Author: TechFlow

Beyond the Meme craze, the crypto industry is still investing in actual projects, and Binance Labs’ investment trends are also attracting much attention.

Yesterday, Binance Labs announced its investment in the decentralized science (DeSci)-related protocol BIO Protocol. This is the first time that Binance Labs has invested in a project in the DeSci track, and BIO Protocol has become the focus of attention.

However, things seem to be on track.

Although CZ has gradually faded out of Binance, when facing legal issues in the first half of the year, he also mentioned in a letter to the judge:

"I feel like too much of current medical research is too profit-driven... I want to help fund small research labs. Over the past few years, I've talked to a lot of biotech startups in the field."

Focusing on the fields of medicine and science was what the key figures of Binance once thought, which more or less also influenced the investment department's focus and decision-making inertia.

So, what exactly is BIO Protocol, and what is so special about it that it attracted Binance Labs’ investment?

An incubator for decentralized science

In fact, in the document announcing Binance Labs’ investment in BIO, the essence of BIO has been named – “the on-chain scientific version of Y Combinator”.

Y Combinator is a well-known technology startup incubator that provides funding, guidance and resources to early-stage startups to help them grow and develop rapidly.

The so-called on-chain science refers to the scientific research and funding process using blockchain technology. "On-chain" means that these activities and transactions are carried out on the blockchain, which is transparent and decentralized.

If we compare it to YCombinator, then a rough functional point of BIO Protocol can be:

- Incubation function: Just like Y Combinator incubates technology startups, BIO Protocol provides support and resources for scientific research projects.

- Funding support: Through blockchain technology, BIO can more easily raise funds for scientific research projects.

- Community Engagement: Allowing scientists, patients and investors around the world to participate in and support research projects.

- Accelerate development: Help scientific research projects grow rapidly, similar to how Y Combinator accelerates the development of startups.

- Innovative model: Introduce new scientific research funding and commercialization models to break the limitations of traditional scientific research funding.

How are the above functional points implemented? This involves the core design of BIO Protocol.

From the perspective of crypto projects, the essence of BIO Protocol is a curation and liquidity protocol in the field of decentralized science (DeSci). Its design concept is derived from the team's previous successful experience in Molecule (a tokenization platform for early biomedical projects) and VitaDAO (the largest decentralized community for longevity science).

The BIO protocol mainly includes the following core components:

