Original: Ignas

Compiled by: Yuliya, PANews

On the surface, cryptocurrencies appear to be booming: After years of exclusion, spot ETFs finally came online, and Bitcoin (BTC) and Ethereum (ETH) ETFs set new records for inflows. Trump's victory brought cryptocurrencies closer to mainstream power in the United States, and the crypto lobby successfully pushed Gary Gensler and skeptics out of office. Today, cryptocurrencies have become a recognized industry, and Bitcoin may even be considered a national reserve asset by some countries.

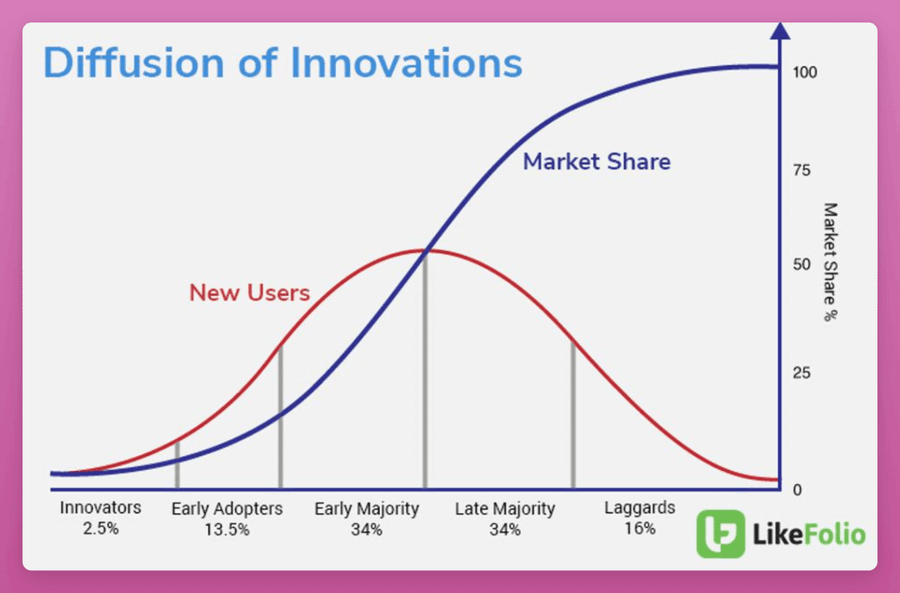

While the price outlook for cryptocurrencies is bullish, most of the gains are driven by external macro factors. However, the cryptocurrency industry’s internal innovation engine is gradually slowing down. As the industry matures, innovation will naturally slow down, but even if innovation slows down, prices may still rise.

However, the slowdown in innovation is not the root problem, but a symptom. The real problem lies in waning ambition and growing risk aversion. Once upon a time, cryptocurrencies were driven by radical ideas that aimed to change the world. Today, the industry seems content to pursue regulatory approval and institutional adoption.

This is also supported by Vitalik Buterin in his 2023 blog post “Reclaiming the Cypherpunk Spirit of Ethereum” : “We are not just creating isolated tools and games, but building a more free and open society and economy in an all-round way, in which different parts of technology, society, and economy can be integrated with each other.”

Think about it: what is the innovation of the current cycle? AI x Crypto is one of them. But AI is an external innovation, without it, this cycle might be different and might continue to focus on meme coin trading.

The only real goal of Memecoin is to get rich quick, not to change the world . Once rich, the problems of the outside world no longer seem to bother the participants. It is worth noting that declarations such as "[project name] is the most egalitarian thing we have ever seen. It is ambitious and, if successful, can truly reshape the fabric of society" are no longer seen frequently. In contrast, the previous cycle did witness several radical innovations:

• Decentralized Finance (DeFi)

• Non-fungible tokens (NFTs)

• DeFi yield farms

• P2E games (such as Axie Infinity)

• Metaverse

The 2020-2021 cycle was also the peak of innovation in token economics, with the emergence of innovative concepts such as Ampleforth's Rebasing Tokens, veTokenomics, (3,3) model, liquidity mining, and SNX as sUSD collateral, as well as the emergence of a variety of algorithmic stablecoins.

However, current crypto projects and the venture capital firms behind them prefer to adopt proven simple economic models to reduce risk, as they usually only have one chance at a token generation event (TGE). $EIGEN's Intersubjective Token is a rare innovative exception.

