Author: 🔫Scof who got caught in the crossfire💀, ChainCatcher

Editor: TB, ChainCatcher

Pump's bullet hit him right between the eyebrows

Just now, pump.fun co-founder Alon posted a message saying that the official X account of pump.fun was stolen and the fraudulent token "PUMP" was released, reminding users to pay attention to the risks.

As the most active meme coin launch platform in the Solana ecosystem, Pump.fun once became a myth of wealth creation for retail investors with its two-stage mechanism of "internal incubation + external explosion". The token first accumulates liquidity through the Bonding Curve mechanism within the platform. When the transaction volume exceeds the threshold of 69,000 US dollars, it automatically migrates to the top DEX Raydium to establish a capital pool, completing the closed loop from project launch to market speculation. This set of precisely designed rules is running wildly in 2024:

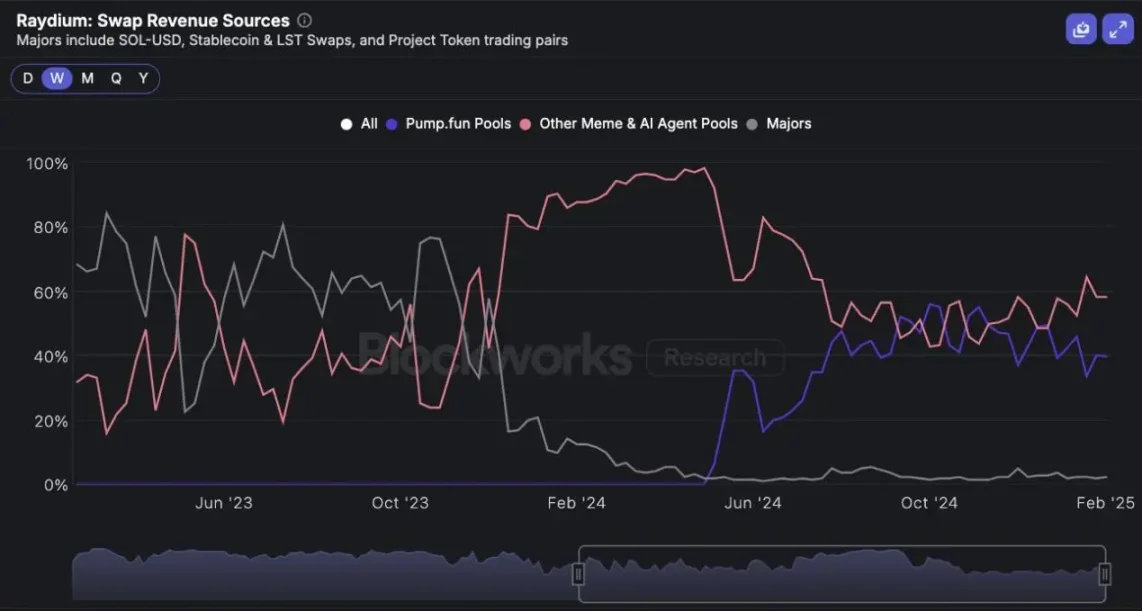

From April 1 last year to date, the tokens launched from Pump.fun have contributed $346 billion in trading volume to Raydium, accounting for half of the total traffic of the DEX. Of the $197 million in fees collected by the platform, $104 million came from pump.fun transactions.

However, when celebrities such as Trump entered the market with "flash" tokens (such as TRUMP and MELANIA), this game of passing the parcel began to reveal the naked logic of harvesting. On-chain data shows that more than 70% of meme coins showed a trend of "peaking as soon as the pool was established" during the external market stage, with an average survival time of less than 48 hours.

The more dangerous signal comes from the overall retreat of liquidity. On February 24, only one of the graduated tokens of Pump.fun barely broke through one million US dollars in market value, and the on-chain speculation craze has almost frozen. The transaction depth of Raydium's meme coin has shrunk by more than 90% from its peak, and the net outflow of Solana's on-chain stablecoin market value has exceeded US$1 billion in the past 30 days, setting a record for the largest capital loss since the collapse of FTX.

This collapse is not accidental. When the project owners, trading platforms and celebrities form a "harvesting iron triangle", and when the mathematical model of Bonding Curve becomes a pumping tool, the confidence of retail investors has long been exhausted in the drama of "opening and crashing the market". The failure of Pump.fun is not only a microcosm of the Solana ecosystem liquidity crisis, but also a cruel interrogation of the meme narrative by the entire crypto world - when the bubble recedes and the carnival ends, who will clean up the mess of capital?

