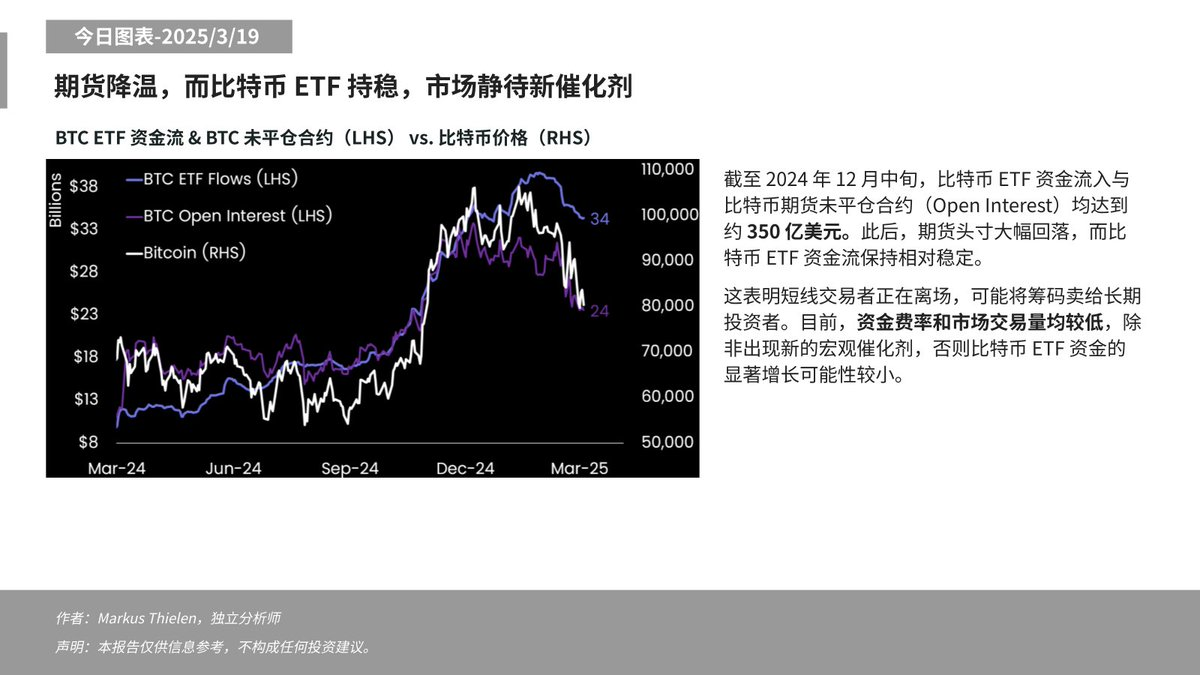

PANews reported on March 19 that Matrixport's analysis today pointed out that the Bitcoin futures market has cooled down, while Bitcoin ETF fund inflows have remained stable. As of mid-December 2024, Bitcoin ETF fund inflows and futures open interest both reached about $35 billion. Subsequently, futures positions fell sharply, but Bitcoin ETF fund flows were relatively stable, indicating that short-term traders are leaving the market and may sell their chips to long-term investors.

Currently, market funding rates and trading volumes are at low levels. Analysts believe that unless new macro catalysts emerge, it is unlikely that Bitcoin ETF funds will grow significantly.