Original text: "The Crypto Geniuses Who Vaporized a Trillion Dollars" by Jen Wieczner

Compiled by Amber, Foresight News

The ship is beautiful: about 500 tons, with a 171-inch hull made of glass and steel as white as Santorini and a swimming pool with a glass bottom. The ship will be completed in July, and it will be perfect for sunset dinners near Sicily and cocktails in the turquoise shallows off the coast of Ibiza. Her future captain showed photos of the $50 million ship to friends at the party, boasting that it was "bigger than all the yachts of the richest billionaires in Singapore" and described plans to decorate the cabins with projector screens so that they can better display their collection of NFT artworks.

This $150 million superyacht is the largest yacht sold in Asia by the veteran shipbuilder Sanlorenzo. It is a carnival for the cryptocurrency "upstarts." "This represents the beginning of a fascinating journey," the yacht broker said in the auction announcement last year, adding that it "looks forward to witnessing many happy moments on board." The buyer also came up with a name for the boat that is both crypto-cultural and interesting enough - Much Wow.

Her buyers, Su Zhu and Kyle Davies, are two Andover University graduates who run a Singapore-based crypto hedge fund called Three Arrows Capital. However, they never got to pop champagne on Much Wow’s bow. Instead, in July of this year, the same month the boat was set to launch, the two filed for bankruptcy and disappeared before making the final payment, leaving the boat “abandoned” at her berth in La Spezia on the Italian coast. Although she has not yet been officially listed for resale, the luxury yacht has already appeared in the circle of international superyacht dealers.

Since then, the yacht has become an endless meme and after-dinner conversation on Twitter. From millions of small-scale cryptocurrency holders to industry practitioners and investors, almost everyone in the world has witnessed the collapse of Three Arrows Capital, which was once perhaps the most respected investment fund in the booming global financial industry, in shock or dismay. The company's collapse triggered a series of effects, not only forcing Bitcoin to be sold at a historic level, but also "destroying" a lot of the "achievements" of the crypto industry in the past two years.

Several crypto companies in New York and Singapore were direct victims of the Three Arrows Capital collapse. Voyager Digital, a publicly traded cryptocurrency exchange based in New York that once had a multibillion-dollar valuation, filed for bankruptcy protection in July, disclosing that Three Arrows Capital owed it more than $650 million. Genesis Global Trading provided a $2.3 billion loan to Three Arrows Capital. Blockchain.com, an early cryptocurrency company that provided digital wallets and grew into a large exchange, has not repaid the $270 million loan from 3AC, and the company has laid off a quarter of its employees as of this writing.

The smartest observers in the cryptocurrency industry generally believe that Three Arrows Capital is responsible for the 2022 cryptocurrency crash, as market chaos and forced selling caused Bitcoin and other digital assets to plummet by 70% or more, evaporating more than $1 trillion in value. "It is estimated that 80% of the cause of this crash is due to the collapse of 3AC," said Sam Bankman-Fried, CEO of FTX, who has rescued several bankrupt lenders over the past period of time and may understand these problems better than anyone. "It's not that 3AC is the only one with problems, it's just that they did it bigger than anyone else. Because of this, they have gained more trust in the entire crypto ecosystem, which ultimately led to more serious consequences."

For a company that has long portrayed itself as playing with only its own money—“We don’t have any outside investors,” 3AC CEO Su Zhu told Bloomberg in February—Three Arrows Capital’s destructive power is staggering when the story stops. As of mid-July, creditors had filed more than $2.8 billion in bond claims, and that number is probably not the full iceberg. From the most well-known lenders to wealthy investors, everyone in the crypto space seemed to have lent their digital currency to 3AC, even 3AC’s own employees, who deposited their salaries into its proprietary platform in exchange for interest. “A lot of people are disappointed, some of them are embarrassed,” said Alex Svanevik, CEO of Nansen, a blockchain analysis company. “They shouldn’t have done this because a lot of people’s lives could be ruined by this, and a lot of people gave them money.”

That money now appears to be gone, along with assets from several affiliated funds and portions of the funding for various crypto projects managed by 3AC. The true scale of the losses may never be known, and for the many crypto startups that parked money with the firm, publicly disclosing the relationship could risk increased scrutiny from investors and government regulators. (For this reason, and the legal complexities of being a creditor, many of the people who spoke about their experiences with 3AC asked to remain anonymous.)