SOL has fallen more than 50% from its high point, and the ecosystem is in a downturn

As one of the most outstanding public chain tokens in 2024, Solana has been advancing by leaps and bounds on the back of Pump and meme, with an increase of nearly 200% throughout the year.

But since Trump released the token on Solana on January 18, this wave seems to have finally been washed ashore: the price of SOL first hit a record high of US$295 on January 19, and then turned sharply downward, with a drop of more than 50% at one point.

There are only three days left until the largest token unlocking in Solana's history (worth $2 billion). By then, 11.2 million SOLs will be unlocked and put into circulation, most of which will be purchased from the FTX auction at a cost of $64, which may also create a huge selling pressure.

In addition to the poor performance of token prices, according to data from Deflama, the TVL of the Solana ecosystem has dropped from a peak of US$12.19 billion to US$7.22 billion today, and daily transaction fee income has also been decreasing.

In addition, the Solana ecosystem’s 24-hour net inflow data showed that $260 million flowed out on January 18 and 19 alone, and the inflow of funds has continued to decrease since then, far less than in previous pump periods.

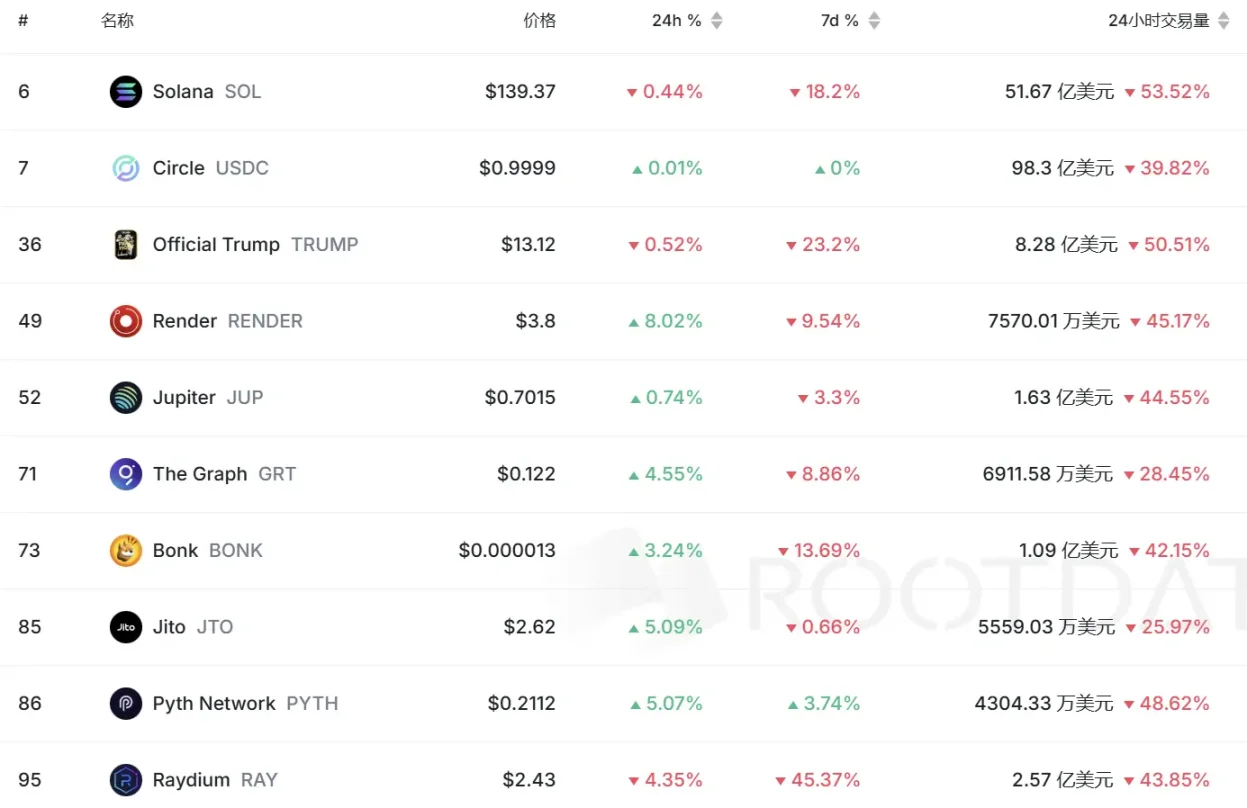

Not only that, a series of other indicators are not optimistic either. The performance of Solana's mainstream protocol token has also shown a downward trend in the past seven days:

Figure Rootdata’s Solana ecosystem performance

Overall, the ecological situation is in a state of "when the tree falls, the monkeys scatter".

