Written by: Riffi / Mat / Darl

Editing and proofreading: Nora

Source: WolfDAO

1. Project Overview

Magic Eden is a multi-chain supported non-fungible token (NFT) trading market. With its layout in multiple blockchain ecosystems such as Solana, Ethereum, Polygon and Bitcoin, it has rapidly risen and become one of the leading platforms in the market in 2024. Since its launch in September 2021, Magic Eden has rapidly expanded its market share through its cross-chain market and innovative features, especially after integrating Bitcoin Ordinals, becoming one of the important players in this field. This survey aims to analyze its economic model, market position and future development direction, and evaluate its future growth potential.

2. Market performance and competition analysis

1. Market sentiment and token performance

source:coinmarketcap

The ME token was first released in August 2024, and the first token generation event (TGE) is scheduled for December. The initial market sentiment was relatively positive, but according to the current market trend, the price of the ME token failed to meet expectations and showed a trend of opening high and closing low. After falling below $3, the price rebounded to around $3.3, with a market capitalization of $424 million and a FDV of $3.264 billion. One of the main reasons for this phenomenon is the overall sluggish market, especially the weakness of the altcoin market, but the continued decline in token prices lacks effective support, which also reflects investors' cautious attitude towards the future prospects of the platform. This phenomenon shows that the NFT market and the altcoin market are generally sluggish, and investors remain on the sidelines about future growth.

