Author: Fourteen Jun

Review: 0xmiddle

Source: Content Association - Investment Research

introduction

Today, it has been more than three years since the DeFi Summer blowout, and more than half a year has passed since the benchmark compliance ETF was approved. Has the situation changed?

Looking back, Ethereum's smart contracts have improved the programmability of blockchain, expanding blockchain from a single accounting function to an infrastructure that supports multiple applications. Among many tracks, there is no doubt that decentralized migration of traditional finance is the most realistic application scenario.

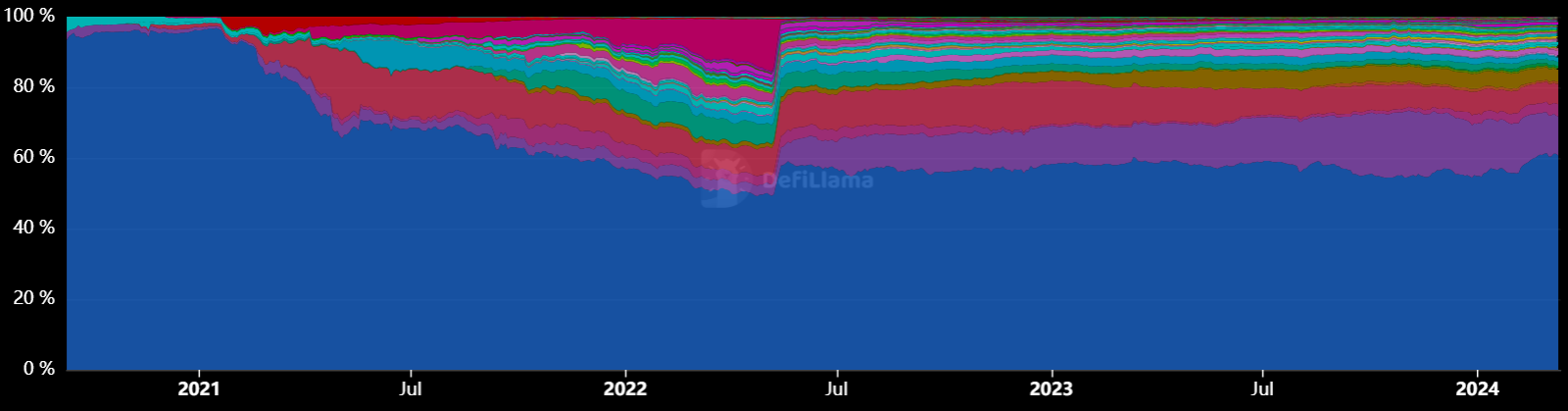

Let’s take a look at the DeFi TVL data on DeFiLlama. The current TVL of DeFi applications has exceeded 80 billion US dollars. In recent years, many public chains have emerged, and even Ethereum’s L2 is diverting the space of Ethereum L1. However, at present, Ethereum alone still stably locks more than half of the total DeFi assets.

Image source: defillama.com/chains

DeFi's original ambition was to try to subvert the lending, payment, insurance and other business models in the traditional financial system, allowing users to complete these operations without relying on traditional financial institutions such as banks. However, DeFi's TVL has actually stagnated for a long time and has not made any breakthroughs across orders of magnitude.

Most people believe that DeFi is limited by the performance and cost of the Ethereum network, so it cannot achieve large-scale applications and complex financial scenarios. However, the DeFi ecosystem on L2 and high-performance new public chains has not brought about a breakthrough in the scale of DeFi, but has instead brought about liquidity fragmentation and decreased interoperability. Ethereum has always maintained the most complete DeFi ecosystem and the most comprehensive interoperability, and is still the preferred platform for DeFi project deployment.

Today, a new trend is emerging: a new DeFi paradigm based on AO - AgentFi . This innovation is breaking the limitations of traditional DeFi.

Based on Arweave's storage layer, AO built a computing layer that supports parallel running processes, solving the scalability problem and achieving almost unlimited scalability. The combination of AO+Arweave is an implementation based on SCP (Storage-based Consensus Paradigm).

