Author: Frank, PANews

In the middle of the night when the cryptocurrency market was turbulent, a precise attack on the decentralized derivatives exchange Hyperliquid was quietly staged. On March 26, a trader pushed Hyperliquid into the abyss of liquidity crisis and liquidation risk through a huge short order of 430 million JELLYJELLY tokens. With the price of JELLYJELLY soaring by 560% and the top exchanges launching contracts at lightning speed, Hyperliquid was forced to make a life-or-death choice between the principle of decentralization and the security of user assets. This offensive and defensive battle, which lasted only 2.5 hours, not only exposed the governance paradox of decentralized exchanges, but also became a textbook case of capital hunting in the crypto world.

Empty order raid, a carefully planned targeted explosion

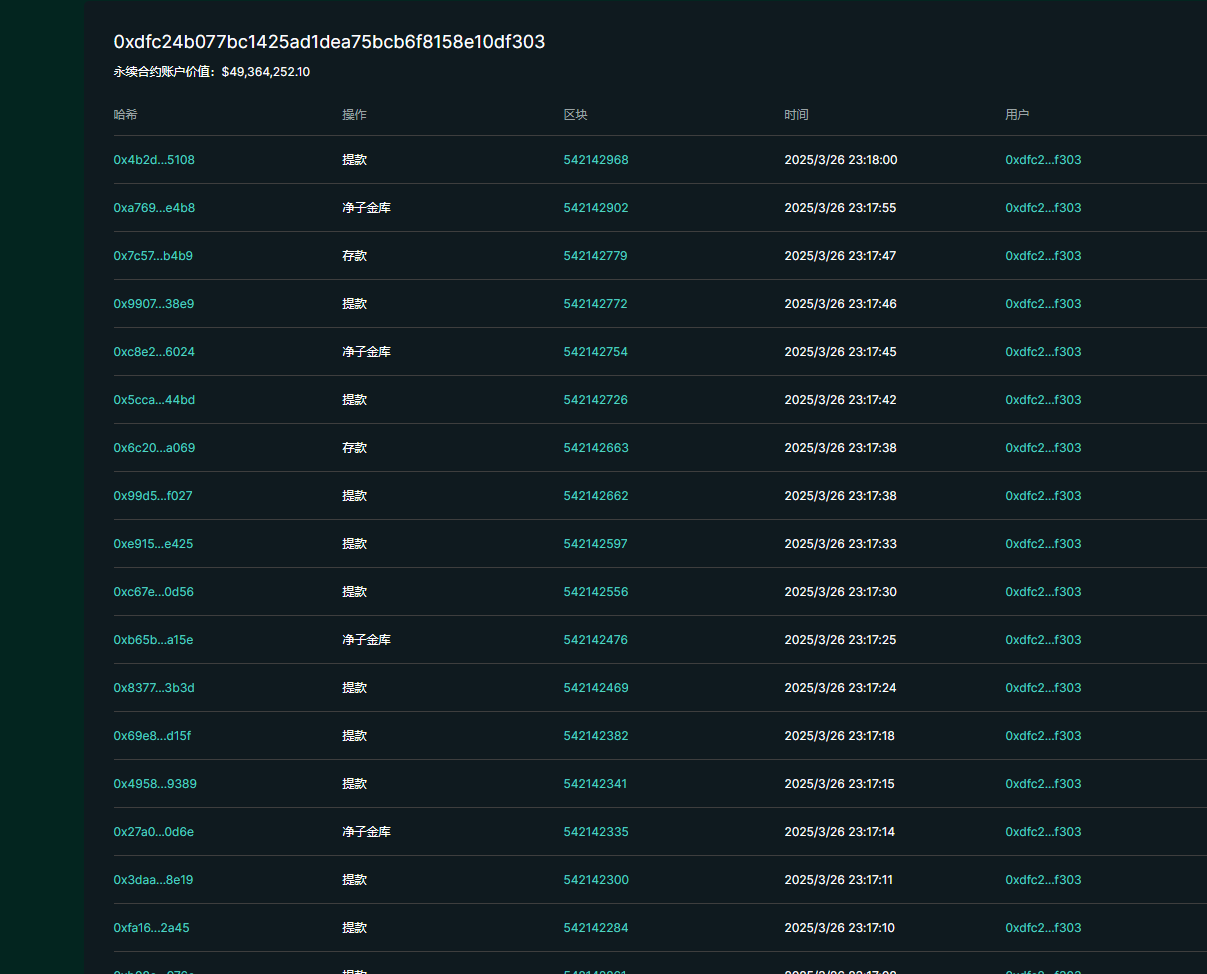

Following the previous 50x leverage whale incident , Hyperliquid was once again targeted by a team with ulterior motives. On the evening of March 26, a trader opened a short order of 430 million JELLYJELLY tokens (worth $4.08 million) on Hyperliquid. After the price rose slightly, the user took the initiative to close part of the order and withdraw the margin. Due to insufficient counterparty orders, the remaining 398 million JELLYJELLY short orders had to be taken over by Hyperliquid again.

Since then, as the price of JELLYJELLY has been rising, Hyperliquid's short orders have continued to lose money, with the maximum floating loss reaching $11.45 million. On-chain analyst @ai_9684xtpa said on social media that if the price of JELLYJELLY tokens rises to $0.17, the vault will liquidate and lose the $240 million currently held (Note: @ai_9684xtpa made a miscalculation here, the actual liquidation price is $0.1479, and Hyperliquid uses a warehouse splitting mechanism, so a single order will not lead to a full warehouse loss).

