By Glendon, Techub News

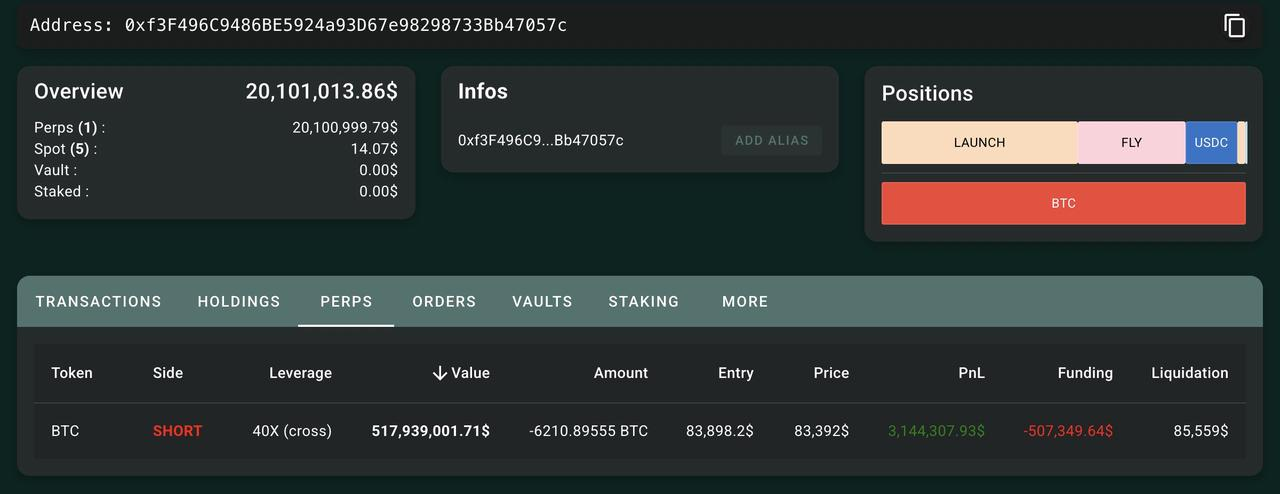

On March 18, the "Hyperliquid 50x leveraged whale" that has recently sparked heated discussions in the crypto community once again shorted Bitcoin with 40x leverage and successfully made a profit of $5.101 million. Hypurrscan.io data shows that the "whale" set a record high in its holdings with 6,210.89 bitcoins, with a holding value of approximately $518 million, a cost price of $83,898.2, and a liquidation price of $85,559.

According to monitoring by Ember, the “whale” had transferred 16.75 million USDC to Hyperliquid as a margin, which was all the funds in its address, including the principal and all profits in the past month.

Prior to this, the “Whale Hunting Squad” was ready to go, claiming that “Bitcoin will break its liquidation price today”, but their public attack this time ended in failure.

According to Ai Yi, an analyst on the chain, the whale has won 8 out of 9 games since March 2, with a winning rate of 88.9% and a total profit of 16.336 million US dollars. Just two hours after completing the last transaction, the whale transferred another 500,000 USDC margin to Hyperliquid and opened a 5x leveraged long order for MELANIA. As a result, MELANIA rose by about 5% in a short period of time.

Seeing this, you may be curious about who this "Hyperliquid 50x leverage whale" is, and how he can drive up the token price by himself? At the same time, what is the "whale hunting team"? Let's understand the ins and outs of this matter.

Seven games and seven wins, is he an "insider" or a "master of operations"?

