With Trump's election as the US President, his promise to replace the SEC Chairman on his first day in office was implemented ahead of schedule. Last week, SEC Chairman Gary Gensler officially announced that he would step down on January 20, 2025, around the time Trump took office. After the news was released, the crypto market sentiment was boosted, and a number of "SEC security coins" such as XRP and ADA, which have long been under SEC regulatory pressure, soared by nearly 30% in a short period of time.

He was regarded as the number one rival in the cryptocurrency circle during his tenure

Since Gary Gensler became the chairman of the SEC, he has treated the cryptocurrency industry with a strict regulatory attitude. He has repeatedly emphasized that BTC is the only commodity currency, while other cryptocurrencies are mostly regarded as securities. This position has brought him a lot of controversy and criticism. During his tenure, Gensler took enforcement actions against multiple entities such as Coinbase, Kraken, Robinhood, OpenSea, Uniswap, MetaMask, etc., completed thousands of enforcement cases in total, and recovered approximately US$21 billion in fines. He is regarded as the number one opponent in the currency circle. Previously, the attorneys general of 18 states in the United States even jointly filed a lawsuit against the SEC and its five commissioners, accusing the SEC, under the leadership of Gary Gensler, of unconstitutional excessive expansion of power and unfair suppression of the cryptocurrency industry.

However, despite Gensler's tough stance on cryptocurrencies, he approved spot ETFs for Bitcoin and Ethereum during his tenure, which undoubtedly gave a boost to the development of cryptocurrencies. This seemingly contradictory behavior is actually based on a common logic, that is, to bring cryptocurrencies into the U.S. regulatory framework, which is also the main policy philosophy of the Biden administration.

SEC Securities Coin Pressure Eased

Gary Gensler's resignation not only brought relief to many investors and crypto companies that were troubled by regulatory pressure, but also brought hope to tokens that were more affected by the SEC, the most obvious of which was Ripple, the leading "SEC security coin".

As early as December 2020, the US SEC began to accuse Ripple of illegally issuing unregistered securities. Coinbase Robinhood and other platforms even temporarily removed their listings, causing XRP prices to plummet. The lawsuit between the SEC and Ripple has officially begun, and has also attracted widespread attention in the crypto market. Is cryptocurrency a security? Whether it is regulated by the SEC has always been controversial, so the final judgment of this case will have a significant impact on the development of the entire cryptocurrency circle.

Every time there is news about XRP, there will be huge fluctuations, which also affects the prices of some altcoins that have also been accused of being securities by the SEC, such as ADA, MATIC, SOL, FIL and dozens of other projects. "SEC security coins" have become a special sector.

