Trump's election as the new president of the United States has become the biggest political and economic topic in November. Unsurprisingly, the impact of Trump's coming to power is huge. His "Trump 2.0" economic policy line, which is different from other parties, and his strong support for cryptocurrencies have reversed the previous trading logic of the market. Stock market liquidity has begun to flow to more sectors, and the carnival of the crypto market is also closely related to Trump. All of this seems to indicate that a new trading logic system is being born.

With the end of the US election, Trump was re-elected as the 47th President of the United States. So far, the election has come to an end, and the United States will return to the right-wing development strategy, which also relieves the concerns of global traders about the risks of the election.

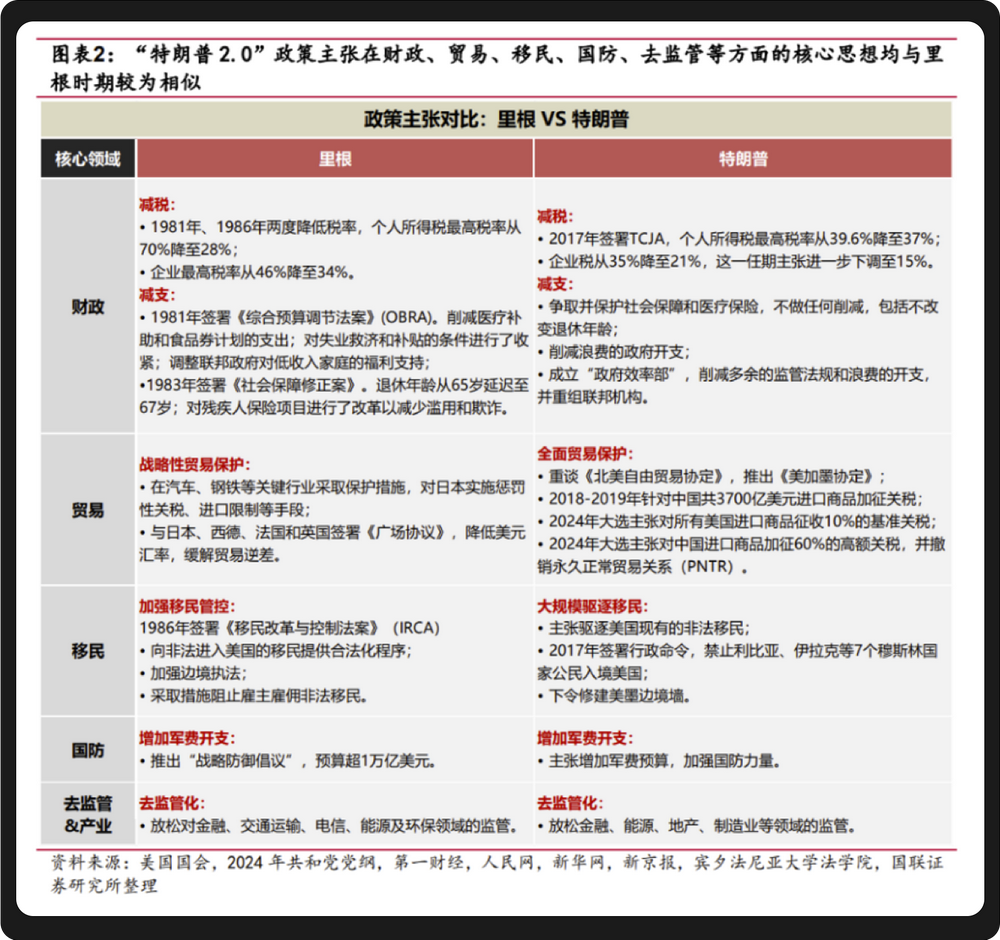

As a conservative in the traditional sense, the Republican Party advocates cutting taxes, revitalizing manufacturing and traditional energy industries, reducing government regulatory power, expelling illegal immigrants, etc. "Trump 2.0" further implements the policy concepts of the "MAGA Party".