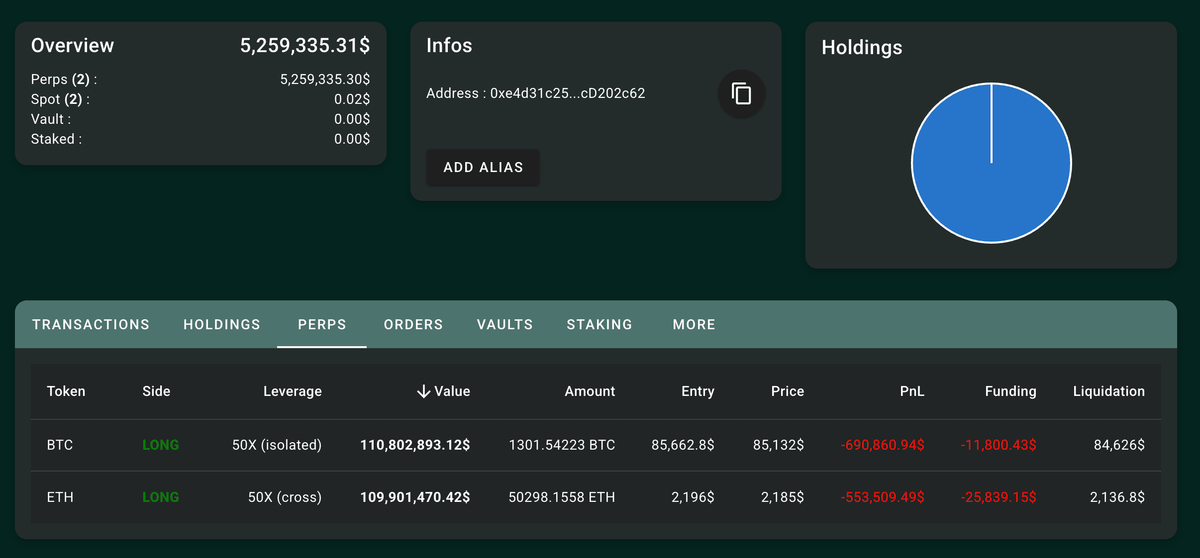

As early as March 2, the "whale" used the address starting with 0xe4d to go long on BTC and ETH with 50x leverage on Hyperliquid, which began to attract the attention of some cryptocurrency KOLs.

Hyperliquid is a decentralized perpetual contract trading platform. With its efficient on-chain order book, zero gas fee and up to 50 times leverage, it has become a paradise for high-risk traders. At that time, the "whale" opened a long position of more than $200 million on this platform with a principal of 6 million USDC.

Bitcoin: 1,260, opening price was $85,671, liquidation price was $84,629;

Ethereum: 49,384 pieces, opening price was $2,196, and liquidation price was $2,133.9.

Since the liquidation space for these two short orders was only $1,042 and $62.1, a drop of only 2.8% would cause the position to be liquidated. Therefore, the “whale” was initially considered the “ultimate gambler”. Subsequently, the long orders of this address added 914 ETH and 41 BTC, and its floating loss at that time exceeded $900,000.

However, the market is always full of variables. At around 23:00 that night, as Trump announced that the presidential task force would promote the strategic reserve of cryptocurrencies including XRP, SOL, ADA, BTC and ETH, the crypto market immediately ushered in a wave of rises, and the address quickly turned losses into profits, and finally successfully made a profit of 6.83 million US dollars.

However, because the timing of opening orders and the position of liquidation were too extreme, the community was full of speculation that he might be an insider close to Trump. Some even thought that the "giant whale" might be Trump's second son Eric Trump. As a result, the "giant whale" was given the title of "Insider Brother".

On March 3, the “whale” once again opened a short order of BTC worth $13.45 million, just 20 minutes before the opening of the U.S. stock market. It was also the familiar 50 times and sensitive time point. At that time, the difference between the opening price ($93,117.5) and the liquidation price ($94,083) was only $965.5, and the floating loss reached $60,000. But similar to the previous situation, the address quickly reversed the loss and finally retired with a profit of nearly $300,000.