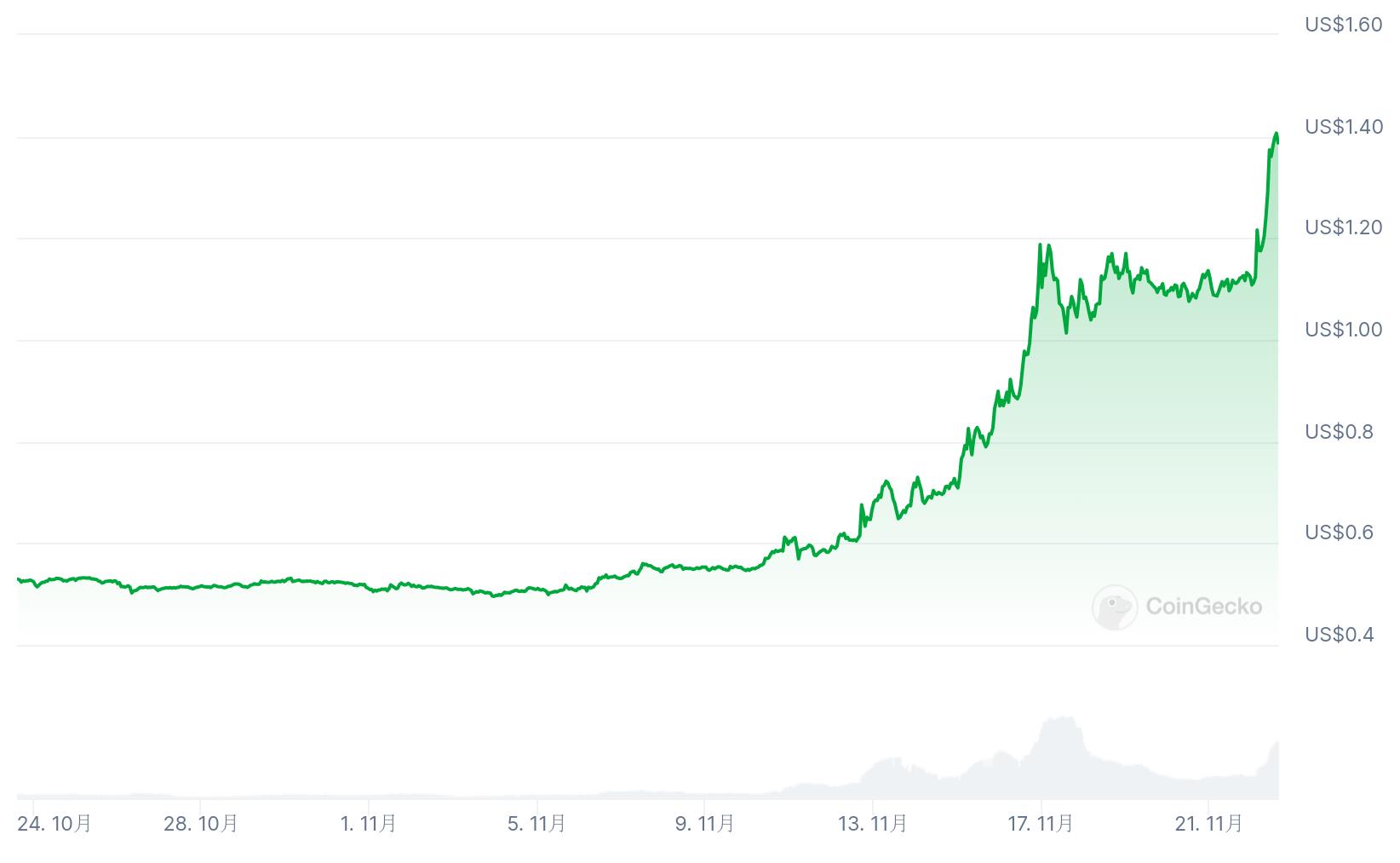

Now, with the departure of the SEC chairman, Ripple, which has a lengthy lawsuit with the SEC, has transformed into the "SEC Revenge" concept coin and ushered in a retaliatory rise. Other tokens that have long been under regulatory pressure from the SEC, such as ADA, SOL, etc., have also seen similar increases.

Which cryptocurrency companies targeted by the SEC are expected to benefit?

At present, Trump has not officially announced his preferred candidate for the new SEC chairman, but several popular candidates are friendly to cryptocurrencies and have publicly expressed their support for cryptocurrencies. Under crypto-friendly policies, it is expected that SEC crypto enforcement will be significantly reduced in the future, and some staff within the SEC who adopt radical enforcement measures may be liquidated.

This means that the lawsuits of "SEC security coins" such as Ripple, which were previously suppressed and sued by the SEC, may be softened, settled or even withdrawn, and the project parties that dare not issue tokens or empower tokens due to fear of the SEC may also become the biggest direct beneficiaries. In addition, it is also expected to promote Ethereum staking services, such as the spot ETH ETF that can provide staking rewards, thereby increasing the price of ether. The following are several representative projects that may directly benefit:

1. XRP: The regulatory haze has dissipated, and the market performance is expected

As an earlier public chain project, XRP's initial vision is to become the global CBDC settlement layer. However, due to competition, litigation and other reasons, the solution has not been truly implemented. It is currently trying to expand and transform its TOC business and introduce smart contract functions to Ripple by supporting some side chain projects.

Due to its business positioning, XRP's data performance on the market side is not very good. However, it has a large user base and fan base, as well as relatively advantageous background resources. XRP's historical accumulation and brand effect are its biggest highlights and leverage points, and it still has considerable potential in the prosperous industry ecosystem. This gives it a great opportunity to easily leverage the market in TOC and make its market value performance better. If XRP can achieve certain results on the TOC route, it will have a greater bonus to the project's market value and TOB business, and its official will also have ample funds and space to expand TOB's cross-border settlement business.