In contrast, the ICO boom in 2017 is considered the peak of the crypto industry's ambitions, when many projects attempted to decentralize everything, but most of them failed for being too radical, with only a few projects surviving and having to tone down their visions.

These crazy ideas have difficulty getting funding in today’s more risk-averse cryptocurrency industry, but these radical concepts once attracted a group of people who dreamed of changing the world.

In their book "Boom: Bubbles and the End of Stagnation", B. Hobart and T. Huber point out that transformative progress often comes from small groups with a unified vision, which are usually well-funded but lack strict accountability mechanisms. They believe that although financial bubbles are often seen as negative phenomena, history shows that many important breakthroughs were driven by bubbles.

While the days of low accountability are not over, regulation brings more risk aversion, and this cycle may be the last chance for a big bubble that can produce substantial innovation. The AI x Crypto bubble can produce at least one or two killer applications.

The most ambitious cryptocurrency projects currently underway

Despite this, there are many ambitious cryptocurrency projects today, including:

• Ethena : Integrating DeFi, CeFi and Traditional Finance (TradFi)

• Chainlink: bridging blockchain and real-world data for immutable smart contracts

• Pudgy Penguins: Leading Web3 IP Brand Expanding to Web2

• WorldCoin: Bringing everyone on-chain, potentially enabling UBI funded by AI

• Liquity/RAI: The final decentralized stablecoin

• Arweave/Filecoin: Permanent storage and censorship resistance

• Farcaster/Lens: Reimagining social media

• Polymarket: A source of truth in a world of fake news

• Bio protocol (DeSci): Revolutionizing science by changing incentives

• Bitcoin: Revolutionary Currency, Digital Gold

Among them, projects like WorldCoin’s eye-scanning Orb and Liquity v2 and $BOLD stablecoins, while radical, are exactly the risks ambitious protocols are willing to take. These projects demonstrate the most egalitarian ideas, are ambitious, and if successful, could reshape the fabric of society.

Ethereum’s Dilemma

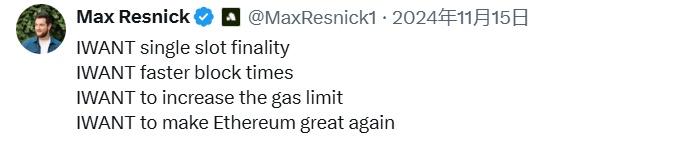

Ethereum is absent from this list of innovative projects. Perhaps the evaluation of Ethereum is a bit harsh, but Vitalik’s vision of “Cyberpunk Ethereum” is almost invisible on social platforms.

The upcoming fork (upgrade) will only be minor changes for ordinary users. Ethereum has already given up on sharding and main chain expansion, and in the near future, the most it will do is slightly increase the gas limit of the block.

It seems that Ethereum has handed over transaction execution and ambitions to the second layer network (L2). The future development direction of Ethereum is still unclear.

In contrast, Solana's attitude is more radical. It chooses to continue to promote the "integrated blockchain" model and refuses to compromise.

However, Ethereum's future network expansion plans may prove that its modular path is correct. I hope Ethereum will be great again, and I also hope to see radical new ideas emerge.

Humans need boundaries

The world, especially the West, seems to be stagnating. From stagnant wages, music that seems repetitive, new iPhones that no longer feel new, to remade movies, people seem to be afraid of innovation because new content often means greater risk. In some ways, we are actually going backwards. For example, due to the grounding of Concorde, the flight time from London to New York is now longer than it was in the 1970s.

Yet cryptocurrency remains one of the fastest-growing and most innovative industries in the world, perhaps second only to AI.

Despite this, the pace of innovation and ambition in the industry is clearly declining. This is partly due to the maturity of the above-mentioned industries, but a deeper reason is that the limitations of many technologies seem to have been accepted and not challenged enough. For example:

- It seems acceptable that DeFi and DAO are no longer fully decentralized. Instead of making DeFi decentralized, it is better to redefine it as on-chain finance and the problem will be solved.

- Ethereum cannot scale at Layer 1 and its token economics lacks innovation, and these seem to be acceptable.

- In the current market, the low market cap of $LQTY compared to $ENA shows that decentralized stablecoins are no longer really needed, and high yields are better.

Perhaps, the ambition to push boundaries is slowly wearing away with each passing cycle, and the crypto industry is becoming dull as a result. In short, if token prices are still rising, why take the risk?