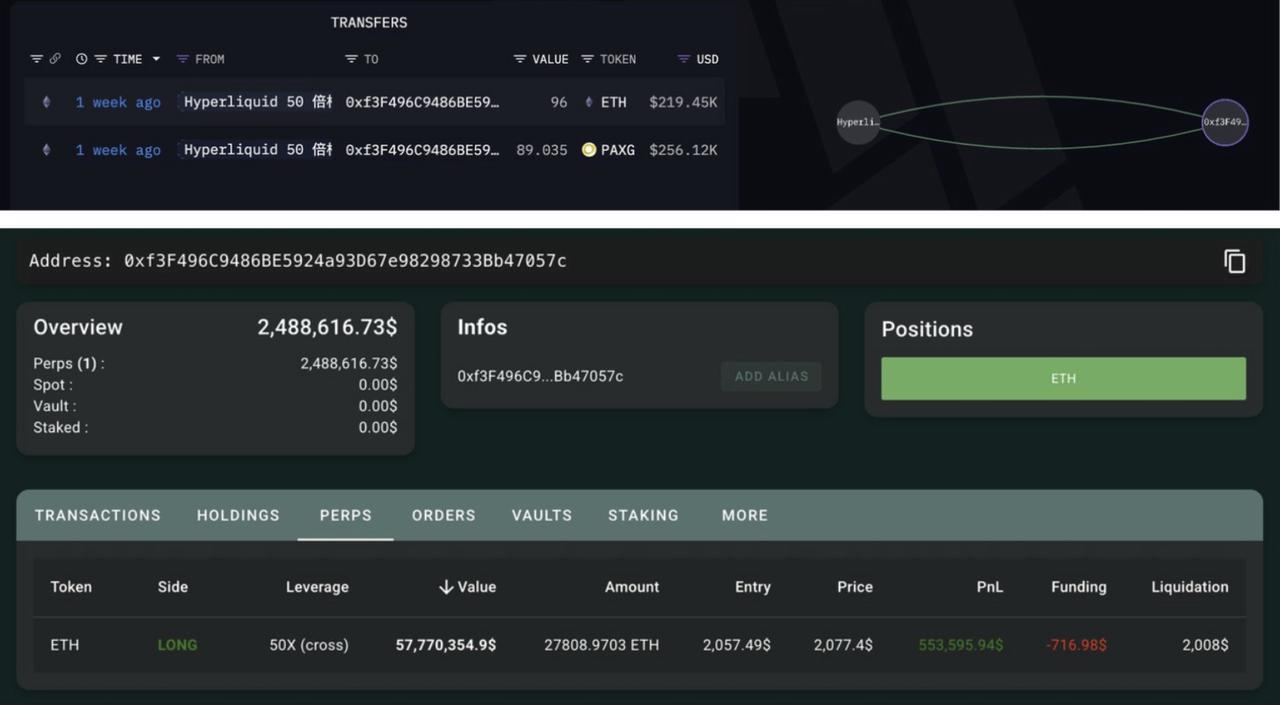

After that, the "giant whale" seemed to have stopped for nearly a week. As of March 10, according to Ai Yi's monitoring, the "giant whale" had received 600,000 followers, and it also began to use a small account (address starting with 0xf3f) to go long on ETH. It used 1.95 million USDC as margin and held 27,809 ETH (about 57.88 million US dollars), which was still 50 times leverage, but the operation was more extreme. The gap between the cost price and the liquidation price narrowed to 50 US dollars. Once it fell below this threshold, it would trigger a liquidation.

But the result was that the address finally made a profit of $2.15 million in 40 minutes and closed its position to take profit. At that time, it had accumulated a profit of $9.28 million through three leverages. After that, the "whale" completed four leveraged transactions from March 11 to 14, making a profit of about $3.106 million. One of the transactions directly caused the Hyperliquid liquidation incident that has been hotly discussed in recent days.