It seems that a deliberate short squeeze operation targeting the Hyperliquid vault is about to take place. If Hyperliquid chooses to intervene manually, it will face community doubts about its identity as a decentralized exchange. If the order is left alone, a large number of users who choose to store their funds in the Hyperliquid vault will suffer huge losses. The sophistication of this conspiracy strategy design can be called the contemporary "two peaches kill three warriors".

Next, the price fluctuations of JELLYJELLY repeatedly touched upon the life and death of Hyperliquid.

The top exchange contracts were launched quickly, and Hyperliquid came to an emergency stop

@off_thetarget, a blogger, revealed on X that someone contacted him on March 24 to help promote the listing of JELLYJELLY on Binance. @off_thetarget believes that for the operation team of the JELLYJELLY event, if it is successfully listed on Binance, it can make a lot of money through spot purchases. If it fails to be listed on Binance, it can also make a profit by holding short orders.

At this point, the question of whether Binance will launch JELLYJELLY at this critical moment has become a sword hanging over Hyperliquid's head, and the discussion on JELLYJELLY on social media has continued to heat up.

At 23:10, OKX exchange announced that it would officially launch the JELLYJELLY perpetual contract trading pair at 23:30. A few minutes later, Binance exchange also announced the launch of the JELLYJELLY perpetual contract.

Influenced by this news, many users flocked to the long side, and the price of JELLYJELLY also rose rapidly, from the initial $0.0095 when the trader opened an order on Hyperliquid to a maximum of $0.06276, an increase of 560%. It only needs to rise by about 135% to trigger the Hyperliquid liquidation price of $0.1479.

Between life and death, Hyperliquid began to take action. At 23:21, users found that the price curve of JELLYJELLY on the Hyperliquid platform stopped updating, and the order book was also blank. The JELLYJELLY position, which had been in huge losses, was also invisible. The community speculated that Hyperliquid had already delisted the JELLYJELLY token and controlled the loss in this way. (Some community users also reported that Hyperliquid actually delisted the JELLY contract after OKX announced the launch of the contract and before Binance launched it.)