This time, Gensler's resignation has not only driven the rise of XRP, but also reflected the expectations of multiple markets. First, XRP may be relisted on more exchanges to expand its market liquidity, such as Robinhood's relisting of Ripple (XRP) transactions on November 13. Secondly, Ripple's business operations will focus more on core technology rather than legal battles. Previously, Ripple has been fully engaged in dealing with the lawsuit since the SEC filed a lawsuit against it. In the second half of 2023, Ripple CEO said that the company had paid more than $200 million in legal fees.

In addition, it is worth noting that several ETF issuers such as 21Shares and Bitwise have submitted applications to the SEC to launch XRP spot ETFs. This development further highlights the market's positive expectations for the future development of XRP.

2. ADA: Greater flexibility under the whale effect

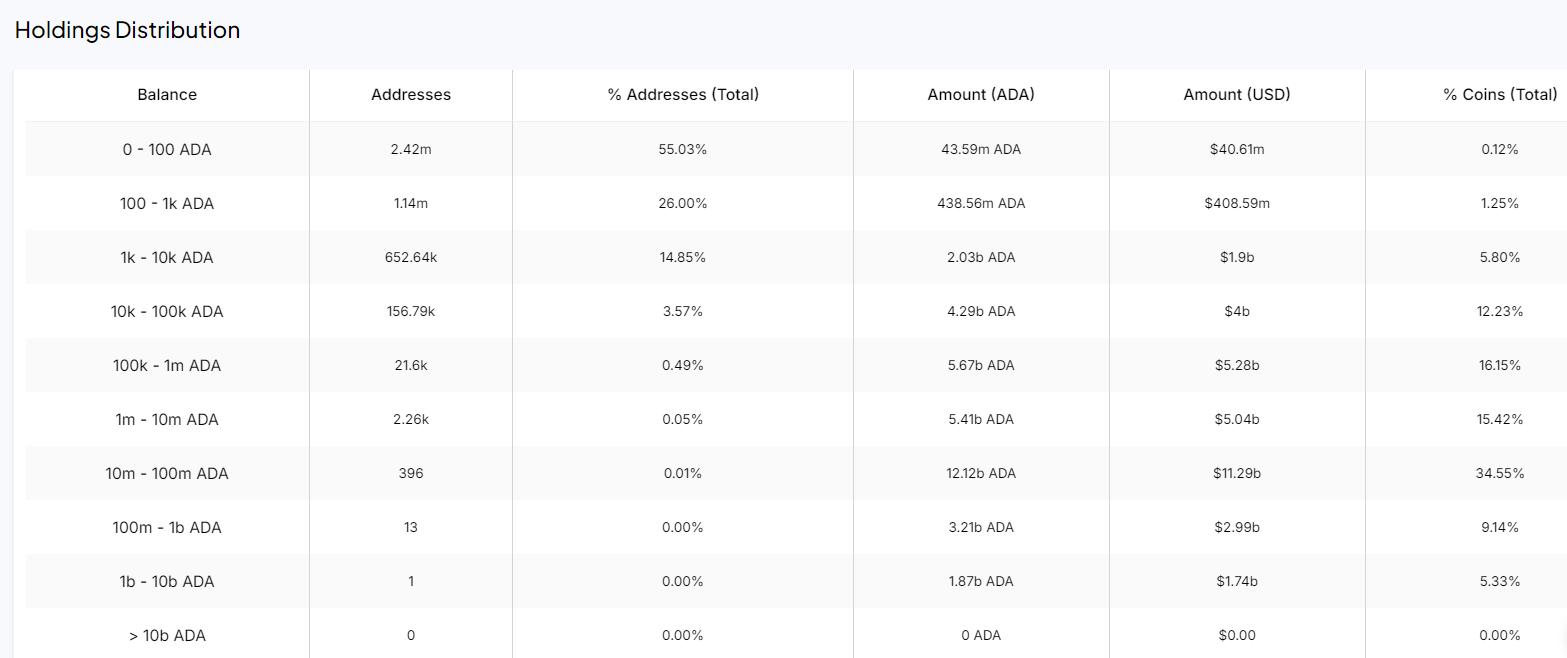

Cardano is a project launched in 2017. Its native token ADA has always been regarded as an innovative platform with technical robustness and academic drive as its core. It gives people the feeling of "stable". It is relatively low-key but has great potential. It ranks in the top ten of the crypto market value rankings for many years. As an old public chain, Cardano's current ecology is relatively average compared with several well-known public chains on the market, so that it is regarded as a "demon coin" in the eyes of many people in the circle. The phenomenon of a large gap between market value and project development is related to the centralization of ADA tokens and the control of giant whales.

