Written by Tanay Ved & Matías Andrade Cabieses

Compiled by: Shan Ouba, Golden Finance

Key Takeaways:

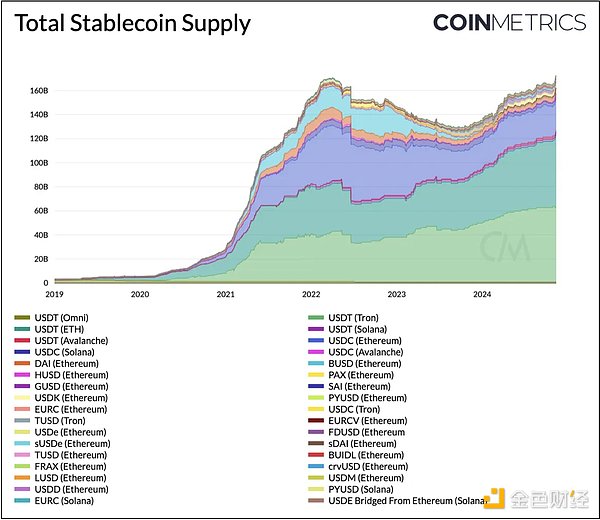

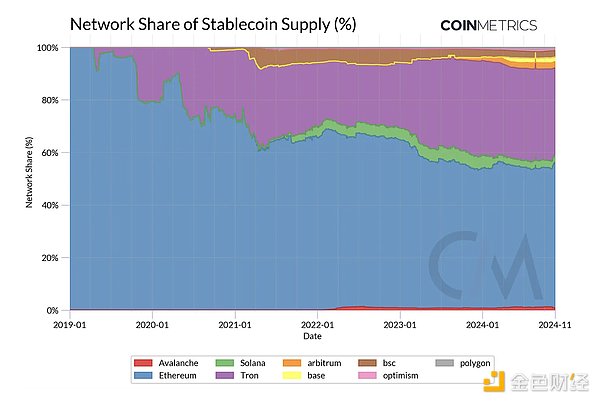

- The total supply of stablecoins issued has expanded to $189 billion, of which Tether’s USDT is $125 billion (66% of the total supply), while stablecoins issued on Ethereum are $104 billion (66% of the total supply). of 55%).

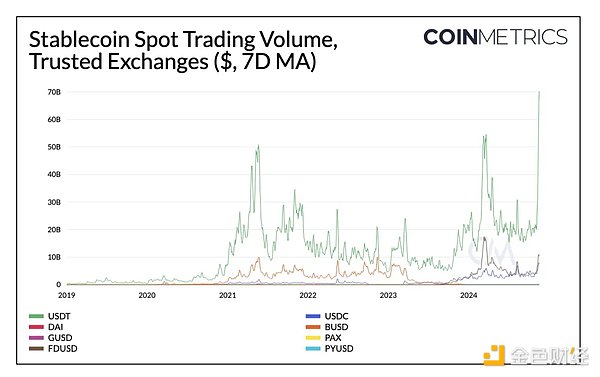

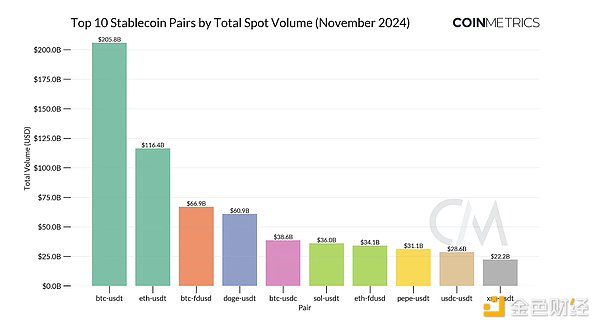

- In addition to being a means of storing value, stablecoins are also a vital medium of exchange in the bull market. After the election, the stablecoin trading volume on major exchanges soared to $120 billion, with the largest trading pairs including BTC, ETH, SOL and memecoins.

