On Wednesday, the U.S. core PCE price index for October rose 2.8% year-on-year, which was in line with expectations but still higher than the Fed’s 2% target. This data further exacerbated market concerns about continued high inflation and raised questions about the effectiveness of the Fed’s monetary policy tightening.

Crescat Capital macro strategist Tavi Costa said the Fed is facing a tricky policy dilemma. He warned that the risk of a second wave of inflation appears to be brewing. If this happens, the Fed will face a difficult choice: further interest rate hikes could increase the government's debt burden, while slowing the pace of rate hikes could cause inflation to get out of control.

U.S. stocks fell in response, while the crypto market rose against the trend

Faced with inflationary pressure and uncertainty about the Fed's policies, traditional financial markets have been cautious. All three major U.S. stock indexes fell. As of the close, the S&P, Dow Jones and Nasdaq fell 0.42%, 0.30% and 0.66% respectively.

However, the crypto market showed strong resilience. Bitcoin prices rose sharply on Wednesday, breaking through the $97,000 mark, and Ethereum rose more than 10%, hitting a multi-month high. Ethereum (ETH) rose 10%, reaching a high of $3,687.01 during the day, the highest since June.

The top 200 tokens by market capitalization all rose. Among them, Kadena (KDA) ranked first with a 25.3% increase, followed by Uniswap (UNI) with a 23.7% increase, and PancakeSwap (CAKE) with a 22% increase.

The current overall market value of cryptocurrencies is $3.34 trillion, and Bitcoin’s market share is 57.1%.

Fund rotation, is the altcoin season coming?

Coinglass data shows that Ethereum ETF has recorded positive capital inflows for three consecutive days, with a net inflow of up to $40.6 million on Tuesday. This trend is in sharp contrast to the continued net outflow of Bitcoin ETF. QCP Capital analysts pointed out that the market is shifting funds from Bitcoin to Ethereum and altcoins. Behind this phenomenon, in addition to investors' expectations for the altcoin season, it is also closely related to the ecological development of Ethereum itself and the strong performance of the derivatives market.

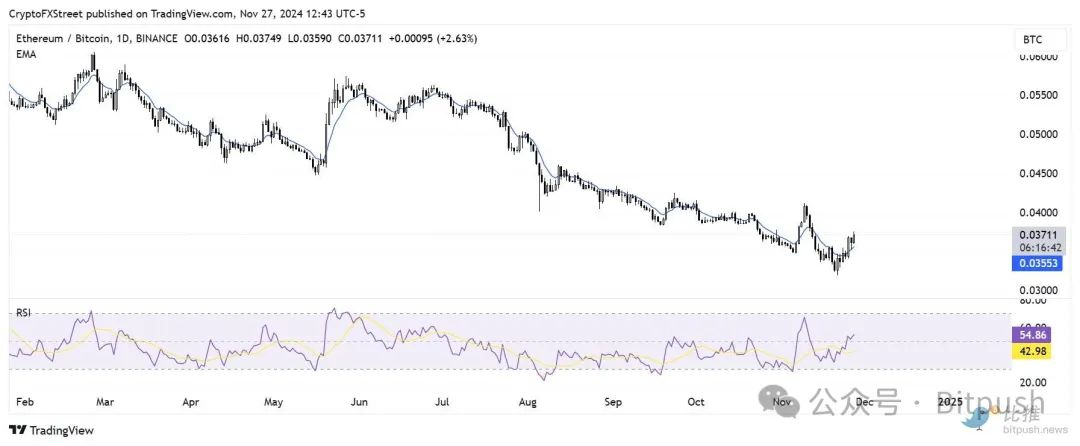

“Ethereum is making a comeback following Bitcoin’s fall, with signs that the market is shifting capital flows toward ETH and altcoins,” the analysts said. The ETH/BTC ratio, which measures ETH’s performance relative to BTC, has surged by more than 15% since falling to a low of $0.3204 on November 21.

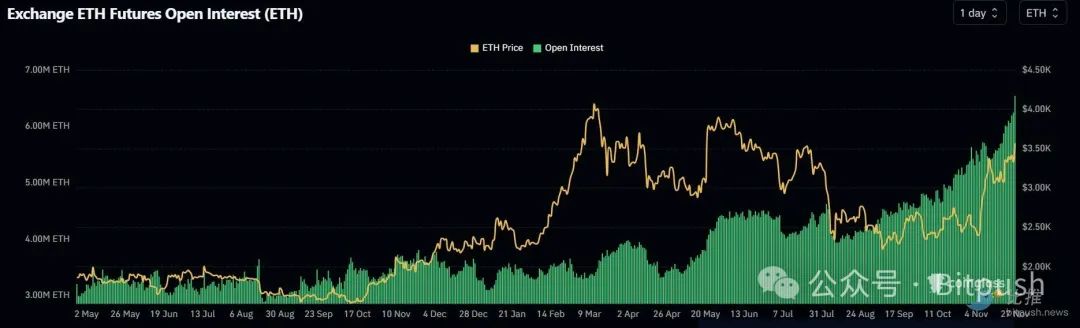

ETH's rise was accompanied by strong bullish sentiment in its derivatives market. According to Coinglass data, ETH open interest (OI) hit a record high of 6.55 million ETH on Wednesday, worth $23.34 billion, continuing the growth momentum of the past two weeks. In addition, data from Velo showed that ETH's three-month premium (the gap between its futures price and spot price) on cryptocurrency exchanges Binance, OKX and Deribit soared to 16%.

Although the market is generally optimistic about the arrival of the altcoin season, CryptoQuant founder and CEO Ki Young Ju believes that the altcoin season may be delayed due to the lack of new retail capital. Ki Young Ju said: "For altcoins to reach a new all-time high market value, a large amount of new capital needs to flow into cryptocurrency exchanges. The altcoin market value below the previous all-time high indicates a decrease in liquidity from new exchange users."

The analyst concluded that altcoins should focus on developing independent strategies to attract new capital rather than relying on Bitcoin’s momentum, but he remains “bullish” on altcoins.