In October, the Federal Reserve released the Beige Book, which revealed the current stable operation of the U.S. economy and dispelled traders' concerns about the macro-economy. The U.S. election became the main logic dominating market transactions; U.S. stock earnings week is approaching, and technology stocks suffered a sharp drop at the end of the month; the crypto market has become a safe haven for election uncertainties, and Bitcoin is approaching its historical high. A new crypto main uptrend may have arrived.

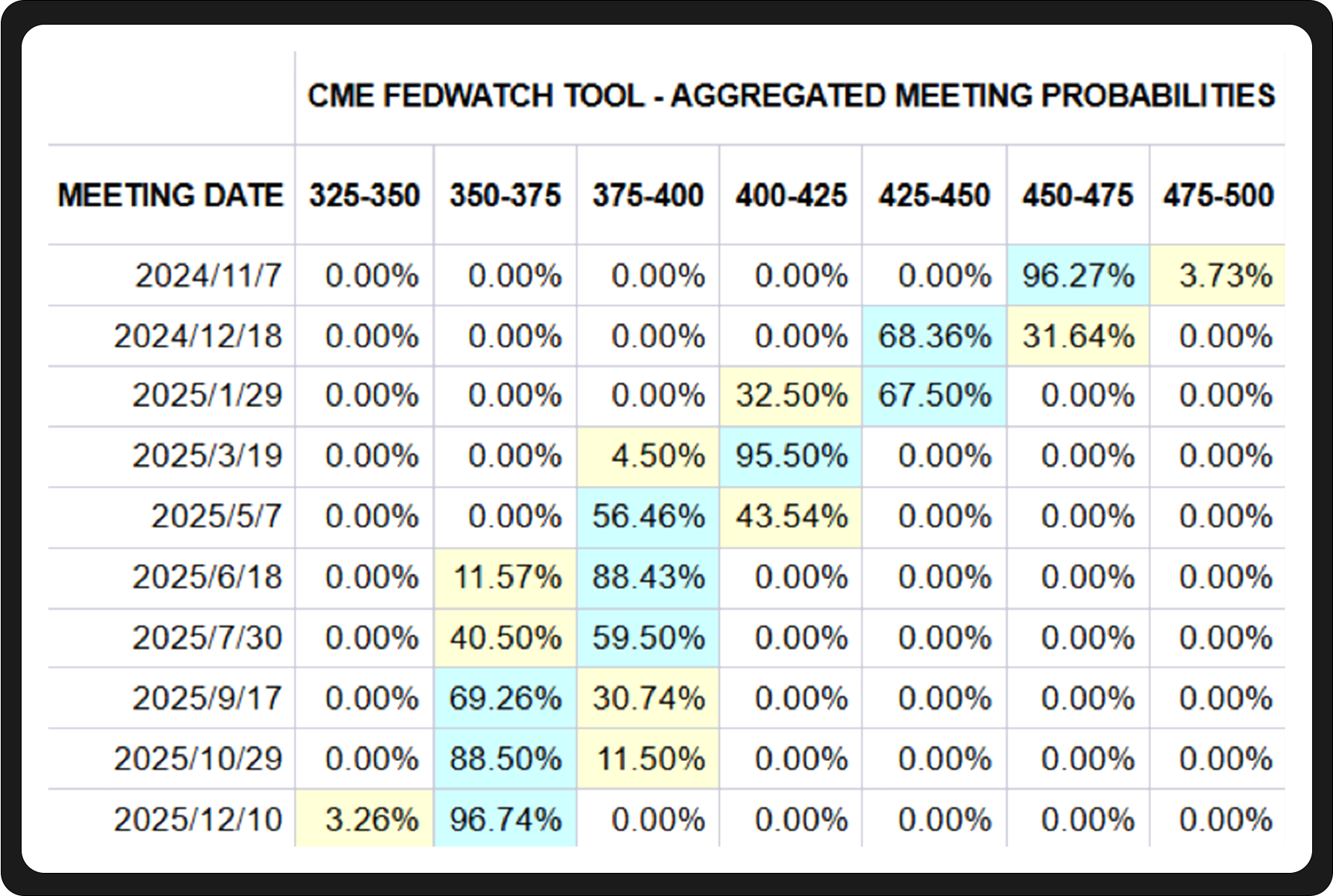

November was another mixed month for the US economy: US non-farm payrolls increased by 254,000 in September, 150,000 higher than expected, and employment in August and July was revised up by 72,000. The unemployment rate was 4.1% in September, lower than the expected 4.2% and 4.2% in August. Average hourly wages in September increased by 4% year-on-year and 0.4% month-on-month, both higher than expected; the initial value of Markit's manufacturing PMI was 47.8 (expected 47.5), a two-month high, and the initial value of Markit's service PMI was 55.3 (expected 55), a two-month high. The stable performance of economic data is accompanied by high inflation: the US CPI rose by 2.4% year-on-year in September, slowing down from the previous value of 2.5%, but exceeding expectations by 2.3%; the core CPI rose by 3.3% year-on-year, slightly exceeding expectations and the previous value of 3.2%. This inflation data directly overwhelmed the debate on "whether to cut interest rates by 25 or 50 basis points in November": almost everyone is betting on a 25 basis point interest rate cut in November, and a small number of people are betting on no interest rate cut. The voices calling for a 50 basis point interest rate cut have completely disappeared.

Source: fedwatch tool

The current state of the US economy and the moderate decline in inflation have basically shown that the US economy is on a soft landing, and macro risks are gradually fading from the traders' horizons. The Federal Reserve's latest Beige Book released in October mentioned that since the beginning of September, economic activity in most parts of the United States has not changed much, and inflationary pressures continue to ease. Overall, the Beige Book depicts a moderate