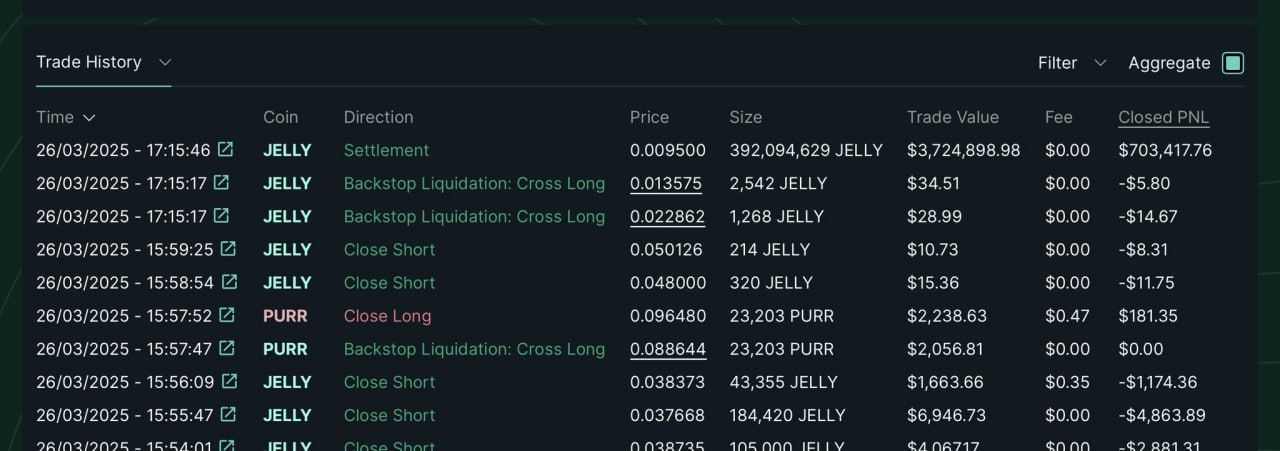

A few minutes later, in the settlement history order book of Hyperliquid's vault, people found the settlement record of JELLYJELLY's short order. The settlement price was $0.0095, the same as the opening price of the initial short order attacker. This also means that Hyperliquid did not suffer any losses in this order.

However, the spot price of JELLYJELLY in the market should be around $0.05 at the time of settlement, a difference of more than 5 times. This operation is obviously not in line with common sense. It seems that Hyperliquid just roughly closed this loss-making order through human intervention.

At 23:44, Hyperliquid officials, who had remained silent throughout the process, finally explained on Discord: "After discovering evidence of suspicious market activity, the validator group held a meeting and voted to remove JELLY violators. All users, except for the marked addresses, will receive full compensation from the Hyper Foundation. This will be done automatically based on on-chain data in the next few days. No ticketing is required. The method will be shared in detail in a later announcement. As with other chains, validators often need to call on everyone to take decisive action to ensure the integrity of the network. Enhancing the robustness and transparency of the voting system is a top priority. Please note that as of the time of writing, HLP's 24-hour profit and loss is approximately 700,000 USDC. We will make technical improvements and learn from experience to make the network stronger. More details will be shared soon."

There are several key elements in this announcement: 1. The operation was decided by voting (maintaining the mechanism of decentralized governance). 2. Users who opened JELLYJELLY positions on Hyperliquid will be compensated for their losses (but violators, that is, the address that launched this attack, will be excluded). 3. In this practice, the vault did not suffer any losses and still maintained a profit of $700,000 within 24 hours (boosting users' confidence in the profitability of the vault).

As Hyperliquid forcibly closed the order, the targeted attack on Hyperliquid also failed. The price of JELLYJELLY began to plummet, plummeting 67% in 13 minutes. Perhaps aware that the drastic market fluctuations may affect the listing effect, OKX immediately announced that it would postpone the listing time of JELLYJELLY.

The dual torture of liquidity trap and safe depository design

At this point, the targeted attack on Hyperliquid seems to have come to an end. Although the entire incident lasted only 2.5 hours, in this short period of time, a leading decentralized derivatives exchange with a market value of approximately US$5 billion became the target of public criticism. The problems exposed and the various struggles among various forces are classic examples of conspiracy in the crypto world. There are still some issues worth interpreting.

First of all, what is the logic behind the initial trader's operation? What design flaws does this reveal about Hyperliquid?

The first problem exposed was Hyperliquid's trading liquidity. Unlike the previous 50x leveraged whale that chose Ethereum as the trading currency, this time the trader chose a relatively niche token such as JELLYJELLY. Data shows that Hyperliquid's JELLYJELLY contract trading is sluggish, with a trading volume of only tens of thousands of dollars per minute. Therefore, when traders try to close large short orders, if there is not enough liquidity in the order book, Hyperliquid will step in to provide liquidity.

