Article author: Ada

On December 5, 2024, Bitcoin broke through $100,000, and the cryptocurrency market was cheering. The prediction made by Kong Jianping, the founder of Nano Labs (Nasdaq: NA), that Bitcoin would reach $100,000 many years ago was also confirmed on this day.

On the same day, Nano Labs announced that it would open a trading account at the Hong Kong-licensed exchange HashKey Exchange and planned to invest $50 million in Bitcoin virtual assets. Nano Labs' stock price also rose from $6 per share in early November to nearly $13 per share at the close of December 5.

Kong Jianping said in an interview with MetaEra that Bitcoin has now reached a new stage. It has changed from an investment target for retail investors to a reserve asset for some institutions or governments. He believes that the risk of listed companies reserving Bitcoin has reached an acceptable level at this stage, and it can bring relatively good profit prospects to the company. This is also one of the motivations for Nano Labs to announce its Bitcoin investment. "In the future, we will hold Bitcoin for a long time." Kong Jianping said.

Bitcoin has risen by more than 140% this year. Trump's victory in the US election and his friendly attitude towards the cryptocurrency industry have become the catalysts for this round of surge. Behind the huge influence and discussion, the boundaries of Bitcoin are constantly expanding.

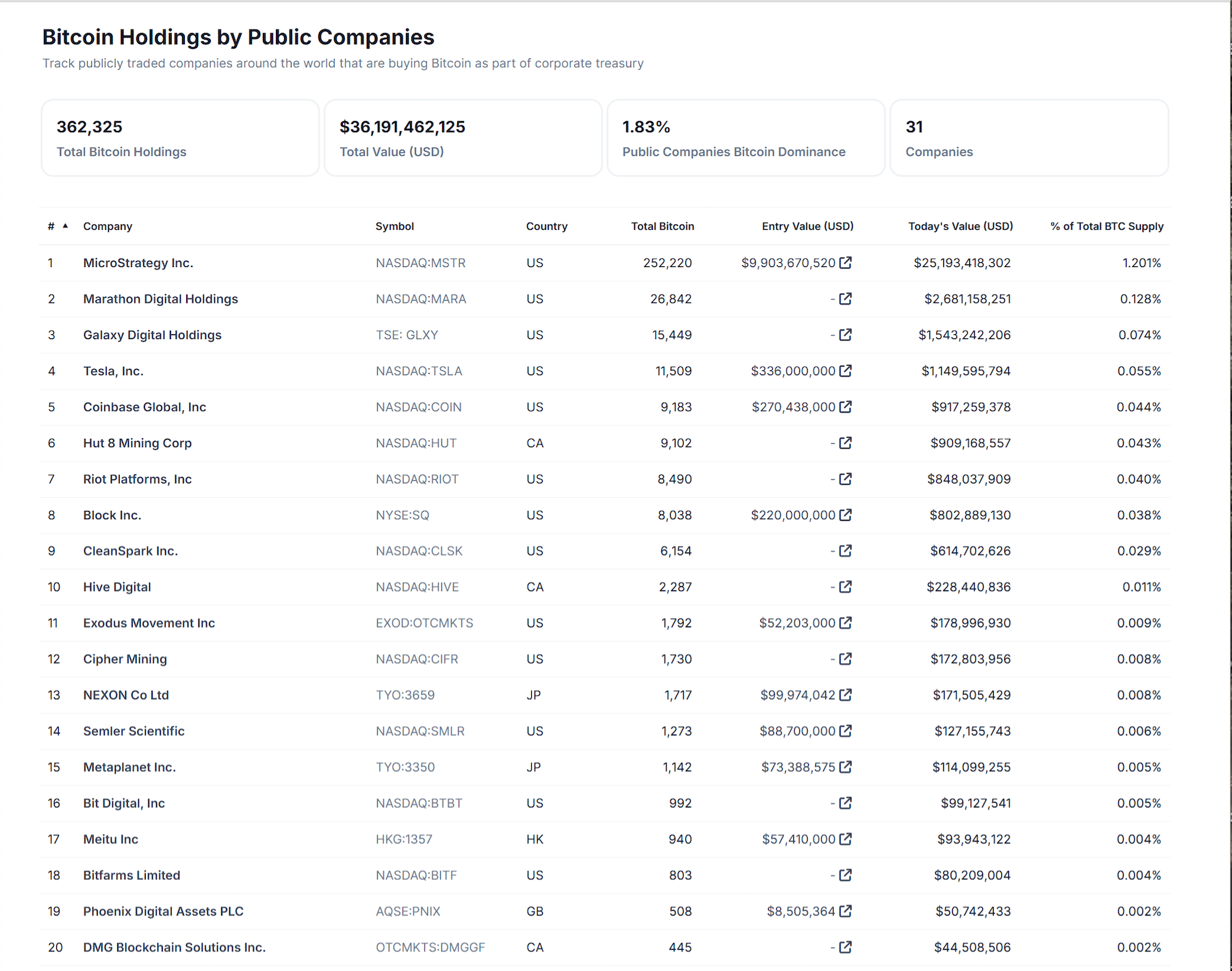

More and more listed companies have allocated Bitcoin as a reserve asset, and this trend is spreading from American companies to Chinese listed companies. According to incomplete statistics, there are currently more than 60 listed companies in the world holding different amounts of Bitcoin.

As the popularity of Bitcoin continues to rise, discussions about listed companies' Bitcoin reserves are also increasing. What are the motivations of listed companies to hold Bitcoin? As a listed company, how should it deal with the risks brought by Bitcoin's volatility? What kind of currency holding strategy should listed companies have?