economic picture of "smooth economic operation, slowing inflation, and some economic indicators need to be improved", which basically characterizes the US economy in the direction of a soft landing. But is that all? The Beige Book also mentioned the uncertainty of the US election in November many times, believing that the election is one of the factors that cause consumers and businesses to postpone investment, hiring and purchasing decisions. At present, the approval ratings of US Vice President and Democratic presidential candidate Harris and Republican presidential candidate Trump are very close, which may lead to unexpected means for the two parties to compete for power.

In general, the US economy has been characterized as a soft landing by the Federal Reserve, and the current impact of the economy on the market is generally expected to be positive, which means that political issues have become the main reason for determining the short-term market trend. Therefore, it is necessary to pay attention to the short-term risks in trading brought about by political issues. However, what was unexpected was that Halloween also prepared a "joke".

Source: S&P 500 Index heatmap.

After the Dow Jones Industrial Average hit a new high last month, everyone is expecting the Nasdaq to follow suit. In particular, they are expecting the stock king Nvidia (NVDA) to continue to break through its historical high and usher in a new wave of market conditions amid many voices bearish on the "AI bubble."

However, the U.S. stock market suffered a heavy blow on the last trading day of October. The three major indexes closed down collectively, and technology stocks generally declined. Among them, the Dow fell 0.90%, the Nasdaq fell 2.76%, the S&P 500 also fell 1.86%, Apple fell 1.82%, Nvidia fell 4.72%, Microsoft fell 6.05%, Google C fell 1.96%, Amazon fell 3.28%, Meta fell 4.09%, and Tesla fell 2.99%. Both the S&P and the Nasdaq recorded their largest single-day declines since September 4, wiping out the gains in October. As Steve Sosnick of Interactive Brokers said: "Halloween brings pranks to many investors, not gifts. The market mentality seems to be changing, from anything AI-related that can arouse enthusiasm to investors hoping that companies can get returns from huge expenditures."