2. Market share and competition

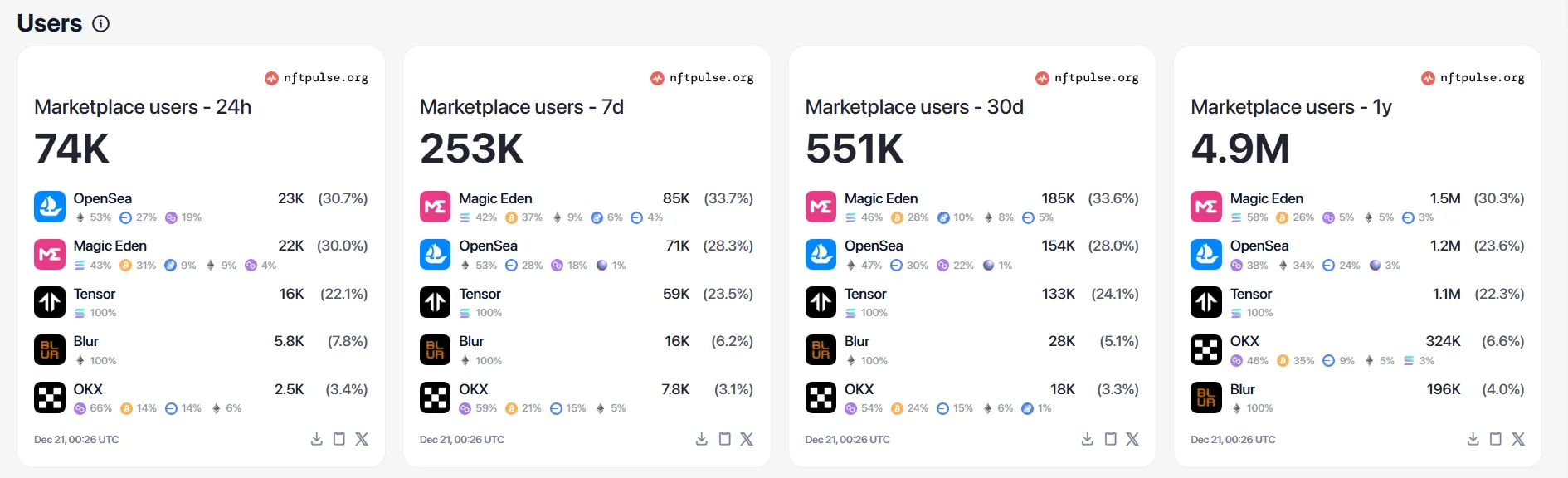

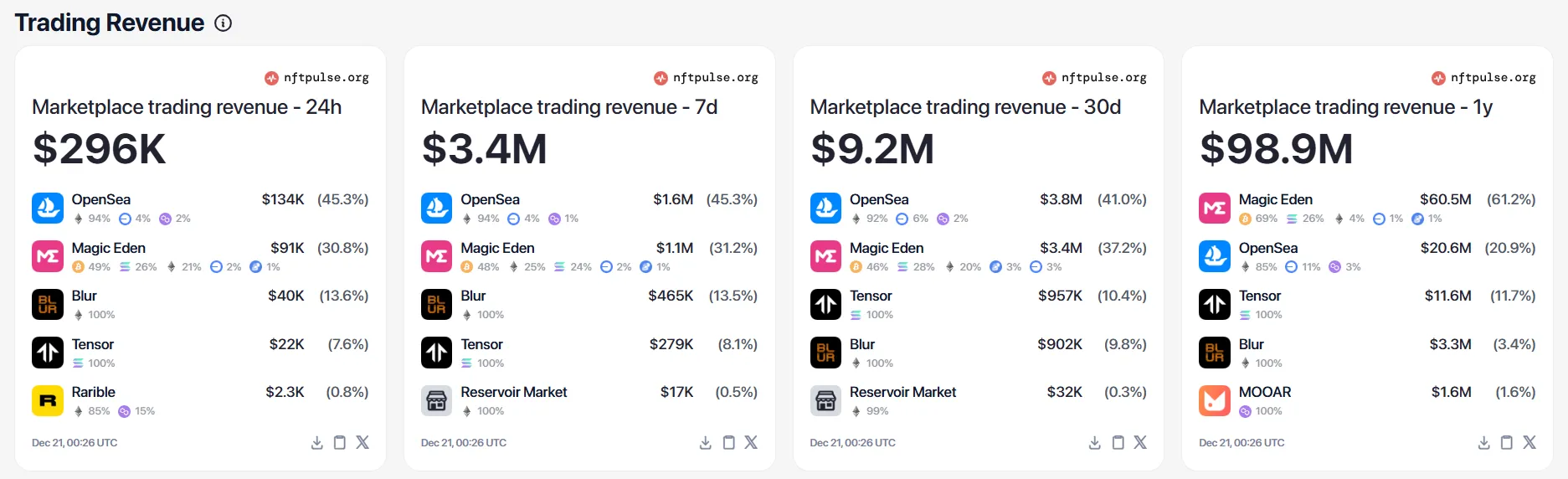

source: nftpluse

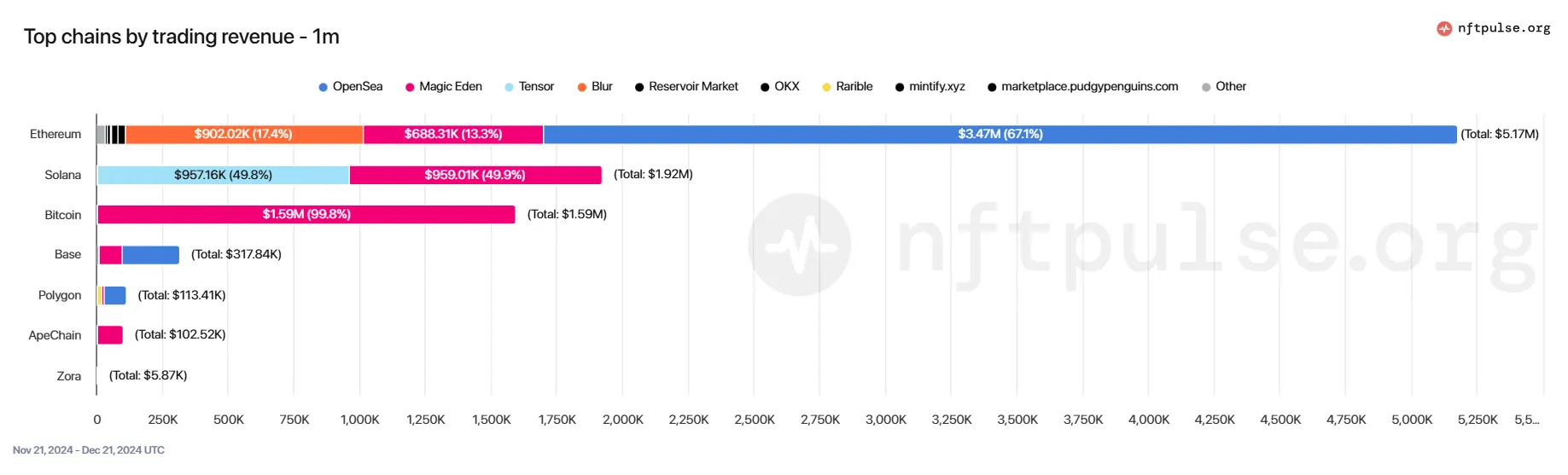

Magic Eden has a dominant position in the Solana and Bitcoin ecosystem, especially in the Bitcoin Ordinals and Runescape NFT markets, with a market share of over 80%. However, Magic Eden still faces huge competition from market giants on the Ethereum chain, such as OpenSea and Blur. OpenSea is still the leader in the Ethereum market, and Blur has gained a competitive advantage in the high-end NFT market through its low fees and frequent transactions.

