Author: Luke, Mars Finance

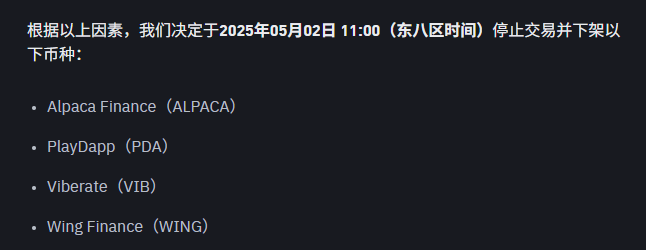

On this day, Binance announced that it would delist four tokens including ALPACA on May 2, on the grounds that these tokens failed to meet the platform's standards in terms of trading liquidity, network security, and community transparency. As soon as the news came out, the price of ALPACA fell, reaching a low of 0.029 USDT, a drop of 10.38% in 15 minutes. However, the plot did not develop as expected-just a few hours later, the price of ALPACA soared to 0.085 USDT, an increase of 93.16% in 1 hour. Behind this wave of roller coaster market, is it the failure of the routine of "shorting delisted coins and picking up money without thinking" or the dealer's carefully planned explosion counterattack?

Delisting announcement: the trigger of panic

As the world's largest cryptocurrency exchange, Binance's every delisting decision is like dropping a bombshell in the market. It is not entirely surprising that ALPACA was included in the delisting list this time. As early as April 10-16, in the Binance community vote, ALPACA ranked sixth on the list of high-risk tokens with 6.3% of the "delisting votes". This vote is like a shot of vaccination in the market in advance, suggesting that ALPACA may face problems with insufficient liquidity or weak community support.

The delisting announcement on April 24 officially triggered market sentiment. The price of ALPACA quickly fell from 0.0329 USDT to 0.029 USDT, and its market value shrank to about 5.9 million US dollars. On the X platform, traders wailed, and some lamented: "Delisting coins is really poisonous, and you can't even run away!" This kind of panic selling is not uncommon - delisting means losing Binance's huge trading flow, and a decline in liquidity is almost certain. What's more, as a low-market-cap token (about 6 million US dollars), ALPACA itself is susceptible to the drastic impact of market sentiment.

But the story has just begun. Just when everyone thought ALPACA would continue to slide into the abyss, the price drew a jaw-dropping upward curve. Within 1 hour, ALPACA soared from 0.029 USDT to 0.075 USDT, an increase of 87.16%. Bitget market data shows that the price once hit 0.085 USDT, and the 24-hour trading volume soared to 70.77 million US dollars, equivalent to 12 times the market value. This wave of rebound came too quickly, like a carefully choreographed drama, which makes people wonder: Is this a frenzy of bottom-fishing by retail investors, or a counterattack by the dealer?

Speculators’ carnival: the charm of low-market-cap tokens

To understand this price storm, we need to first look at the "background" of ALPACA. ALPACA is the native token of Alpaca Finance, a DeFi protocol that allows users to farm leveraged yields. In March 2021, ALPACA was launched in a "fair launch" (no pre-sale, no investors, no pre-mining) mode, and was once regarded as a community-driven DeFi rising star. However, the good times did not last long. The price of ALPACA fell from its historical high of 8.60 USDT to 0.04887 USDT today (CoinMarketCap data), a drop of 99.43%. With low market value, high volatility, and support for futures trading, ALPACA has become a paradise for speculators.

After the announcement of the delisting, ALPACA's low price (0.029 USDT) was like a piece of cheese with an alluring aroma, attracting countless speculators. On the X platform, a user named @BroLeonAus said bluntly: "With a market value of 6 million, the risk-return ratio of short positions is too poor, so I decisively went long!" His logic is simple: ALPACA's market value is so low that there is almost no room for decline, and the high trading volume (24-hour trading volume/market value ratio of 961.13%) means that the market is extremely active, and any slight disturbance can set off a huge wave. Another user @bigbottle44 pointed out that ALPACA's futures positions (about 2 million US dollars) account for a very high proportion of the market value, which may be a signal of hot money or institutional intervention.

This kind of speculative logic is not new in the crypto market. Low-market-cap tokens are often targeted by dealers or large investors due to their small circulation and price sensitivity. The panic selling caused by the delisting news pushed the price of ALPACA to a low point, which just provided an excellent opportunity for bargain hunters. The high leverage attribute of the futures market further amplified the amplitude of price fluctuations. It can be said that this 87.16% surge is not only a carnival of retail investors to bargain, but also a masterpiece of dealers to pull the market.

Is it the market FOMO?

So, is this surge a spontaneous market behavior or a careful layout by the banker? Let's analyze several possibilities.