From the perspective of policy thinking, Trump's policy thinking is very similar to that of Reagan, both of which are a combination of "loose fiscal policy + deregulation + trade protectionism". Reagan relied on this thinking to lead the United States out of the economic environment of stagflation after the oil crisis, drive economic recovery, and ultimately achieve the "Reagan Great Cycle", which continued to influence subsequent US economic policies. Whether Trump can replicate President Reagan's "successful" path and pull the US economy back from the brink of stagflation has become the most watched focus of his term.

This similarity between Trump's policies and Reagan's policies may become the main trading logic for subsequent "Trump transactions", and investors can continue to pay attention.

Back to the November inflation data and the Fed's policy. On November 26, local time, the Fed released the minutes of the Federal Open Market Committee (FOMC) meeting from November 6 to 7. The minutes showed that the interest rate was cut by 25 basis points in November, which was in line with expectations. At the same time, the Fed emphasized that "participants expect that if the data is consistent with expectations, inflation continues to fall to 2%, and the economy remains close to maximum employment, then it may be appropriate to gradually shift to a more neutral policy stance over time." This "more neutral policy stance" means that the Fed no longer deliberately pursues interest rate hikes or cuts, but makes daily adjustments based on market economic conditions. This undoubtedly implies that the Fed has optimistic expectations that the US economy will recover from recession concerns and will recover in the future.

In November, the US stock market was stable, breaking through historical highs in small steps. In the field of AI, although Nvidia (NVDA)'s third-quarter financial report exceeded expectations, it did not "exceed expectations too much", resulting in a 5% drop in the after-hours market on the day of the financial report. The current market attitude towards AI seems to be "as long as it is not too explosive, it is not as good as expected."

Since Trump was elected, Bitcoin has been like a wild horse running away, heading straight for $100,000. The market FOMO sentiment was serious, and it was not until the last week of November that it eased slightly. Against the backdrop of Trump's call for "Bitcoin strategic reserves", Pennsylvania took the lead in passing the "Bitcoin Rights Act". The market seems to have ushered in the "Trump era" of cryptocurrency. Cryptocurrency is becoming the object of legislative protection in the traditional world and is truly entering everyone's life.

If Trump's election brought Bitcoin to a new high, then Musk completely ignited the MEME track. As Musk joined the "Trump 2.0" government team, three Musk concept coins rose violently. The longer-term narrative behind this episode is that Musk, as a leader in technological innovation, has the potential political influence to accelerate the advancement of encryption technology, such as promoting the integration of AI and blockchain.

Therefore, cryptocurrency deserves to replace AI as the new favorite of the stock market in November, and people naturally look for opportunities related to cryptocurrency in the secondary US stock market. In the Bitcoin carnival in November, the biggest winner was MicroStrategy (MSTR) - MicroStrategy's stock price rose by more than 140% in November.

Source: StockCharts.com

MicroStrategy was originally a niche software company founded in the 1990s. After surviving the tech bubble in 2000, it entered a period of stable business, but there was almost no room for growth until the company's CEO Michael Saylor became a Bitcoin believer around 2020, incorporated Bitcoin as a core strategy into the company's balance sheet, and successfully built his own "Bitcoin-driven" company growth logic: Bitcoin accounts for a large proportion of the company's assets, and its value fluctuations directly affect the company's value. As the price of Bitcoin rises, MicroStrategy's stock price has risen sharply due to the increase in assets, and its daily trading volume exceeds Nvidia. Through leveraged capital operations, the company can issue additional shares to sell for money to continue buying coins. During November, MicroStrategy issued additional shares in exchange for US$4.6 billion and reinvested all of it in Bitcoin, pushing up the price of Bitcoin, thus forming a cycle of buying Bitcoin-stock price increase-borrowing or issuing additional shares to buy more Bitcoin, making shareholder interests closely linked to the appreciation of Bitcoin. The unexpected rise in MicroStrategy's stock price is essentially that some investors regard it as an indirect way to hold Bitcoin and are willing to pay a premium for it.