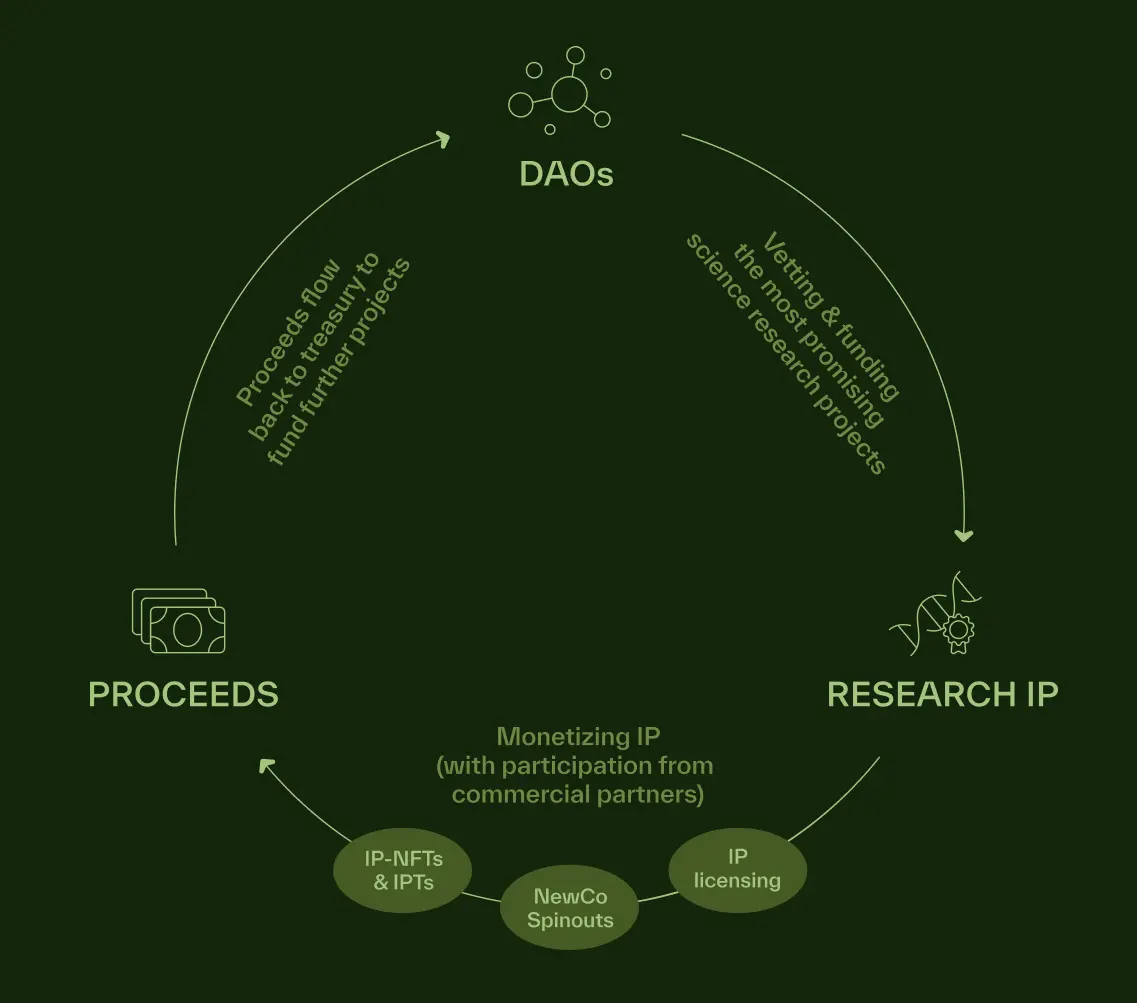

1. BioDAO: Sub-DAOs focusing on different specific scientific or medical research

BioDAO members pool resources (data, capital, labor) to leverage the power of a globally distributed collective of stakeholders (e.g., patients, scientists, and biotech builders) to accelerate R&D and develop new intellectual property.

BioDAO raises funds through token sales and uses its funds to support