Secondly, it brings up the disadvantage of Hyperliquid’s vault acting as a counterparty. Compared with Hyperliquid, CEX relies more on centralized management of market makers and order books when processing large orders, rather than relying on community-provided liquidity pools (such as GLP or HLP).

Behind the zero-sum game: There are no winners among those who add fuel to the flames

It seems that Hyperliquid has retained the reputation of decentralized governance through voting. But later, according to @spreekaway's revelation, Hyperliquid's voting validators are all votes from the Hyper Foundation. This was also criticized by the community. This vote was still not a resolution reached by the entire community, but an official decision of Hyperliquid. Although the matter was urgent, from this perspective, Hyperliquid's decentralized governance is still covered up.

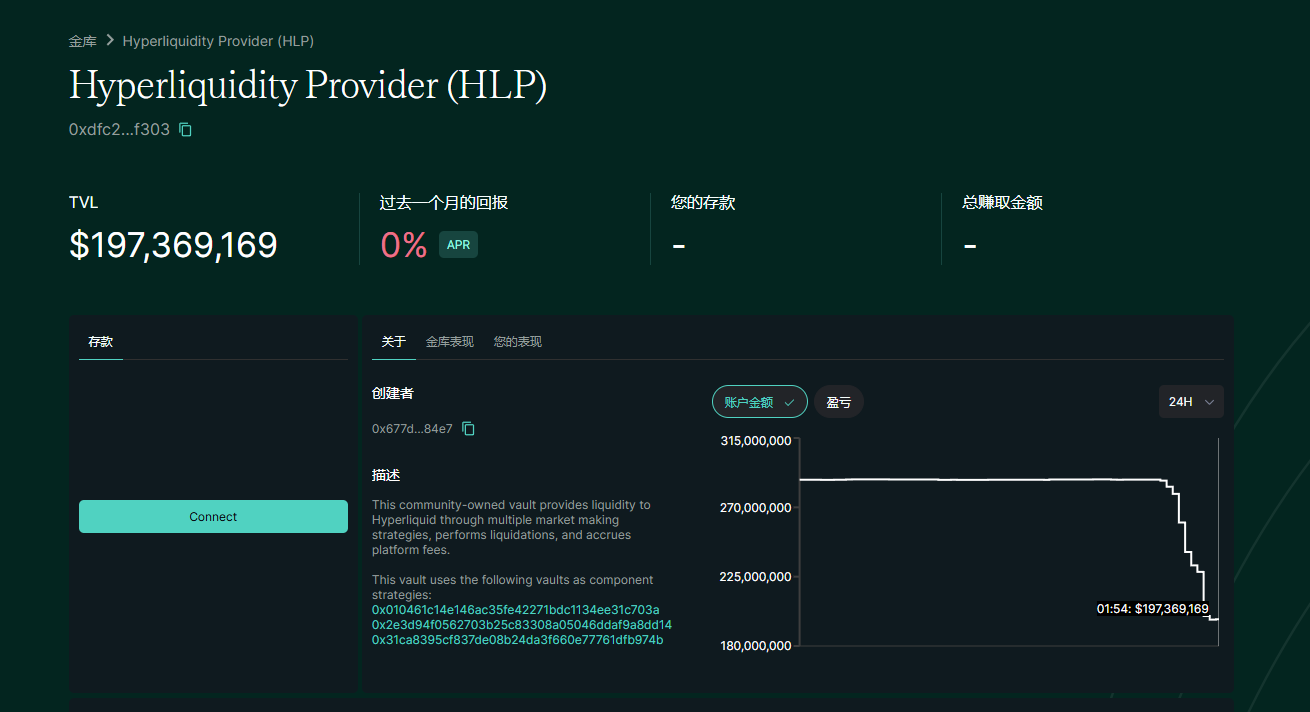

In addition, Hyperliquid's user trust has also suffered a real blow. During the short position holding process, PANews found that many funds on the chain chose to withdraw funds from the vault to avoid joint losses in the event of liquidation. Although the yield of the Hyperliquid vault was eventually pulled back to normal levels, the deposit amount decreased by 90 million US dollars in a short period of time, a decrease of 30%. From this perspective, Hyperliquid seems to have avoided vault losses, but it has also suffered a heavy blow.