This also begs the question: Is Solana’s story over?

Solana labs co-founded Toly, and is also afraid of collapse!

Faced with the risk of token price collapse, the Solana ecosystem is experiencing the greatest fear, uncertainty, and FUD since the FTX crash. Analysts have estimated that scammers have amassed more than $10 billion during the entire meme coin hype cycle.

Faced with unavoidable real-life problems, many community members have responded.

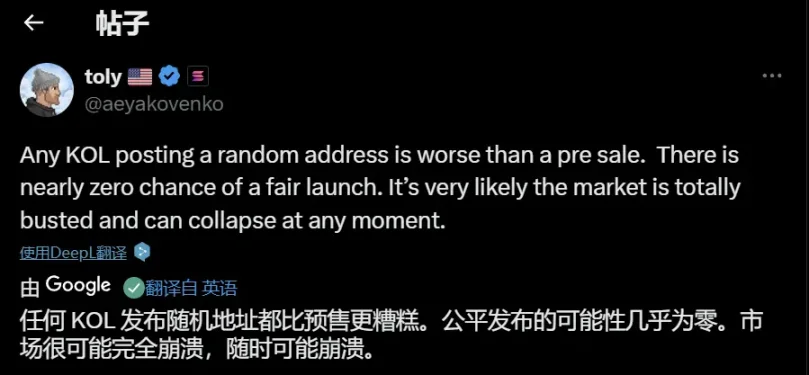

As the co-founder of Solana Labs, Toly has always advocated healthy technological development and innovation. He has also repeatedly called on builders to return to innovation and build high-quality projects. Although he did not directly criticize, he repeatedly revealed his dissatisfaction with Pump in conversations with other community members in X. In the face of doubts from long-term supporters, he responded by saying, "The assholes that mess with markets to max extract can go f' themselves." The group this refers to is self-evident.

Crypto KOL @cobie has also pointed out the problems of the PVP model many times. He said, "The current market development trend is that market participants are actively rushing into these scams like moths. Most people know that these are scams, but their goal is to sell them to the receivers at 3 times the price. They just want to get rich in 2 weeks, not 2-4 years. Players hope that they can also win the big prize in the next action."

Of course, the community is also trying to save itself. Solana launched the SIMD-0228 proposal on February 26, setting a target staking rate of 50%. If the staking rate exceeds 50%, the issuance will decrease and the yield will decrease; if it is less than 50%, the issuance will increase and the yield will increase. The minimum inflation rate is 0%, and the maximum inflation rate is determined based on the current issuance curve. The proposal aims to shift SOL issuance to a market-driven model.

In addition, Solana spot ETF has become another life-saving straw - data from the prediction platform Polymarket shows that the market believes that the probability of approval before 2025 is as high as 85.4%, and the probability of approval before June has also risen to 34%. If this comes true, referring to the siphoning effect of the Bitcoin ETF with a cumulative capital of 100 billion US dollars and the Ethereum ETF with a capital of 10 billion US dollars, Solana may usher in billions of dollars of fresh capital injection.

Solana’s predicament is by no means an isolated case, but rather a microcosm of the entire industry’s “speculation backfiring on innovation.”

As KOL @0xNing0x summarized: "Now we have entered the settlement moment of this cycle. The P players are MVPs, Solana, Pump.fun, and Jupiter are the best supports, TRUMP is a dog who wins easily, AI16Z is a dog who wins easily, and JLP holder is a dog who wins easily. The losing SVPs are Base and Virtual, and Ethereum, Arbitrum, Optimism, ZkSync, and Starknet are mixed top, mid, jungle, and support players."

At present, Solana may have only two options: either rely on external capital such as ETFs to prolong its life, but this may deepen its path dependence on financial casinos; or "scrape the bone to cure the poison" as Toly advocates, endure short-term pain and rebuild the faith of developers.