and develop biotech projects relevant to its mission, creating shared intellectual property ownership among its members.

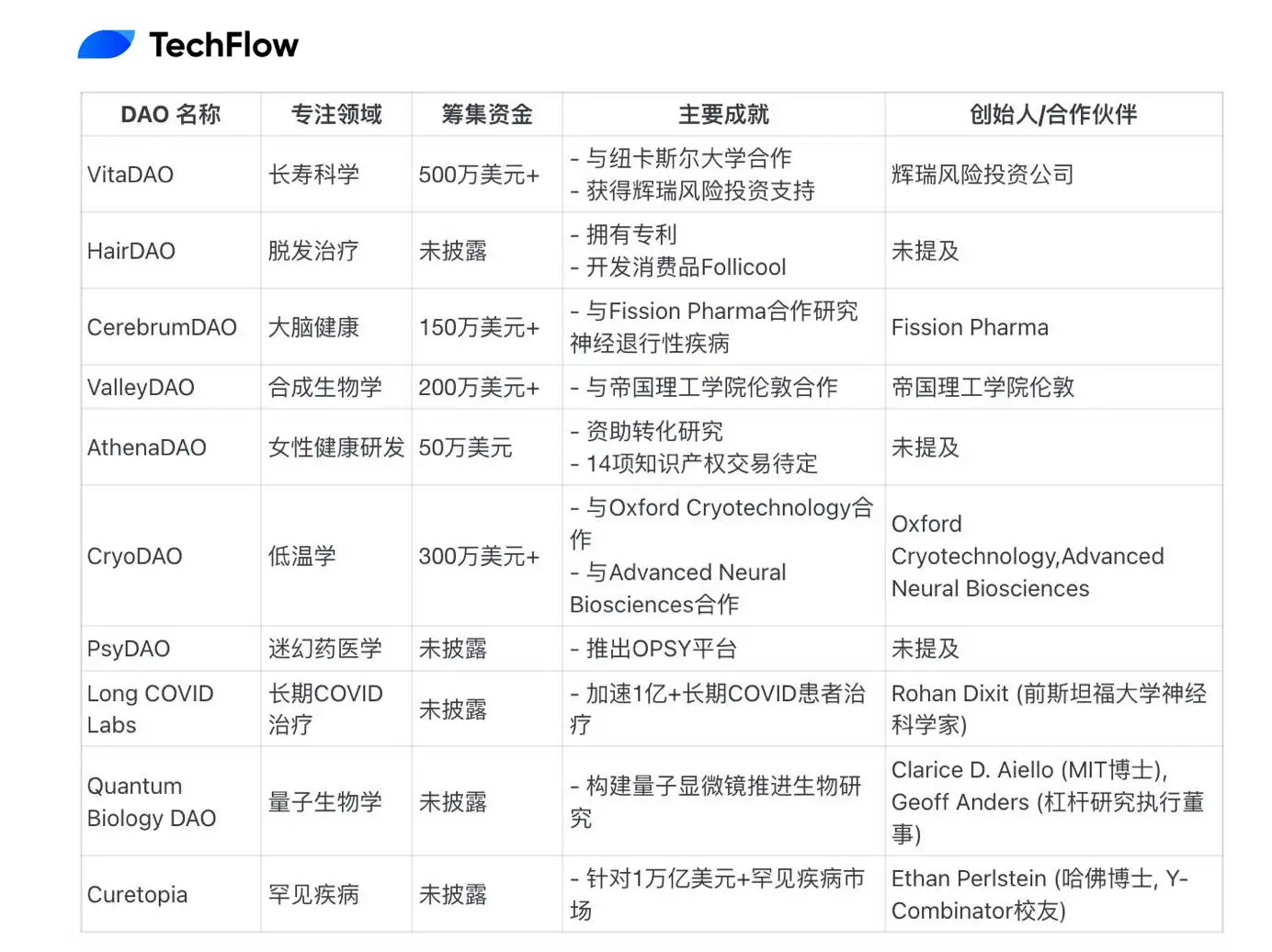

At present, BIO has also officially announced some successful cases of DAO, some of which have also been connected with universities, research institutions and pharmaceutical companies in the real world, successfully demonstrating the effectiveness of this model:

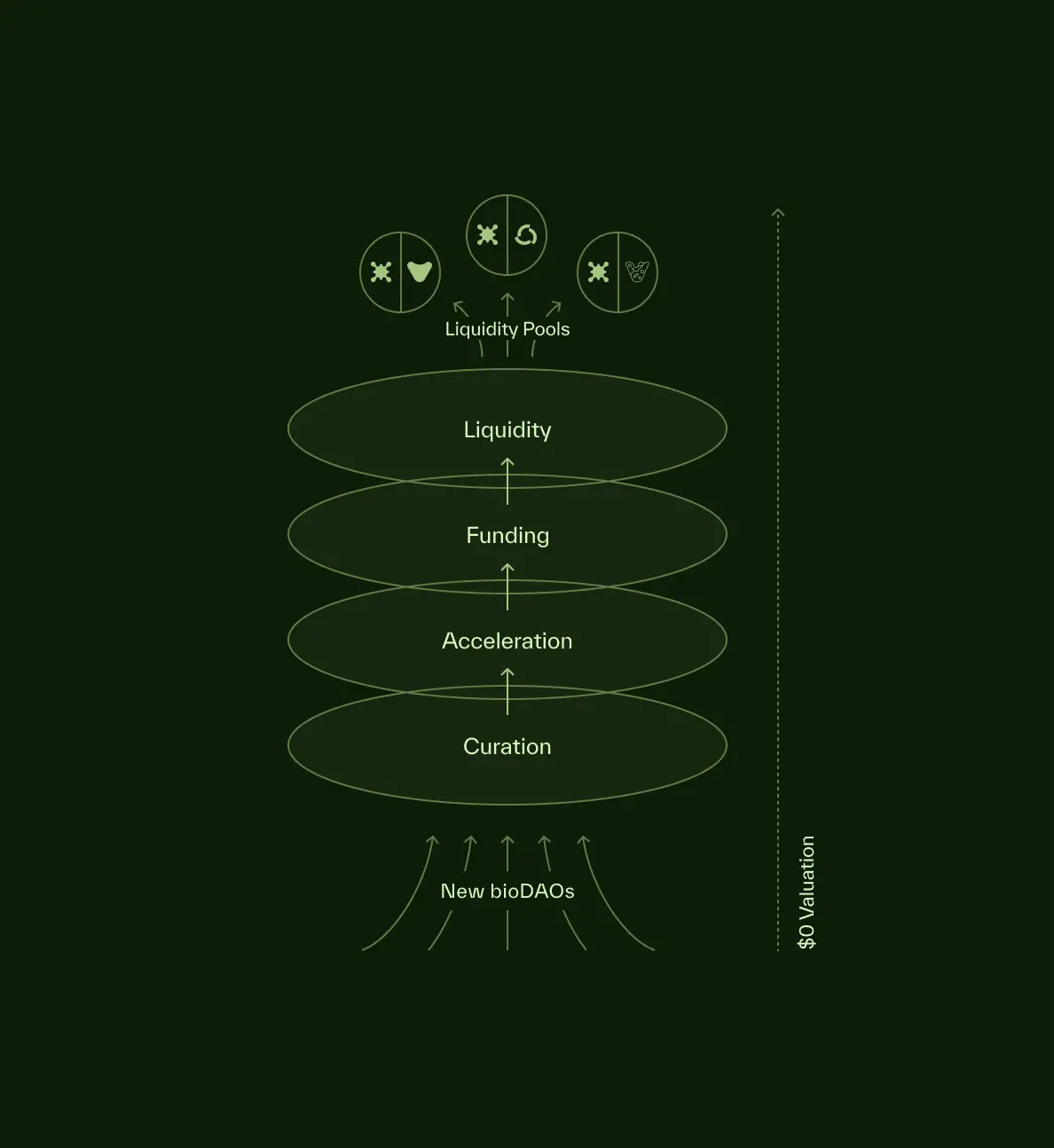

2. Curation

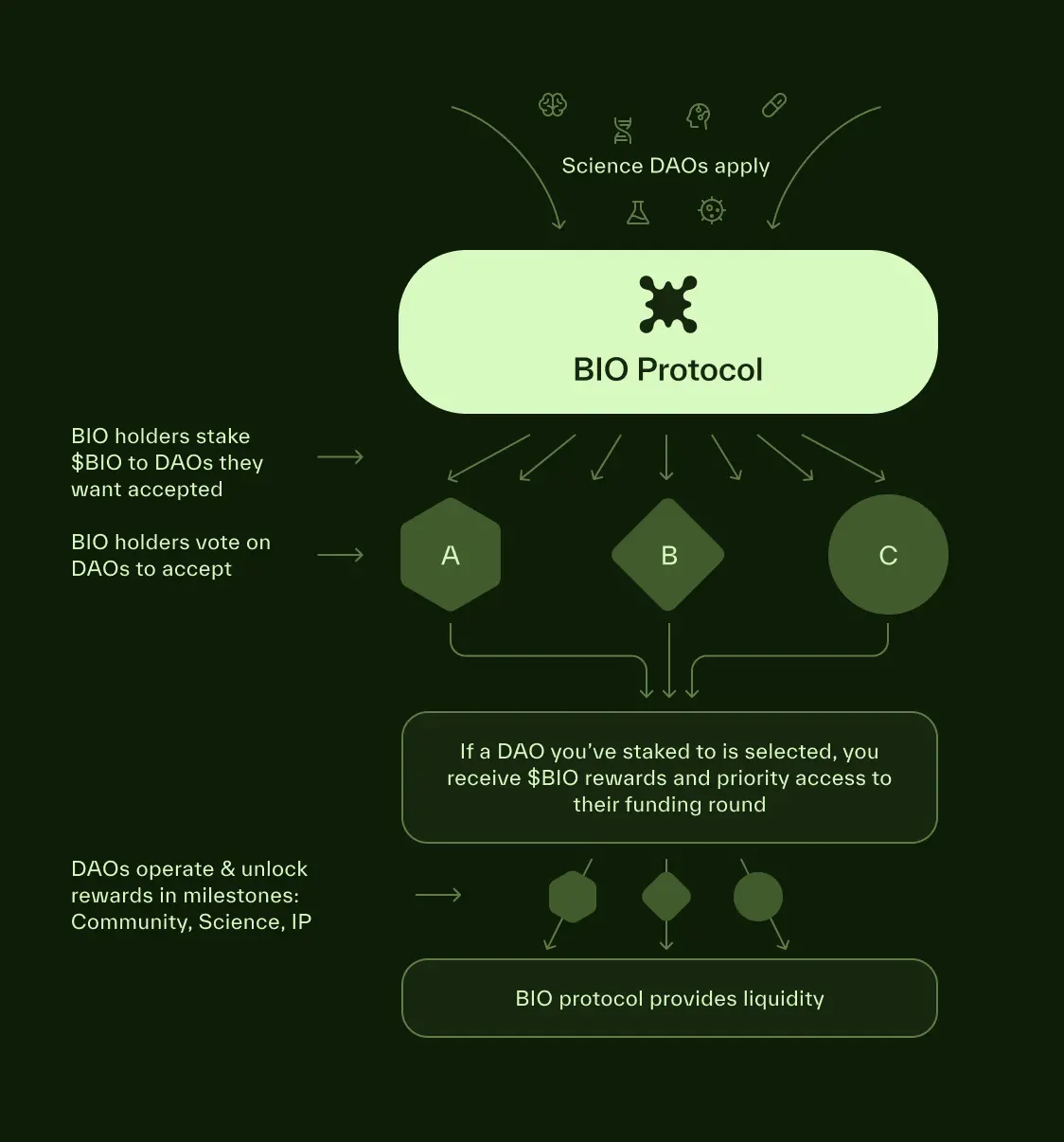

We use a token staking mechanism to screen and support high-quality biotech projects through a combination of community voting and professional evaluation.

Specifically, BIO token holders can manage which bioDAOs are accepted into the BIO network by staking BIO tokens on the bioDAOs they wish to be accepted.

BioDAOs voted into the network receive funding through the BIO Launchpad, as well as token liquidity support, incentives, and other acceleration services from the community.