The treasury growth of the past three months was wiped out overnight.

In addition, the traders who initiated the incident did not seem to profit from this incident. Since Hyperliquid chose to exclude the violators from the compensation list, the long orders and spot orders opened by this trading team on Hyperliquid will suffer losses from price changes and will not gain the expected benefits. Its open positions on other platforms may also suffer losses due to the drastic market fluctuations.

As for the other exchanges that chose to list the token quickly during this process, the popularity of JELLYJELLY has come and gone, and it may not attract many users after this incident. Instead, it has caused many users’ disgust on social media because of this suspected operation of adding insult to injury. Especially in the Hyperliquid community, many users can be seen condemning Binance’s operation.

The initiator of this incident is also one of the focuses of discussion on social media. According to @off_thetarget’s revelation, it seems that the JELLYJELLY team tried to gain a profit through this loophole.

Many users also believe that this was a deliberate attack on Hyperliquid by other centralized exchanges. According to Lookonchain monitoring, the funds used to attack Hyperliquid and open positions were withdrawn from Binance and OKX exchanges.

In addition, during this process, many KOLs also participated in the discussion and added fuel to the flames.

Retail investors pay for the farce

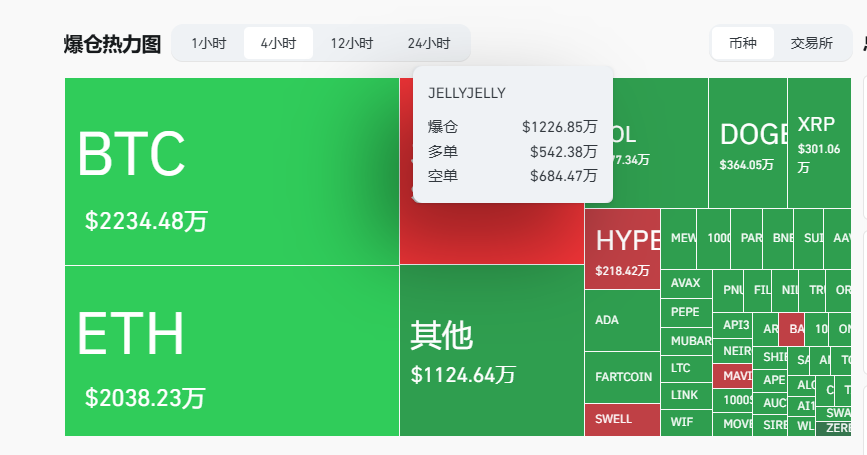

In fact, in this incident, retail investors who followed the trend and bought or went long became the biggest victims. According to data from coinglass, within 4 hours, the liquidation amount of JELLYJELLY reached 12.2685 million US dollars (the market value of JELLYJELLY is only 23 million US dollars), ranking third in the entire network, second only to Bitcoin and Ethereum.

As the price rose from $0.0082 to $0.0627 within 2 hours, and then fell from the high point to $0.021, the maximum increase reached 665% and the maximum decrease reached 67%. In this operation, how many retail investors will have sleepless nights.

When the price of JELLY finally settled at $0.021, this thrilling sniper battle seemed to end with Hyperliquid's "defensive victory", but the battlefield left behind a deeper industry question: Does the governance of decentralized exchanges belong to the community or the foundation? Can the liquidity dilemma avoid becoming a gap for capital hunting? And are retail investors destined to become victims of conspiracy amid KOL misleading, exchange games and price manipulation? The incident may be temporarily stopped, but the road to rebuilding trust in the crypto world is much longer than a thrilling liquidation operation. As the community said: This is not the first time, nor will it be the last time - under the guise of decentralization, the Game of Thrones has never left the stage.