In the past week, the stablecoin Season and Superchain narratives offer thoughts on the DeFi world.

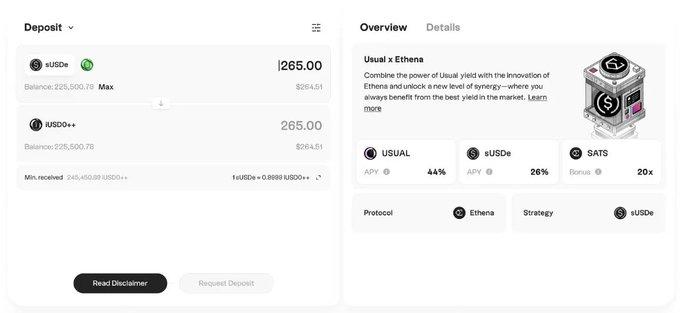

1/ Ethena and Usual kick off the stablecoin season

(1) Ethena launches USDtb, supported by BlackRock’s BUIDL

(2) Ethena and Usual collaborate to transfer TVL and incentives to each other

(3) WLFI cooperates with Ethena to integrate sUSDe into the lending market

Different from the previous Stablecoin war, this round of stablecoins has a clear trend of banding together, and is much more stable and sophisticated than the impulsive boys in the previous cycle.

Usual has a built-in multi-party game stablecoin mining mechanism, which is similar to the underlying logic of DeFi Summer's Pool1-3. The differences are 1. RWA concept 2. The game model is further refined 3. Partners such as Binance provide massive liquidity exit.

Cooperation with Ethena is conducive to the expansion of USD0. The early high-speed TVL growth depends on the coin price. Raising the coin price -> pulling TVL -> increasing the token staking income. The upper limit of this perpetual motion model is that when the TVL growth slows down, it may usher in an inflection point. Eventually, the token price and TVL gradually balance and match, forming a reasonable return close to the market.

Another X factor is that favorable external stimuli (given RWA’s unique policy dividends in this cycle) may stimulate the coin price again to drive a new round of TVL growth.

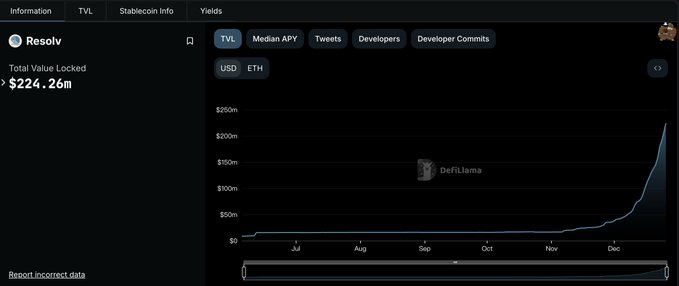

2/ Resolv TVL has increased by nearly 400% in the last two weeks

(1) A Delta neutral stablecoin protocol similar to Ethena. The core difference is the introduction of RLP, which is used to absorb the risk of market fluctuations and is an insurance layer between USR and the underlying assets.

(2) If the collateral pool incurs losses (such as funding rate losses or unexpected losses), these losses will be borne first by RLP and will not affect USR holders.

(3) To incentivize users to mint RLP, RLP users will receive a higher profit share as compensation for taking on market and counterparty risks.

(4) The design of RLP and USR is equivalent to risk stratification for users with different risk preferences.