On AO, smart contracts exist in the form of processes. Since they are free from performance limitations, everyone can run their own processes to proxy their financial behavior, and the consensus is handled by Arweave's storage layer. This is the basis of AgentFi .

Will this new form of DeFi, AgentFi, replace traditional DeFi and become the new mainstream form of DeFi? Let me explain in detail.

Limitations of Traditional DeFi

In the traditional blockchain architecture, block space is designed to be a scarce resource. Users and applications need to compete for this resource. When the network is congested, people need to pay more to compete for block space. This is the fundamental reason for performance limitations. Ethereum’s performance limitations have already been revealed. With only about 30 TPS[1], it seems to be stretched. During peak hours, gas fees often soar by dozens of times. People have long been accustomed to this. In fact, L2 and most high-performance public chains also have performance ceilings. Their ceilings may be higher, but it is also difficult to accommodate the business scale of traditional finance.

In order to save performance, save gas for users, and improve user experience, traditional DeFi is designed to use a single smart contract to host business assets and run financial services. Since both funds and business logic are managed by a unified contract, it is difficult to achieve truly diversified and personalized business operations. Although such a design can simplify the management process and ensure consistency, it also deprives users of autonomy in business logic and financial operations, making it difficult to meet the increasingly diversified needs of users.

For developers, when writing contracts, they must consider the gas call fee and must try to avoid writing complex contract code. On Ethereum, the gas limit for an ETH transfer is 21,000 gwei, and the gas limit for an ERC20 token transfer is 65,000 gwei. Slightly more complex scenarios, such as swaps, NFT transactions, and lending, require at least 300,000 gwei [2]. If the business is more complex, the gas consumption will be even more unbearable for users. This greatly limits the room for developers to play and also limits the richness and innovation of DeFi.

In order to fundamentally solve the above problems, the market needs a stronger infrastructure and supporting financial system.

AO was born, and AgentFi is a new exploration of the next generation of DeFi in the AO ecosystem.

AO: Almost infinitely scalable infrastructure

AO is the abbreviation of Actor Oriented. As the name suggests, it is a role-oriented decentralized computing protocol.

In fact, compared with Ethereum, AO is closer to the concept of a world computer. I understand AO as a supercomputing layer, and its core goal is to achieve trustless and collaborative computing services without scale restrictions.