Meanwhile, the unclaimed yacht appears to be a slightly absurd embodiment of the arrogance, greed, and recklessness of the company’s 35-year-old co-founder. Su Zhu and Davies are currently in hiding as their hedge fund is in the midst of a messy liquidation process. (Multiple emails sent to them and their lawyers requesting comment went unanswered, except for Davies’s automated response that read, “Please note that I am out of the office right now.”) For an industry that constantly defends itself, cryptocurrency practitioners have been trying to prove that it is not a scam since day one, but Three Arrows Capital seems to have single-handedly proved the “opposing debater’s” point.

Su Zhu and Davies are two ambitious young men who are very smart and understand the structural opportunity of digital currency very well: cryptocurrency is a game of creating virtual wealth out of thin air and convincing others in the form of traditional currency that they insist that virtual wealth should become real-world wealth. They build social media credibility by playing the role of billionaire financial geniuses, converting it into actual financial credit, and then borrowing billions of dollars for speculative investments that they can fuel success through their influential large platforms. Unknowingly, the pretend billionaires have grown into real billionaires with the financial resources to buy super yachts. They fumble forward, but always seem to make the plan fall into place perfectly, until the end suddenly arrives.

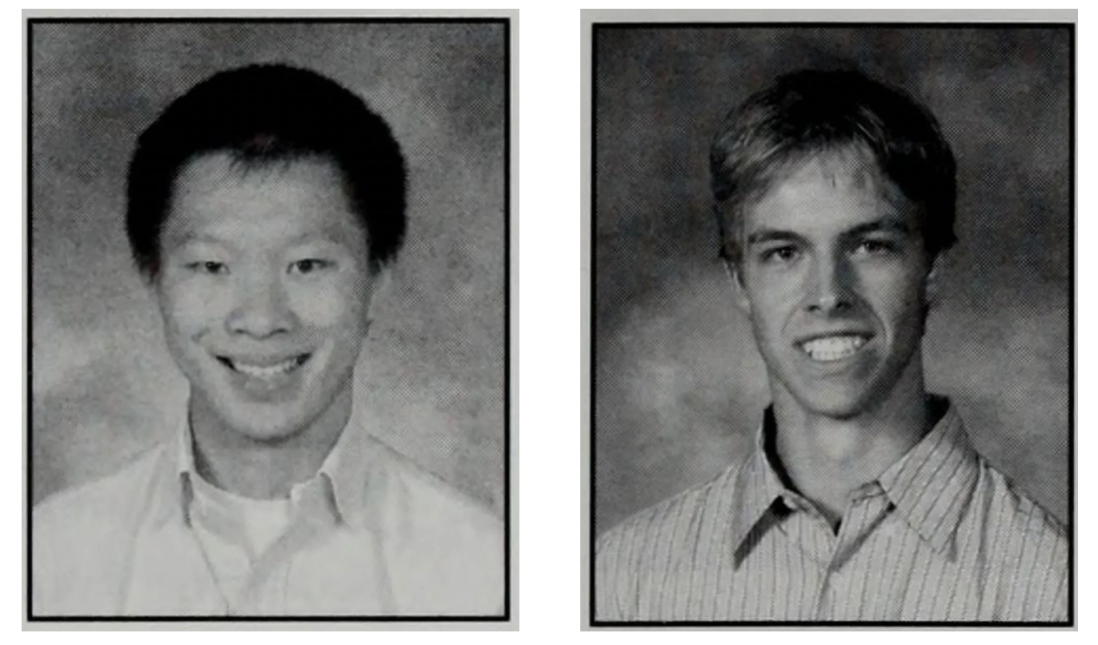

Su Zhu and Davies were seniors at Andover University in 2005. Source: Phillips Academy

Su Zhu and Kyle Davies met at Phillips Academy in Andover, Mass. It was well known that many of the Andover kids came from wealthy or prominent families, but Su Zhu and Davies grew up in relatively ordinary circumstances in the Boston suburbs. “Neither of our parents were wealthy,” Davies said in an interview last year. “We were very middle-class people.” They weren’t particularly popular, either. “They were all called weird, especially Su,” a classmate said. “Actually, they weren’t weird at all—just shy.”

Su Zhu, a Chinese immigrant who came to the United States with his family when he was 6, was known for his perfect GPA and heroic AP classes; in his senior yearbook, he received the top honor of “most diligent.” He received a special award for his work in math, but he was more than just a numbers savant—he also won Andover’s top prize for fiction when he graduated. “Su was the smartest guy in our class,” a classmate recalled.

Davies was also a star on campus, but his classmates viewed him as an outsider in other ways—if they remembered him at all. A budding Japanese speaker, Davies graduated with highest honors in Japanese. According to Davies, he and Su Zhu weren’t particularly close at the time. “We went to high school together, went to college together, got our first jobs together. We were never the best of friends,” he said on the Crypto Podcast in 2021. “I didn’t know him that well in high school. I knew he was a smart guy—he was like valedictorian of our class—but in college, we talked a lot more.”