However, putting aside market sentiment, judging from the latest financial reports of the "Seven Sisters" of the U.S. stock market, Tesla (TSLA) performed quite well, rising 21.92% on October 24. The financial report shows that Tesla's revenue in the third quarter increased by nearly 8% year-on-year, which is still lower than expected, but the profit was a surprise. The gross profit margin did not decrease year-on-year but increased by 195 basis points to 19.8%, and the gross profit margin of the automotive business exceeded expectations and rose to 17.1%; the revenue from "selling carbon" increased by more than 30% year-on-year, setting a record high in a single quarter. At the same time, the computing power of artificial intelligence (AI) training increased by more than 75% in the third quarter. In the quarter, Tesla deployed a cluster of 29,000 Nvidia H100 chips in advance at the Gigafactory in Texas, and conducted training. It is expected to have a production capacity of 50,000 H100 chips by the end of October. AI has also become one of the core driving forces of Tesla's stock price.

This month, in addition to the AI narrative, there has been a new and interesting change in the US stock market, that is, the political aspect has surpassed the macro aspect and become the core logic of trading. It is very interesting that Trump Media Technology (DJT) has soared by nearly 250% this month, which seems to indicate that, at least in the US stock market, traders generally bet on Trump's victory. This is also the vote made by the market with real money. "Trump trading" has become the main theme of the current US stock market. Trump's current policy inclination is relatively obvious, such as increasing tariffs on imports from other countries, thereby protecting the country's manufacturing industry. Therefore, traders are generally more optimistic about US domestic companies at present, which is also one of the logics for the continued surge of local technology giants.

This October, the U.S. stock market is on the eve of the election and coincides with the earnings season. The combination of these two factors has further exacerbated the market volatility. The stock markets of Japan, France, Germany and other countries are generally in a "lying flat" state, quietly waiting for the changes brought about by the U.S. election.