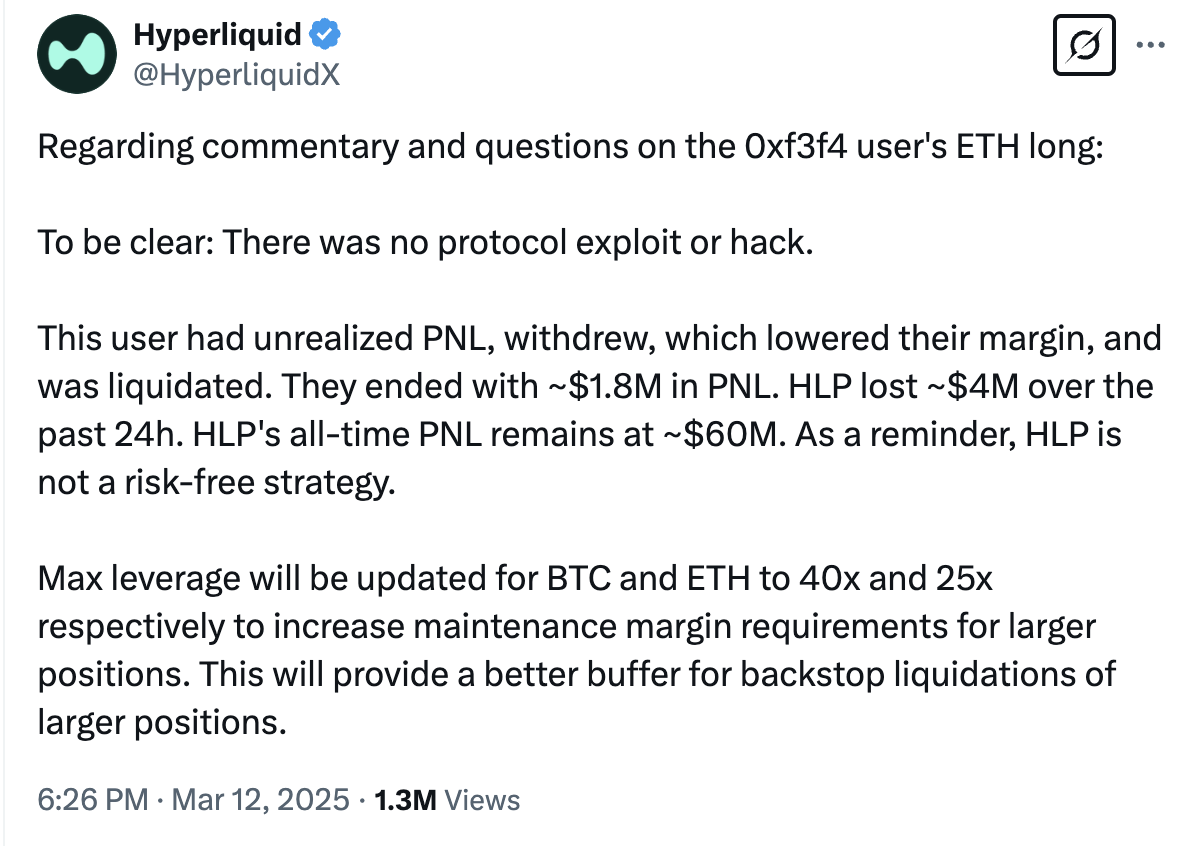

On March 12, the "whale" continued to increase its position until its ETH long position reached 175,000, and its position value once exceeded US$340 million. Just when everyone thought it would close its position for profit or continue to increase its position to increase its profit, it unexpectedly chose to "self-destruct" and took away most of the principal and profits by withdrawing the margin, in order to compress the liquidation price, resulting in the remaining long positions of more than 160,000 ETH being "actively liquidated". Due to this move, Hyperliquid's automatic liquidation system took over the position, and its community-driven liquidity pool "HLP Vault" was forced to take over and close the position at a high price. In the process, Hyperliquid lost US$4 million.

The direct impact of this incident is the adjustment of Hyperliquid's contract rules. Hyperliquid reduced the maximum leverage of BTC from 50x to 40x, and ETH from 50x to 25x, respectively, to limit the potential impact of large positions. In addition, the platform has upgraded the margin system and introduced new margin rules, requiring isolated positions to maintain a 20% margin rate after transfer to prevent liquidation through withdrawal manipulation.

The “Hyperliquid 50x leveraged whale” made a profit of $1.857 million in this incident. As of the 14th, the “whale” had achieved seven wins in seven battles through two addresses. Since then, it has only lost $1.15 million when opening LINK long orders.

On March 15, the whale once again shorted Bitcoin with a 40x leverage. Interestingly, apart from some retail investors who copied the trades and made money, its multiple victories seemed to have finally aroused the anger of some well-known traders, and a "whale hunting operation" against it was launched in a big way.

The "Whale Hunting Team" was established. What impact will the liquidation of "big whales" have on Hyperliquid and the market?