“Going to college together” was at Columbia University, where they both took math-heavy courses and joined the squash team. Su Zhu graduated a year early with honors, then moved to Tokyo to work in derivatives trading at Credit Suisse, and Davies followed him as an intern. Their desks were next to each other until Su Zhu was fired during the financial crisis and subsequently joined a high-frequency trading platform called Flow Traders in Singapore.

There, Su Zhu learned the art of arbitrage—trying to capture tiny changes in the relative value between two related assets, typically by selling the overpriced asset and buying the underpriced one. He focused on exchange-traded funds (basically mutual funds that are listed like stocks), buying and selling related funds to make a small profit. He excelled at it, topping Flow’s profit rankings. That success gave him new confidence. He was known to be outspoken about the performance of his colleagues and even his boss. Su Zhu stood out in another way: In the hot, server-filled Flow offices, he would come to work in shorts and a T-shirt, then take his shirt off, not getting dressed even to walk through the building’s lobby. “Su would walk around shirtless in his mini shorts,” a former colleague recalled. “He was the only one who would trade with his shirt off.”

After Flow, Zhu worked for a while at Deutsche Bank, following in the footsteps of crypto legend and billionaire co-founder of the BitMEX exchange Arthur Hayes. Davies stayed at Credit Suisse, but by then both were tired of big-bank life. Zhu complained to acquaintances about the poor quality of his bank colleagues, letting people lose the firm’s money on trades with few consequences. In his view, the best talent had left hedge funds or struck out on their own. He and Davies, now 24, decided to start their own platform. “There was almost no downside to leaving,” Davies explained in an interview last year. “Like, if we left and really screwed up, we would definitely get another job.”

In 2012, while living temporarily in San Francisco, Su Zhu and Davies pooled their savings and borrowed money from their parents to raise about $1 million in seed funding for Three Arrows Capital. The name comes from a Japanese legend in which a prominent daimyo, or warlord, taught his sons the difference between trying to break a single arrow — effortless — and trying to break three arrows at once — impossible.

In less than two months, they doubled their money, Davies said on the podcast UpOnly. The two soon headed to Singapore, which has no capital gains tax, and by 2013 they had registered the fund there with plans to give up their U.S. passports and become citizens. Mr. Su Zhu, who spoke fluent Chinese and English, moved easily in Singapore's social circles, occasionally hosting poker games and friendly matches with Mr. Davies. Still, they seemed frustrated that they couldn't take Three Arrows Capital to the next level. At a dinner around 2015, Mr. Davies lamented to another trader how difficult it was to raise money from investors. The trader wasn't surprised — after all, Mr. Su Zhu and Mr. Davies didn't have much pedigree or track record.

At this early stage, Three Arrows Capital is focused on a niche: arbitrage emerging market foreign exchange (or “FX”) derivatives — financial products pegged to the future price of smaller currencies, such as the Thai baht or the Indonesian rupiah. Access to these markets depends on building strong trading relationships with big banks, which can be “almost impossible,” BitMEX’s Hayes wrote recently in a Medium post. “When Su and Kyle told me how they got started, I was impressed by their haste to get into this lucrative market.”

At the time, foreign exchange trading was moving to electronic platforms, and it was easy to spot the differences, or spreads, between different banks’ quotes. Three Arrows Capital found its sweet spot by trolling and “picking them,” as Wall Street calls it, when prices were wrong, often making just pennies on every dollar traded. It was a tactic that the banks loathed — Su Zhu and Davies were essentially siphoning off money that the institutions would otherwise have kept. Sometimes, when the banks realized they had misquoted Three Arrows Capital, they would ask to modify or cancel the trades, but Su Zhu and Davies wouldn’t budge. Last year, Su Zhu tweeted a photo of himself smiling in front of 11 screens in 2012. Appearing to refer to their foreign exchange trading strategy of picking banks’ quotes, he wrote, “You haven’t survived until you’ve beaten five dealers with the same quote at 2:30 in the morning.”

By 2017, banks began trying to stop the arbitrage. “Whenever Three Arrows Capital asked for a quote, all the bank forex traders would say, ‘Fuck these guys, I’m not going to price them,’ ” said a former trader who was a counterparty to 3AC. Lately, there’s a joke among forex traders that they knew about Three Arrows Capital very early on and are now watching it fail with a bit of schadenfreude. “We forex traders are partly responsible for this because we knew these guys couldn’t make money in forex,” the former trader said. “But when they came to crypto, everyone thought they were geniuses.”

