Initially, no one cared about this transaction. It was just a farce, a “network unplugging”, the extinction of an idea (decentralization), and the disappearance of an L1. Until this disaster became closely related to everyone.

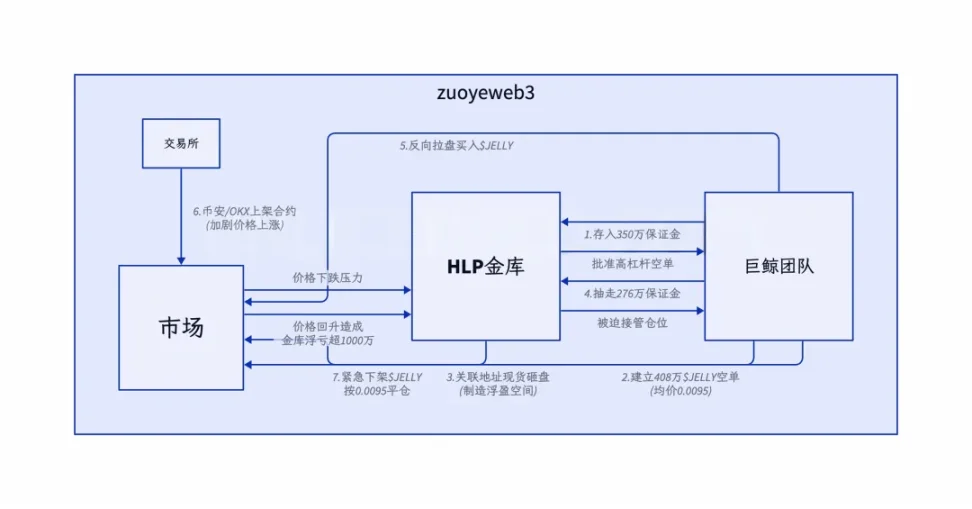

On March 26, Hyperliquid encountered a bloody incident caused by a meme. The method used by the 50x whale was exactly the same as before. The whale gathered funds and used the "loophole" in the rules to attack the HLP vault.

Image description: Attack process Source: @ai_9684xtpa

Originally, this was a story between an attacker and Hyperliquid. Hyperliquid actually took over the order from the giant whale. PVP became PVH. The loss of $4 million was only a minor problem for the Hyperliquid protocol.

However, Binance and OKX followed up with the launch of the $JELLYJELLY contract, which seemed like they were taking advantage of your weakness. The principle is similar. If Hyperliquid can absorb the losses of whales with its financial volume, then exchanges such as Binance can also rely on deeper liquidity to continue bleeding Hyperliquid until it loses too much blood and enters a death loop similar to Luna-UST.

In the end, Hyperliquid chose to go against the concept of decentralization and chose to delist $JELLYJELLY "after voting", commonly known as "pulling the plug", admitting that it could not afford to lose.

To review, Hyperliquid’s response is normal for CEX, and we can also make a judgment that after Hyperliquid, the on-chain ecosystem will gradually recognize this "new normal". Centralization or not is not important, and transparency of governance is more critical.

DEX does not need to be completely decentralized, but will be more transparent than CEX, achieving a certain balance between crypto culture and capital efficiency in order to survive.

9% of Binance: Crypto Culture Surrenders to Capital Efficiency

Unplugging the network cable is a sign of being unlearned, plugging in pins is a sign of being broken, and getting caught for market making is a sign of being stupid.

According to data from The Block, Hyperliquid has accounted for about 9% of Binance's contract trading volume for two consecutive months. This is the fundamental reason why Binance responded fiercely, strangling the danger at the starting line. Hyperliquid has already stepped out of the cradle.

The mall is like a battlefield. Yesterday, Binance was able to grab wallet market share when OKX DEX was delisted. Today, Binance and OK were able to attack together under Hayek's leadership, which shows that the contract market is divided among three companies.

Looking back at recent industry hot spots, on-chain protocols are all in a difficult situation, and it is difficult to insist on decentralization. Polymarket admitted that large investors manipulated the results of the UMA oracle and tampered with them, and the community was dissatisfied; Hyperliquid eventually "pulled the plug" under pressure from Binance and was repeatedly accused by Bitget CEO and BitMEX co-founder Arthur Hayes.

First of all, what they said is right. Hyperliquid did not choose the absolute concept of decentralization, but prioritized capital efficiency and protocol security. Personally, I feel that Hyperliquid's degree of decentralization is not as good as Coinbase. After all, the latter is really strictly regulated, and the true face of Hyperliquid is No KYC CEX as Perp DEX.