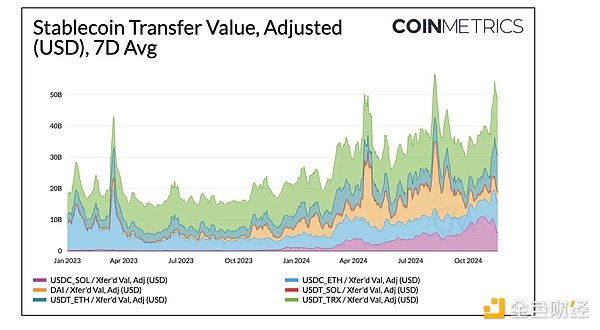

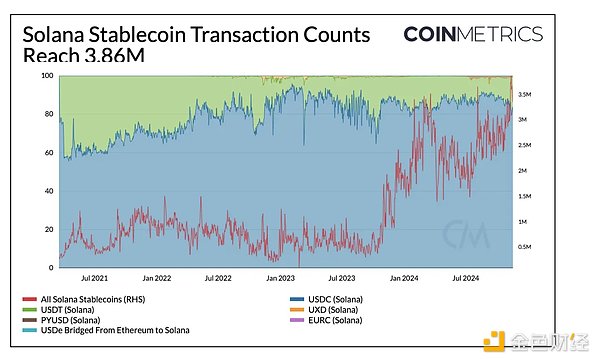

- On-chain activity is on the rise as adjusted stablecoin transfer volume (USD) surpassed $50 billion in November. Solana stablecoin transaction volume hit an all-time high, driven by USDC usage.

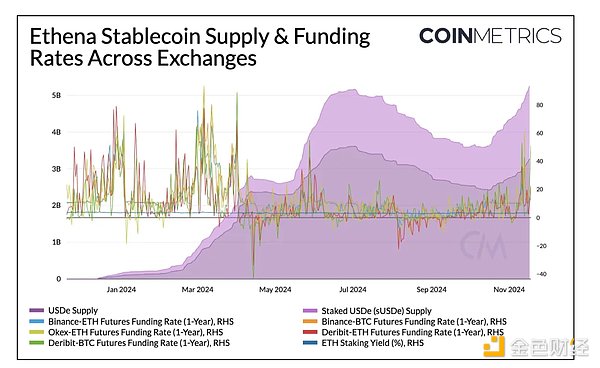

- Driven by bullish market sentiment and rising funding rates, Ethena’s USDe and staked USDe (sUSDe) have achieved rapid growth since the third quarter, demonstrating the changing yield-driven dynamics of stablecoins.

introduce

As the cryptocurrency market enters a bull run, stablecoins have also resumed their upward momentum, with total issuance exceeding $189 billion. This influx indicates a growing liquidity environment as users take advantage of price increases and the emergence of new on-chain ecosystems. Opportunities to profit. M&A activity in the cryptocurrency space has heated up, with Stripe acquiring stablecoin payment platform Bridge for $1.1 billion in October and Coinbase acquiring Utopia Labs, further fueling the industry's growth momentum. Stablecoins continue to become a major player in the financial sector. The central theme of the 2020 World Bank Summit is expected to become the backbone of fintech, payments and the global financial system.

In this week’s Coin Metrics State of the Network report, we take a deep dive into the stablecoin space based on data, explore its critical role as a medium of exchange during a bull run, and analyze on-chain adoption across key metrics.

Stablecoin Overview

The stablecoin space continues to expand in depth and breadth. Following the significant profitability of existing companies such as Tether, traditional finance and cryptocurrency native issuers have also continued to enter the market, leading to a continuous influx of stablecoins. At the same time, stablecoins are Establishing a broader footprint in the cross-chain space, especially as alternative Layer-1 and Layer-2 ecosystems mature. As a result, Coin Metrics’ stablecoin coverage has expanded to more than 35 stablecoins and is still growing. .

Tether’s USDT total supply is $125 billion, continuing to maintain the largest share of stablecoin issuance, with a market share of 66%. Circle’s USDC follows closely behind, with a total supply of $36 billion and a market share of 19%. In terms of networks, Ethereum is the blockchain with the most stablecoin issuance, accounting for $104 billion (55%) of the total stablecoin supply. Tron continues to maintain a 33% network share of stablecoin supply, mainly driven by USDT. Solana and Ethereum layer 2 networks (Arbitrum, Base, Optimism) together account for approximately 7.5% of the total stablecoin supply, reflecting their growing but still emerging stablecoin ecosystem.

Stablecoin volumes surge as markets rise

As one of the earliest use cases, stablecoins have proven their usefulness as a medium of exchange in both bull and bear markets. In an upward-trending market, stablecoins serve as a bridge for users to access other tokens in the ecosystem and are a means of facilitating on-chain and They are an essential source of liquidity for trading activities. They can also serve as a store of value or a means of savings during market downtrends or volatility, allowing users to store wealth or earn returns from on-chain and off-chain sources. This makes stablecoins popular in various It is essential in all market conditions, geographical locations and time zones.

As the cryptocurrency market rose after the election, the stablecoin trading volume on various exchanges exceeded $120 billion as trading activity increased. Among them, Tether's USDT accounted for about 80% of the spot trading volume recorded on November 12. FirstDigital USD (FDUSD) also gained significant traction, with daily spot volumes soaring to $16 billion (about 17% of total volume), while Circle’s USDC reached $11 billion, a record high to date. The highest weekly average spot volume to date.

