Author: Chloe, PANews

With Trump's victory and return to the White House, and cryptocurrency-friendly candidates entering the U.S. Congress, it is expected that cryptocurrency will flourish in a favorable regulatory environment, causing the price of Bitcoin to soar to over $90,000. According to a CNA report on November 18, Taiwan's "legislators" were concerned about the taxation of cryptocurrencies in Taiwan during questioning recently, and discussed whether personal cryptocurrency transactions should be taxed.

At the questioning meeting, legislators questioned the Ministry of Finance's taxation measures on personal cryptocurrency trading income, stating that currently only business tax and corporate income tax are levied on cryptocurrency exchanges, and there are no clear tax regulations for individuals or legal persons who profit from transactions. They emphasized that Taiwan's Ministry of Finance should take the initiative to improve Taiwan's cryptocurrency taxation mechanism.

Currently, there are 26 virtual asset operators in Taiwan that have completed the declaration of compliance with the Anti-Money Laundering Act to the Financial Supervisory Commission. All of them have completed tax registration and paid business tax and income tax. However, legislators still believe that the taxation of cryptocurrencies is mainly levied on operators, and the taxation and auditing of personal transactions are still not perfect enough for the Ministry of Finance.

Song Xiuling, director of the Taxation Bureau, pointed out that according to the current tax law, cryptocurrency is not a currency, but a digital asset transaction. As long as there is income from asset transactions, it must be taxed. However, because it is self-declared, it must be audited more strictly. The Ministry of Finance will also cooperate with the Financial Supervisory Commission to enact a special law for virtual assets, and there will be new audit measures in the future. "Currently, the tax department has audit tools available to review the transaction of digital goods, and promised to study the relevant methods for taxing income from cryptocurrency transactions within 3 months," said Song Xiuling.

Finally, the Ministry of Finance stated that it will continue to pay attention to international tax trends on cryptocurrencies and digital service taxes, and adjust the tax system in a timely manner based on Taiwan’s actual situation.

The taxation of cryptocurrency transactions has become a focus of attention in various countries in recent years. PAnews has briefly summarized for readers how countries/regions around the world handle taxation of crypto assets.

The world is gradually increasing the transparency of tax information on crypto asset transactions

The United States, the European Union, and other regions have successively proposed new tax information reporting requirements for crypto asset brokers and other intermediaries in 2023, aiming to increase transaction transparency. The Organization for Economic Cooperation and Development (OECD) also launched the Crypto Asset Reporting Framework (CARF) in June last year, and updated the Common Reporting Standard (CRS) for Financial Institutions to include new types of financial products in the reporting scope.

Countries have been promoting tax information reporting for crypto assets to avoid becoming a tool for tax avoidance. PwC's "2024 Global Crypto Asset Tax Survey Report" pointed out that as of December 1, 2023, 54 major crypto market jurisdictions have indicated that they will quickly introduce the "Crypto Asset Reporting Framework" (CARF) announced by the OECD, and it is expected that the automatic exchange mechanism for crypto asset transaction information will be implemented by 2027. Transactions that need to be reported include: exchanges between crypto assets, exchanges between crypto assets and legal currencies, and transfers of crypto assets with a value of more than US$50,000 for goods or services.

Judging from the cryptocurrency taxation issue that was of concern to the "legislators" during the recent questioning in Taiwan, the current situation in Taiwan is mainly focused on KYC and money laundering prevention, that is, cryptocurrency-related practitioners need to have access to customer information, and when there are large withdrawals (over NT$500,000), they must actively report it. This means that in Taiwan, apart from the Anti-Money Laundering Act, there are no clear guidance or income tax regulations applicable to cryptocurrencies.

For general trading users, there is currently no transaction tax required for buying and selling cryptocurrencies. Profits are treated as profits from other asset transactions (such as profits from foreign exchange trading), and "property transaction income" must be reported and included in personal comprehensive income tax.

In simple terms, the current cryptocurrency taxation principle in Taiwan is that only "profit exit" counts. As long as investors' profit funds are not withdrawn to bank accounts, no actual profit will be generated. Once the cryptocurrency has profit remitted to a bank account, that is, withdrawal and reaches a certain amount, tax will be levied.

In addition, cryptocurrency traders whose main business is buying and selling cryptocurrencies are considered regular trading cryptocurrency traders if their monthly sales exceed NT$40,000 and they must complete tax registration and pay business tax and income tax.

The United States considers cryptocurrencies as taxable property, and each state calculates taxes differently

The U.S. government defines virtual currency as any digital asset represented by a digital value recorded on a cryptographically secure distributed ledger. Digital assets are not true legal tender because they are not U.S. coins and banknotes, nor are they legal tender issued by any country's central bank.