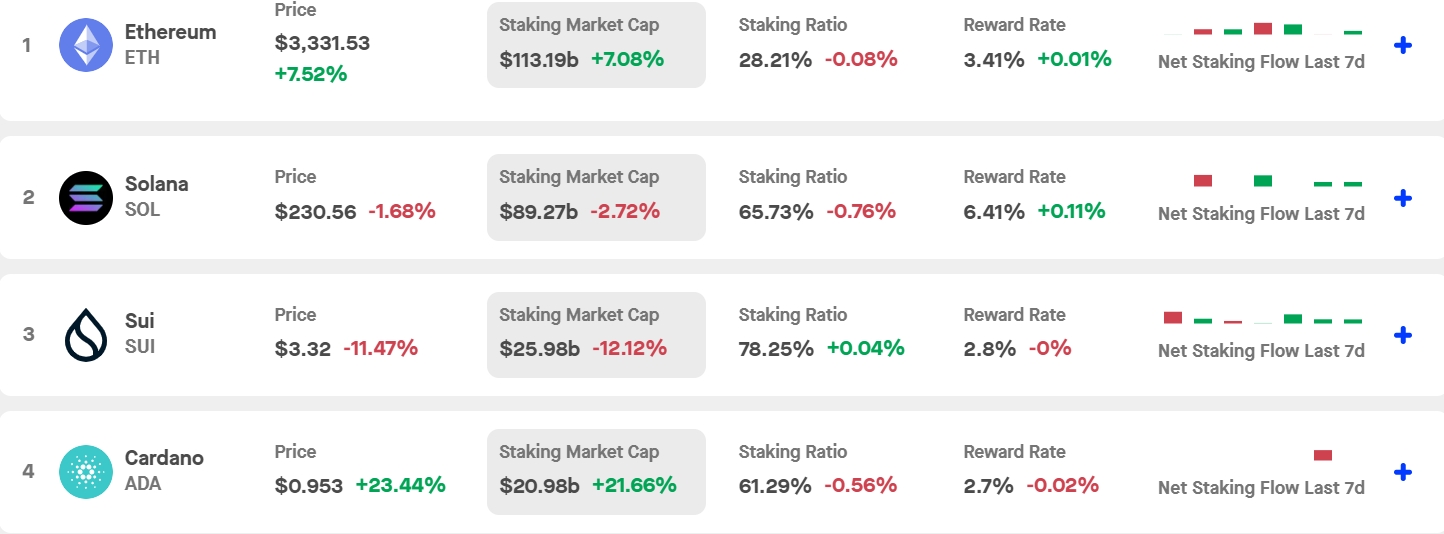

According to statistics from stakingrewards.com, Cardano (ADA) is the fourth-largest cryptocurrency in terms of total staked value, with a total ADA staked value of nearly $21 billion and a stake rate of over 61%. This indicates that ADA has been locked up in a centralized manner, which has controlled the market circulation to a certain extent.