Competitor Analysis:

The main competitors in the market are OpenSea, Magic Eden and Tensor. In terms of user data, OpenSea and Magic Eden have a solid position in their respective ecosystems. With its first-mover advantage, OpenSea maintains an absolute dominant position in the Ethereum mainnet and its second-layer network; Magic Eden occupies the vast majority of the Solana and Bitcoin ecosystems. The future competition between the two will mainly depend on the further development of both parties in their respective markets and user growth.

In the Solana market, Magic Eden's direct competitor is Tensor, but Tensor's shortcomings are quite obvious. First, Tensor's user quality is relatively low, and many low-royalty transactions have attracted a large number of retail investors, resulting in low user loyalty and an average transaction price that is much lower than other platforms.

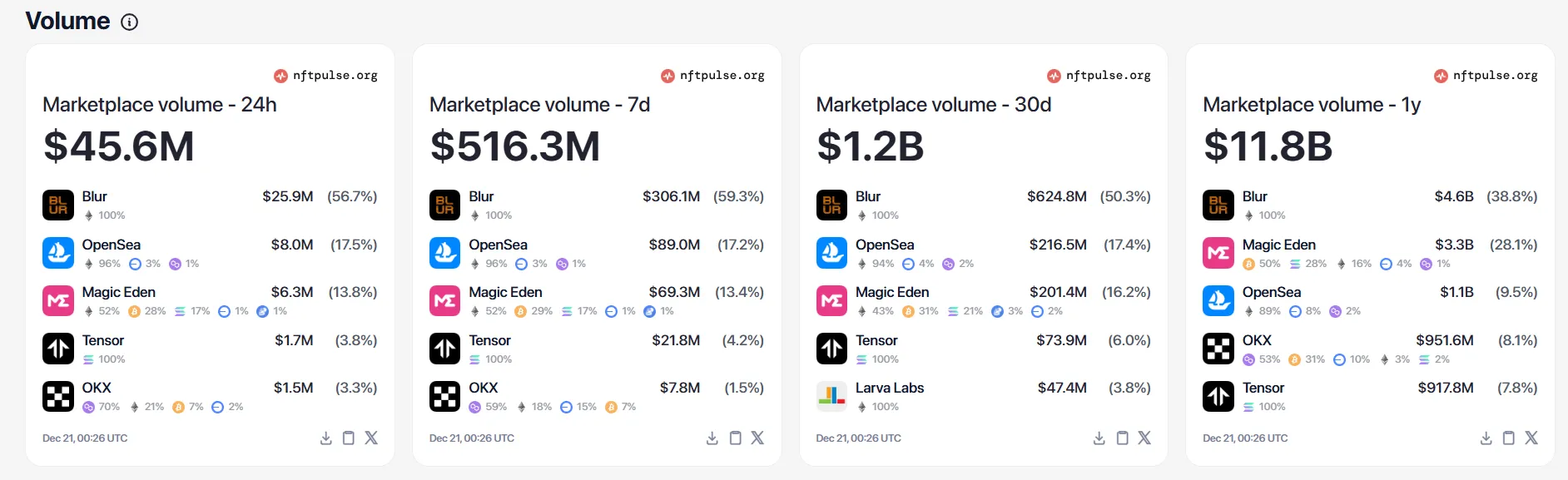

source: nftpluse

- Main competing platforms:

- OpenSea : It occupies a dominant position in the Ethereum ecosystem and maintains its market leadership by relying on its strong brand effect and user base.

- Blur : Focusing on low fees and high-frequency transactions, it has attracted a large number of high-end NFT trading users, especially in the transactions of high-value assets.

- Tensor : Mainly competes in the Solana market. Although it has gained a certain market share on this chain, its user base and market depth still lag behind Magic Eden.