Public companies race to buy Bitcoin

In this "coin hoarding wave" sweeping the world, MicroStrategy, a US listed company, is undoubtedly the pioneer of this wave.

As early as 2020, its founder Michael Saylor announced that Bitcoin would be part of the company's assets. At that time, MicroStrategy's "Bitcoin Strategy" began.

The "Bitcoin strategy" has brought MicroStrategy both stock and cryptocurrency gains. So far, its stock price has increased by 3,000% and its market value has exceeded $100 billion. As Bitcoin breaks through $100,000, MicroStrategy's total Bitcoin return has reached 63.3% since the beginning of the year.

Stimulated by the huge economic benefits, many US-listed companies have also begun to follow MicroStrategy's Bitcoin strategy and use Bitcoin as a reserve asset.

According to data from Bitcoin Treasuries, since November, fitness equipment manufacturer Interactive Strength announced an investment of US$5 million to purchase Bitcoin; artificial intelligence company Genius Group spent US$14 million to purchase 153 Bitcoins; medical company Semler Scientific approved an investment plan for 1,570 Bitcoins. In addition, many companies such as Rumble, Anixa Biosciences and LQR House have joined the ranks of Bitcoin investment.

In addition to spending money on Bitcoin, e-commerce platform LQR House Inc. (LQR) is also accepting cryptocurrency payments on CWSpirits.com, giving customers the flexibility to purchase alcoholic beverages using digital currencies. As part of the initiative, LQR House has adopted a policy to retain up to $10 million in crypto payments as Bitcoin.

The Bitcoin investment boom soon spread to Chinese listed companies.

In addition to Nano Labs mentioned above, Chinese concept stock SOS Ltd also invested in Bitcoin. It announced an investment of 50 million US dollars to purchase Bitcoin. Other Chinese listed companies such as Boyaa Interactive, Coolpad Group, Guofu Innovation, and NetDragon Network have also joined the ranks of Bitcoin investment.

It is worth mentioning that Boyaa Interactive, a Hong Kong-listed company, converted its reserve of 49.48 million USD of Ethereum into Bitcoin from November 19 to November 28, and finally obtained 515 Bitcoins. It was this decision that brought its Bitcoin holdings to 3,183. This move made Boyaa Interactive's holdings exceed that of Metaplanet, the Japanese listed company that was previously the largest Bitcoin corporate holder in Asia, and it is known as Asia's "MicroStrategy".

According to the latest news from MetaEra, as of December 12, 2024, Nano Labs holds a total of approximately 360 bitcoins, with a total value of approximately $36 million at current prices. According to Coingecko data on December 12, the holdings are already ranked 21st in terms of the number of BTC held by listed companies.

According to Kong Jianping's observation, listed companies that currently hold Bitcoin can be divided into three main categories: one is native digital currency companies or companies doing Web3 projects, whose main business sectors include digital currency-related businesses; the second is companies in the Crypto Miner ecosystem, who tend to hold Bitcoin for a long time, such as Canaan Technology and The9; the third is some technology, game or Internet companies that hold Bitcoin across borders and regard it as part of their asset portfolio, such as Boyaa Interactive and Meitu.

Kong Jianping believes that it will be a long-term trend for listed companies to hold Bitcoin. In terms of currency holding strategy, he said that Bitcoin should be allocated and held without affecting the company's cash flow. "In this way, the short-term fluctuations of Bitcoin will not have a substantial impact on the company's operations," Kong Jianping said.

At the same time, Nano Labs' strategic reserve of Bitcoin has also been recognized. Recently, Nano Labs also announced a plan for a private placement, raising a total of US$36.25 million. Participants in the private placement include Fenbushi Inc -US, Longling Capital, Golden Forest Management Limited, etc.

Is it a long-term holding?

On the evening of December 4, Meitu issued an announcement on the Hong Kong Stock Exchange, stating that it had sold all its cryptocurrencies, including approximately 31,000 Ethereum coins and 940 Bitcoins, making a profit of approximately US$79.63 million (equivalent to approximately RMB 571 million).

Meitu first purchased cryptocurrency in March 2021. Over the past three years, Meitu's investment return on cryptocurrency has been about 44%. Although Meitu has made a lot of profit from its investment, it has also attracted a lot of controversy.

According to The Paper, many netizens have a negative attitude towards Meitu's purchase of digital currency. Some analysts also believe that Meitu's short-term behavior is "not doing its job properly" and is suspected of speculation.

In Kong Jianping's view, the allocation of Bitcoin by listed companies, whether for short-term speculation or long-term allocation, shows that there is a hot spot in the market. In essence, it promotes the Bitcoin and Web3 tracks, which is beneficial to the development of this track as a whole.

Nano Labs prefers to hold Bitcoin for the long term. "We don't make short-term investments because I am optimistic about the long-term value of Bitcoin." Kong Jianping said, "Compared to gold, Bitcoin aggregates the world's network effects and liquidity, and also has technological attributes. In the past, gold was the value anchor of the world, because in the era of the industrial revolution, everyone needed such an equivalent worldwide. But with the advent of the information age, gold is becoming less and less applicable. In the future, with the advent of the digital age and the era of artificial intelligence. We need a new value anchor, and at present, only Bitcoin is the most suitable. However, Bitcoin and gold are not substitutes, but the embodiment of value in another era."

Currently, the cryptocurrency market is welcoming a new round of growth. "There were many challenges in the past, including disapproval from the government, regulators, banks, etc., but with Trump's coming to power, the whole world has become more and more friendly to this track." Kong Jianping said, "At present, we are facing more cognitive challenges rather than external challenges."

In the future, as governments around the world gradually improve their regulatory frameworks for virtual assets, the compliance path for listed companies holding Bitcoin will become clearer.