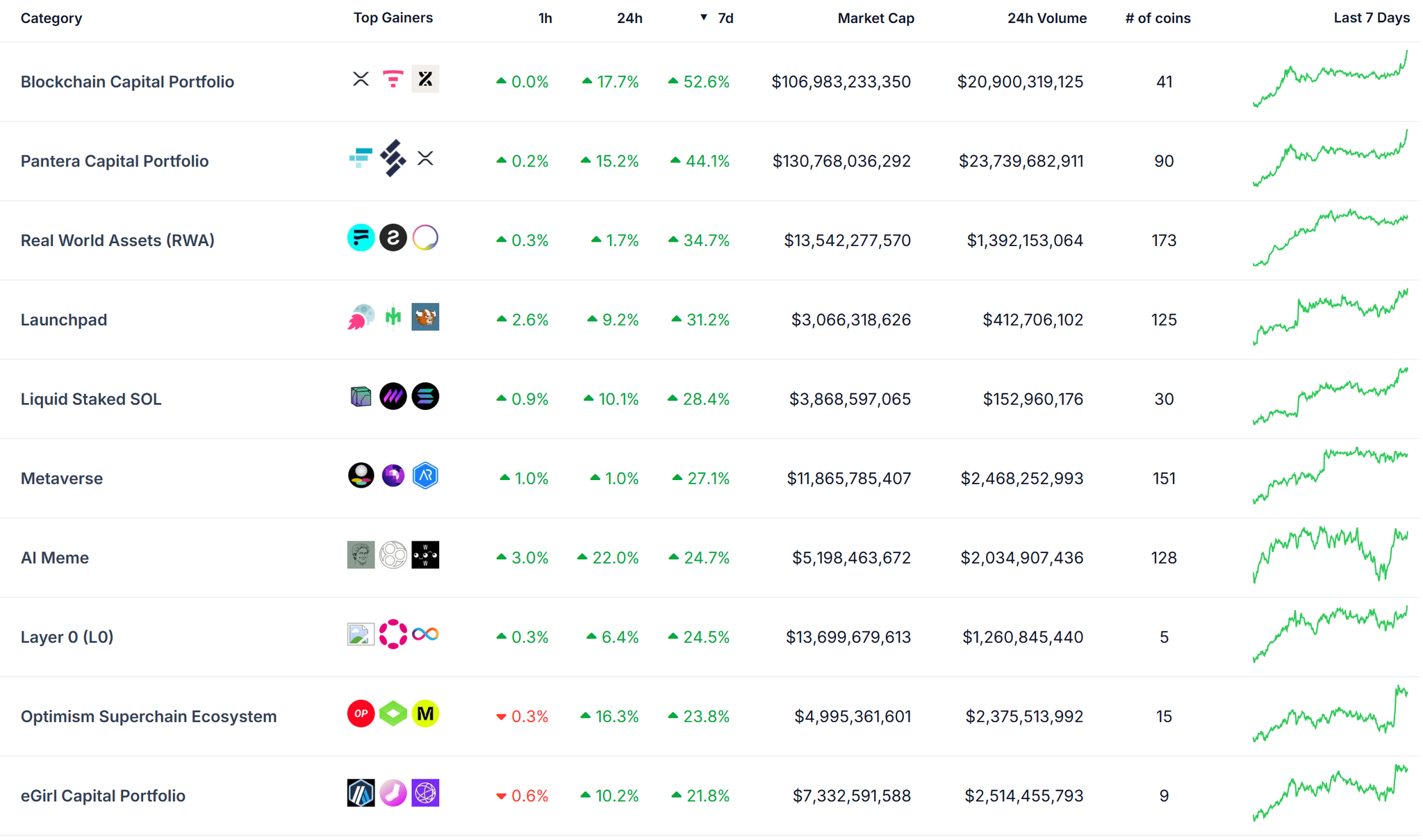

This week’s Coingecko gainers list is as follows:

It can be seen that many tracks are on the list, but most of them are launched with the market, without any special benefits. After our screening, the track that should be paid attention to this week is DeSci (decentralized science).

DeSci aims to use Web3 technology to build public infrastructure (fundraising, publishing, review, data openness, commercialization, etc.) to support the movement of scientific research and try to change and innovate traditional science. It does not rely on centralized institutions and intermediaries, but implements decentralized knowledge creation and dissemination practices to promote knowledge sharing and scientific progress.

The rise of DeSci was mainly influenced by CZ and V God, who attended the DeSci conference, and then Binance announced its investment in Bio Protocol, which ignited the entire track.

There are not many targets in the track at present, mainly some small and medium-sized market value projects, and some old projects such as TRAC have also been affected and have seen an increase.

We have also recommended the ResearchHub and AminoChain projects in our public opinion, and Teacher Dong will give you a detailed introduction.

Summarize

On the one hand, this week, as BTC is about to break through the 100,000 mark, the altcoin market has generally followed the rise, and the MEME track has begun to die down. It may take some time to adjust and wait for the next heavyweight narrative to appear before it can bring about the myth of getting rich quickly again.

On the other hand, the rise of the DeSci track has opened up new risk exposure for the copycat market. The relatively low market capitalization track and higher odds are suitable for investors with higher risk appetite to learn about.