Bitcoin made MicroStrategy successful, and MicroStrategy also made Bitcoin successful. Its crazy issuance of bonds and selling of stocks to buy Bitcoin, as well as its high-profile market style, helped boost the price of Bitcoin from 70,000 to 90,000, just as the Bitcoin ETF boosted the price of Bitcoin from 40,000 to 70,000. Therefore, MicroStrategy is also considered the biggest promoter of this round of Bitcoin from 70,000 to 90,000.

Some investors believe that MicroStrategy has uniquely discovered a clever way to exploit loopholes in the fiat currency system, taking full advantage of the inefficiency of traditional capital markets to gain leverage advantages against fiat currencies and perfectly integrating it with the predictability of Bitcoin, thereby giving itself extremely significant upside potential. In short, it is to use cheap and expanding capital to acquire scarce assets with appreciation potential. Of course, the premise of this logic is to assume that Bitcoin will inevitably succeed in the long run. As of the latest data, MicroStrategy currently holds 279,420 bitcoins.

MicroStrategy's "digital gold standard" strategy and capital operation model provide us with a new experimental paradigm. If the market continues to improve, this model may become an industry pioneer, leading other companies to adopt similar strategies, accelerating the popularization of Bitcoin in corporate balance sheets, and promoting Bitcoin to be recognized as the top predator of assets.

The rise of the market has long caused retail investors to sell Bitcoin in pursuit of the high returns of so-called meme coins. Currently, Bitcoin has become the main battlefield for whales. Some people believe that the biggest risk of Bitcoin currently comes from the selling of whales. As one of the largest whales, MicroStrategy's biggest selling risk lies in the forced liquidation of bonds caused by the decline in Bitcoin prices, which has led to a self-reinforcing decline in Bitcoin prices.

However, this argument ignores the bond structure of MicroStrategy. The bonds issued by MicroStrategy are convertible bonds, which are over-the-counter leverage. Even if MicroStrategy cannot repay the debt on the repayment date three years later, the creditors can only convert the debt into stocks and dump the market in the stock market, which cannot shake the price of Bitcoin. Therefore, instead of worrying about MicroStrategy being forced to liquidate and sell coins to repay debts, it is better to worry about people who buy MicroStrategy stocks in the US stock market.

Investor Victor Dergunov has clearly pointed out that although MicroStrategy has shown advanced foresight, its stock is clearly overbought and can be seen as a typical example of the bubble in the entire crypto field. Although Bitcoin is far from its peak, the reality has sounded the alarm, reminding us what will happen when the market heats up too quickly. The market will reach a clearer consensus on MicroStrategy's valuation, and this valuation should be significantly lower than the current level.

Of course, a more promising future is that we might see Bitcoin gain a place on the balance sheets of thousands of companies, and MicroStrategy will go down in history as a financial pioneer of a generation.

In November, with Trump elected as the US president, the economy showed multi-dimensional changes. The FOMC meeting cut interest rates by 25 basis points, and there is a high probability that the easing will continue in December, injecting liquidity expectations into the economy. The formation of Trump's economic team is advancing, and its policy propositions are expected to replicate the previous high economic growth path. US stocks continued to rise to new highs, and the crypto market was revelling in Trump's good news. Bitcoin approached $100,000. MicroStrategy emerged as a new force due to its Bitcoin holdings and the opening up of new capital operation experiments. Looking ahead, we need to pay attention to the intensity and rhythm of Trump's policy implementation, as well as the impact of interest rate cuts on the economic structure. If Trump's commitment to the crypto industry is partially realized, $100,000 may not be the end of Bitcoin's price, but only a stage mark in its rising process. The road is tortuous, but the future is bright.