On May 5, 2021, as Three Arrows Capital’s fortunes reached their peak, Su Zhu tweeted a photo of the firm’s early days in 2012, when he and Davies were working on deals in a two-bedroom apartment. The message was implicit in the tweet: Think how great it is that we built a multi-billion dollar company from such humble beginnings. Source: Su Zhu Twitter

One fundamental thing to understand about cryptocurrency is that, so far anyway, it has been in a progression of extreme but roughly regular boom-and-bust cycles. In Bitcoin’s 13-year history, the 2018 bear market was particularly painful. After reaching an all-time high of $20,000 in late 2017, the cryptocurrency fell to $3,000, and thousands of smaller tokens emerged on the market. It was against this backdrop that Three Arrows Capital turned its attention to cryptocurrencies, investing at such an opportune time that Su Zhu is often cited as a genius (that is, he gets credit) for accurately calling the bottom of that cycle. In later years, it looked like brilliance to the many impressionable crypto newbies — and even industry insiders — who followed Su Zhu and Davies on Twitter. But in fact, the timing was probably just luck.

As cryptocurrencies traded on exchanges around the world, the company’s arbitrage experience came in handy immediately. One well-known trading strategy was called “kimchee premium” — it involved buying bitcoin in the U.S. or China and then selling it at a higher price in South Korea, where exchanges are more tightly regulated, causing prices to rise. Back then, winning trade setups like these were plentiful and profitable. They are the bread and butter of Three Arrows Capital, which tells investors that it practices low-risk strategies designed to make money in both bull and bear markets.

Another type of crypto arbitrage might involve buying bitcoin at the current (or “spot”) price while simultaneously selling bitcoin futures, or vice versa, to capture a price premium. “The fund’s investment objective is to achieve consistent market-neutral returns while preserving capital,” 3AC’s official filing reads. Of course, investing with limited downside regardless of what the broader market is doing is called “hedging” (hedge funds get their name). But hedging strategies tend to strip out the most money when executed at scale, so Three Arrows Capital began borrowing money and putting it to work. If all went well, the profits it generated could exceed the interest it owed on the loan. Then it would do it all over again, continuing to grow its investment pool, which would allow it to borrow even larger amounts.

In addition to massive lending, the company’s growth strategy relies on another plan: building a massive social media presence for the two founders. In the crypto space, the only social media platform that matters is Twitter. Many of the key figures in what has become a global industry are anonymous or pseudo-anonymous Twitter accounts with silly cartoon avatars. In an unregulated space without traditional institutions and where global markets trade 24/7, Crypto Twitter is the center of the arena, a clearinghouse for news and opinions that drive the market.

Su Zhu has earned his way into the upper echelons of Crypto Twitter. According to friends, Su Zhu had a clear plan to become a “Twitter celebrity”: it entails tweeting a lot, catering to the crypto masses with extremely optimistic predictions, attracting a large number of followers, and in turn becoming the top predator on Crypto Twitter, profiting at the expense of everyone else.

Su Zhu gained 570,000 followers by promoting his crypto “supercycle” theory — the idea of a years-long bull run in bitcoin prices that sees prices rise to millions of dollars per coin. “As the crypto supercycle continues, there will be more and more people trying to understand how far ahead they are,” Su Zhu tweeted last year. “The only thing that matters is how many coins you have now.” And: “As the supercycle continues, mainstream media will try to talk about how early whales own everything. The richest person in crypto now has a net worth close to zero in 2019. I know someone who ironically said that if someone had loaned them $50k more in the past, they would have $500m more now.” Su Zhu constantly emphasizes this point on the platform and in crypto podcasts and video shows: Buy, buy, buy now, the supercycle will drive you crazy one day.

“They used to brag that they could borrow as much as they wanted,” said a former trader who knew them in Singapore. “It was all planned, man, from the way they built their credibility to the way the fund was structured.”

As it grew, Three Arrows Capital expanded beyond Bitcoin to a range of startup crypto projects and more obscure cryptocurrencies (sometimes called “shitcoins”). The firm seems fairly indiscriminate in its bets, almost as if it were treating them like a charity. Earlier this year, Davies tweeted: “It doesn’t matter what VCs invest in, more fiat in the system is good for the industry.”

Many investors remember the first time they sensed something might be wrong at Three Arrows Capital was in 2019. That year, the fund began reaching out to industry peers, calling it a rare opportunity. 3AC had invested in a crypto options exchange called Deribit and sold a portion of its stake; the term sheet pegged Deribit’s value at $700 million. But some investors noticed the valuation seemed off — and discovered it was actually valued at just $280 million. It turned out that Three Arrows Capital was trying to sell some of its investment at a significant markup, essentially generating a huge kickback for the fund. It’s a sketchy thing to do in venture capital, and it blindsided both outside investors and Deribit itself.