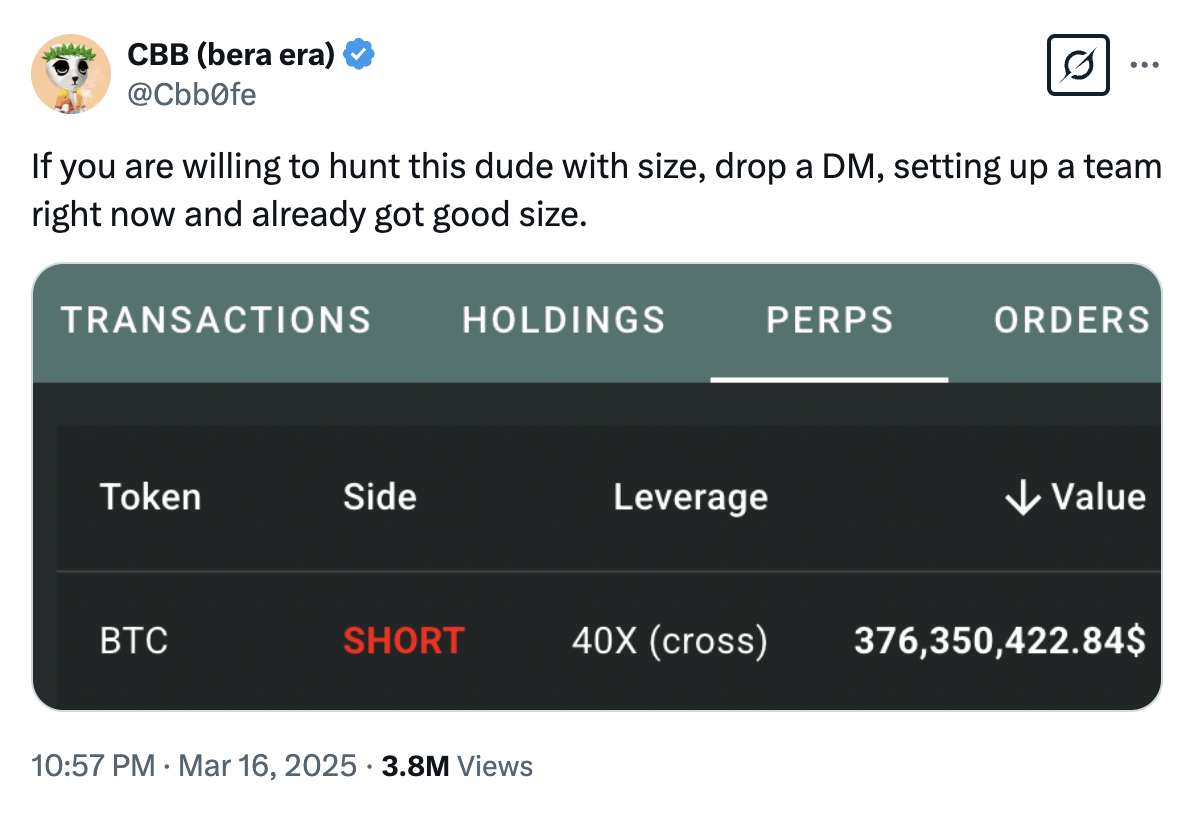

On March 16, cryptocurrency KOL @Cbb0fe posted a message to recruit a "whale hunting team" and said: "If you are willing to work with this guy, please send me a private message. We are building a team and it has already grown to a good size." Later, the KOL also posted a picture saying, "Justin Sun will join the action."

During this period, many netizens left messages and appealed to the official X account of the U.S. Securities and Exchange Commission (SEC), saying: "(Hyperliquid 50x leverage whale) looks like an organized 'Pump' (referring to the operation of artificially raising asset prices and then selling for profit), it's time to investigate."

This “whale hunting operation” lasted for nearly two days and came to an end yesterday. In the end, the “Hyperliquid 50x leveraged whale” still had the last laugh.

Cryptocurrency KOL "@Cbb0fe" said: "Shorter (short) closed with a profit of $9 million. We lost the war, but we haven't had so much fun in a long time. I wish Shorter victory!"

However, rather than a hunt, this is actually a showdown between the team led by @Cbb0fe and the "Hyperliquid 50x leverage whale" and its copycats. So the question is, if the "whale" is really liquidated, will this drive the Bitcoin market up?

Theoretically, once liquidation is carried out, it will inevitably trigger the forced liquidation mechanism of short contracts, which means that an equal amount of Bitcoin needs to be purchased in the market to complete the settlement, which may drive prices up in the short term. However, the explosion of the "whale" does not represent a signal of "shorts are out", so this may not attract more longs to enter the market, especially in the current situation where the overall market sentiment is low and investors lack confidence. Bitcoin lacks the upward momentum, and even if it rises, its increase and duration may be quite limited.

From another perspective, the frequent occurrence of transactions such as the "Hyperliquid 50x leverage whale" is actually an inevitable part of the Hyperliquid platform's development and growth, which can help it discover the fragility of its own mechanism in the face of extreme market behavior. After all, as an emerging market, it has not yet undergone long-term market testing.

As mentioned above, in order to prevent the recurrence of previous liquidation events, Hyperliquid has taken a series of measures, including adjusting the leverage multiples of contracts and increasing the margin ratio, to limit users from opening overly large positions. In terms of risk management, Hyperliquid uses a price oracle mechanism across multiple exchanges to achieve a price update frequency of every three seconds, thereby avoiding incorrect prices caused by malicious operations in a single market. At the same time, the platform allows anyone to participate in liquidation to increase decentralization, and has established an independent HLP Vault to act as a liquidation vault to centrally manage and bear losses caused by liquidation.

It is worth mentioning that the multiple transactions of this “whale” have also brought considerable trading volume and attention to Hyperliquid. As the platform’s contract market matures, market makers join in, and the platform’s liquidity gradually improves, the cost of price manipulation will increase significantly, and by then the fairness and stability of the market will be further guaranteed.

As for whether this “Hyperliquid 50x leverage whale” is an “insider” or an “operation master”, and whether it can maintain its reputation as an “invincible general”, all this remains to be tested by time.