We can further drill down into the specific stablecoins and crypto assets that drove November’s activity. Large-cap assets like BTC, ETH, and SOL, as well as memecoins like DOGE and PEPE, feature prominently in the top 10 pairs by volume across exchanges. The dominance of major currencies is not surprising, but the influence of memecoins shows that retail participation has increased as BTC hits new price highs. Therefore, the "Specialized Coins" section in datonomy™ (including meme coins) , privacy coins, and remittance coins) became the best performing sector, with a return of 63% in the past 30 days.

On-chain economic activity and usage

Stablecoins not only play an important role as a medium of exchange and source of liquidity in exchanges, but are also critical for non-transaction use cases, such as facilitating transactions and settling economic value on-chain. Stablecoins are a key enabler for consumer and B2B payments, remittances, and other , storing wealth or seeking economic stability and access to financial infrastructure, especially in emerging markets.

With the help of some on-chain metrics, we can better understand how stablecoin-driven economic activity evolves over time and the extent to which they influence the usage of different public blockchains.

In November, the weekly adjusted transfer value of native unit transfers between different stablecoin addresses exceeded $50 billion. Of this, $18.2 billion (38%) came from USDT on Tron and $12.3 billion (23%) came from Ethereum. USDT on Ethereum and Solana also showed greater appeal, with transfer amounts on the rise.

It is worth noting that the stablecoin transaction volume on Solana hit a record high of 3.86 million in November. USDC continues to be the preferred stablecoin on Solana, accounting for 83% of all stablecoin-related transactions on the network. The average USDC transfer amount on the network is $20, while Ethereum is $1,400. This leads to a higher number of transactions on Solana, with 3.86 million stablecoin transactions in November, much higher than Ethereum's 230,000. Trading, although Ethereum’s stablecoins are more liquid.

We can use several other metrics to understand on-chain stablecoin activity, including supply held by smart contracts and externally owned accounts (EOAs), stablecoin velocity (turnover), active addresses, and stablecoin holdings above a certain amount. The number of addresses and supply distribution of a coin. These metrics can be further explored through coin dashboards created using our charting tools.

The need for yield: Higher funding rates drive Ethena’s growth

Another way to drive demand for stablecoins is by providing yield, which can serve as a form of passive income or risk management in both bull and bear markets. In order to compete with giants such as Tether and Circle in terms of adoption, some stablecoin issuers have adopted Passing interest to holders to incentivize the growth of stablecoins, thereby enhancing their value storage properties. This covers a variety of approaches and risk profiles, from passing on part of the returns generated by off-chain real-world assets (RWA) (such as US Treasuries), to transfer on-chain collateral assets such as staked ETH, or in some cases to transfer revenue generated by operations related to on-chain protocols (in terms of protocols)

for the stablecoins issued by the exchange).

Ethena brings a relatively new yield generation approach to its synthetic USDe (dubbed “internet bonds”). It combines the hedging strategies of centralized exchanges with staking rewards to maintain the stability of the peg. Crypto assets are used as collateral (BTC, ETH) to open short positions in the perpetual futures market, aiming to benefit from positive financing rates. Combining financing and basis, Ethena converts the ETH staking rewards into The returns are delivered in the form of interest-bearing tokens called sUSDe.

It is worth noting that there is a close relationship between the supply of USDe and ETH funding rates on various exchanges. In an environment with positive funding rates, the supply of USDe and pledged USDe (sUSDe) increased, while in an environment with positive funding rates, the supply of USDe and pledged USDe (sUSDe) increased. When it is negative, the supply has decreased or stagnated. Interestingly, Ethena recently announced plans to launch USTb, a new stablecoin collateralized by BlackRock’s tokenized U.S. Treasury bond fund BUIDL. This stablecoin Designed to serve as a backing asset for USDe, helping manage risk during periods of market volatility that lead to weak funding rates. As the fastest growing stablecoin since Q3, Ethena is well positioned to take advantage of rising funding rates.

in conclusion

Stablecoins remain a cornerstone of the digital asset ecosystem, driving liquidity, facilitating payments, enabling on-chain economic activity, and serving as a tool for savings and wealth preservation. According to multiple indicators, the adoption and use of stablecoins continue to grow, proving that As stablecoins gain traction, regulatory clarity in areas such as reserve transparency and issuance standards will drive innovation across the ecosystem and fuel growth in stablecoin-related businesses. As regulatory efforts continue to advance, the stage is set for the next phase of stablecoin growth, with the potential to reshape the financial ecosystem.