But the company is thriving. Crypto markets rallied for months as the Federal Reserve pumped money into the economy during the pandemic. By the end of 2020, Bitcoin had risen fivefold from its March low. To many, it really did look like a supercycle was underway. Three Arrows Capital’s main fund returned more than 5,900%, according to its annual report. By the end of that year, it had more than $2.6 billion in assets under management and $1.9 billion in liabilities.

One of 3AC’s largest positions — and one that plays a big role in its fate — is a form of Bitcoin traded on a stock exchange called GBTC (short for Grayscale Bitcoin Trust). The company broke away from its old routine of making profits through arbitrage, accumulating as much as $2 billion in GBTC. At the time, it was trading at a premium to regular Bitcoin, and 3AC was happy to pocket the difference. On Twitter, Su Zhu often makes bullish comments about GBTC, and has repeatedly observed that buying it is “savvy” or “smart.”

Su Zhu and Davies’ public personas became more extreme; their tweets became increasingly bombastic, and social acquaintances said they were unabashedly condescending toward past friends and less wealthy contemporaries. “They don’t have much empathy for most people, especially ordinary civilians,” said one former friend.

Three Arrows Capital was known for high staff turnover, especially among traders, who complained that they were never recognized for winning trades but were insulted as stupid when they screwed up — even having their salaries garnished and bonuses cut. (Still, 3AC traders are highly sought after within the industry; before the fund collapsed, Steve Cohen’s hedge fund Point72 was interviewing a team of 3AC traders to poach members of its trading team.)

Su Zhu and Davies kept the company’s inner workings secret. Only the two of them could transfer funds between certain crypto wallets, and most Three Arrows Capital employees had no idea how much money the company was managing. While employees complained about long hours, Su Zhu was reluctant to hire new people, fearing they would “leak trade secrets,” the friend said. In Su Zhu’s view, Three Arrows Capital was doing a favor for anyone who worked for it. “Su said they should be paid for providing valuable learning opportunities for employees,” the friend added. Some business acquaintances in Singapore describe the 3AC founders as playing the Wolf of Wall Street trading floor in the 1980s.

Both men, now married fathers with young children, have become exercise fanatics, working out up to six times a week and following a calorie-restricted diet. Su Zhu has cut his body fat to around 11 percent and posts “updates” on Twitter in which he posed shirtless. A friend recalled that on at least one occasion, he called his personal trainer “fat.” When asked about his drive to become “big,” Su Zhu told an interviewer, “I was very weak most of my life. After COVID, I found a personal trainer. I have two kids, so it’s like wake up, play with your kids, go to work, go to the gym, go home, and put them to sleep.”

Although not yet billionaires, Su Zhu and Davies are beginning to enjoy some of the luxuries of the super-rich. In September 2020, Su Zhu bought a $20 million mansion in his wife's name, known as a "superior bungalow" in Singapore. The following year, he bought another property in his daughter's name for $35 million. (Davies also purchased a mansion after becoming a Singaporean citizen, but the house is still under renovation and he has not moved in yet.)

Yet in person, Su Zhu is an introvert who doesn’t like to chat. Davies is outspoken in both the company’s business dealings and social events. Some acquaintances who first encounter the pair on Twitter find them surprisingly low-key in person. “He’s very dismissive of a lot of mainstream, popular things,” says one friend of Davies. When he became wealthy, Davies went to great lengths to buy and customize a Toyota Century, a simple-looking car that costs about the same as a Lamborghini. “He would be proud of it,” says another friend.

While Su Zhu and Davies grew accustomed to their new wealth, Three Arrows Capital remained a huge funnel of borrowed money. A lending boom has swept the crypto industry as DeFi (short for “decentralized finance”) projects offer depositors interest rates far higher than what traditional banks can offer. Three Arrows Capital will hold cryptocurrencies belonging to employees, friends, and other wealthy people through its platform. When lenders asked Three Arrows Capital to post collateral, it was often rejected. Instead, it offered to pay interest rates of 10% or more, higher than any competitor was offering. Because of their “gold standard” reputation, as one trader put it, some lenders don’t ask for audited financial statements or any documentation at all. Even with its size and capital, Three Arrows Capital has a reputation for being a “gold standard.”