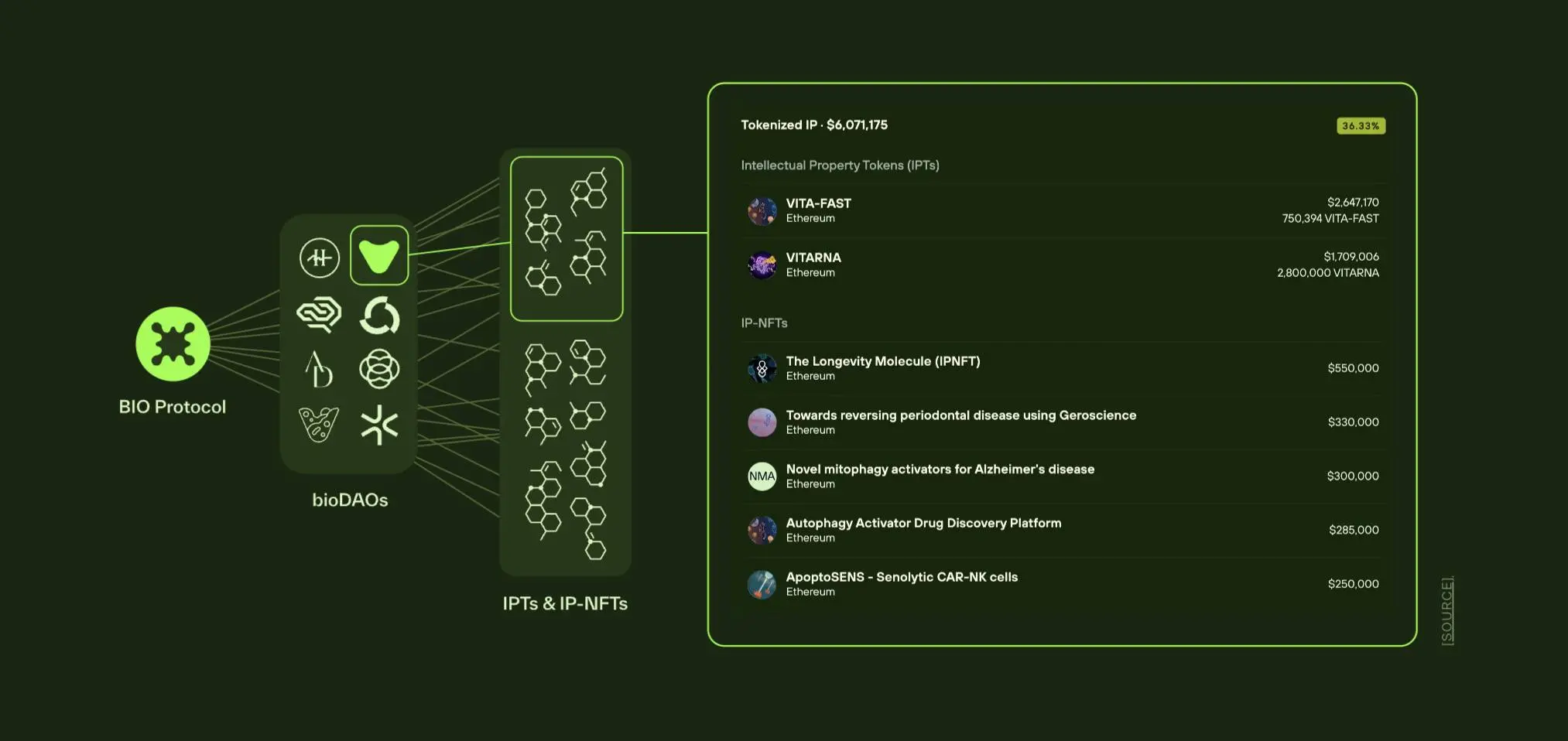

3. Liquidity and IP

Provide tokenization solutions for biotech IPs, allowing these IPs to be tokenized (such as NFT and FT forms); at the same time, establish a secondary market trading mechanism to achieve liquidity in scientific research project investments.

Among them, Intellectual Property Tokens ("IP-Tokens" or "IPT") represent partial governance rights over the generated intellectual property (IP). These tokens give holders the opportunity to directly participate in the development, decision-making and future direction of the research.

BioDAOs develop and acquire ownership of IP tokens. Each BioDAO typically holds a portfolio of IP tokens that represent intellectual property related to the BioDAO’s specific area of scientific research. For example, VitaDAO developed and owns shares in the IPTVitaRNA and VITA-FAST.

When someone acquires an IPToken, he or she receives a stake in the IP generated by the research, which can include patents for new compounds, proprietary screening systems, and potentially even treatments.

However, unlike other NFT profit-sharing models, IPToken does not give holders the right to obtain guaranteed financial returns or revenue sharing from the commercialization of these assets, but to obtain benefits in real scientific research, such as:

Get exclusive information, receive the latest information and detailed reports on the progress of IP research and development, and get early or priority access to IP-related innovations, collaborations or future opportunities, etc.

4. Incentive Mechanism (Bio/AccRewards)

Design a special acceleration reward mechanism to incentivize early participants and contributors to promote the rapid development of the ecosystem.

Bio/Acc Rewards provides rewards to bioDAO in the form of BIO tokens for achieving key milestones. In fact, in layman's terms, it is to incentivize both toB and toC parties at the same time, as long as they complete the following events:

For institutions and research organizations: Initial token auctions through BIO Launchpad, funding science (IP-Token issuance), significant revenue from consumer product launches, and decentralized clinical trials.

For general users: contributing to clinical trials or self-reported health data, using bioDAO products (such as certain medical supplies), and purchasing bioDAO products in online/offline stores, etc.

Token Economics and Auction Analysis

The native token of the BIO protocol is $BIO, which is deployed on Ethereum.

Contract address: 0xcb1592591996765Ec0eFc1f92599A19767ee5ffA

Holders can participate in key decision-making of the protocol, including:

- Select and support a bioDAO that joins the BIO Network

- Decide on the terms of participation in bioDAO and its IP token sale

- Provide support and discounts for bioDAO's health products/services

- Governance in a member-based bioDAO

- Decide on the issuance of BIO tokens, treasury allocations, and protocol upgrades

BIO token holders may benefit as bioDAOs in the BIO network grow and IP assets appreciate. The BIO Treasury accumulates value through various mechanisms, including token distributions from incubated bioDAOs and protocol-owned liquidity (POL).