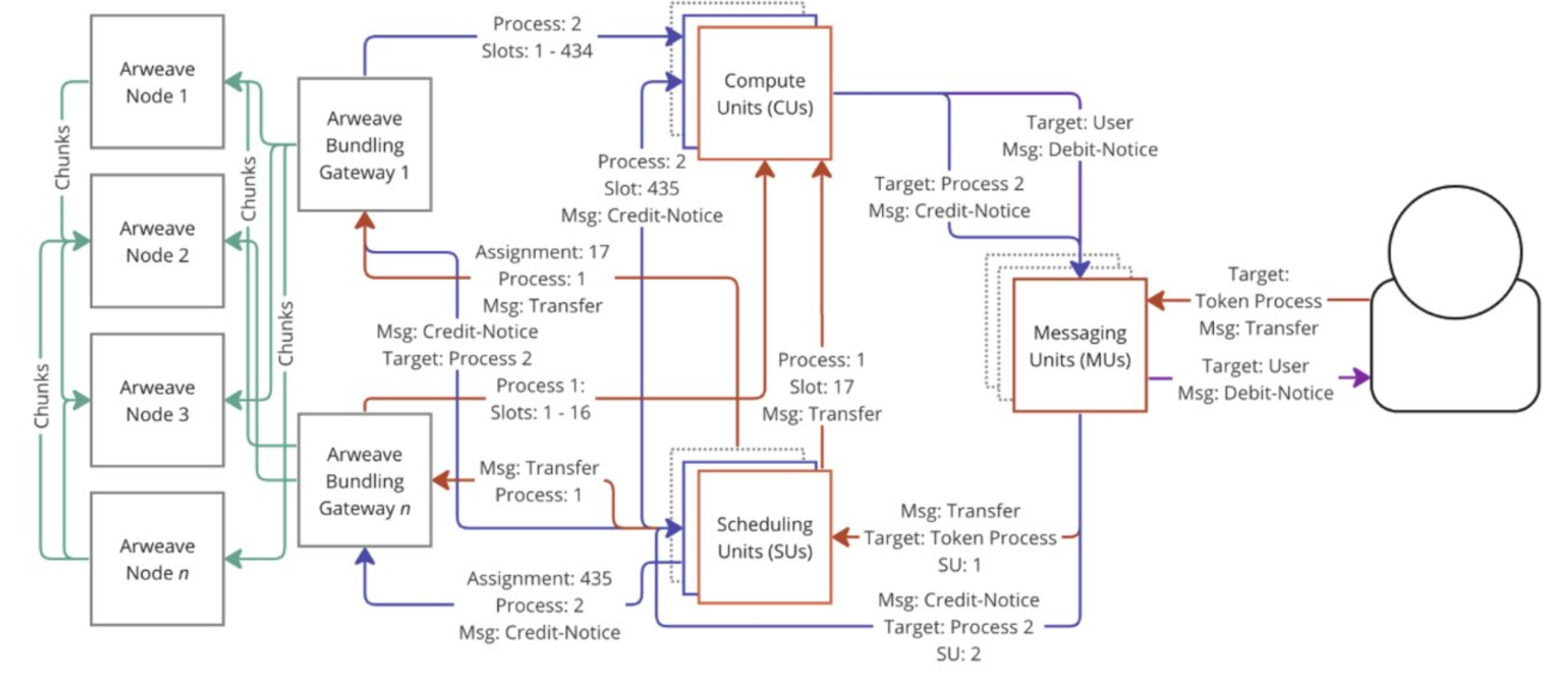

Let's take a look at the workflow diagram of a super-parallel computer built on AO:

Image source: AO White Paper

- Message generation : Users or processes initiate requests by creating messages. These messages must comply with the specifications specified by the AO protocol in order to be correctly transmitted and processed in the network.

- Messenger Unit (MU) transfer : The Messenger Unit (MU) is responsible for receiving messages generated by users, which is equivalent to a routing role, forwarding the messages to the appropriate SU node in the network. In this process, the MU will sign the message to ensure the integrity of the data.

- Scheduling Unit (SU) processing : When a message arrives at the SU node, the SU assigns a nonce to the message to ensure its order within the same process, and uploads the message and nonce to the Arweave consensus layer for permanent storage.

- CU calculation : After receiving the message, the CU will perform the corresponding calculation task according to the message. After the calculation, the CU will generate a signature with the calculation result and return it to the SU. This signature proof ensures the correctness and verifiability of the calculation result.

So, where does the consensus come from?

On AO, storage is equivalent to consensus. When a process is running, messages will be transmitted, and the messages will be written to Arweave, thus generating a "holographic state". This means that the running state of the process can be verified. In other words, Arweave's immutable storage guarantees verifiability. This is a bit counterintuitive, but if you fully understand the SCP paradigm, you will understand it instantly. If you still don't understand it, you can understand it by analogy with inscriptions.

In addition to verifiability, we also need to solve the problem of who will verify. With verifiability, anyone can provide verification services. On AO, applications can choose verification services themselves and flexibly determine their security based on the nature of their business. Combined with the economic game of optimistic challenges, the reliability of verification can be guaranteed.

On computers built with AO, applications are constructed from any number of communicating processes.

AO does not allow processes to share memory, but allows them to communicate via native messaging standards.

By focusing on message passing, AO implements a scaling mechanism similar to traditional Web2 distributed system environments since message passing is asynchronous.

This means that theoretically, there is no performance limitation for AO.

For developers, you can choose public nodes, but you can also use your own nodes to run your own services. In this case, if you encounter performance bottlenecks, you can directly expand the capacity of your own nodes, just like running Web2 services.