For other investors, Three Arrows Capital’s need for cash was another warning sign. In early 2021, a fund called Warbler Capital, managed by a 29-year-old Chicago native, tried to raise $20 million to pursue a strategy that largely involved outsourcing its capital to 3AC. Matt Walsh, co-founder of cryptocurrency-focused Castle Island Ventures, couldn’t understand why a multibillion-dollar fund like Three Arrows Capital would bother investing such a small amount of money. “I was sitting there scratching my head,” Walsh recalls. “It started to ring alarm bells. Maybe these institutions were insolvent.”

The trouble seemed to have started last year, with Three Arrows Capital’s massive bet on GBTC at the crux of the matter. Just as the firm was rewarded when it traded at a premium, it felt pain when GBTC began trading at a discount to Bitcoin. GBTC’s premium was a result of the product’s initial uniqueness — it was a way to own Bitcoin in your eTrade account without having to deal with cryptocurrency exchanges and esoteric wallets. As more people flocked to the industry and new alternatives emerged, that premium disappeared — and then turned negative. But many smart market players had seen this coming. “All the arbitrage disappears after a point,” said a trader and former colleague of Su Zhu.

Davies was aware of the risk this posed to Three Arrows Capital, and in a September 2020 episode of a podcast produced by Castle Island, he admitted that he expected to lose money on this part of the trade. But before the show aired, Davies asked for the segment to be cut. Three Arrows Capital’s GBTC shares were locked up for six months at a time—and while Su Zhu and Davies had an opportunity to exit at some point that fall, they didn’t.

“They had ample opportunity to run,” Fauchier said. “I don’t think they were stupid enough to do it with their own money. I don’t know what controlled their minds. It’s obviously one of those trades where you want to be the first in, and you don’t want to be the last out.” Colleagues now say Three Arrows Capital is hanging on to its GBTC position because it’s betting the SEC will approve GBTC’s long-awaited exchange-traded fund conversion, making it more liquid and tradable and potentially eliminating bitcoin price mismatches. (In June, the SEC rejected GBTC’s application.)

By the spring of 2021, GBTC had fallen below the price of Bitcoin, and Three Arrows Capital was devastated as a result. Despite this, cryptocurrencies experienced a bull run that lasted until April, with Bitcoin hitting a record above $60,000 and Dogecoin soaring in an irrational rally driven by Elon Musk. Su Zhu was also bullish on Dogecoin, and reports said that 3AC had assets of about $10 billion at the time, citing Nansen (although Nansen's CEO now clarifies that most of the amount may have been borrowed).

In retrospect, Three Arrows Capital seems to have suffered a fatal loss later that summer—if it was a human loss, not a financial one. In August, the fund’s two minority partners, who were based in Hong Kong and worked 80 to 100 hours a week to run much of 3AC’s business, retired simultaneously. That left much of their work to Davies, Three Arrows Capital’s chief risk officer, who seemed to take a more laid-back approach to looking for downsides at the firm. “I thought their risk management was much better before,” the former friend said.

Around that time, there were signs that Three Arrows Capital was facing a cash crunch. When lenders ask for collateral for the fund’s margin trading, it typically pledges its equity in private company Deribit, rather than an easily sellable asset like Bitcoin. This illiquid asset isn’t ideal collateral. But there was another obstacle: Three Arrows Capital co-owned Deribit shares with other investors who refused to sign agreements to use their shares as collateral. Clearly, 3AC was trying to pledge assets it had no rights to — and trying to do so repeatedly, offering the same shares to various institutions, especially after Bitcoin began to fall in late 2021. The company appears to have pledged the same locked block of GBTC to several lenders as well. “We suspect Three Arrows Capital was trying to pledge some collateral to multiple people at once,” said Bankman-Fried, the FTX CEO. “I’d be very surprised if that was the entire misrepresentation here; that would be a very strange coincidence. I strongly suspect they made more.”

Cryptocurrency bear markets tend to dwarf the swings of any traditional financial market. Crashes are so severe that insiders call them “crypto winters,” and they can last for years. This is the situation Three Arrows Capital found itself in in mid-January 2022, with the GBTC position eating a growing hole in 3AC’s balance sheet, and much of its capital was tied up in restricted shares in smaller crypto projects. Other arbitrage opportunities had dried up. In response, Three Arrows Capital appears to have decided to increase the riskiness of its investments in hopes of scoring high and getting the firm back on its feet. “What made them change was just an excessive pursuit of returns,” said a leading lending executive. “They probably said, ‘What if we go long?’ ”

In February, Three Arrows made its biggest move yet: It poured $200 million into a hot token called Luna, founded by a brash, charming Korean developer and Stanford dropout named Do Kwon.