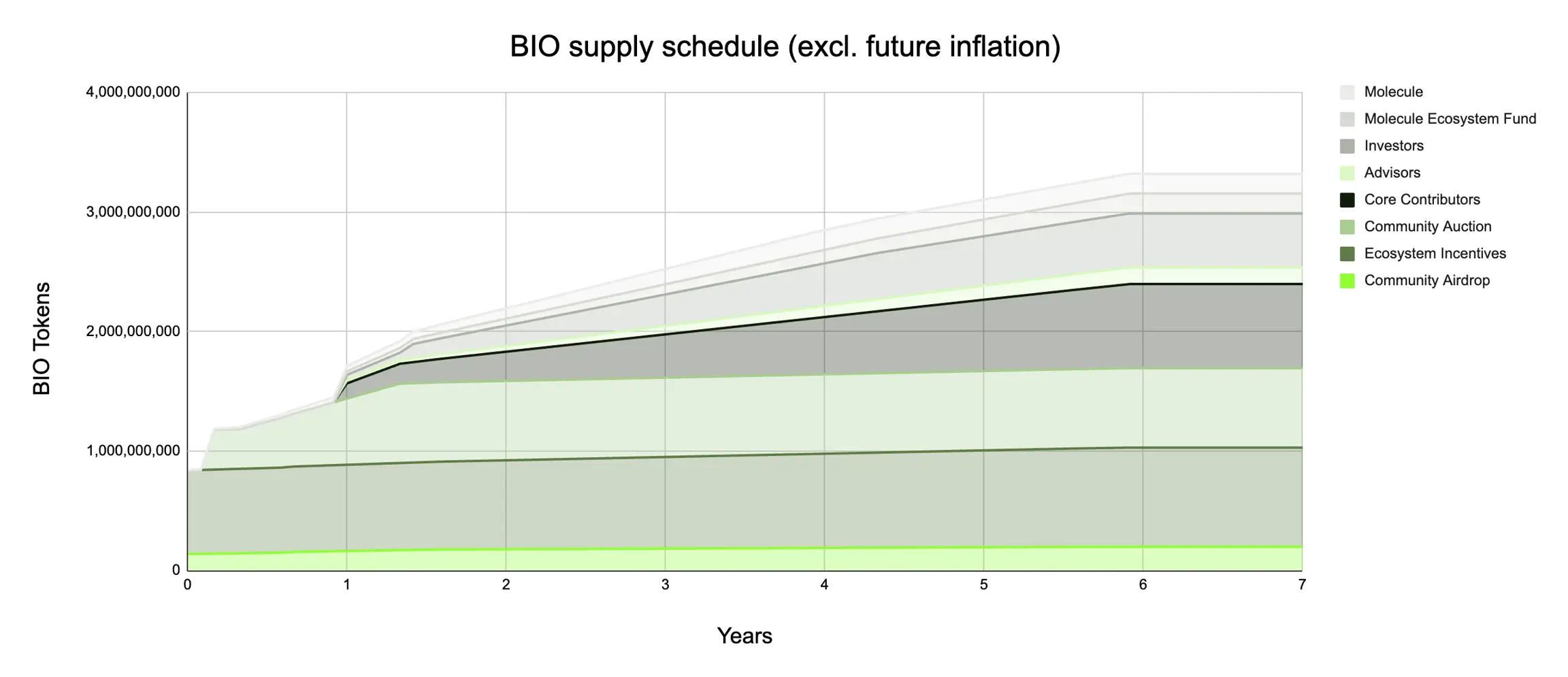

In terms of token supply, the total initial supply is 3,320,000,000 BIO, with the following features:

- Current Status: Non-transferable (not currently tradable on the secondary market)

- Maximum supply: Unlimited, additional supply may be decided through governance voting in the future

- Issuance mechanism: A new token contract needs to be deployed to replace the current BIO token