In addition, this working mode also brings additional benefits - computing nodes can provide computing power support for AI scenarios. We will have the opportunity to discuss this in detail later.

How is AgentFi different?

Unlike traditional DeFi, which uses a unified smart contract to hold funds and run financial services, the concept of AgentFi is that everyone can run processes on AO computers and hold their own funds, acting as an agent for their own financial behavior. What is the specific form? Let's take Permaswap, the leading DEX on AO, as an example to explain.

In traditional DeFi, if Alice wants to exchange Token A for Token B, she first needs a liquidity pool on the DEX, where the smart contract escrows the funds to provide the A/B token exchange function. The exchange rate of the transaction is determined by the market-making curve adopted by the smart contract (for example, x*y=k). In Permaswap, it is in this form that each LP escrows its own market-making funds through its own proxy process and customizes the market-making curve and market-making strategy. Of course, LP can also adopt an "extreme market-making strategy" - just place a limit order.

In fact, we found that Permaswap can integrate the two trading forms of AMM and order book. For users, when they initiate a transaction, what matches and helps them complete the transaction may be AMM, a limit order, or even both.

In general, AgentFi has three features:

- Self-custody: Users use a proxy process under their control to custody their own funds and execute their own trading strategies, rather than entrusting them to a unified contract.

- Personalization: Users can flexibly set their own financial business parameters through the proxy process they control. In other words, this is equivalent to users opening an exchange and being able to customize trading strategies and rates. If it is extended to the lending business, it can be understood as users opening a bank and being able to customize interest rates. Furthermore, users can use self-hosted processes to run customized financial strategy programs, and even intelligent strategy programs that integrate AI.

- Peer-to-peer: The matching between supply and demand is no longer the traditional DeFi peer-to-pool model, but returns to the peer-to-peer model.

On Ethereum, there is a distinction between contract accounts (CA) and external accounts (EOA). Different financial scenario functions are implemented through different contract codes, and financial behavior requires active human participation. On AO, it is another concept for Agents. Different Agents can implement different functions, and financial behavior can be delegated by Agents. The author believes that the concept of AgentFi is more like building blocks, which can be combined to create a richer decentralized financial ecosystem.

When there are a large number of self-hosted processes, how can they communicate with each other and be composable? This is where FusionFi Protocol comes in. It is a development standard and communication specification for Agents on an AO. Almost all financial services can be abstracted as the circulation and processing of bills. FusionFi Protocol defines a set of format standards for bills. With such a standard, complex and diverse financial forms can be integrated. Developers can implement a variety of financial services such as exchanges, lending, futures, and even stablecoins based on FusionFi's standards. In the future, FusionFi Protocol can refer to the models of industry standardization proposal mechanisms such as BIP, EIP, and NIP, so that more people can participate in formulating protocol standards and promote the sustainable development of the ecosystem.

The author will write a separate article to explain the FusionFi Protocol in detail.

3 Conclusion

Ethereum's performance and cost issues have limited the current pace of DeFi development. Although the expansion of L2 and new public chains has been quite effective, there is still an invisible ceiling that restricts the development of financial business.

In order to completely break the ceiling, a network different from the traditional blockchain paradigm, AO super-parallel computer, was born. Due to the infinite scalability of AO, AgentFi became possible. Users can run their own processes, manage funds by themselves, and customize financial services.

The agent-oriented financial model has a wider range of application scenarios compared to traditional DeFi.

Data Source

[1] Interpretation of Ethereum TPS

https://www.chaincatcher.com/zh-tw/article/2102262

[2] Ethereum transaction gas usage statistics

https://etherscan.io/gastracker

References

1. Technical explanation of ao super parallel computer

https://mp.weixin.qq.com/s/8ociIMl_Pi28rvQJvretAg

2. AO Protocol: A decentralized, permissionless supercomputer

https://x.com/kylewmi/status/1802131298724811108

3. Smart Finance: From AgentFi to FusionFi

https://www.notion.so/permadao/AgentFi-FusionFi-6461feb8915c4ea5a1252eca80aa6a4a