Around the same time, Su Zhu and Davies were planning to abandon Singapore. They had already moved some of the fund’s legal infrastructure to the British Virgin Islands, and in April, Three Arrows Capital announced it would move its headquarters to Dubai. That same month, friends say, Su Zhu and Davies bought two villas for a total of about $30 million, one on the Crystal Lagoon in Dubai’s District One, a man-made aquamarine oasis larger than anywhere else in the world. Showing photos of the side-by-side mansions, Su Zhu told friends he had purchased his new seven-bedroom property — a sprawling 17,000-square-foot yard — from the consul.

But in early May, Luna suddenly plummeted to near zero, wiping out more than $40 billion in market value in a matter of days. Its value is pegged to a related stablecoin called terraUSD. When terraUSD failed to maintain its peg to the dollar, both currencies collapsed. According to Herbert Sim, a Singaporean investor who tracks 3AC wallets, Three Arrows Capital’s stake in Luna was once about $5 billion, and this huge sum of money “disappeared out of thin air” almost overnight, and a death spiral ensued.

Scott Odell, head of lending at Blockchain.com, contacted the firm to find out the scale of the impact. After all, the loan agreement stipulated that Three Arrows Capital would notify the firm if its overall withdrawal rate reached at least 4%. "As a portion of the portfolio, it's not that large anyway," Edward Zhao, a top trader at 3AC, wrote, according to information disclosed by Blockchain.com. A few hours later, Odell sent a notice saying that a large portion of its $270 million loan needed to be recovered and would be paid in dollars or stablecoins. This caught them off guard.

The next day, Odell contacted Davies directly, who tersely assured him that all was well. He sent a simple, one-sentence letter with no watermark to Blockchain.com, claiming that the company managed $2.387 billion. Meanwhile, Three Arrows Capital was making similar claims to at least six lenders. Blockchain.com “now doubts the accuracy of this net asset value statement,” according to an affidavit included in the 1,157-page document released by 3AC’s liquidators.

A few days later, rather than backing down, Davies threatened to “boycott” Blockchain.com if it called in 3AC’s loan. “Once that happened, we knew something was wrong,” said Lane Kasselman, Blockchain.com’s chief commercial officer.

Inside the Three Arrows Capital offices, the mood changed.

Su Zhu and Davies used to hold regular pitch meetings over Zoom, but they stopped showing up that month, and then managers stopped the scheduling altogether, according to a former employee.

In late May, Su Zhu tweeted what could have been his epitaph: “The supercycle price thesis is wrong, sadly.” Still, he and Davies played it cool as they called up seemingly every wealthy crypto investor they knew, asking to borrow large amounts of bitcoin and offering the same high interest rates the firm had been offering. “They were clearly promoting themselves as a crypto hedge fund after they already knew they were in trouble,” said a person close to one of the largest lenders. In effect, Three Arrows Capital was seeking funds just to pay off other lenders. “This is robbing Peter to pay Paul,” Matt Walsh said. In mid-June, a month after Luna’s collapse, Davies told Charles McGarraugh, chief strategy officer at Blockchain.com, that he was trying to find another lender to avoid having his position liquidated.

But in practice, such financial disarray often leads to massive sell-offs by all involved to raise cash to stay solvent. Three Arrows Capital’s position was so large that it actually began to hammer the broader cryptocurrency market: 3AC itself and other panicked investors scrambled to sell and meet margin calls, which in turn drove prices down in a vicious cycle. The decline triggered further declines as lenders demanded more collateral and sold positions when 3AC and other firms couldn’t post them, sending Bitcoin and its peers to multi-year lows. The crash made global headlines as the overall value of the crypto market fell from a peak of $3 trillion in late 2021 to less than $1 trillion. McGarraugh said Davies told him, “If the crypto market keeps falling, 3AC won’t have a chance.” That was the last time anyone at Blockchain.com spoke to Davies. After that, he and Su Zhu stopped answering their lenders, partners, and friends.

Rumors that the company was shutting down spread quickly on Twitter, further fueling a larger cryptocurrency sell-off. On June 14, CEO Su Zhu finally acknowledged the issue: “We are communicating with the relevant parties and working hard to resolve this issue,” he wrote on Twitter. A few days later, Davies gave an interview to the Wall Street Journal in which he noted that he and Su Zhu were still “believers in crypto” but admitted that “the situation with Terra-Luna caught us very off guard.”