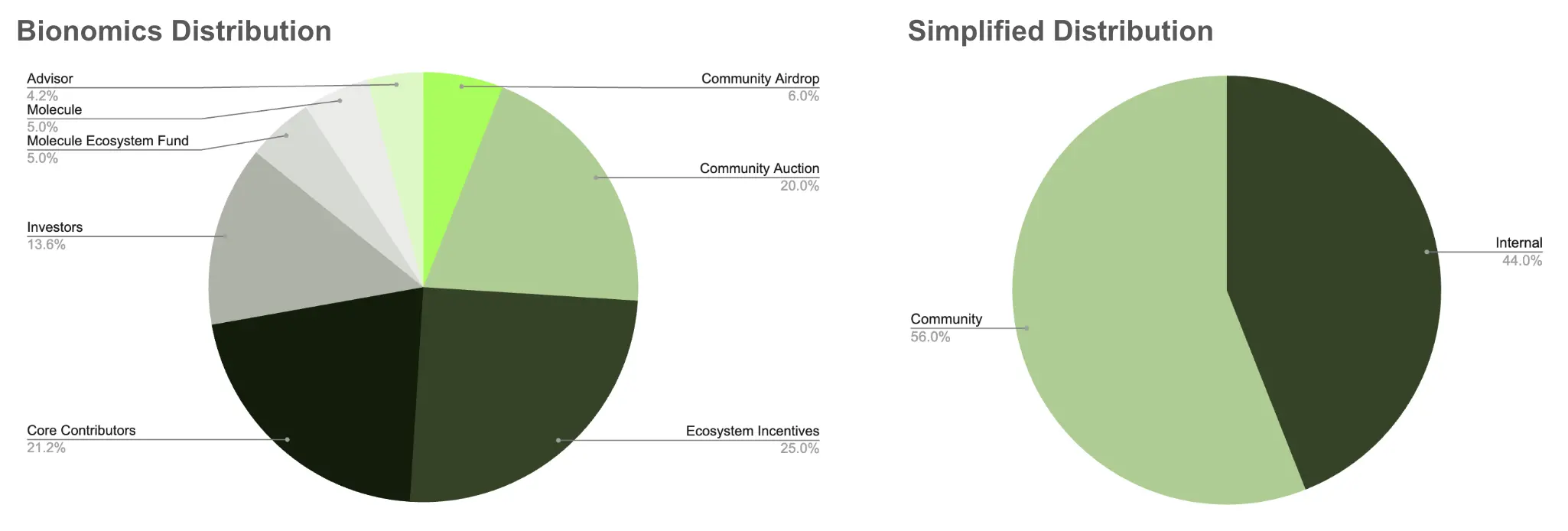

In terms of token distribution, the community (56% in total):

- Community airdrop (6%): 199,200,000 BIO

- Community Auction (20%): 664,000,000 BIO

- Ecosystem Incentives (25%): 830,000,000 BIO

- Molecule Ecosystem Fund (5%): 166,000,000 BIO

Other allocations are as follows:

- Core Contributors (21.2%): 703,840,000 BIO

- Investors (13.6%): 451,520,000 BIO

- Molecule (5%): 166,000,000 BIO

- Consultants (4.2%): 139,440,000 BIO

Each category has its own specific unlock schedule:

- Community Airdrop:

- Public airdrop: No lock-up

- bioDAO and Genesis Members: 6-year linear unlock after 1-year cliff

- Community Auction: 50% available immediately, 50% unlocked linearly over 1 year

- Ecosystem Incentives: No Lock-in

- Core Contributors: 1 year lock-up period, followed by 6 years of linear unlocking

- Molecule Ecosystem Fund: 4-year linear unlocking

- Molecule: 4-year linear unlock

- Investors: 1-year lock-up period followed by 4-year linear unlocking

- Advisor: 1 year lock-up followed by 6 years of linear unlocking

At the same time, the BIO protocol adopts a two-round Genesis auction mechanism to carry out Token launch.

Genesis is the launch plan of the BIO protocol, which aims to distribute initial tokens through auction and raise funds for the protocol. This plan is divided into two rounds, each with its own specific goals and mechanisms.

The first round adopted the English auction mechanism, and participants used ETH to bid. The main purpose of this round of auctions was to build the initial community and discover the market price of BIO tokens.

and raising initial funding for the protocol.