In addition, the U.S. Internal Revenue Service (IRS) considers cryptocurrencies to be taxable property. If the market value of cryptocurrencies changes and their current price is higher than the value at which investors originally purchased them, investors who withdraw funds during transactions will generate capital gains or losses. If there is a profit, the holder must pay taxes on the cryptocurrencies sold. In addition, if one party is engaged in business activities and receives payment in cryptocurrency from the other party, the party receiving Canadian dollars must treat it as business income and pay taxes.

For example, if Party A buys 1 BTC for $5,000 and sells it for $7,000 three months later, then according to the short-term capital gains tax rate, the party must pay tax on the $2,000 withdrawal gain. If the profit from the sale of assets held for less than a year is between 0% and 37% for the 2023 US tax year, the specific tax rate depends on the amount of actual income reported by the party.

In addition to trading income, other income in the cryptocurrency ecosystem is also subject to tax. For example, cryptocurrency rewards from mining activities, rewards for participating in staking, and interest earned through lending platforms are generally classified as recurring income and are subject to general income tax rates. In 2023, the IRS passed a series of new regulations to further clarify the timing of income recognition for staking rewards and defined NFTs as collectibles, making them subject to special tax treatment rules.

In the middle of this year, the U.S. Internal Revenue Service (IRS) released the final draft of the cryptocurrency tax system. Starting from 2025, cryptocurrency brokers will need to submit Form 1099-DA to the IRS to report customer transaction information. This new system is expected to significantly improve tax compliance and also bring more compliance requirements to market participants.

At the state level, each state has different ways of calculating taxes, but currently the states have not yet reached a consensus on the definition and taxation methods of NFTs.