Su Zhu began trying to sell at least one of his top properties. At the same time, the company began moving money. On June 14, the same day that Su Zhu tweeted, 3AC sent nearly $32 million in stablecoins to a crypto wallet at an affiliated shell company in the Cayman Islands. “It’s unclear where the funds subsequently went,” the liquidators wrote in their affidavit. But there’s a working theory. In Three Arrows Capital’s final days, the partners reached out to every wealthy crypto whale they knew to borrow more bitcoin, and top crypto executives and investors — from the U.S. to the Caribbean to Europe to Singapore — believe 3AC found willing lenders of last resort among organized crime figures. Owing these figures large sums of money would explain why Su Zhu and Davies went into hiding. These are also the types of lenders you’d want to get through before anyone else, but you’d probably have to move the money through the Cayman Islands. “They gave [the money] back to the mafia,” the former trader and 3AC business partner said, adding, “You must be very desperate if you start borrowing from these people.”

After the crash, cryptocurrency exchange executives began to examine the traces they had left. They were surprised to find that Three Arrows Capital had taken no short positions at all, meaning it had stopped hedging, which had been fundamental to their investment strategy. “That’s easy to do,” the main lending executive said. “No trading desk knows you’re doing it.” Investors and exchange executives now estimate that 3AC was leveraged to about three times its assets by the end of the year, and some suspect the number could be even higher.

Three Arrows Capital appears to have kept all the money in commingled accounts — unbeknownst to the owners of those funds — and taken out every bit of it to pay back lenders. “They probably ran the whole thing on an Excel sheet,” Walsh said. That meant that when 3AC ignored margin calls in mid-June and hid from lenders, those lenders, including FTX and Genesis, liquidated their accounts, not realizing they were also selling assets belonging to 3AC’s partners and clients.

After the firm’s traders stopped responding to messages, lenders tried calling, emailing and messaging them on every platform, even contacting their friends and stopping by their homes before liquidating their collateral. Some peered through the door of 3AC’s Singapore office, where weeks of mail lay piled on the floor. People who had considered Su Zhu and Davies close friends and lent them money — even $200,000 or more — just weeks ago felt angry and betrayed when they heard nothing about the fund’s troubles. “They must be sociopaths,” said one former friend. “The numbers they reported in May were very, very wrong,” said Kasselman. “We firmly believe they committed fraud. There’s no other way to put it — it was a fraud, and they lied.” Genesis Global Trading, which lent Three Arrows the most of any lender, has filed claims totaling $1.2 billion. Others lent them billions more, much of it in bitcoin and ethereum. So far, liquidators have recovered just $40 million in assets. “It was clear that they were insolvent but they continued to borrow, and it looked like a classic Ponzi scheme,” Kasselman said. “The comparisons to Bernie Madoff were not far off.”

When Three Arrows Capital filed for Chapter 15 bankruptcy in the Southern District of New York on July 1, we got some interesting details. Even as creditors rushed to file claims, 3AC’s founders had already beaten them to the punch: First on the list of claimants were Su Zhu himself, who filed a $5 million claim on June 26, and Davies’ wife, Kelly Kaili Chen, who claimed she had loaned the fund nearly $66 million. Their claims, however, were based on little more than a number. “It was a complete joke,” Walsh says. While insiders had no idea Chen was involved in the company, they assumed she must have been acting on Davies’ behalf; her name appeared on various corporate entities, probably for tax reasons. Su Zhu’s mother and Davies’ mother also filed claims, according to people familiar with the matter. (Su Zhu later told Bloomberg, “You know, they’re going to say I absconded with the funds in the last period, when I actually put more of my own money in.”)

Since the company filed for bankruptcy, liquidators had not contacted Su Zhu and Davies until press time and still don’t know where they are, according to people familiar with the matter. Their lawyers say the co-founders have received death threats. During an awkward Zoom call on July 8, participants using the usernames of Su Zhu and Davies logged in with their cameras turned off and refused to unmute even as the British Virgin Islands liquidators peppered their avatars with dozens of questions.

Regulators are also taking a closer look at Three Arrows Capital. The Monetary Authority of Singapore — the country’s equivalent of the U.S. Securities and Exchange Commission — is investigating whether 3AC committed “serious breaches” of its rules, having already been sanctioned for providing “false or misleading” information.

On July 21, Su Zhu and Davies spoke to Bloomberg “from an undisclosed location.” The interview was unusual for several reasons — Su Zhu protested headlines about his free-spending lifestyle by cycling to work, avoiding nightclubs, and having “only two homes in Singapore” — and blamed 3AC’s collapse with his partners on their failure to foresee that the cryptocurrency market might fall. Neither mentioned the term “supercycle,” but the tone was clear. As Davies put it, “We did very well when the market was good. It’s just that we lost the most in the bad phases.”

The two also told Bloomberg that they planned to go to Dubai "soon." Their friends said they were already there. Lawyers say the desert oasis offers a particular advantage: the country has no extradition treaty with Singapore or the United States.