In July, Base, the "digital American West", welcomed a big player: SynFutures. As of today, SynFutures has accumulated $26 billion in trading volume on Base, accounting for more than half of the market share of the PerpDEX track in the Base ecosystem.

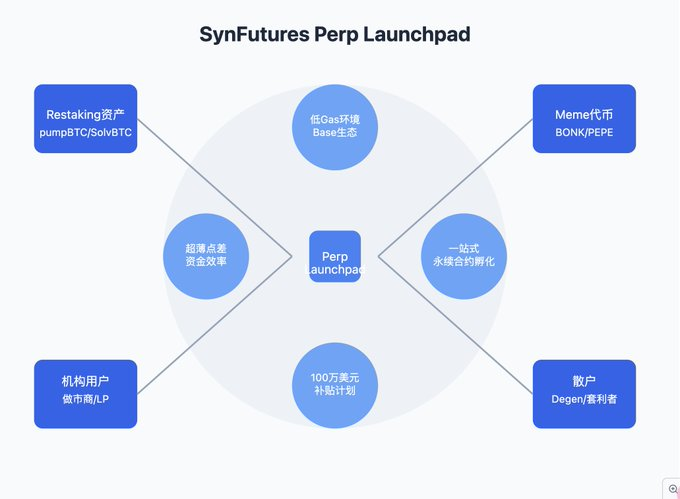

Recently, SynFutures launched the Perp Launchpad platform on Base, creating a new perpetual contract issuance model.

But before we deconstruct this new toy, we must first understand a cruel reality: in the current market environment, PerpDEX's growth has encountered a bottleneck, and leading players such as dYdX, Hyperliquid, GMX and SynFutures have already divided up all the profitable perpetual contract varieties. The remaining ones either have a pitiful trading volume that is difficult to maintain, or have become arbitrage tools due to inefficient pricing.

In such a segmented track context, in order to gain new growth space, SynFutures chose to take a different approach.

1. Innovation of Perp Launchpad: One-stop perpetual contract launcher

Perp Launchpad provides liquidity depth and price discovery channels for the Restaking and Meme tracks through ultra-low Gas environment + ultra-thin spread capital efficiency + $1 million subsidy, attempting to capture incremental users mainly based on on-chain Degen and build for the PerpDEX track.

With just one token, you can start a perpetual contract trading pair without permission.

The biggest highlight of this model is:

--Lowered the entry threshold to the perpetual contract market

-- Rapidly build depth through LP incentive mechanism

--Use Base's low Gas advantage to achieve fast deployment

Take the case of Lido as an example: wstETH/ETH perpetual contract was launched only 2 months ago, and it has achieved:

--Cumulative transaction volume: US$260 million

-- Peak TVL: $918,000 -- Number of on-chain transactions: 132,000

--Number of users:1955+

2. Investor perspective: new sources of income and risk management tools

For on-chain Degens, SynFutures provides triple profit opportunities:

--LP market making income (up to 50%+ annualized) --Partner community share

--Expected future token airdrops and points rewards

At the same time, it can help Degens on the chain manage Restaking assets and Meme coin risks.

But beware:

--The liquidity of the perpetual contract market tends to be highly cyclical

--The price discovery process of newly listed trading pairs may bring greater volatility

--LP market making faces risk of impermanent loss

3. A new toy for restaking enthusiasts

SynFutures chooses to cooperate with Liquid Staking leaders such as Lido, which, to some extent, provides a new monetization channel for Restaking assets. We can foresee:

--More Restaking assets will be introduced into the perpetual contract market

--The liquidity of LRT tokens will be further improved

--May give rise to new Restaking derivatives

SynFutures’ data reveals an interesting phenomenon: BTC Restaking assets are becoming the new favorite in the perpetual contract market.

The performance of pumpBTC/ETH and SolvBTC/ETH perpetual contracts was particularly outstanding:

--pumpBTC/ETH 24h trading volume 429.3K, TVL scale 12M

--SolvBTC/ETH 24h trading volume 341.8K, TVL scale 5M

The TVL scale of these two trading pairs is close to that of the mainstream currency pair ETH/USDC. Why does this phenomenon occur?

--BTC Restaking is hot, and funds need hedging tools

--The price correlation between native BTC and ETH provides a natural pricing benchmark for these trading pairs

--Intensified competition among restaking protocols has generated more speculative demand

4. Long-tail Meme coin perpetual contract

Surprisingly, the performance of Memecoin perpetual contracts is relatively average, and it is not as popular as spot Memecoin. The data is not very good:

--BONK/USDC perpetual contract: 24h trading volume 7.7K, market making depth 405.3K

--PEPE's perpetual contract: average daily trading volume fluctuates between 5K-10K, and market depth is maintained in the range of 300K-500K

Other Meme Tokens Performed Worse

Possible reasons for this phenomenon include:

--The combination of high leverage and high volatility scares away traders because the risk is too high

--The speculative nature of the Meme coin spot market leads to frequent imbalances in perpetual rates, which is not friendly to traders

--The probability and magnitude of impermanent loss are relatively high, and LPers need to control risk exposure

Conclusion

This innovation of SynFutures is essentially reshaping the issuance paradigm of perpetual contracts. It is no longer limited to mainstream assets, but opens the door to the derivatives market for any token.

The innovation of SynFutures lies not only in lowering the issuance threshold of perpetual contracts, but more importantly, it has opened up an important value discovery channel: from "blue chip assets" such as Restaking to "retail favorites" such as Meme coins, their market pricing can be found here.

Although this inclusive strategy is risky, it may be the only way for perpetual contracts to enter the mainstream market. After all, in a bear market, sometimes the craziest ideas can create the greatest value.