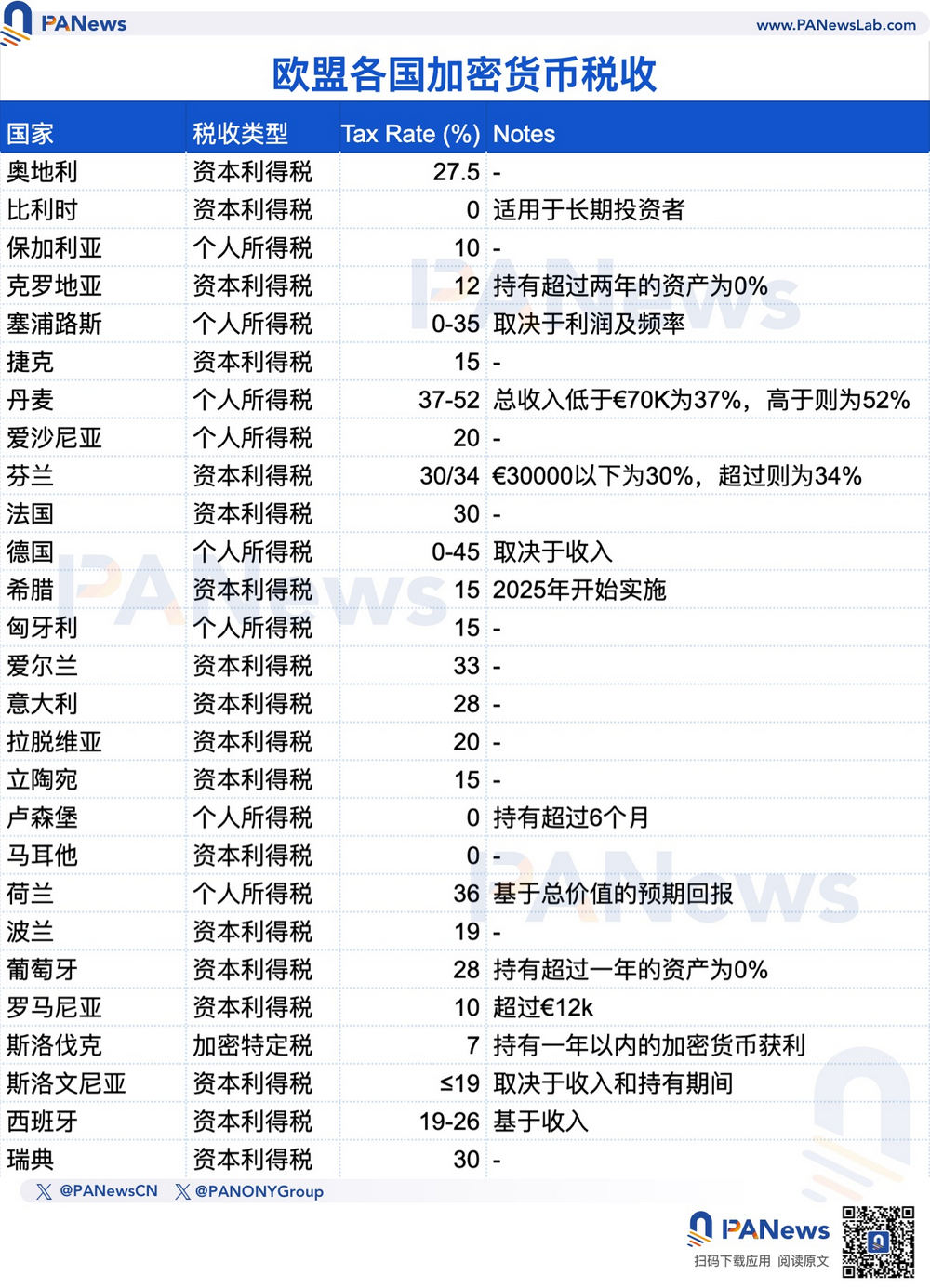

The tax rates in EU countries vary greatly, with Denmark's as high as 52%?

In addition, in Europe, EU countries are constantly updating their cryptocurrency tax systems. If you consider minimizing the tax burden on cryptocurrencies, Slovakia, Luxembourg, Bulgaria, Greece, Hungary or Lithuania would be more friendly choices. Currently, these countries have the lowest interest rates for cryptocurrency holders among EU countries.

In comparison, Denmark, Finland, the Netherlands, Germany and Ireland are not very friendly to cryptocurrency transactions. Denmark regards cryptocurrency gains as personal income and imposes high tax rates of 37% to 52%. The following are the tax types and tax rates in EU countries. Among them, capital gains tax is mainly levied on investment income, and the tax rate is usually relatively fixed. Personal income tax adopts a progressive tax rate system, which is related to the total income of the taxpayer.

Hong Kong and Singapore currently do not tax capital gains on individuals.

Finally, there are Asian countries. For example, in Japan, for personal transactions, the income generated by cryptocurrency transactions is classified as "miscellaneous income" and is subject to progressive tax rates. The tax rate depends on personal income. The lowest cryptocurrency tax rate in Japan is 5% and the highest is 45%. For example, the tax rate for annual income exceeding 40 million yen (about 276,000 US dollars) can be as high as 45%. In particular, the Japanese government stipulates that cryptocurrency losses cannot be deducted from taxpayers' income or other assets. Only losses from real estate, business and forestry income can be deducted from income, and cryptocurrencies do not belong to these categories.

In South Korea, the country plans to impose a 20% cryptocurrency profit tax on profits exceeding 2.5 million won (about US$1,800). However, the implementation time has been repeatedly postponed. It was originally scheduled to be postponed to 2025 after 2023, and now it will be postponed to 2028. The main reason for the postponement is due to market volatility considerations. In the past, there was a lack of proper tax infrastructure and concerns that premature implementation would affect investor sentiment.

In addition, personal capital gains are not currently taxed in Hong Kong and Singapore. First of all, Hong Kong currently does not have any tax law provisions specifically for digital assets, but the Hong Kong Inland Revenue Department updated the Inland Revenue Ordinance Interpretation and Practice Notes (DIPN) No. 39 in March 2020, adding chapters on digital asset taxation.

However, the guidelines do not yet cover pledge, DeFi, Web3 related content (such as NFT and physical asset tokenization). However, Hong Kong adopts the territorial taxation principle and imposes a 16.5% capital gains tax on domestic income profits from trade, profession or business in Hong Kong, but does not include capital profits. As for whether the income from cryptocurrency transactions is of income or capital nature, it needs to be determined based on specific facts and circumstances.

The Inland Revenue Authority of Singapore (IRAS) does not impose capital gains tax on individuals' cryptocurrency transactions. Profits earned from long-term cryptocurrency investments are tax-free. However, if an individual frequently trades cryptocurrencies or operates a cryptocurrency-related business, the income may be considered trading income and subject to income tax at progressive rates up to 22%.

Tax policies of various countries have always significantly affected cryptocurrency investment strategies, and low tax rates attract multinational companies to invest in their countries. On the contrary, high tax rates in the United States, Japan, France, and Spain may scare away some investors. According to a Coincub survey, the United States alone collected about $1.87 billion in taxes on cryptocurrencies last year.

The situation in European countries is mixed, with some countries offering favorable conditions for long-term holders, while others maintain high tax rates, which may affect investor behavior, but overall, the level of cryptocurrency tax rates in European countries is higher than the global average, reflecting part of the EU's overall fiscal system.