Secondly, Hyperliquid should be criticized in its dual identity with CEX and Perp DEX. All the problems Hyperliquid is facing now have been experienced by CEX, including Arthur Hayes' BitMEX, which accused Hyperliquid of not being decentralized enough. If the network cable had not been unplugged during the March 12 incident in 2020, the entire crypto industry might have been ruined.

Decentralization and centralization is a classic trolley problem. If you want to decentralize, capital efficiency will inevitably be lower than that of centralization. If you want to centralize, you will not be able to attract free capital flow.

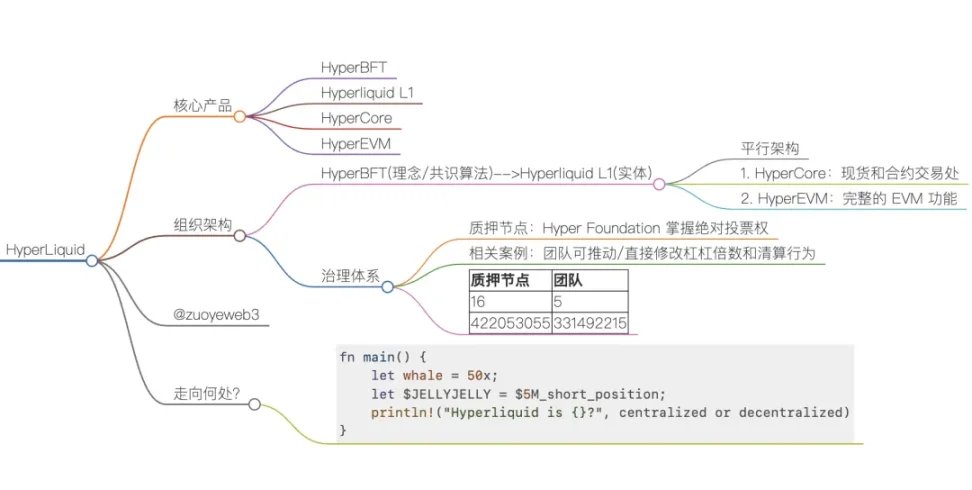

Image caption: Hyperliquid organizational structure Image source: @zuoyeweb3

Hyperliquid is actually a consensus with two business points:

- The consensus is the HyperBFT algorithm and its materialized product Hyperliquid L1;

- The businesses are HyperCore built on L1, which is a customized spot and contract exchange, basically controlled by Hyperliquid, and in parallel, HyperEVM built on L1, which is the "EVM chain" in the usual sense.

In this architecture, the cross-chain behavior of L1 and HyperCore/HyperEVM, and the interaction between HyperCore and HyperEVM are all potential attack points. Therefore, the complexity of the organizational structure is also an inevitable move for the Hyperliquid project to have a high degree of control.

In the Perp DEX sequence, Hyperliquid's innovation lies not in architectural innovation, but in using a "slightly centralized" approach to learn from GMX's LP tokenization, and in coordinating listing and airdrop strategies to continuously stimulate market competition and successfully seize the derivatives market firmly occupied by CEX.

This is not to defend hyperliquid, this is the underlying tone of Perp DEX. If you want absolute decentralized governance, you will not be able to deal with black swan events and will not have time to respond quickly. If you want to respond efficiently, you will definitely need a sword holder.

In fact, just like LooksRare failed to defeat OpenSea, Blur eventually defeated OpenSea. The centralization discussed by everyone is also hierarchical. Hyperliquid is more focused on the changes in the protocol. The focus of this article is not to debate whether it is centralized or not, but to emphasize that capital efficiency will automatically prompt the new generation of on-chain protocols to do so - a little more centralized in exchange for capital efficiency.

78% Centralization: A Token Economic Necessity

The special thing about Hyperliquid is that it exchanges on-chain structure for CEX efficiency, token economics for liquidity, and customized technology stack for security.

Beyond the technical architecture, the real danger for Hyperliquid is the survival of its token economics. As mentioned earlier, Hyperliquid is a tokenized upgraded version of GMX LP. Users can share in the protocol revenue, thereby creating more liquidity and supporting token prices for the project.

But the prerequisite is that the project party must have sufficient control capabilities to maintain the normal operation of the protocol income, especially in the contract market with leverage. While the profits are magnified, they are also more dangerous. This is also the biggest difference from spot DEXs such as Uniswap.