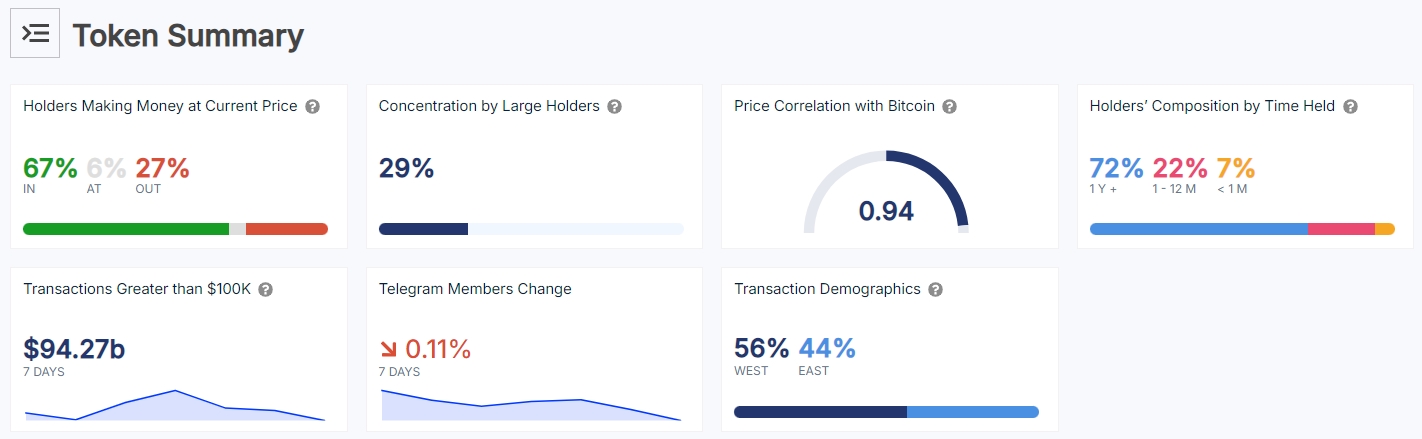

In addition, according to data from the blockchain analysis platform IntoTheBlock, 72% of ADA holding addresses have not transferred funds for more than a year, and currently 67% of holders are in a profitable state at the current market price, which shows that its investor group is mainly long-term holding. The existence of this "belief layer" provides stable support for ADA prices and also shows the market's optimistic expectations for its future growth.

According to the data, nearly half of Cardano's circulating supply is controlled by about 400 addresses. This concentrated distribution of tokens has weakened market liquidity to a certain extent, making ADA prices more susceptible to large capital inflows. It also shows the confidence and interest of whales in the rise of ADA prices.

The current crypto market continues to be strong, investors' risk appetite has increased, sector rotation is obvious, and altcoins are making up for the rise. Although Cardano's ecological performance still needs to be improved, as a well-known old public chain, its high pledge rate and whale holding ratio give the price greater flexibility and growth space.

3. Uniswap: Empowering Acceleration

As the leader of DEX, Uniswap is a rare project in the crypto industry with sustainable high profitability. However, due to long-term regulatory pressure, the empowerment of UNI tokens has been pending. In February of this year, the Uniswap Foundation issued a proposal on "Starting Uniswap Protocol Governance", proposing to distribute protocol fees proportionally to UNI token holders who stake and delegate voting rights. Once the news was released, it quickly aroused market enthusiasm, and the price of UNI soared from US$7 to around US$12 overnight. However, until May, this fee allocation mechanism has not yet been truly implemented.

In April this year, the SEC issued a warning to Uniswap Labs and planned to take enforcement action against it. This incident dealt a certain blow to market sentiment, and UNI's market performance has since been flat. Until October this year, Uniswap Labs announced plans to launch the Unichain chain. This move has injected new imagination into the Uniswap ecosystem and made the empowerment issue of UNI tokens the focus of the market again.

Now, with the departure of the SEC chairman, the market has shown highly optimistic expectations for the future relaxation of the regulatory environment. In this context, the easing of regulatory pressure has released more potential for decentralized platforms, while providing good conditions for the expansion of the Uniswap ecosystem, helping the UNI token to gradually transform from a single governance token to a core asset with multiple functions such as governance, revenue capture, and ecosystem empowerment. How this transformation will further empower UNI token holders through the fee allocation mechanism and the implementation of Unichain is worthy of the market's continued attention and expectations.

4. Base: Expectations for coin issuance increase

Since the official launch of Base, the Ethereum second-layer protocol incubated by Coinbase, in August last year, community members have been paying attention to and looking forward to the issuance of Base tokens. At that time, Coinbase had clearly stated that there was no plan to issue tokens. At that time, since the lawsuit between Coinbase and the SEC had not yet ended, the strategy of not issuing tokens may also help Coinbase avoid regulatory minefields under the pressure of litigation. When the community recently asked about the coin issuance plan, Coinbase's chief legal officer reiterated that there was no plan to issue coins, but said that issuing tokens would be a feasible solution in the future when the regulations are clear, and said that Base does not rule out launching tokens in the future.