In the short term, Magic Eden's strong position in the Solana and Bitcoin markets is not easy to shake, especially after TGE, its funding and exposure will likely further expand its advantage. However, Magic Eden's biggest challenge is still to break the monopoly of Blur and OpenSea in the Ethereum market. Although Bitcoin's Ordinals and Inscriptions once ushered in a boom, their market stability is far less than that of Ethereum. Even when the Ethereum NFT market is sluggish, OpenSea and Blur still monopolize most blue-chip projects and have stronger community cohesion and market recognition. The so-called " Blur controls the big players, and OS occupies the retail investors."

3. Market analysis summary

source: nftpluse

Although Bitcoin's ordinarys and inscriptions once experienced a blowout, its market stability is far less than that of the ETH market. Even when the Ethereum NFT market is very depressed, it still monopolizes several recognized blue chips, and its community cohesion and recognition are far ahead. On the other hand, although the prices of SOL and BTC Bitcoin Frogs once exceeded BAYC, they were short-lived and soon became a mess after the heat. If Magic Eden cannot come up with some evergreen projects in the future, the continued profitability of its protocol remains to be seen.

3. Economic Model and Token Economics Analysis

1. Token issuance and distribution

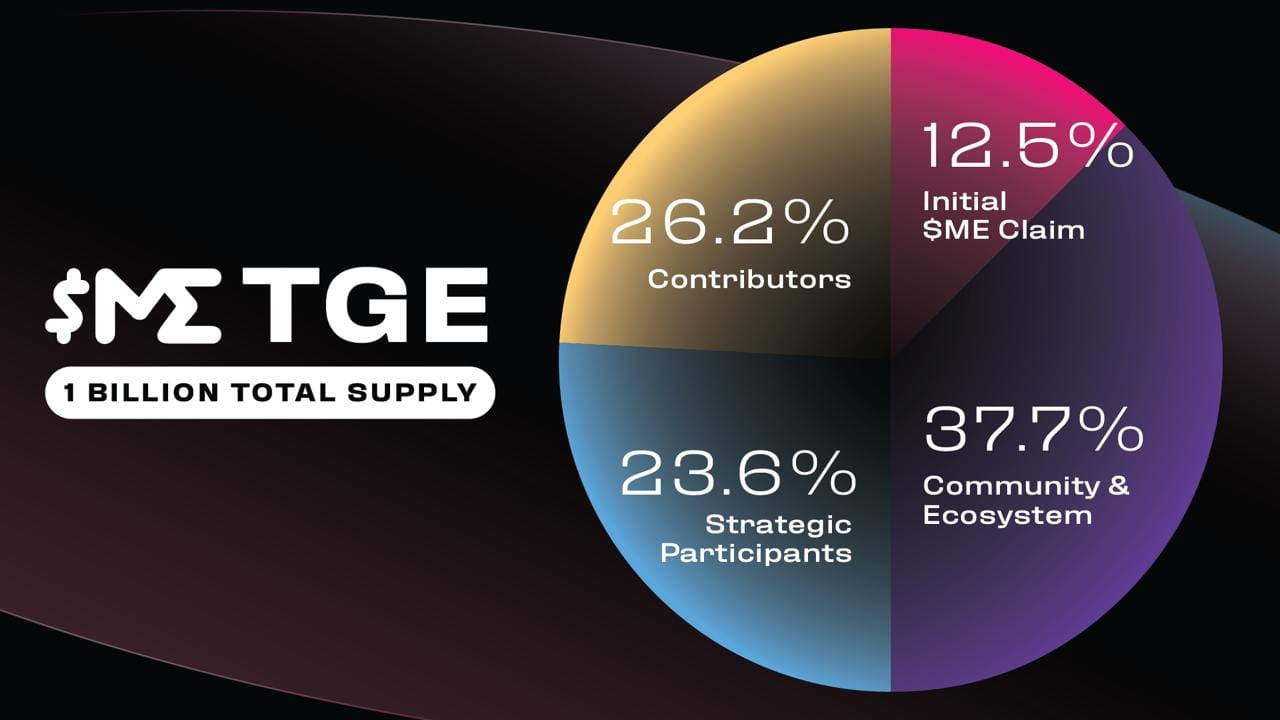

The total supply of Magic Eden's token ($ME) is 1 billion, which is planned to be issued gradually over 4 years. More than half of the tokens will be allocated to the community, as follows:

Initial Token Claim (12.5%)

The initial airdrop will be fully unlocked at the Token Generation Event (TGE) and distributed to active users from ecosystems such as Bitcoin, Solana, and Ethereum. These users will become part of the Magic Eden DAO. The unclaimed portion will be returned to $ME stakers as part of future community rewards.