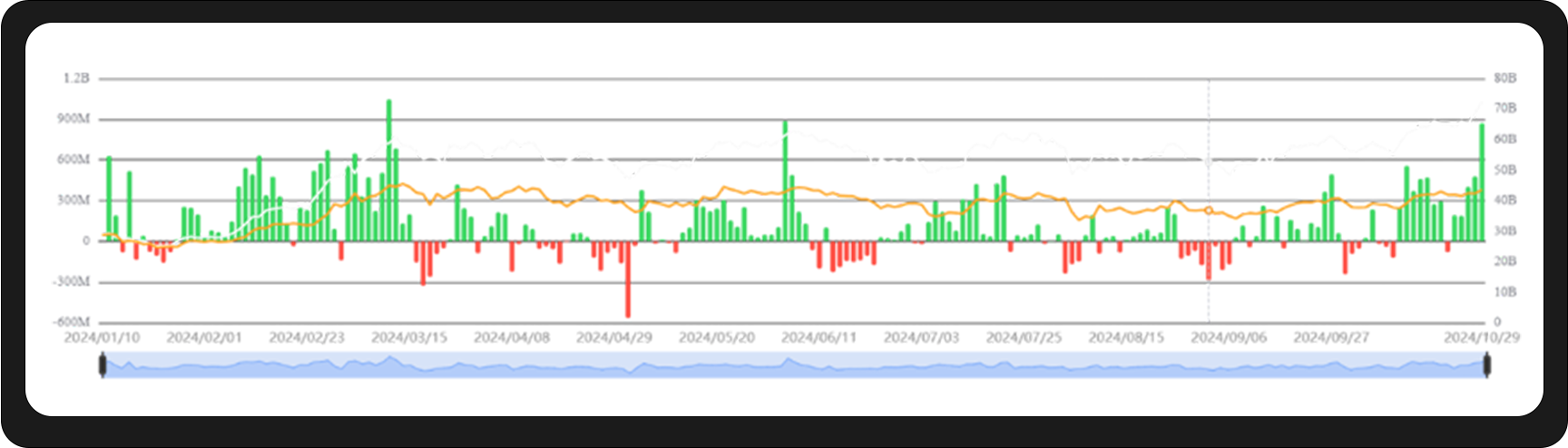

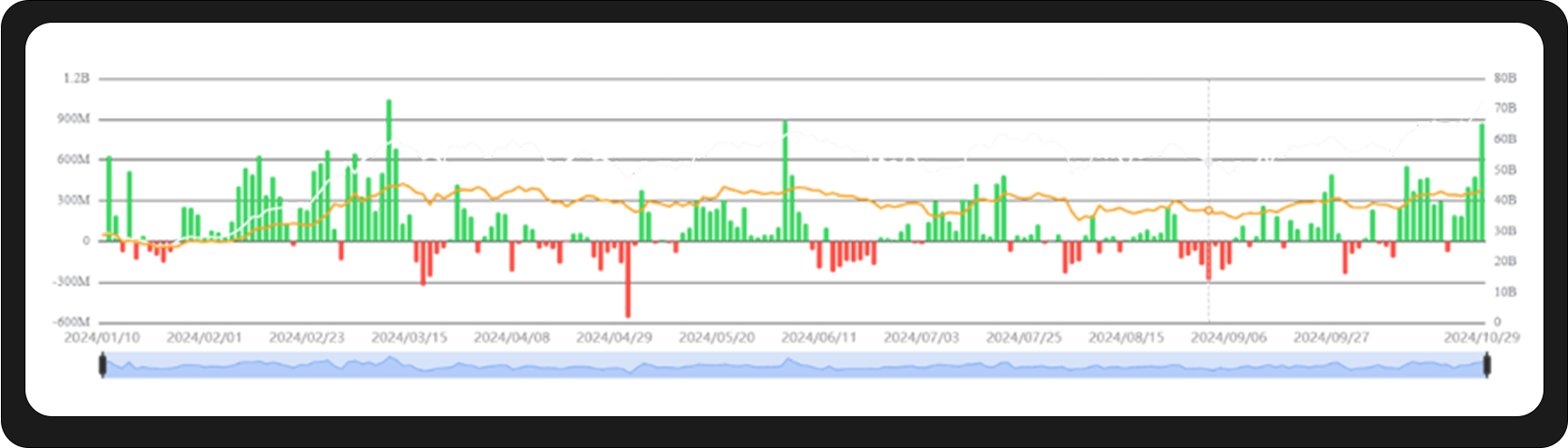

After seven months of sideways trading, Bitcoin finally ushered in a decent main uptrend, approaching its previous high. In particular, the US Bitcoin ETF ushered in a period of intensive inflows during the October "Uptober".

Trump has played the "crypto card" since the beginning of the election, unwaveringly winning the votes of crypto investors. In July 2024, he revised the official platform of the Republican Party to include the right to "mine Bitcoin" and "self-custody of digital assets", and boldly advocated the permission of "no government monitoring" transactions. The Democratic Party has also gradually relaxed its hostility to cryptocurrencies, passing Bitcoin and Ethereum spot ETFs during Biden's term. Although Harris is not as outspoken as Trump on the issue of cryptocurrencies, her campaign team has tried to attract the support of the crypto community in the late stage, expressing its willingness to explore a regulatory framework that will not stifle innovation. It can be said that no matter what the result of this US election is, cryptocurrencies will usher in a new round of development. Therefore, cryptocurrency has become the "promised land" for capital hedging before the election, which is almost a clear logic. According to historical past, the market often experiences a period of increased volatility before the election, and investors' risk aversion and uncertainty about policies will trigger frequent fluctuations in crypto market prices. For example, during the 2020 US election, the price of Bitcoin experienced a large fluctuation in a few weeks.

But overall, in the absence of an on-chain narrative, politics has become the main driving force. The integration of Bitcoin with the traditional world has spread from the financial field to the political field, and it has officially become an important member of the world order.