(5) In the future, Resolv will be launched on HyperEVM

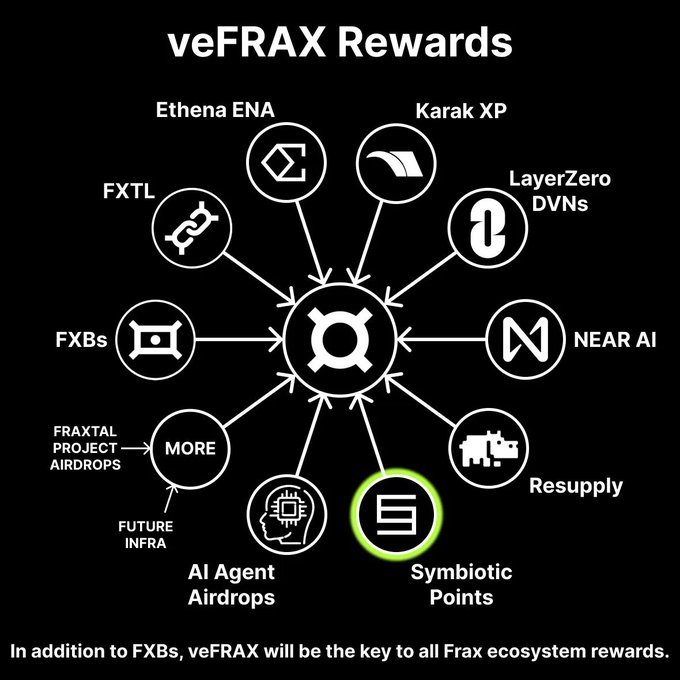

3/ Frax is being recast

(1) Frax and Symbiotic collaboration

(2) veFRAX multiple income structure

(3) Proposal to use BlackRock BUIDL as collateral for Frax USD

4/ Superchain Narrative

(1) Ink developed by Kraken is launched on the mainnet and joins the Hyperchain

(2) Dinero launches the first LST on ink

(3) Velodrome will be integrated into Ink in 2025. Ink has purchased and locked up 2.5M veLO compliant exchanges to develop their own L2, which will be a trend in the next few years. With the success of Base, Ink's market expectations are also high. As the liquidity center of the superchain, Velo may no longer expand through a fork such as Aerodrome. Strategically, Velodrome will be used to expand horizontally to occupy other superchain members.

5/ Convex and Yearn collaborate to launch decentralized stablecoin Resupply

(1) reUSD: Stablecoins that generate returns from the lending market are used as collateral, such as stablecoin certificates in Curve Lend and Frax Lend.

(2) Leverage support: through built-in leverage loop function

A classic nesting doll from old DeFi.

6/ GammaSwap Yield Token is about to be completed and sent for audit

GammaSwap’s track is to cut in from hedging impermanent loss, lending/splitting and reorganizing LP tokens, and at the same time achieving a profit and loss curve similar to that of options. The use of old DeFis is increasing, and the growth of TVL is mainly observed after the launch of Yield Token.

7/ Ethena’s new proposal for integrating Derive options and perpetual futures is now published on the governance forum

(1) If approved, Derive will serve as the on-chain hedging and underlying trading venue for a portion of Ethena’s $6 billion TVL.

(2) Derive is one of the few options trading products on the chain. If it can obtain better liquidity through Ethena, its competitiveness will be greatly improved.

8/ Aptos changed its leader, Mo said that no APT was sold, and the new CEO will pay more attention to the development of DeFi

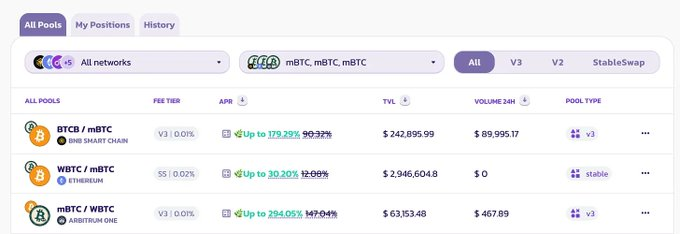

9/ Babypie incentivizes mBTC-BTC liquidity on multiple chains and dex

10/ Fluid expands to Arbitrum

- Introducing $FLUID to the Arbitrum Network and implementing growth incentives

- One of the most efficient dex currently, L2 expansion will capture larger transaction volumes

11/ (1) Avalanche Foundation launches infraBUIDL(AI) program

(2) LFJ is about to launch a DEX aggregator on Avalanche

(3) Morpho Labs proposes to deploy core smart contracts to multiple chains

(4) Sonic mainnet launch, token conversion, Aave integration, and some ecosystem projects