Possibility 1: Market overshoot and natural rebound

The panic selling caused by the delisting news may cause the price of ALPACA to be seriously undervalued. The price of 0.029 USDT, equivalent to a market value of just over 5 million US dollars, is indeed too cheap for a DeFi project that still has an active community and trading volume. Some traders may think that the market has overreacted to the delisting, so they quickly bought the bottom and pushed the price back up. This "overshoot-rebound" pattern is common in the crypto market, especially among low-market-cap tokens.

Possibility 2: The dealer pulls back

Another possibility is that the dealer or big investors took advantage of the panic caused by the delisting news to deliberately create a low point, and then raised the price through large purchases. ALPACA's 24-hour trading volume reached 70.77 million US dollars, far exceeding its market value, indicating that a large amount of funds poured in in a short period of time. On the X platform, some users speculated that there may be "main force" operations behind this wave of pull-ups, with the purpose of squeezing out the high-leverage shorts. ALPACA supports futures trading on Binance, and its holdings account for a high proportion of its market value. Once the price rises rapidly, the shorts are forced to close their positions, further pushing up the price and forming a "short squeeze" effect.

Possibility 3: FOMO driven by retail investors

Retail investors in the crypto market are often easily driven by FOMO sentiment. When the price of ALPACA began to rebound from 0.029 USDT, discussions on social media quickly heated up. Coinbase data shows that 32.18% of X posts are bullish on ALPACA, while Coingecko shows that 75% of community members are bullish. Retail investors may flock to the market and push up prices when they see the rapid rise in prices. This FOMO-driven market is usually accompanied by high trading volume, but it is also prone to callback in a short period of time.

Overall, this surge is likely the result of a "multi-party dance": market overshoot provides opportunities for bargain hunters, bankers or large investors take the opportunity to pull the market, and retail investors' FOMO sentiment adds fuel to the market. Regardless of who is behind the scenes, ALPACA's price storm is a textbook case in the crypto market.

Community divisions: optimists versus cautious

The surge in ALPACA not only ignited the enthusiasm of traders, but also triggered heated debates in the community. On the X platform, optimists and cautious people formed a sharp contrast.

Optimists: Low market value is an opportunity

For optimists, ALPACA's low market value and high trading volume are the biggest attractions. They believe that even if Binance is delisted, ALPACA can still be traded on other exchanges such as Gate.io and MEXC, and liquidity will not be completely exhausted. What's more, some users regard ALPACA as a potential "double coin" stock, arguing that its low market value and high volatility make it suitable for short-term speculation. A user wrote on X: "6 million market value, 70 million trading volume, isn't this the prelude to the market maker's pull? All in!"

Cautious people: The shadow of delisting is hard to dispel

The cautious are skeptical about ALPACA's prospects. Binance is the most active trading platform for ALPACA, and its decision to delist may lead to a significant drop in trading volume, thereby increasing bid-ask spreads and liquidity risks. A user commented on X: "After the delisting, who will go to small exchanges to trade ALPACA? The price will collapse sooner or later." In addition, the ALPACA team's lack of activity in community communication and project development has also caused some investors to question its long-term value.

Discussions on Reddit were relatively quiet, with only a few posts mentioning Binance's community vote and the risk of ALPACA being delisted. In contrast, the X platform is more real-time, reflecting the rapid changes in market sentiment. Whether optimistic or cautious, the consensus of the community is that the future of ALPACA is full of uncertainty.

Future Outlook: Where is ALPACA headed?

Although this price storm is exciting, the future of ALPACA is still full of variables. In the short term, high trading volume and speculative enthusiasm may continue to drive price fluctuations, but the long-term prospects depend on the following factors:

Support from other exchanges: ALPACA currently still has trading pairs on platforms such as Gate.io and MEXC. If these exchanges can attract more trading volume, ALPACA's liquidity crisis may be alleviated.

Project team efforts: The ALPACA team needs to strengthen community communication and release a clear development roadmap to rebuild investor confidence.

DeFi market trends: As a DeFi protocol, ALPACA's performance is closely related to the overall trend of the DeFi sector. If the DeFi market picks up, ALPACA may usher in new opportunities.

Regulatory and market risks: Binance’s delisting decision may trigger other exchanges to follow suit. Investors need to be wary of liquidity risks and high volatility.

The price storm of ALPACA is a typical game in the crypto market. The news of delisting ignited panic, speculators took advantage of the low price to buy, dealers or big investors took advantage of the trend to pull the market, and the FOMO sentiment of retail investors added fuel to the fire. All of this constitutes the unique drama of the crypto market. Some people made a lot of money by buying the bottom at 0.029 USDT, while others were trapped by chasing the high at 0.075 USDT. Whether you are an optimist or a cautious person, this storm reminds us: the crypto market is never short of opportunities or traps.

Shorting delisted coins to make money without thinking? Maybe it works at some point, but when the market makers pull back, the shorts may be crushed in an instant. The story of ALPACA is still going on, and the next price storm may be brewing.