2. Review of public opinion strategies and hot topics

2.1 Short-term public opinion summary (one week)

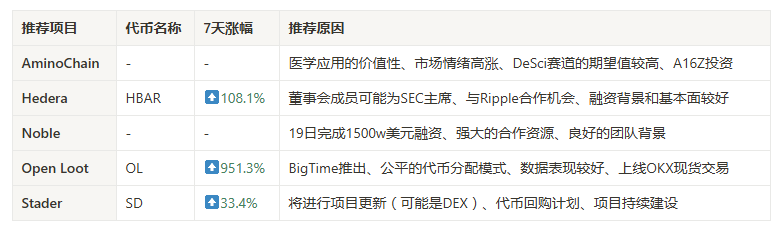

2.2 Popular Projects

1️⃣ AminoChain (DeSci, infrastructure)

Cause of heat

- DeSci meme hot

- Head mechanism push

- New narrative hype

Recommended attention

- Related early projects

- DeSci Ecosystem Development

AminoChain's mission is to build a new bioeconomy that connects medical institutions, streamlines translational research, and puts patients at the center of scientific progress. It also connects global biospecimen and research data repositories to power the next generation of preclinical research economy.

DeSci The Wind Blows

DeSci is based on blockchain technology and the concept of decentralization, aiming to revolutionize an emerging trend in scientific research, funding, and knowledge dissemination, as traditional scientific research often faces problems such as centralized research funding, data monopoly, and high fees from academic publishers.

Recently, with the meme craze of Pump.Science on the chain (a platform launched by Molecule DAO on Token 2049, where users can purchase drug meme tokens and participate in prediction and data transactions), the development of the DeSci industry has been driven. The biological concepts $RIF and $URO, the donation concept Scihub, and the quantum entanglement concepts $PRO and $ANTI have all seen good growth.

$RIF price trend source: GMGN

Previously, Binancelabs and a16z announced their first foray into the field by investing in BIO Protocol and AminoChain respectively. At the Desci Day event in Bangkok, Vtalik Buterin showed CZ VitaDAO's first long-lived product, VD001. The trend in the cryptocurrency industry is getting stronger and stronger towards DeSci.

Still in the early stages

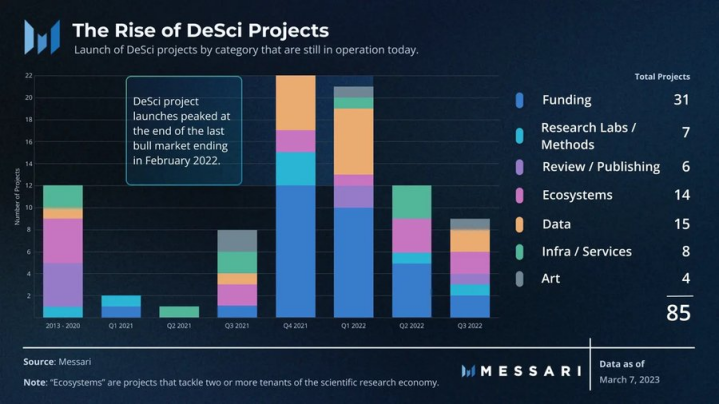

DeSci is an emerging ecosystem that has not yet been battle-tested. Most of the projects in it were launched in the past two and a half years, starting at the peak of the last bull market in the fourth quarter of 2021. Most of the protocols have not yet been fully launched on the mainnet. There are many emerging DeSci ecosystem designs. It remains to be seen which projects can successfully achieve value acquisition and maintain long-term development.

DeSci project launch source: Messari

2️⃣ Open Loot (games, game platforms)

Cause of heat

- OKX spot trading launched

- Built by Big Time Team

- Fair token distribution

Recommended attention

- Subsequent price trend

- Overall platform construction

Open Loot is a complete solution designed for launching games with a Web3 economy. It helps partners fully manage NFTs and tokens while providing players with an extremely smooth and easy-to-use experience.

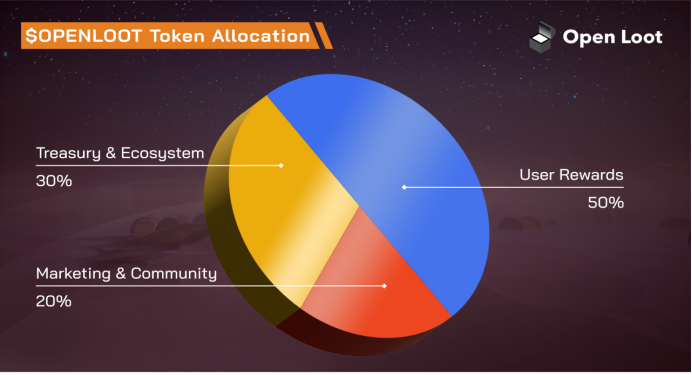

Fair token distribution model

Open Loot is the largest Web3 marketplace built by the studio behind the BigTime game. In October 2023, Big Time released a new game economy system, which achieved remarkable results, generating more than $150 million in revenue, and four other partners plan to launch their own game economies by the end of 2024. $OL was launched with a fair distribution model, with a supply cap of 5 billion, no fundraising, no token sales, no allocation to the team, and no shares provided to early investors, reflecting a true community drive. 50% of it is used for user rewards and game studio activities, 20% for marketing and community activities, and 30% for ecosystem development.

OL Token Economics source: Official Document

Because users exchange bigtime for OL to participate in game ecological activities, and more OL can be exchanged through game activities, it will cause bigtime deflation to a certain extent. In turn, the resources of the entire bigtime will also drive the development of the platform. Later, as the market's funds overflow and attention shifts, the entire project may have opportunities.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / Nora / WolfDAO

Editor: Punko

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, communication, research or appreciation only.