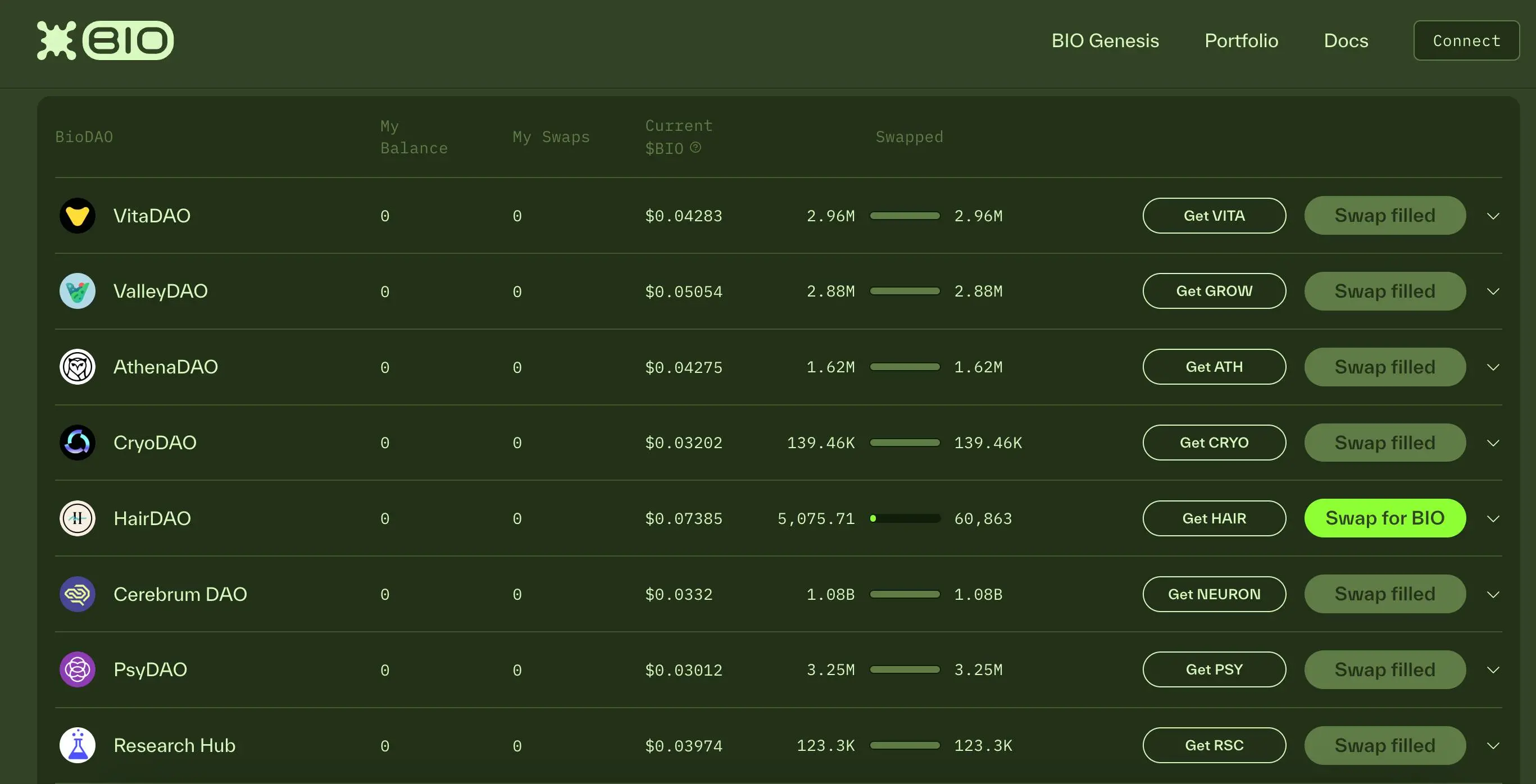

The first round has been successfully completed, and BIO is currently in the second round of the Genesis plan. This round uses a Dutch auction mechanism to allocate a total of 12.75% of the token supply; as of the latest news, the second round of auctions is in progress, most of the auctions have been completed, and only a few are still in progress.

Interested investors can participate in the auction through BIO's official platform. Participants need to connect their wallets first, and then choose to participate in the auction of the bioDAO asset pool or the ETH pool according to their interests. (Note: This is only a link and information collation, and does not constitute investment advice. Please DYOR)

After the auction is completed, participants will receive BIO tokens, 50% of which are immediately available and the other 50% are unlocked linearly over a year. This mechanism is designed to balance immediate liquidity and long-term holding incentives.

In addition to the Genesis Auction, BIO has also designed a comprehensive airdrop program to reward early supporters and expand the community. The following are the main features of the airdrop program:

The BIO airdrop program allocated 6% of the total supply, about 199,200,000 BIO tokens. This is a considerable amount, showing the importance the project places on community building.

The airdrop is mainly aimed at three groups:

- Public airdrop: for early users of the Molecule platform, members of life science-related DAOs, etc.

- bioDAO Airdrop: Exclusively for bioDAOs that have joined the BIO Network

- Genesis Member Airdrop: Rewarding Early Contributors

Different types of airdrops have different lock-up periods; public airdrops have no lock-up period and users can use them immediately. However, airdrops for bioDAO and Genesis members have longer lock-up periods, including a 1-year lock-up period and a 6-year linear unlock.

Overall, BIO's Genesis launch plan and airdrop strategy demonstrate the project's emphasis on fair distribution, community engagement, and long-term development. Through multiple rounds of auctions and multi-level airdrops, BIO is actively building a diverse and engaged community, laying a solid foundation for its decentralized biomedical research network.

Not an isolated case

In addition to Binance Labs' involvement in the DeSci track through this project, other VCs are also waiting for opportunities.

Previously, we mentioned in "Interpreting AminoChain: a16z's first involvement in DeSci led a US$5 million investment, and patients contributed biological samples to obtain profits" that about 40 days ago, a16z also entered this track for the first time to invest in projects.

In a market where VC coins are not taking over each other and memes are flying all over the place, if crypto can do something good for traditional industries, and if VC can really invest in a project that can benefit other industries, it can be regarded as a correct and unique fresh stream.

As Paul Kohlhaas, founder of this BIO Protocol, said, “Science drives human progress, but we’ve trapped our brightest minds in an endless funding maze—where they spend 80% of their time writing grants instead of solving humanity’s greatest challenges”.

Less hype and more meaningful technological projects to unlock breakthrough progress. The decisions of the industry's top investors are certainly worthy of attention, but the investment results and final returns will inevitably also require time and the market to test.