It is worth noting that ConsenSys, the parent company of MetaMask, which is also under investigation by the SEC, was also rumored by the community earlier that it would cancel or postpone its Layer 2 protocol Linea token plan due to regulatory pressure, which caused heated discussions in the market. After Trump's victory, ConsenSys expressed optimism about the issuance of tokens under a more relaxed regulatory environment, and announced at the Devcon conference held in Bangkok that it would issue tokens in Q1 next year, which indirectly fueled the market's expectations for Base's issuance of tokens.

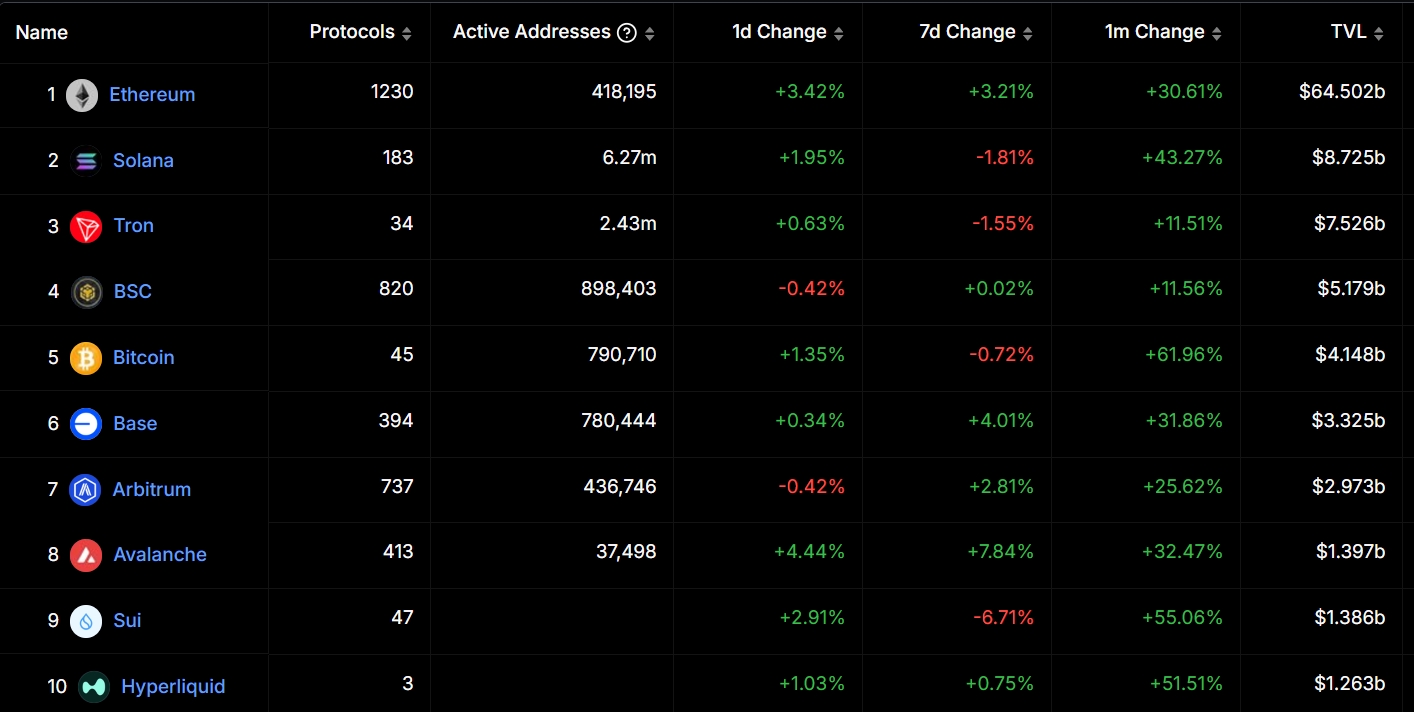

According to defillama data, Base currently ranks sixth in the total value locked (TVL) of DeFi protocols, with a total deposit of $3.3 billion, second only to ETH and BSC in the EVM chain. With the relaxation of the regulatory environment and the continuous maturity of the Base chain ecosystem, whether to issue tokens in the future and the specific design of tokens will be the focus of market attention.

At present, Trump's cabinet formation has been basically completed, and many of his nominated ministers have expressed support for cryptocurrencies, showing that cryptocurrencies have a huge political influence in the United States. Market optimism is also growing for the future development of the crypto industry.