Community and Ecosystem (37.7%)

- Active User Rewards (22.5%) : This part will be used to reward active users through Magic Eden’s reward program and distributed through the platform’s mobile decentralized application (dApp).

- Ecosystem Development (15.2%) : Includes long-term investment in the ecosystem, funds to support creators and active advocates. This part of the funds will be provided through long-term agreements to ensure long-term stakeholder participation. In addition, 5% of the ecological development funds will be allocated to the Magic Eden Foundation Treasury for protocol support and liquidity provision.

Contributors (26.2%)

This portion is mainly allocated to consultants, contractors, and platform employees who provide support for the Magic Eden protocol and platform. In order to ensure long-term commitment, core contributors (accounting for more than 60% of the total contributor tokens) will be locked within 18 months after the TGE and then gradually unlocked.

Strategic partners (23.6%)

Strategic partners provide important support for the development of the Magic Eden Foundation protocol. All strategic participants will lock up their tokens for at least 12 months after the TGE, and token unlocking will follow the specified token release schedule.

Overall, this structure does not have any particularly innovative mechanisms, and mainly relies on conventional staking transactions and community governance to promote user participation and ecosystem construction.

The initial release of tokens accounts for 12.5% of the total, which may create a certain selling pressure on the market. However, since the unclaimed tokens will return to the staking reward pool and early investors usually prefer to wait and see, the short-term impact is relatively controllable.

The unlocking of tokens by contributors and strategic partners in the medium term may gradually increase the market supply, and the market may experience greater volatility during this stage. If the market demand is insufficient at this time, the token price may be under downward pressure.

If Magic Eden can attract more users through ecological expansion and innovative functions, its token selling pressure may be absorbed by strong demand.

2. Sustainability of the economic model

source:nftpluseMagic Eden's profit model currently relies mainly on transaction fees and market revenue. The platform's multi-chain strategy (especially the deep integration of Solana and Bitcoin) enables it to obtain transaction volume from users of different chains. However, as market competition intensifies, especially on Ethereum and Layer-2 solutions, Magic Eden needs to diversify its profit model through innovative ecosystems and product features.

The trading revenue of Magic Eden platform in the month before the token issuance was 2.8 million US dollars, with a market share of 45.4%, leading the second-ranked OpenSea by about 600,000 US dollars, and 9.3 times the revenue of Blur platform (301,000) that has issued tokens. Such revenue remains strong after the airdrop, with the recent 24h and 7d revenues of 91k and 1.1M respectively. Although the market share has been surpassed by OpenSea due to the recent recovery of Ethereum blue chips, it still shows relatively strong profitability. Nevertheless, based on Magic Eden's $60 million in revenue in the past year, its price-to-earnings ratio (PE) is 50, and its recent revenue has declined, indicating that its long-term profitability and market valuation are facing certain pressures. Although the market value assessment of Web3 projects is more complicated than that of traditional markets, it is also a very important reference indicator.

IV. Challenges and Future Prospects

1. Market bottleneck

Although Magic Eden has a dominant position in the Solana and Bitcoin ecosystems, competition in the Ethereum ecosystem remains a huge challenge. The strong position of OpenSea and Blur in the Ethereum market puts Magic Eden under great pressure to attract Ethereum users.

2. Token unlocking and market selling pressure

The distribution structure of ME tokens is relatively aggressive, especially in the early stage when the tokens are released less, and the large amount of unlocking in the later stage may lead to an increase in market supply, which will put pressure on the token price. This unlocking mechanism may cause price fluctuations and increase market instability.

3. Insufficient innovation and ecological expansion

At present, Magic Eden's investment in innovative products and ecological construction is still insufficient. The platform needs to accelerate the innovation and expansion of the ecosystem, especially in terms of cross-chain support, differentiation of NFT market functions and improvement of community governance.

in conclusion

Magic Eden has demonstrated a solid industry position with its market share and revenue capabilities in the Solana and Bitcoin ecosystems. However, its token $ME has faced multiple challenges since its launch, including insufficient market confidence, fierce competition, and unlocking selling pressure. In the competition with Blur and OpenSea, breaking through the bottleneck of the Ethereum market is crucial. In the future, the platform needs to strengthen the design of token economics, improve ecological construction and user stickiness, and lead the market through innovative products to continuously consolidate and expand its leading position.