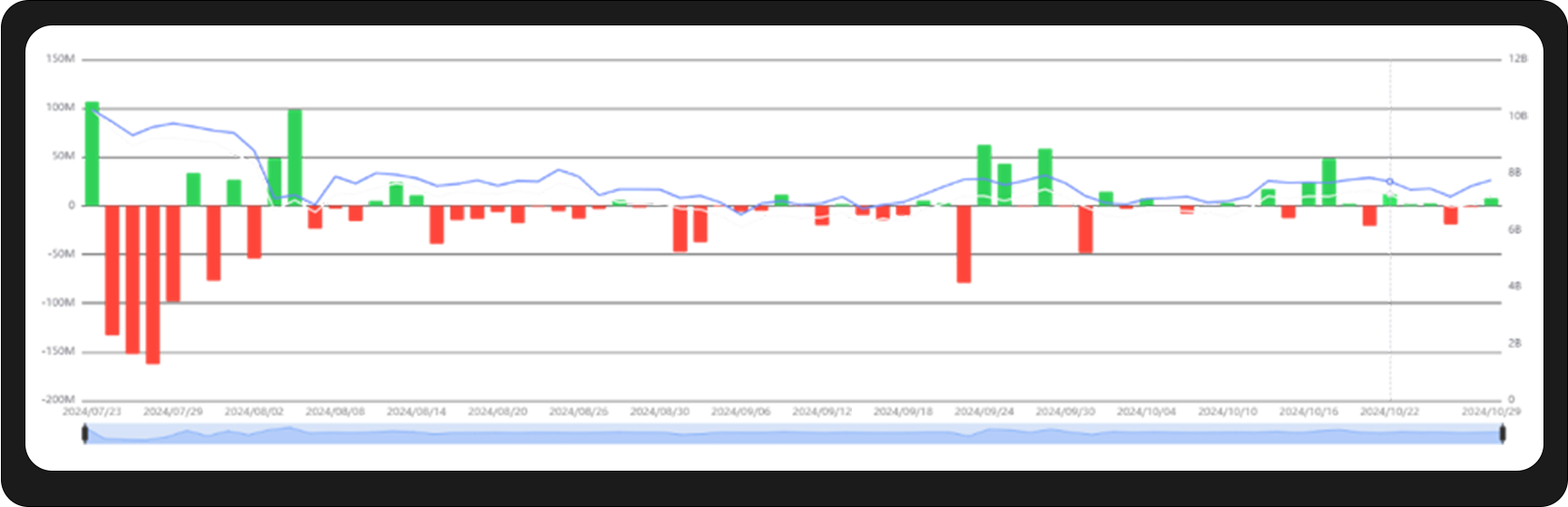

It is worth mentioning that compared with Bitcoin, Ethereum's performance is quite poor. In the past two months, Ethereum has been in a sideways state. Judging from the ETF data, its inflow and outflow have not fluctuated much.

One of the important reasons for Ethereum's current weakness is the siphoning of funds from other public chains such as Solana. Currently, the trend of "speculating on memes" is hot in the crypto community, and Ethereum is not the main battlefield of memes. The US election also led to the emergence of countless meme coins with Trump's image on the Solana chain, which also drained a lot of funds from Ethereum. This short-term community factor cannot determine the long-term trend of Ethereum. After the US election, the meme speculation will come to an end, and then Ethereum will have the possibility to step out of the shadows and welcome back the oversold funds.

As economic concerns fade, the market has returned to the AI mainline. Although the US election has left many investors waiting for changes, the crypto market has unexpectedly become the best choice for investment at the moment. This may be a kind of destiny, that is, Bitcoin is indeed a better investment asset, and more and more people will notice its safe-haven properties. With the arrival and end of the US election, the global macro situation gradually becomes clear, the market may re-enter the AI mainline narrative, and the crypto market is expected to continue to remain active, and it may once again usher in the prosperous scene of "stock and currency flying" in the first half of the year.