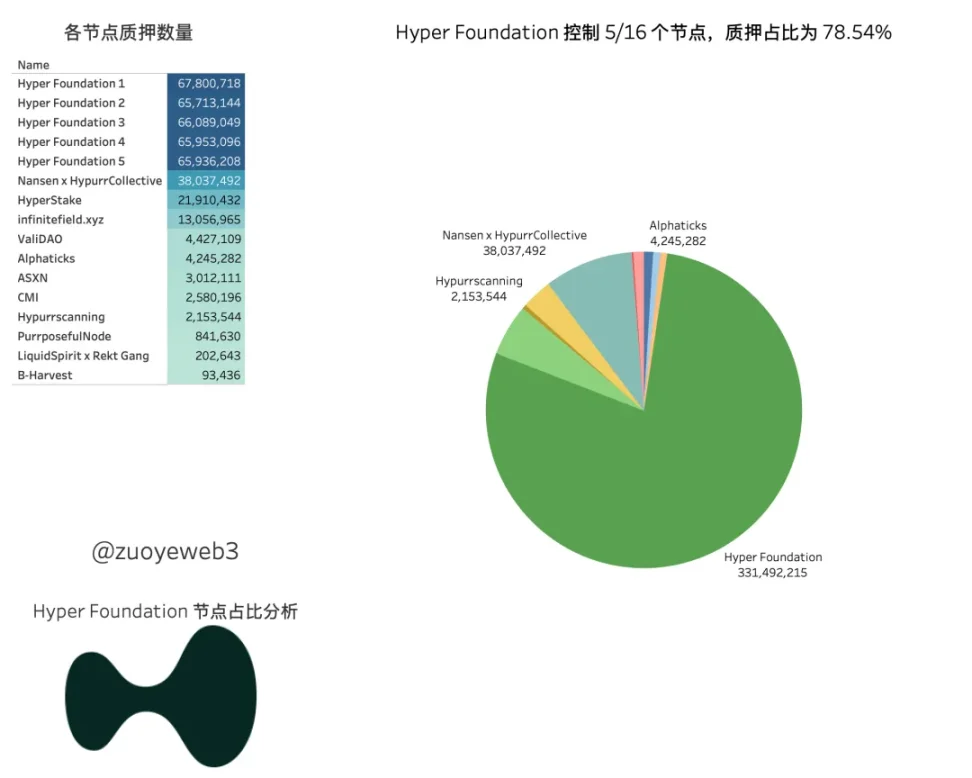

The above is the economic principle behind Hyperliquid's choice of a more centralized architecture. Currently, Hyper Foundation controls 5 of the 16 nodes, but in terms of the stake ratio, the Foundation holds a total of 330 million Hyper, accounting for 78.54% of all nodes, far exceeding the 2/3 majority.

Image description: Hyperliquid node Image source: @zuoyeweb3

Review of security incidents in the past six months:

November 2024: Big V accuses Hyperliquid of not being centralized enough: basically true

Early 2025: 50x Whale: Made the same mistake every exchange makes, but on-chain transparency has become the target of public criticism

March 26, 2025: "Pulling the Internet Cable" to Liquidate JELLYJELLY, Completely True, the Foundation Controls the Majority of Voting Rights

It is in the repeated games and confrontations that the concept of decentralization has gradually succumbed to the reality of capital efficiency. Hyperliquid has tried its best to reduce the evil of VC, Airdrop, and internal liquidation (compared with the continuous sales of the founder of XRP), tried its best to retain the normal product form, and hopes to make money from handling fees.

Compared to the falsified NFT market, Perp DEX is an on-chain necessity, so I think hyperliquid will definitely be accepted by the market.

However, just as the community suspected whether the exchange would fleece the users after the Bybit theft, it is more worthy of attention whether the mentality of the founder and team will change after the Hyperliquid crisis. Will they insist on being the good guy who is pointed at with a rob, or will they go along with the exchange and further close the rules?

In other words, worrying about whether it is centralized or not deviates from the focus of the discussion. Or you can think about whether completely transparent protocol rules leading to open hunting of the entire market is a necessary pain for on-chain protocols, or whether it will cause the process of on-chain migration to regress.

The truly profound lesson or experience is: Should we follow the concept of decentralization or surrender directly to capital efficiency? Just like this increasingly shaky world, the middle ground has become increasingly narrow.

Do you want partial centralization + transparent rules + intervention when necessary, or 100% centralization + black box status + intervention at all times?

Conclusion

08 After the financial crisis, the U.S. government directly rescued the market without the consent of taxpayers, drained the blood of leeks, continued the veins of Wall Street, and became the mother body of Bitcoin. Now, Hyperliquid is just a replica of the old drama, but the role has become the on-chain Wall Street to be rescued.

After the Hyperliquid crisis, big Vs took turns to torture: from Arthur Hayes to AC, they all asked Hyperliquid to adhere to the concept of decentralization. This is also a continuation of the on-chain business war. AC once criticized the feasibility of Ethena, but it did not prevent the two from standing on the same front today.

Once a chess player enters the game, he must be prepared to become a chess piece.

Whether on the chain or off the chain, there must be absolute concepts and relative bottom lines.